International Flavors & Fragrances (IFF)

International Flavors & Fragrances is in for a bumpy ride. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think International Flavors & Fragrances Will Underperform

Responsible for the scents in your favorite perfumes and the flavors in your daily snacks, International Flavors & Fragrances (NYSE:IFF) creates and manufactures ingredients for food, beverages, personal care products, and pharmaceuticals used in countless consumer goods.

- Annual revenue declines of 4.3% over the last three years indicate problems with its market positioning

- Forecasted revenue decline of 2.1% for the upcoming 12 months implies demand will fall even further

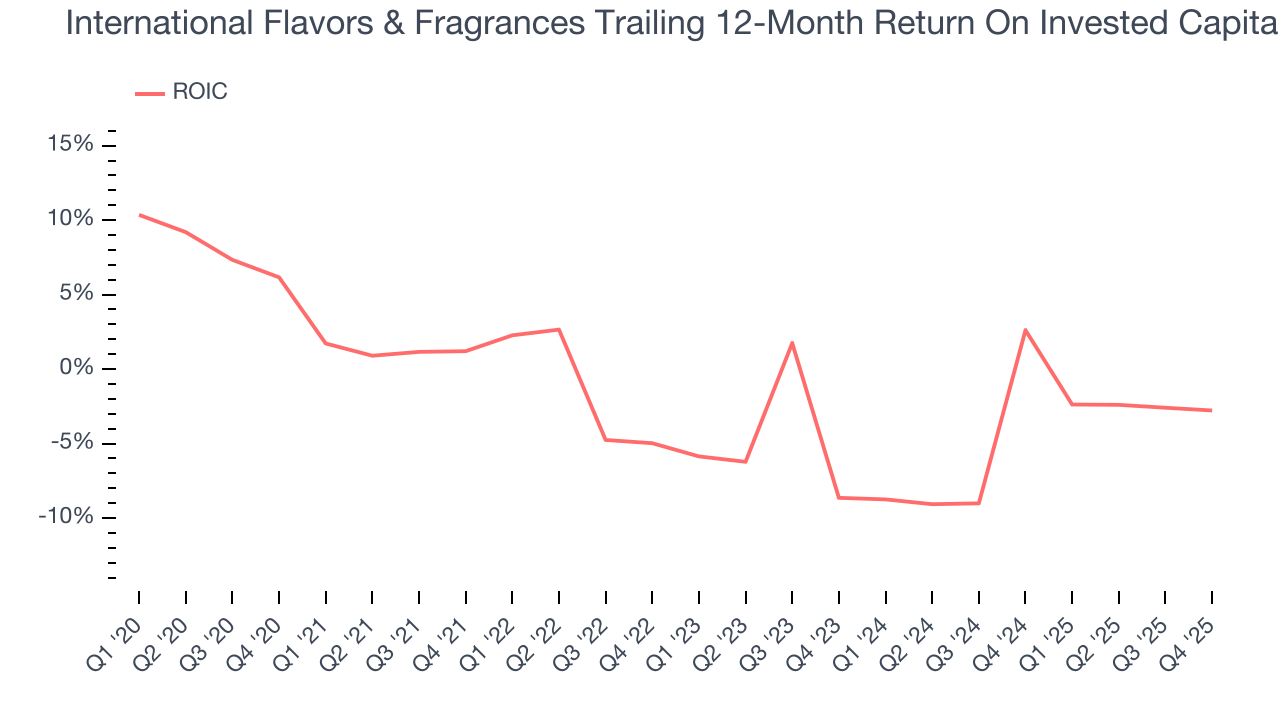

- Negative returns on capital show management lost money while trying to expand the business

International Flavors & Fragrances falls short of our quality standards. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than International Flavors & Fragrances

Why There Are Better Opportunities Than International Flavors & Fragrances

International Flavors & Fragrances is trading at $82.84 per share, or 18.5x forward P/E. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. International Flavors & Fragrances (IFF) Research Report: Q4 CY2025 Update

Flavor and fragrance producer IFF (NYSE:IFF) announced better-than-expected revenue in Q4 CY2025, but sales fell by 6.6% year on year to $2.59 billion. The company expects the full year’s revenue to be around $10.65 billion, close to analysts’ estimates. Its non-GAAP profit of $0.80 per share was 3.8% below analysts’ consensus estimates.

