Gates Industrial Corporation (GTES)

We aren’t fans of Gates Industrial Corporation. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Gates Industrial Corporation Will Underperform

Helping create one of the most memorable moments for the iconic “Jurassic Park” film, Gates (NYSE:GTES) offers power transmission and fluid transfer equipment for various industries.

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

- Low returns on capital reflect management’s struggle to allocate funds effectively

- On the bright side, its earnings per share grew by 16.8% annually over the last five years and beat its peers

Gates Industrial Corporation falls below our quality standards. Better stocks can be found in the market.

Why There Are Better Opportunities Than Gates Industrial Corporation

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Gates Industrial Corporation

Gates Industrial Corporation is trading at $27.54 per share, or 16.5x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Gates Industrial Corporation (GTES) Research Report: Q4 CY2025 Update

Power transmission and fluid power solutions provider Gates Corporation (NYSE:GTES) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 3.2% year on year to $856.2 million. Its non-GAAP profit of $0.38 per share was 4% above analysts’ consensus estimates.

Gates Industrial Corporation (GTES) Q4 CY2025 Highlights:

- Revenue: $856.2 million vs analyst estimates of $855.1 million (3.2% year-on-year growth, in line)

- Adjusted EPS: $0.38 vs analyst estimates of $0.37 (4% beat)

- Adjusted EBITDA: $187.8 million vs analyst estimates of $194.6 million (21.9% margin, 3.5% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.60 at the midpoint, beating analyst estimates by 1%

- EBITDA guidance for the upcoming financial year 2026 is $805 million at the midpoint, below analyst estimates of $811.3 million

- Operating Margin: 12.6%, in line with the same quarter last year

- Free Cash Flow Margin: 29.3%, up from 19% in the same quarter last year

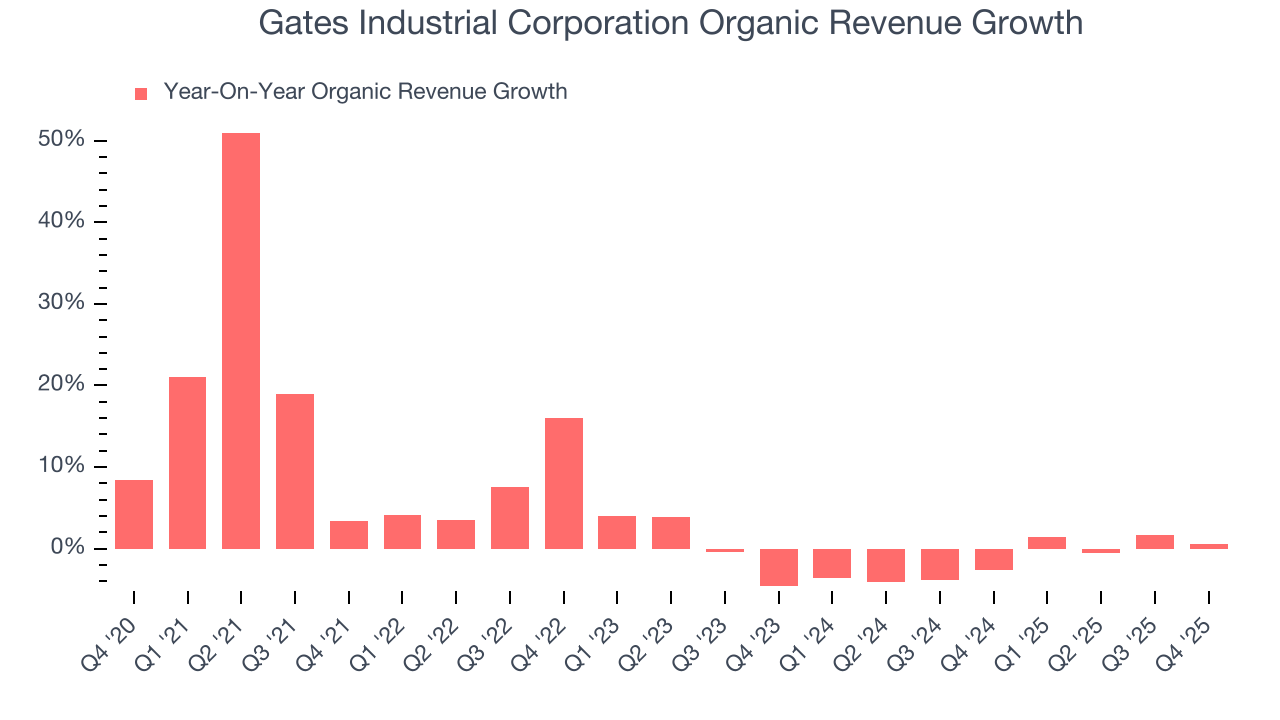

- Organic Revenue was flat year on year (miss)

