International Paper (IP)

We wouldn’t recommend International Paper. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think International Paper Will Underperform

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

- Earnings per share fell by 14.9% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its shrinking returns suggest its past profit sources are losing steam

- Annual sales growth of 2.4% over the last five years lagged behind its industrials peers as its large revenue base made it difficult to generate incremental demand

International Paper’s quality is inadequate. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than International Paper

High Quality

Investable

Underperform

Why There Are Better Opportunities Than International Paper

International Paper is trading at $42.11 per share, or 27.5x forward P/E. This multiple expensive for its subpar fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. International Paper (IP) Research Report: Q3 CY2025 Update

Packaging and materials company International Paper (NYSE:IP) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 32.8% year on year to $6.22 billion. Its non-GAAP loss of $0.43 per share was significantly below analysts’ consensus estimates.

International Paper (IP) Q3 CY2025 Highlights:

- Revenue: $6.22 billion vs analyst estimates of $6.48 billion (32.8% year-on-year growth, 4% miss)

- Adjusted EPS: -$0.43 vs analyst estimates of $0.56 (significant miss)

- Adjusted EBITDA: $424 million vs analyst estimates of $936.8 million (6.8% margin, 54.7% miss)

- Operating Margin: -10.8%, down from 3.7% in the same quarter last year

- Free Cash Flow Margin: 2.4%, down from 6.6% in the same quarter last year

- Market Capitalization: $23.35 billion

Company Overview

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper was formed by the merger of 17 pulp and paper mills in the northeastern United States, and today, its products include corrugated packaging, cellulose fibers, and paper.

In packaging, the company primarily supplies shipping containers, display packaging, and bulk bins to the food and beverage industry. On the cellulose fibers side, its materials are utilized in diapers and other hygiene products. Lastly, its papers are used for printing and writing.

International Paper markets its products worldwide through direct sales teams and distributors. It maintains a cost structure that includes significant fixed costs linked to manufacturing and variable costs primarily associated with raw materials and distribution.

4. Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

Competitors include WestRock (NYSE:WRK, Graphic Packaging (NYSE:GPK), and Packaging Corporation of America (NYSE:PKG)

