Integer Holdings (ITGR)

We’re cautious of Integer Holdings. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why We Think Integer Holdings Will Underperform

With its name reflecting the mathematical term for "whole" or "complete," Integer Holdings (NYSE:ITGR) is a medical device outsource manufacturer that produces components and systems for cardiac, vascular, neurological, and other medical applications.

- Demand is forecasted to shrink as its estimated sales for the next 12 months are flat

- Revenue base of $1.83 billion puts it at a disadvantage compared to larger competitors exhibiting economies of scale

- A bright spot is that its earnings growth has topped the peer group average over the last five years as its EPS has compounded at 12.9% annually

Integer Holdings’s quality is lacking. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Integer Holdings

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Integer Holdings

At $86.46 per share, Integer Holdings trades at 14x forward P/E. Yes, this valuation multiple is lower than that of other healthcare peers, but we’ll remind you that you often get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Integer Holdings (ITGR) Research Report: Q4 CY2025 Update

Medical technology company Integer Holdings (NYSE:ITGR) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 5% year on year to $472.1 million. The company expects the full year’s revenue to be around $1.85 billion, close to analysts’ estimates. Its non-GAAP profit of $1.76 per share was 3.6% above analysts’ consensus estimates.

Integer Holdings (ITGR) Q4 CY2025 Highlights:

- Revenue: $472.1 million vs analyst estimates of $462.7 million (5% year-on-year growth, 2% beat)

- Adjusted EPS: $1.76 vs analyst estimates of $1.70 (3.6% beat)

- Adjusted EBITDA: $91.6 million vs analyst estimates of $104.2 million (19.4% margin, 12.1% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $6.54 at the midpoint, beating analyst estimates by 3.8%

- EBITDA guidance for the upcoming financial year 2026 is $402.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 11.8%, in line with the same quarter last year

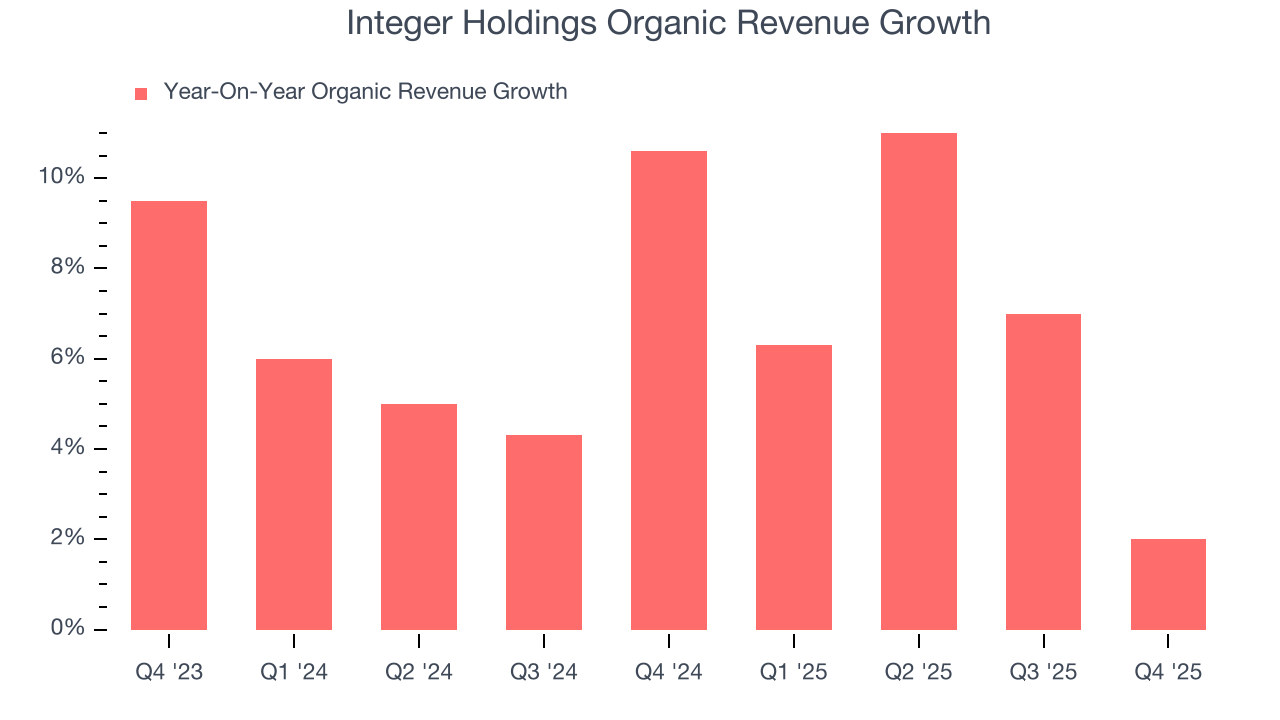

- Organic Revenue rose 2% year on year (beat)

