International Paper (IP)

We wouldn’t buy International Paper. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think International Paper Will Underperform

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 14.9% annually while its revenue grew

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its shrinking returns suggest its past profit sources are losing steam

- Sizable revenue base leads to growth challenges as its 2.4% annual revenue increases over the last five years fell short of other industrials companies

International Paper falls short of our expectations. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than International Paper

High Quality

Investable

Underperform

Why There Are Better Opportunities Than International Paper

International Paper is trading at $41.83 per share, or 27x forward P/E. This multiple rich for the business quality. Not a great combination.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. International Paper (IP) Research Report: Q4 CY2025 Update

Packaging and materials company International Paper (NYSE:IP) announced better-than-expected revenue in Q4 CY2025, with sales up 31.1% year on year to $6.01 billion. Its non-GAAP loss of $0.08 per share was significantly below analysts’ consensus estimates.

International Paper (IP) Q4 CY2025 Highlights:

- Revenue: $6.01 billion vs analyst estimates of $5.89 billion (31.1% year-on-year growth, 1.9% beat)

- Adjusted EPS: -$0.08 vs analyst estimates of $0.25 (significant miss)

- Adjusted EBITDA: -$1.96 billion vs analyst estimates of $778 million (-32.6% margin, significant miss)

- Operating Margin: -44.2%, down from -1.6% in the same quarter last year

- Free Cash Flow Margin: 4.2%, up from 3% in the same quarter last year

- Market Capitalization: $21.91 billion

Company Overview

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper was formed by the merger of 17 pulp and paper mills in the northeastern United States, and today, its products include corrugated packaging, cellulose fibers, and paper.

In packaging, the company primarily supplies shipping containers, display packaging, and bulk bins to the food and beverage industry. On the cellulose fibers side, its materials are utilized in diapers and other hygiene products. Lastly, its papers are used for printing and writing.

International Paper markets its products worldwide through direct sales teams and distributors. It maintains a cost structure that includes significant fixed costs linked to manufacturing and variable costs primarily associated with raw materials and distribution.

4. Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

Competitors include WestRock (NYSE:WRK, Graphic Packaging (NYSE:GPK), and Packaging Corporation of America (NYSE:PKG)