5. Revenue Growth

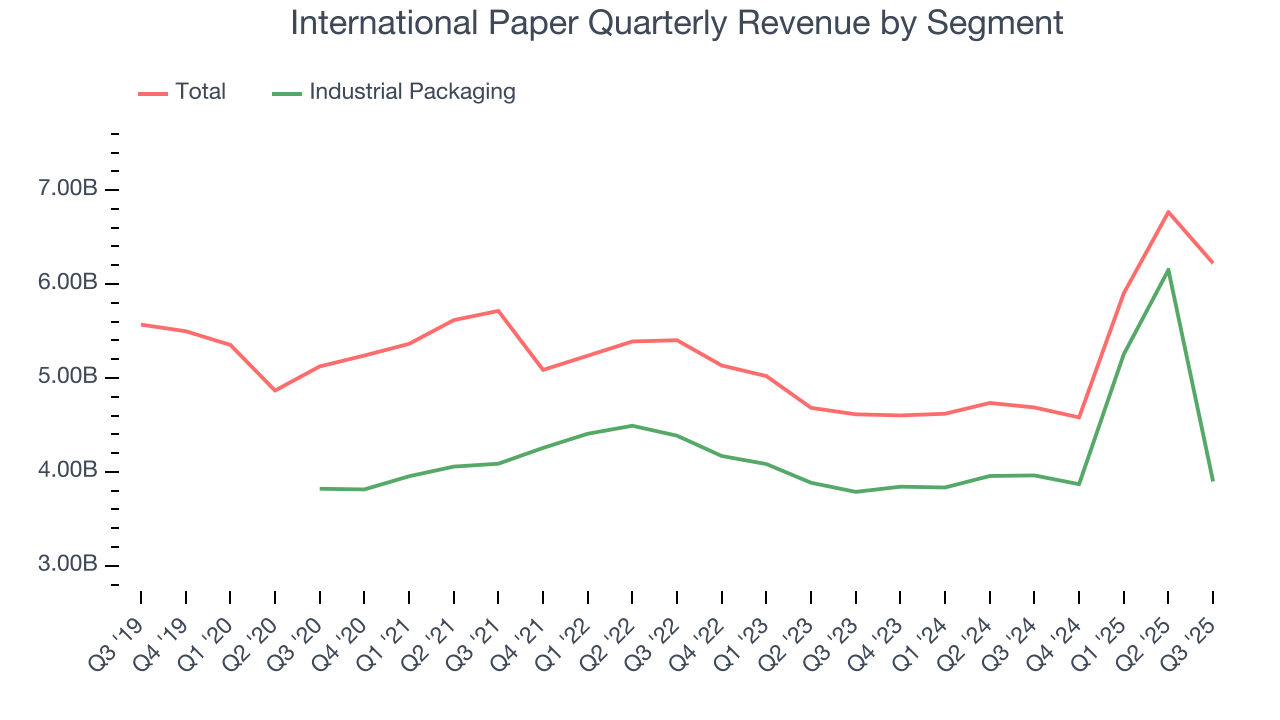

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, International Paper’s 2.4% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. International Paper’s annualized revenue growth of 9.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

International Paper also breaks out the revenue for its most important segment, Industrial Packaging. Over the last two years, International Paper’s Industrial Packaging revenue (containers, displays, bins) averaged 10.5% year-on-year growth.

This quarter, International Paper pulled off a wonderful 32.8% year-on-year revenue growth rate, but its $6.22 billion of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, similar to its two-year rate. This projection is particularly noteworthy for a company of its scale and implies the market sees success for its products and services.

6. Gross Margin & Pricing Power

International Paper’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand. As you can see below, it averaged a decent 30.1% gross margin over the last five years. Said differently, International Paper paid its suppliers $69.91 for every $100 in revenue.

International Paper produced a 31.1% gross profit margin in Q3, marking a 2.1 percentage point increase from 29% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

