1. News

2. Summary

Why Goldman Sachs Is Interesting

Founded in 1869 as a small commercial paper business in New York City, Goldman Sachs (NYSE:GS) is a global financial institution that provides investment banking, securities, asset management, and consumer banking services to corporations, governments, and individuals.

- Additional sales over the last five years increased its profitability as the 15.2% annual growth in its earnings per share outpaced its revenue

- Adequate return on equity shows management makes decent investment decisions

- A drawback is its scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 6.5% for the last five years

Goldman Sachs has some noteworthy aspects. If you like the story, the price seems fair.

Why Is Now The Time To Buy Goldman Sachs?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Goldman Sachs?

Goldman Sachs is trading at $928.25 per share, or 17.2x forward P/E. When stacked up against other financials companies, we think Goldman Sachs’s multiple is fair for the fundamentals you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Goldman Sachs (GS) Research Report: Q4 CY2025 Update

Global investment bank Goldman Sachs (NYSE:GS) reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales fell by 3% year on year to $13.45 billion. Its GAAP profit of $14.01 per share was 20.2% above analysts’ consensus estimates.

Goldman Sachs (GS) Q4 CY2025 Highlights:

- Revenue: $13.45 billion vs analyst estimates of $13.38 billion (3% year-on-year decline, 0.5% beat)

- Pre-tax Profit: $5.86 billion (43.5% margin)

- EPS (GAAP): $14.01 vs analyst estimates of $11.65 (20.2% beat)

- Tangible Book Value per Share: $357.60 vs analyst estimates of $336.24 (13.7% year-on-year growth, 6.4% beat)

- Market Capitalization: $292.6 billion

Company Overview

Founded in 1869 as a small commercial paper business in New York City, Goldman Sachs (NYSE:GS) is a global financial institution that provides investment banking, securities, asset management, and consumer banking services to corporations, governments, and individuals.

Goldman Sachs operates through three main segments: Global Banking & Markets, Asset & Wealth Management, and Platform Solutions. The Global Banking & Markets division serves as the firm's core investment banking arm, providing advisory services for mergers and acquisitions, capital raising through debt and equity underwriting, and market-making activities across fixed income, currencies, commodities, and equities. This division works with corporations, governments, and institutional investors worldwide.

The Asset & Wealth Management segment manages investments across various asset classes including equities, fixed income, and alternatives (hedge funds, private equity, real estate). The division serves both institutional clients like pension funds and individual high-net-worth clients, offering tailored investment strategies, financial planning, and private banking services including loans secured by real estate or securities.

Platform Solutions encompasses the firm's more technology-driven offerings, including consumer-focused financial products like credit cards (including the Apple Card), transaction banking services for corporate clients, and deposit-taking activities. This segment represents Goldman's expansion beyond traditional investment banking into more consumer-oriented financial services.

Goldman Sachs generates revenue through multiple streams: advisory and underwriting fees, trading commissions, asset management fees, incentive fees based on investment performance, interest income from lending activities, and investments made with the firm's own capital. The firm maintains a global footprint with significant operations in major financial centers worldwide and employs thousands of professionals across finance, technology, risk management, and other disciplines.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Goldman Sachs competes with other global investment banks including JPMorgan Chase (NYSE:JPM), Morgan Stanley (NYSE:MS), Bank of America (NYSE:BAC), and Citigroup (NYSE:C). In wealth and asset management, it faces competition from BlackRock (NYSE:BLK), Blackstone (NYSE:BX), and UBS Group (NYSE:UBS).

