Lazard (LAZ)

Lazard catches our eye. Its impressive 29% ROE illustrates its ability to invest in high-quality growth initiatives.― StockStory Analyst Team

1. News

2. Summary

Why Lazard Is Interesting

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE:LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- On a dimmer note, its earnings per share fell by 3.1% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

Lazard has some respectable qualities. This is a good stock to keep your eye on.

Why Should You Watch Lazard

High Quality

Investable

Underperform

Why Should You Watch Lazard

Lazard’s stock price of $52.90 implies a valuation ratio of 17.2x forward P/E. Lazard’s valuation hovers around the sector average.

For now, this is a stock we’ll keep an eye on rather than one we’ll recommend you buy. We prefer owning businesses with better fundamentals that trade at similar multiples.

3. Lazard (LAZ) Research Report: Q4 CY2025 Update

Financial advisory firm Lazard (NYSE:LAZ) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 14.4% year on year to $929.4 million. Its non-GAAP profit of $0.80 per share was 16.2% above analysts’ consensus estimates.

Lazard (LAZ) Q4 CY2025 Highlights:

- Assets Under Management: $254.3 billion vs analyst estimates of $260.9 billion (12.4% year-on-year growth, 2.5% miss)

- Revenue: $929.4 million vs analyst estimates of $814.7 million (14.4% year-on-year growth, 14.1% beat)

- Pre-tax Profit: $84.95 million (9.1% margin)

- Adjusted EPS: $0.80 vs analyst estimates of $0.69 (16.2% beat)

- Market Capitalization: $4.99 billion

Company Overview

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE:LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

Lazard operates through two main business segments: Financial Advisory and Asset Management. The Financial Advisory business helps clients navigate mergers and acquisitions, capital structure issues, restructuring, and sovereign advisory matters. When a corporation considers acquiring another company, Lazard evaluates potential targets, analyzes valuations, and proposes financial structures. Similarly, when a business is considering a sale, Lazard advises on the process, prepares materials, identifies potential buyers, and assists in negotiations.

For companies facing financial distress, Lazard reviews operations, evaluates debt capacity, and helps structure amendments to debt agreements. The firm also provides shareholder advisory services, helping companies prepare for and respond to activist investors. For example, when a multinational corporation faces pressure from activist shareholders questioning its strategy, Lazard might analyze the company's position, provide insights on shareholder perspectives, and advise on potential responses.

In its Asset Management segment, Lazard offers investment solutions across equity, fixed income, and alternative investments. The firm employs fundamental security selection approaches, conducting global research to develop market insights and evaluate opportunities. Lazard manages assets for institutional clients like pension funds and sovereign wealth funds, as well as for individual investors through various distribution channels.

Lazard generates revenue through advisory fees in its Financial Advisory business and management fees based on assets under management in its Asset Management business. The firm maintains offices across major financial centers worldwide, allowing it to serve clients globally while providing local expertise.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

Lazard's competitors in financial advisory include Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), JPMorgan Chase (NYSE:JPM), and boutique investment banks like Evercore (NYSE:EVR) and PJT Partners (NYSE:PJT). In asset management, it competes with firms such as BlackRock (NYSE:BLK), T. Rowe Price (NASDAQ:TROW), and Franklin Resources (NYSE:BEN).