- Market Capitalization: $6.85 billion

Company Overview

Helping create one of the most memorable moments for the iconic “Jurassic Park” film, Gates (NYSE:GTES) offers power transmission and fluid transfer equipment for various industries.

Founded in 1911 and headquartered in Denver, Colorado, Gates has established itself as a leader in the manufacturing of critical components.The company operates through two primary business segments: Power Transmission and Fluid Power. The Power Transmission segment focuses on the design and manufacture of elastomer drive belts and related components used to efficiently transfer power. The Fluid Power segment specializes in hoses, tubing, and fittings designed to convey hydraulic fluid at high pressures in both mobile and stationary applications, as well as other high-pressure and fluid transfer hoses.

Gates serves end markets including automotive replacement and first-fit, diversified industrial applications, industrial off-highway and on-highway, energy and resources, and personal mobility. Gates' sales and marketing strategy is tailored to serve both replacement and first-fit markets efficiently. The majority of the company's sales come from replacement channels, which provide high-margin, recurring revenue streams. Gates maintains long-standing relationships with a diverse group of customers, ranging from regional distributors to large, global multinational corporations and OEMs.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Eaton (NYSE:ETN), Parker-Hannifin (NYSE:PH), and Continental AG (FSE:CON).

5. Revenue Growth

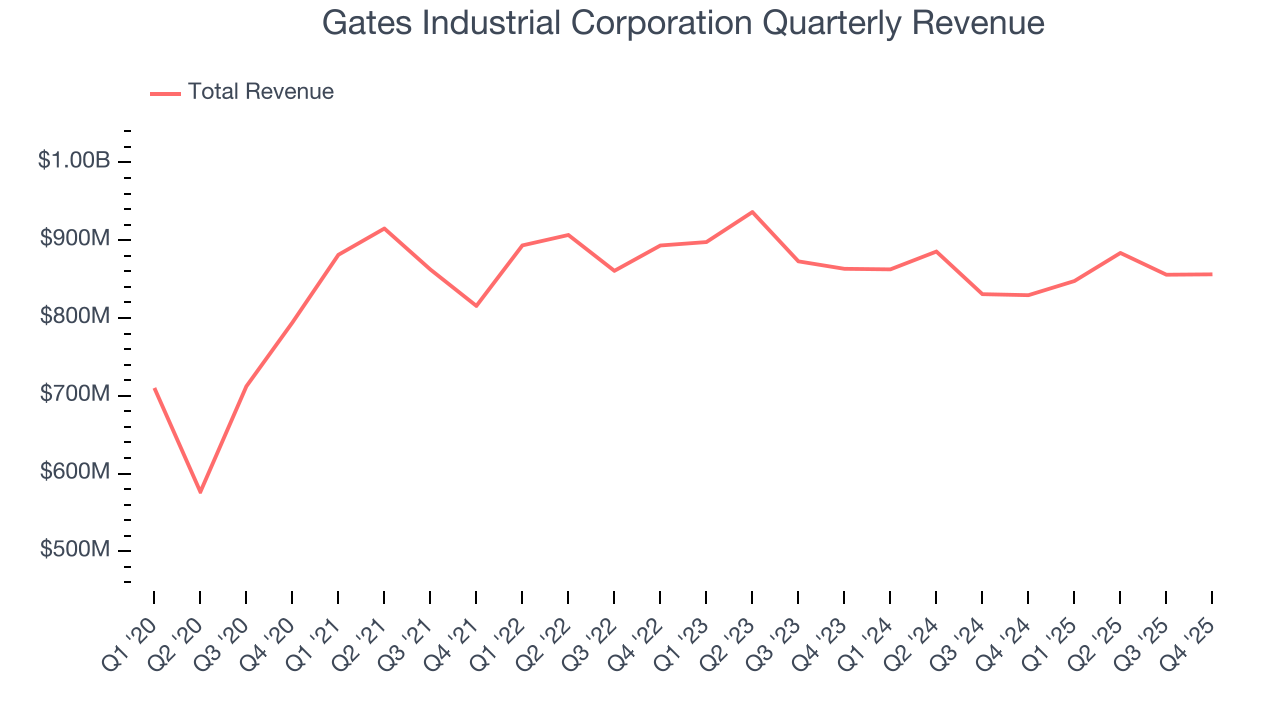

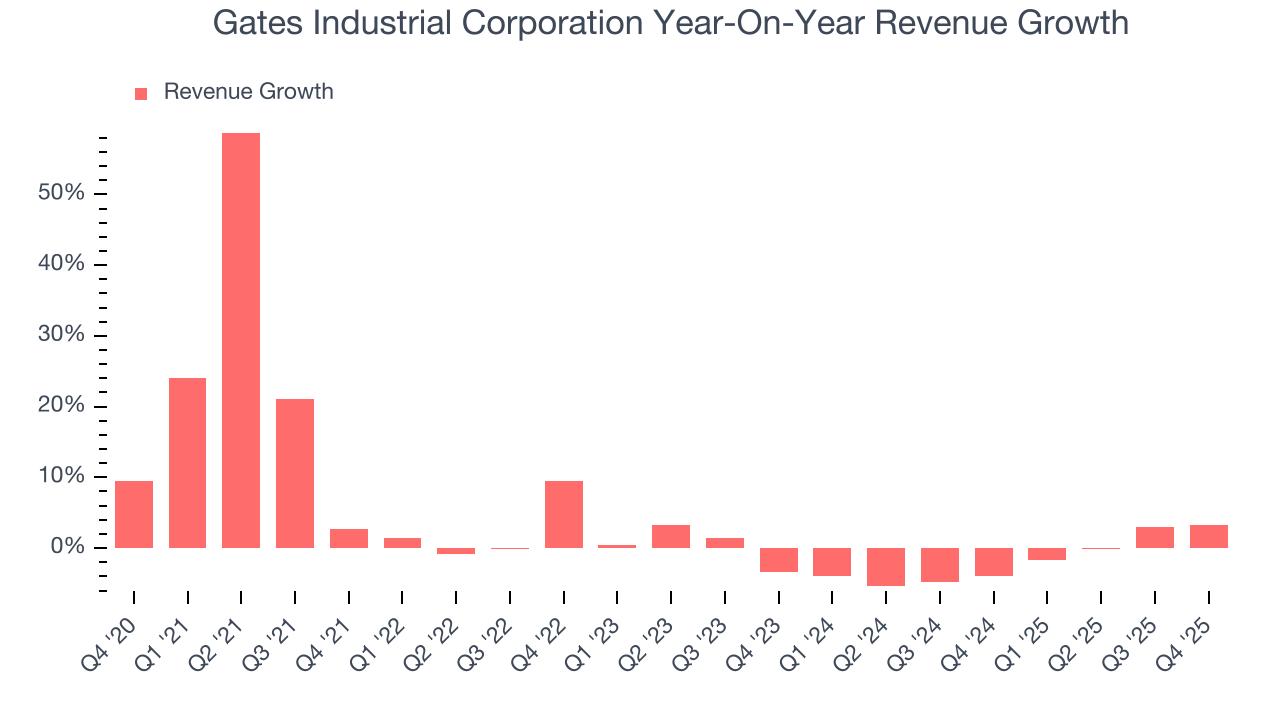

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Gates Industrial Corporation grew its sales at a sluggish 4.3% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Gates Industrial Corporation’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.8% annually.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Gates Industrial Corporation’s organic revenue averaged 1.4% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Gates Industrial Corporation grew its revenue by 3.2% year on year, and its $856.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

