Johnson Controls (JCI)

We’re wary of Johnson Controls. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Johnson Controls Will Underperform

Founded after patenting the electric room thermostat, Johnson Controls (NYSE:JCI) specializes in building products and technology solutions, including HVAC systems, fire and security systems, and energy storage.

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its decreasing returns suggest its historical profit centers are aging

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

- One positive is that its 10.3% annual revenue growth over the last five years surpassed the sector average as its offerings resonated with customers

Johnson Controls lacks the business quality we seek. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Johnson Controls

Why There Are Better Opportunities Than Johnson Controls

At $123.61 per share, Johnson Controls trades at 26.6x forward P/E. This multiple rich for the business quality. Not a great combination.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Johnson Controls (JCI) Research Report: Q4 CY2025 Update

Building operations company Johnson Controls (NYSE:JCI) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 6.8% year on year to $5.80 billion. Its non-GAAP profit of $0.89 per share was 5.7% above analysts’ consensus estimates.

Johnson Controls (JCI) Q4 CY2025 Highlights:

- Revenue: $5.80 billion vs analyst estimates of $5.64 billion (6.8% year-on-year growth, 2.8% beat)

- Adjusted EPS: $0.89 vs analyst estimates of $0.84 (5.7% beat)

- Adjusted EBITDA: $1.05 billion vs analyst estimates of $911.9 million (18.1% margin, 15.2% beat)

- Management raised its full-year Adjusted EPS guidance to $4.70 at the midpoint, a 3.3% increase

- Operating Margin: 14.7%, up from 9.1% in the same quarter last year

- Free Cash Flow Margin: 9.2%, up from 2.5% in the same quarter last year

- Organic Revenue rose 6% year on year (beat)

- Market Capitalization: $75.9 billion

Company Overview

Founded after patenting the electric room thermostat, Johnson Controls (NYSE:JCI) specializes in building products and technology solutions, including HVAC systems, fire and security systems, and energy storage.

Johnson Controls was founded in 1885 by Warren S. Johnson, a professor who invented the electric room thermostat. Since its inception, the company has grown to provide a variety of building products and technology solutions, focusing on intelligent buildings, efficient energy solutions, and integrated infrastructure.

Johnson Controls provides products including HVAC systems, fire detection and suppression systems, security systems, and energy management solutions. For example, the company’s building management systems can automate and monitor heating and cooling operations in commercial buildings to improve energy efficiency and reduce operational costs.

The company generates revenue through the sale of equipment, installation and service fees, and performance contracting. Johnson Controls serves a diverse clientele, including commercial building owners, operators, occupants, and various industrial sectors.

Johnson Controls sells its products and services through direct sales forces and service networks, supplemented by independent distributors and installers. Johnson Controls's revenue sources include transaction-based and recurring revenues from long-term service agreements and maintenance contracts, ensuring a steady income stream.

4. Commercial Building Products

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

Competitors in the building efficiency and security solutions industry include Honeywell (NASDAQ:HON), Carrier Global (NYSE:CARR), and Trane Technologies (NYSE:TT).

