Kemper (KMPR)

Kemper is in for a bumpy ride. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Kemper Will Underperform

Originally known as Unitrin until rebranding in 2011, Kemper (NYSE:KMPR) is an insurance holding company that provides automobile, homeowners, life, and other insurance products to individuals and businesses across the United States.

- Sales were flat over the last five years, indicating it’s failed to expand this cycle

- Sales over the last five years were less profitable as its earnings per share fell by 4.7% annually while its revenue was flat

- Net premiums earned remained stagnant over the last five years, indicating expansion challenges this cycle

Kemper doesn’t pass our quality test. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Kemper

Why There Are Better Opportunities Than Kemper

Kemper is trading at $38.79 per share, or 0.8x forward P/B. Yes, this valuation multiple is lower than that of other insurance peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Kemper (KMPR) Research Report: Q3 CY2025 Update

Insurance holding company Kemper (NYSE:KMPR) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.8% year on year to $1.24 billion. Its non-GAAP profit of $0.33 per share was 75% below analysts’ consensus estimates.

Kemper (KMPR) Q3 CY2025 Highlights:

Company Overview

Originally known as Unitrin until rebranding in 2011, Kemper (NYSE:KMPR) is an insurance holding company that provides automobile, homeowners, life, and other insurance products to individuals and businesses across the United States.

Kemper operates through two main business segments: Specialty Property & Casualty Insurance and Life Insurance. The Specialty Property & Casualty segment, marketed under the Kemper Auto brand, specializes in providing personal automobile insurance to consumers who may have difficulty obtaining standard coverage due to their driving records or claims history. This segment also offers commercial automobile coverage targeting specific markets like contractors and short-haul delivery services. Operating in 16 states, these products reach customers through a network of independent agents and brokers.

The Life Insurance segment distributes individual life and supplemental accident and health insurance products through approximately 2,200 career agents who work as full-time employees. These agents visit customers in their homes to sell policies, provide service, and collect premiums. The segment's primary offerings include permanent life insurance, term insurance, and guaranteed issue policies, generally provided on a non-participating, guaranteed-cost basis.

In 2023, Kemper established the Kemper Reciprocal Exchange, which primarily writes specialty automobile policies. To manage risk exposure, particularly from catastrophic events, the company employs geographical diversification strategies and maintains comprehensive reinsurance programs across both segments.

A typical Kemper customer might be a driver with a less-than-perfect record who has been denied coverage by standard insurers but still needs reliable auto protection, or a family seeking affordable life insurance with straightforward terms and personal service. The company generates revenue through premium payments from policyholders, with pricing structured to balance risk coverage with profitability.

4. Multi-Line Insurance

Multi-line insurance companies operate a diversified business model, offering a broad suite of products that span both Property & Casualty (P&C) and Life & Health (L&H) insurance. This diversification allows them to generate revenue from multiple, often uncorrelated, underwriting pools while also earning investment income on their combined float. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. The market environment also matters for P&C operations specifically, with a 'hard market' characterized by pricing increases that outstrip claim costs, resulting in higher profits while a 'soft market' is the opposite. On the other hand, a key headwind is increasing volatility and severity of catastrophe losses, driven by climate change, which poses a significant threat to P&C underwriting results.

Kemper's competitors in the property and casualty insurance space include Progressive (NYSE:PGR), Allstate (NYSE:ALL), and State Farm, while its life insurance business competes with companies like MetLife (NYSE:MET), Prudential Financial (NYSE:PRU), and Globe Life (NYSE:GL).

