Granite Construction (GVA)

Granite Construction is a sound business. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why Granite Construction Is Interesting

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE:GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 30.9% annually, topping its revenue gains

- Demand for the next 12 months is expected to accelerate above its two-year trend as Wall Street forecasts robust revenue growth of 14.5%

- On a dimmer note, its gross margin of 12.2% is below its competitors, leaving less money to invest in areas like marketing and R&D

Granite Construction has some respectable qualities. If you like the stock, the valuation looks reasonable.

Why Is Now The Time To Buy Granite Construction?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Granite Construction?

Granite Construction is trading at $133.16 per share, or 22.2x forward P/E. Granite Construction’s current valuation is below that of most industrials companies, but this doesn’t make it a bargain. Instead, the price is warranted for the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Granite Construction (GVA) Research Report: Q4 CY2025 Update

Construction and construction materials company Granite Construction (NYSE:GVA) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 19.2% year on year to $1.17 billion. The company’s full-year revenue guidance of $5 billion at the midpoint came in 2.4% above analysts’ estimates. Its non-GAAP profit of $1.40 per share was 1.8% above analysts’ consensus estimates.

Granite Construction (GVA) Q4 CY2025 Highlights:

- Revenue: $1.17 billion vs analyst estimates of $1.16 billion (19.2% year-on-year growth, 0.8% beat)

- Adjusted EPS: $1.40 vs analyst estimates of $1.38 (1.8% beat)

- Operating Margin: 6.4%, in line with the same quarter last year

- Free Cash Flow Margin: 11%, down from 14.8% in the same quarter last year

- Market Capitalization: $5.81 billion

Company Overview

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE:GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

The company's solutions typically include construction and maintenance, and its other projects consist of wastewater management and treatment facilities, underground tunneling for transit and water transportation, flood control projects, and contracting for federal agencies, including military facilities. It also produces construction materials, like asphalt and concrete, used during the construction process.

Due to its numerous product lines and service offerings, the company has multiple revenue streams. Historically, civil construction projects (highways, bridges, and tunnels) have been the biggest revenue drivers followed by the production of construction materials. The latter provides a steady source of income from sales to external customers but also supports the company’s internal project needs, giving it an advantage during times of inflated materials prices. Maintenance and service revenue is also part of the company’s business model, so it enjoys some aspect of recurring revenue.

4. Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Other companies competing in this industry include Flour (NYSE:FLR), AECON (NYSE:ACM), and private company Kiewit.