- Market Capitalization: $3.03 billion

Company Overview

With its name reflecting the mathematical term for "whole" or "complete," Integer Holdings (NYSE:ITGR) is a medical device outsource manufacturer that produces components and systems for cardiac, vascular, neurological, and other medical applications.

Integer operates as a critical link in the medical device supply chain, designing and manufacturing components, subassemblies, and complete medical device systems for original equipment manufacturers (OEMs). The company's expertise spans across multiple specialized medical fields, organized into two main segments: Medical and Non-Medical.

The Medical segment, which generates the vast majority of Integer's revenue, is further divided into three product lines. The Cardio & Vascular line produces components for interventional cardiology, structural heart treatments, and vascular access devices. These include coronary stents, balloon catheters, guidewires, and specialized catheters used in procedures ranging from heart valve replacements to stroke treatment.

The Cardiac Rhythm Management & Neuromodulation line focuses on implantable devices that regulate heart rhythm or stimulate nerves to treat various conditions. Integer manufactures critical components like batteries, capacitors, and feedthroughs for pacemakers and neurostimulators, as well as complete lead systems that connect these devices to the heart or nervous system.

The Advanced Surgical, Orthopedics & Portable Medical line produces components for minimally invasive surgical tools and orthopedic instruments, along with power solutions for portable medical equipment like ventilators and defibrillators.

Integer's Non-Medical segment, operating under the Electrochem brand, leverages the company's battery expertise to serve markets requiring power solutions for extreme environments, such as downhole drilling tools and military applications.

The company maintains manufacturing facilities across the United States, Mexico, Uruguay, Ireland, Malaysia, and the Dominican Republic, allowing it to serve global medical device companies. Integer's business model relies on long-term partnerships with major medical device manufacturers, with three customers—Abbott Laboratories, Boston Scientific, and Medtronic—accounting for nearly half of its total sales.

4. Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Integer Holdings competes with other medical device contract manufacturers including Jabil (NYSE:JBL), TE Connectivity (NYSE:TEL), and Flex (NASDAQ:FLEX), as well as specialized medical component manufacturers like Greatbatch Medical (which Integer acquired) and privately-held companies such as Cirtec Medical and Viant Medical.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.85 billion in revenue over the past 12 months, Integer Holdings is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

