Jacobs Solutions (J)

We wouldn’t buy Jacobs Solutions. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Jacobs Solutions Will Underperform

With a workforce of approximately 45,000 professionals tackling complex challenges from water scarcity to cybersecurity, Jacobs Solutions (NYSE:J) provides engineering, consulting, and technical services focused on infrastructure, sustainability, and advanced technology solutions.

- Annual sales declines of 5.4% for the past five years show its products and services struggled to connect with the market during this cycle

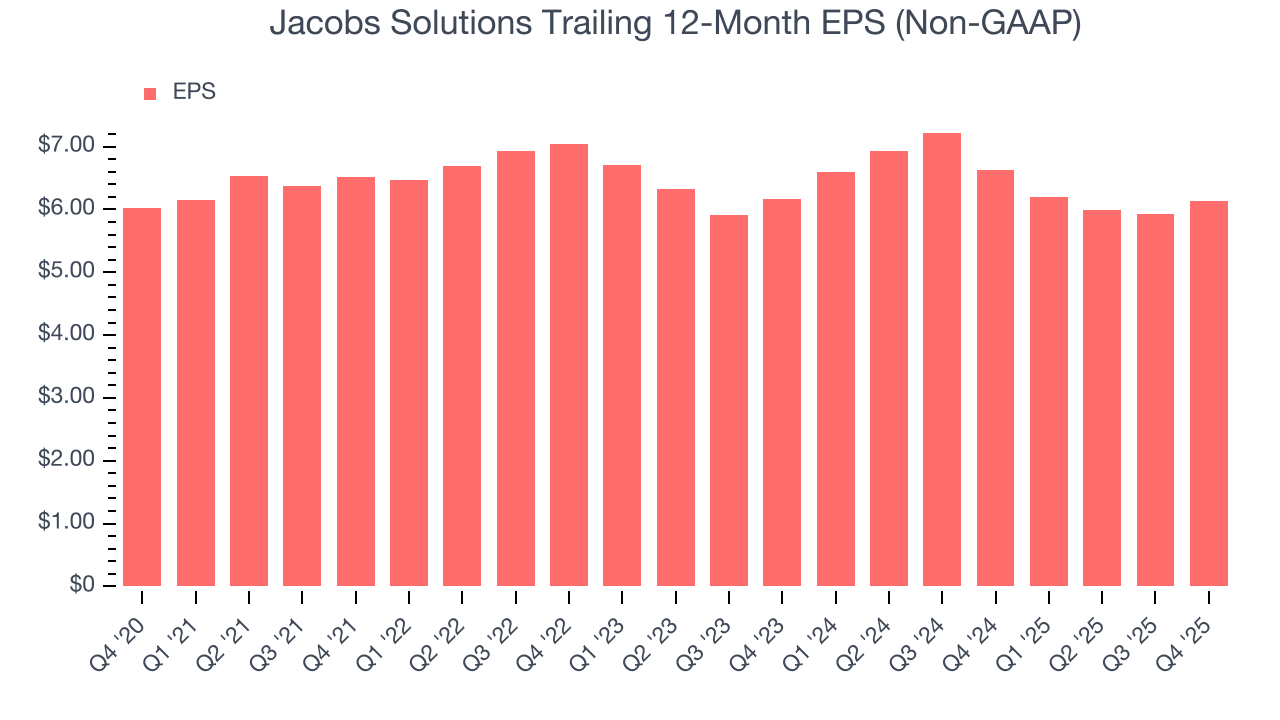

- Earnings per share have contracted by 8.4% annually over the last two years, a headwind for returns as stock prices often echo long-term EPS performance

- Low returns on capital reflect management’s struggle to allocate funds effectively

Jacobs Solutions doesn’t measure up to our expectations. There are more appealing investments to be made.

Why There Are Better Opportunities Than Jacobs Solutions

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Jacobs Solutions

Jacobs Solutions’s stock price of $133.98 implies a valuation ratio of 18.7x forward P/E. This multiple is quite expensive for the quality you get.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Jacobs Solutions (J) Research Report: Q4 CY2025 Update

Global professional services company Jacobs Solutions (NYSE:J) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 12.3% year on year to $3.29 billion. Its non-GAAP profit of $1.53 per share was 1.8% above analysts’ consensus estimates.