5. Revenue Growth

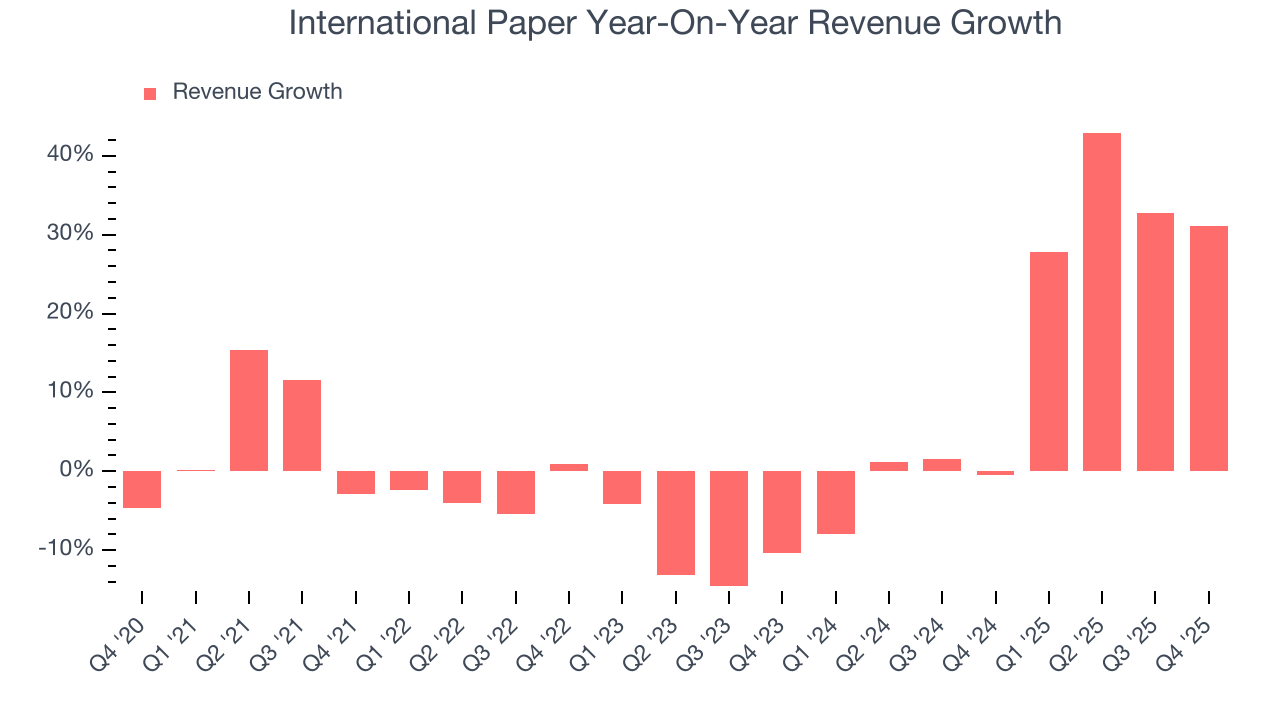

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, International Paper grew its sales at a sluggish 3.9% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. International Paper’s annualized revenue growth of 14.7% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

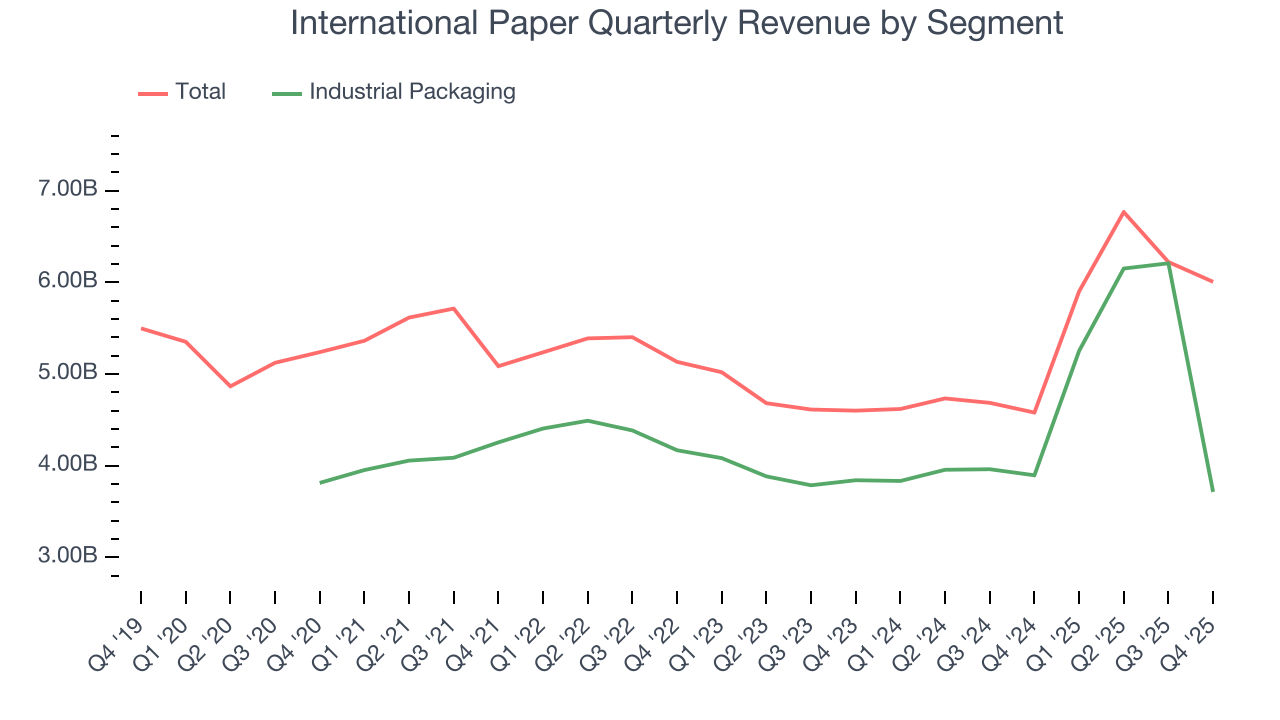

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Industrial Packaging. Over the last two years, International Paper’s Industrial Packaging revenue (containers, displays, bins) averaged 18.3% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, International Paper reported wonderful year-on-year revenue growth of 31.1%, and its $6.01 billion of revenue exceeded Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to decline by 1.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

International Paper’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand.As you can see below, it averaged a decent 30.9% gross margin over the last five years. That means for every $100 in revenue, roughly $30.85 was left to spend on selling, marketing, R&D, and general administrative overhead.

