fuboTV (FUBO)

fuboTV is up against the odds. Its negative returns on capital show it destroyed value by losing money on unprofitable business ventures.― StockStory Analyst Team

1. News

2. Summary

Why We Think fuboTV Will Underperform

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

- Estimated sales decline of 39.7% for the next 12 months implies a challenging demand environment

- Suboptimal cost structure is highlighted by its history of operating margin losses

- Negative free cash flow raises questions about the return timeline for its investments

fuboTV is in the penalty box. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than fuboTV

High Quality

Investable

Underperform

Why There Are Better Opportunities Than fuboTV

fuboTV’s stock price of $1.52 implies a valuation ratio of 2.2x forward EV-to-EBITDA. fuboTV’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. fuboTV (FUBO) Research Report: Q4 CY2025 Update

Live sports and TV streaming service fuboTV (NYSE:FUBO) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 249% year on year to $1.55 billion. Its non-GAAP loss of $0.13 per share was significantly below analysts’ consensus estimates.

fuboTV (FUBO) Q4 CY2025 Highlights:

- Revenue: $1.55 billion vs analyst estimates of $409 million (249% year-on-year growth, 279% beat)

- Adjusted EPS: -$0.13 vs analyst estimates of $0.02 (significant miss)

- Adjusted EBITDA: $41.4 million vs analyst estimates of $37.13 million (2.7% margin, 11.5% beat)

- Operating Margin: -1.3%, up from -8.7% in the same quarter last year

- Free Cash Flow was -$204 million, down from $16.27 million in the same quarter last year