5. Revenue Growth

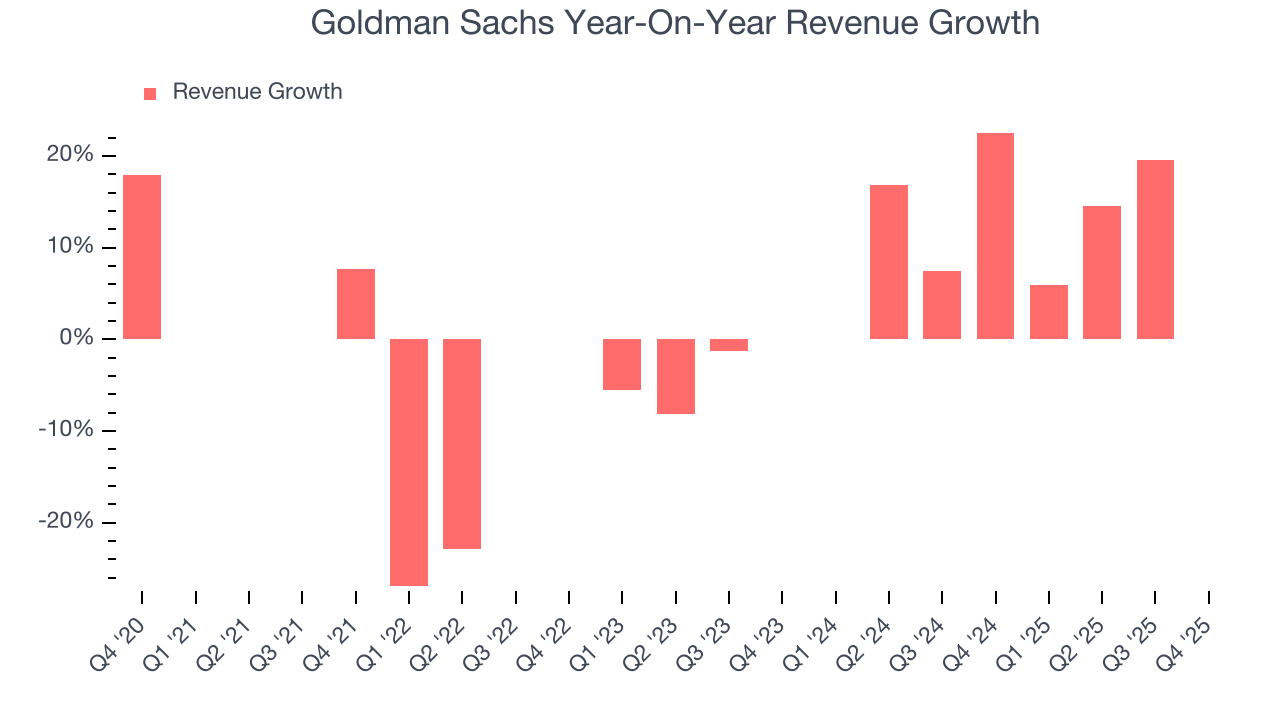

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Goldman Sachs’s 5.5% annualized revenue growth over the last five years was tepid. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Goldman Sachs.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Goldman Sachs’s annualized revenue growth of 12.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