5. Revenue Growth

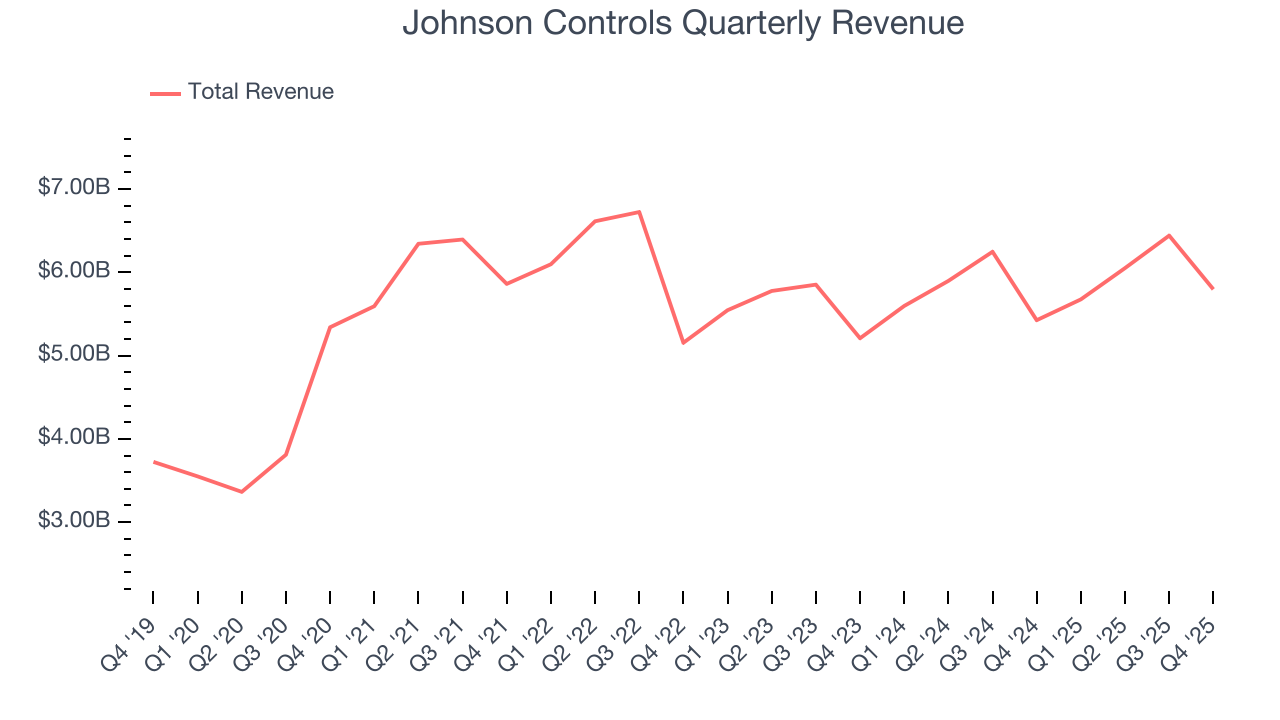

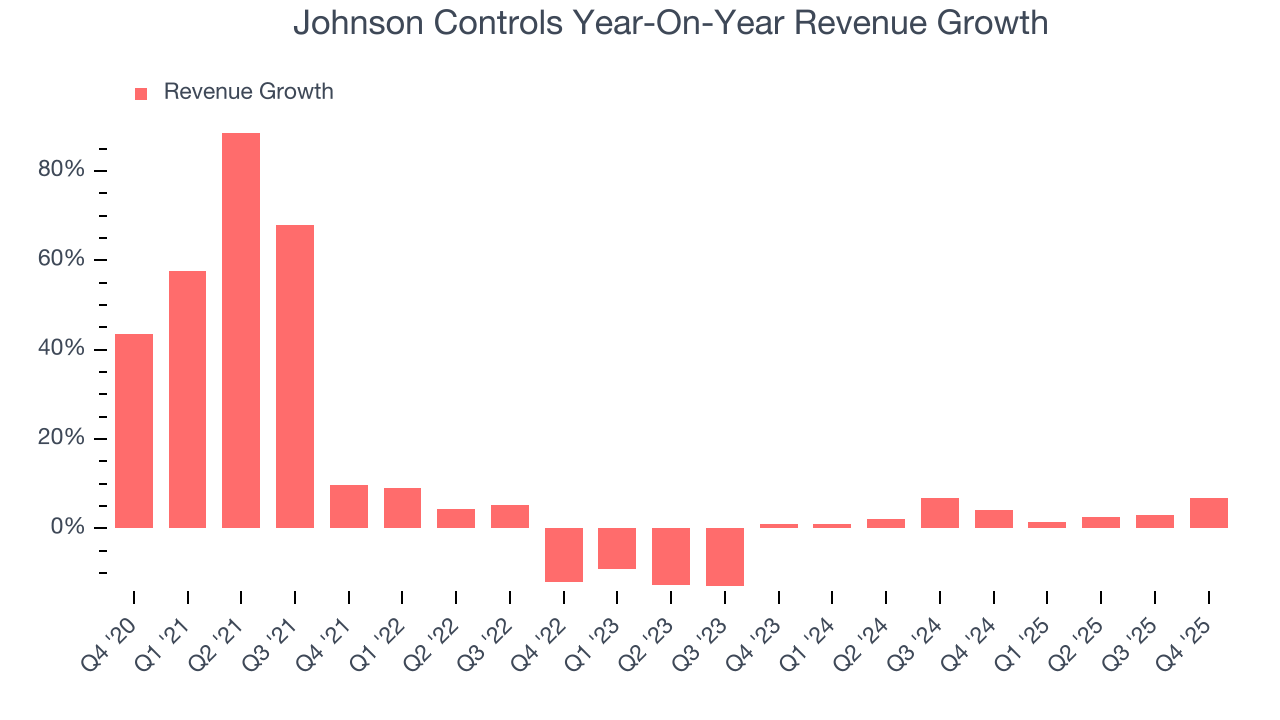

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Johnson Controls’s 8.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Johnson Controls’s recent performance shows its demand has slowed as its annualized revenue growth of 3.5% over the last two years was below its five-year trend.

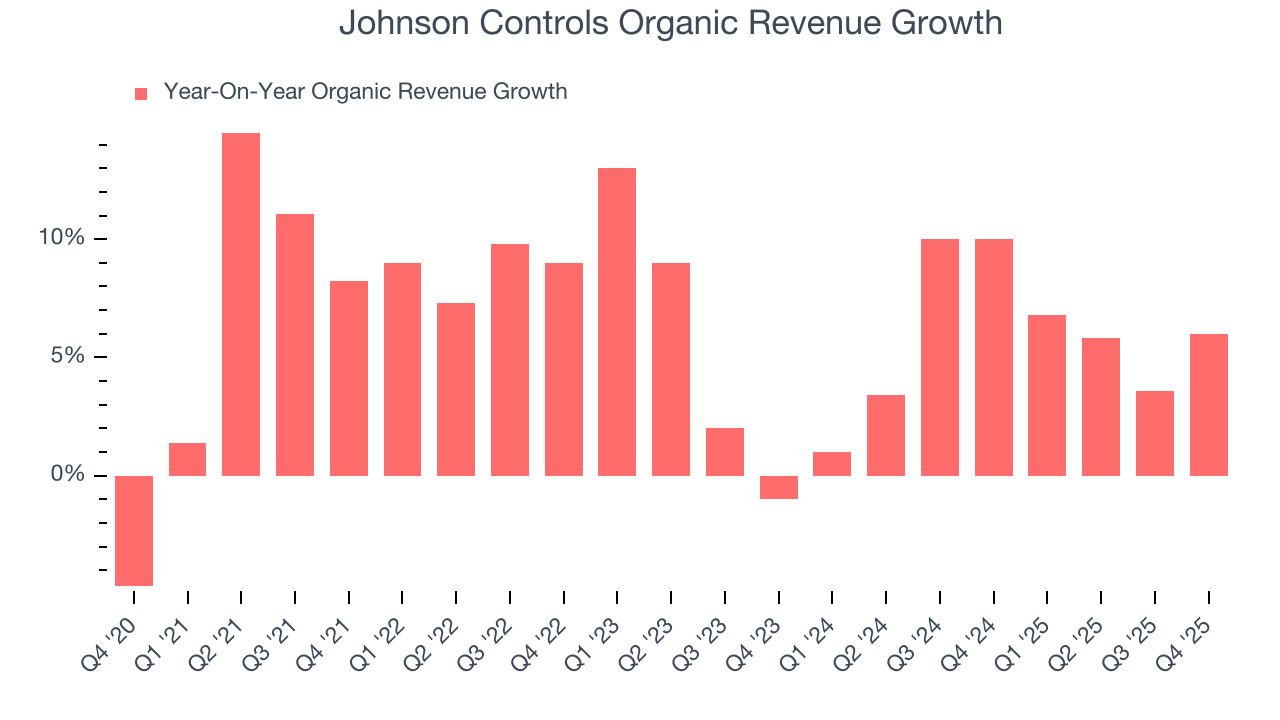

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Johnson Controls’s organic revenue averaged 5.8% year-on-year growth. Because this number is better than its two-year revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Johnson Controls reported year-on-year revenue growth of 6.8%, and its $5.80 billion of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, similar to its two-year rate. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