International Flavors & Fragrances (IFF) Q4 CY2025 Highlights:

- Revenue: $2.59 billion vs analyst estimates of $2.52 billion (6.6% year-on-year decline, 2.9% beat)

- Adjusted EPS: $0.80 vs analyst expectations of $0.83 (3.8% miss)

- EBITDA guidance for the upcoming financial year 2026 is $2.1 billion at the midpoint, in line with analyst expectations

- Operating Margin: 3.7%, in line with the same quarter last year

- Organic Revenue rose 1% year on year (beat)

- Market Capitalization: $19.66 billion

Company Overview

Responsible for the scents in your favorite perfumes and the flavors in your daily snacks, International Flavors & Fragrances (NYSE:IFF) creates and manufactures ingredients for food, beverages, personal care products, and pharmaceuticals used in countless consumer goods.

IFF operates through four main segments: Nourish, Health & Biosciences, Scent, and Pharma Solutions. The Nourish segment develops natural-based ingredients that enhance nutritional value, texture, and taste in foods and beverages, while also providing food protection solutions to extend shelf life. The Health & Biosciences division produces enzymes, food cultures, probiotics, and specialty ingredients for applications ranging from dietary supplements to household detergents.

In its Scent business, IFF creates both fragrance compounds—proprietary combinations used in fine perfumes and consumer products like laundry detergents and air fresheners—and individual fragrance ingredients sold to other manufacturers. The Pharma Solutions segment produces pharmaceutical excipients, primarily derived from cellulose and seaweed, which improve the functionality and delivery of medications.

A global operation with manufacturing facilities in over 40 countries, IFF serves a diverse customer base that includes major food producers who use its flavors in snacks and beverages, personal care companies that incorporate its scents into soaps and cosmetics, and pharmaceutical firms that utilize its excipients to improve drug delivery. The company maintains extensive research and development capabilities, investing nearly 6% of sales into creating new ingredients and technologies that respond to changing consumer preferences.

4. Ingredients, Flavors & Fragrances

Ingredients, flavors, and fragrances companies supply essential components to food, beverage, personal care, and household product manufacturers. These firms develop proprietary formulations that enhance taste, scent, and texture, creating customer stickiness through specialized expertise and regulatory-approved ingredient portfolios. Tailwinds include growing consumer demand for natural and clean-label products, expansion in emerging markets, and innovation in plant-based and functional ingredients. However, headwinds persist from volatile raw material costs, particularly for agricultural and petrochemical inputs. Regulatory scrutiny over synthetic additives and fragrance allergens poses compliance challenges, while consolidation among major customers increases pricing pressure and negotiating leverage against suppliers.

IFF competes with other major global flavor and fragrance companies including Givaudan, DSM-Firmenich, Symrise, and in certain segments with food ingredient suppliers like Kerry, Archer-Daniels-Midland (NYSE:ADM), and Novonesis.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $10.89 billion in revenue over the past 12 months, International Flavors & Fragrances is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, International Flavors & Fragrances likely needs to optimize its pricing or lean into new products and international expansion.

