Harley-Davidson (HOG)

Harley-Davidson keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Harley-Davidson Will Underperform

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

- Lackluster 1.2% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Forecasted revenue decline of 8% for the upcoming 12 months implies demand will fall even further

- 6× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Harley-Davidson doesn’t meet our quality standards. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Harley-Davidson

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Harley-Davidson

Harley-Davidson’s stock price of $20.22 implies a valuation ratio of 14.5x forward P/E. Yes, this valuation multiple is lower than that of other consumer discretionary peers, but we’ll remind you that you often get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Harley-Davidson (HOG) Research Report: Q3 CY2025 Update

American motorcycle manufacturing company Harley-Davidson (NYSE:HOG) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 16.5% year on year to $1.34 billion. Its non-GAAP profit of $3.10 per share was 88.8% above analysts’ consensus estimates.

Harley-Davidson (HOG) Q3 CY2025 Highlights:

- Revenue: $1.34 billion vs analyst estimates of $1.3 billion (16.5% year-on-year growth, 2.8% beat)

- Adjusted EPS: $3.10 vs analyst estimates of $1.64 (88.8% beat)

- Adjusted EBITDA: $418.2 million vs analyst estimates of $265.9 million (31.2% margin, 57.3% beat)

- Operating Margin: 35.4%, up from 9.2% in the same quarter last year

- Free Cash Flow was -$129.1 million, down from $300.4 million in the same quarter last year