5. Revenue Growth

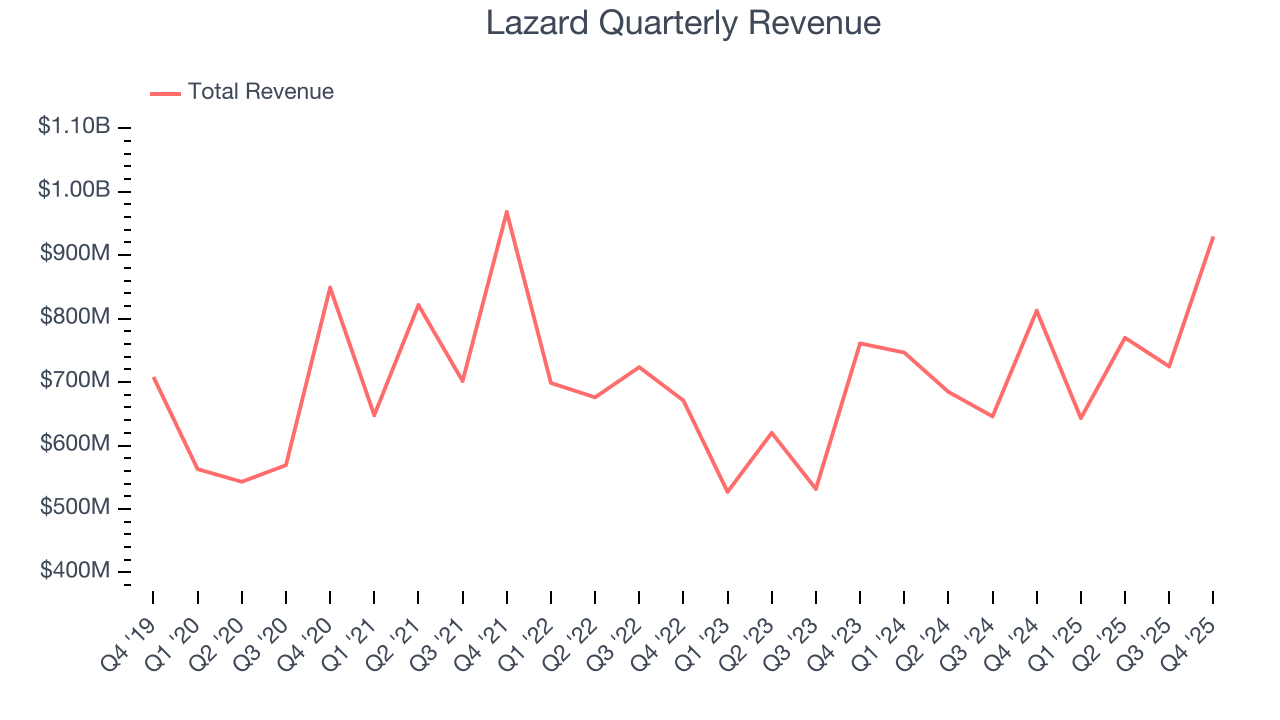

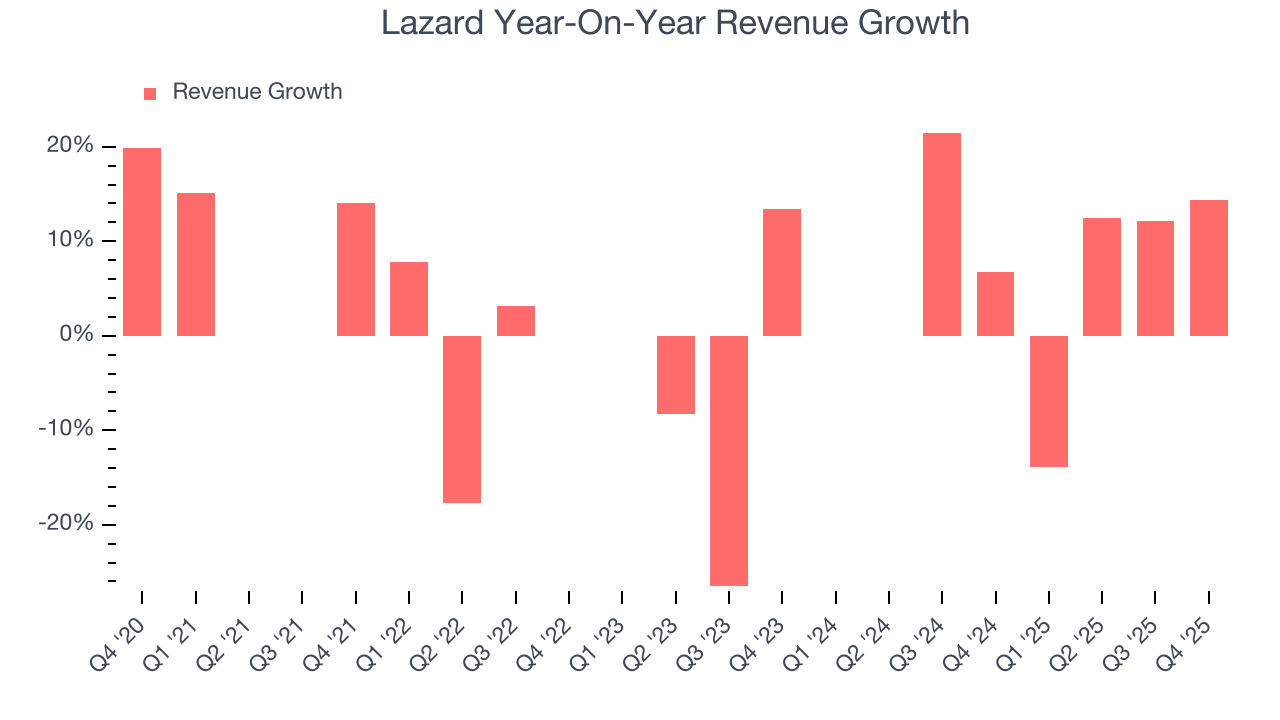

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Lazard’s 4% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about Lazard.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Lazard’s annualized revenue growth of 12.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Lazard reported year-on-year revenue growth of 14.4%, and its $929.4 million of revenue exceeded Wall Street’s estimates by 14.1%.

