GEO Group (GEO)

GEO Group is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think GEO Group Will Underperform

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE:GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

- Sales trends were unexciting over the last five years as its 1.1% annual growth was below the typical business services company

- Underwhelming 8.1% return on capital reflects management’s difficulties in finding profitable growth opportunities

- On the bright side, its exciting sales outlook for the upcoming 12 months calls for 13.5% growth, an acceleration from its two-year trend

GEO Group lacks the business quality we seek. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than GEO Group

Why There Are Better Opportunities Than GEO Group

GEO Group is trading at $15.98 per share, or 14.1x forward P/E. This multiple is cheaper than most business services peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. GEO Group (GEO) Research Report: Q3 CY2025 Update

Private corrections company GEO Group (NYSE:GEO) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 13.1% year on year to $682.3 million. On the other hand, next quarter’s revenue guidance of $663.5 million was less impressive, coming in 4.7% below analysts’ estimates. Its GAAP profit of $1.24 per share was 58.5% above analysts’ consensus estimates.

GEO Group (GEO) Q3 CY2025 Highlights:

- Revenue: $682.3 million vs analyst estimates of $665.7 million (13.1% year-on-year growth, 2.5% beat)

- EPS (GAAP): $1.24 vs analyst estimates of $0.78 (58.5% beat)

- Adjusted EBITDA: $120.1 million vs analyst estimates of $120.1 million (17.6% margin, in line)

- Revenue Guidance for Q4 CY2025 is $663.5 million at the midpoint, below analyst estimates of $696.2 million

- EPS (GAAP) guidance for Q4 CY2025 is $0.25 at the midpoint, missing analyst estimates by 17.4%

- EBITDA guidance for the full year is $460 million at the midpoint, below analyst estimates of $471.8 million

- Operating Margin: 6%, down from 13.7% in the same quarter last year

- Market Capitalization: $2.33 billion

Company Overview

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE:GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

GEO Group's business model revolves around public-private partnerships with government agencies to provide correctional and detention services. The company both owns and leases facilities, ranging from maximum-security prisons to minimum-security and community reentry centers. Beyond physical infrastructure, GEO provides comprehensive services including security, administrative support, rehabilitation programs, education, and food services.

The company operates through four main segments. U.S. Secure Services manages detention and correctional facilities domestically. Electronic Monitoring and Supervision Services provides technology-based supervision using radio frequency, GPS, and alcohol monitoring devices. Reentry Services focuses on community-based programs to help individuals reintegrate into society. International Services handles secure facilities in Australia and South Africa.

A typical government client might contract with GEO Group to manage a detention facility for Immigration and Customs Enforcement (ICE), where the company provides everything from physical security to healthcare services. In another scenario, a state corrections department might lease a GEO-owned facility and have the company provide specialized rehabilitation programs.

GEO generates revenue primarily through government contracts, with payment structures typically based on either a per-diem rate per occupied bed or fixed-fee arrangements. Contract terms vary but often include base periods with option years for renewal. The company also offers facility design and construction services, leveraging its architectural expertise to develop new facilities or renovate existing ones.

The company maintains a business development team that pursues new contracts through government Request for Proposal (RFP) processes, while also working to renew existing agreements with federal, state, and local agencies.

4. Safety & Security Services

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

GEO Group's primary competitors include CoreCivic (formerly Corrections Corporation of America), Management and Training Corporation, and several smaller private corrections companies like Emerald Companies and LaSalle Southwest Corrections. In the international market, they compete with G4S (now part of Allied Universal), Sodexo Justice Services, and Serco.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $2.53 billion in revenue over the past 12 months, GEO Group is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