5. Revenue Growth

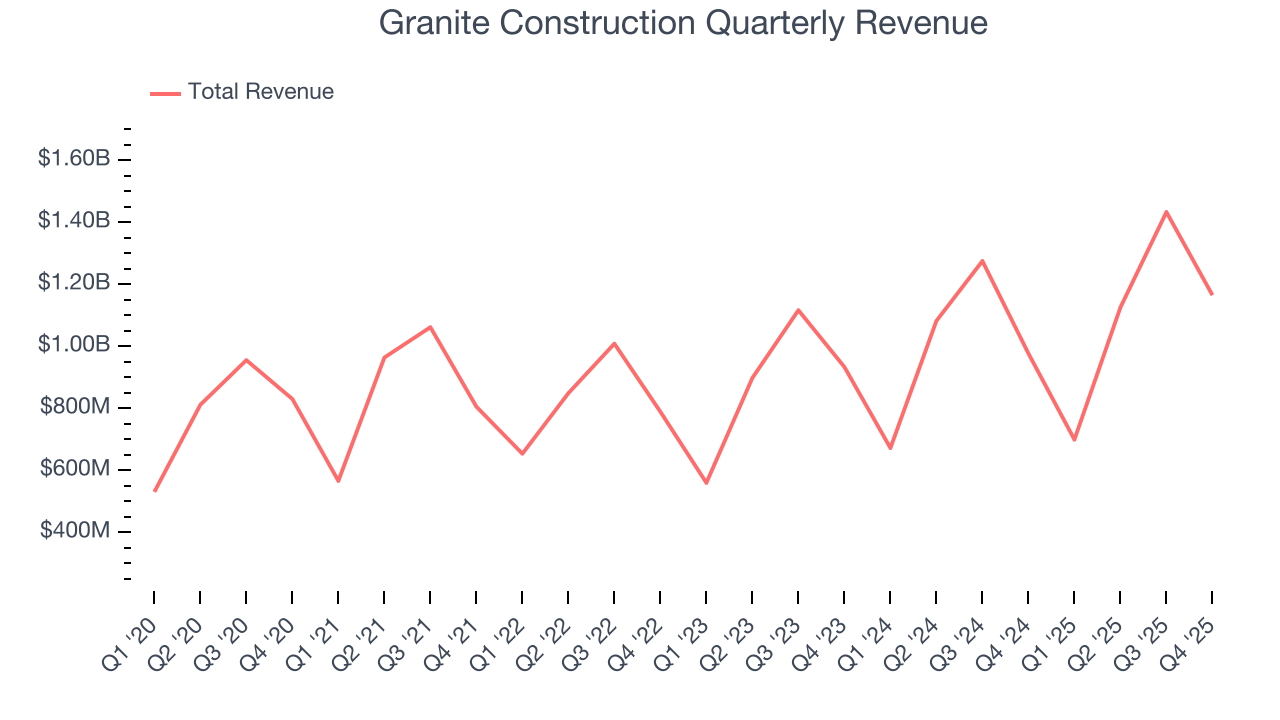

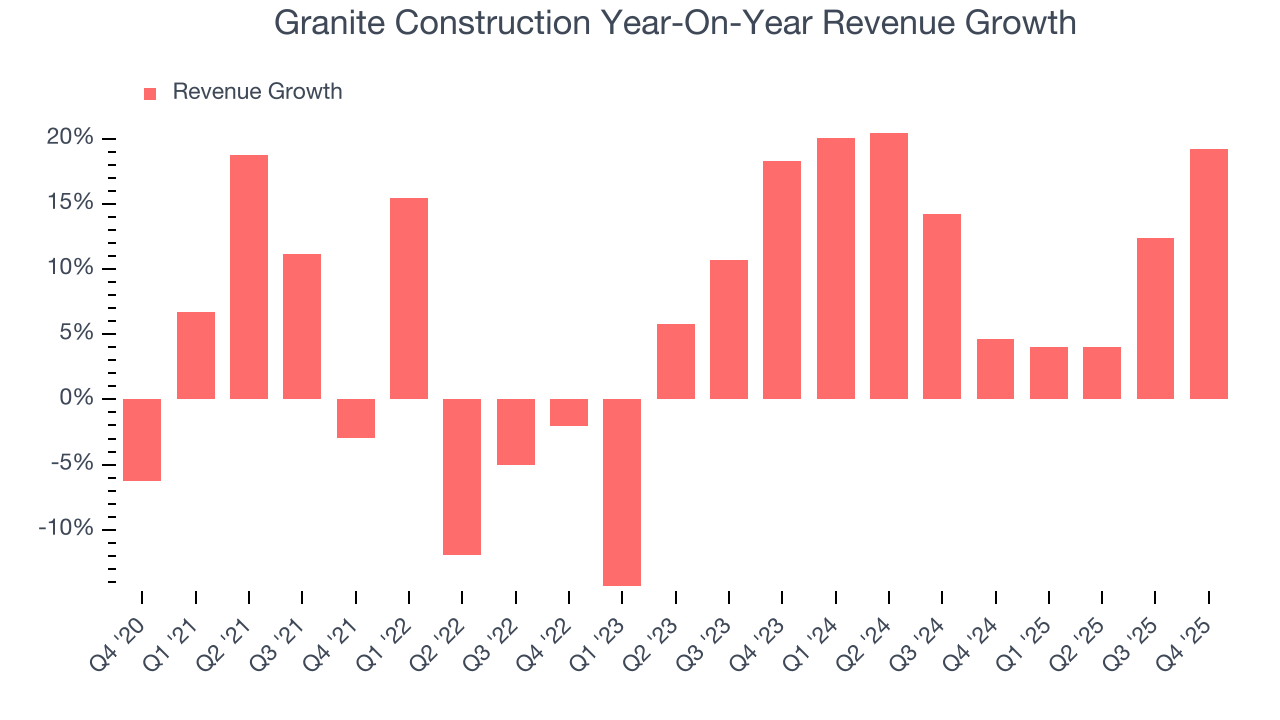

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Granite Construction’s 7.2% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Granite Construction.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Granite Construction’s annualized revenue growth of 12.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Granite Construction reported year-on-year revenue growth of 19.2%, and its $1.17 billion of revenue exceeded Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 11.1% over the next 12 months, similar to its two-year rate. Still, this projection is admirable and implies the market is forecasting success for its products and services.