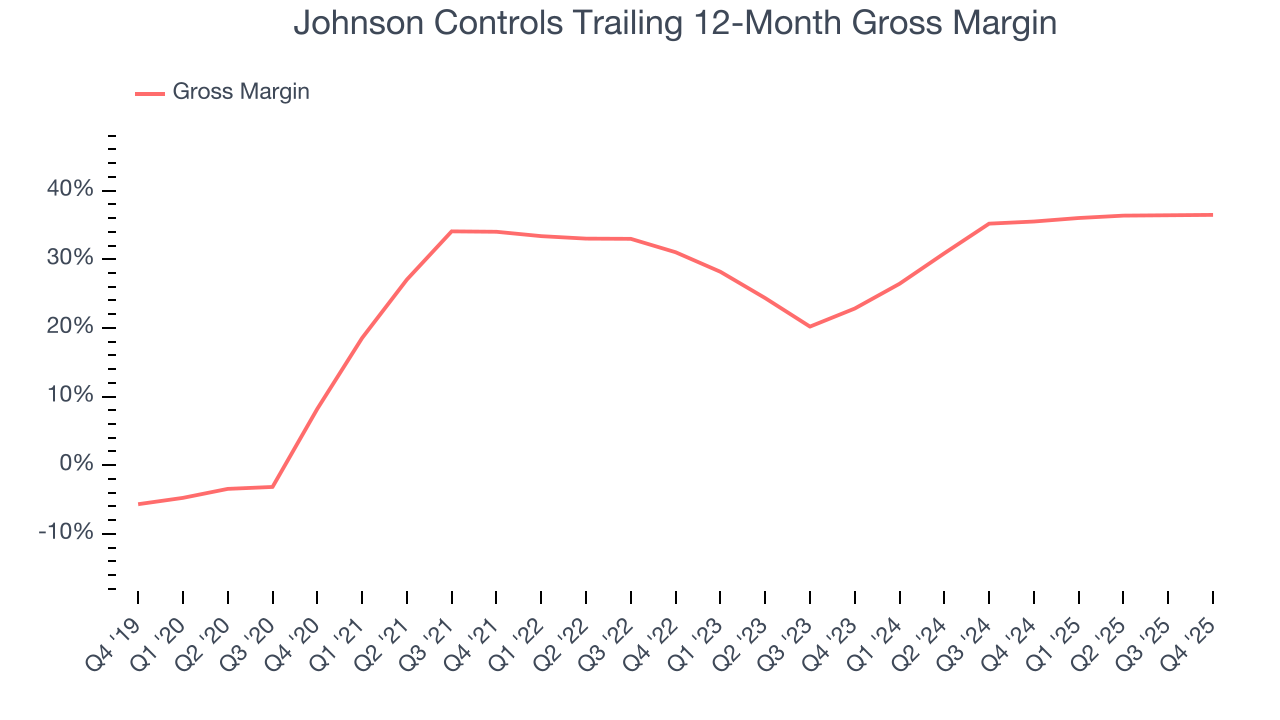

Johnson Controls’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand.As you can see below, it averaged a decent 32.1% gross margin over the last five years. That means for every $100 in revenue, roughly $32.06 was left to spend on selling, marketing, R&D, and general administrative overhead.