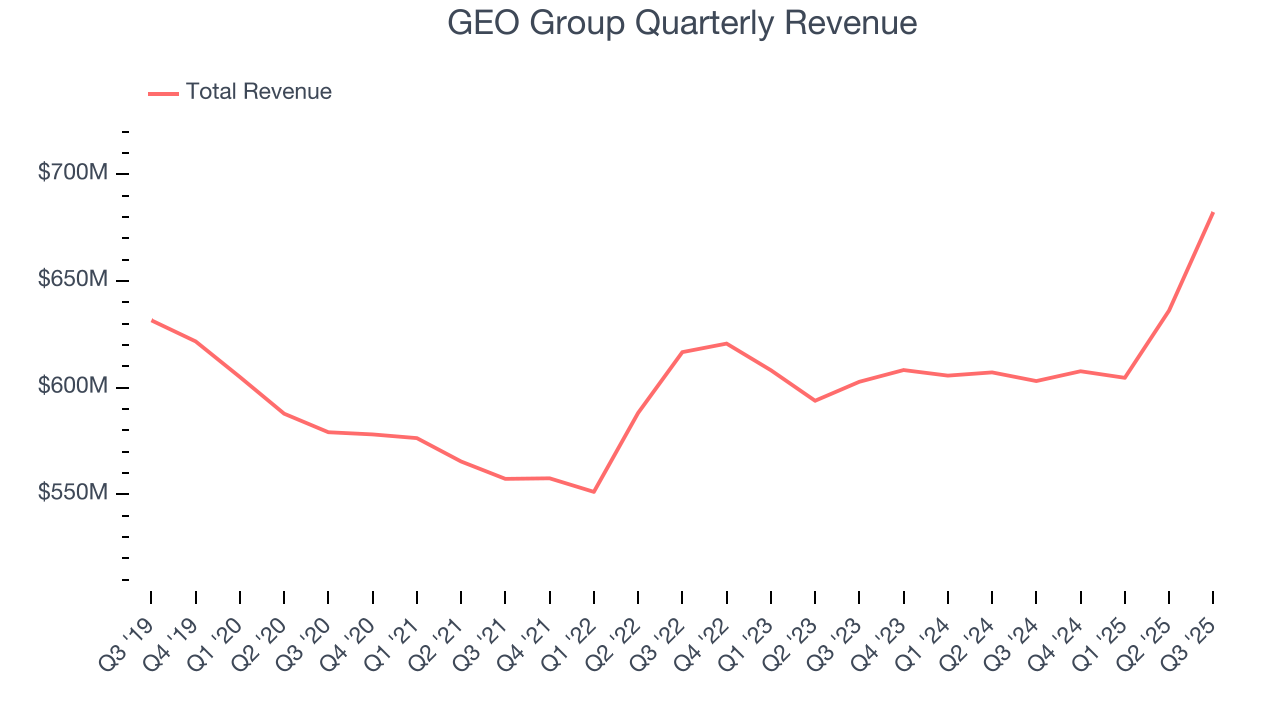

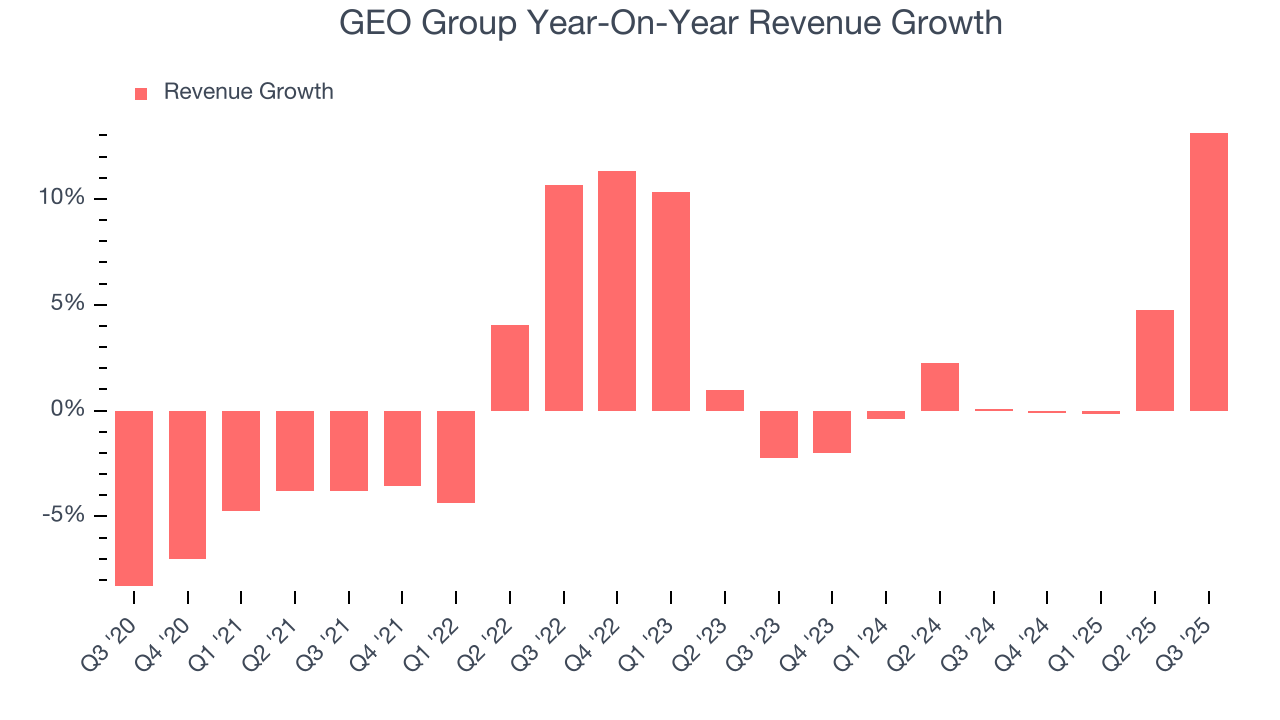

As you can see below, GEO Group’s sales grew at a sluggish 1.1% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. GEO Group’s annualized revenue growth of 2.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, GEO Group reported year-on-year revenue growth of 13.1%, and its $682.3 million of revenue