Houlihan Lokey (HLI)

Houlihan Lokey is a special business. Its exceptional revenue growth and returns on capital show it can expand quickly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like Houlihan Lokey

Founded in 1972 and known for its expertise in complex financial situations, Houlihan Lokey (NYSE:HLI) is a global investment bank specializing in mergers and acquisitions, capital markets, financial restructurings, and valuation advisory services.

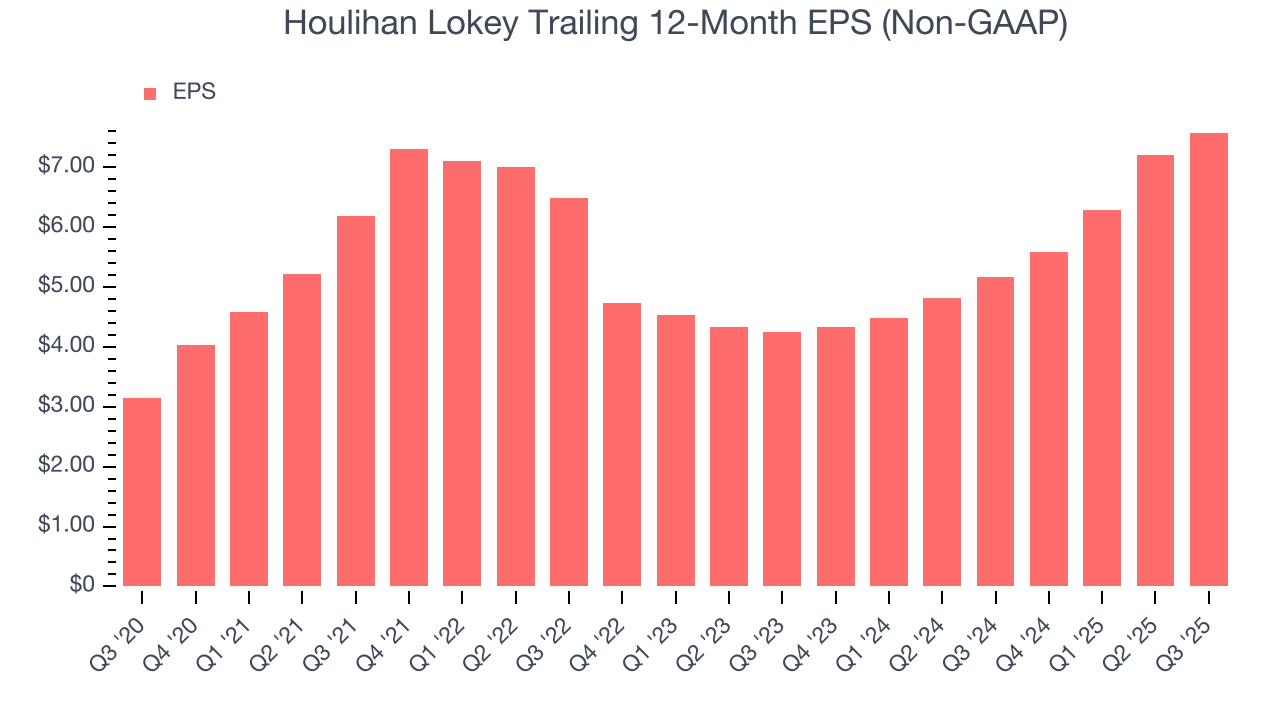

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 33.5% over the last two years outstripped its revenue performance