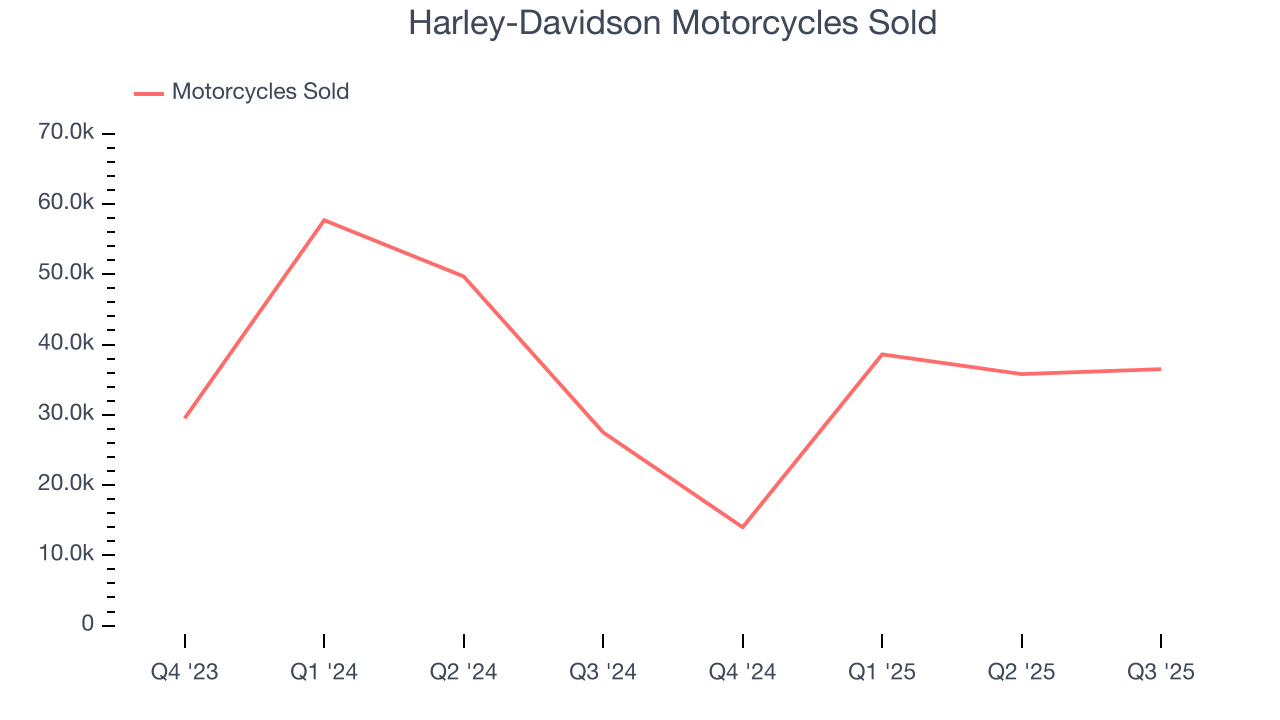

- Motorcycles Sold: 36,500, up 9,000 year on year

- Market Capitalization: $2.37 billion

Company Overview

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson was established to fulfill the need for a powerful and reliable motorcycle. Its creation was driven by the founders' passion for mechanics and the freedom of the road, leading to the production of motorcycles that would become symbols of American culture and craftsmanship.

Harley-Davidson manufactures and sells an array of heavyweight motorcycles, along with motorcycle parts, accessories, and general merchandise. The company's products are known for their distinctive design, sound, and performance, catering to a global community of enthusiasts seeking the Harley-Davidson riding experience. Additionally, Harley-Davidson offers motorcycle financing services, enhancing accessibility for buyers.

The company's revenue model is multifaceted, encompassing the sale of motorcycles, parts, and accessories, alongside offering financial services such as loans and insurance for buyers. Harley-Davidson also earns from licensing its brand to a variety of merchandise. Its distribution strategy relies on a global network of independent dealerships which also provide maintenance services, further enhancing revenue.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the recreational vehicle industry include Polaris (NYSE:PII), Honda (NYSE:HMC), and Arcimoto (NASDAQ:FUV).