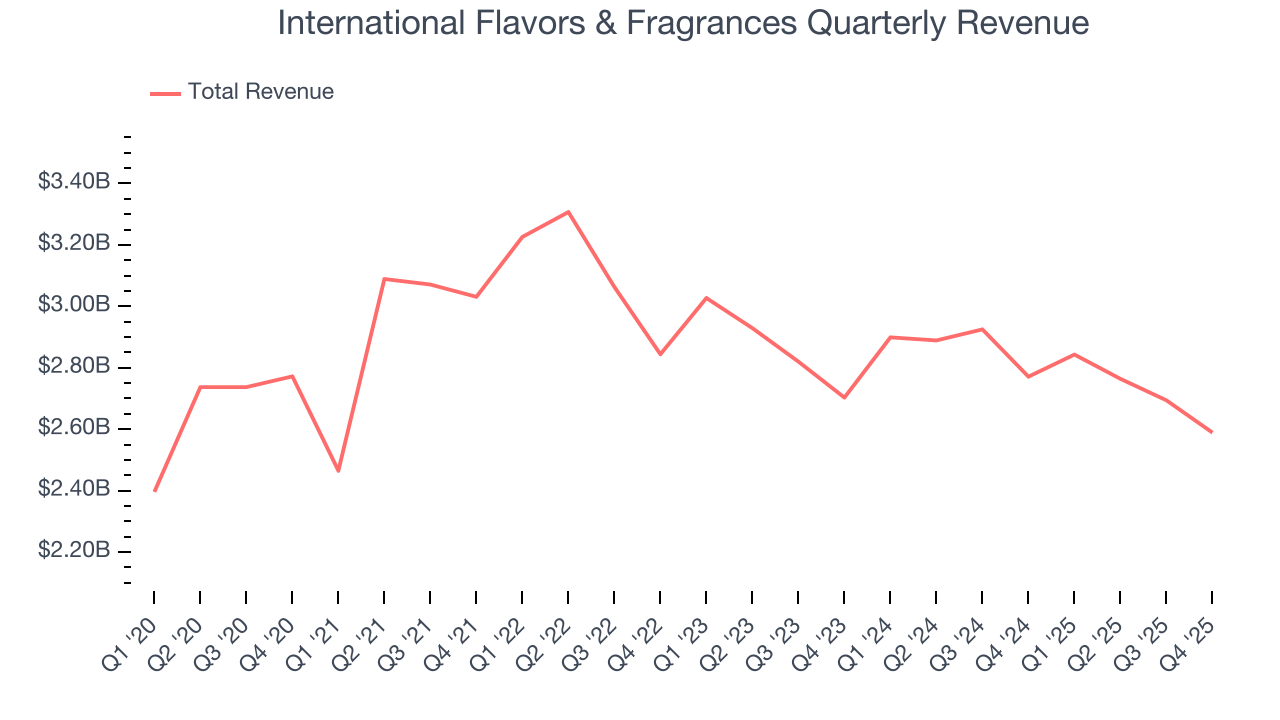

As you can see below, International Flavors & Fragrances struggled to generate demand over the last three years. Its sales dropped by 4.3% annually, a rough starting point for our analysis.

This quarter, International Flavors & Fragrances’s revenue fell by 6.6% year on year to $2.59 billion but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to decline by 2.7% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

