Jackson Financial (JXN)

Jackson Financial doesn’t impress us. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why Jackson Financial Is Not Exciting

Spun off from British insurer Prudential plc in 2021 after more than 60 years as its U.S. subsidiary, Jackson Financial (NYSE:JXN) offers annuity products and retirement solutions that help Americans grow and protect their retirement savings and income.

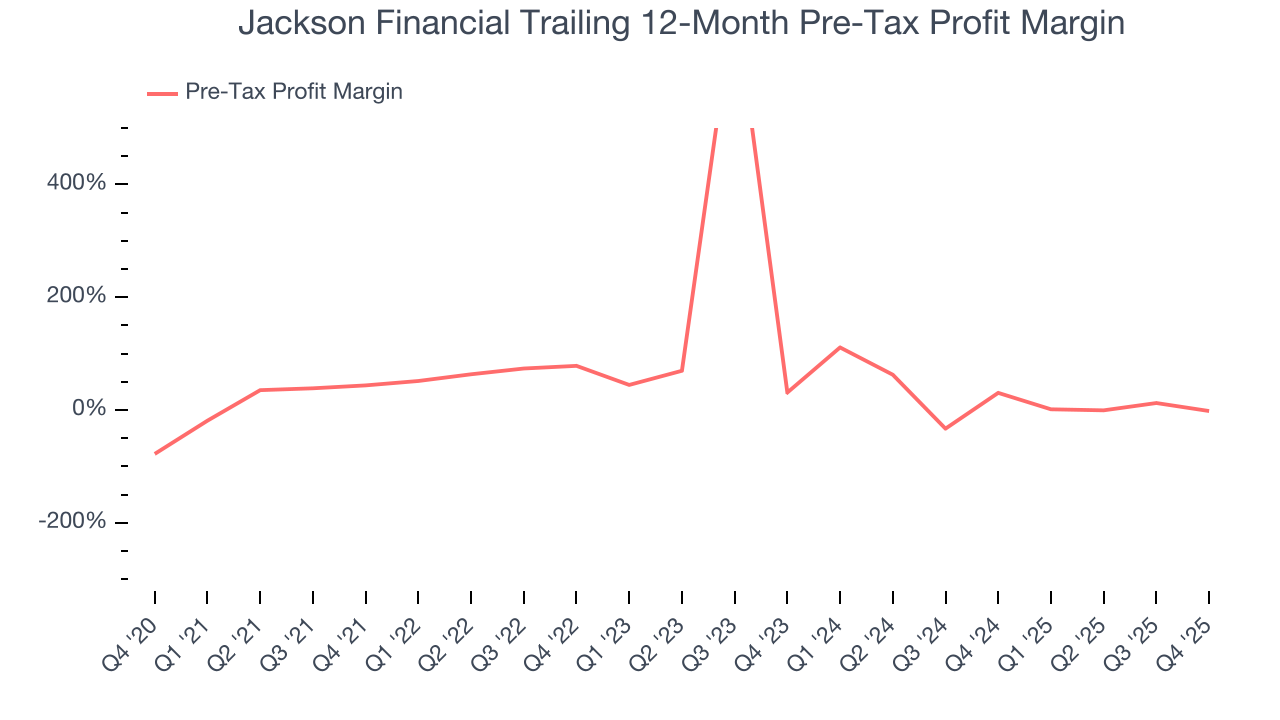

- Efficiency has decreased over the last four years as its pre-tax profit margin fell by 26.1 percentage points