5. Revenue Growth

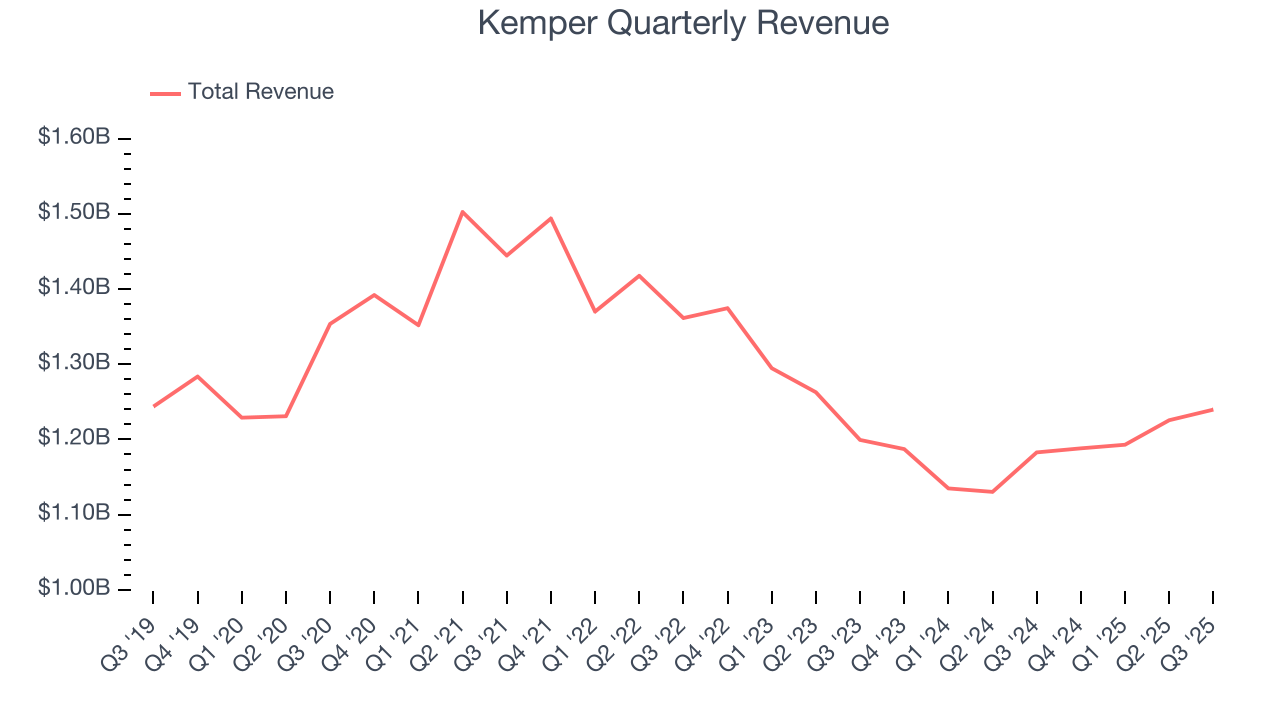

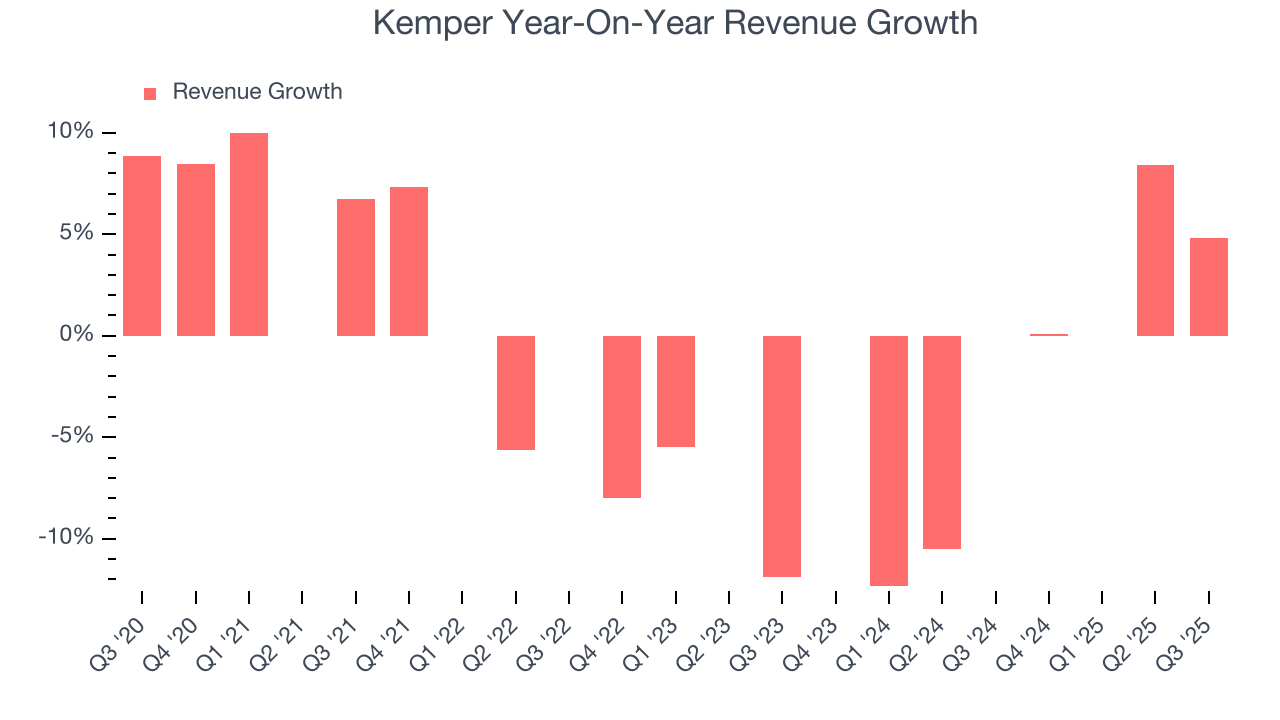

Insurance companies earn revenue from three primary sources: 1) The core insurance business itself, often called underwriting and represented in the income statement as premiums 2) Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities 3) Fees from various sources such as policy administration, annuities, or other value-added services. Kemper’s demand was weak over the last five years as its revenue fell at a 1% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Kemper’s recent performance shows its demand remained suppressed as its revenue has declined by 2.8% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Kemper reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 1.5%.

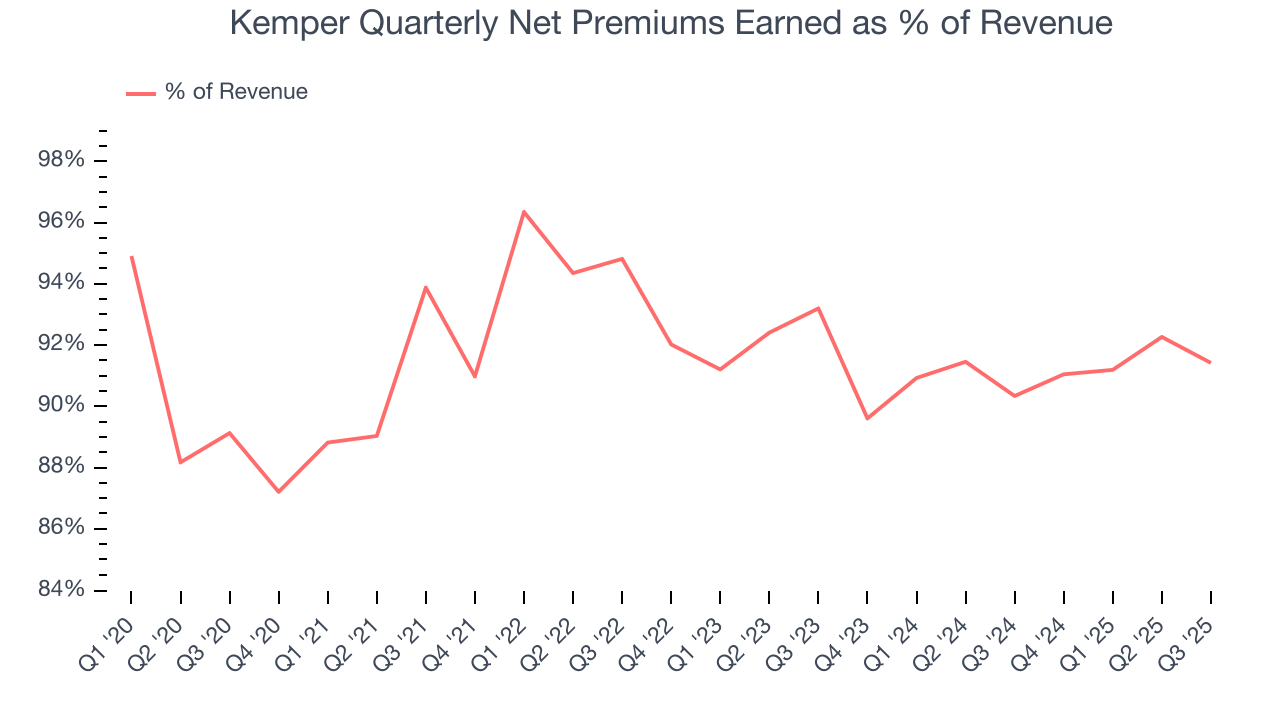

Net premiums earned made up 91.6% of the company’s total revenue during the last five years, meaning Kemper lives and dies by its underwriting activities because non-insurance operations barely move the needle.