Johnson Controls produced a 35.8% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Johnson Controls’s operating margin has risen over the last 12 months and averaged 9% over the last five years. Its profitability was higher than the broader industrials sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Johnson Controls’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Johnson Controls generated an operating margin profit margin of 14.7%, up 5.6 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

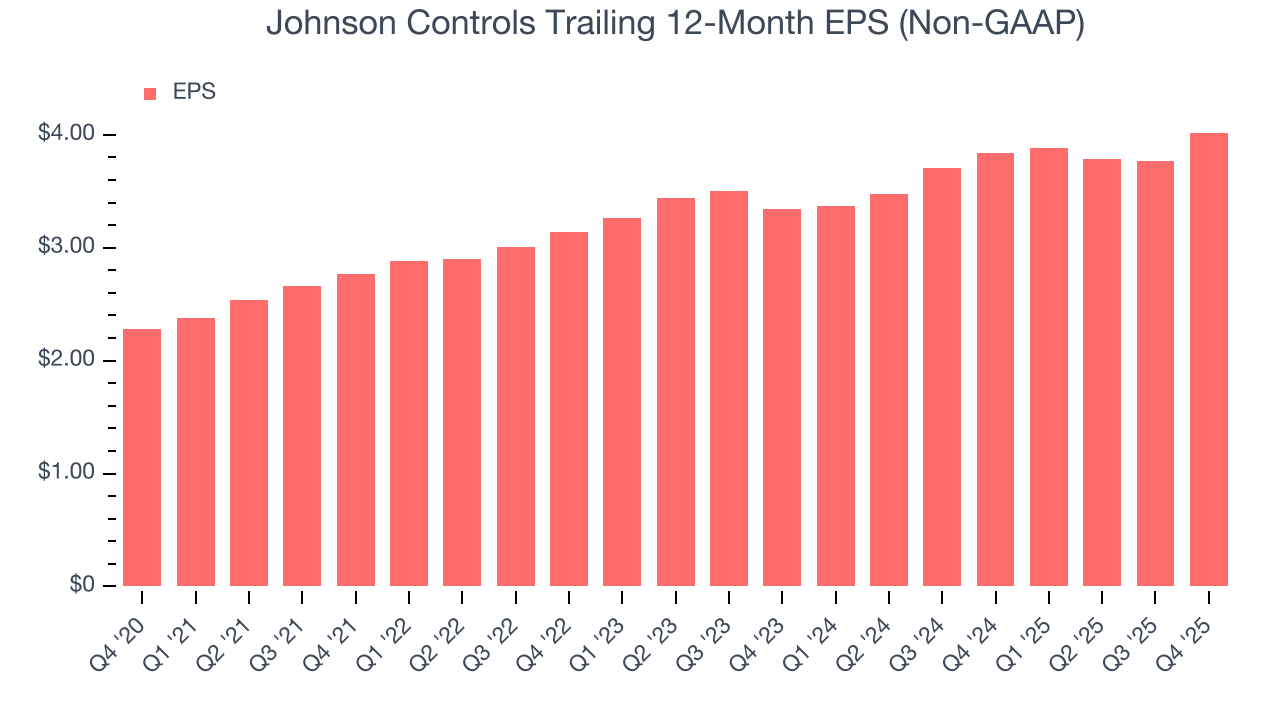

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

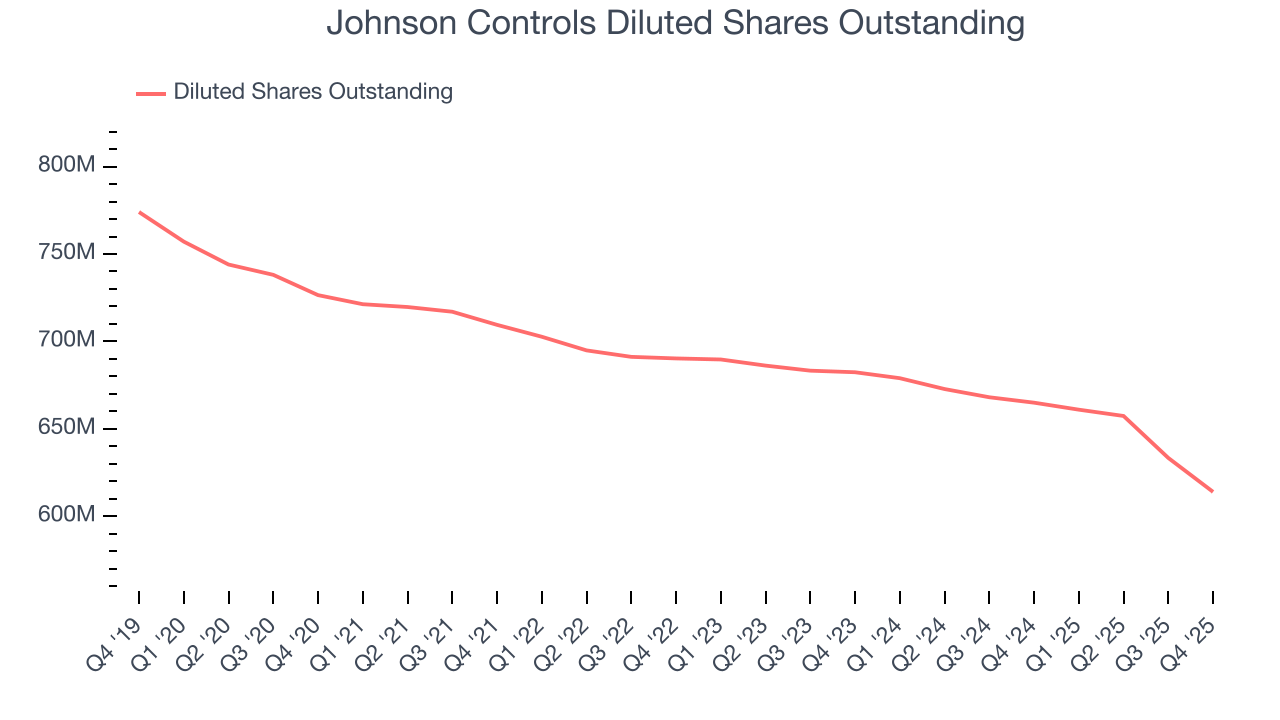

Johnson Controls’s EPS grew at a remarkable 12% compounded annual growth rate over the last five years, higher than its 8.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Johnson Controls’s earnings can give us a better understanding of its performance. A five-year view shows that Johnson Controls has repurchased its stock, shrinking its share count by 15.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Johnson Controls, its two-year annual EPS growth of 9.7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Johnson Controls reported adjusted EPS of $0.89, up from $0.64 in the same quarter last year. This print beat analysts’ estimates by 5.7%. Over the next 12 months, Wall Street expects Johnson Controls’s full-year EPS of $4.02 to grow 19%.