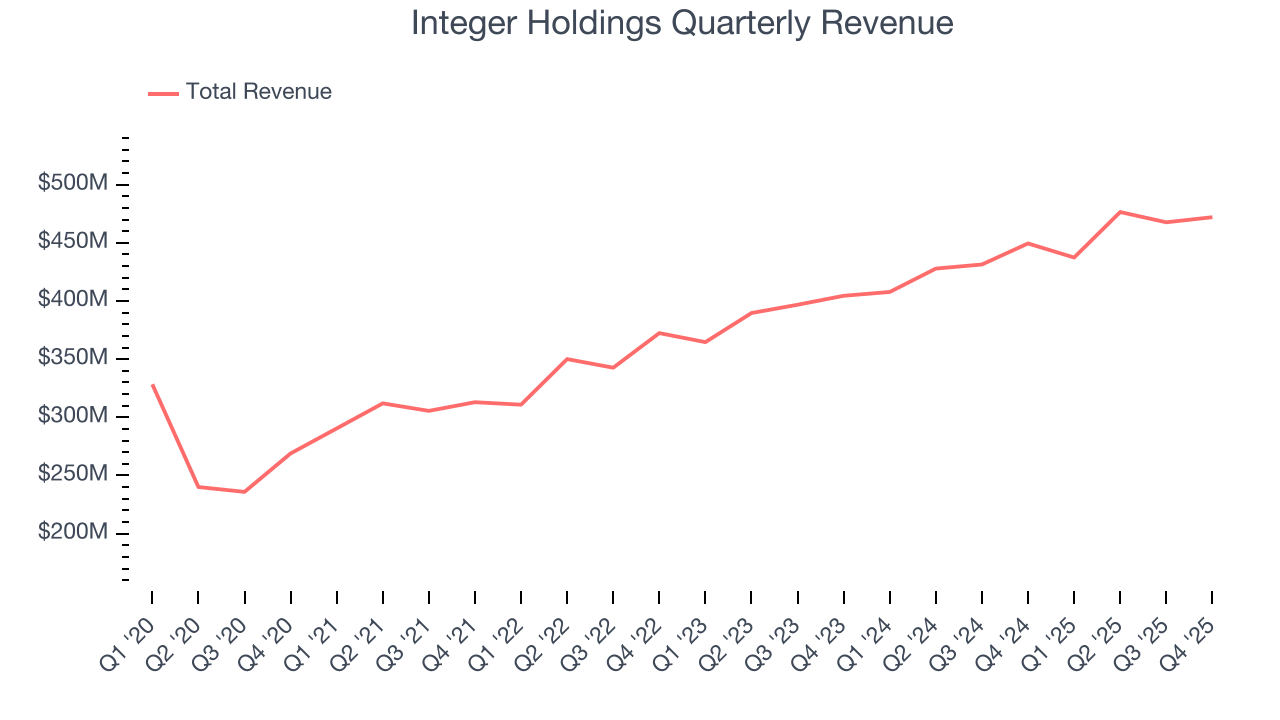

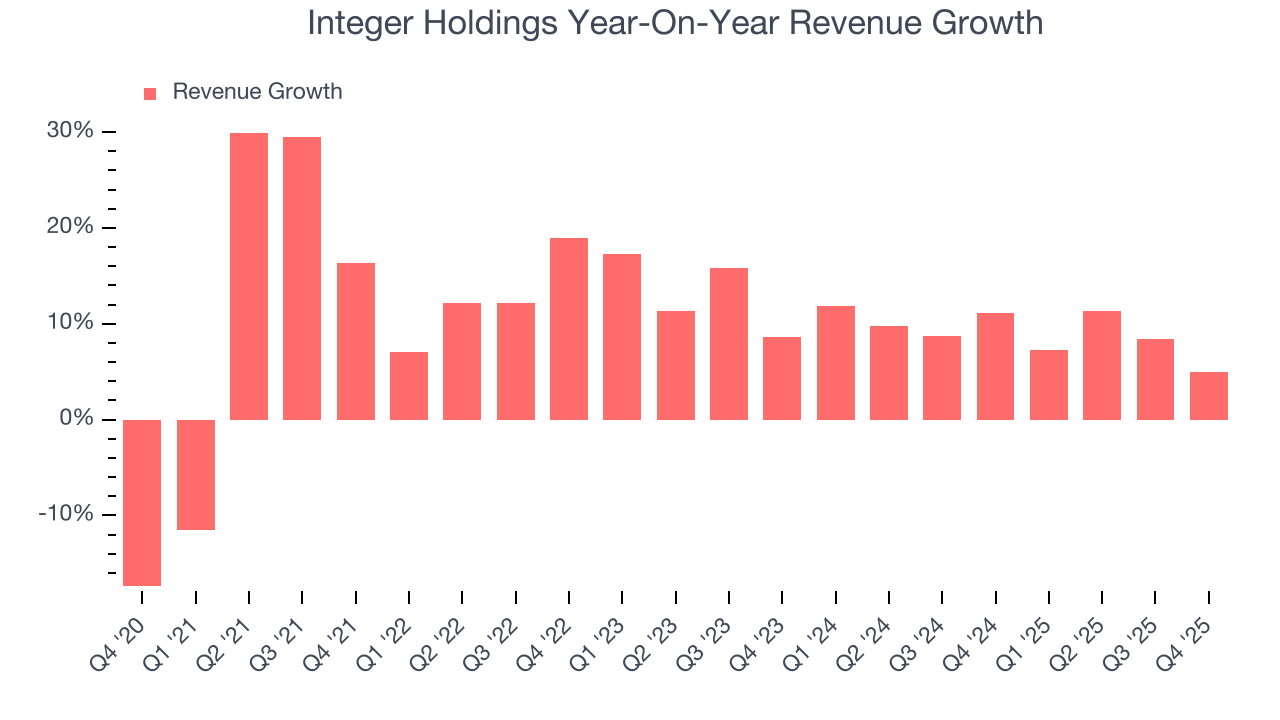

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Integer Holdings’s 11.5% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Integer Holdings’s annualized revenue growth of 9.2% over the last two years is below its five-year trend, but we still think the results were respectable.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Integer Holdings’s organic revenue averaged 6.5% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Integer Holdings reported year-on-year revenue growth of 5%, and its $472.1 million of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