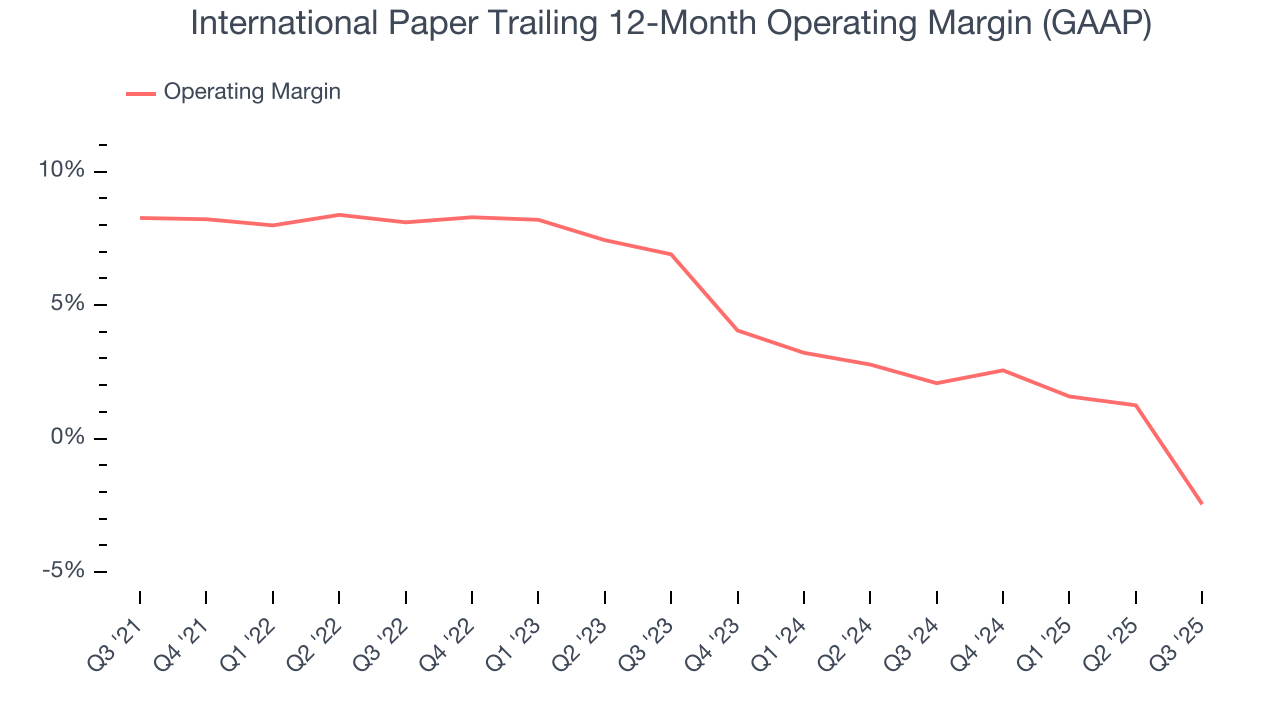

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

International Paper was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.5% was weak for an industrials business.

Looking at the trend in its profitability, International Paper’s operating margin decreased by 10.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. International Paper’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, International Paper generated an operating margin profit margin of negative 10.8%, down 14.6 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