exceeded Wall Street’s estimates by 2.5%. Company management is currently guiding for a 9.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.4% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

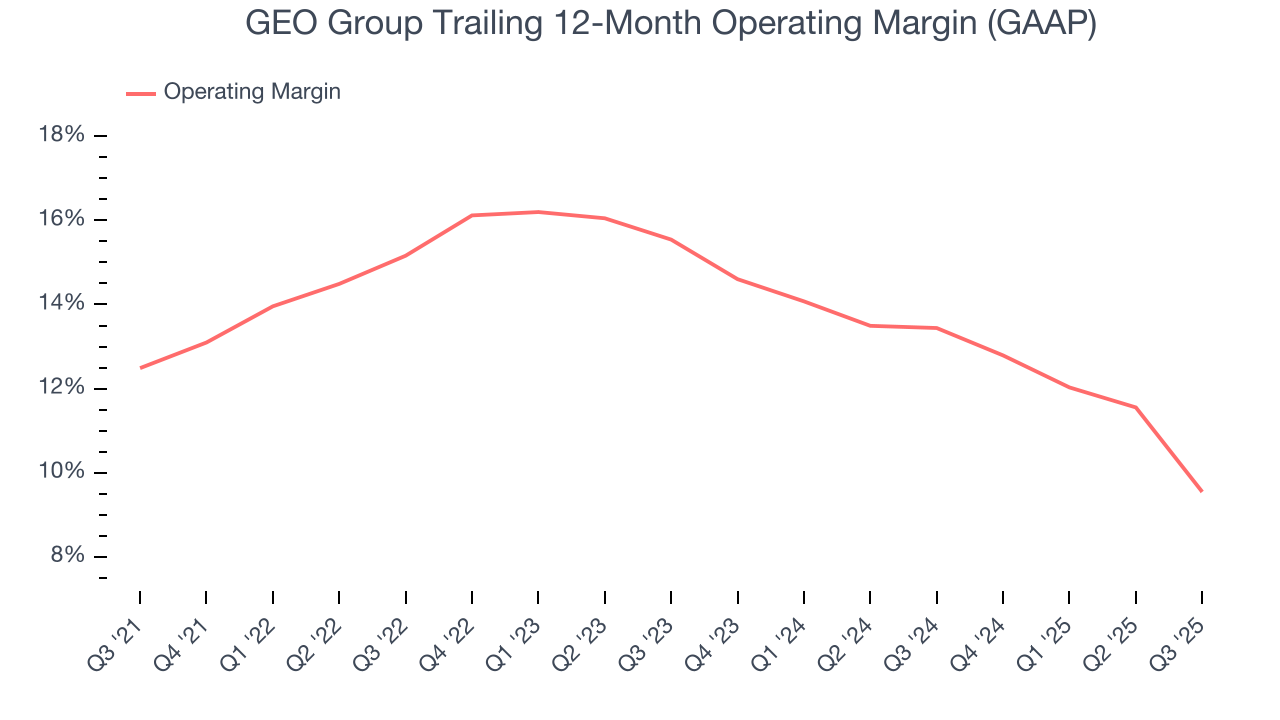

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

GEO Group has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average operating margin of 13.2%.