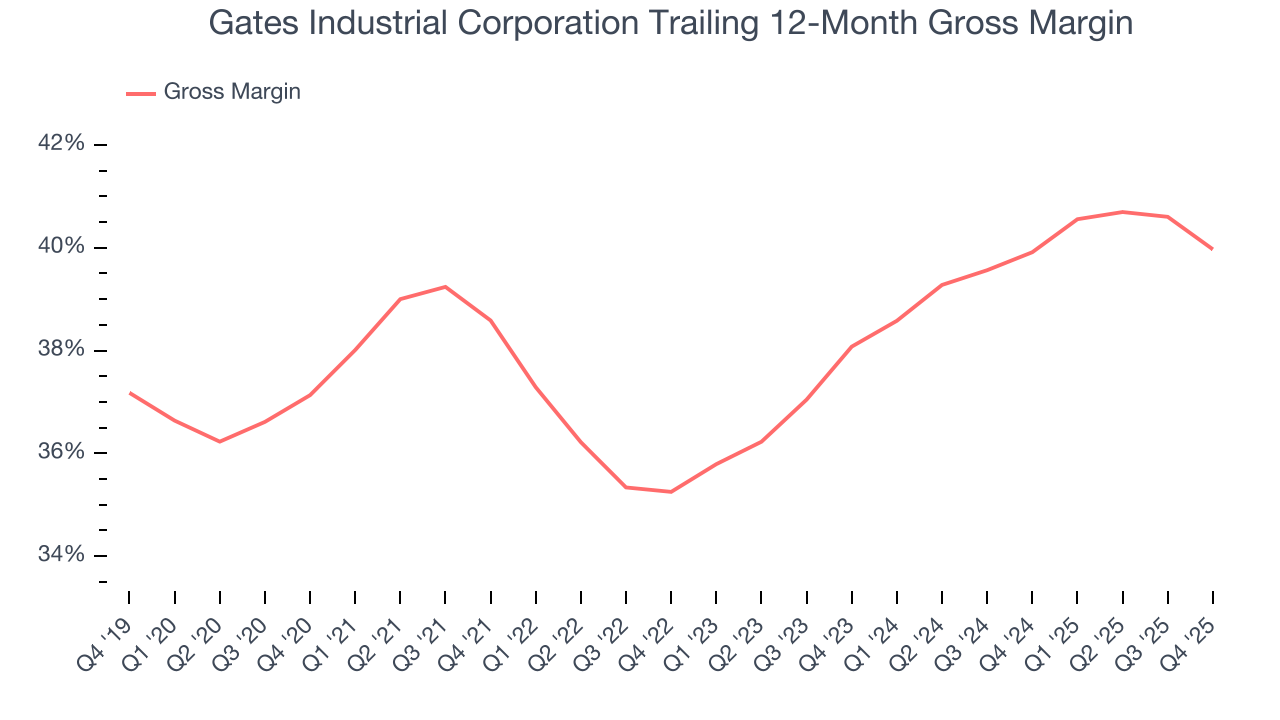

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Gates Industrial Corporation’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 38.3% gross margin over the last five years. Said differently, roughly $38.33 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Gates Industrial Corporation produced a 38% gross profit margin in Q4 , marking a 2.5 percentage point decrease from 40.5% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Gates Industrial Corporation’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 13% over the last five years. This profitability was top-notch for an industrials business, showing it’s an well-run company with an efficient cost structure. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Gates Industrial Corporation’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Gates Industrial Corporation generated an operating margin profit margin of 12.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