7. Operating Margin

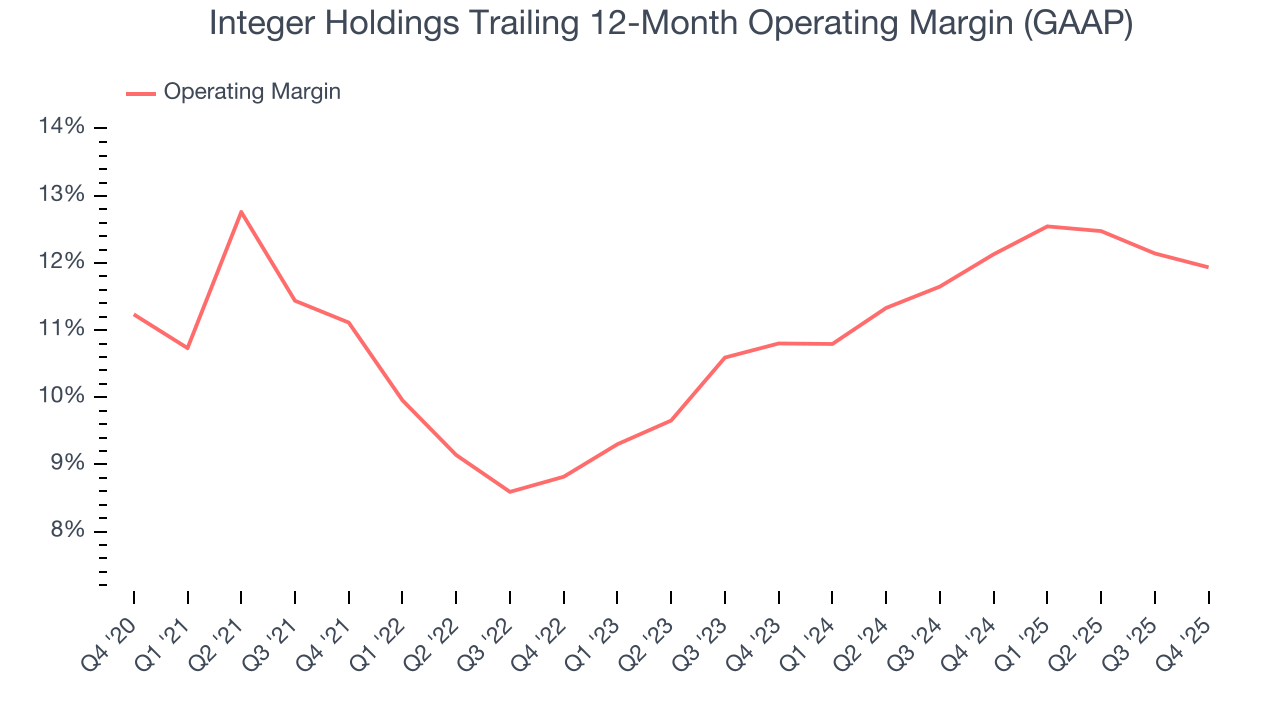

Integer Holdings’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 11.1% over the last five years. This profitability was higher than the broader healthcare sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Integer Holdings’s operating margin of 11.9% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.1 percentage points over the last two years.

In Q4, Integer Holdings generated an operating margin profit margin of 11.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