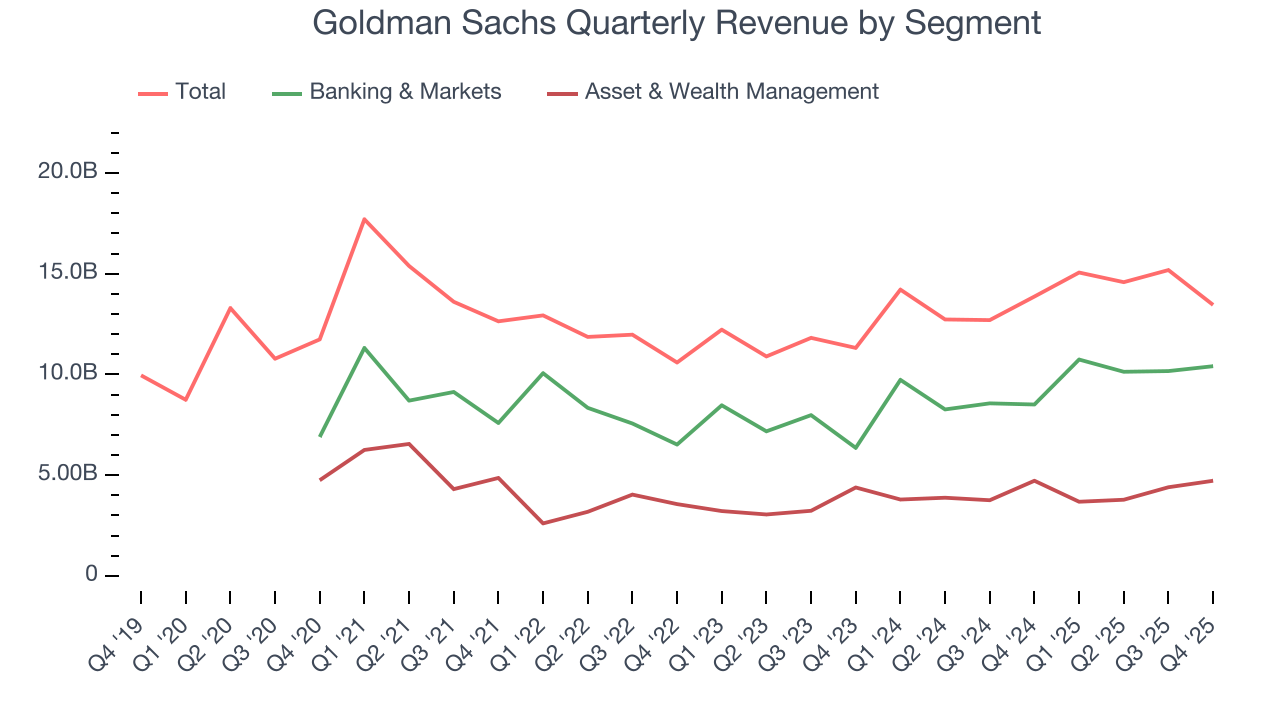

We can better understand the company’s revenue dynamics by analyzing its most important segments, Banking & Markets and Asset & Wealth Management, which are 77.4% and 35.1% of total revenue. Banking & Markets revenue grew by 6.3% and 17.6% annually over the past five and two years, respectively. At the same time, Asset & Wealth Management revenue increased by 3.8% and 9.3% per year over the past five and two years, respectively. These results underperformed its total revenue.

This quarter, Goldman Sachs’s revenue fell by 3% year on year to $13.45 billion but beat Wall Street’s estimates by 0.5%.

6. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

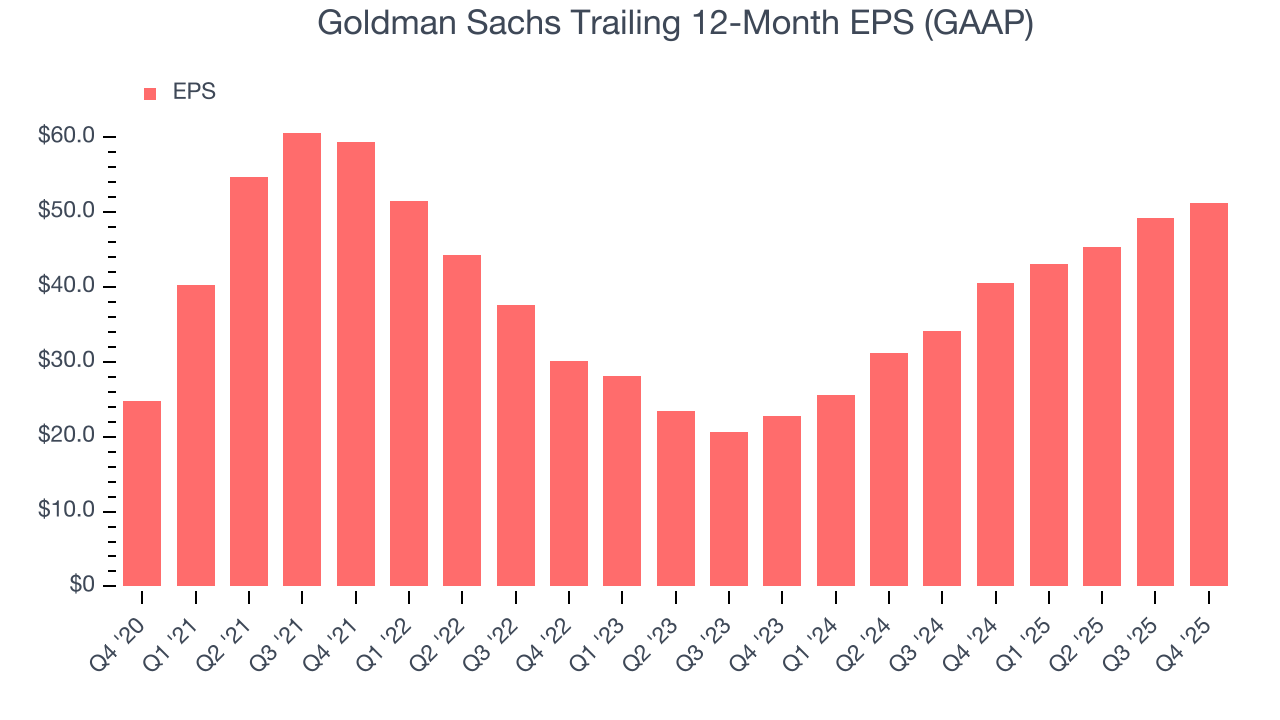

Goldman Sachs’s EPS grew at a solid 15.7% compounded annual growth rate over the last five years, higher than its 5.5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its efficiency ratio didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Goldman Sachs, its two-year annual EPS growth of 49.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Goldman Sachs reported EPS of $14.01, up from $11.95 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Goldman Sachs’s full-year EPS of $51.29 to grow 11%.

7. Tangible Book Value Per Share (TBVPS)

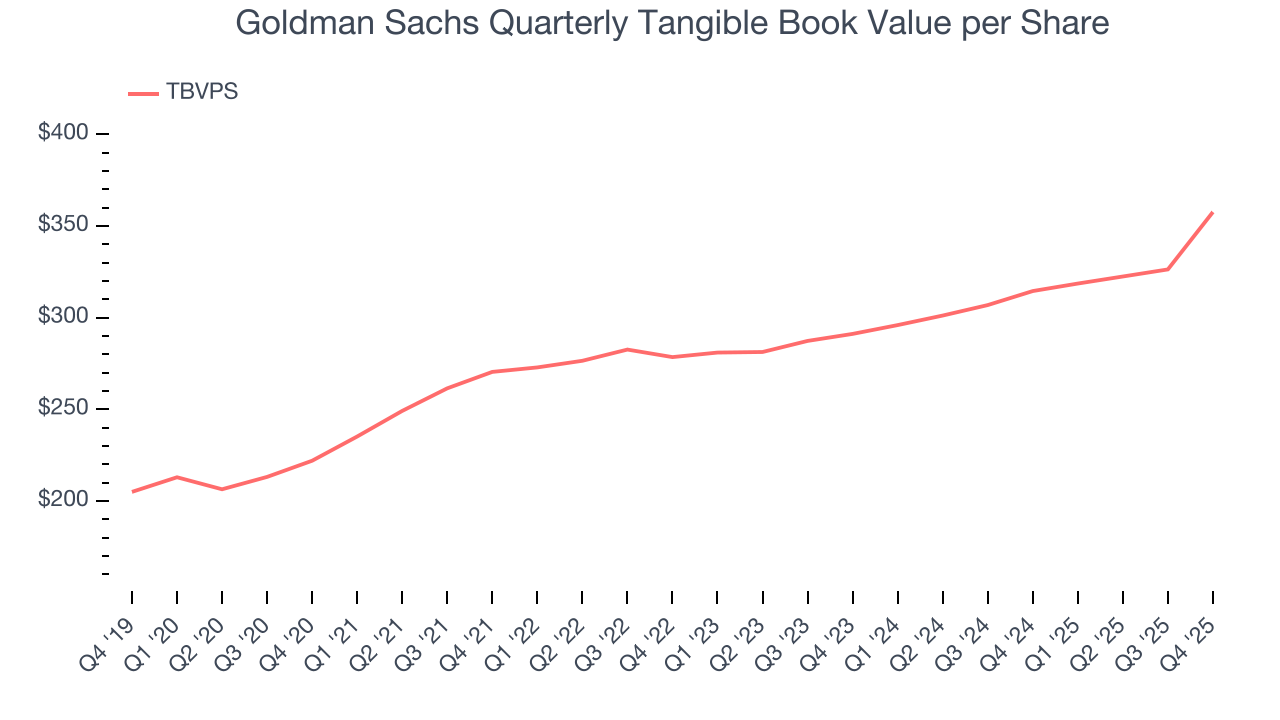

Financial institutions with multiple business lines manage complex balance sheets that span various financial activities. Market valuations reflect this operational complexity, prioritizing balance sheet strength and sustainable book value growth across all business segments.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Goldman Sachs’s TBVPS grew at a solid 10% annual clip over the last five years. The last two years show a similar trajectory as TBVPS grew by 10.8% annually from $291.15 to $357.60 per share.