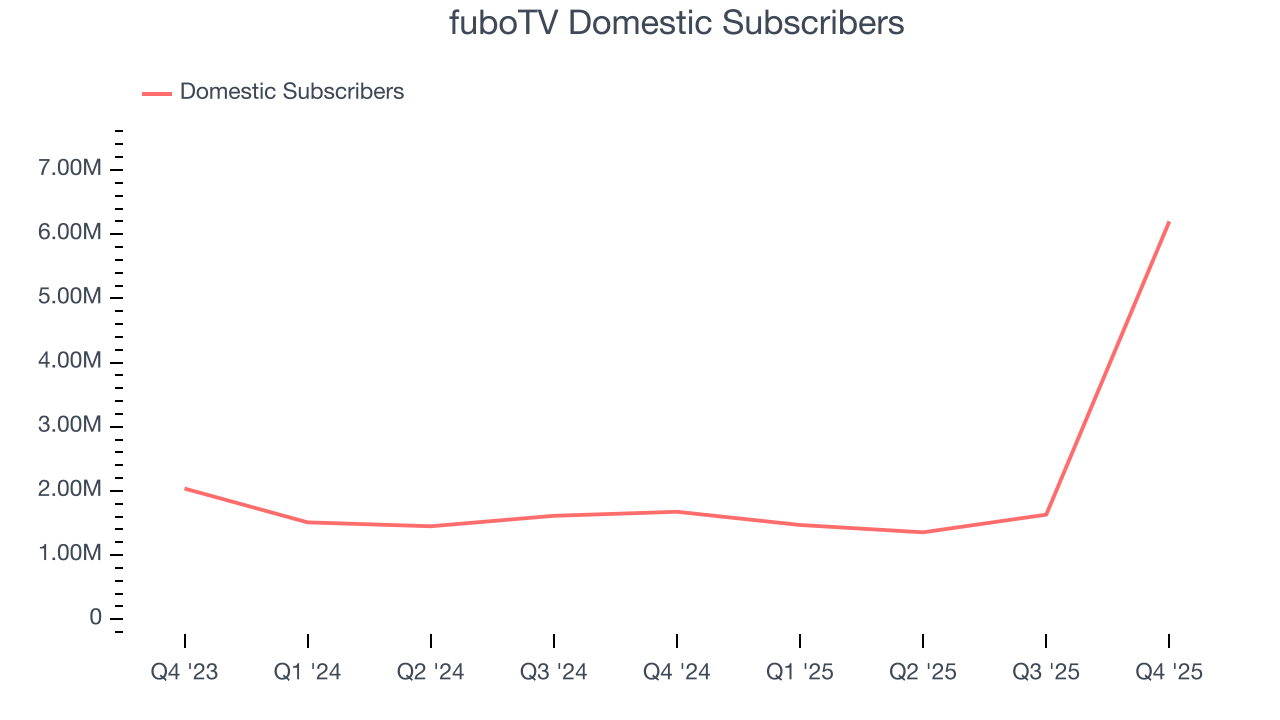

- Domestic Subscribers: 6.2 million, up 4.52 million year on year

- Market Capitalization: $486.7 million

Company Overview

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

fuboTV's original focus on live soccer paved the way for a broader scope, and the company has since evolved into a versatile streaming platform that includes a wide array of major sports leagues, news, and entertainment content. This growth aligns with the increasing shift towards cord-cutting, positioning fuboTV as a comprehensive and flexible alternative to conventional cable TV. fuboTV's on-demand content is accessible across multiple devices, increasing convenience for its subscribers.

fuboTV primarily generates revenue through subscription fees and has various add-on plans to suit different content preferences. This strategy has enabled fuboTV to attract a demographic that values choice, convenience, and comprehensive coverage on a user-friendly platform.

4. Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Competitors in the live TV streaming market include YouTube TV (owned by NASDAQ:GOOGL), Comcast (NASDAQ:CMCSA), Charter Communications (NASDAQ:CHTR), and DISH Network (NASDAQ:DISH).