International Paper produced a 31.4% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, International Paper’s full-year margin has been trending down over the past 12 months, decreasing by 1.8 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

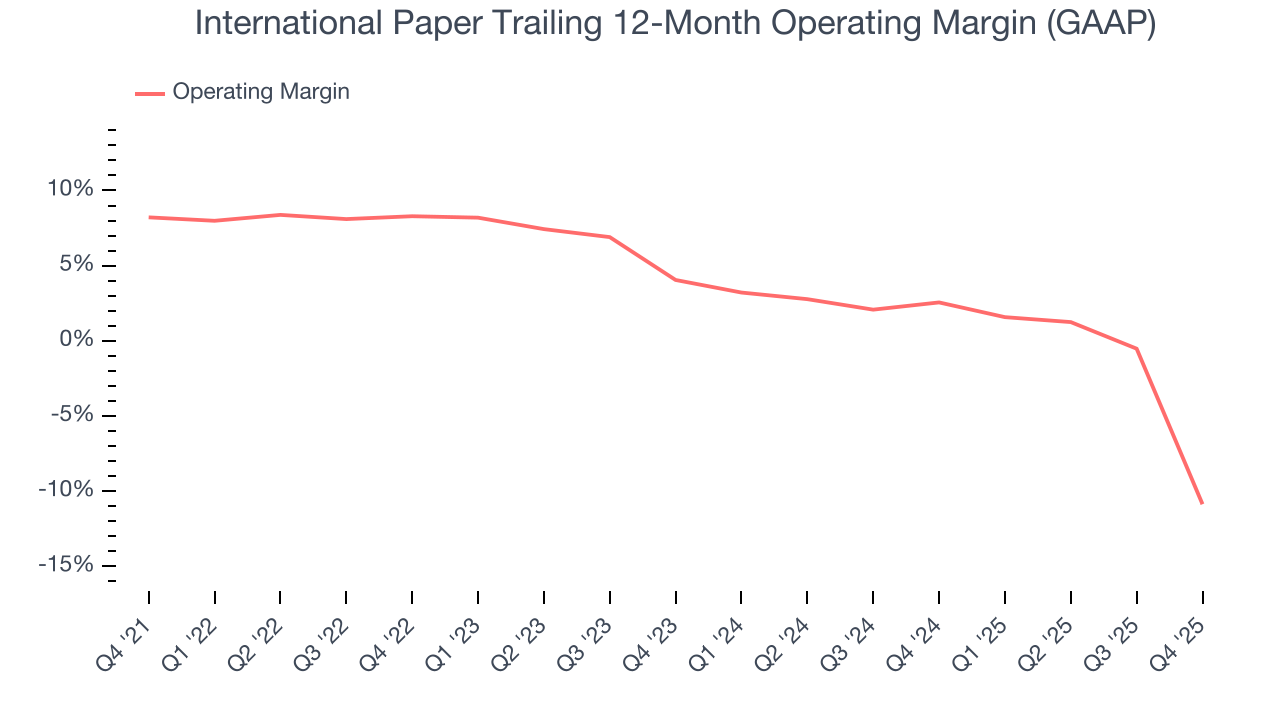

International Paper was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for an industrials business.

Analyzing the trend in its profitability, International Paper’s operating margin decreased by 19.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. International Paper’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, International Paper generated an operating margin profit margin of negative 44.2%, down 42.6 percentage points year on year. Since International Paper’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