6. Gross Margin & Pricing Power

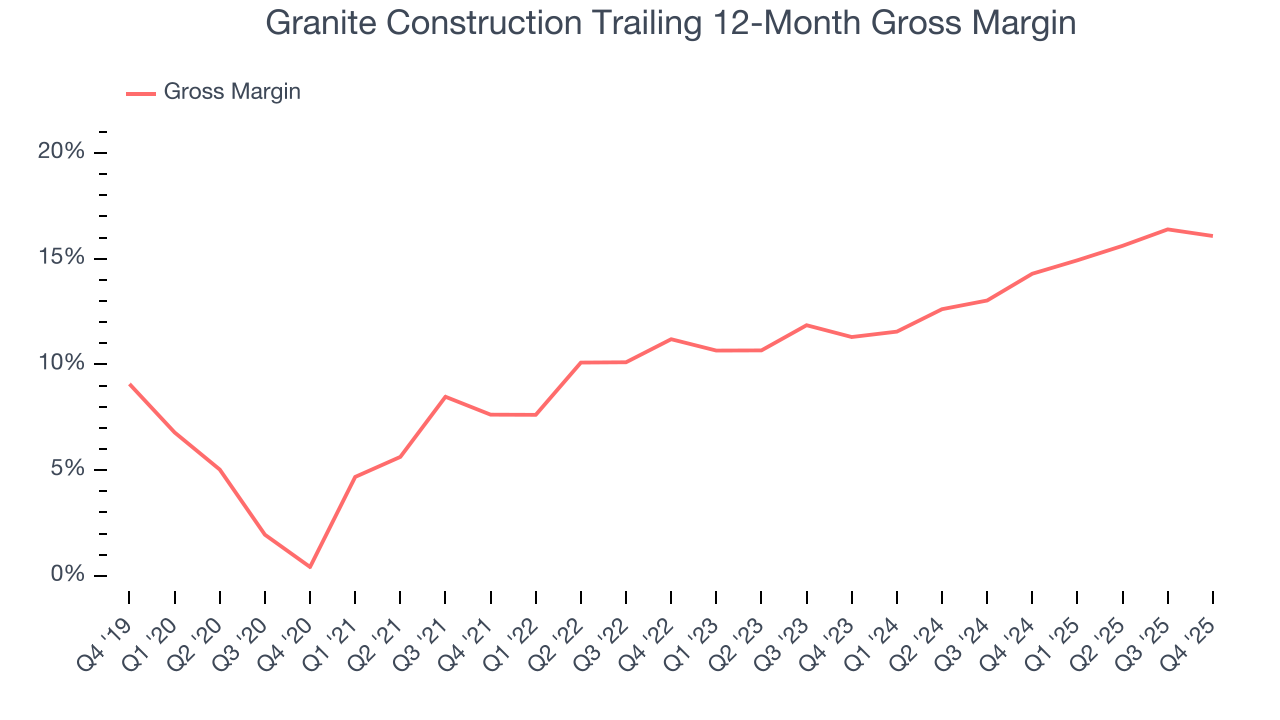

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Granite Construction has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 12.4% gross margin over the last five years. Said differently, Granite Construction had to pay a chunky $87.61 to its suppliers for every $100 in revenue.