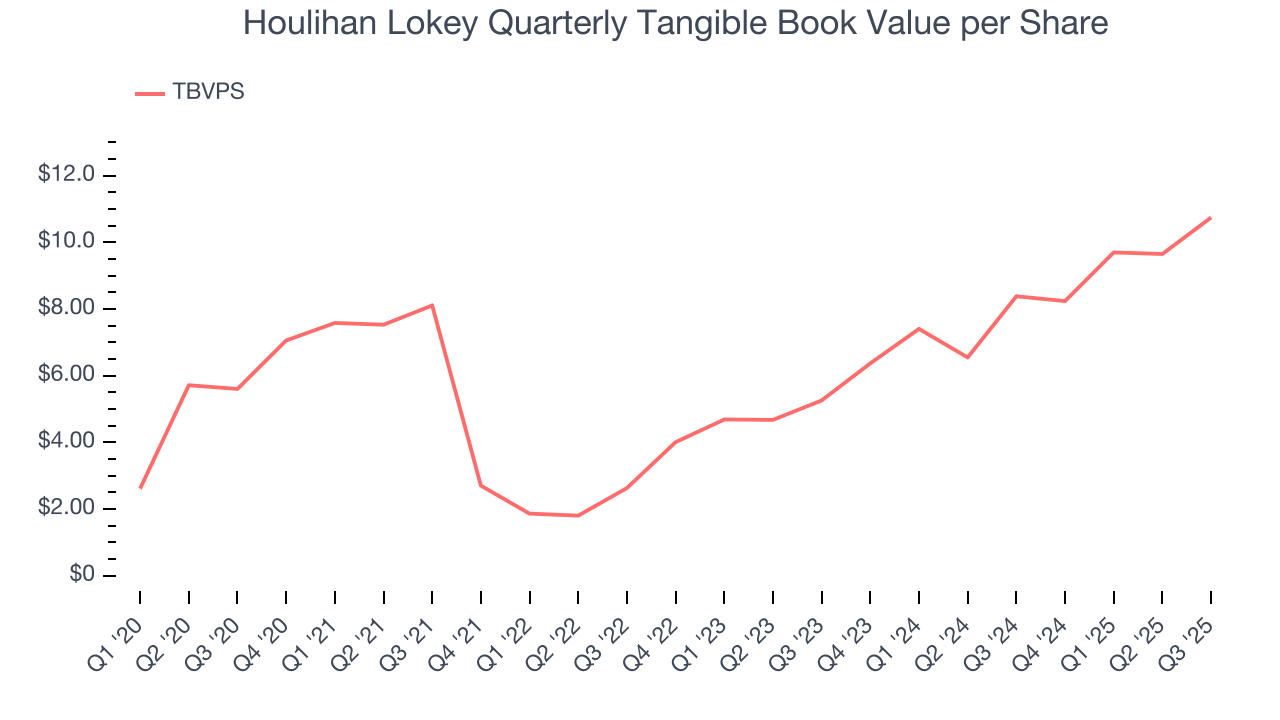

- Annual tangible book value per share growth of 42.9% over the last two years was superb and indicates its capital strength increased during this cycle

- Industry-leading 22% return on equity demonstrates management’s skill in finding high-return investments

Houlihan Lokey is a no-brainer. The price looks fair when considering its quality, and we think now is an opportune time to invest.

Why Is Now The Time To Buy Houlihan Lokey?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Houlihan Lokey?

At $186.29 per share, Houlihan Lokey trades at 23.8x forward P/E. Valuation is above that of many financials companies, but we think the price is justified given its business fundamentals.

By definition, where you buy a stock impacts returns. Still, our extensive analysis shows that investors should worry much more about business quality than entry price if the ultimate goal is long-term returns.

3. Houlihan Lokey (HLI) Research Report: Q3 CY2025 Update

Investment banking firm Houlihan Lokey (NYSE:HLI) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 14.7% year on year to $659.5 million. Its non-GAAP profit of $1.84 per share was 9.3% above analysts’ consensus estimates.

Houlihan Lokey (HLI) Q3 CY2025 Highlights:

- Revenue: $659.5 million vs analyst estimates of $652.7 million (14.7% year-on-year growth, 1% beat)

- Pre-tax Profit: $160.1 million (24.3% margin, 17.6% year-on-year growth)

- Adjusted EPS: $1.84 vs analyst estimates of $1.68 (9.3% beat)

- Market Capitalization: $13.95 billion

Company Overview

Founded in 1972 and known for its expertise in complex financial situations, Houlihan Lokey (NYSE:HLI) is a global investment bank specializing in mergers and acquisitions, capital markets, financial restructurings, and valuation advisory services.