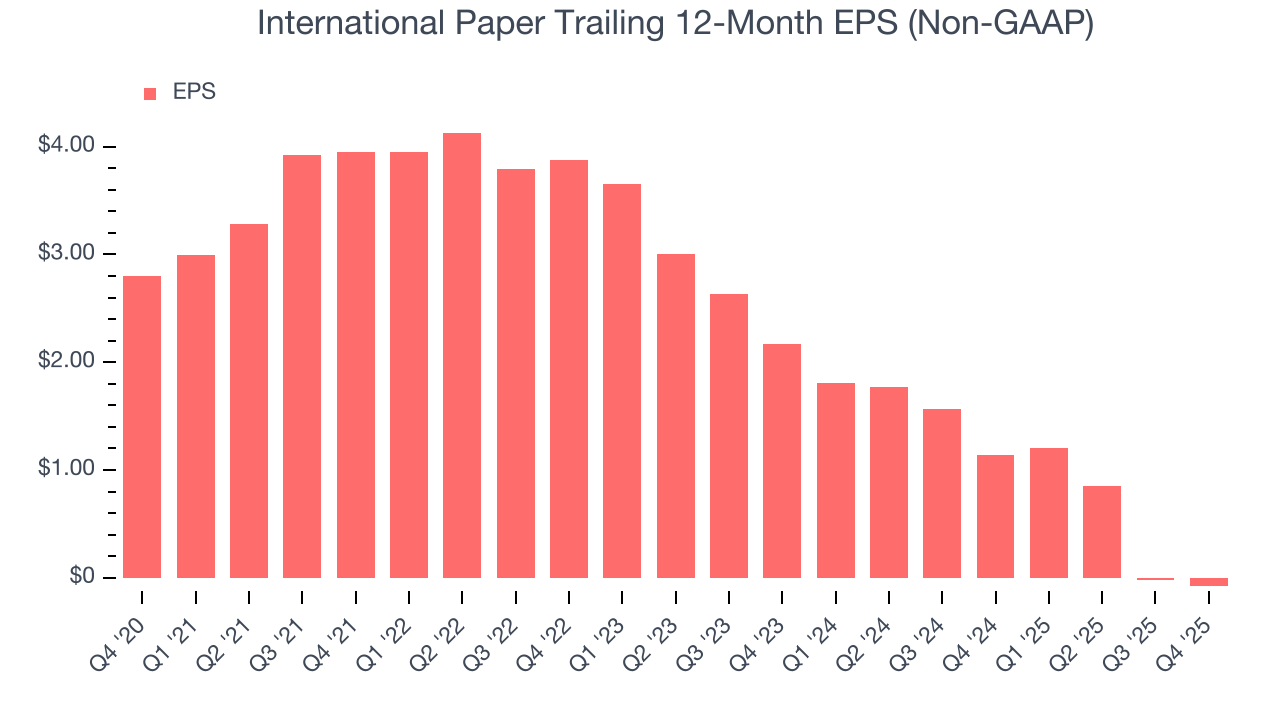

Sadly for International Paper, its EPS declined by 15.2% annually over the last five years while its revenue grew by 3.9%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of International Paper’s earnings can give us a better understanding of its performance. As we mentioned earlier, International Paper’s operating margin declined by 19.1 percentage points over the last five years. Its share count also grew by 33.4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For International Paper, its two-year annual EPS declines of 42.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, International Paper reported adjusted EPS of negative $0.08, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast International Paper’s full-year EPS of negative $0.08 will flip to positive $1.80.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

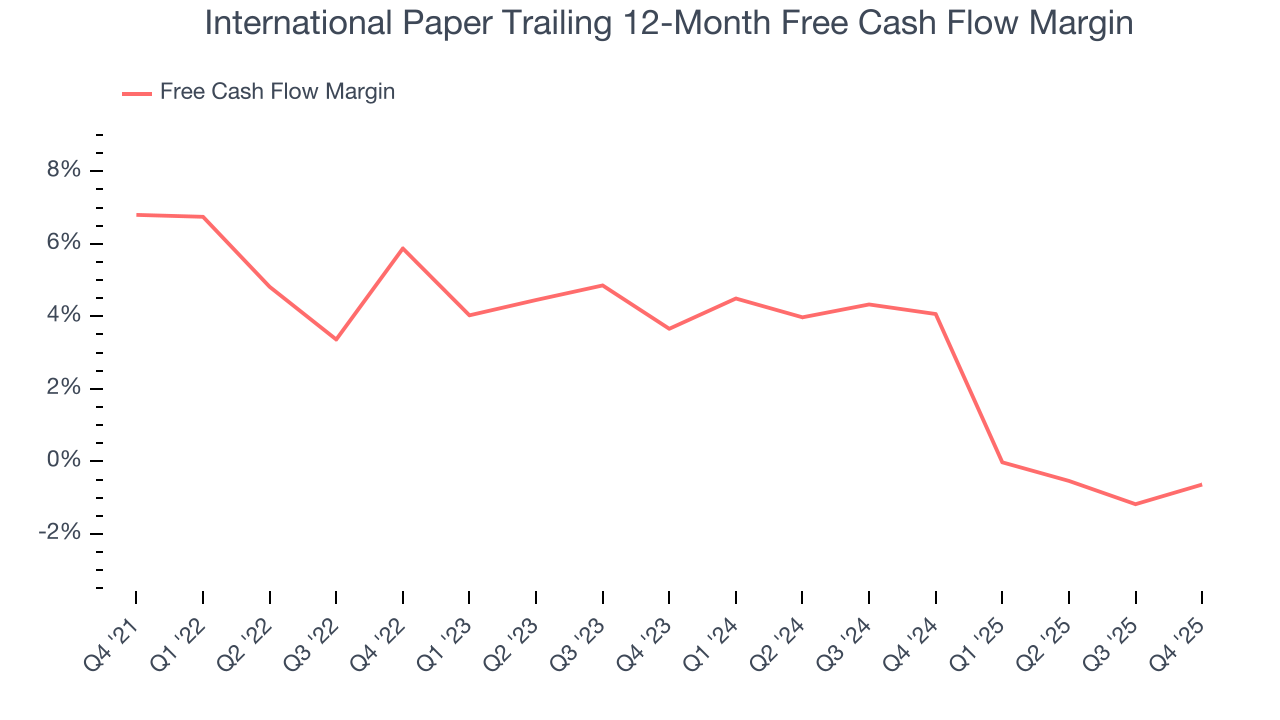

International Paper has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for an industrials business.