Granite Construction’s gross profit margin came in at 14.4% this quarter, down 1 percentage points year on year. Zooming out, however, Granite Construction’s full-year margin has been trending up over the past 12 months, increasing by 1.8 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

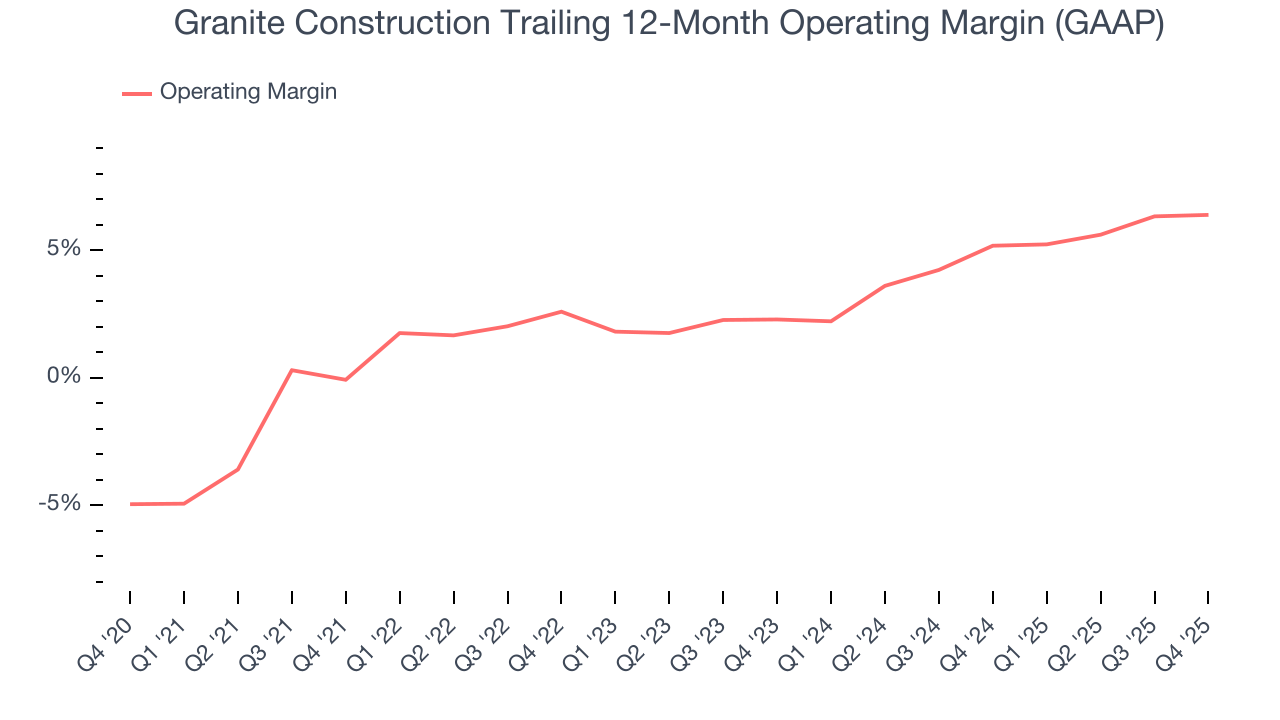

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Granite Construction was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Granite Construction’s operating margin rose by 6.5 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Granite Construction generated an operating margin profit margin of 6.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

