Labcorp (LH)

We’re skeptical of Labcorp. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Labcorp Will Underperform

With over 600 million tests performed annually and involvement in 90% of FDA-approved drugs in 2023, Labcorp (NYSE:LH) provides laboratory testing services and drug development solutions to doctors, hospitals, pharmaceutical companies, and patients worldwide.

- Performance over the past five years shows its incremental sales were less profitable as its earnings per share were flat

- The company has faced growth challenges as its 2% annual revenue increases over the last five years fell short of other healthcare companies

- A bright spot is that its adjusted operating margin of 18.3% highlights its superior profitability versus many of its healthcare peers

Labcorp doesn’t pass our quality test. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Labcorp

Why There Are Better Opportunities Than Labcorp

At $282.63 per share, Labcorp trades at 16.5x forward P/E. This multiple is cheaper than most healthcare peers, but we think this is justified.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Labcorp (LH) Research Report: Q4 CY2025 Update

Healthcare diagnostics company Labcorp Holdings (NYSE:LH) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 5.6% year on year to $3.52 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $14.7 billion at the midpoint. Its non-GAAP profit of $4.07 per share was 3.2% above analysts’ consensus estimates.

Labcorp (LH) Q4 CY2025 Highlights:

- Revenue: $3.52 billion vs analyst estimates of $3.57 billion (5.6% year-on-year growth, 1.4% miss)

- Adjusted EPS: $4.07 vs analyst estimates of $3.94 (3.2% beat)

- Adjusted EBITDA: $470.3 million vs analyst estimates of $591.3 million (13.4% margin, 20.5% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $17.90 at the midpoint, beating analyst estimates by 2.2%