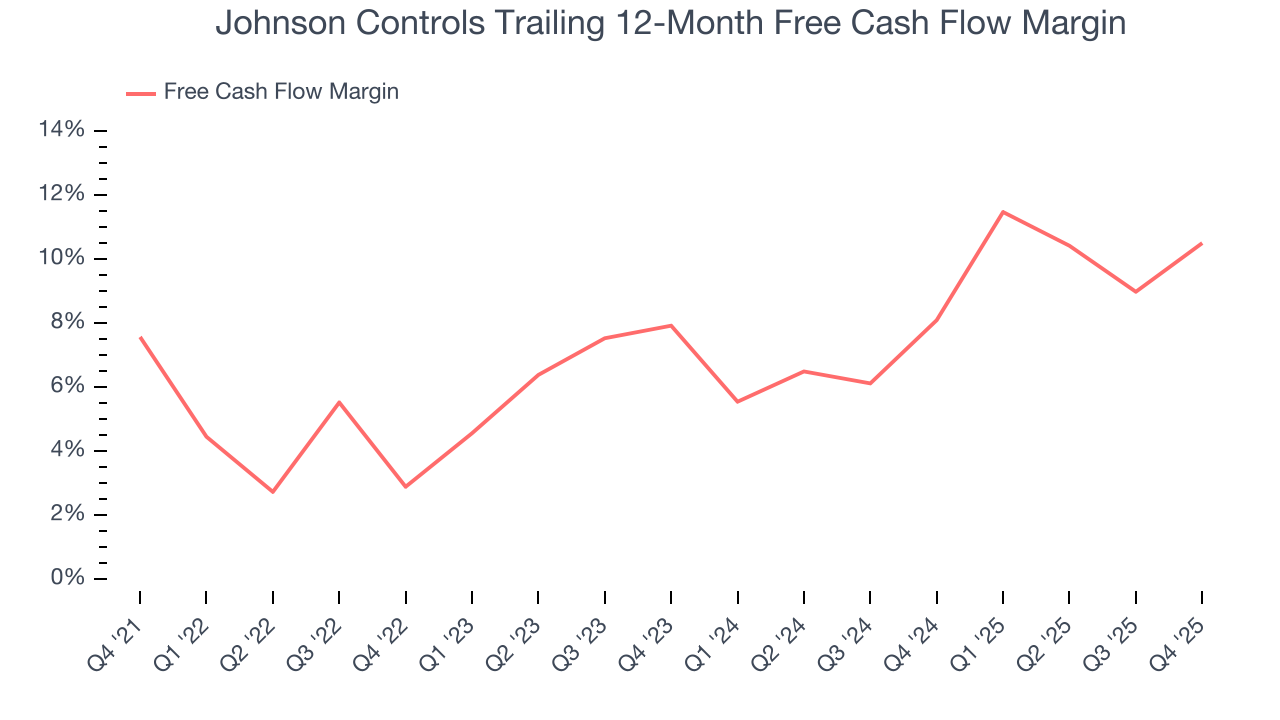

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Johnson Controls has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.4% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Johnson Controls’s margin expanded by 2.9 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Johnson Controls’s free cash flow clocked in at $531 million in Q4, equivalent to a 9.2% margin. This result was good as its margin was 6.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

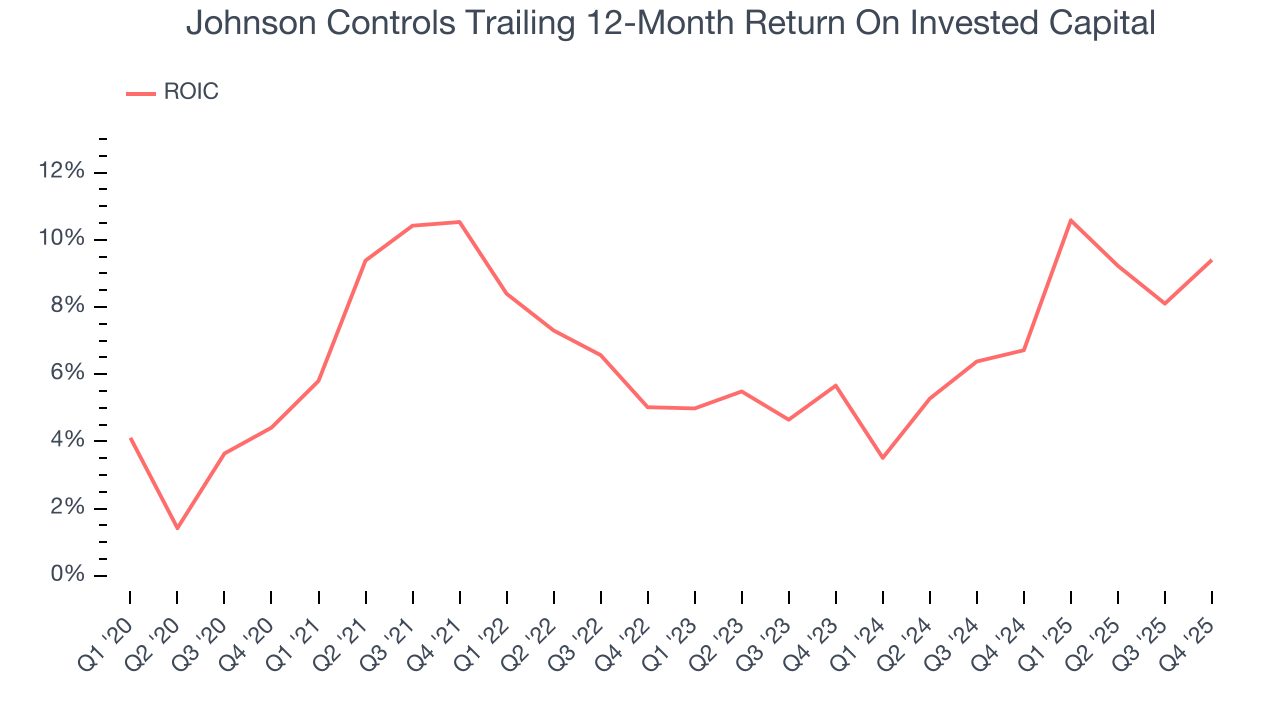

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Johnson Controls historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.5%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Johnson Controls’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

