Korn Ferry (KFY)

We aren’t fans of Korn Ferry. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Korn Ferry Is Not Exciting

With clients including 97% of the S&P 100 and operations in 103 offices across 51 countries, Korn Ferry (NYSE:KFY) is a global consulting firm that helps organizations design optimal structures, recruit talent, develop leaders, and create effective compensation strategies.

- Anticipated sales growth of 3.9% for the next year implies demand will be shaky

- On the bright side, its earnings growth has outpaced its peers over the last five years as its EPS has compounded at 24.8% annually

Korn Ferry’s quality doesn’t meet our bar. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Korn Ferry

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Korn Ferry

Korn Ferry’s stock price of $68.02 implies a valuation ratio of 12.7x forward P/E. This multiple is cheaper than most business services peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Korn Ferry (KFY) Research Report: Q3 CY2025 Update

Organizational consulting firm Korn Ferry (NYSE:KFY) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 7% year on year to $729.8 million. On the other hand, next quarter’s revenue guidance of $687 million was less impressive, coming in 1.4% below analysts’ estimates. Its non-GAAP profit of $1.33 per share was 1.4% above analysts’ consensus estimates.

Korn Ferry (KFY) Q3 CY2025 Highlights:

- Revenue: $729.8 million vs analyst estimates of $717.4 million (7% year-on-year growth, 1.7% beat)

- Adjusted EPS: $1.33 vs analyst estimates of $1.31 (1.4% beat)

- Adjusted EBITDA: $124.8 million vs analyst estimates of $122.4 million (17.1% margin, 2% beat)

- Revenue Guidance for Q4 CY2025 is $687 million at the midpoint, below analyst estimates of $696.7 million

- Adjusted EPS guidance for Q4 CY2025 is $1.22 at the midpoint, below analyst estimates of $1.24

- Operating Margin: 13.5%, in line with the same quarter last year

- Market Capitalization: $3.40 billion

Company Overview

With clients including 97% of the S&P 100 and operations in 103 offices across 51 countries, Korn Ferry (NYSE:KFY) is a global consulting firm that helps organizations design optimal structures, recruit talent, develop leaders, and create effective compensation strategies.

Korn Ferry's business spans five core capabilities: organizational strategy, assessment and succession, talent acquisition, leadership development, and total rewards. The company serves as a strategic partner throughout the entire talent lifecycle, from helping clients design their organizational structures to recruiting executives and developing their leadership teams.

For organizational strategy, Korn Ferry maps talent strategy to business strategy, designing operating models that help companies execute their plans. Its assessment solutions identify growth opportunities for leaders and employees, while its talent acquisition services include executive search, professional search, interim staffing, and recruitment process outsourcing.

A typical client might engage Korn Ferry to restructure their organization following a merger, with the firm designing the new organizational chart, assessing existing leadership for key roles, recruiting new executives where needed, and developing comprehensive compensation packages to retain top talent.

The company monetizes its expertise through consulting services and subscription-based digital products. Its technology platform includes tools like Profile Manager (defining role requirements), Architect (organization structure planning), Assess (evaluating individual capabilities), Engage (employee feedback), Pay (compensation benchmarking), and Sell (sales methodology).

Korn Ferry also offers specialized solutions for workforce transformation, cost optimization, M&A integration, culture change, career transition, inclusion initiatives, and sales effectiveness. The company maintains a research arm, the Korn Ferry Institute, which develops proprietary intellectual property and analytics that inform its consulting work and digital products.

4. Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

Korn Ferry competes with global consulting firms like Aon, Mercer, Willis Towers Watson, McKinsey, and Deloitte in the organizational consulting space. In executive search, its competitors include Egon Zehnder, Heidrick & Struggles, Russell Reynolds Associates, and Spencer Stuart.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.84 billion in revenue over the past 12 months, Korn Ferry is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