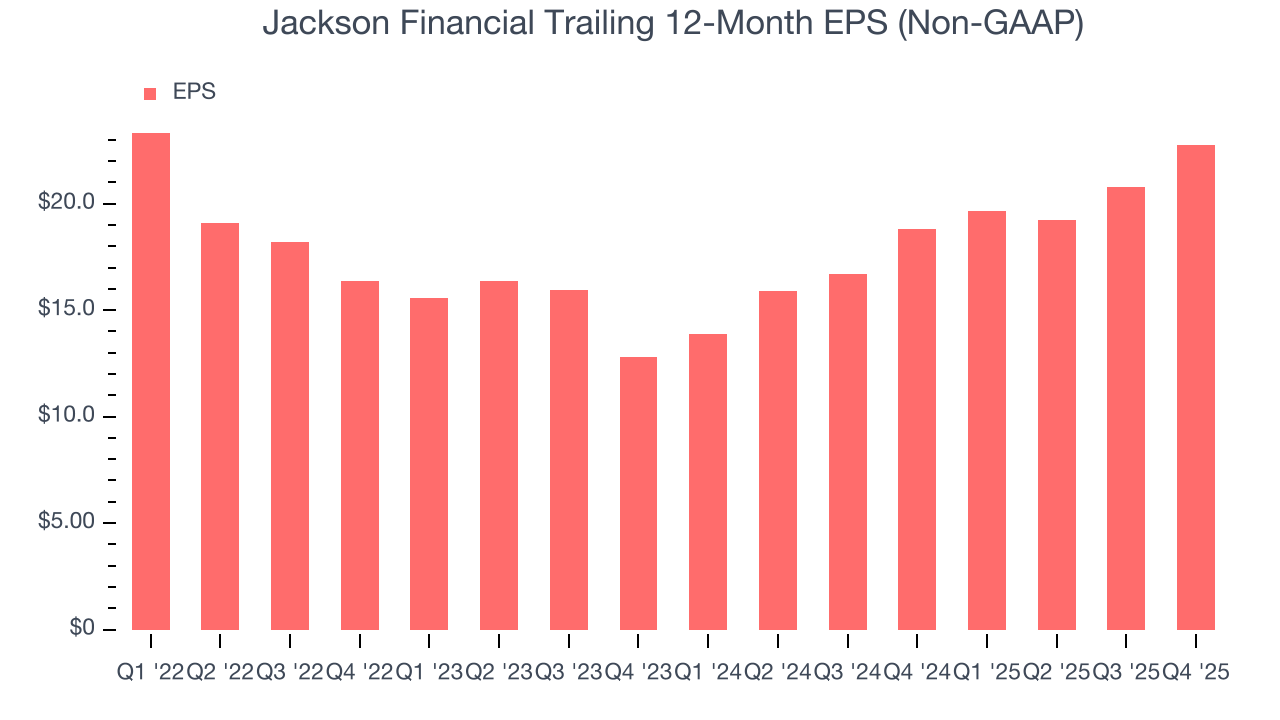

- Earnings per share have dipped by 1.9% annually over the past four years, which is concerning because stock prices follow EPS over the long term

- The good news is that its stellar return on equity showcases management’s ability to surface highly profitable business ventures

Jackson Financial is skating on thin ice. There are better opportunities in the market.

Why There Are Better Opportunities Than Jackson Financial

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Jackson Financial

Jackson Financial is trading at $117.04 per share, or 0.6x forward P/B. Jackson Financial’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Jackson Financial (JXN) Research Report: Q4 CY2025 Update

Retirement solutions provider Jackson Financial (NYSE:JXN) announced better-than-expected revenue in Q4 CY2025, with sales up 711% year on year to $1.99 billion. Its non-GAAP profit of $6.61 per share was 12.8% above analysts’ consensus estimates.

Jackson Financial (JXN) Q4 CY2025 Highlights:

- Net Premiums Earned: $2.03 billion (2.6% year-on-year decline)

- Revenue: $1.99 billion vs analyst estimates of $1.92 billion (711% year-on-year growth, 3.5% beat)

- Pre-tax Profit: -$358 million (-18% margin)

- Adjusted EPS: $6.61 vs analyst estimates of $5.86 (12.8% beat)

- Market Capitalization: $8.42 billion

Company Overview

Spun off from British insurer Prudential plc in 2021 after more than 60 years as its U.S. subsidiary, Jackson Financial (NYSE:JXN) offers annuity products and retirement solutions that help Americans grow and protect their retirement savings and income.

Jackson Financial operates primarily through its main subsidiary, Jackson National Life Insurance Company, offering a diverse suite of annuity products across all 50 states. The company's product lineup includes variable annuities, fixed index annuities, fixed annuities, and registered index-linked annuities (RILAs), each designed to address different retirement planning needs and risk tolerances.

Variable annuities, Jackson's flagship product, allow customers to participate in market returns through a broad selection of investment funds while offering optional benefits that provide guaranteed minimum protection. Fixed index annuities offer a guaranteed minimum crediting rate with potential for additional growth based on market index performance. Traditional fixed annuities provide guaranteed interest rates typically higher than bank savings accounts, while RILAs offer customizable market exposure with downside protection through "floors" or "buffers."