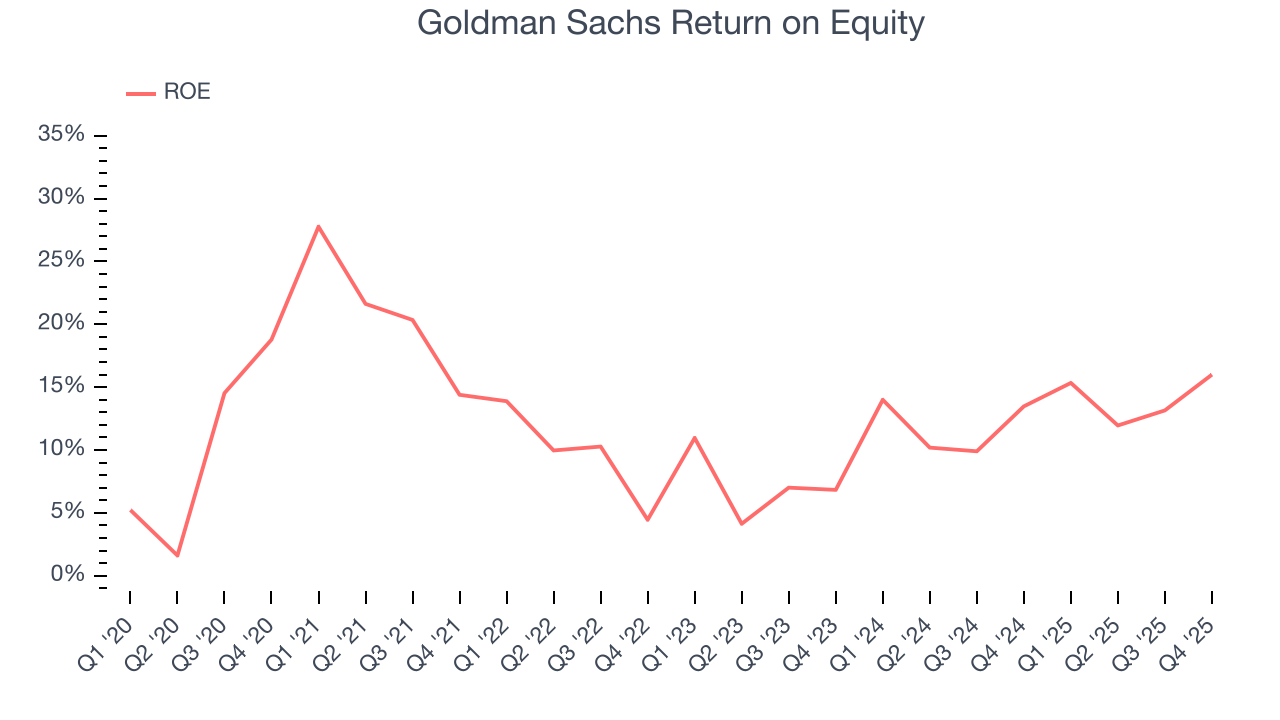

8. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Goldman Sachs has averaged an ROE of 12.8%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Goldman Sachs has a narrow competitive moat.

9. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Goldman Sachs has averaged a Tier 1 capital ratio of 15.4%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

10. Key Takeaways from Goldman Sachs’s Q4 Results

It was good to see Goldman Sachs beat analysts’ EPS expectations this quarter. We were also excited its Banking & Markets segment outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. Investors were likely hoping for more, and shares traded down 1.4% to $919.51 immediately following the results.

11. Is Now The Time To Buy Goldman Sachs?

Updated: January 15, 2026 at 7:57 AM EST

Before investing in or passing on Goldman Sachs, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Goldman Sachs is a fine business. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. On top of that, Goldman Sachs’s worsening efficiency ratio shows the business has become less productive, and the company’s solid EPS growth over the last five years shows its profits are trickling down to shareholders.

Goldman Sachs’s P/E ratio based on the next 12 months is 16.3x. Looking at the financials space right now, Goldman Sachs trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $893.79 on the company (compared to the current share price of $919.51).