5. Revenue Growth

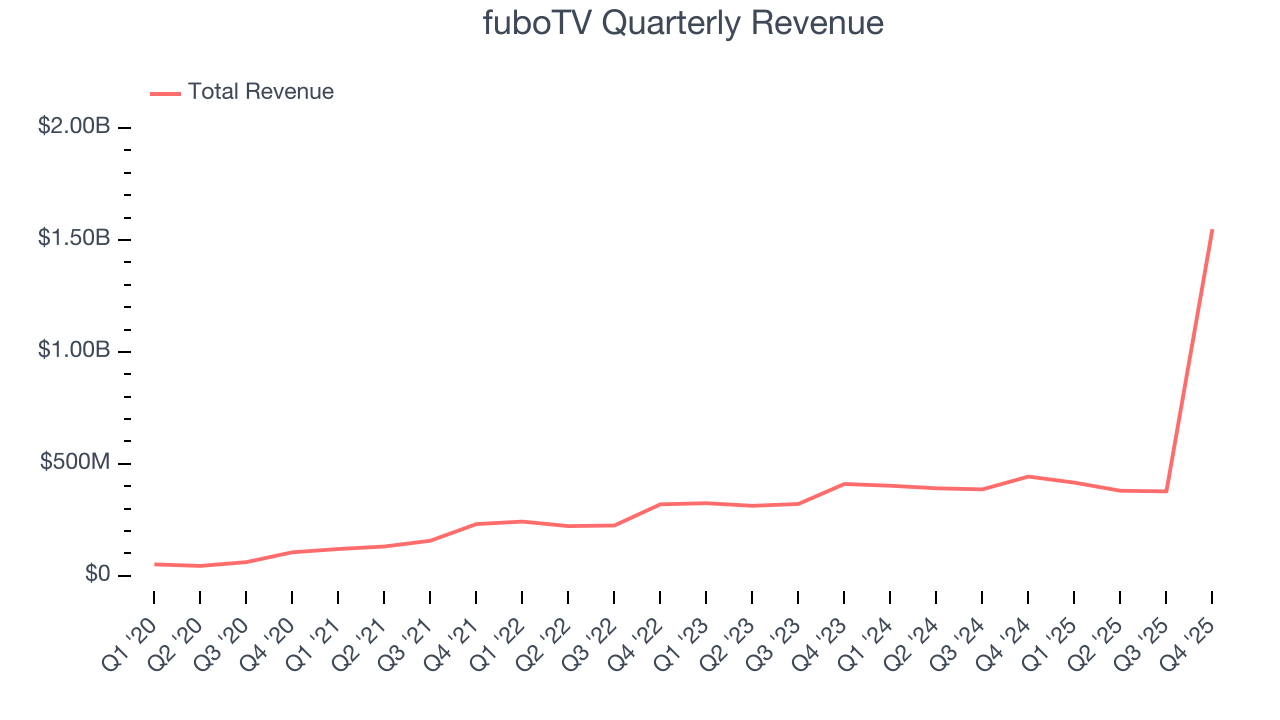

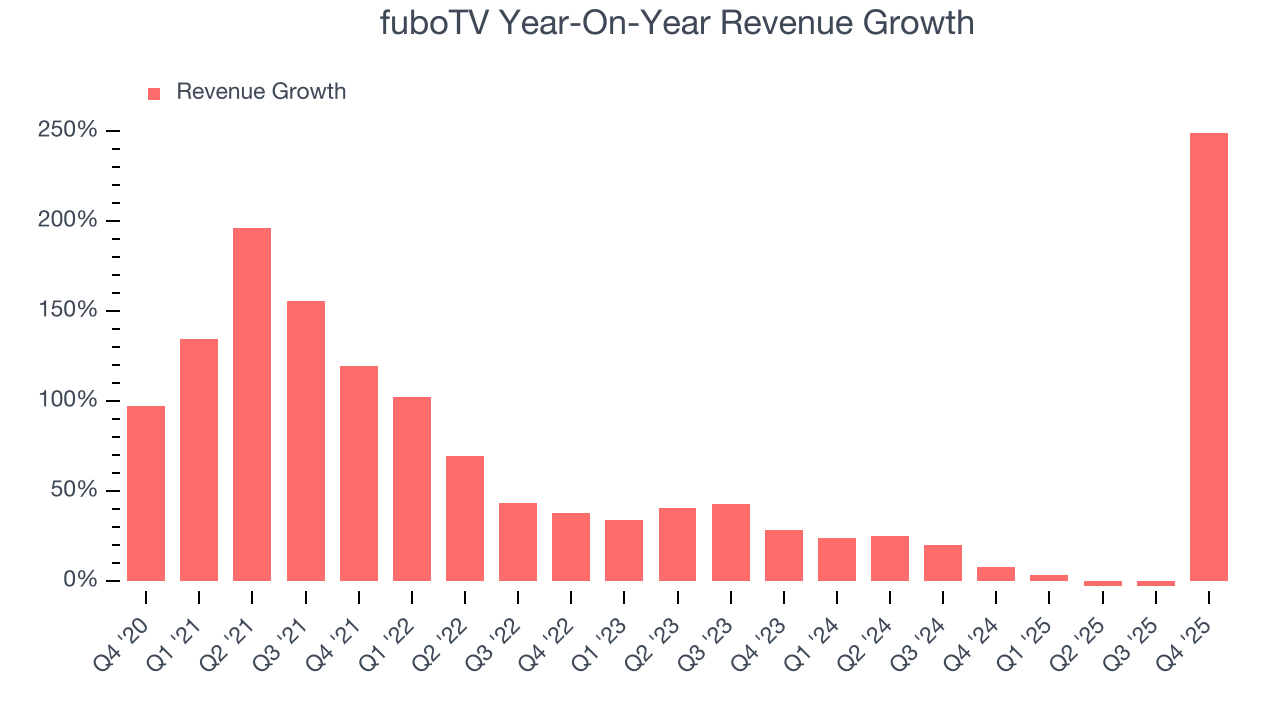

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, fuboTV grew its sales at an excellent 59.8% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. fuboTV’s annualized revenue growth of 41.1% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s revenue dynamics by analyzing its number of domestic subscribers and international subscribers, which clocked in at 6.2 million and 335,000 in the latest quarter. Over the last two years, fuboTV’s domestic subscribers averaged 48.8% year-on-year growth. On the other hand, its international subscribers averaged 10.1% year-on-year declines.

This quarter, fuboTV reported magnificent year-on-year revenue growth of 249%, and its $1.55 billion of revenue beat Wall Street’s estimates by 279%.