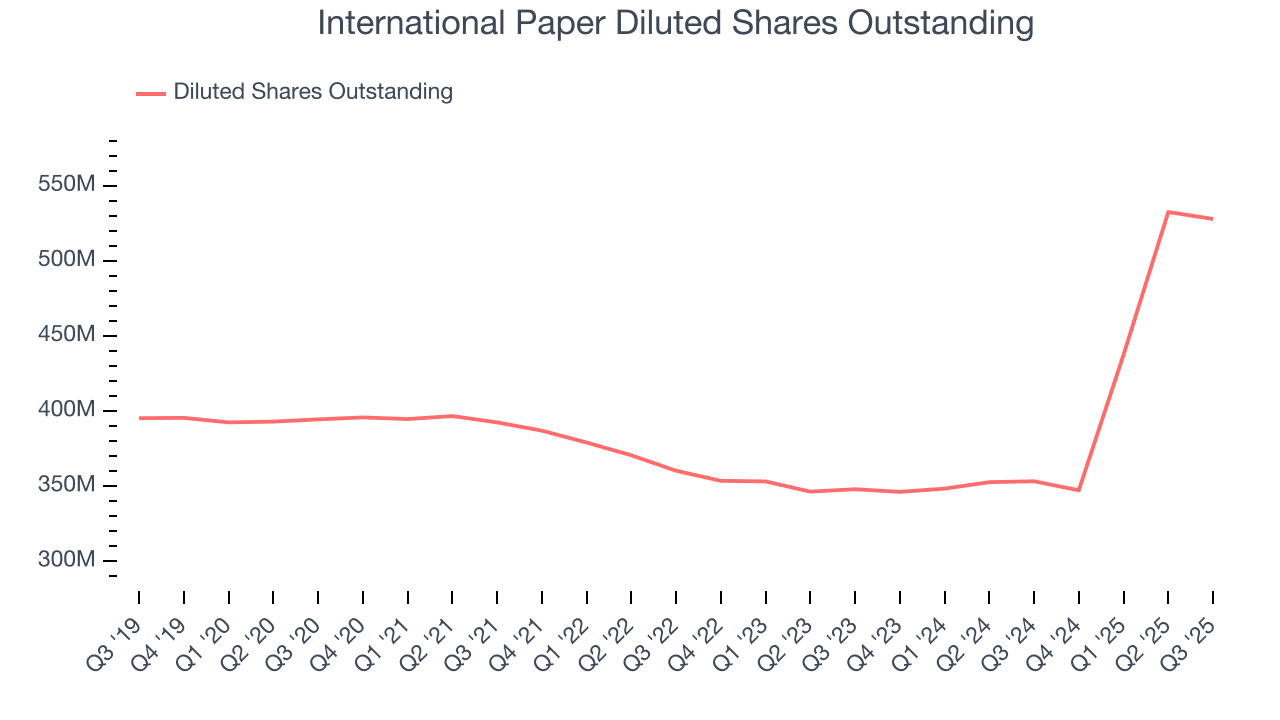

Sadly for International Paper, its EPS declined by 14.9% annually over the last five years while its revenue grew by 2.4%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of International Paper’s earnings can give us a better understanding of its performance. As we mentioned earlier, International Paper’s operating margin declined by 10.7 percentage points over the last five years. Its share count also grew by 33.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For International Paper, its two-year annual EPS declines of 41.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, International Paper reported adjusted EPS of negative $0.43, down from $0.44 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast International Paper’s full-year EPS of negative $0.02 will flip to positive $2.77.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

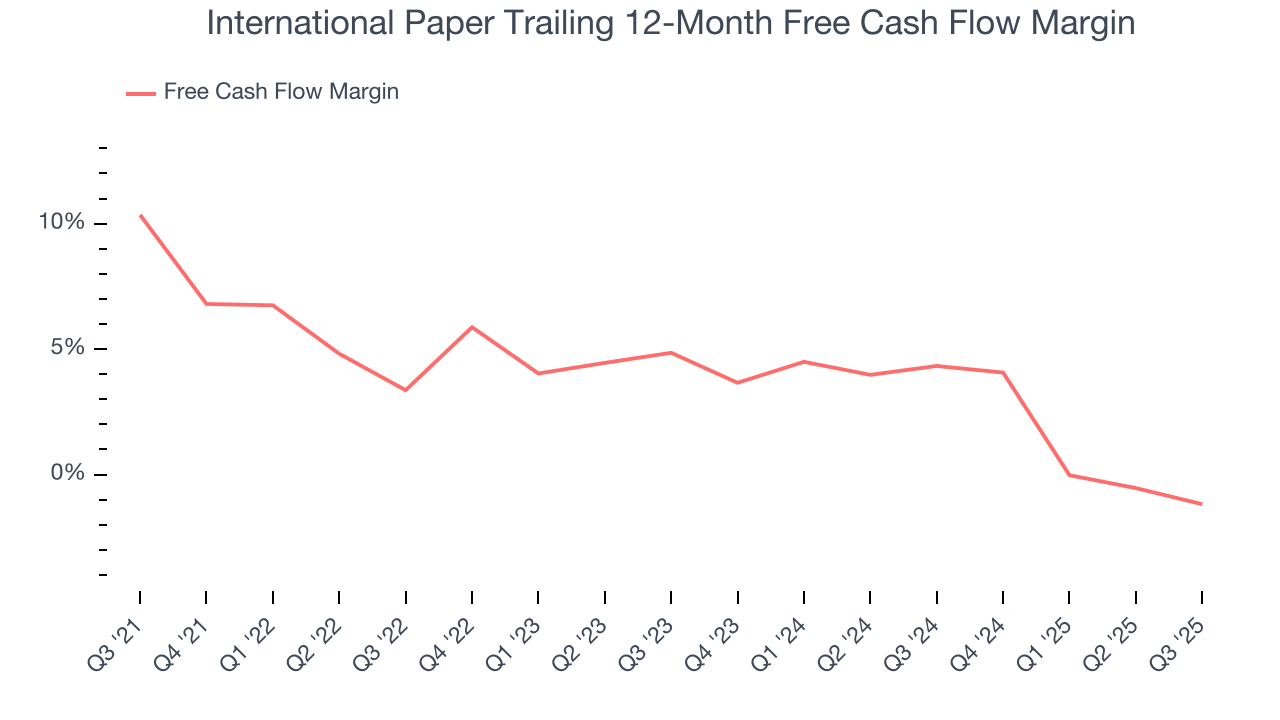

International Paper has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for an industrials business.

Taking a step back, we can see that International Paper’s margin dropped by 11.5 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of a big investment cycle.