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

6. Net Premiums Earned

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

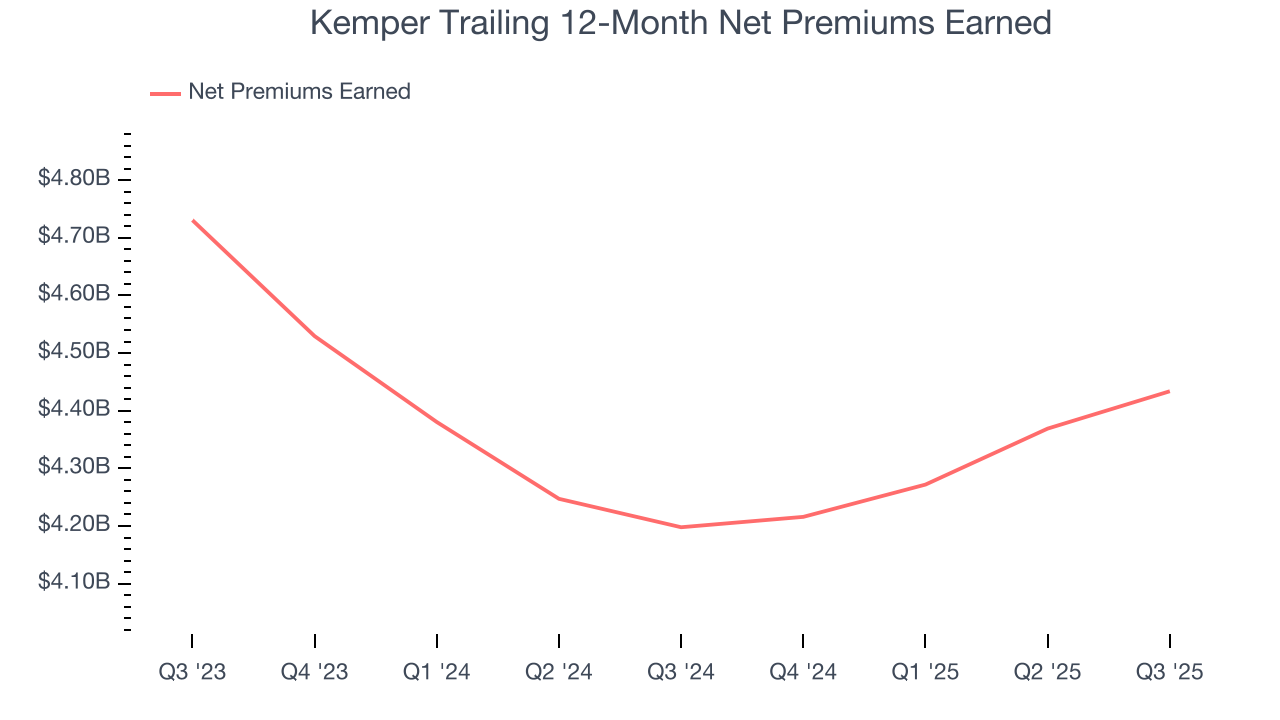

Kemper’s net premiums earned was flat over the last five years, much worse than the broader insurance industry and in line with its total revenue.

When analyzing Kemper’s net premiums earned over the last two years, we can see its woes have continued as income dropped by 3.2% annually. This performance was similar to its total revenue.

Kemper’s net premiums earned came in at $1.13 billion this quarter, up 6.1% year on year and topping Wall Street Consensus estimates by 1.7%.