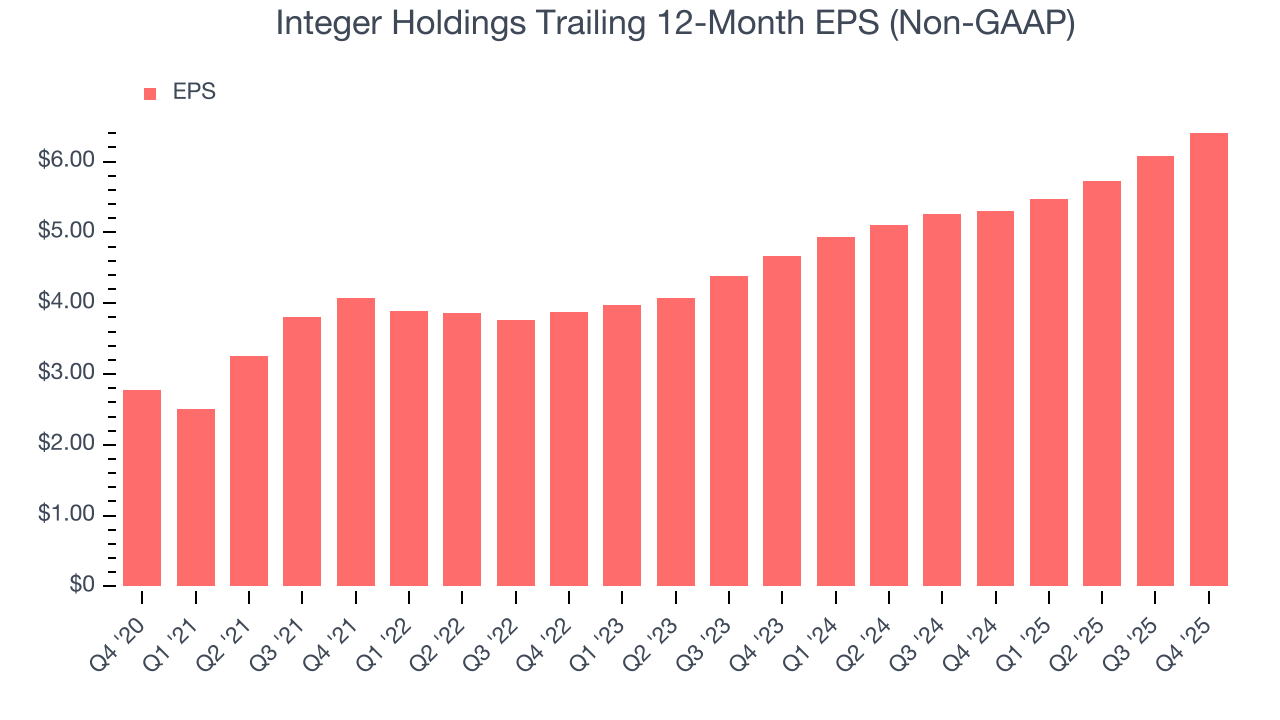

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Integer Holdings’s EPS grew at an astounding 18.2% compounded annual growth rate over the last five years, higher than its 11.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Integer Holdings reported adjusted EPS of $1.76, up from $1.43 in the same quarter last year. This print beat analysts’ estimates by 3.6%. Over the next 12 months, Wall Street expects Integer Holdings’s full-year EPS of $6.41 to shrink by 2.2%.