6. Gross Margin & Pricing Power

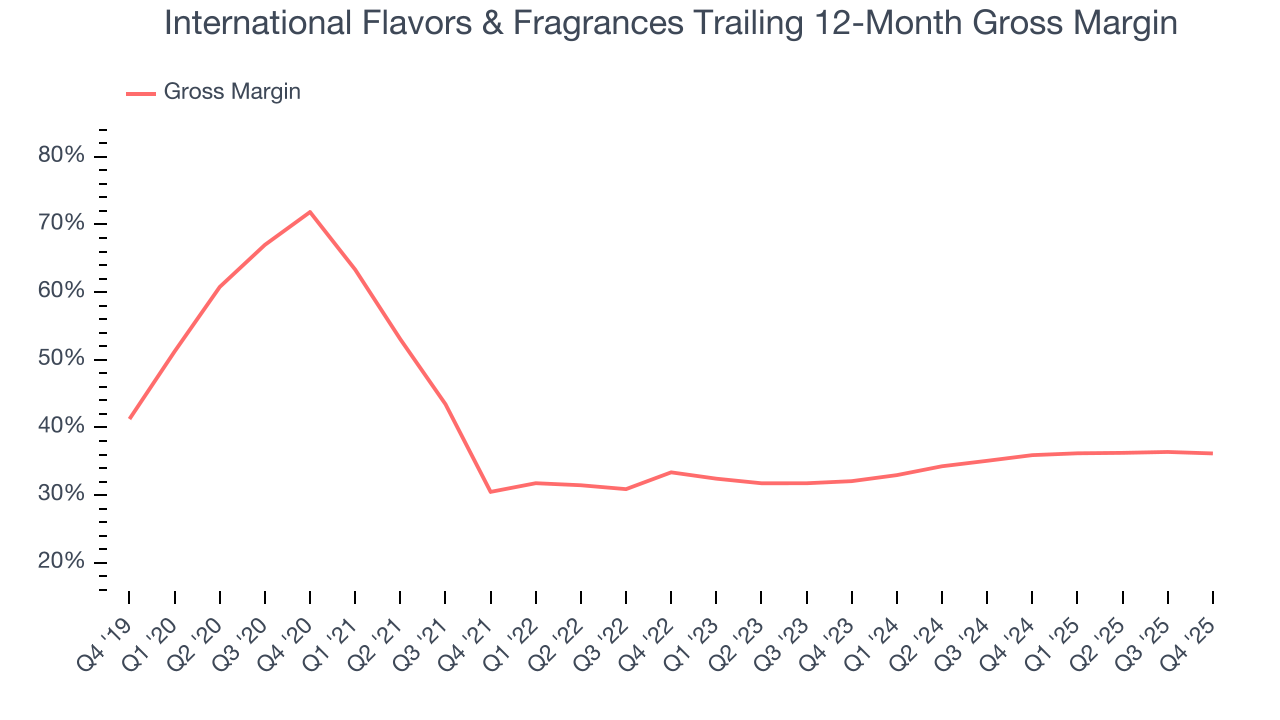

International Flavors & Fragrances has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 36% gross margin over the last two years. Said differently, International Flavors & Fragrances paid its suppliers $63.97 for every $100 in revenue.

International Flavors & Fragrances’s gross profit margin came in at 34.4% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