Looking at the trend in its profitability, GEO Group’s operating margin decreased by 2.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, GEO Group generated an operating margin profit margin of 6%, down 7.7 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

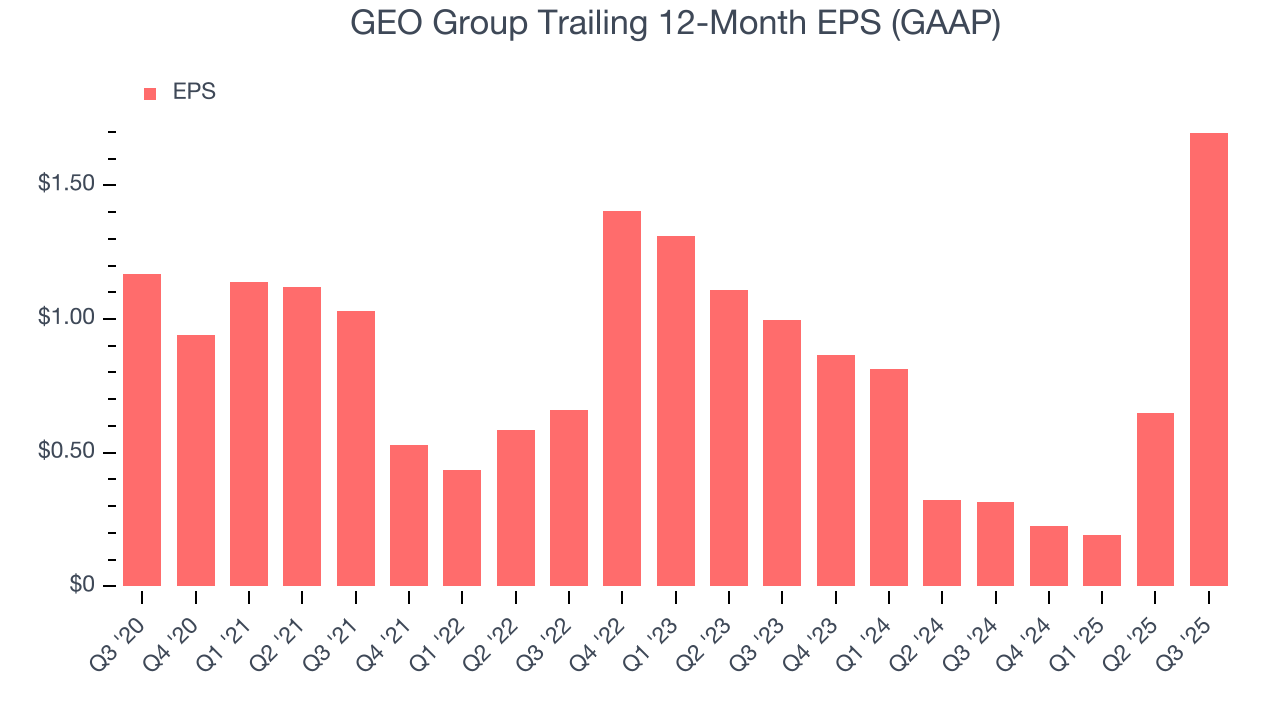

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

GEO Group’s EPS grew at a decent 7.7% compounded annual growth rate over the last five years, higher than its 1.1% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For GEO Group, its two-year annual EPS growth of 30.5% was higher than its five-year trend. This acceleration made it one of the faster-growing business services companies in recent history.

In Q3, GEO Group reported EPS of $1.24, up from $0.19 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects GEO Group’s full-year EPS of $1.70 to grow 2.4%.