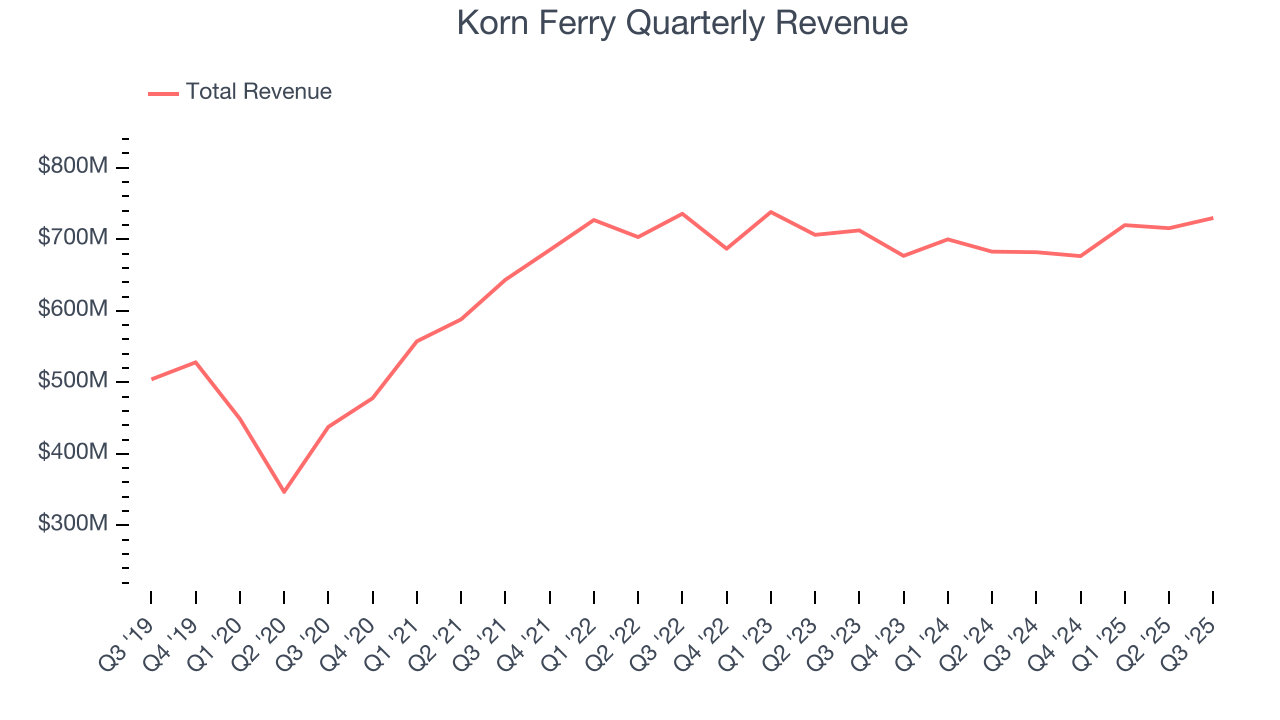

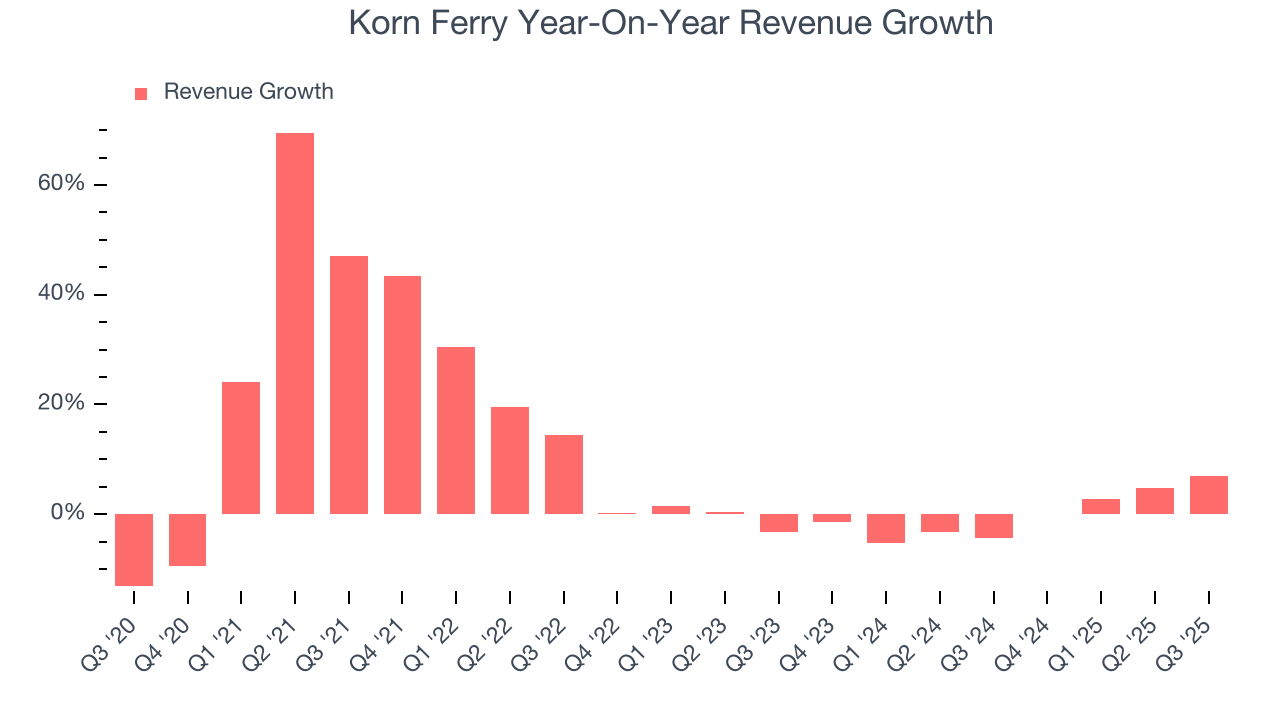

As you can see below, Korn Ferry grew its sales at an impressive 10% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Korn Ferry’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

This quarter, Korn Ferry reported year-on-year revenue growth of 7%, and its $729.8 million of revenue