- Operating Margin: 7.6%, up from 6.5% in the same quarter last year

- Free Cash Flow Margin: 13.9%, down from 20% in the same quarter last year

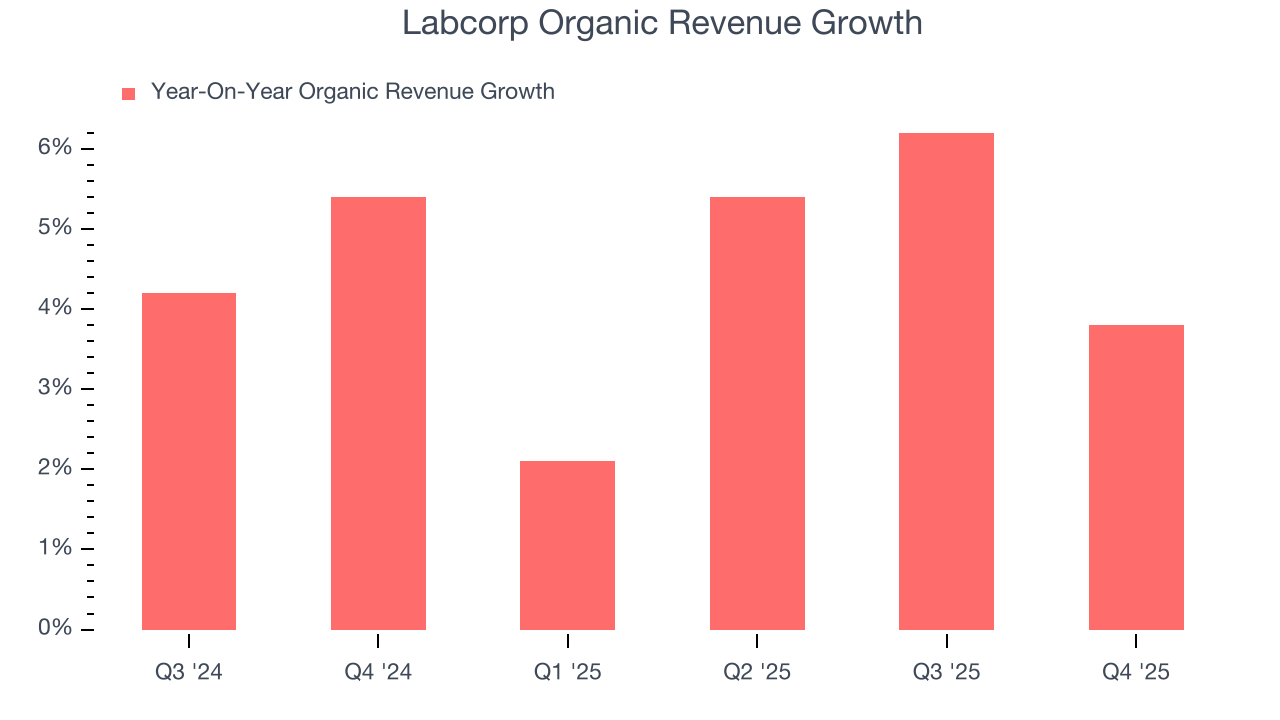

- Organic Revenue rose 3.8% year on year (miss)

- Market Capitalization: $23.43 billion

Company Overview

With over 600 million tests performed annually and involvement in 90% of FDA-approved drugs in 2023, Labcorp (NYSE:LH) provides laboratory testing services and drug development solutions to doctors, hospitals, pharmaceutical companies, and patients worldwide.

Labcorp operates through two main business segments: Diagnostics Laboratories (Dx) and Biopharma Laboratory Services (BLS). The Diagnostics segment functions as an independent clinical laboratory network across the U.S. and Canada, offering both routine and specialty testing through more than 2,000 patient service centers and 6,000 in-office phlebotomists. This network processes everything from standard blood work to complex genetic testing, with most results delivered electronically within 1-2 days.

The Biopharma Laboratory Services segment supports pharmaceutical, biotechnology, and medical device companies throughout the drug development process. This includes early-stage research, preclinical studies, and clinical trials. BLS provides specialized services like safety assessment, analytical testing, and clinical laboratory services for trial participants through a global network of central laboratories.

A physician might order a comprehensive metabolic panel through Labcorp's diagnostic services to evaluate a patient's kidney function, liver health, and electrolyte balance. Meanwhile, a pharmaceutical company developing a new cancer treatment might engage Labcorp's biopharma services to conduct safety assessments, analyze blood samples from clinical trial participants, and develop companion diagnostic tests that identify which patients would benefit most from the therapy.

Labcorp generates revenue primarily through fee-for-service arrangements. For diagnostics, payment comes from health insurance plans, government programs like Medicare, and sometimes directly from patients. The biopharma segment earns revenue through contracts with drug developers, typically structured as milestone-based payments throughout the development process.

The company maintains a global presence, serving clients in approximately 100 countries, though the majority of its operations are in the United States. Labcorp continuously invests in new testing technologies and capabilities, launching more than 130 new tests in 2023 alone.

4. Testing & Diagnostics Services

The testing and diagnostics services industry plays a crucial role in disease detection, monitoring, and prevention, serving hospitals, clinics, and individual consumers. This sector benefits from stable demand, driven by an aging population, increased prevalence of chronic diseases, and growing awareness of preventive healthcare. Recurring revenue streams come from routine screenings, lab tests, and diagnostic imaging, with reimbursement from Medicare, Medicaid, private insurance, and out-of-pocket payments. However, the industry faces challenges such as pricing pressures, regulatory compliance, and the need for continuous investment in new testing technologies. Looking ahead, industry tailwinds include the expansion of personalized medicine, increased adoption of at-home and rapid diagnostic tests, and advancements in AI-driven diagnostics that enhance accuracy and efficiency. However, headwinds such as reimbursement uncertainties, competition from decentralized testing solutions, and regulatory scrutiny over test validity and cost-effectiveness may impact profitability. Adapting to evolving healthcare models and integrating automation will be key for sustaining growth and maintaining operational efficiency.