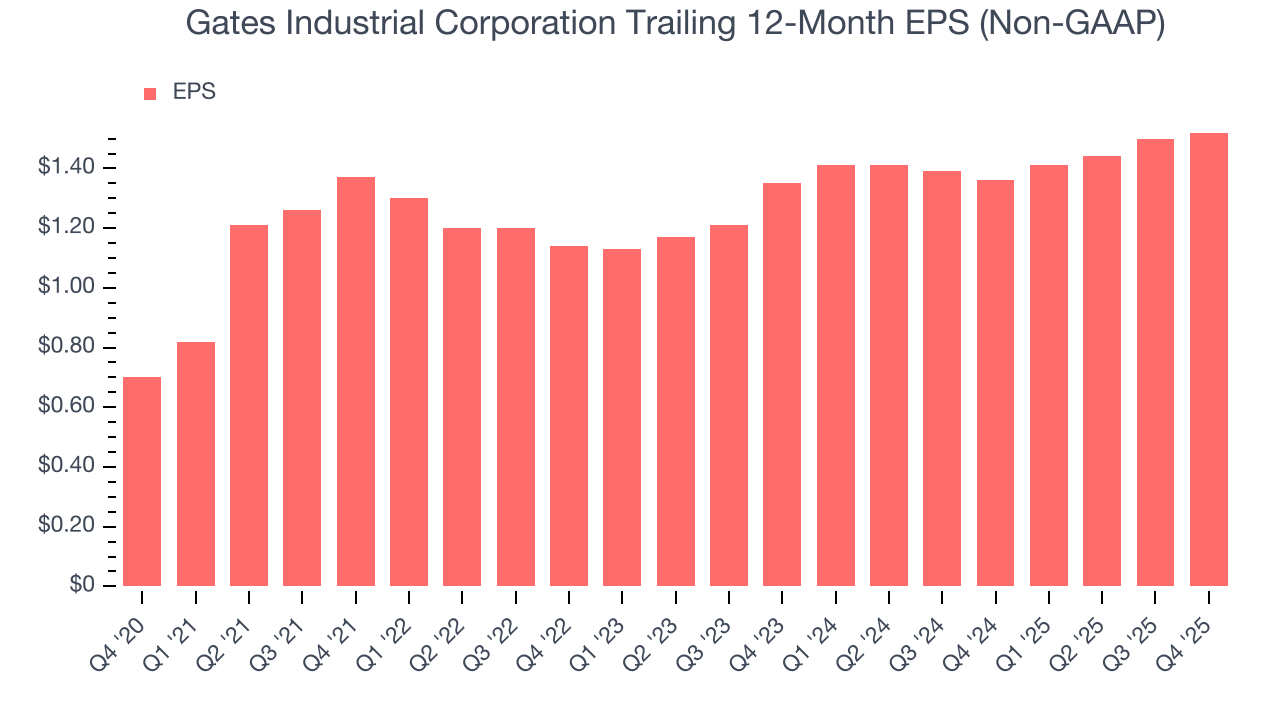

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

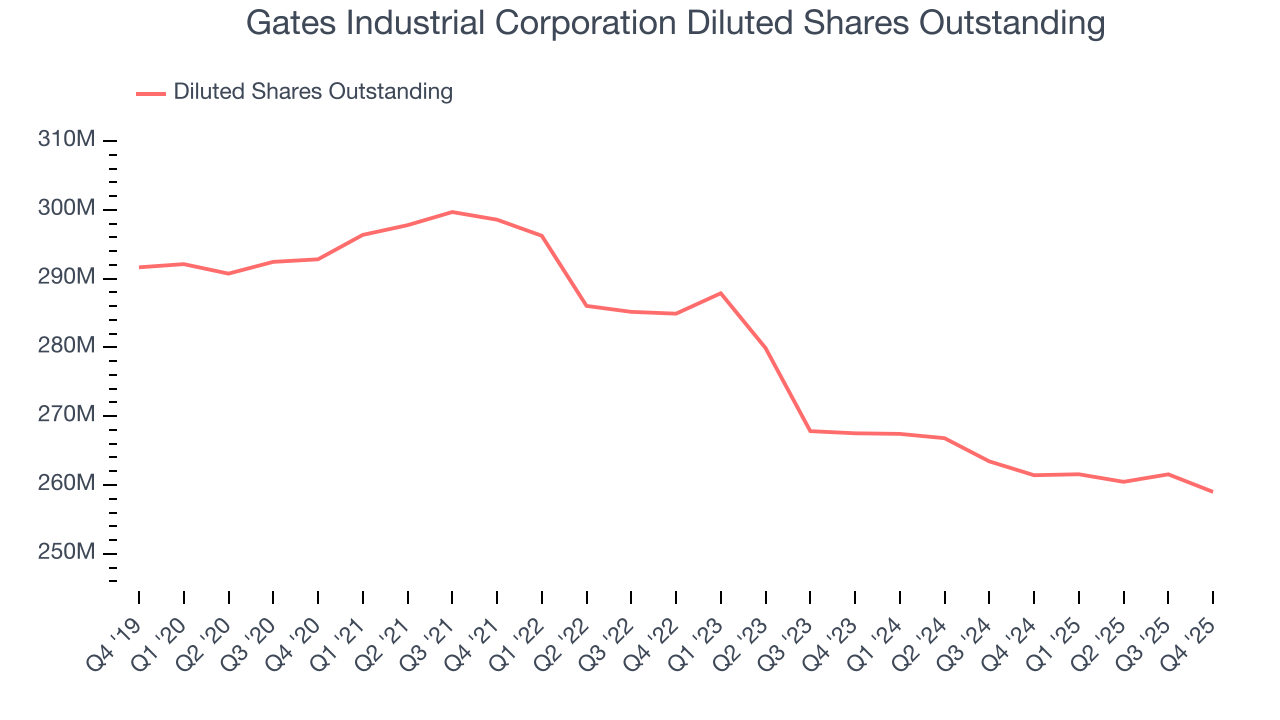

Gates Industrial Corporation’s EPS grew at a spectacular 16.8% compounded annual growth rate over the last five years, higher than its 4.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Gates Industrial Corporation’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Gates Industrial Corporation has repurchased its stock, shrinking its share count by 11.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Gates Industrial Corporation, its two-year annual EPS growth of 6.1% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Gates Industrial Corporation reported adjusted EPS of $0.38, up from $0.36 in the same quarter last year. This print beat analysts’ estimates by 4%. Over the next 12 months, Wall Street expects Gates Industrial Corporation’s full-year EPS of $1.52 to grow 4.1%.

