Samsara (IOT)

Samsara sets the gold standard. Its efficient sales engine has led to first-class growth, showing it can win market share organically.― StockStory Analyst Team

1. News

2. Summary

Why We Like Samsara

From sensors on vehicles to AI-powered cameras that help prevent accidents, Samsara (NYSE:IOT) is a cloud-based Internet of Things platform that helps businesses improve the safety, efficiency, and sustainability of their physical operations.

- Market share has increased as its 47.8% annual revenue growth over the last five years was exceptional

- ARR growth averaged 30.5% over the last year, showing customers are willing to take multi-year bets on its software

- Software platform has product-market fit given the rapid recovery of its customer acquisition costs

Samsara is a top-tier company. The valuation looks reasonable based on its quality, and we think now is a good time to invest.

Why Is Now The Time To Buy Samsara?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Samsara?

At $32.12 per share, Samsara trades at 10.3x forward price-to-sales. Many software names may carry a lower valuation multiple, but Samsara’s price is fair given its business quality.

By definition, where you buy a stock impacts returns. But according to our work on the topic, business quality is a much bigger determinant of market outperformance over the long term compared to entry price.

3. Samsara (IOT) Research Report: Q3 CY2025 Update

IoT solutions provider Samsara (NYSE:IOT) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 29.2% year on year to $416 million. Guidance for next quarter’s revenue was better than expected at $422 million at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP profit of $0.15 per share was 26.4% above analysts’ consensus estimates.

Samsara (IOT) Q3 CY2025 Highlights:

- Revenue: $416 million vs analyst estimates of $399.4 million (29.2% year-on-year growth, 4.1% beat)

- Adjusted EPS: $0.15 vs analyst estimates of $0.12 (26.4% beat)

- Adjusted Operating Income: $79.79 million vs analyst estimates of $59.41 million (19.2% margin, 34.3% beat)

- Revenue Guidance for Q4 CY2025 is $422 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $0.51 at the midpoint, a 9.8% increase

- Operating Margin: -0.4%, up from -14.7% in the same quarter last year

- Free Cash Flow Margin: 13.4%, up from 11.3% in the previous quarter

- Customers: 2,990 customers paying more than $100,000 annually

- Annual Recurring Revenue: $1.75 billion vs analyst estimates of $1.73 billion (29.4% year-on-year growth, 1.1% beat)

- Billings: $416 million at quarter end, up 22.7% year on year

- Market Capitalization: $22.38 billion

Company Overview

From sensors on vehicles to AI-powered cameras that help prevent accidents, Samsara (NYSE:IOT) is a cloud-based Internet of Things platform that helps businesses improve the safety, efficiency, and sustainability of their physical operations.

Samsara's technology connects physical assets to the digital world through a combination of hardware devices and software applications. The company's hardware includes vehicle telematics, equipment monitors, environmental sensors, and AI-enabled safety cameras that collect real-time data from trucks, construction equipment, factories, and other physical infrastructure. This data is then processed on Samsara's cloud platform, providing actionable insights through intuitive dashboards and mobile apps.

Transportation and logistics companies use Samsara to track vehicle locations, monitor driver behavior, optimize routes, and ensure compliance with safety regulations. For example, a trucking company might use Samsara to identify unsafe driving practices, reduce idle time, and improve fuel efficiency across their fleet. Similarly, construction firms deploy Samsara sensors on heavy equipment to prevent theft, schedule maintenance based on actual usage, and maximize equipment utilization.

Samsara operates on a subscription-based model, charging customers for both hardware devices and access to its cloud software platform. The company serves thousands of customers across diverse industries including transportation, logistics, construction, field services, utilities, and manufacturing. As physical operations become increasingly digitized, Samsara positions itself at the intersection of the Internet of Things, artificial intelligence, and cloud computing—enabling businesses to transform traditionally analog operations with digital intelligence.

4. Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Samsara competes with established industrial technology providers like Trimble (NASDAQ:TRMB), Verizon Connect (NYSE:VZ), and Geotab in the fleet management space, as well as Honeywell (NASDAQ:HON) and Rockwell Automation (NYSE:ROK) in industrial IoT applications.