exceeded Wall Street’s estimates by 1.7%. Company management is currently guiding for a 1.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

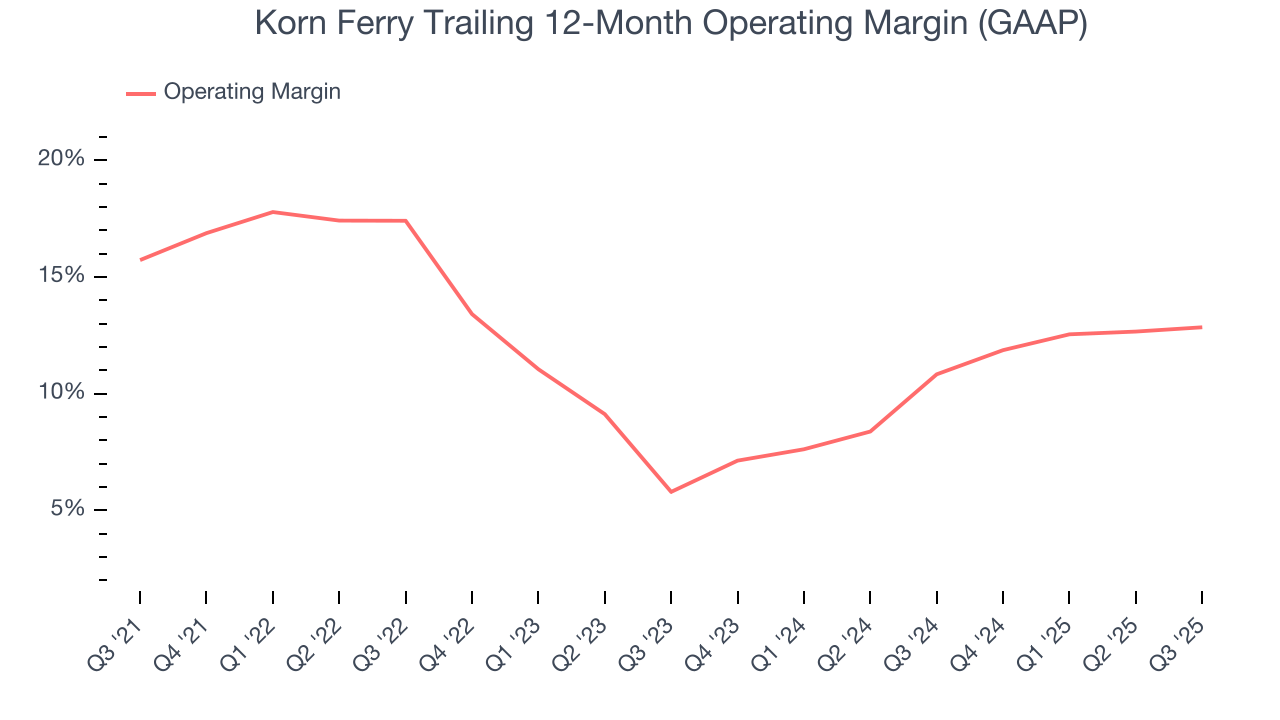

Korn Ferry has managed its cost base well over the last five years. It demonstrated solid profitability for a business services business, producing an average operating margin of 12.4%.