Labcorp's main competitors include Quest Diagnostics (NYSE:DGX) in clinical laboratory services, and IQVIA (NYSE:IQV), Charles River Laboratories (NYSE:CRL), and Syneos Health in the drug development and clinical trials space.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $13.95 billion in revenue over the past 12 months, Labcorp has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

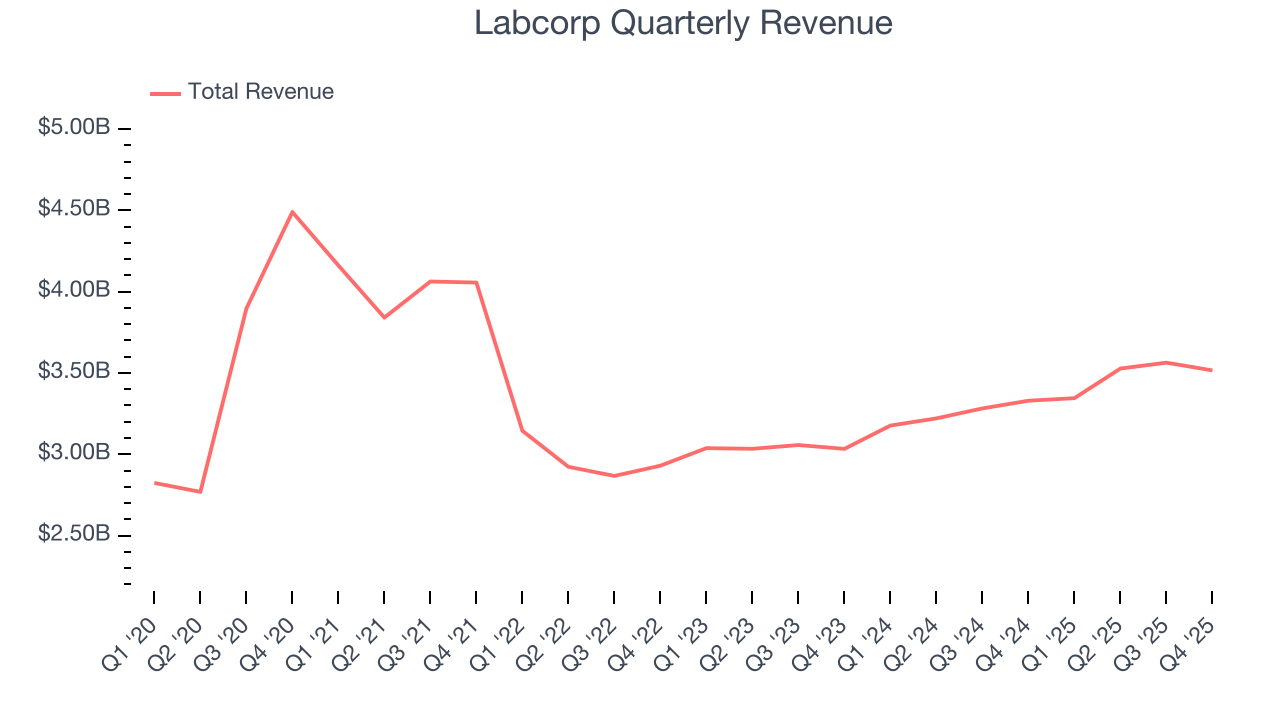

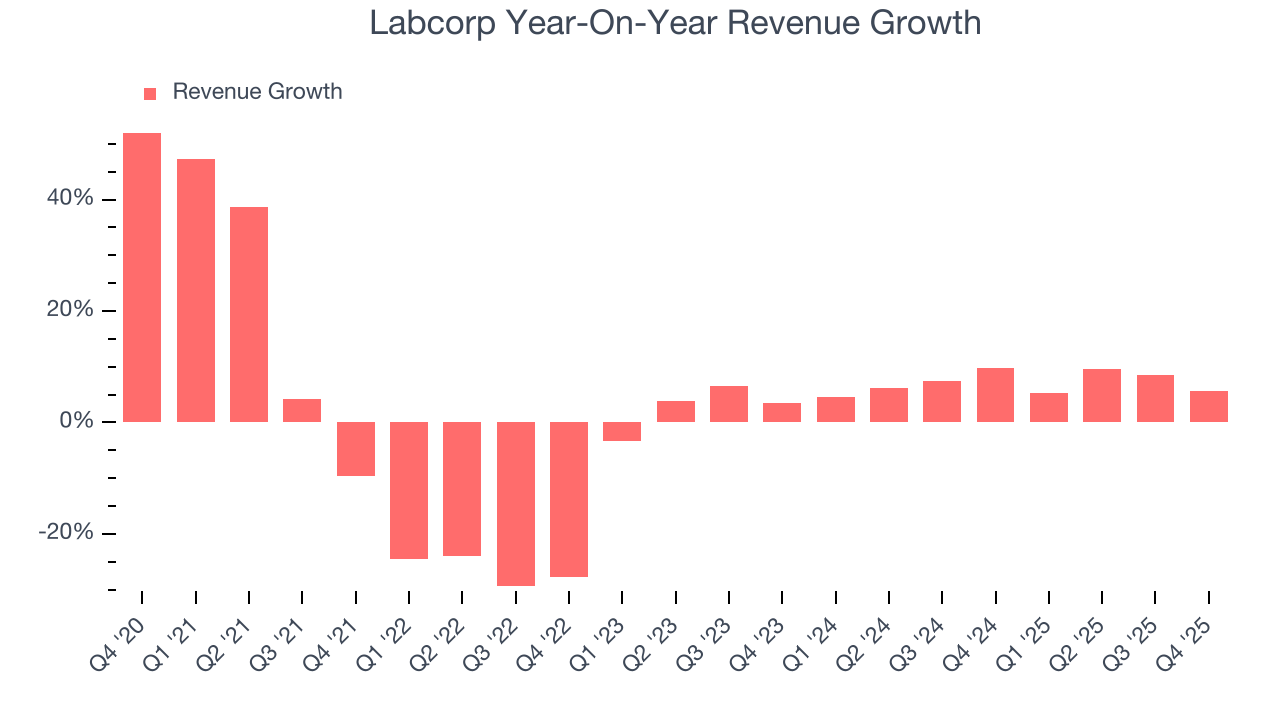

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Labcorp struggled to consistently increase demand as its $13.95 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a lower quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Labcorp’s annualized revenue growth of 7.1% over the last two years is above its five-year trend, which is encouraging.

Labcorp also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Labcorp’s organic revenue averaged 4.5% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Labcorp’s revenue grew by 5.6% year on year to $3.52 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