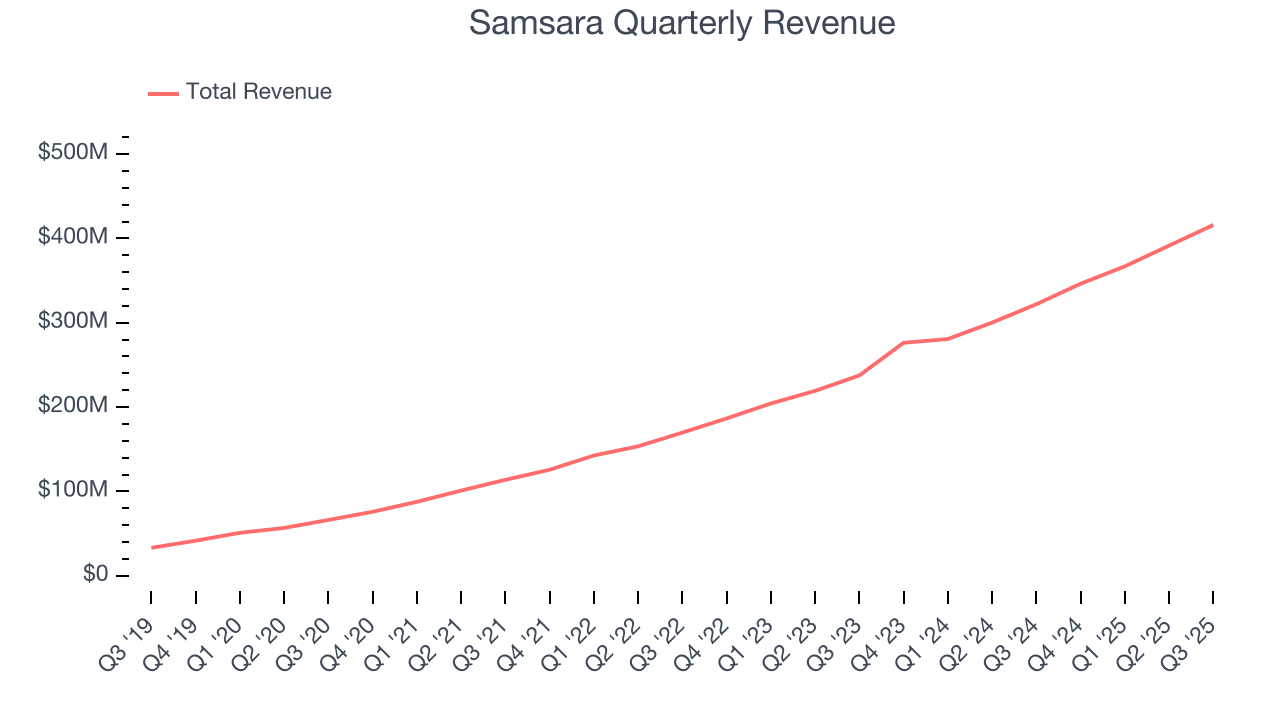

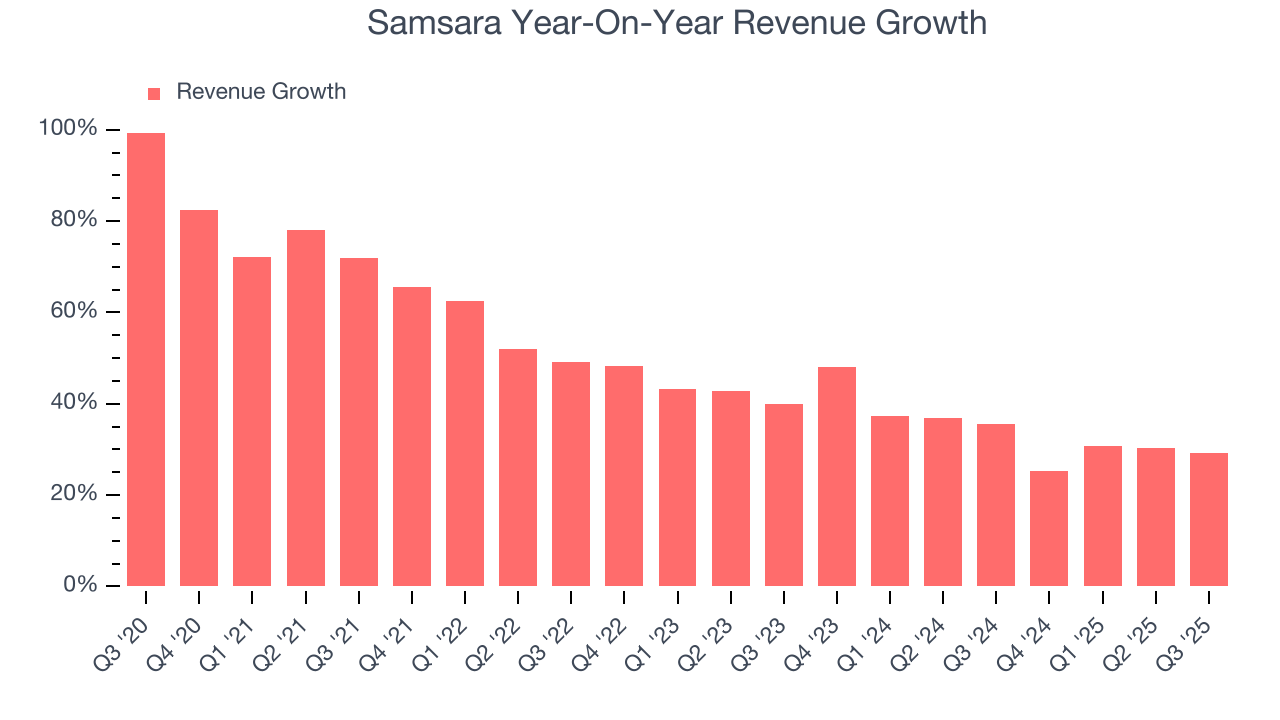

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Samsara’s 47.8% annualized revenue growth over the last five years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Samsara’s annualized revenue growth of 33.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Samsara reported robust year-on-year revenue growth of 29.2%, and its $416 million of revenue topped Wall Street estimates by 4.1%. Company management is currently guiding for a 21.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and implies the market is baking in success for its products and services.