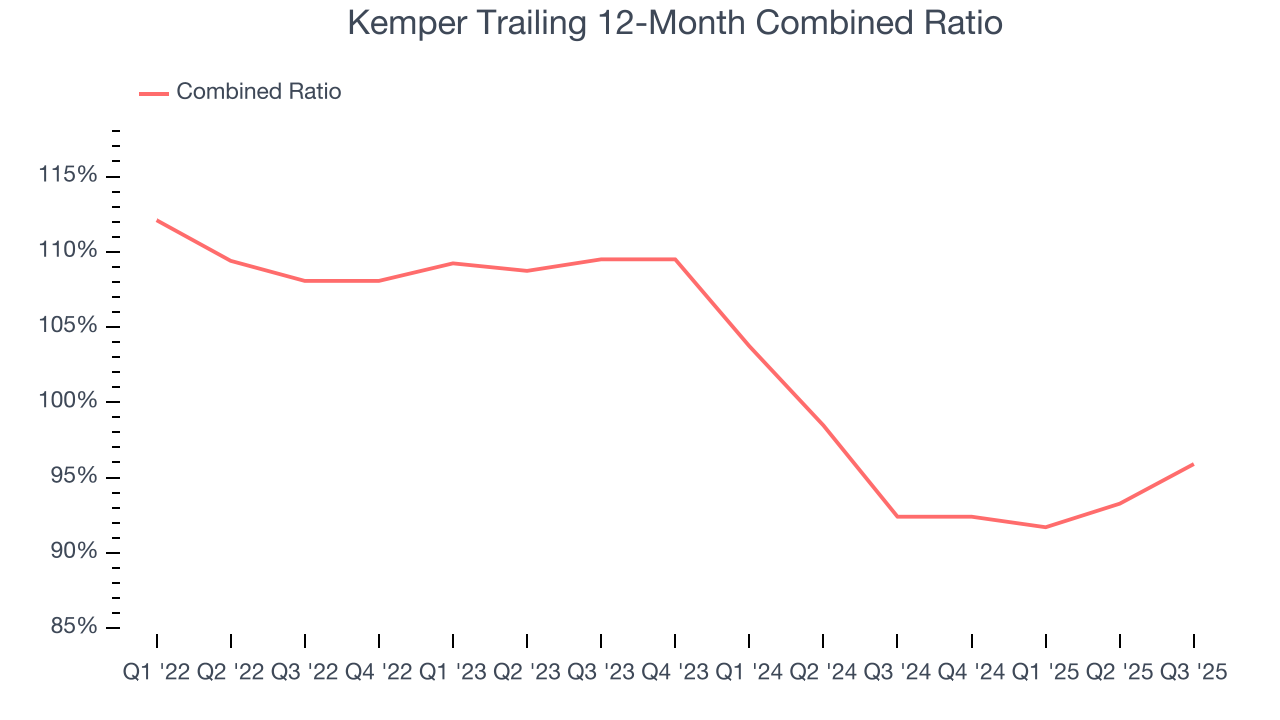

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio sums the costs of underwriting (salaries, commissions, overhead) as well as what an insurer pays out in claims (losses) and divides it by net premiums earned. If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Given the calculation, a lower expense ratio is better. Over the last two years, Kemper’s combined ratio has swelled by 13.6 percentage points, going from 110% to 95.9%. Said differently, the company’s expenses have grown at a slower rate than revenue, which typically signals prudent management.

Kemper’s combined ratio came in at 99.6% this quarter, falling short of analysts’ expectations by 493.3 basis points (100 basis points = 1 percentage point). This result was 7.9 percentage points worse than the same quarter last year.