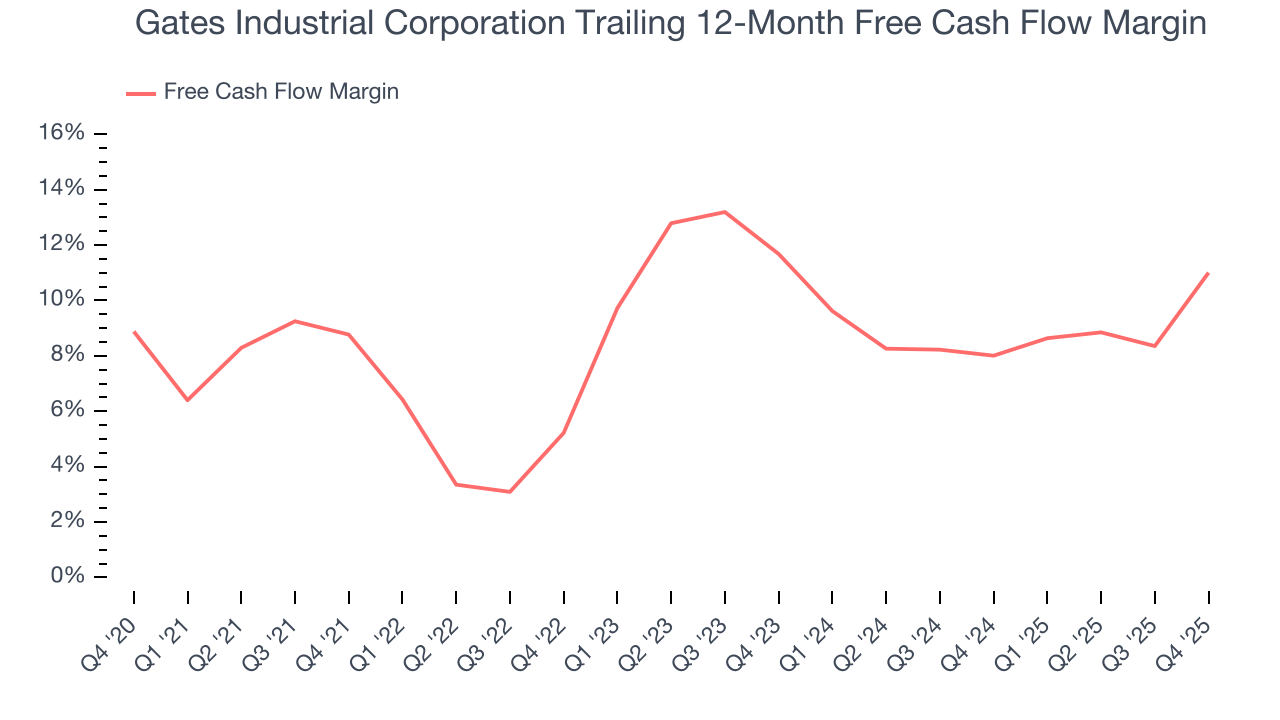

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Gates Industrial Corporation has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.9% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Gates Industrial Corporation’s margin expanded by 2.2 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Gates Industrial Corporation’s free cash flow clocked in at $251 million in Q4, equivalent to a 29.3% margin. This result was good as its margin was 10.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Gates Industrial Corporation historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.1%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Gates Industrial Corporation’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