The company distributes its products through an extensive network of financial professionals, including independent broker-dealers, wirehouses, banks, and registered investment advisors. A typical customer might be a 55-year-old professional looking to secure guaranteed lifetime income while maintaining growth potential for a portion of their retirement savings.

Jackson generates revenue primarily through investment spread income (the difference between what it earns on investments and what it pays to customers) and fees charged on variable annuity account values. The company also offers institutional products like guaranteed investment contracts and funding agreements to corporate and institutional investors, providing an additional source of investment spread-based income.

Jackson's operations are supported by its in-house policy administration platform, which handles approximately 79% of its in-force policies, giving the company flexibility to administer multiple product types efficiently.

4. Life Insurance

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

Jackson Financial competes with other major annuity providers including Prudential Financial (NYSE:PRU), Lincoln National (NYSE:LNC), Brighthouse Financial (NASDAQ:BHF), and Equitable Holdings (NYSE:EQH), as well as diversified insurers like AIG (NYSE:AIG) that offer retirement products.

5. Revenue Growth

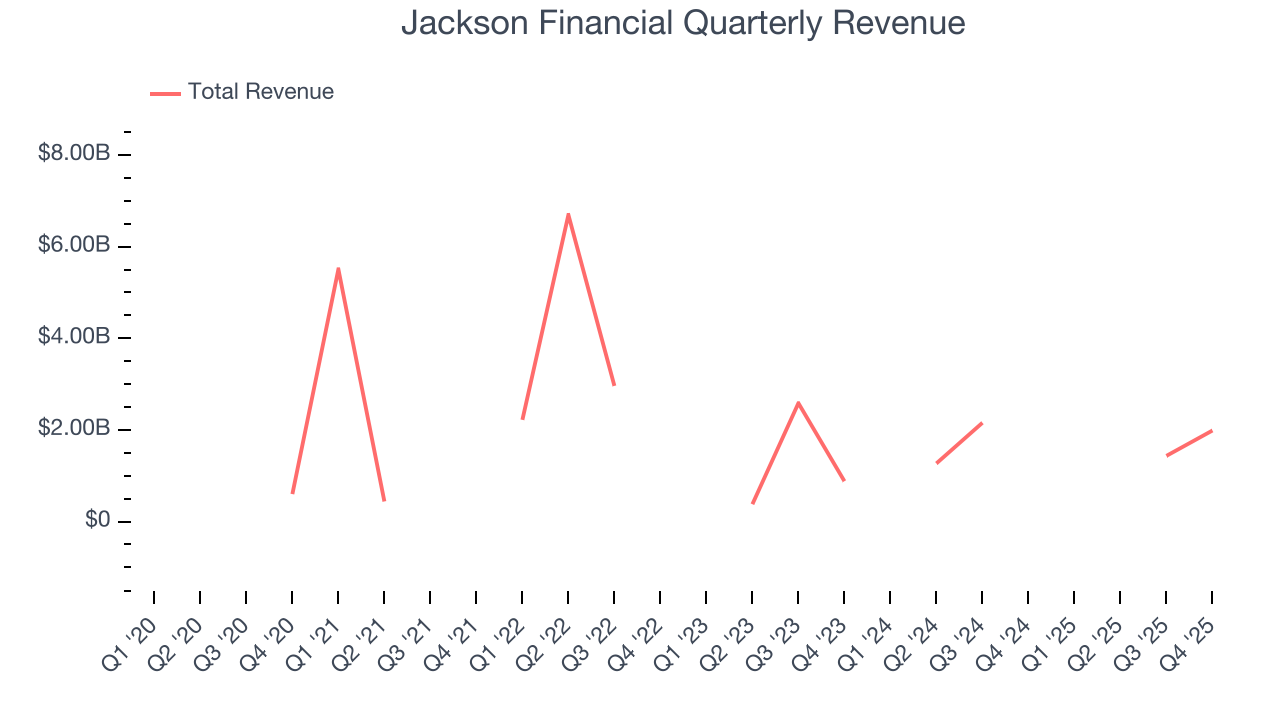

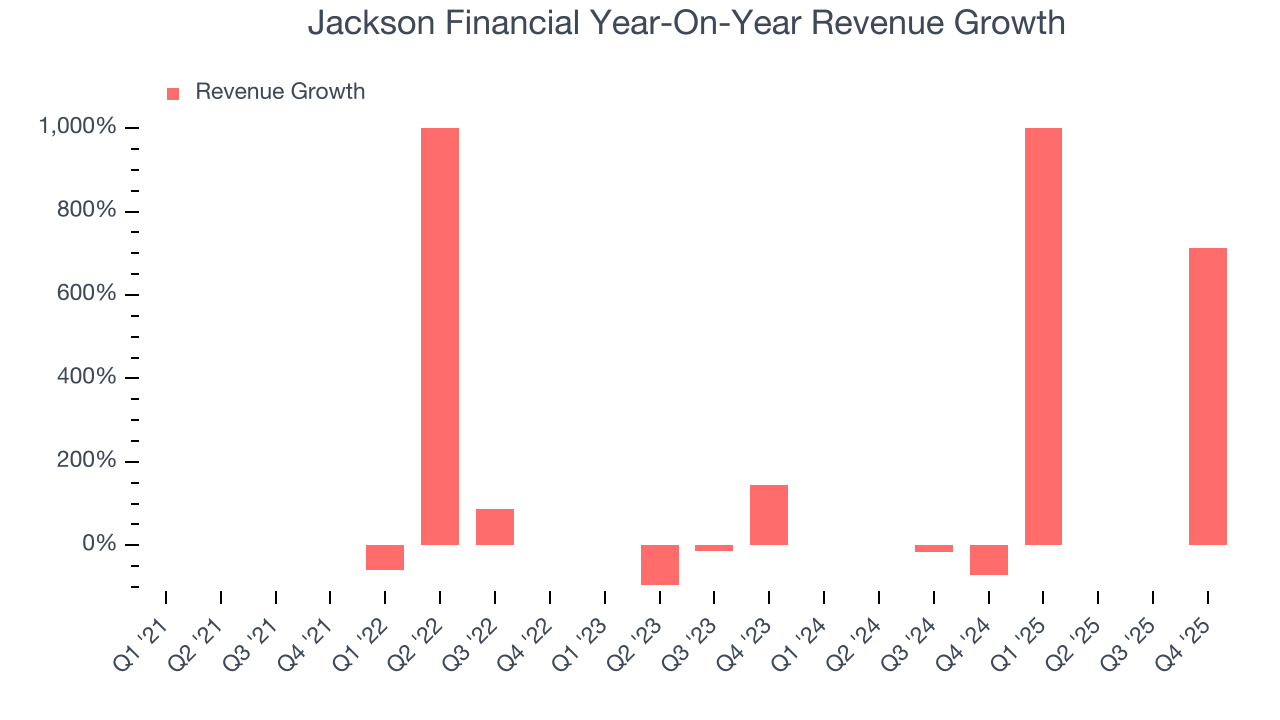

Insurance companies generate revenue three ways. The first is the core insurance business itself, represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected but not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from policy administration, annuities, and other value-added services. Thankfully, Jackson Financial’s 30.9% annualized revenue growth over the last five years was incredible. Its growth beat the average insurance company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Jackson Financial’s annualized revenue growth of 11% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Jackson Financial reported magnificent year-on-year revenue growth of 711%, and its $1.99 billion of revenue beat Wall Street’s estimates by 3.5%.