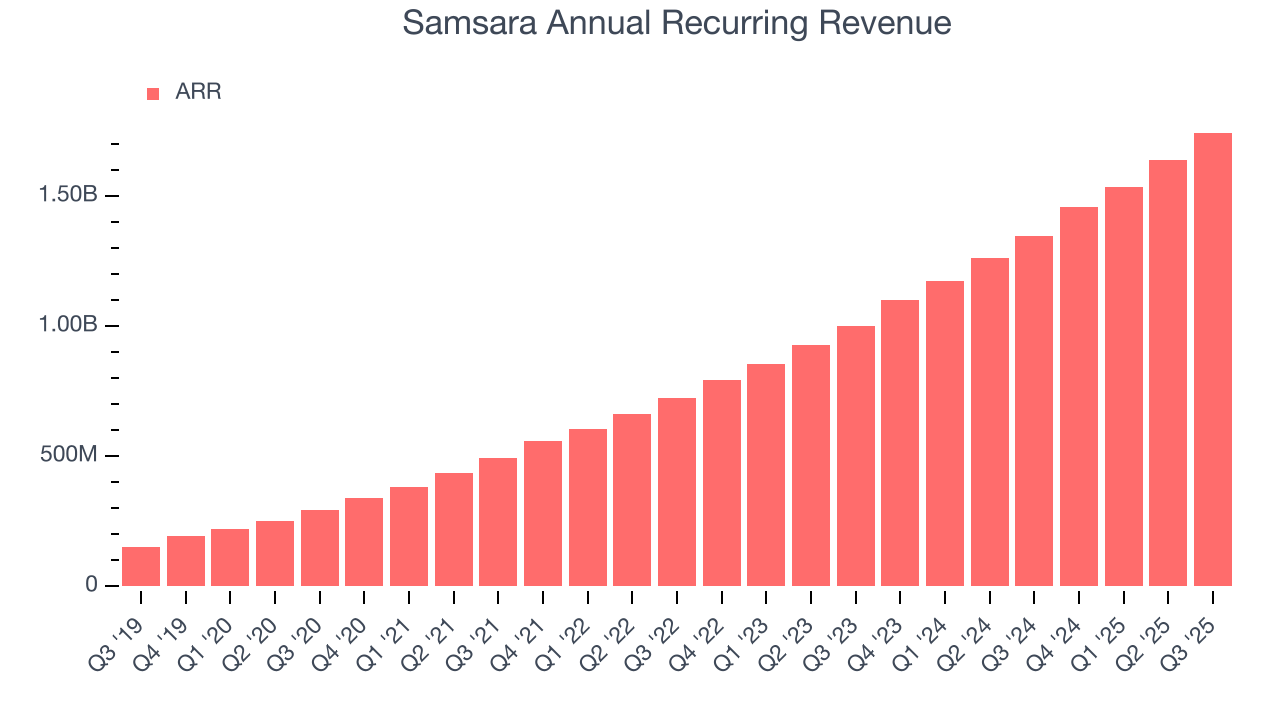

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Samsara’s ARR punched in at $1.75 billion in Q3, and over the last four quarters, its growth was fantastic as it averaged 30.5% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Samsara a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

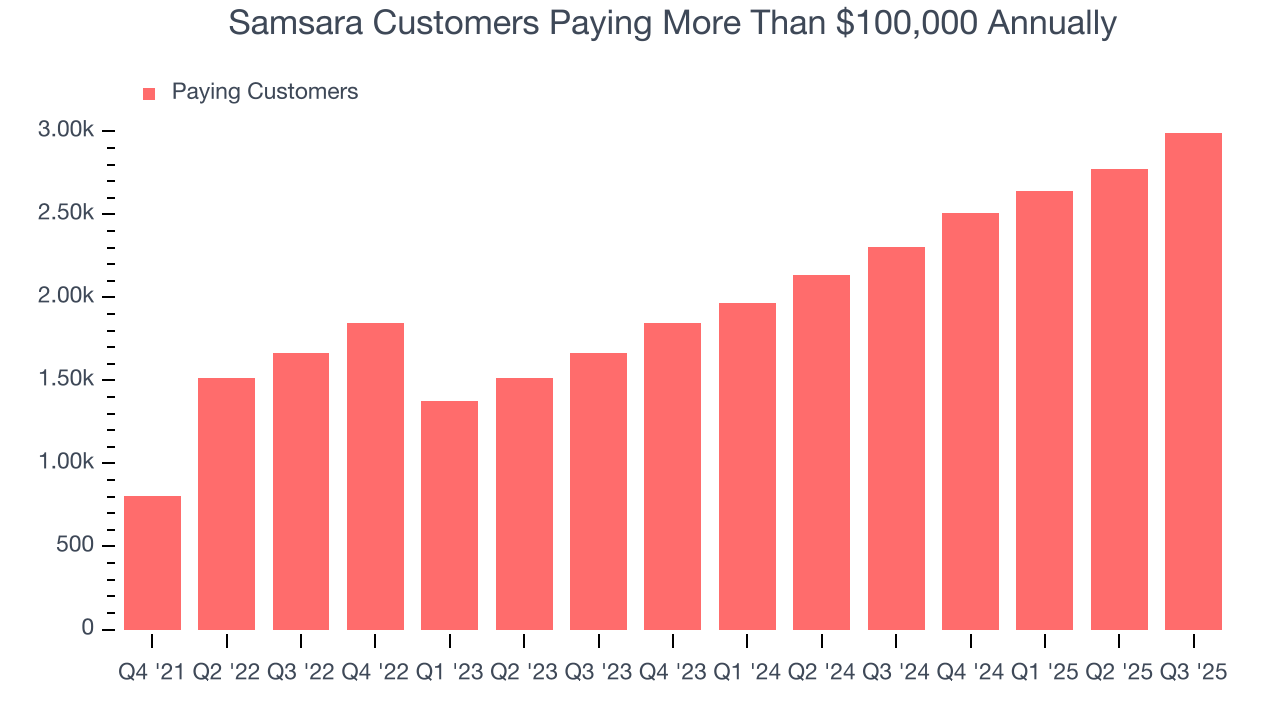

7. Enterprise Customer Base

This quarter, Samsara reported 2,990 enterprise customers paying more than $100,000 annually, an increase of 219 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that Samsara’s go-to-market strategy is working well.