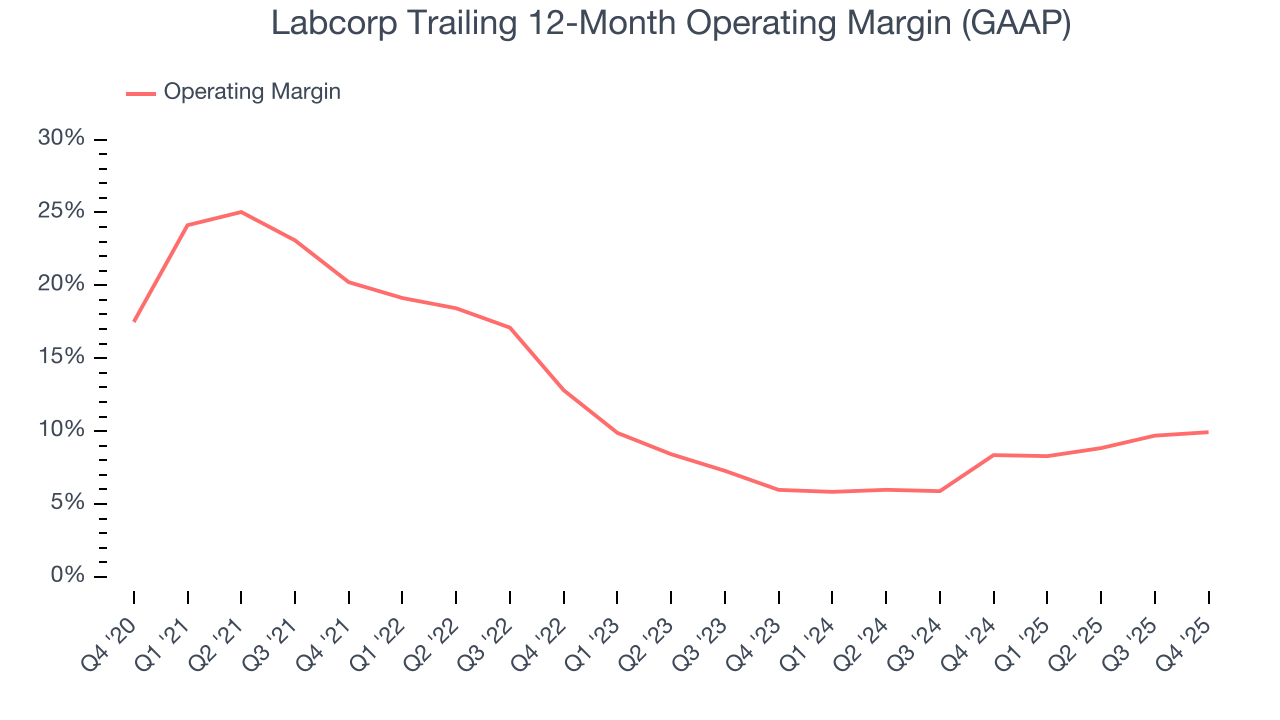

Labcorp has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.9%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Labcorp’s operating margin decreased by 10.3 percentage points over the last five years, but it rose by 4 percentage points on a two-year basis. Still, shareholders will want to see Labcorp become more profitable in the future.

In Q4, Labcorp generated an operating margin profit margin of 7.6%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