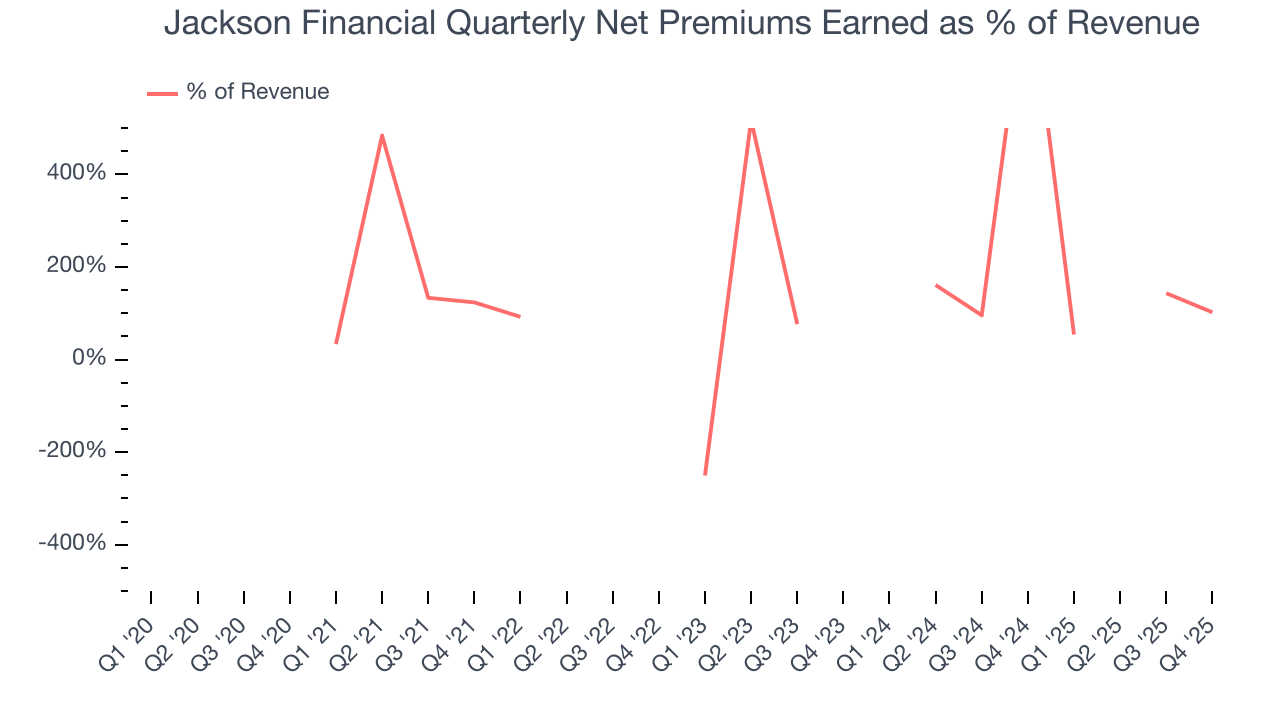

Since the company recorded losses on certain securities, it generated more net premiums earned than revenue (a 1.2x multiple of its revenue to be exact) during the last five years, meaning Jackson Financial lives and dies by its underwriting activities because non-insurance operations barely move the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