Looking ahead, sell-side analysts expect revenue to decline by 39.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

6. Operating Margin

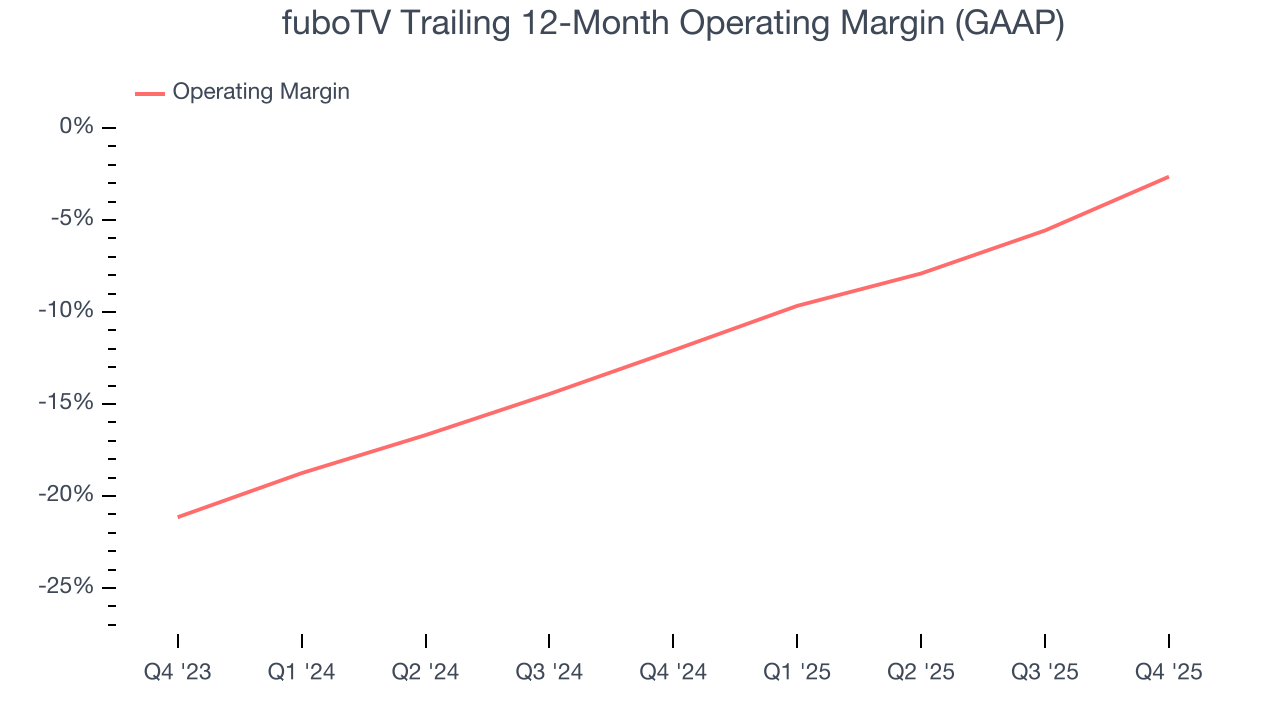

fuboTV’s operating margin has risen over the last 12 months, but it still averaged negative 6.2% over the last two years. This is due to its large expense base and inefficient cost structure.

fuboTV’s operating margin was negative 1.3% this quarter.