International Paper’s free cash flow clocked in at $150 million in Q3, equivalent to a 2.4% margin. The company’s cash profitability regressed as it was 4.2 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

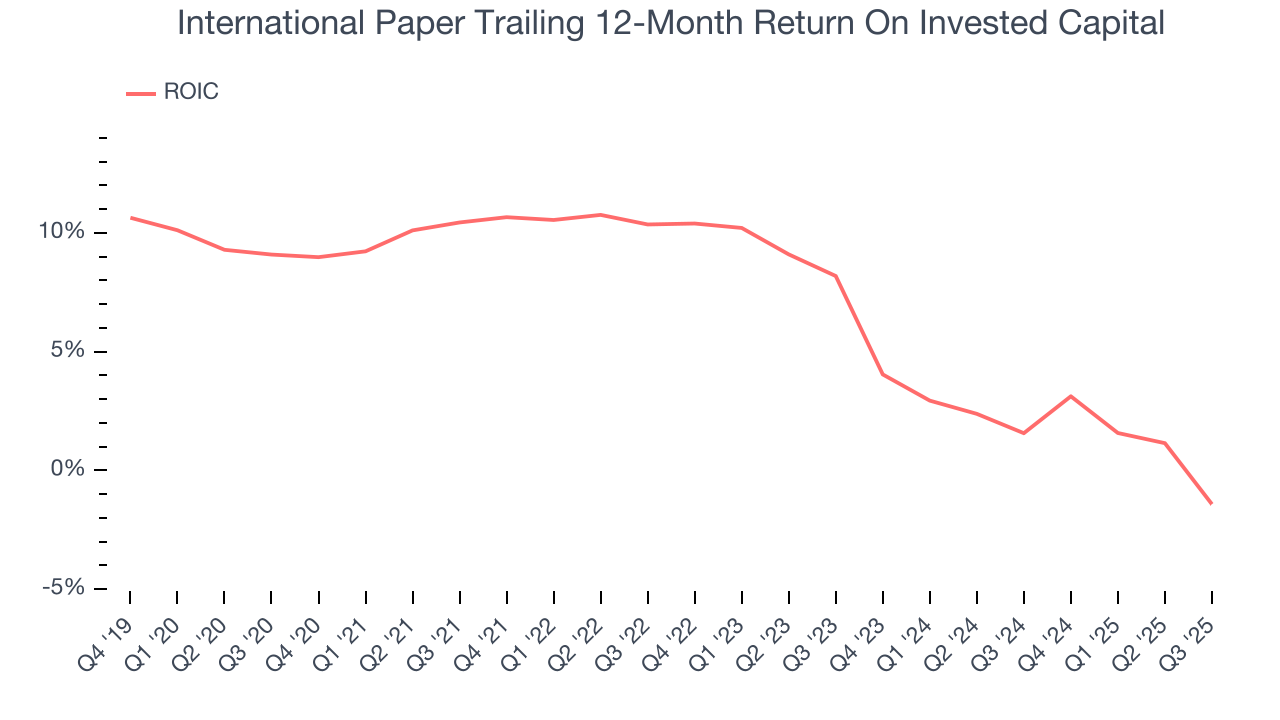

International Paper historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, International Paper’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

International Paper reported $995 million of cash and $10.41 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.43 billion of EBITDA over the last 12 months, we view International Paper’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $159 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from International Paper’s Q3 Results

We struggled to find many positives in these results. Its and its revenue fell short of Wall Street’s estimates, leading to an EPS shortfall versus expectations. Overall, this quarter could have been better. The stock traded down 8.5% to $40.50 immediately after reporting.

13. Is Now The Time To Buy International Paper?

Updated: January 22, 2026 at 10:41 PM EST

Before deciding whether to buy International Paper or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies helping their customers, but in the case of International Paper, we’re out. For starters, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

International Paper’s P/E ratio based on the next 12 months is 27.5x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $47.35 on the company (compared to the current share price of $42.11).