5. Revenue Growth

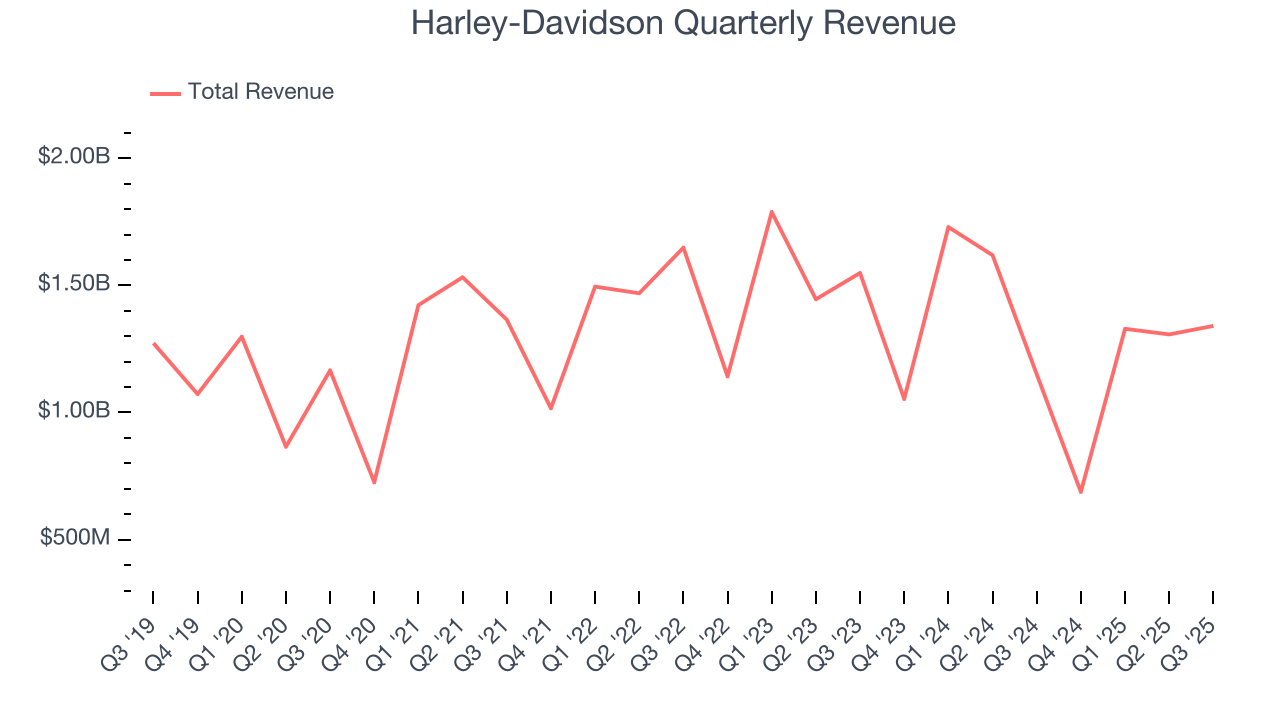

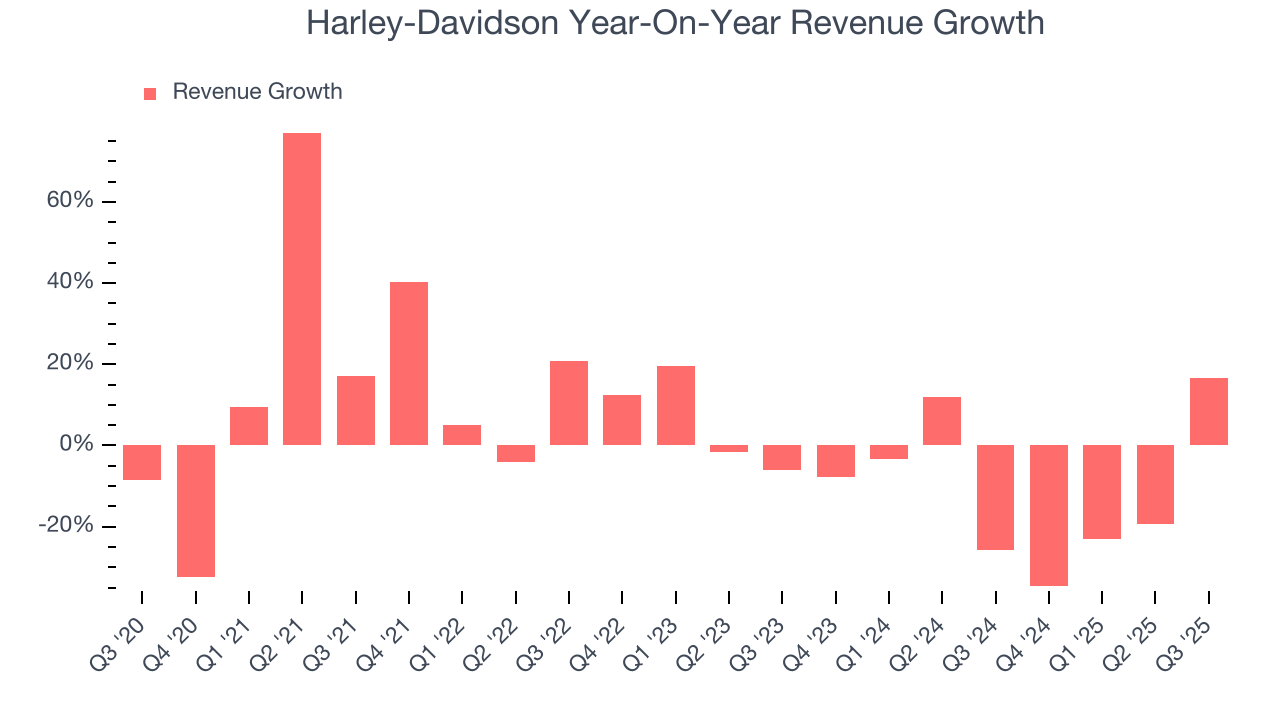

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Harley-Davidson’s 1.2% annualized revenue growth over the last five years was weak. This fell short of our benchmarks and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Harley-Davidson’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 11.3% annually.