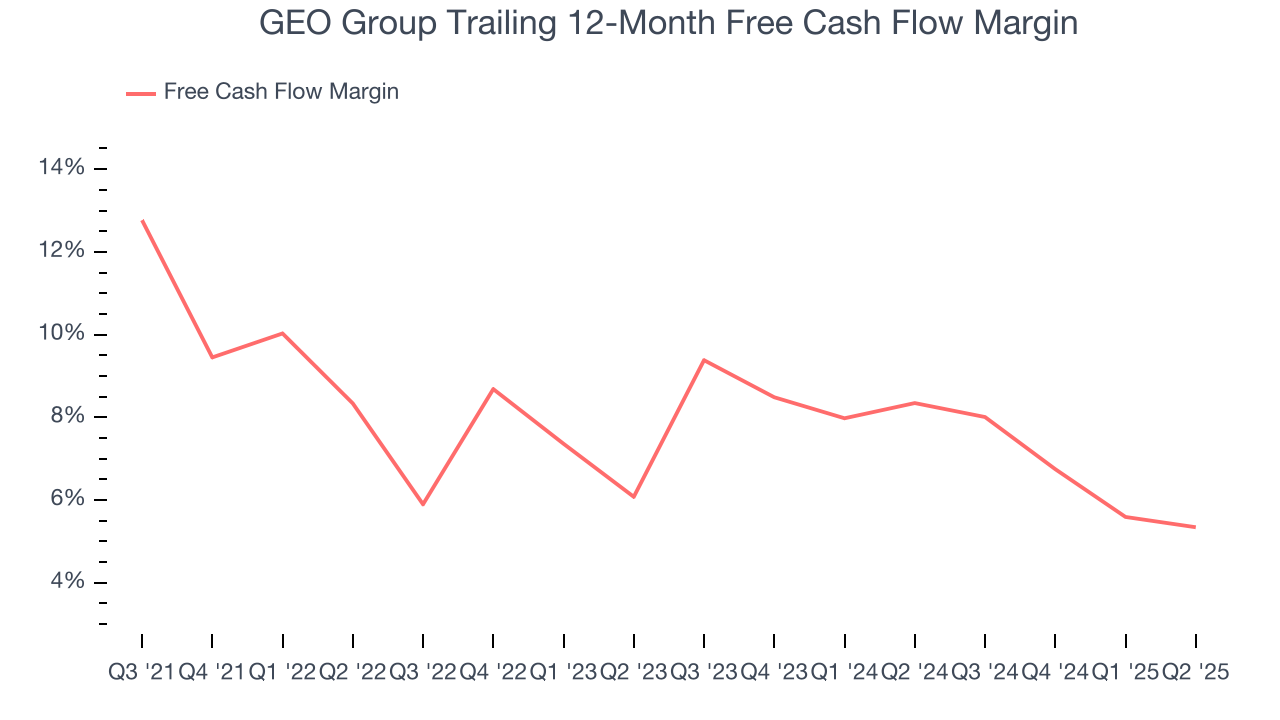

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

GEO Group has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.9% over the last five years, better than the broader business services sector.

Taking a step back, we can see that GEO Group’s margin dropped by 10.6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