8. Customer Acquisition Efficiency

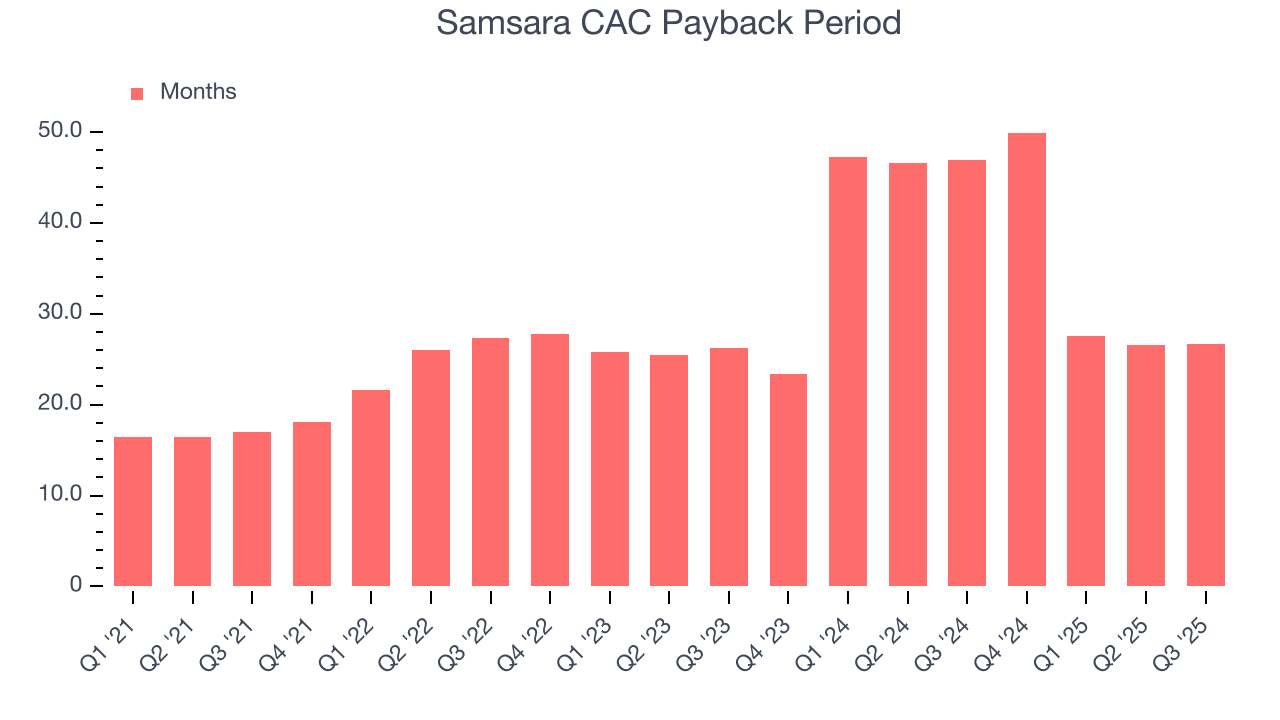

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Samsara is very efficient at acquiring new customers, and its CAC payback period checked in at 26.7 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Samsara more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

9. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

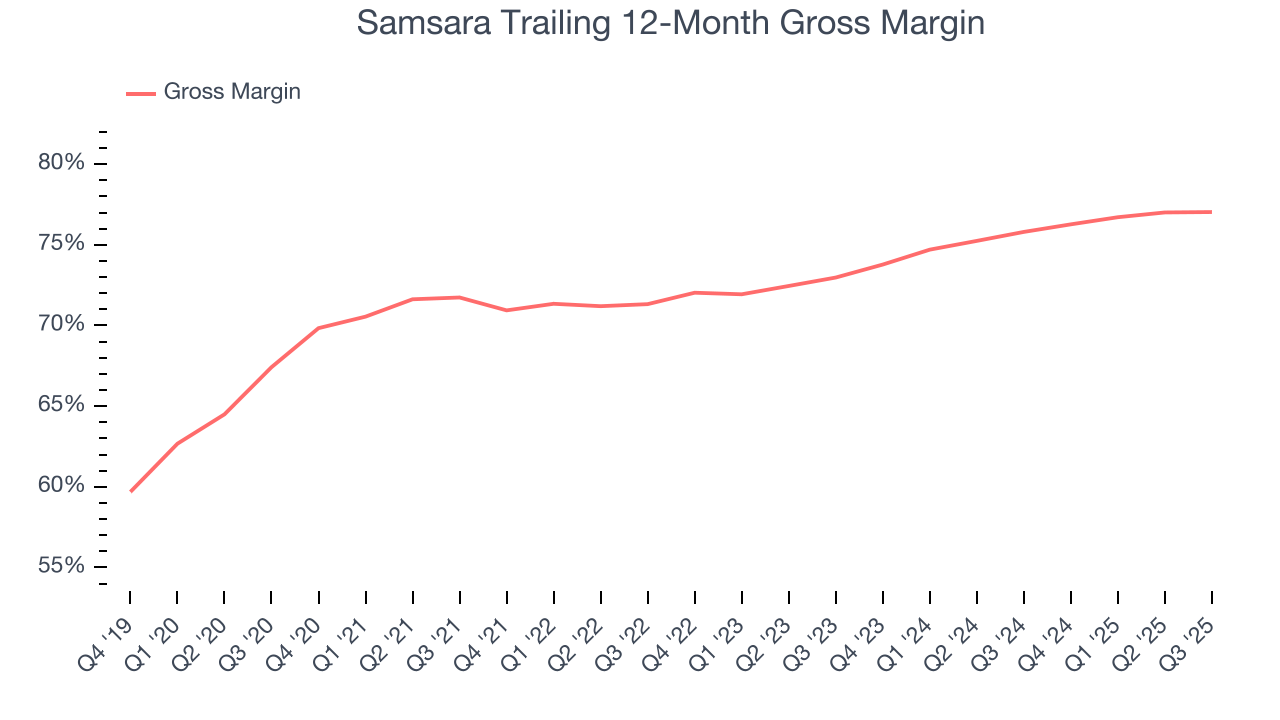

Samsara’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 77% gross margin over the last year. That means for every $100 in revenue, roughly $77.03 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Samsara has seen gross margins improve by 4.1 percentage points over the last 2 year, which is very good in the software space.

This quarter, Samsara’s gross profit margin was 76.7%, in line with the same quarter last year. Zooming out, Samsara’s full-year margin has been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