We can better understand the company’s revenue dynamics by analyzing its number of motorcycles sold, which reached 36,500 in the latest quarter. Over the last two years, Harley-Davidson’s motorcycles sold averaged 20.2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Harley-Davidson reported year-on-year revenue growth of 16.5%, and its $1.34 billion of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to decline by 8% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

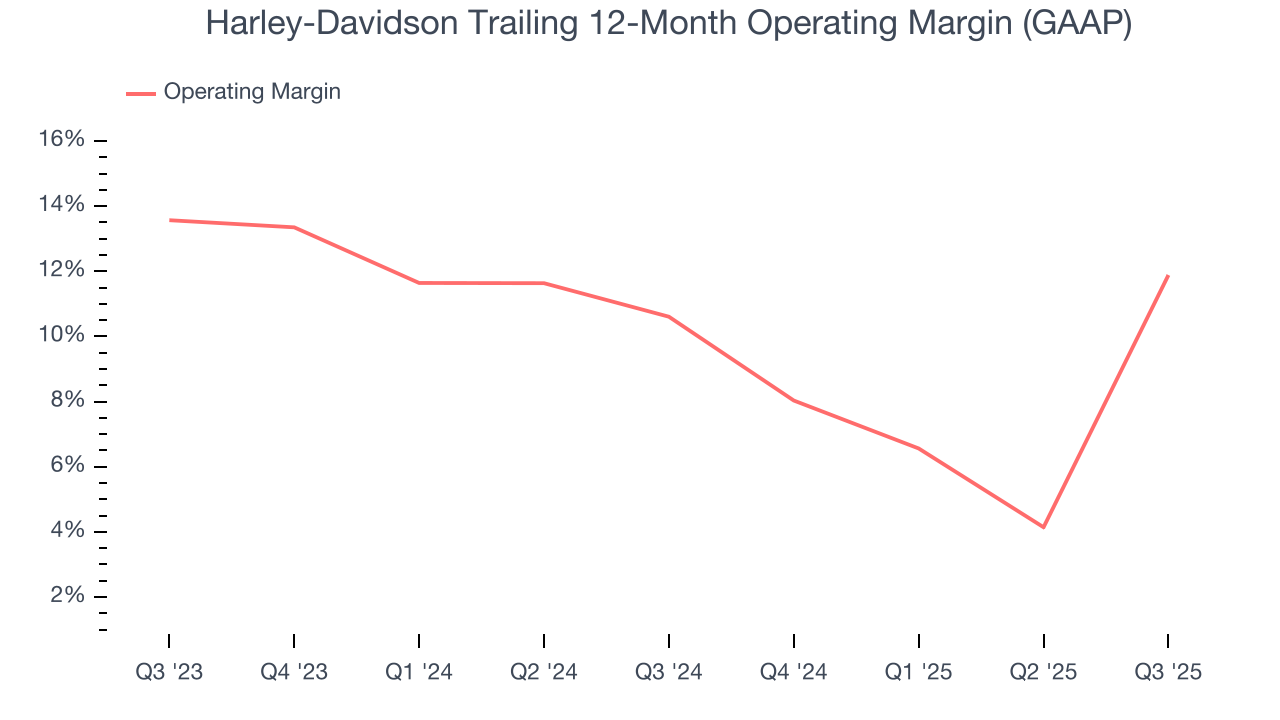

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Harley-Davidson’s operating margin has risen over the last 12 months and averaged 11.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Harley-Davidson generated an operating margin profit margin of 35.4%, up 26.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