7. Earnings Per Share

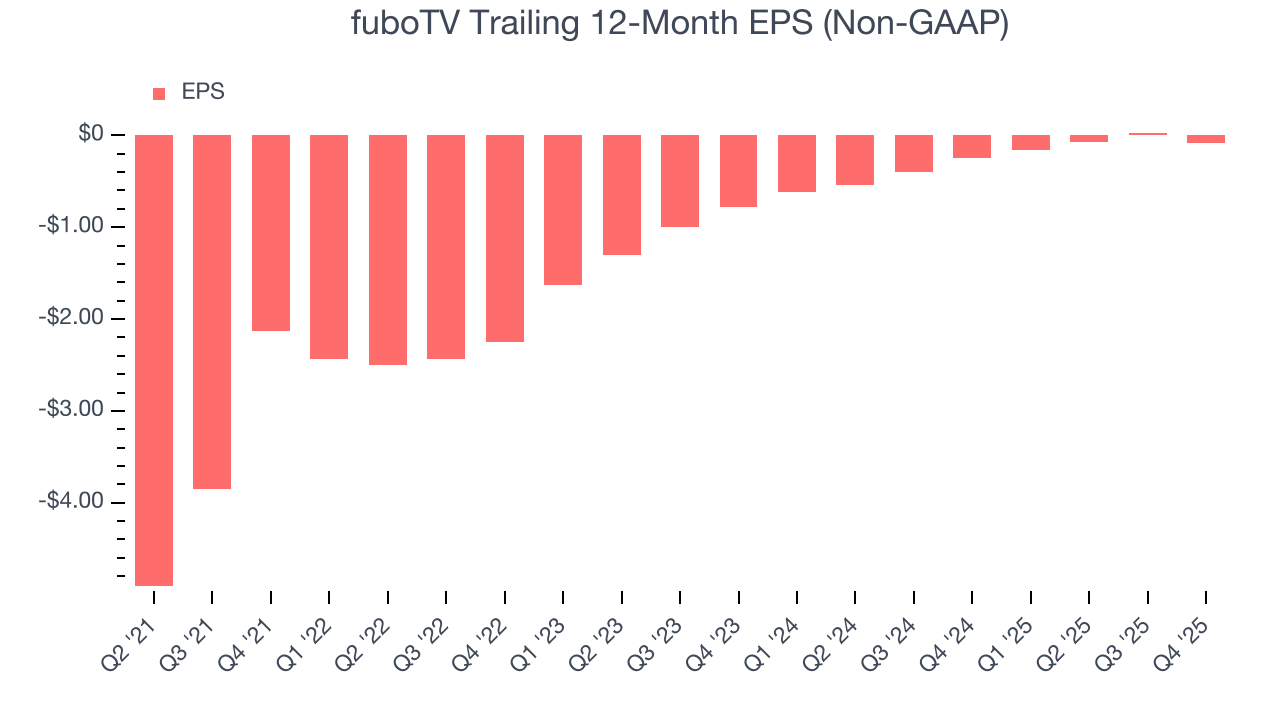

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although fuboTV’s full-year earnings are still negative, it reduced its losses and improved its EPS by 50.9% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, fuboTV reported adjusted EPS of negative $0.13, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects fuboTV to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.08 will advance to negative $0.03.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