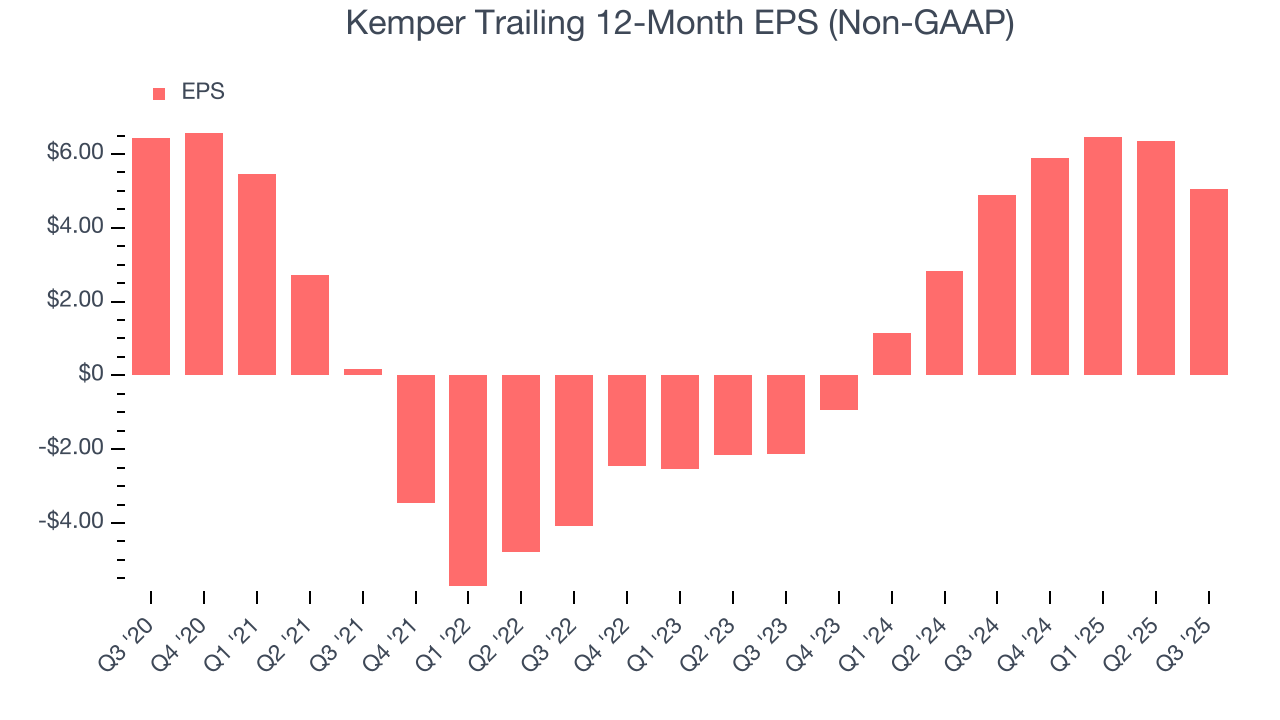

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Kemper, its EPS declined by 4.7% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Kemper, its two-year annual EPS growth of 109% was higher than its five-year trend. This acceleration made it one of the faster-growing insurance companies in recent history.

In Q3, Kemper reported adjusted EPS of $0.33, down from $1.62 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Kemper’s full-year EPS of $5.06 to grow 8.6%.

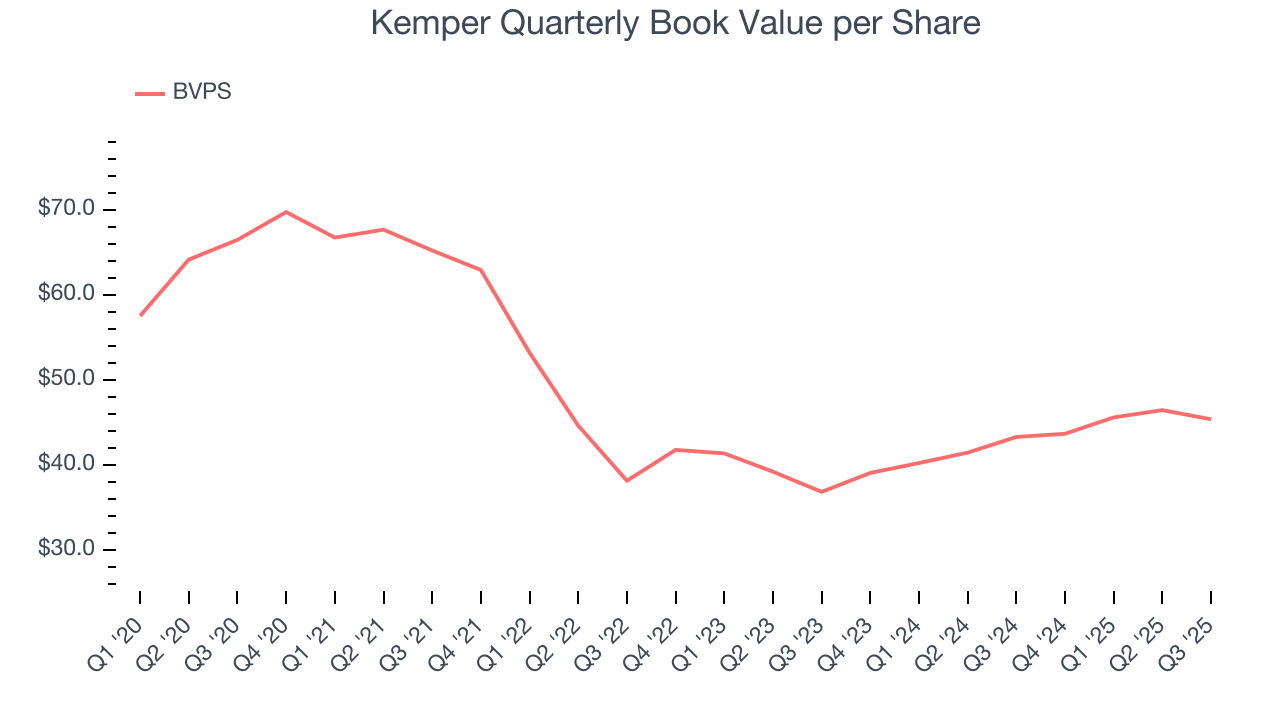

9. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float – premiums collected but not yet paid out – are invested, creating an asset base supported by a liability structure. Book value captures this dynamic by measuring:

- Assets (investment portfolio, cash, reinsurance recoverables) - liabilities (claim reserves, debt, future policy benefits)

BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality. While other (and more commonly known) per-share metrics like EPS can sometimes be lumpy due to reserve releases or one-time items and can be managed or skewed while still following accounting rules, BVPS reflects long-term capital growth and is harder to manipulate.

Kemper’s BVPS declined at a 7.3% annual clip over the last five years. However, BVPS growth has accelerated recently, growing by 11% annually over the last two years from $36.85 to $45.38 per share.

Over the next 12 months, Consensus estimates call for Kemper’s BVPS to grow by 25.4% to $51.52, elite growth rate.

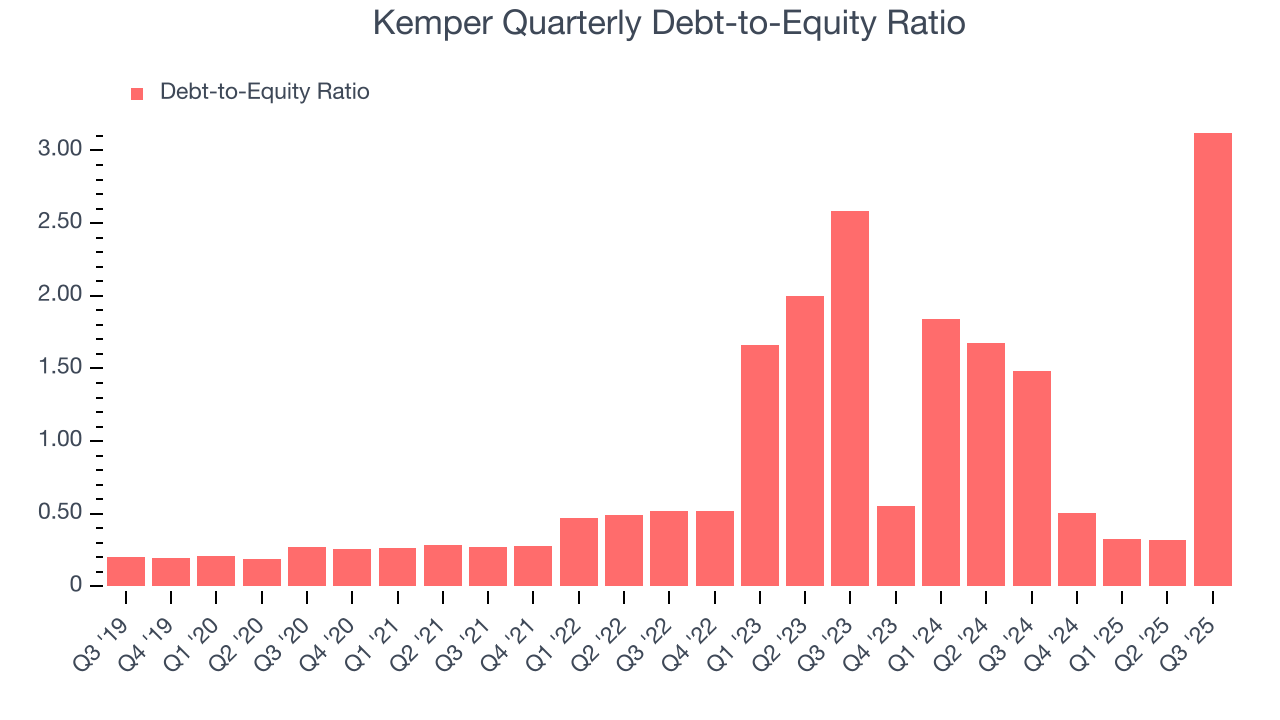

10. Balance Sheet Risk

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Kemper currently has $943.1 million of debt and $302 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.1×. We think this is dangerous - for an insurance business, anything above 1.0× raises red flags.