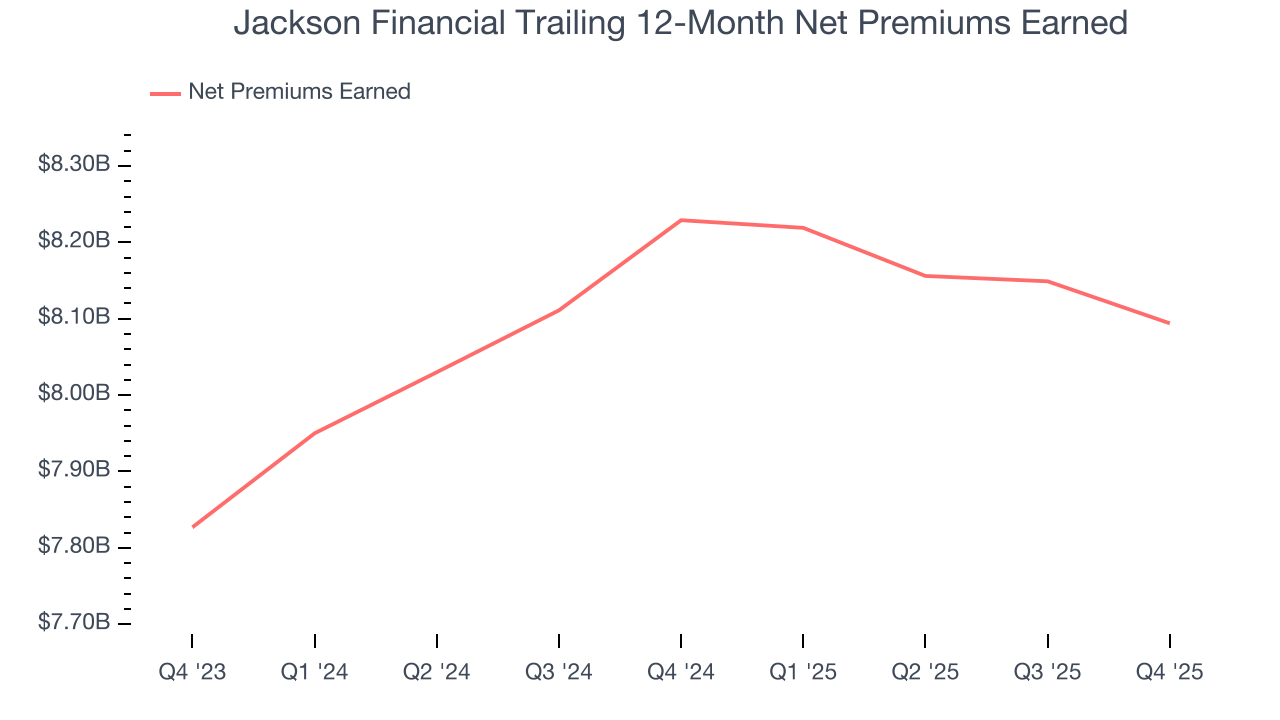

Jackson Financial’s net premiums earned has grown at a 3.7% annualized rate over the last five years, worse than the broader insurance industry and slower than its total revenue.

When analyzing Jackson Financial’s net premiums earned over the last two years, we can see that growth decelerated to 1.7% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these supplementary streams affect the bottom line, their contribution can fluctuate. Some firms have been more successful and consistent in investing their float over the long term, but sharp movements in the fixed income and equity markets can play a substantial role in short-term performance.

This quarter, Jackson Financial’s net premiums earned was $2.03 billion, down 2.6% year on year.

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The economics of insurers are driven by their balance sheets, where assets (investing the float + premiums receivable) and liabilities (claims to pay) define the fundamentals. Interest income and expense should therefore be factored into the definition of profit but taxes - which are largely out of a company’s control - should not.

Over the last five years, Jackson Financial’s pre-tax profit margin has fallen by 76 percentage points, going from 43.8% to negative 1.7%. However, the company gave back some of its expense savings as its pre-tax profit margin declined by 32.8 percentage points on a two-year basis.

In Q4, Jackson Financial’s pre-tax profit margin was negative 18%. This result was 173.1 percentage points worse than the same quarter last year.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Jackson Financial’s full-year EPS dropped 9.6%, or 2.3% annually, over the last four years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Jackson Financial’s EPS grew at a spectacular 33.2% compounded annual growth rate over the last two years, higher than its 11% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