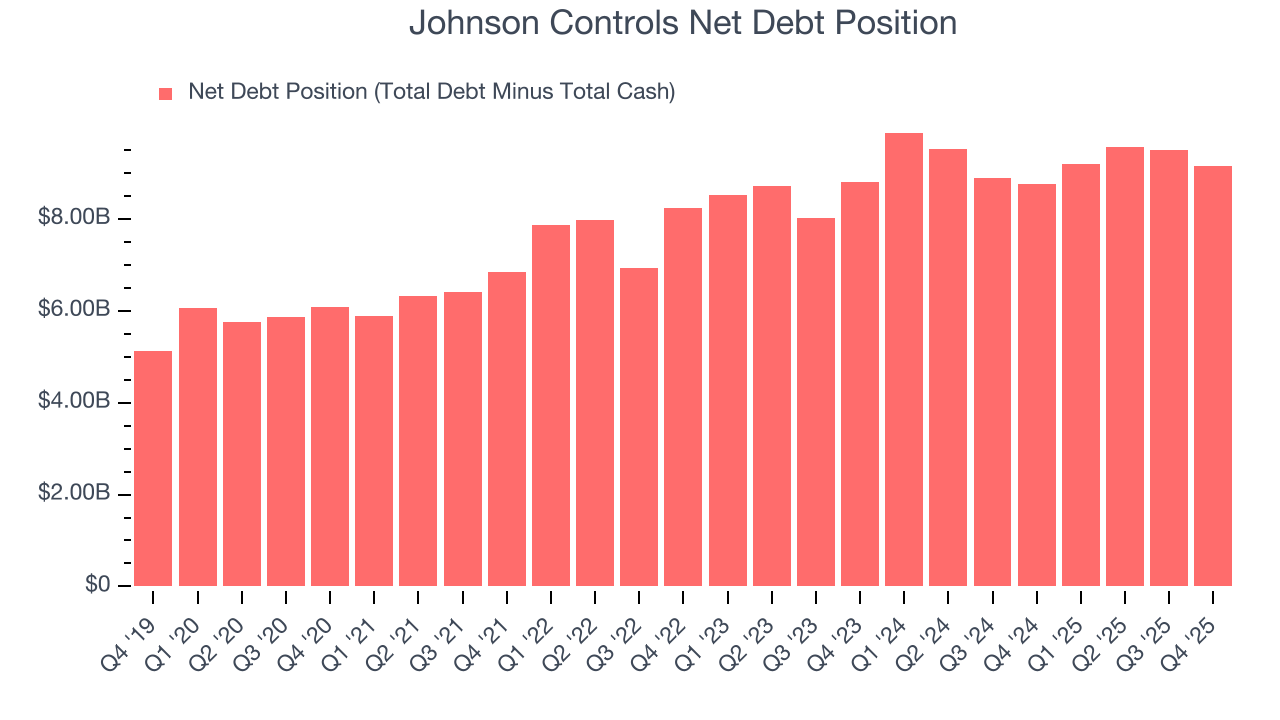

Johnson Controls reported $552 million of cash and $9.71 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $4.28 billion of EBITDA over the last 12 months, we view Johnson Controls’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $85 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Johnson Controls’s Q4 Results

We were impressed by how significantly Johnson Controls blew past analysts’ EBITDA expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 8.5% to $134.49 immediately after reporting.

13. Is Now The Time To Buy Johnson Controls?

Updated: February 4, 2026 at 7:16 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Johnson Controls.

Johnson Controls’s business quality ultimately falls short of our standards. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its organic revenue growth has disappointed.

Johnson Controls’s P/E ratio based on the next 12 months is 25.9x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $134.44 on the company (compared to the current share price of $134.49).