10. Operating Margin

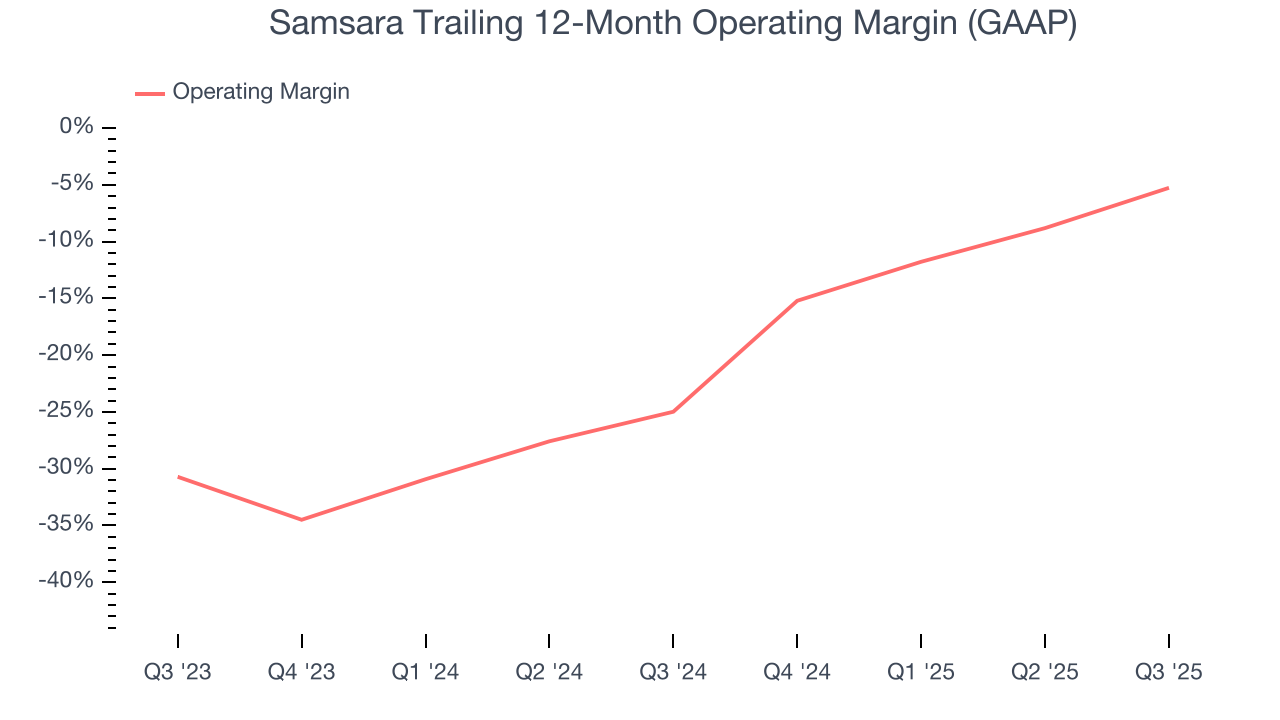

Although Samsara broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 5.3% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Over the last two years, Samsara’s expanding sales gave it operating leverage as its margin rose by 19.7 percentage points. Still, it will