Jacobs Solutions (J) Q4 CY2025 Highlights:

- Revenue: $3.29 billion vs analyst estimates of $3.09 billion (12.3% year-on-year growth, 6.5% beat)

- Adjusted EPS: $1.53 vs analyst estimates of $1.50 (1.8% beat)

- Adjusted EBITDA: $302.6 million vs analyst estimates of $300.1 million (9.2% margin, 0.8% beat)

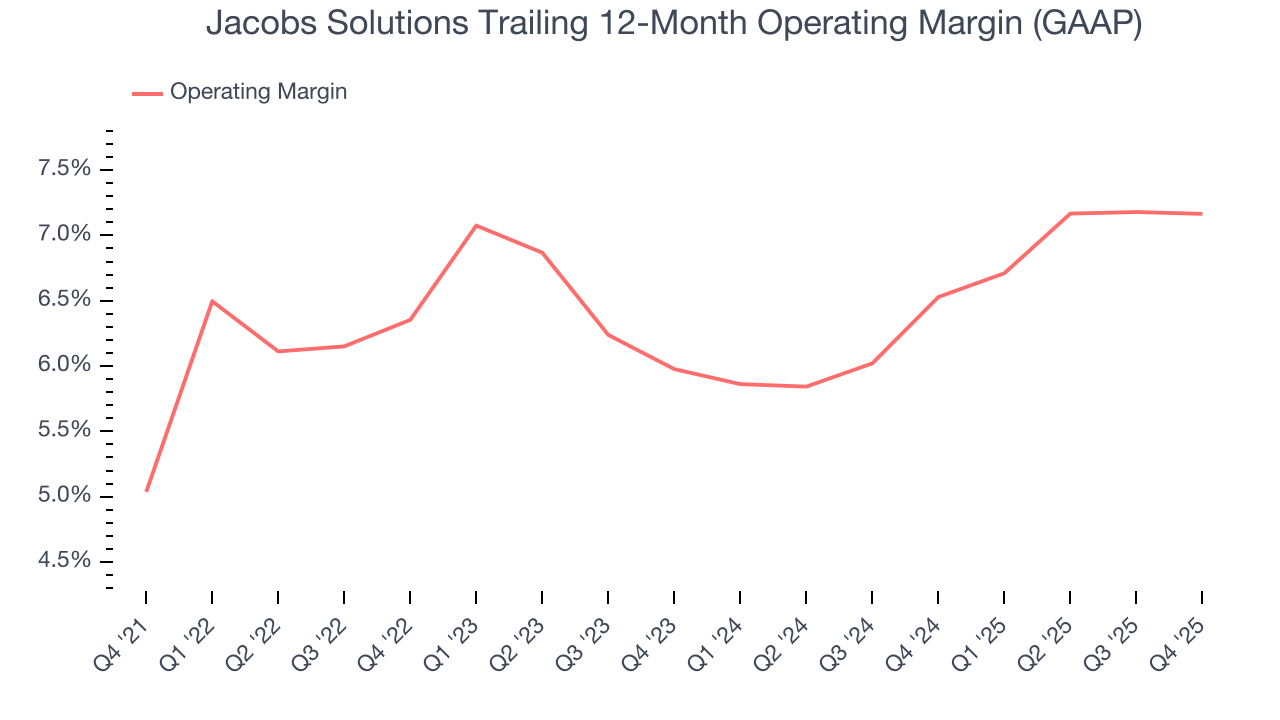

- Operating Margin: 7.1%, in line with the same quarter last year

- Free Cash Flow Margin: 11.1%, up from 3.3% in the same quarter last year

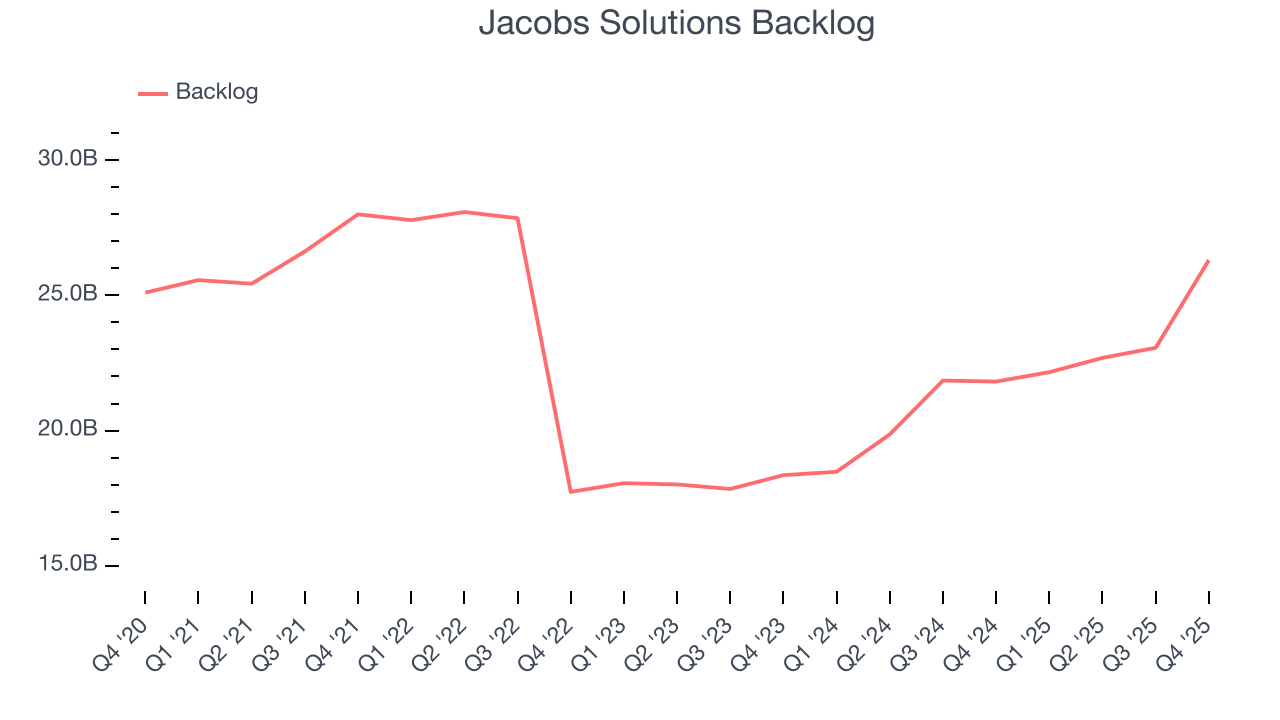

- Backlog: $26.31 billion at quarter end, up 20.6% year on year

- Market Capitalization: $16.16 billion

Company Overview

With a workforce of approximately 45,000 professionals tackling complex challenges from water scarcity to cybersecurity, Jacobs Solutions (NYSE:J) provides engineering, consulting, and technical services focused on infrastructure, sustainability, and advanced technology solutions.

Jacobs operates through two main segments: Infrastructure & Advanced Facilities (I&AF) and its 65% stake in PA Consulting. The I&AF segment delivers solutions across critical infrastructure, water management, and life sciences sectors, helping clients navigate complex challenges related to climate change, energy transition, and infrastructure development.

The company's services span the entire project lifecycle, from initial advisory and planning through design, implementation, and ongoing management. For example, Jacobs might help a city develop a comprehensive climate resilience plan, design flood protection systems, and then oversee their construction and implementation. For a pharmaceutical client, they might design and engineer manufacturing facilities that meet strict regulatory requirements.

Jacobs generates revenue primarily through professional service fees charged to clients for consulting, engineering, design, and project management. Their client base includes national and local governments across the U.S., Europe, UK, Middle East, and Asia Pacific, as well as multinational corporations and private sector businesses worldwide.