11. Return on Equity

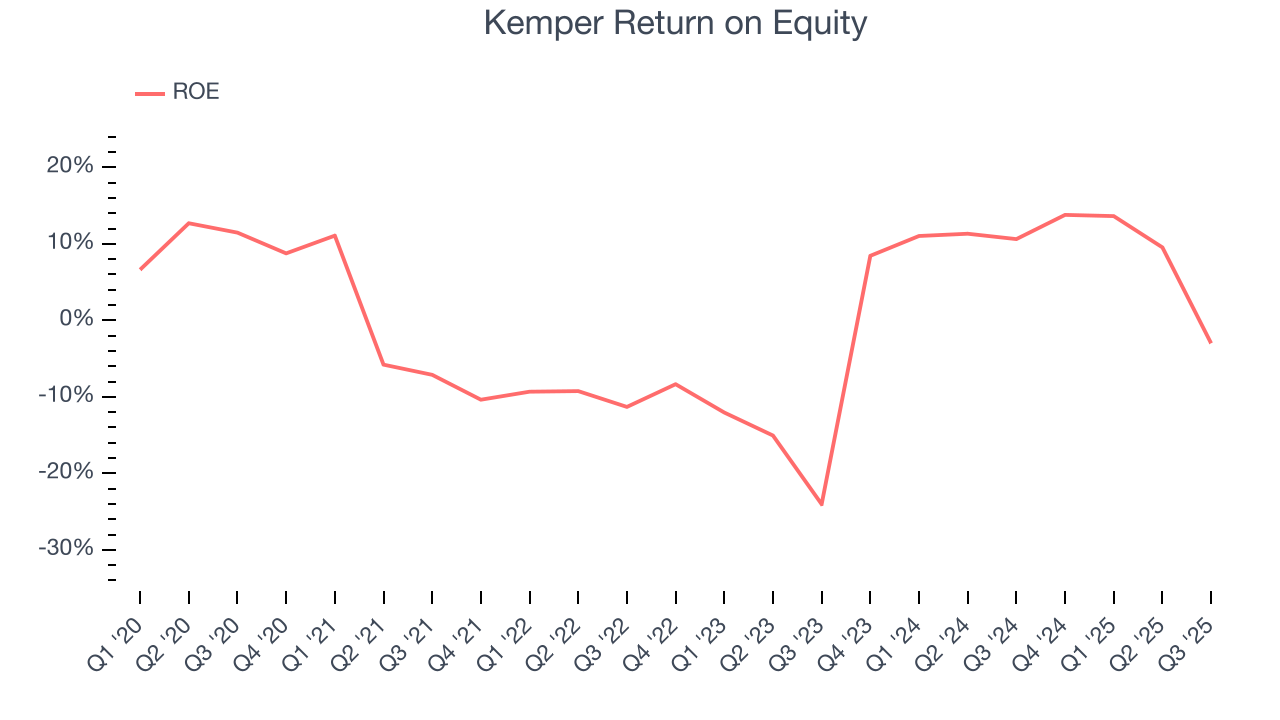

Return on Equity, or ROE, ties everything together and is a vital metric. It tells us how much profit the insurer generates for each dollar of shareholder equity entrusted to management. Over a long period, insurers with higher ROEs tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Kemper has averaged an ROE of negative 0.9%, a bad result not only in absolute terms but also relative to the majority of insurers putting up 20%+. It also shows that Kemper has little to no competitive moat.

12. Key Takeaways from Kemper’s Q3 Results

We enjoyed seeing Kemper beat analysts’ net premiums earned expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed and its book value per share fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 10.6% to $38.15 immediately following the results.

13. Is Now The Time To Buy Kemper?

Updated: January 22, 2026 at 11:23 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Kemper.

We cheer for all companies serving everyday consumers, but in the case of Kemper, we’ll be cheering from the sidelines. To begin with, its revenue growth was weak over the last five years. And while its improving combined ratio shows the business has become more productive, the downside is its relatively low ROE suggests management has struggled to find compelling investment opportunities. On top of that, its BVPS has declined over the last five years.

Kemper’s P/B ratio based on the next 12 months is 0.8x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $58.20 on the company (compared to the current share price of $38.79).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.