Houlihan Lokey operates through three primary business practices. Its Corporate Finance division handles mergers, acquisitions, divestitures, and capital raising, with particular strength in sell-side advisory for mid-cap transactions—a segment often underserved by larger investment banks. The Financial Restructuring group works with distressed companies and creditor constituencies to navigate complex financial challenges, both in formal bankruptcy proceedings and out-of-court negotiations. The Financial and Valuation Advisory practice delivers specialized valuation services, transaction opinions, and financial consulting.

The firm's business model emphasizes independence and intellectual rigor, with senior-level involvement as a hallmark of its client service approach. For example, a family-owned manufacturing business seeking to sell might engage Houlihan Lokey to leverage its industry expertise and buyer relationships to maximize value, while a company facing financial distress might turn to the firm to negotiate with creditors and develop a viable restructuring plan.

Houlihan Lokey generates revenue through advisory fees, which vary based on the complexity, time requirements, and successful completion of transactions. The firm maintains a global footprint with offices across the Americas, Europe, Asia, Australia, and the Middle East, allowing it to serve clients worldwide while providing localized expertise. Its countercyclical business model is particularly notable—when economic conditions deteriorate and M&A activity slows, restructuring work often increases, helping to stabilize the firm's overall performance across different market environments.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Houlihan Lokey competes with other independent investment banks like Lazard (NYSE:LAZ), Evercore (NYSE:EVR), and PJT Partners (NYSE:PJT), as well as the investment banking divisions of larger financial institutions such as Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), and JPMorgan Chase (NYSE:JPM).