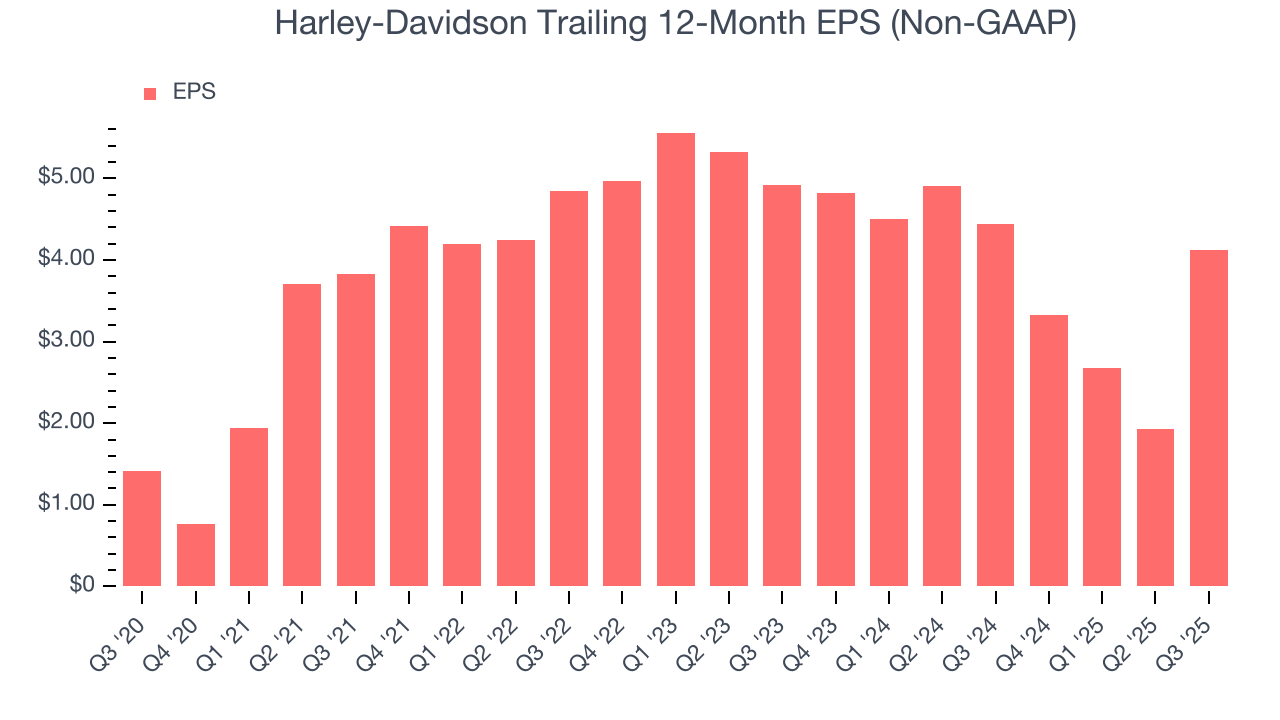

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Harley-Davidson’s EPS grew at an unimpressive 23.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.2% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Harley-Davidson reported adjusted EPS of $3.10, up from $0.91 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Harley-Davidson’s full-year EPS of $4.12 to shrink by 65.7%.