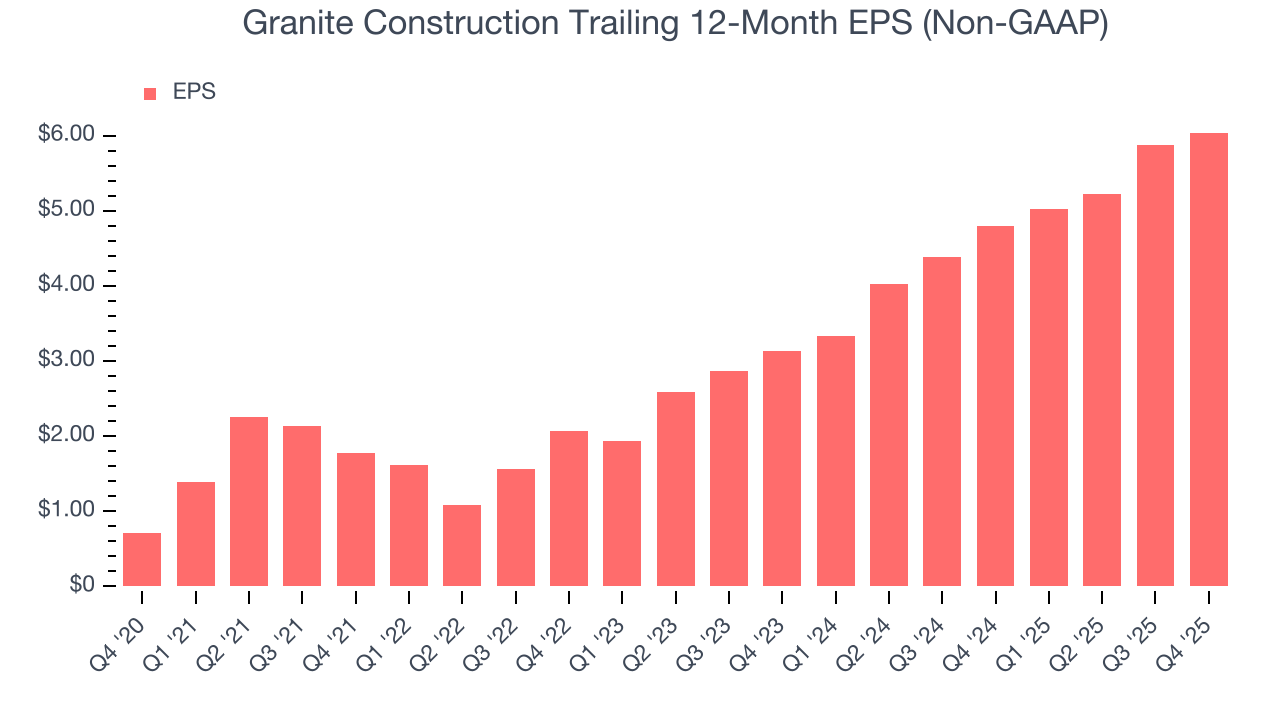

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Granite Construction’s EPS grew at an astounding 53.6% compounded annual growth rate over the last five years, higher than its 7.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Granite Construction’s earnings to better understand the drivers of its performance. As we mentioned earlier, Granite Construction’s operating margin was flat this quarter but expanded by 6.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Granite Construction, its two-year annual EPS growth of 38.9% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Granite Construction reported adjusted EPS of $1.40, up from $1.23 in the same quarter last year. This print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects Granite Construction’s full-year EPS of $6.04 to grow 2.6%.