6. Assets Under Management (AUM)

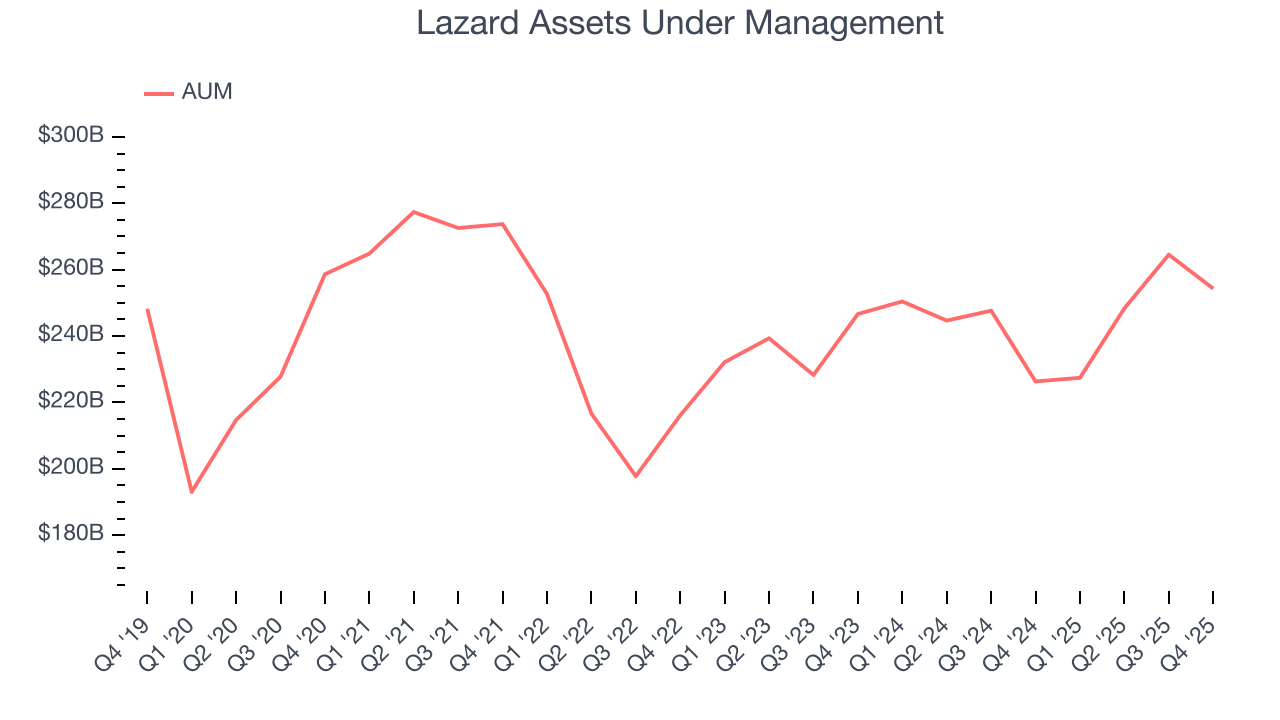

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Lazard’s AUM has grown at an annual rate of 2.2% over the last five years, much worse than the broader financials industry and slower than its total revenue. When analyzing Lazard’s AUM over the last two years, we can paint a similar picture as it recorded 2.5% annual growth. Fundraising or short-term investment performance were net detractors to the company over this shorter period since assets grew slower than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

Lazard’s AUM punched in at $254.3 billion this quarter, falling 2.5% short of analysts’ expectations. This print was 12.4% higher than the same quarter last year.