take much more for the company to reach long-term profitability.

This quarter, Samsara generated a negative 0.4% operating margin.

11. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

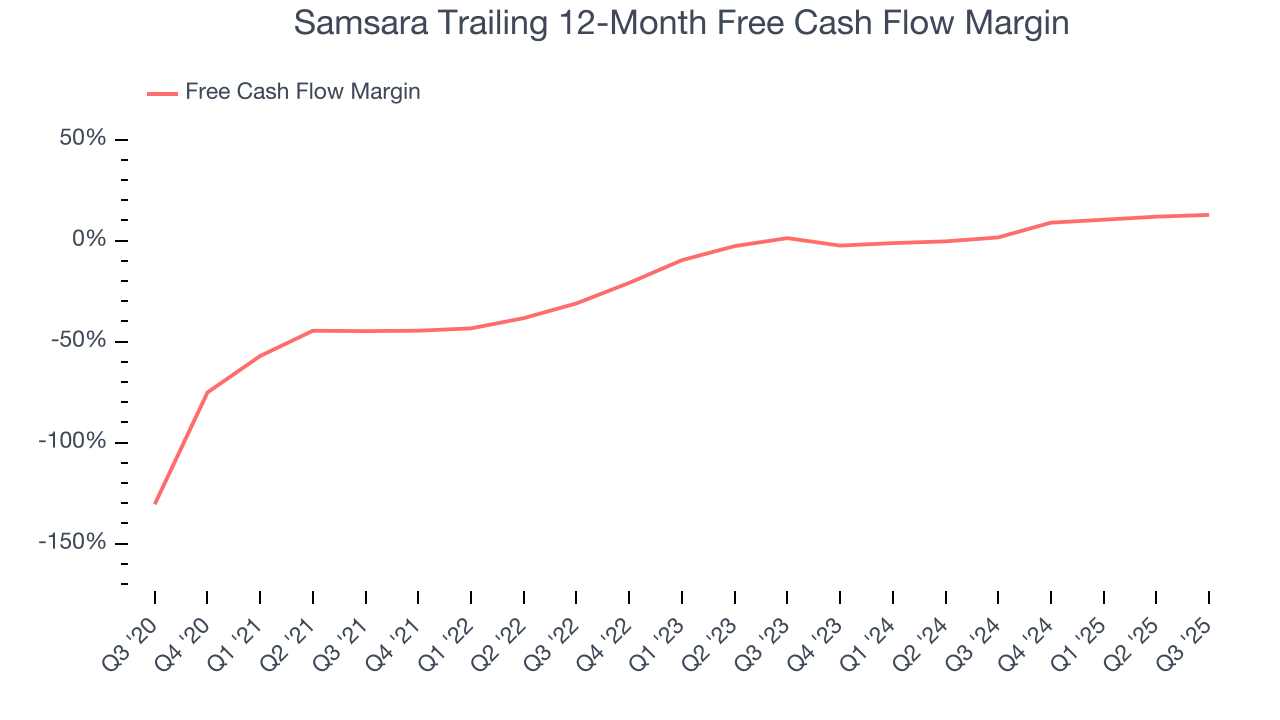

Samsara has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 12.8%, subpar for a software business.