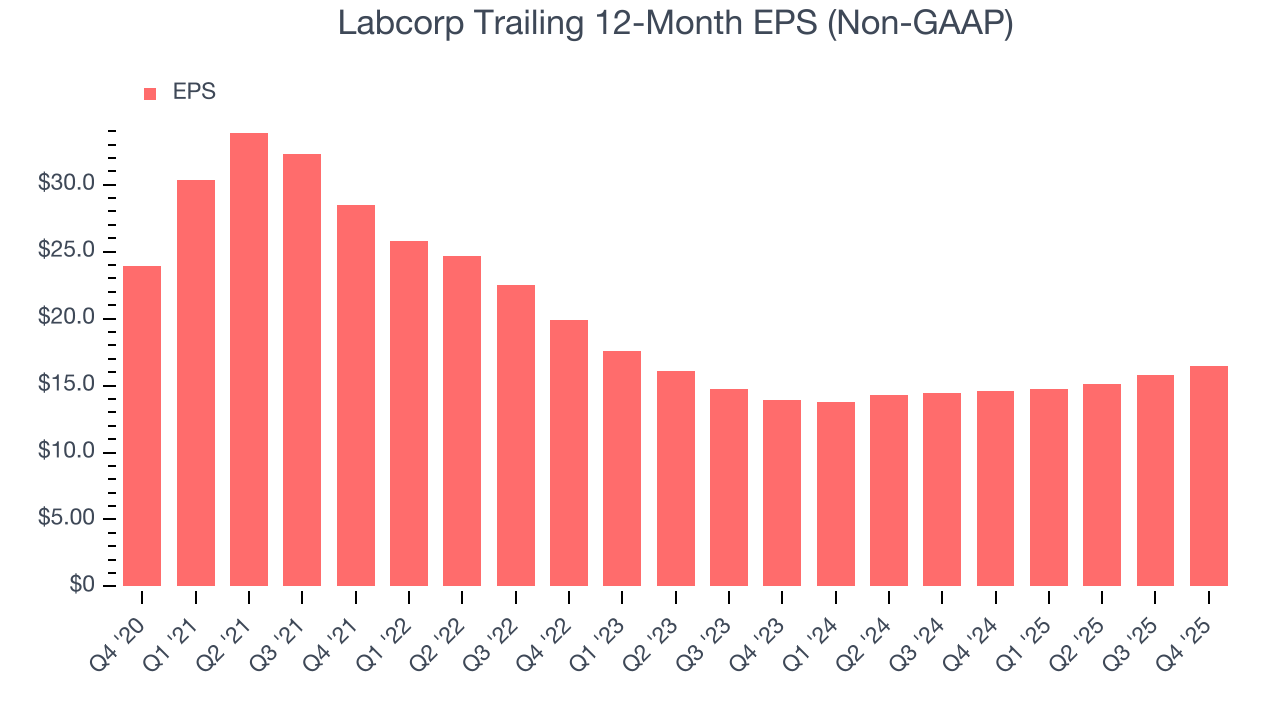

Sadly for Labcorp, its EPS declined by 7.2% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Diving into the nuances of Labcorp’s earnings can give us a better understanding of its performance. As we mentioned earlier, Labcorp’s operating margin expanded this quarter but declined by 10.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Labcorp reported adjusted EPS of $4.07, up from $3.45 in the same quarter last year. This print beat analysts’ estimates by 3.2%. Over the next 12 months, Wall Street