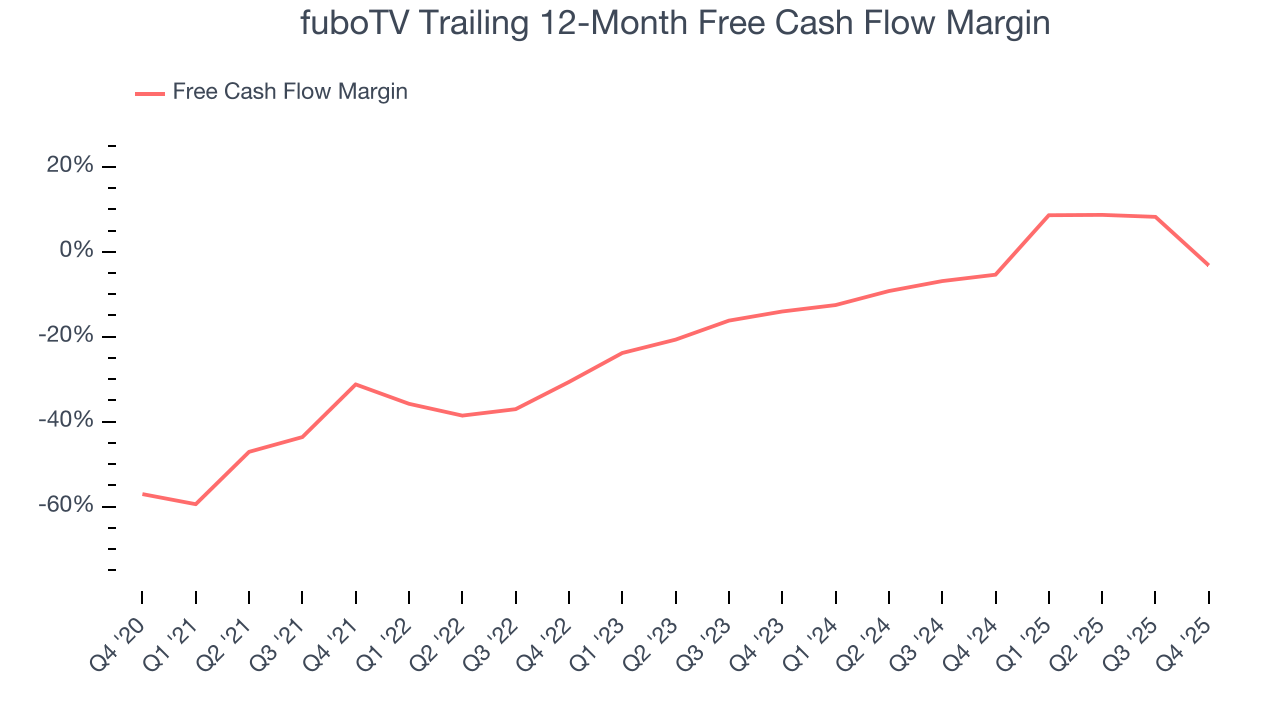

Over the last two years, fuboTV’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 4%, meaning it lit $4.03 of cash on fire for every $100 in revenue.

fuboTV burned through $204 million of cash in Q4, equivalent to a negative 13.2% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Looking forward, analysts predict fuboTV will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 3.2% for the last 12 months will increase to positive 11%, giving it more optionality.

9. Return on Invested Capital (ROIC)

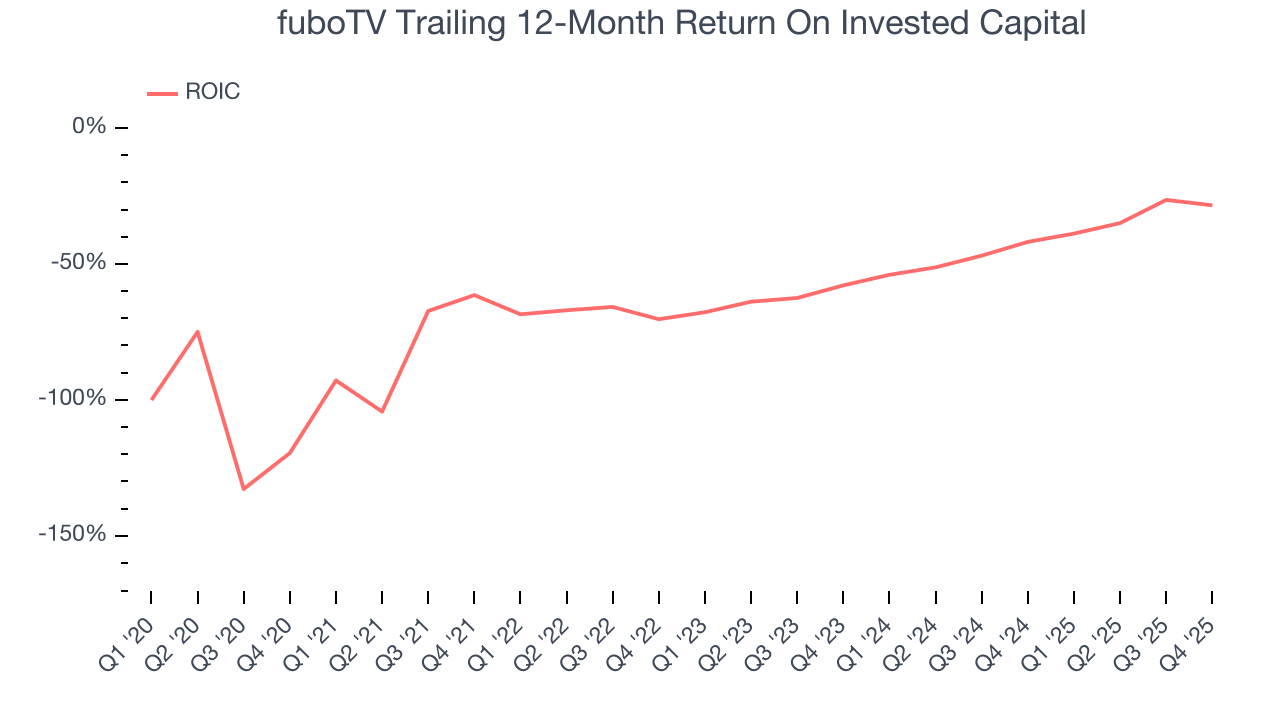

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

fuboTV’s five-year average ROIC was negative 52%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, fuboTV’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