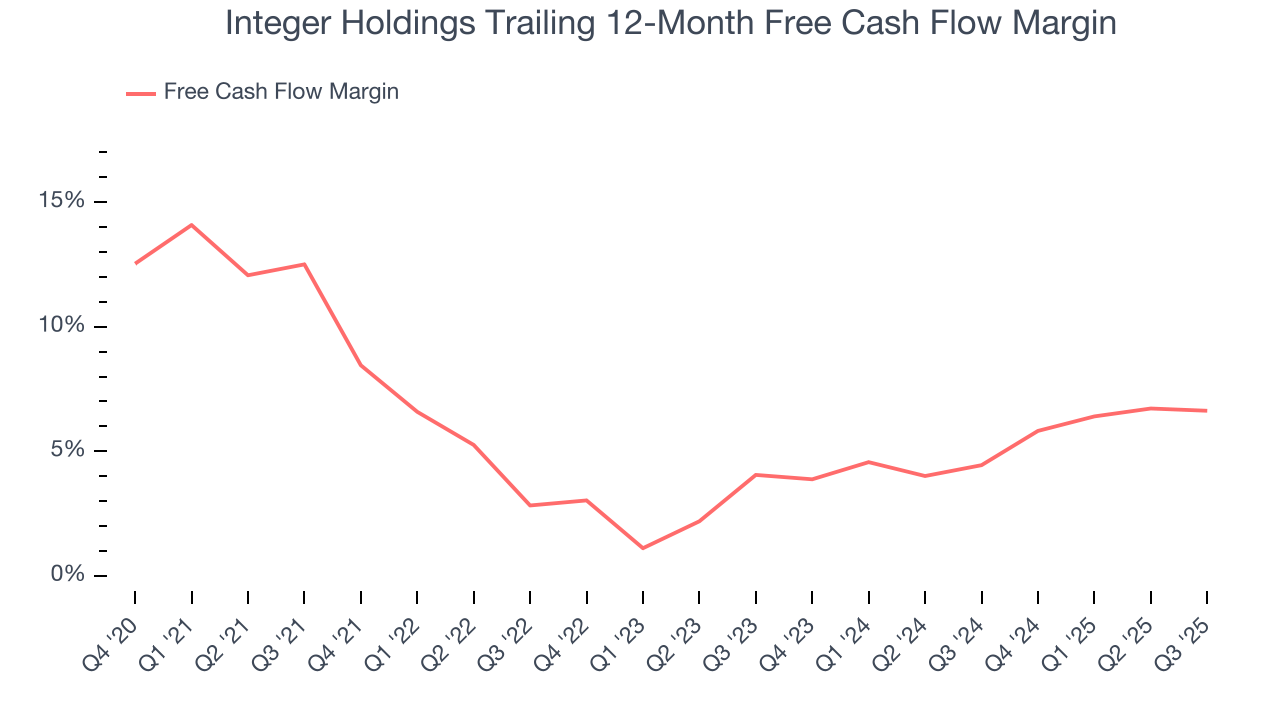

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Integer Holdings has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.3% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Integer Holdings’s margin dropped by 4.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

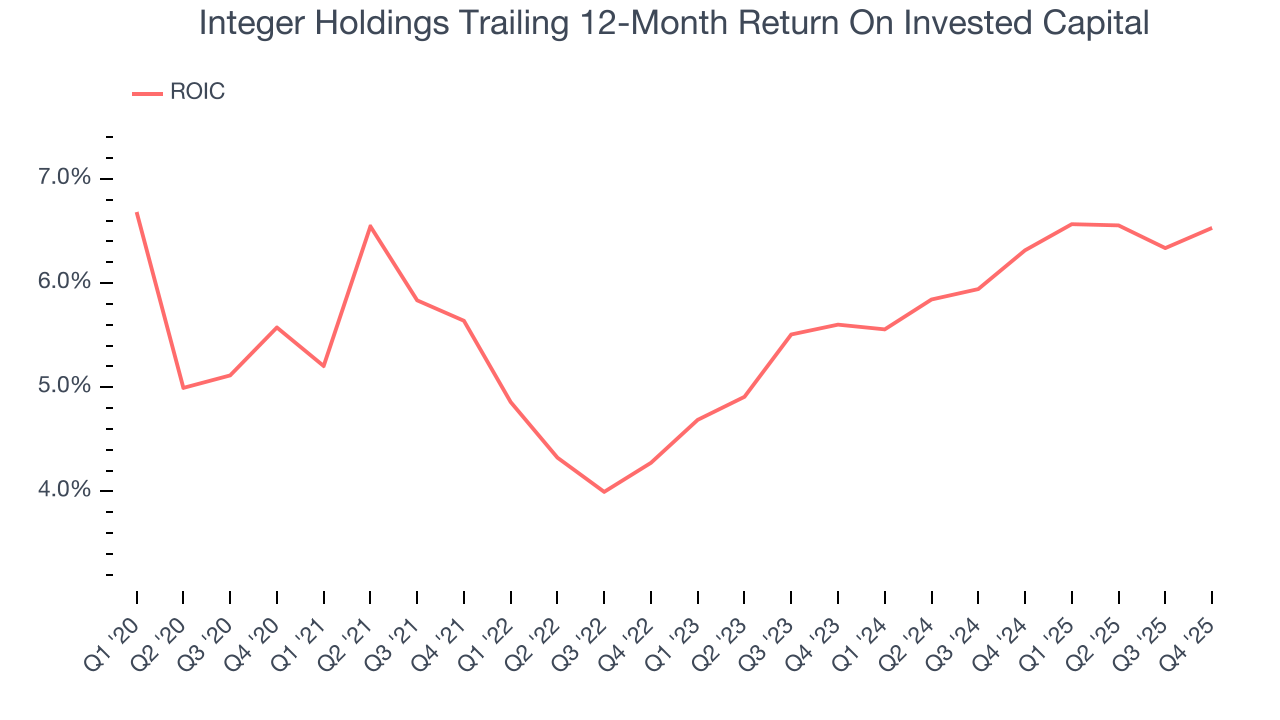

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Integer Holdings historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.7%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Integer Holdings’s ROIC averaged 1.5 percentage point increases each year over the last few years. This is a good sign, and we hope the company can continue improving.