Analyzing the trend in its profitability, Korn Ferry’s operating margin decreased by 2.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Korn Ferry generated an operating margin profit margin of 13.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

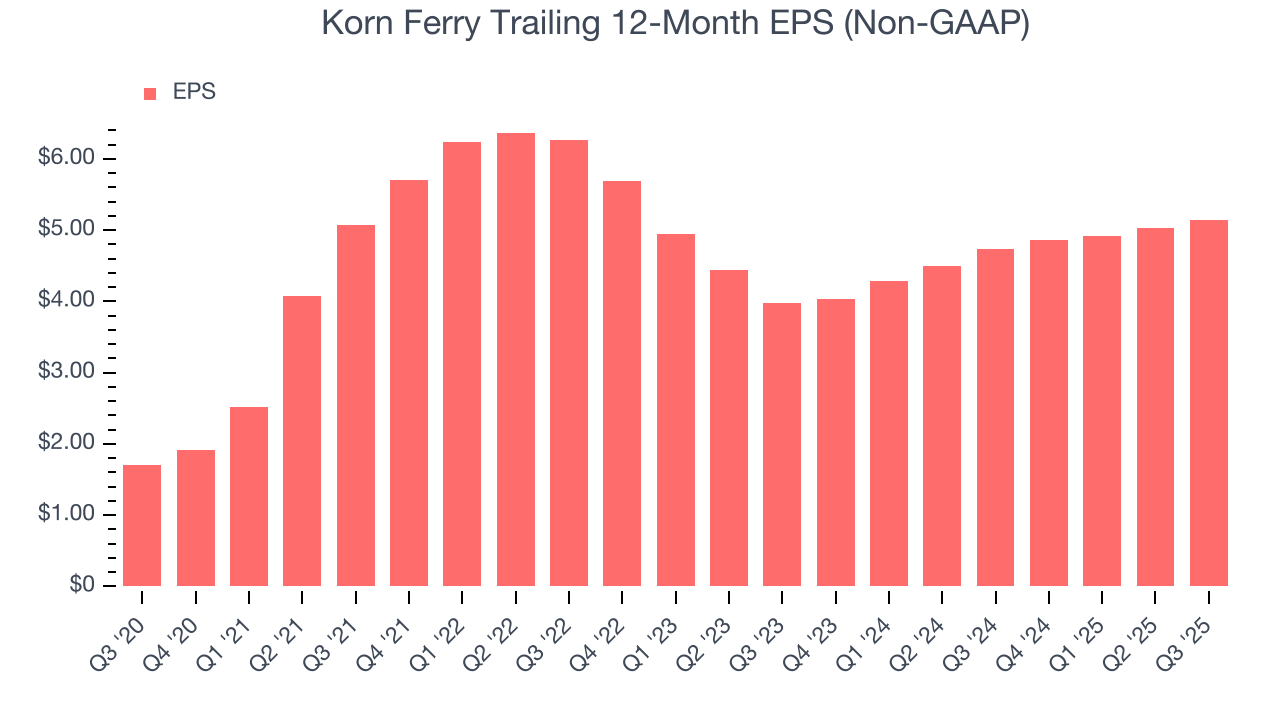

Korn Ferry’s EPS grew at an astounding 24.8% compounded annual growth rate over the last five years, higher than its 10% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