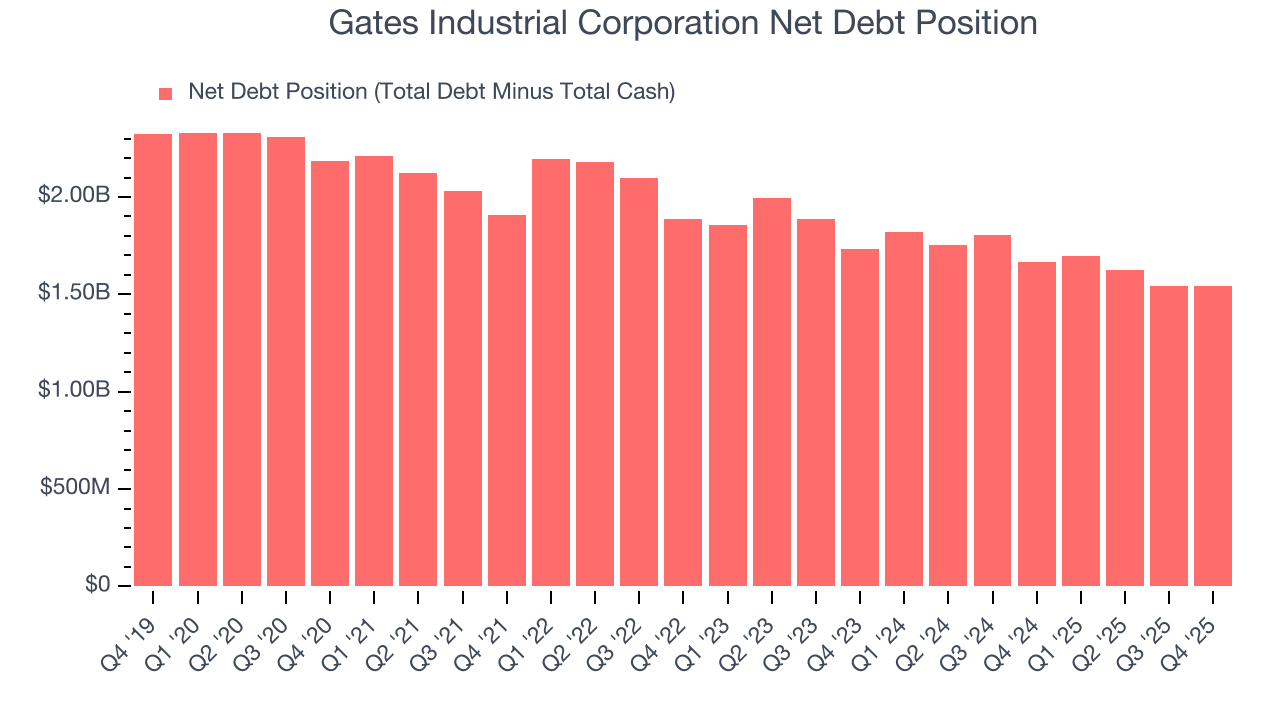

11. Balance Sheet Assessment

Gates Industrial Corporation reported $812.1 million of cash and $2.36 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $770.1 million of EBITDA over the last 12 months, we view Gates Industrial Corporation’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $53.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Gates Industrial Corporation’s Q4 Results

It was good to see Gates Industrial Corporation beat analysts’ EPS expectations this quarter. On the other hand, its EBITDA missed and its organic revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 2.8% to $27.25 immediately following the results.

13. Is Now The Time To Buy Gates Industrial Corporation?

Updated: February 12, 2026 at 10:55 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Gates Industrial Corporation.

Gates Industrial Corporation’s business quality ultimately falls short of our standards. First off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. While its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its organic revenue declined. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Gates Industrial Corporation’s P/E ratio based on the next 12 months is 16.5x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $28.33 on the company (compared to the current share price of $27.54).