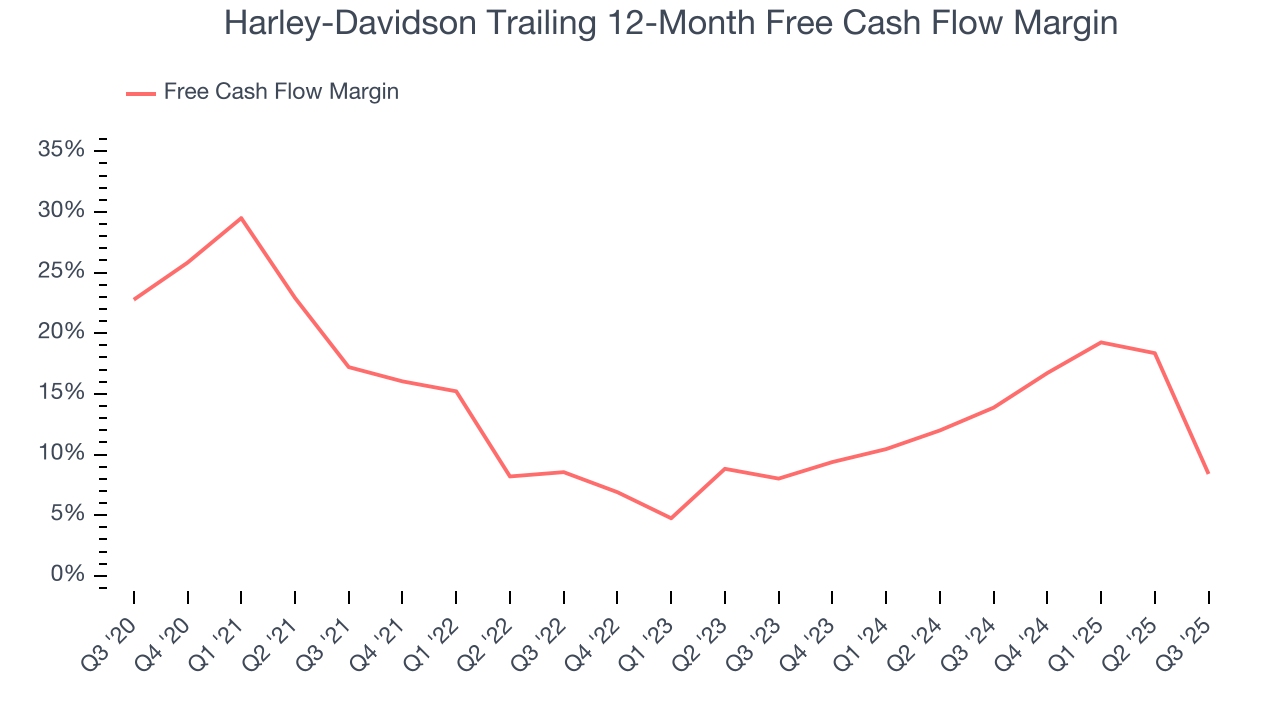

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Harley-Davidson has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.4%, lousy for a consumer discretionary business.

Harley-Davidson burned through $129.1 million of cash in Q3, equivalent to a negative 9.6% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Harley-Davidson’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 8.4% for the last 12 months will decrease to 9.9%.

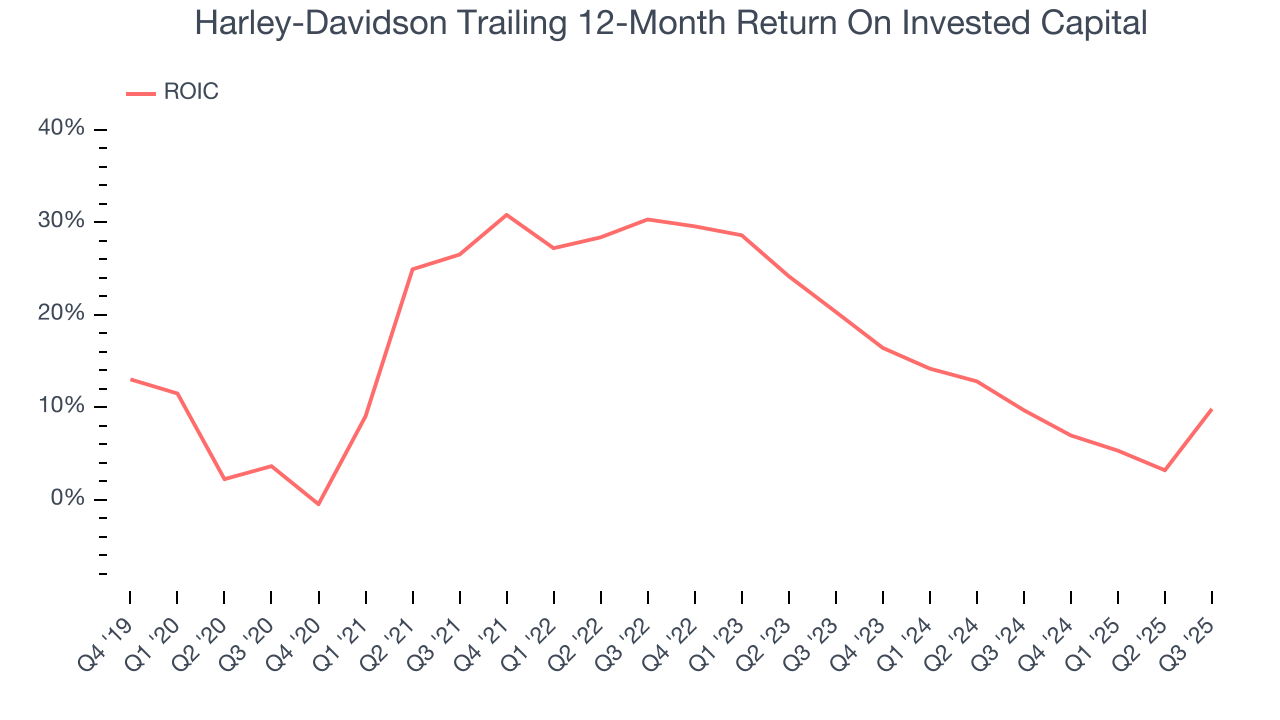

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Harley-Davidson historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 19.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Harley-Davidson’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