Samsara’s free cash flow clocked in at $55.85 million in Q3, equivalent to a 13.4% margin. This result was good as its margin was 3.7 percentage points higher than in the same quarter last year. We hope the company can build on this trend.

Over the next year, analysts’ consensus estimates show they’re expecting Samsara’s free cash flow margin of 12.8% for the last 12 months to remain the same.

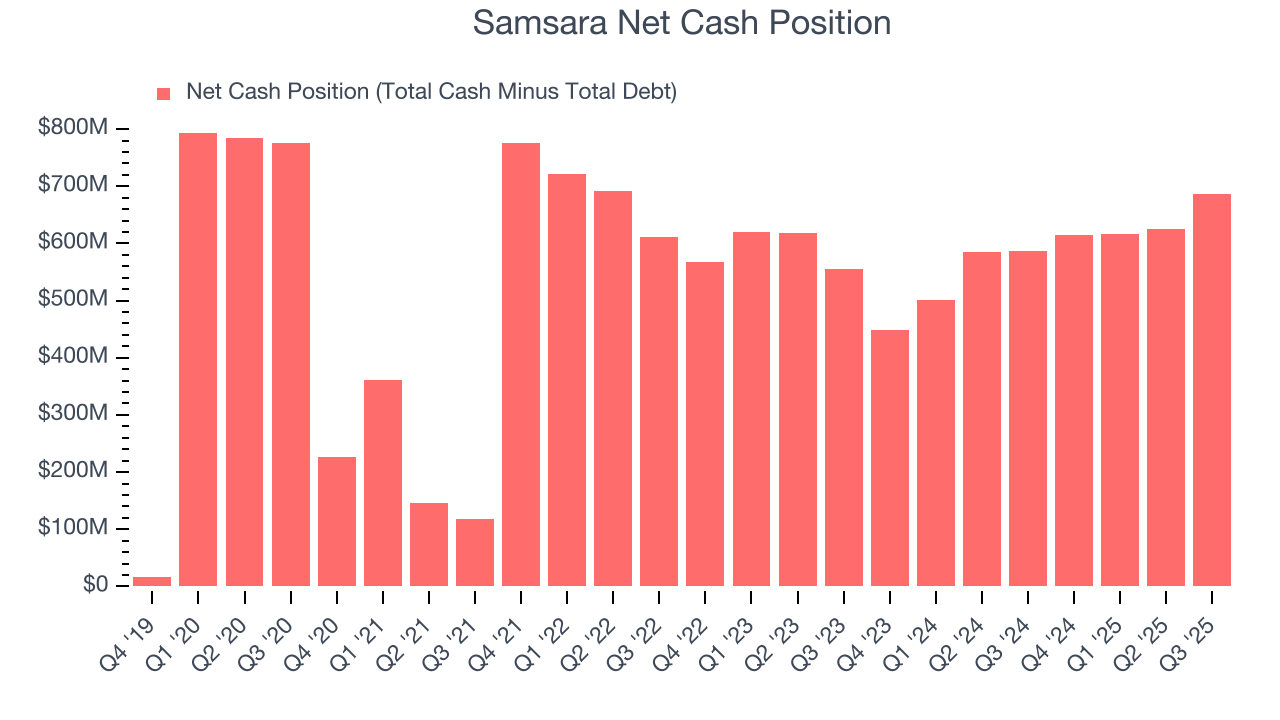

12. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Samsara is a well-capitalized company with $761.8 million of cash and $75.64 million of debt on its balance sheet. This $686.2 million net cash position is 3.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Samsara’s Q3 Results

We were impressed by how significantly Samsara blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its billings slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 2.1% to $39.99 immediately following the results.

14. Is Now The Time To Buy Samsara?

Updated: January 24, 2026 at 9:23 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Samsara is one of the best software companies out there. First of all, the company’s revenue growth was exceptional over the last five years. And while its operating margins are low compared to other software companies, its surging ARR shows its fundamentals and revenue predictability are improving. On top of that, Samsara’s efficient sales strategy allows it to target and onboard new users at scale.

Samsara’s price-to-sales ratio based on the next 12 months is 10.3x. Looking across the spectrum of software businesses, Samsara’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $50.18 on the company (compared to the current share price of $32.12), implying they see 56.2% upside in buying Samsara in the short term.