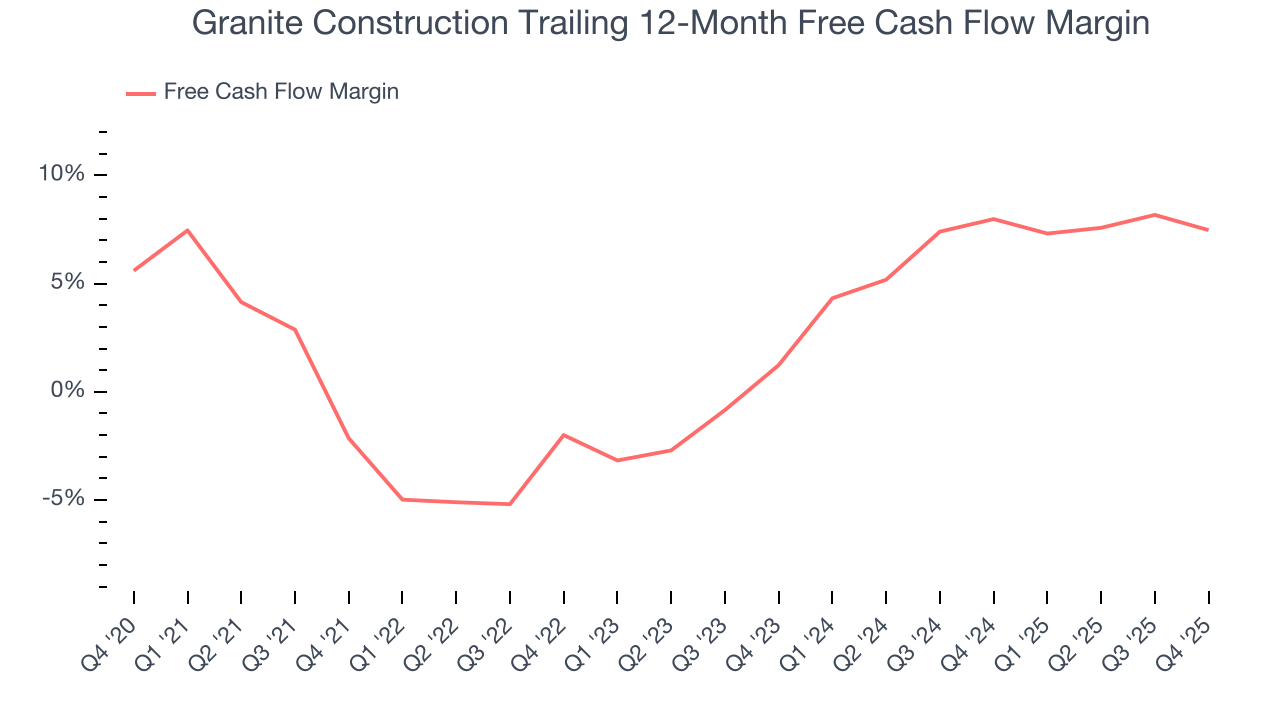

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Granite Construction has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3%, lousy for an industrials business.

Taking a step back, an encouraging sign is that Granite Construction’s margin expanded by 9.6 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Granite Construction’s free cash flow clocked in at $128.8 million in Q4, equivalent to a 11% margin. The company’s cash profitability regressed as it was 3.7 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends are more important.

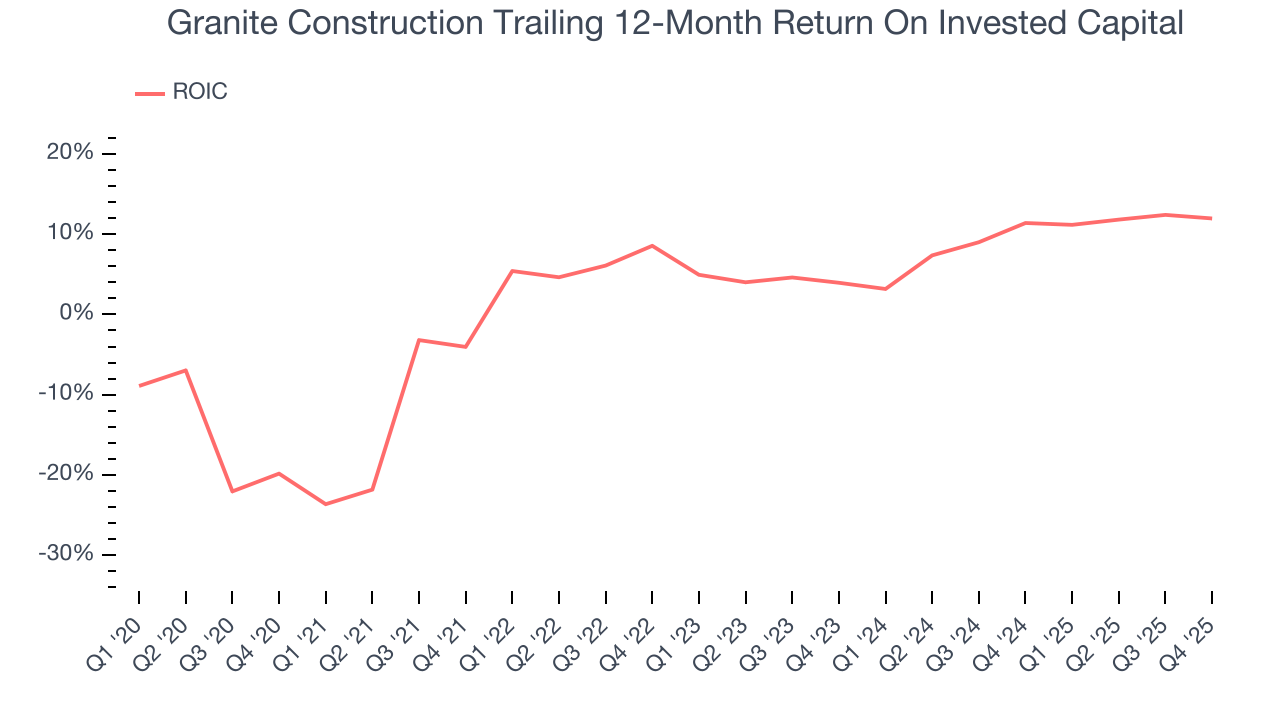

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Granite Construction has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Granite Construction’s ROIC has increased. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