The company's PA Consulting investment enhances its capabilities in innovation and digital transformation. This unit brings together strategists, designers, scientists, and technologists to help clients develop new products and services or transform their operations. For instance, PA Consulting might help a traditional manufacturer develop IoT-enabled products or assist a government agency in digitizing citizen services.

Jacobs has strategically positioned itself around three growth accelerators: Climate Response (focusing on energy transition and resilience solutions), Consulting & Advisory (helping clients conceptualize and shape their future), and Data Solutions (leveraging digital capabilities and AI to improve client operations). This approach allows Jacobs to address emerging market needs while maintaining its core engineering and technical expertise.

4. Government & Technical Consulting

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

Jacobs Solutions competes with global engineering and consulting firms like AECOM, WSP, Tetra Tech, and Arcadis in the infrastructure space, while also facing competition from management consulting firms such as Accenture, Deloitte, and McKinsey & Company in its advisory services.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $12.39 billion in revenue over the past 12 months, Jacobs Solutions is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Jacobs Solutions to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

As you can see below, Jacobs Solutions grew its sales at a sluggish 1.2% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Jacobs Solutions’s annualized revenue growth of 5.6% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Jacobs Solutions’s backlog reached $26.31 billion in the latest quarter and averaged 14.3% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Jacobs Solutions’s products and services but raises concerns about capacity constraints.

This quarter, Jacobs Solutions reported year-on-year revenue growth of 12.3%, and its $3.29 billion of revenue exceeded Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months, similar to its two-year rate. This projection is above the sector average and suggests its newer products and services will help sustain its recent top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Jacobs Solutions was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.2% was weak for a business services business.