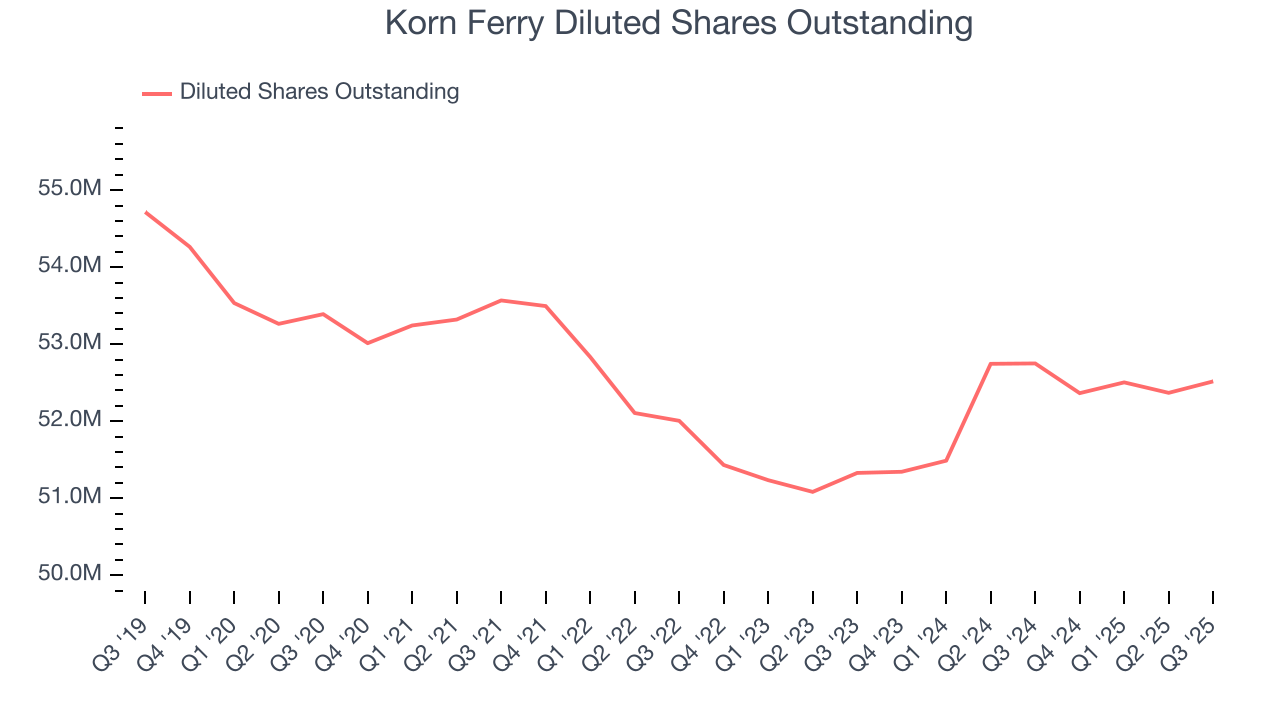

Diving into the nuances of Korn Ferry’s earnings can give us a better understanding of its performance. A five-year view shows that Korn Ferry has repurchased its stock, shrinking its share count by 1.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Korn Ferry, its two-year annual EPS growth of 13.8% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Korn Ferry reported adjusted EPS of $1.33, up from $1.21 in the same quarter last year. This print beat analysts’ estimates by 1.4%. Over the next 12 months, Wall Street expects Korn Ferry’s full-year EPS of $5.15 to grow 4.8%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