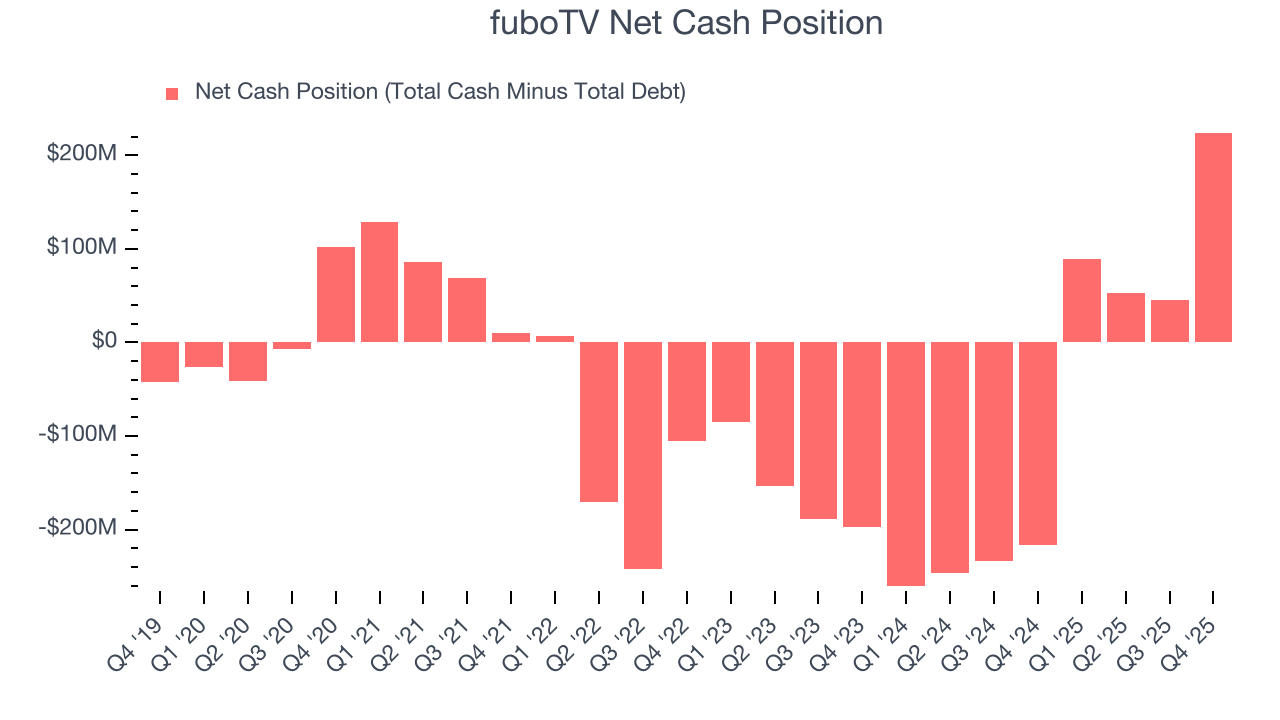

fuboTV is a well-capitalized company with $458.6 million of cash and $234.3 million of debt on its balance sheet. This $224.2 million net cash position is 46.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from fuboTV’s Q4 Results

We were impressed by how significantly fuboTV blew past analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock remained flat at $1.39 immediately after reporting.

12. Is Now The Time To Buy fuboTV?

Updated: February 11, 2026 at 9:30 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own fuboTV, you should also grasp the company’s longer-term business quality and valuation.

fuboTV falls short of our quality standards. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

fuboTV’s EV-to-EBITDA ratio based on the next 12 months is 2.3x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $3.44 on the company (compared to the current share price of $1.39).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.