On the plus side, Jacobs Solutions’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Jacobs Solutions generated an operating margin profit margin of 7.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Jacobs Solutions’s flat EPS over the last five years was below its 1.2% annualized revenue growth. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Unfortunately for Jacobs Solutions, things didn’t get any better over the last two years as its EPS didn’t budge. We hope its earnings can grow in the coming years.

In Q4, Jacobs Solutions reported adjusted EPS of $1.53, up from $1.32 in the same quarter last year. This print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects Jacobs Solutions’s full-year EPS of $6.13 to grow 19.8%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Jacobs Solutions has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.8% over the last five years, slightly better than the broader business services sector.

Jacobs Solutions’s free cash flow clocked in at $364.9 million in Q4, equivalent to a 11.1% margin. This result was good as its margin was 7.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Jacobs Solutions historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.8%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Jacobs Solutions’s ROIC increased by 4.9 percentage points annually over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

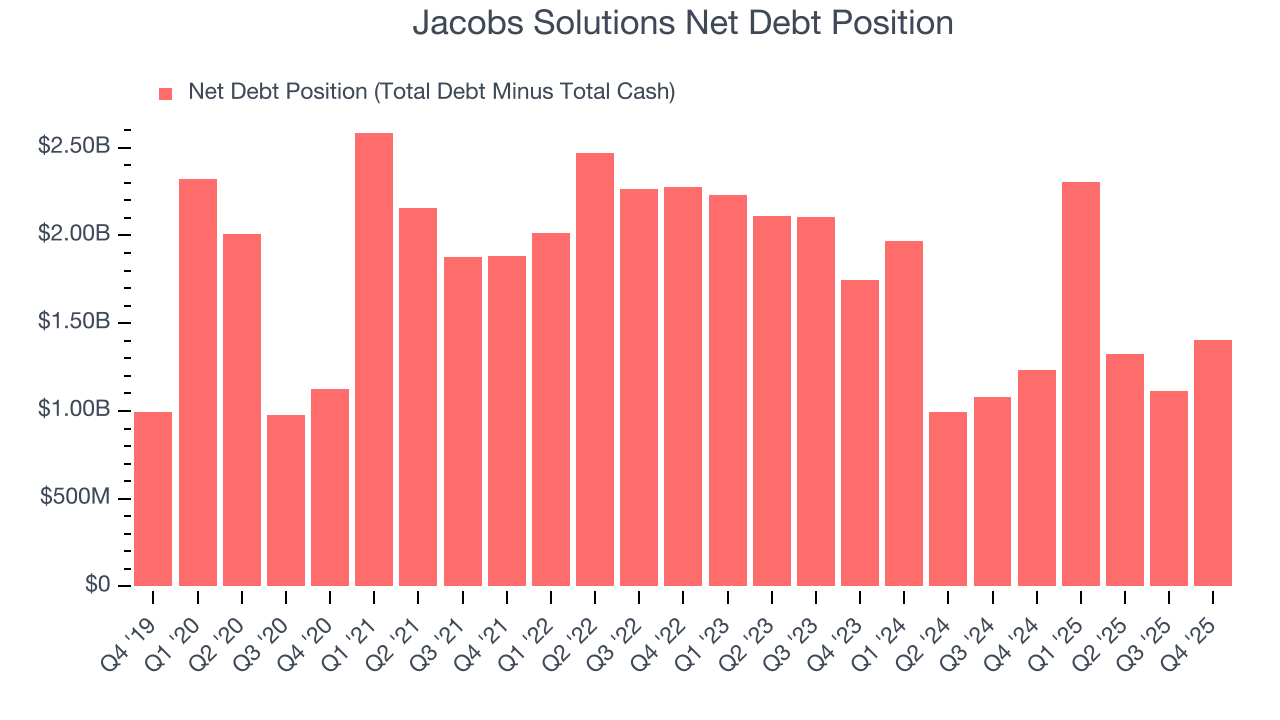

Jacobs Solutions reported $1.55 billion of cash and $2.96 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.23 billion of EBITDA over the last 12 months, we view Jacobs Solutions’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $58.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Jacobs Solutions’s Q4 Results

We were impressed by how significantly Jacobs Solutions blew past analysts’ backlog expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 1.7% to $135.00 immediately following the results.

12. Is Now The Time To Buy Jacobs Solutions?

Updated: February 22, 2026 at 9:05 PM EST

Before investing in or passing on Jacobs Solutions, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Jacobs Solutions doesn’t pass our quality test. To begin with, its revenue has declined over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders. On top of that, its mediocre ROIC lags the market and is a headwind for its stock price.

Jacobs Solutions’s P/E ratio based on the next 12 months is 18.9x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $157.53 on the company (compared to the current share price of $137.90).