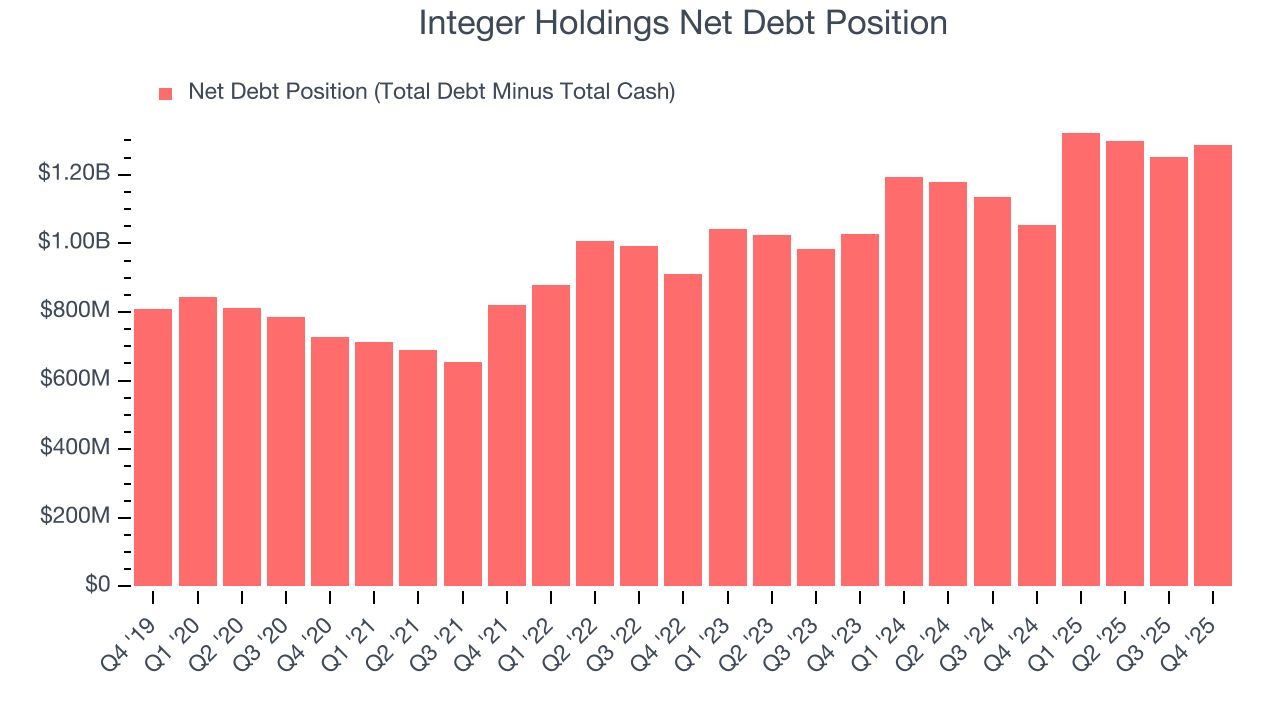

11. Balance Sheet Assessment

Integer Holdings reported $17.16 million of cash and $1.30 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $388 million of EBITDA over the last 12 months, we view Integer Holdings’s 3.3× net-debt-to-EBITDA ratio as safe. We also see its $24.65 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Integer Holdings’s Q4 Results

We enjoyed seeing Integer Holdings beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 8.3% to $93.68 immediately after reporting.

13. Is Now The Time To Buy Integer Holdings?

Updated: February 19, 2026 at 8:31 AM EST

Before making an investment decision, investors should account for Integer Holdings’s business fundamentals and valuation in addition to what happened in the latest quarter.

Integer Holdings’s business quality ultimately falls short of our standards. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its subscale operations give it fewer distribution channels than its larger rivals. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its cash profitability fell over the last five years.

Integer Holdings’s P/E ratio based on the next 12 months is 13.8x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $85.57 on the company (compared to the current share price of $93.68).