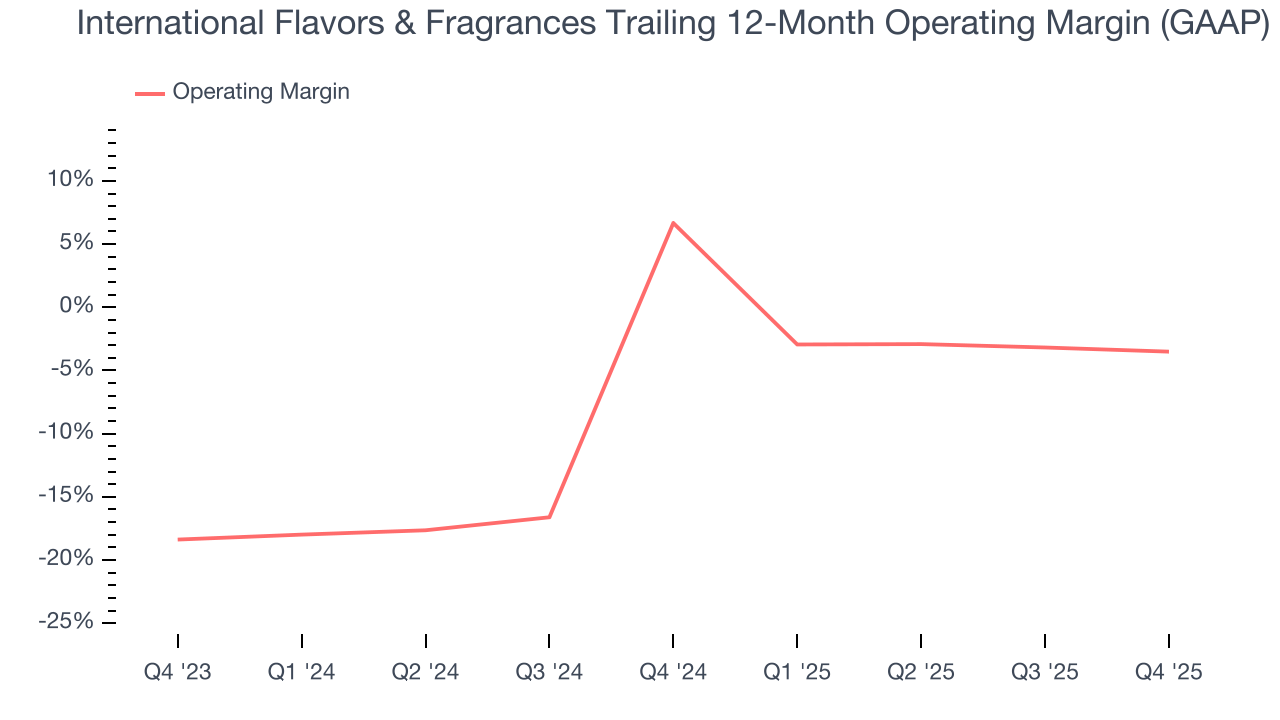

International Flavors & Fragrances was profitable over the last two years but held back by its large cost base. Its average operating margin of 1.7% was weak for a consumer staples business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, International Flavors & Fragrances’s operating margin decreased by 10.2 percentage points over the last year. International Flavors & Fragrances’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, International Flavors & Fragrances generated an operating margin profit margin of 3.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