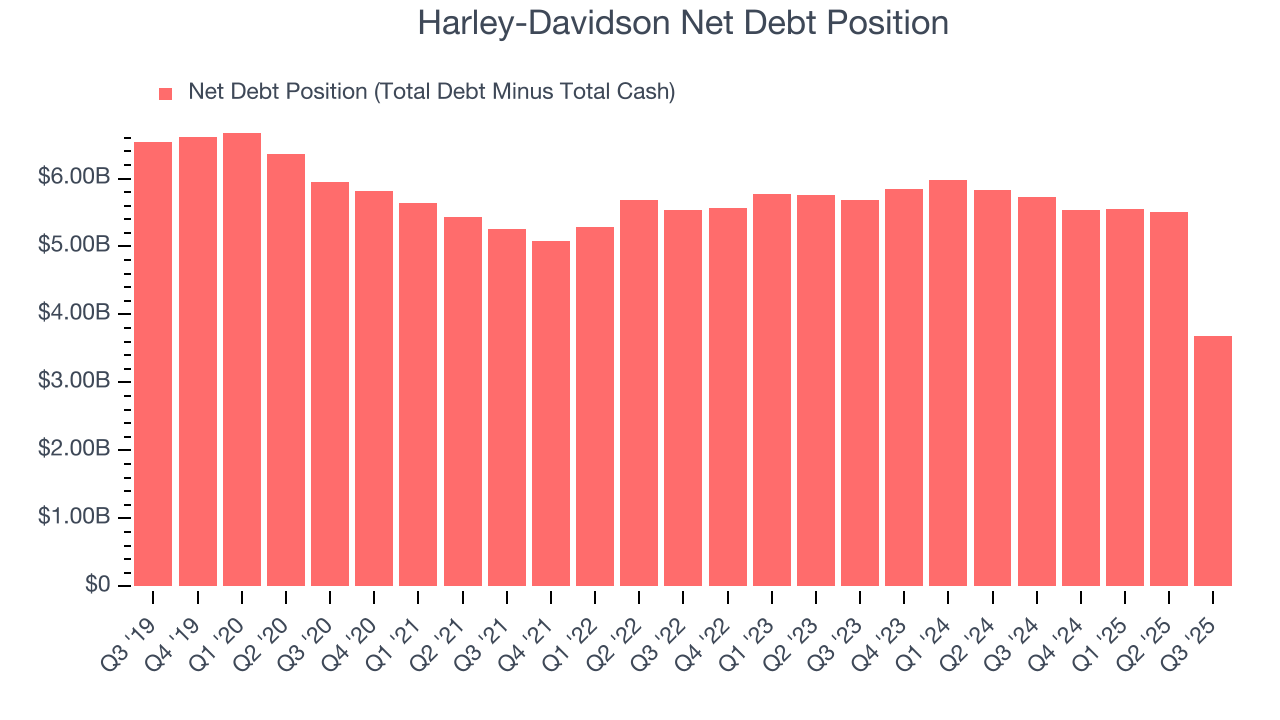

Harley-Davidson’s $5.45 billion of debt exceeds the $1.78 billion of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $604.7 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Harley-Davidson could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Harley-Davidson can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Harley-Davidson’s Q3 Results

It was good to see Harley-Davidson beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock remained flat at $20.28 immediately following the results.

12. Is Now The Time To Buy Harley-Davidson?

Are you wondering whether to buy Harley-Davidson or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Harley-Davidson falls short of our quality standards. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Harley-Davidson’s number of motorcycles sold has disappointed, and its Forecasted free cash flow margin suggests the company will ramp up its investments next year.

Harley-Davidson’s P/E ratio based on the next 12 months is 14.2x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $26.50 on the company (compared to the current share price of $20.28).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.