5. Revenue Growth

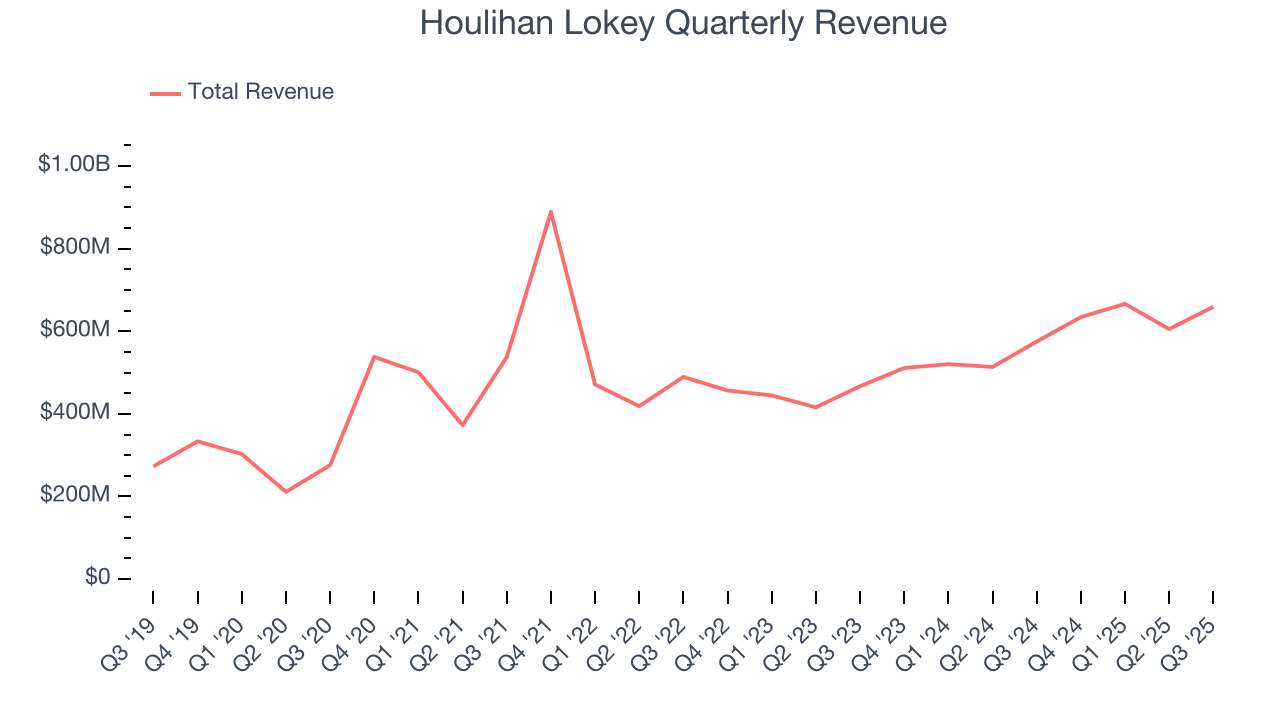

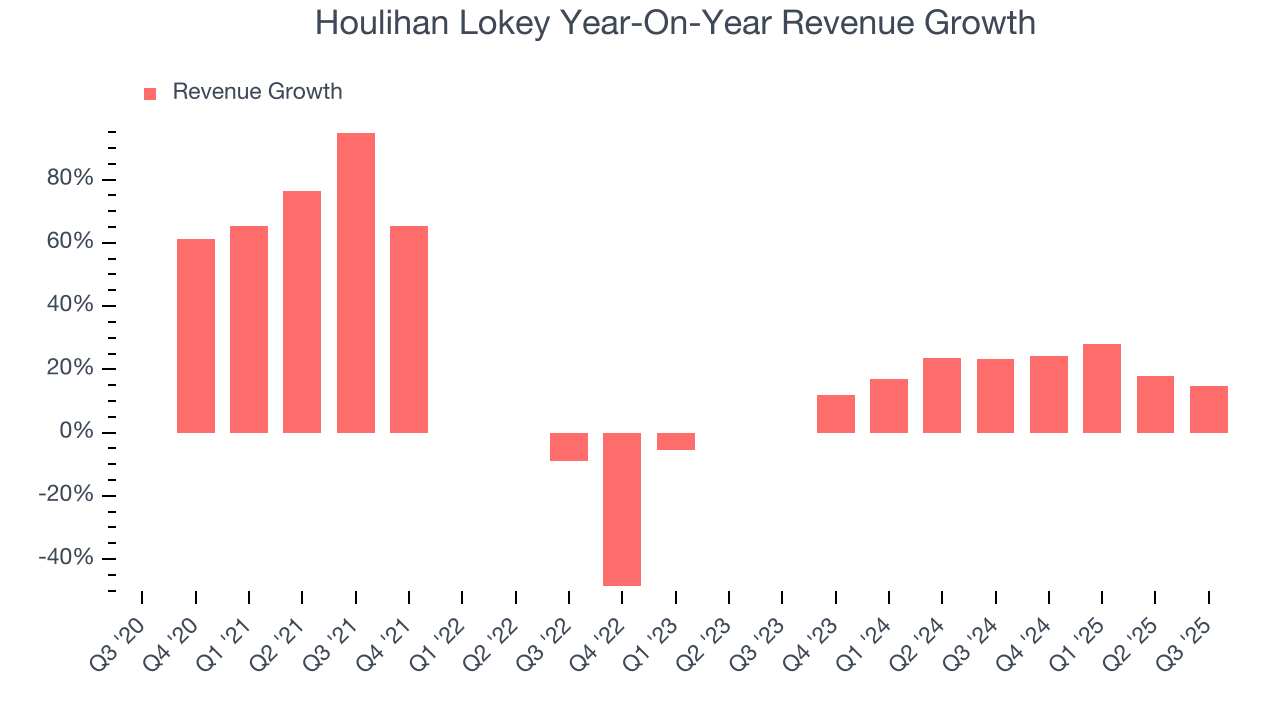

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Houlihan Lokey’s 18% annualized revenue growth over the last five years was impressive. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Houlihan Lokey’s annualized revenue growth of 19.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Houlihan Lokey reported year-on-year revenue growth of 14.7%, and its $659.5 million of revenue exceeded Wall Street’s estimates by 1%.