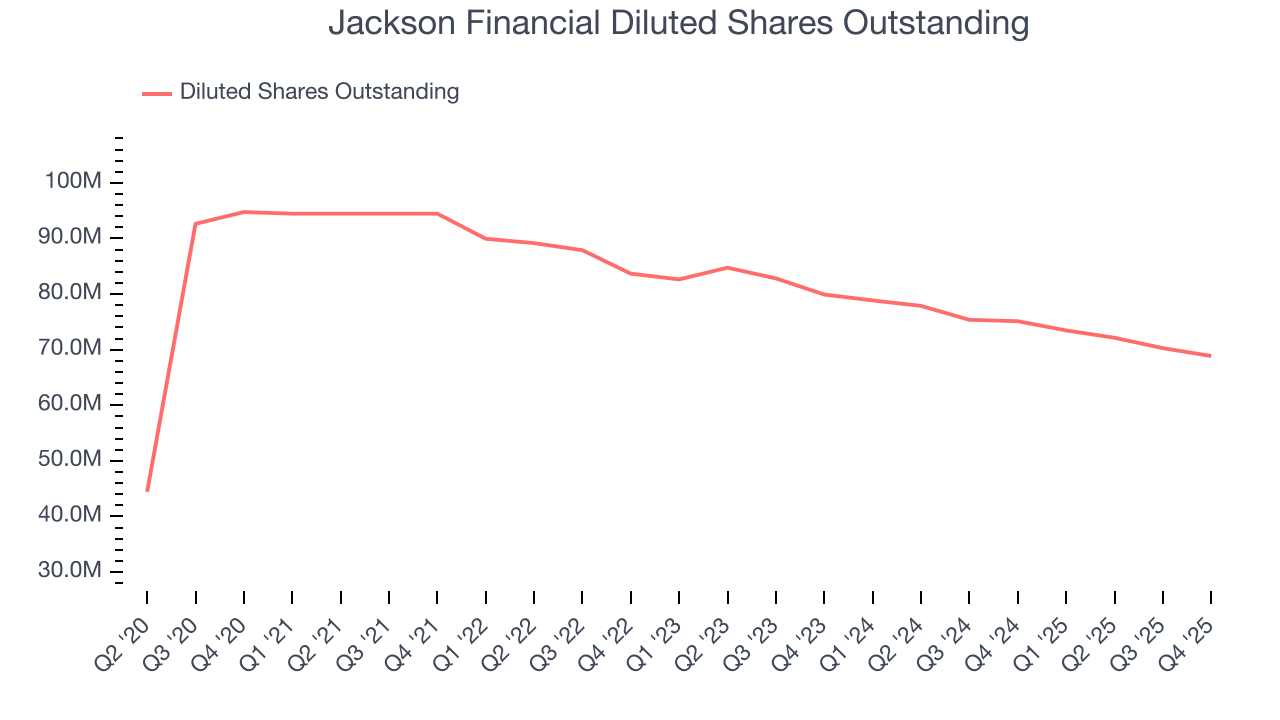

Diving into the nuances of Jackson Financial’s earnings can give us a better understanding of its performance. A two-year view shows that Jackson Financial has repurchased its stock, shrinking its share count by 13.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Jackson Financial reported adjusted EPS of $6.61, up from $4.65 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Jackson Financial’s full-year EPS of $22.74 to grow 2.8%.

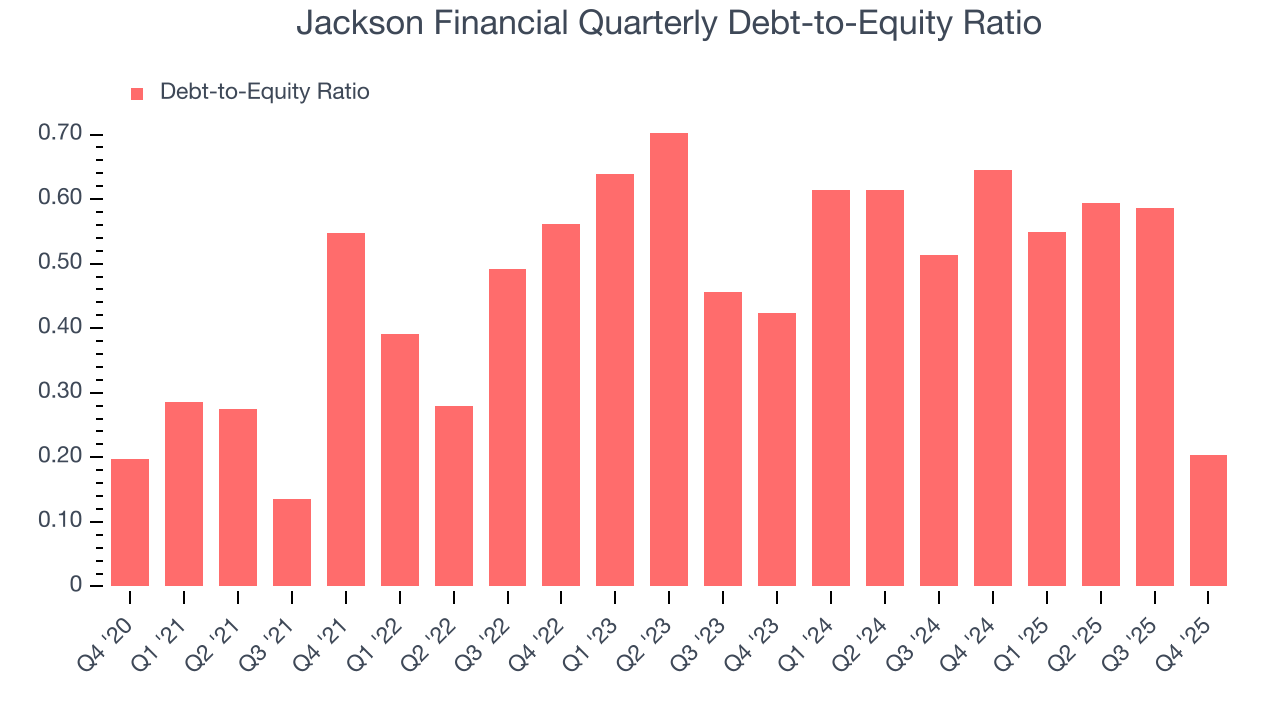

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Jackson Financial currently has $2.03 billion of debt and $9.95 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.5×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