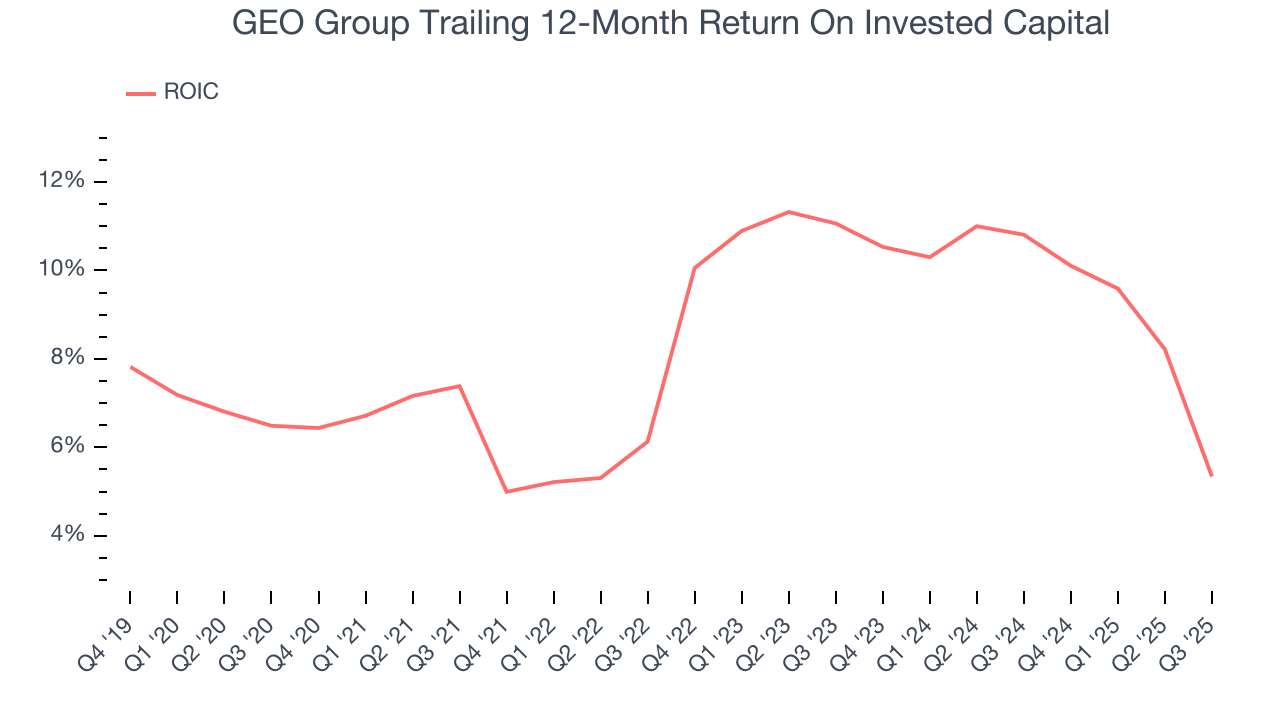

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

GEO Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.1%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, GEO Group’s ROIC averaged 1.3 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

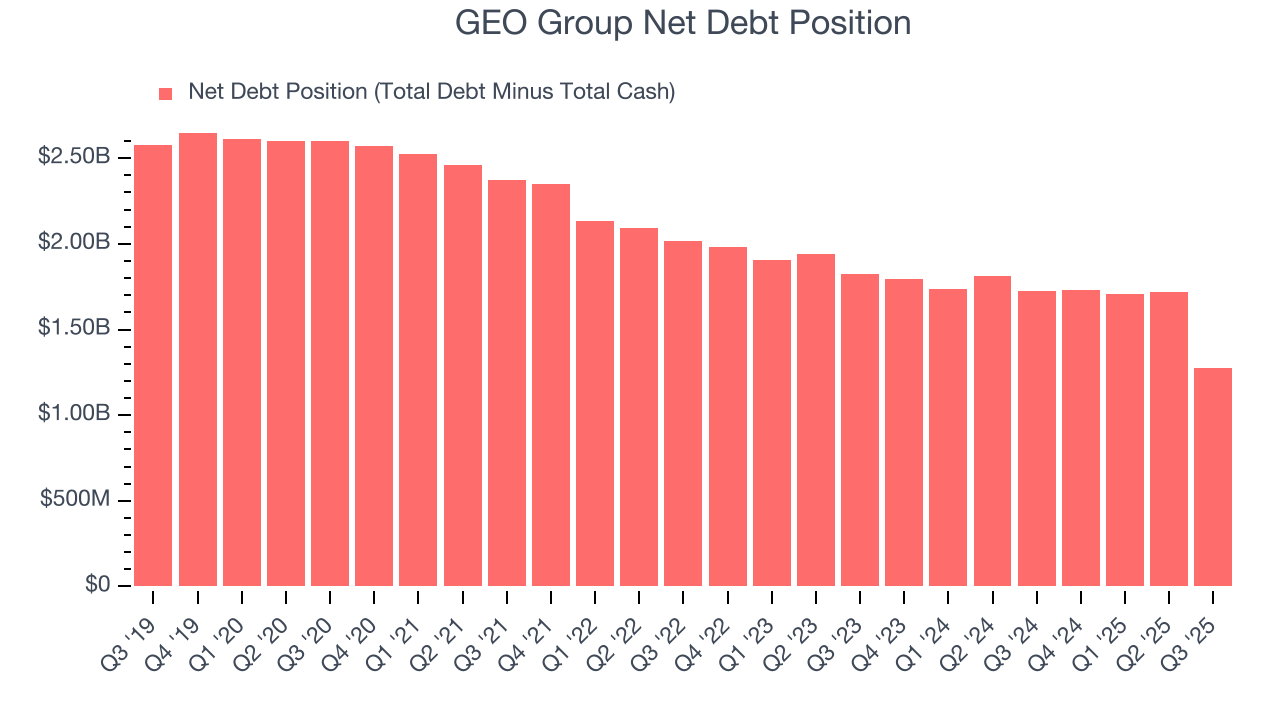

GEO Group reported $353.9 million of cash and $1.63 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $446.4 million of EBITDA over the last 12 months, we view GEO Group’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $86.24 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from GEO Group’s Q3 Results

It was good to see GEO Group beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 2.3% to $17.21 immediately after reporting.

12. Is Now The Time To Buy GEO Group?

Updated: January 30, 2026 at 10:43 PM EST

Before investing in or passing on GEO Group, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

GEO Group doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years. And while its sturdy operating margins show it has disciplined cost controls, the downside is its projected EPS for the next year is lacking. On top of that, its declining adjusted operating margin shows the business has become less efficient.

GEO Group’s P/E ratio based on the next 12 months is 14.1x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $32.25 on the company (compared to the current share price of $15.98).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.