6. Pre-Tax Profit Margin

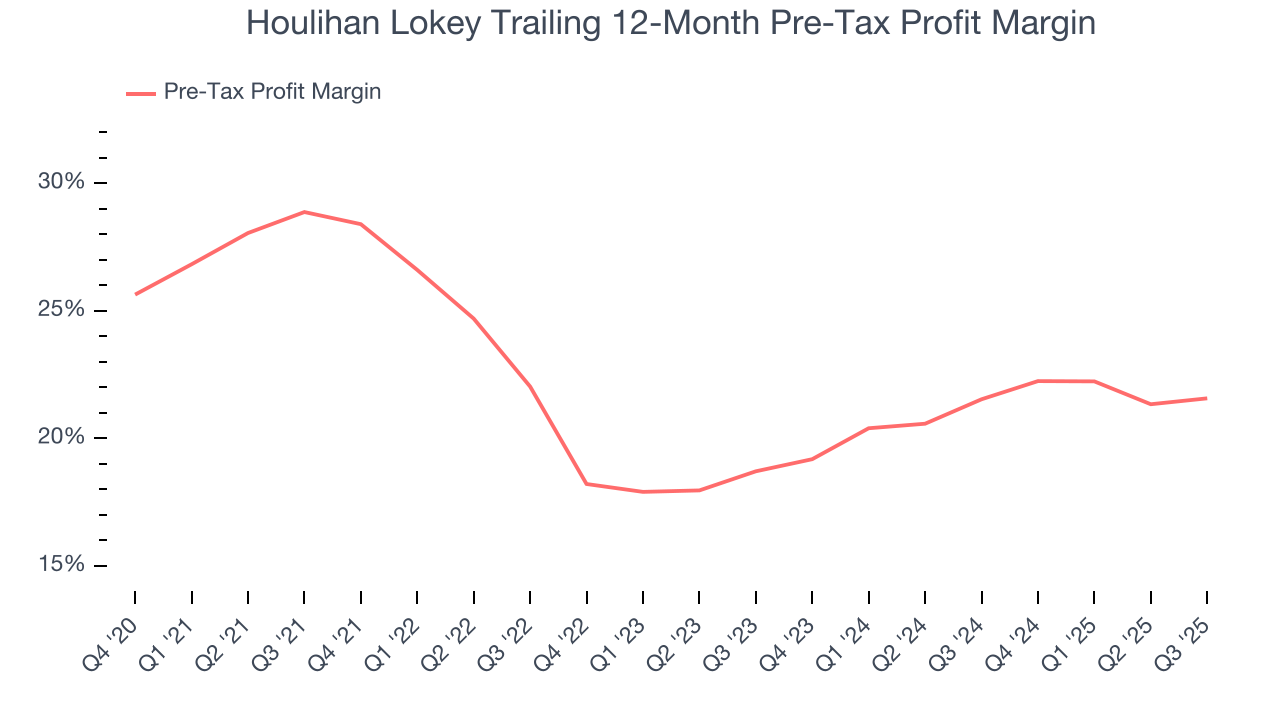

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last four years, Houlihan Lokey’s pre-tax profit margin has risen by 7.3 percentage points, going from 28.9% to 21.6%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 2.9 percentage points on a two-year basis.

Houlihan Lokey’s pre-tax profit margin came in at 24.3% this quarter. This result was in line with the same quarter last year.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Houlihan Lokey’s remarkable 19.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Houlihan Lokey’s two-year annual EPS growth of 33.5% was fantastic and topped its 19.9% two-year revenue growth.

Diving into the nuances of Houlihan Lokey’s earnings can give us a better understanding of its performance. While we mentioned earlier that Houlihan Lokey’s pre-tax profit margin was flat this quarter, a two-year view shows its margin has expanded. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Houlihan Lokey reported adjusted EPS of $1.84, up from $1.46 in the same quarter last year. This print beat analysts’ estimates by 9.3%. Over the next 12 months, Wall Street expects Houlihan Lokey’s full-year EPS of $7.58 to grow 5.4%.

8. Tangible Book Value Per Share (TBVPS)

Financial institutions manage complex balance sheets spanning various financial activities. Valuations reflect this complexity, emphasizing balance sheet quality and long-term book value compounding across multiple revenue streams.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Houlihan Lokey’s TBVPS grew at an impressive 13.9% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 42.9% annually over the last two years from $5.26 to $10.75 per share.

9. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Houlihan Lokey has averaged an ROE of 22.1%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Houlihan Lokey has a strong competitive moat.

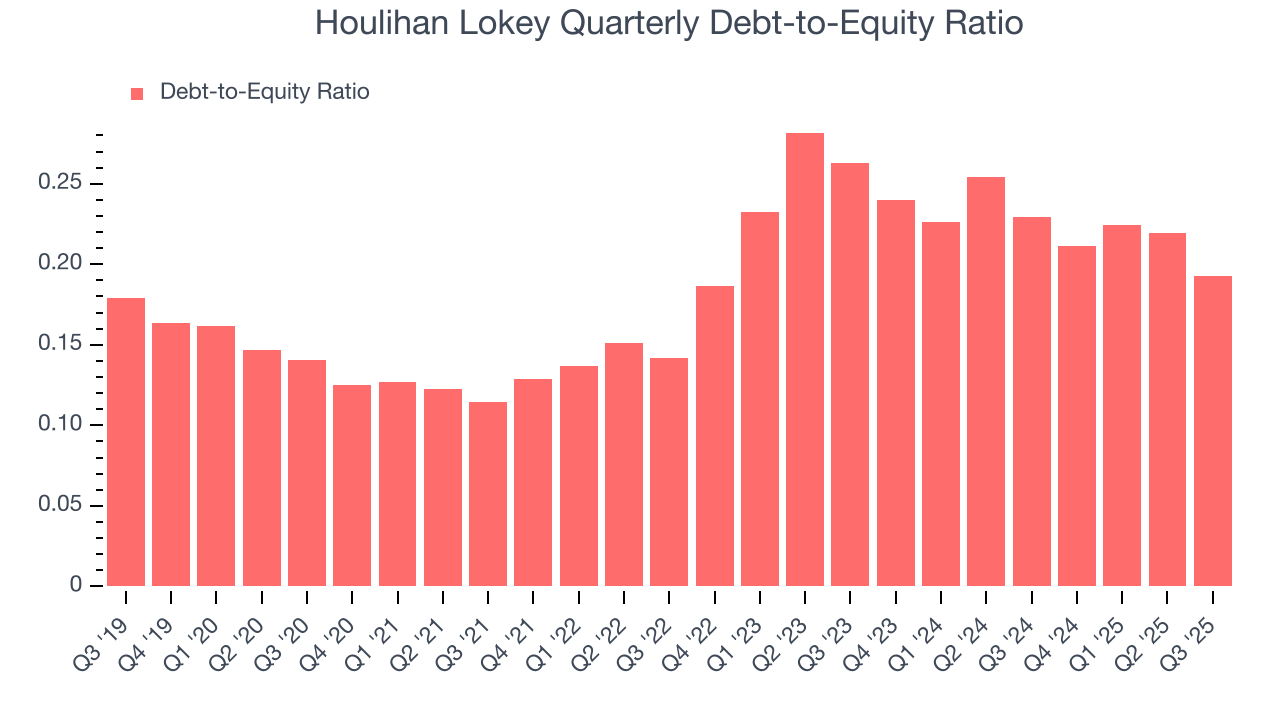

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Houlihan Lokey currently has $432.9 million of debt and $2.25 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Houlihan Lokey’s Q3 Results

It was good to see Houlihan Lokey beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $199.29 immediately following the results.

12. Is Now The Time To Buy Houlihan Lokey?

Updated: January 24, 2026 at 11:22 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Houlihan Lokey.

Houlihan Lokey is one of the best financials companies out there. First of all, the company’s revenue growth was impressive over the last five years. And while its pre-tax profit margin didn’t move over the last five years, its stellar ROE suggests it has been a well-run company historically. Additionally, Houlihan Lokey’s remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

Houlihan Lokey’s P/E ratio based on the next 12 months is 23.8x. Scanning the financials landscape today, Houlihan Lokey’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $207.75 on the company (compared to the current share price of $186.29), implying they see 11.5% upside in buying Houlihan Lokey in the short term.