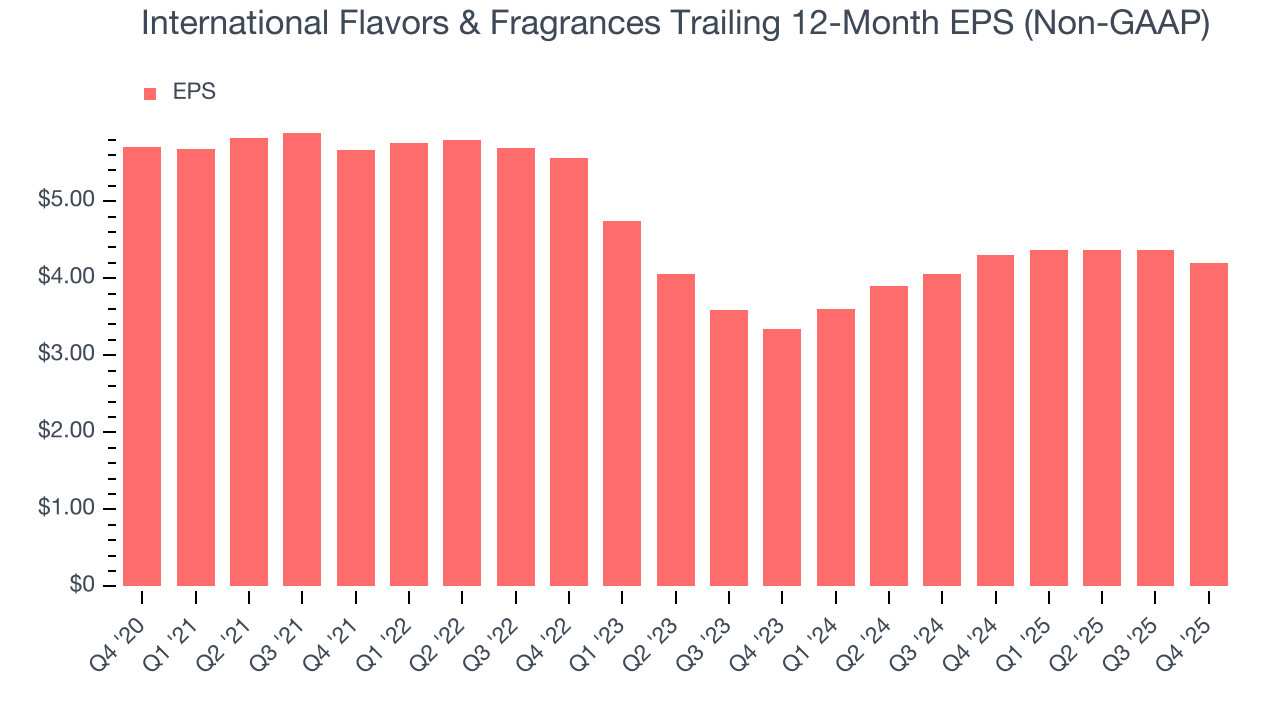

Sadly for International Flavors & Fragrances, its EPS declined by 8.9% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, International Flavors & Fragrances reported adjusted EPS of $0.80, down from $0.97 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects International Flavors & Fragrances’s full-year EPS of $4.20 to grow 5.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

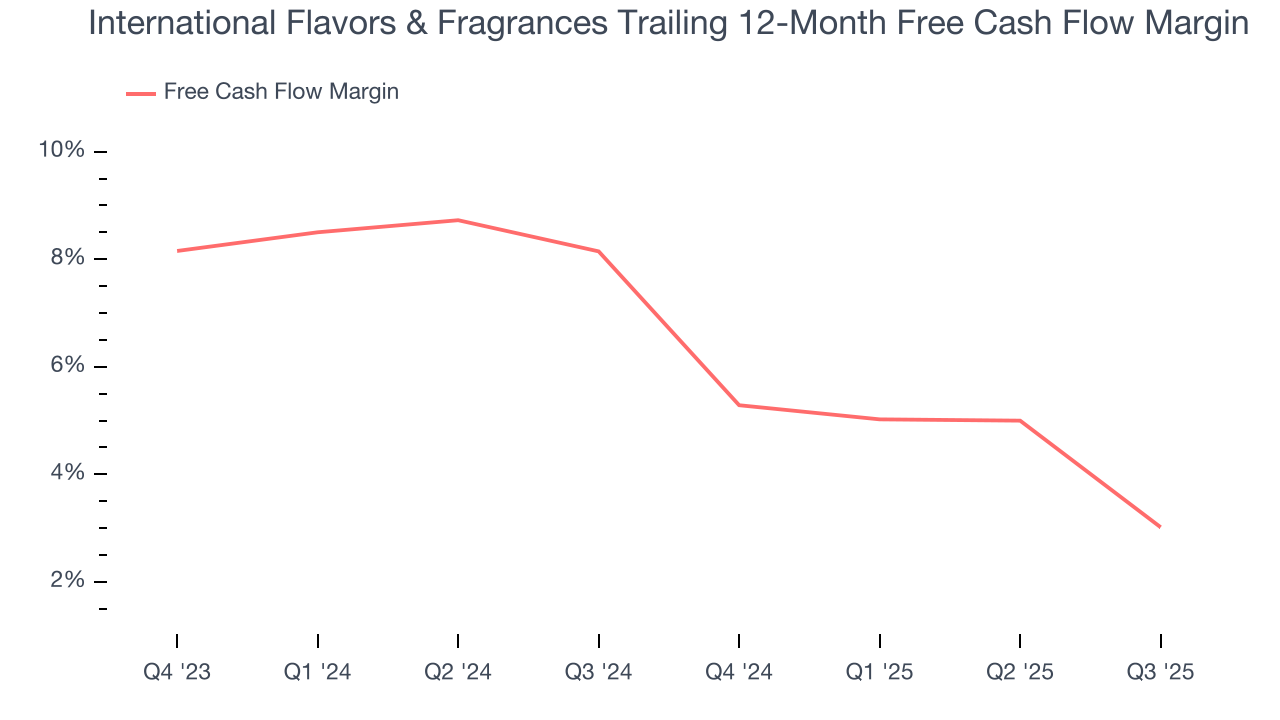

International Flavors & Fragrances has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.7%, subpar for a consumer staples business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

International Flavors & Fragrances’s five-year average ROIC was negative 2.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