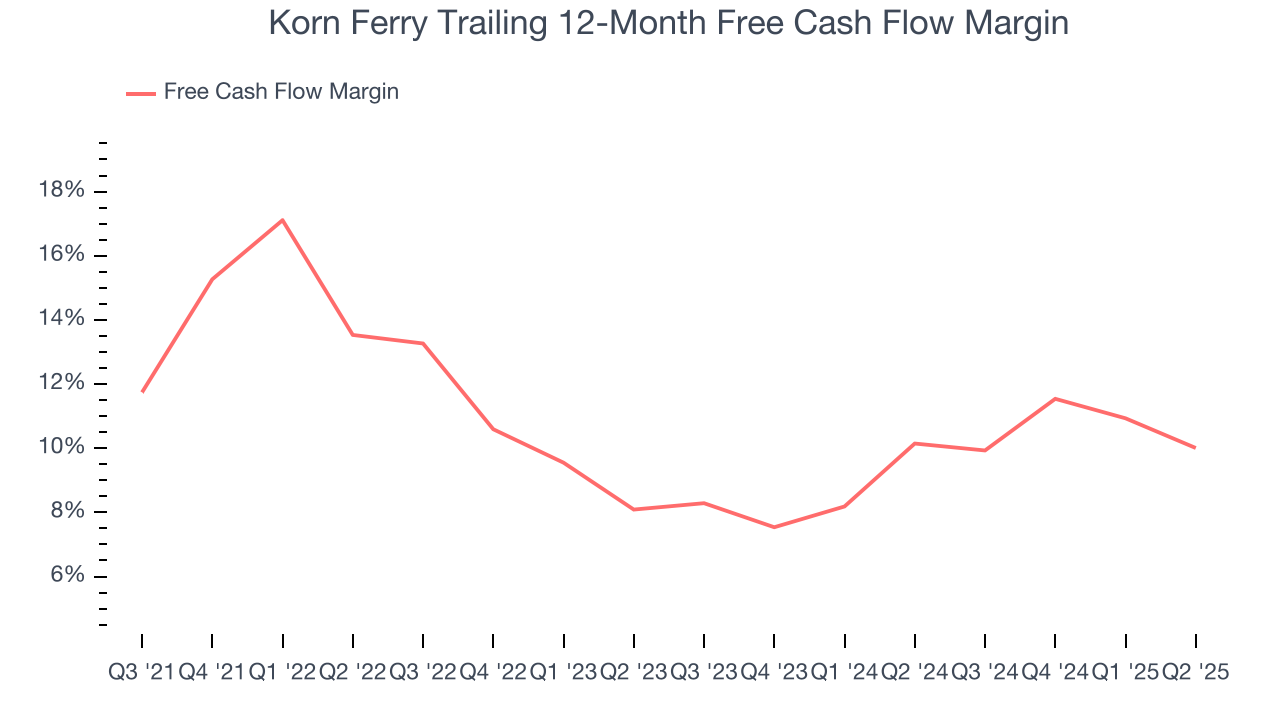

Korn Ferry has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.3% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Korn Ferry’s margin dropped by 1.6 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

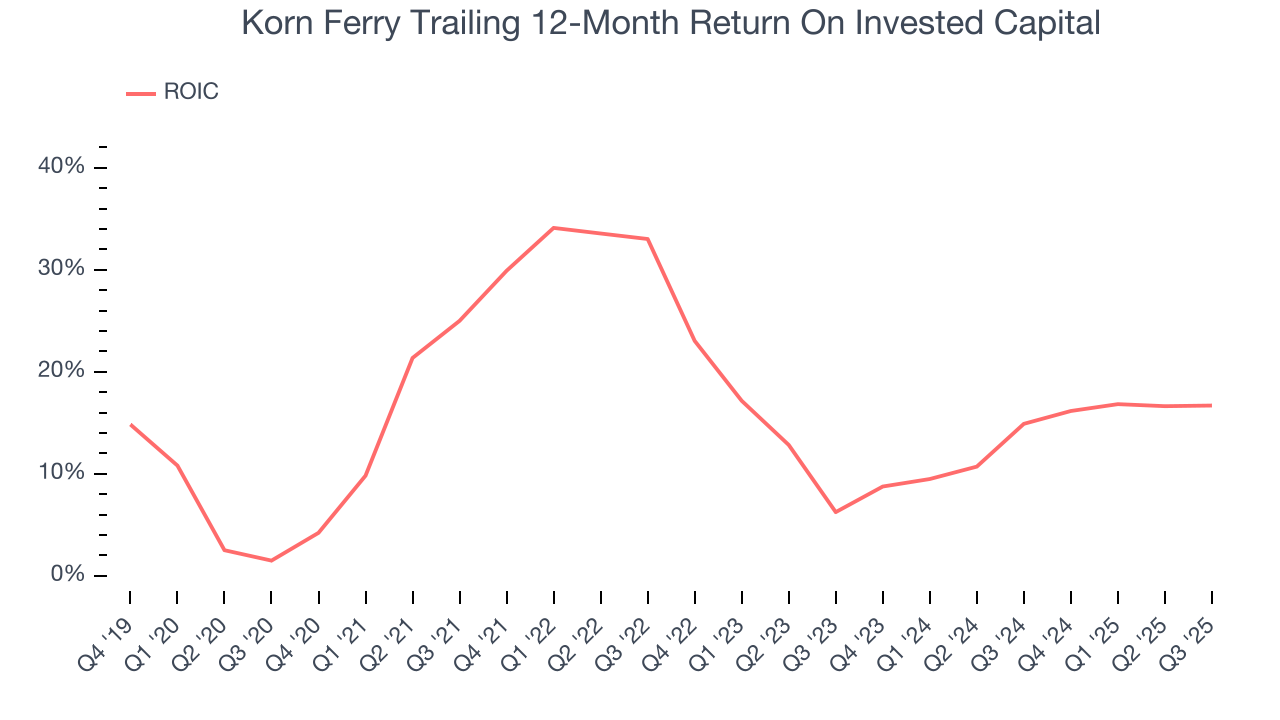

Although Korn Ferry hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 19.2%, impressive for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Korn Ferry’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