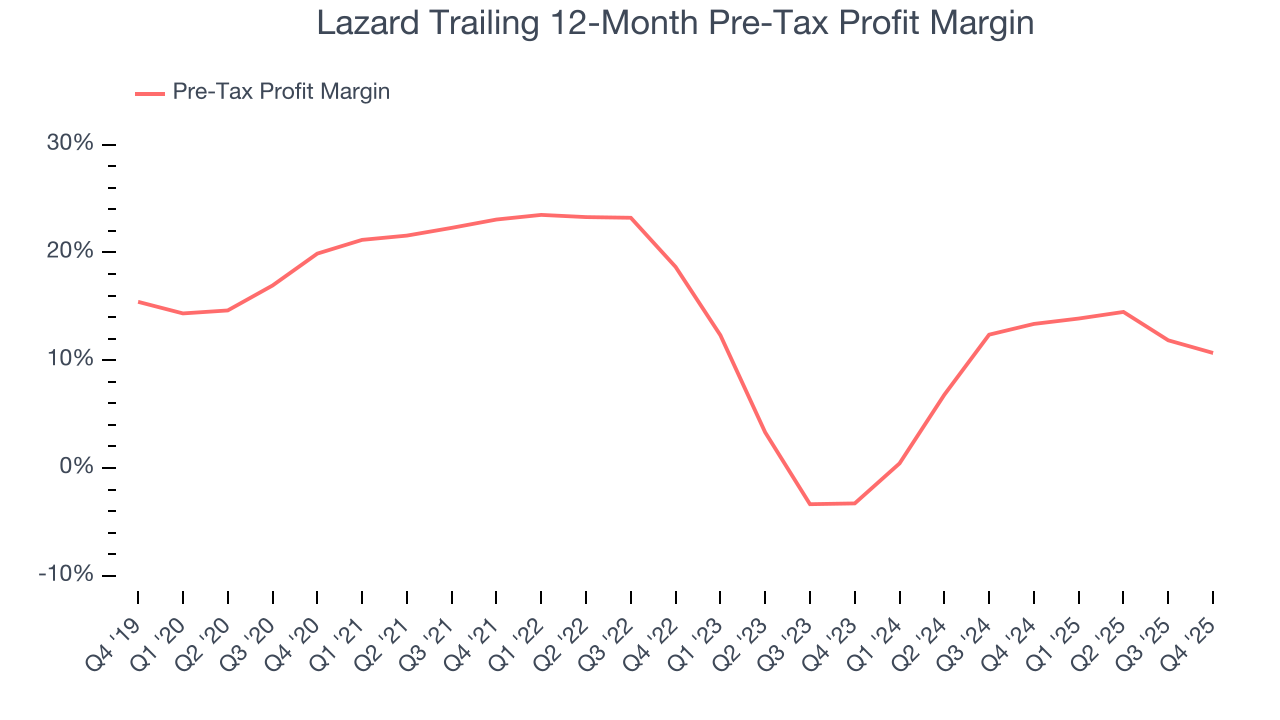

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Lazard’s pre-tax profit margin has risen by 9.2 percentage points, going from 23.1% to 10.7%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 14 percentage points on a two-year basis.

In Q4, Lazard’s pre-tax profit margin was 9.1%. This result was 4 percentage points worse than the same quarter last year.

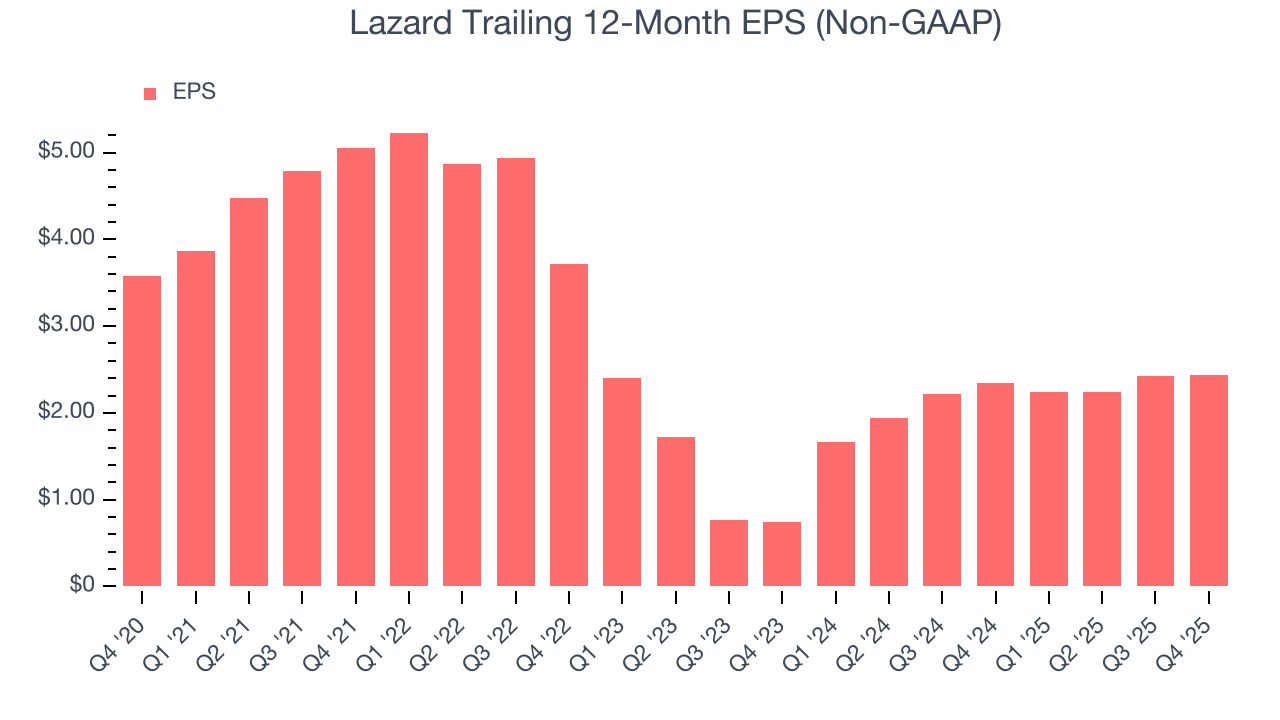

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Lazard, its EPS declined by 7.4% annually over the last five years while its revenue grew by 4%. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lazard, its two-year annual EPS growth of 81.6% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, Lazard reported adjusted EPS of $0.80, up from $0.78 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lazard’s full-year EPS of $2.44 to grow 49.7%.

9. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Lazard has averaged an ROE of 25.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Lazard has a strong competitive moat.

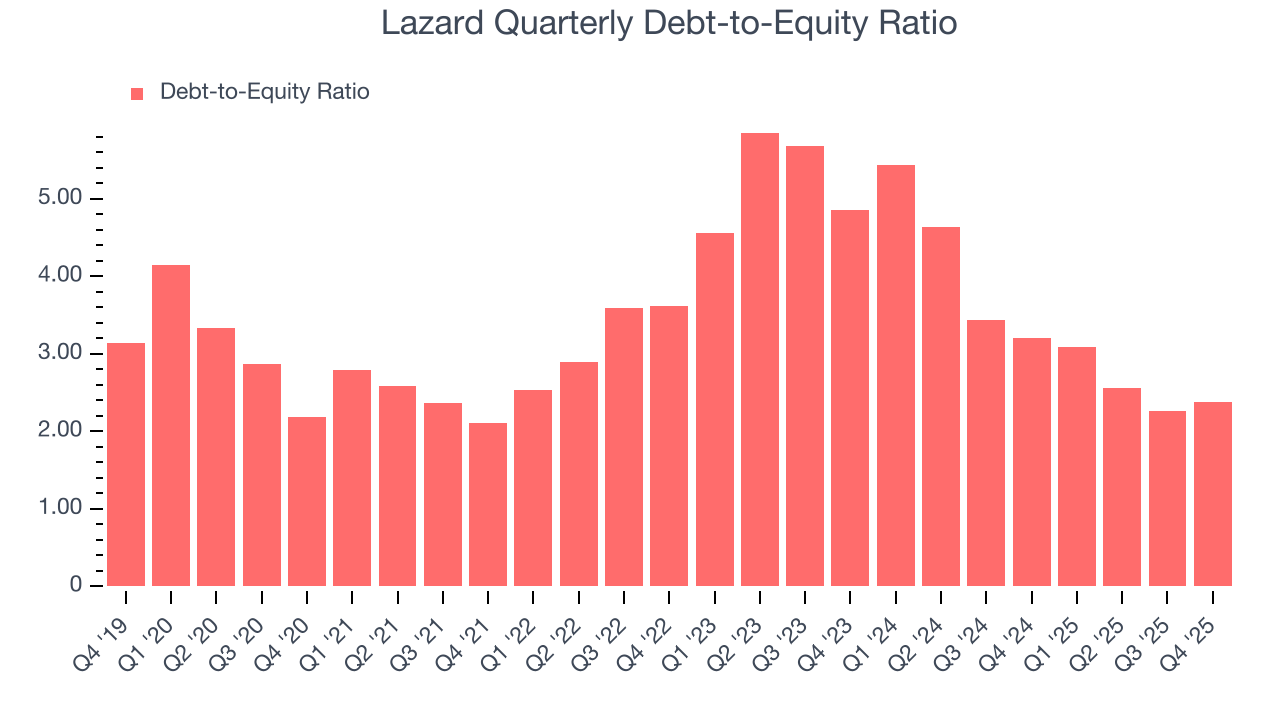

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Lazard currently has $2.17 billion of debt and $910.8 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.6×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Lazard’s Q4 Results

We were impressed by how significantly Lazard blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its AUM missed. Zooming out, we think this was a mixed print. The stock remained flat at $52.90 immediately after reporting.

12. Is Now The Time To Buy Lazard?

Updated: January 29, 2026 at 7:17 AM EST

Before investing in or passing on Lazard, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are things to like about Lazard. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Lazard’s declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically.

Lazard’s P/E ratio based on the next 12 months is 14.4x. Looking at the financials space right now, Lazard trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $58.13 on the company (compared to the current share price of $52.90), implying they see 9.9% upside in buying Lazard in the short term.