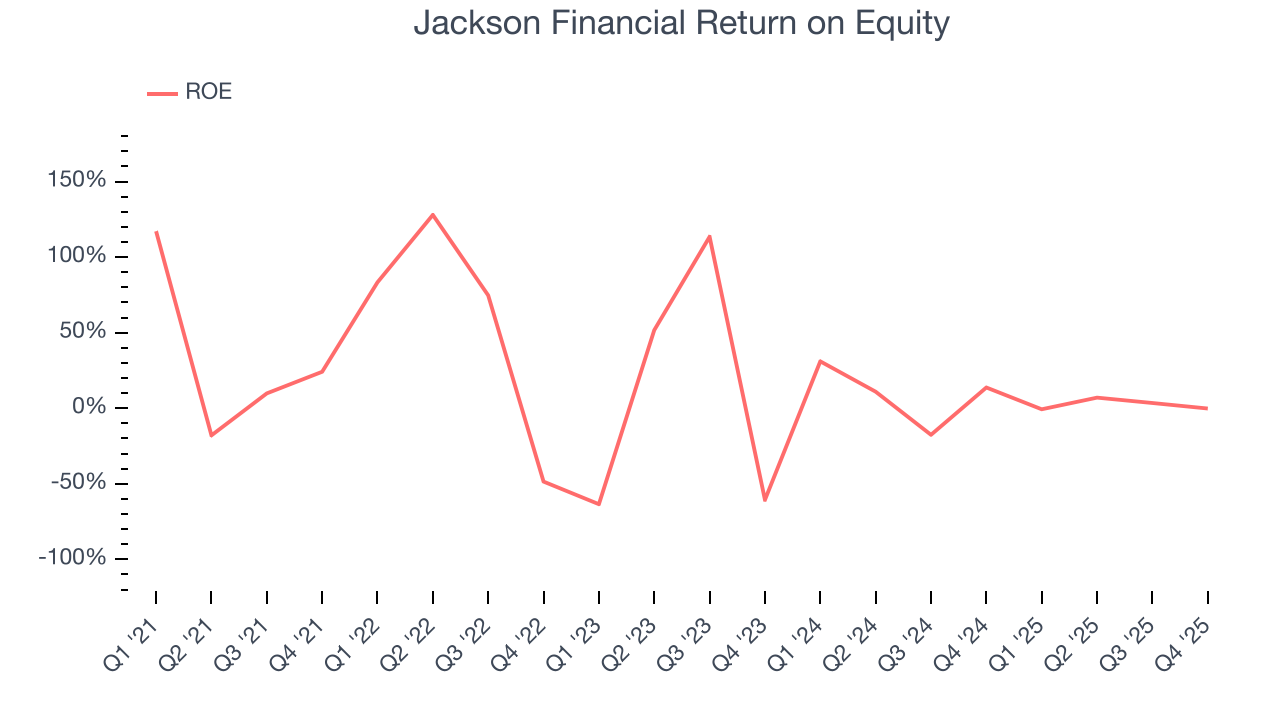

10. Return on Equity

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Jackson Financial has averaged an ROE of 23%, exceptional for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This is a bright spot for Jackson Financial.

11. Key Takeaways from Jackson Financial’s Q4 Results

We enjoyed seeing Jackson Financial beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 2.2% to $119.46 immediately after reporting.

12. Is Now The Time To Buy Jackson Financial?

Updated: February 18, 2026 at 4:53 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Jackson Financial, you should also grasp the company’s longer-term business quality and valuation.

Jackson Financial has some positive attributes, but it isn’t one of our picks. To kick things off, its revenue growth was exceptional over the last five years. And while its declining EPS over the last four years makes it a less attractive asset to the public markets, its expanding pre-tax profit margin shows the business has become more efficient. On top of that, its stellar ROE suggests it has been a well-run company historically.

Jackson Financial’s P/B ratio based on the next 12 months is 0.6x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $118.33 on the company (compared to the current share price of $119.46).