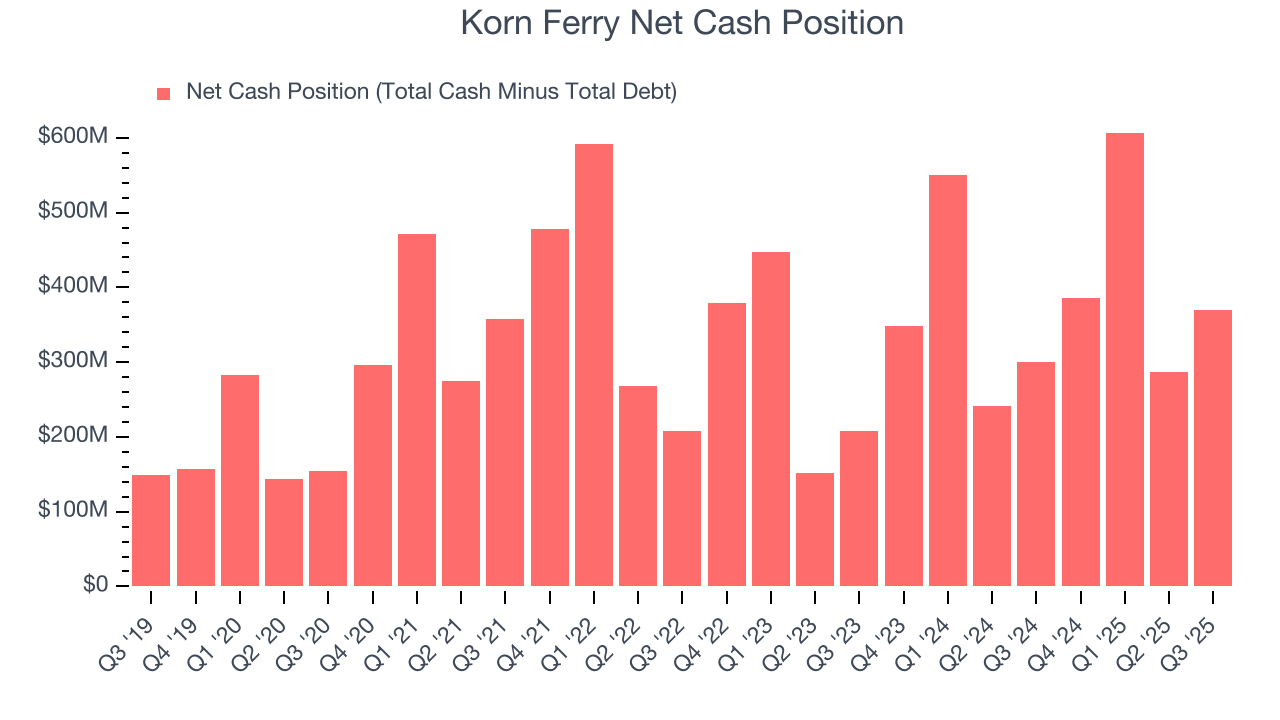

Korn Ferry is a profitable, well-capitalized company with $801.1 million of cash and $431.1 million of debt on its balance sheet. This $369.9 million net cash position is 10.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Korn Ferry’s Q3 Results

It was encouraging to see Korn Ferry beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter slightly missed and its EPS guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $64.87 immediately after reporting.

12. Is Now The Time To Buy Korn Ferry?

Updated: January 25, 2026 at 11:09 PM EST

Before making an investment decision, investors should account for Korn Ferry’s business fundamentals and valuation in addition to what happened in the latest quarter.

Korn Ferry isn’t a bad business, but we have other favorites. To kick things off, its revenue growth was impressive over the last five years. And while Korn Ferry’s diminishing returns show management's prior bets haven't worked out, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Korn Ferry’s P/E ratio based on the next 12 months is 12.7x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $80.25 on the company (compared to the current share price of $68.02).