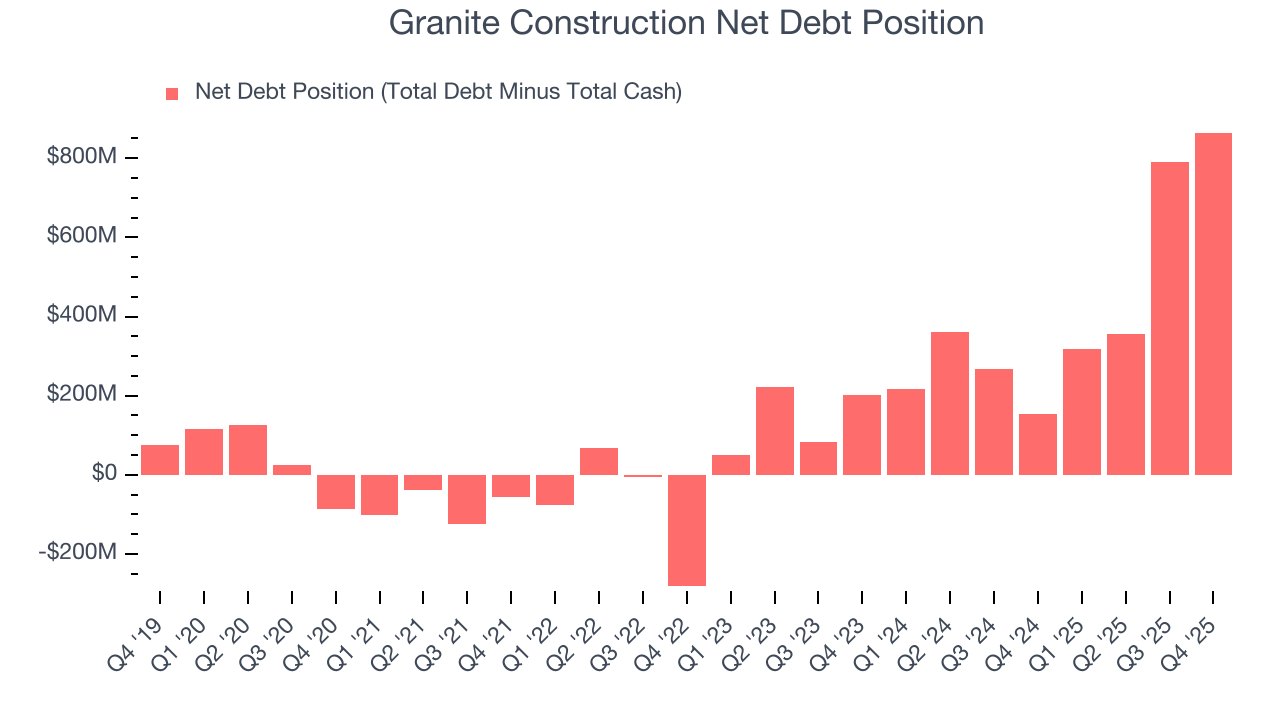

11. Balance Sheet Assessment

Granite Construction reported $600.2 million of cash and $1.46 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $527.1 million of EBITDA over the last 12 months, we view Granite Construction’s 1.6× net-debt-to-EBITDA ratio as safe. We also see its $1.73 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Granite Construction’s Q4 Results

It was great to see Granite Construction’s full-year revenue guidance top analysts’ expectations. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $133.16 immediately after reporting.

13. Is Now The Time To Buy Granite Construction?

Updated: February 12, 2026 at 7:10 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Granite Construction, you should also grasp the company’s longer-term business quality and valuation.

There’s plenty to admire about Granite Construction. Although its revenue growth was mediocre over the last five years, its growth over the next 12 months is expected to be higher. And while Granite Construction’s low gross margins indicate some combination of competitive pressures and high production costs, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Granite Construction’s P/E ratio based on the next 12 months is 21.5x. When scanning the industrials space, Granite Construction trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $135.20 on the company (compared to the current share price of $133.16).