Taking a step back, we can see that International Paper’s margin dropped by 7.4 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of a big investment cycle.

International Paper’s free cash flow clocked in at $255 million in Q4, equivalent to a 4.2% margin. This result was good as its margin was 1.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

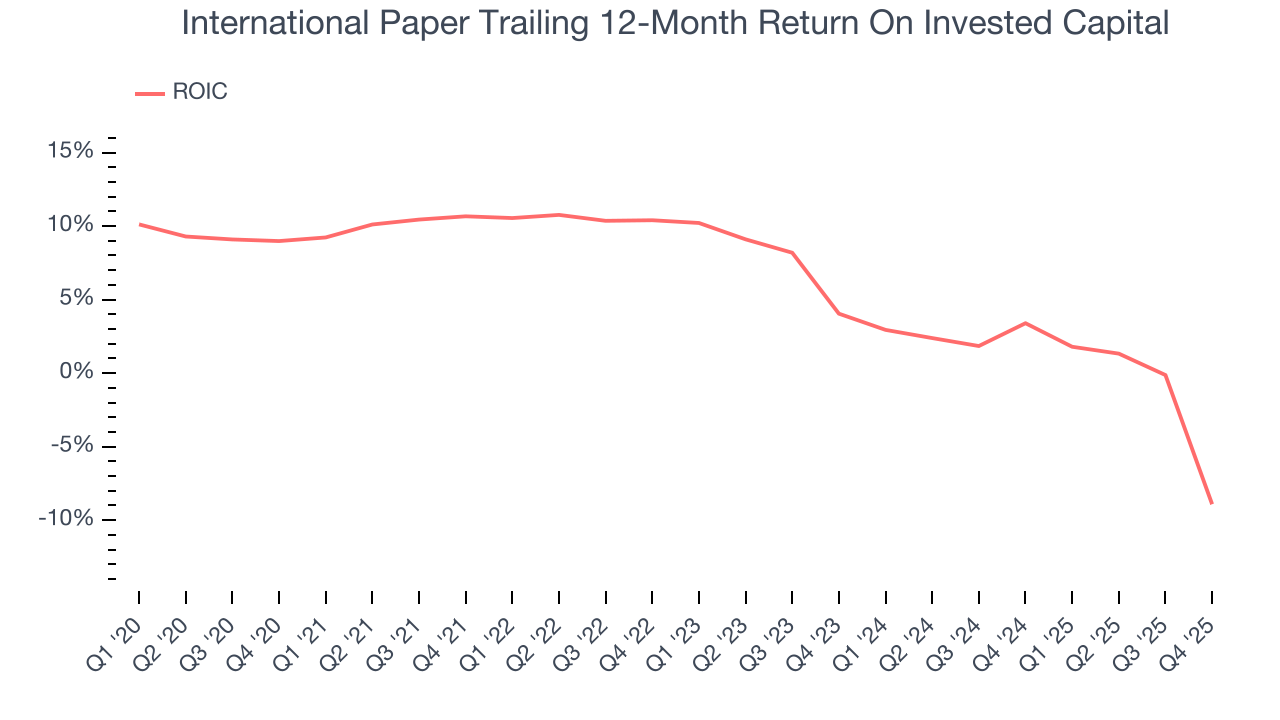

International Paper historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.9%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, International Paper’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

International Paper’s $10.32 billion of debt exceeds the $1.15 billion of cash on its balance sheet. Furthermore, its 35× net-debt-to-EBITDA ratio (based on its EBITDA of $261 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. International Paper could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope International Paper can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from International Paper’s Q4 Results

We enjoyed seeing International Paper beat analysts’ revenue expectations this quarter. On the other hand, its Industrial Packaging revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 2.1% to $42.38 immediately following the results.

13. Is Now The Time To Buy International Paper?

Updated: January 29, 2026 at 7:57 AM EST

Before deciding whether to buy International Paper or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies helping their customers, but in the case of International Paper, we’re out. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

International Paper’s P/E ratio based on the next 12 months is 23.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $46.80 on the company (compared to the current share price of $42.38).