11. Balance Sheet Assessment

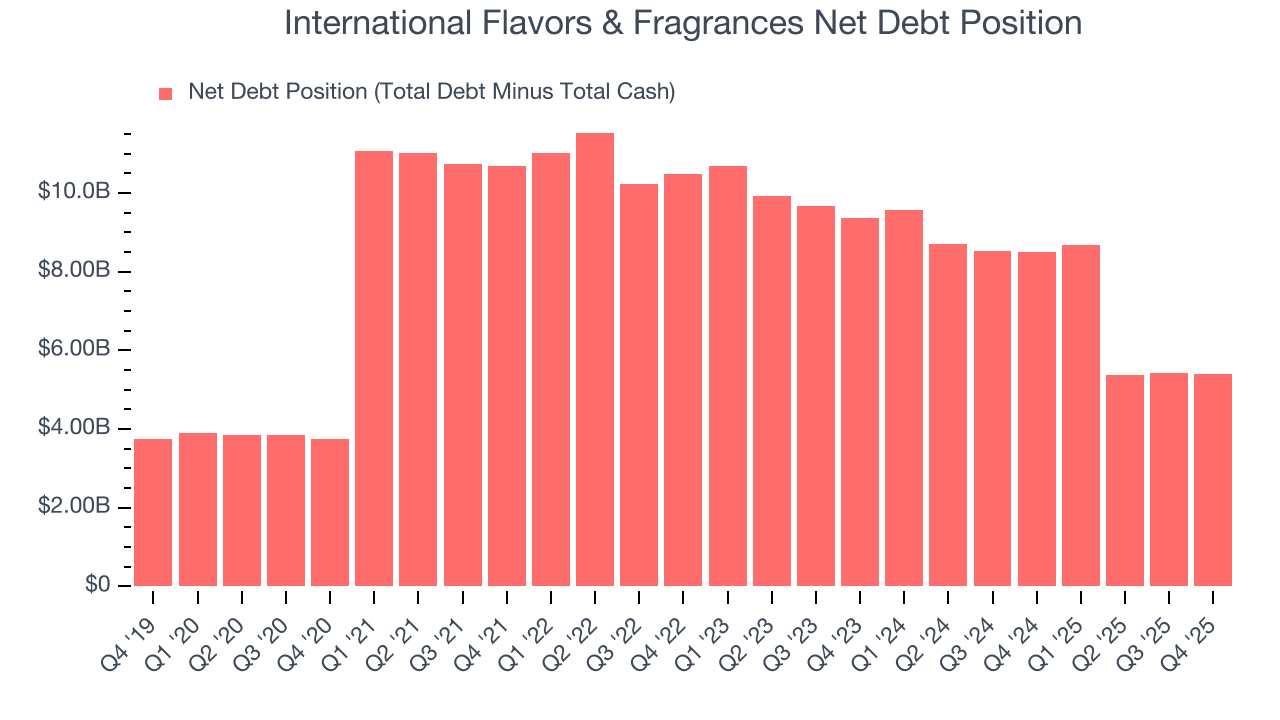

International Flavors & Fragrances reported $590 million of cash and $5.99 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.09 billion of EBITDA over the last 12 months, we view International Flavors & Fragrances’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $214 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from International Flavors & Fragrances’s Q4 Results

We enjoyed seeing International Flavors & Fragrances beat analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed and its gross margin fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $76.22 immediately after reporting.

13. Is Now The Time To Buy International Flavors & Fragrances?

Updated: February 15, 2026 at 12:01 AM EST

Are you wondering whether to buy International Flavors & Fragrances or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies serving everyday consumers, but in the case of International Flavors & Fragrances, we’ll be cheering from the sidelines. First off, its revenue has declined over the last three years. While its favorable brand awareness gives it meaningful influence over consumers’ dining decisions, the downside is its declining operating margin shows the business has become less efficient. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

International Flavors & Fragrances’s P/E ratio based on the next 12 months is 18.5x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $89.36 on the company (compared to the current share price of $82.84).