expects Labcorp’s full-year EPS of $16.44 to grow 6.2%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

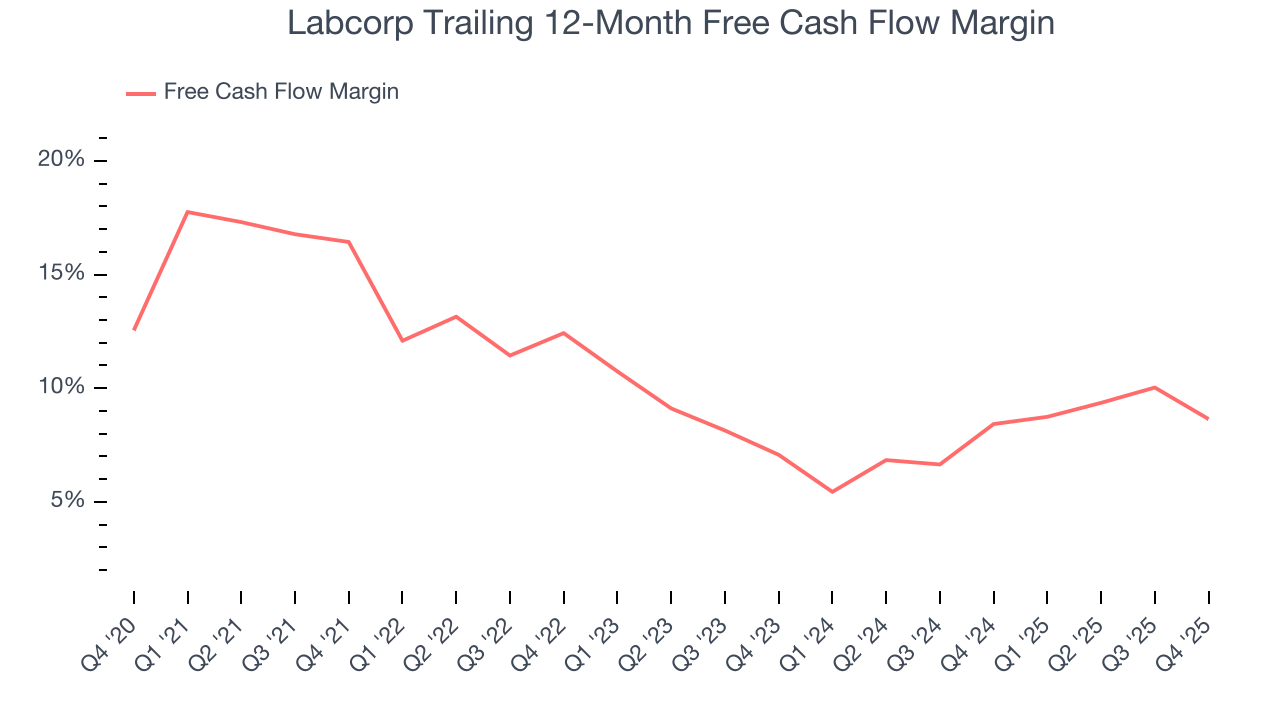

Labcorp has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.9% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Labcorp’s margin dropped by 7.8 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Labcorp’s free cash flow clocked in at $490.3 million in Q4, equivalent to a 13.9% margin. The company’s cash profitability regressed as it was 6 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

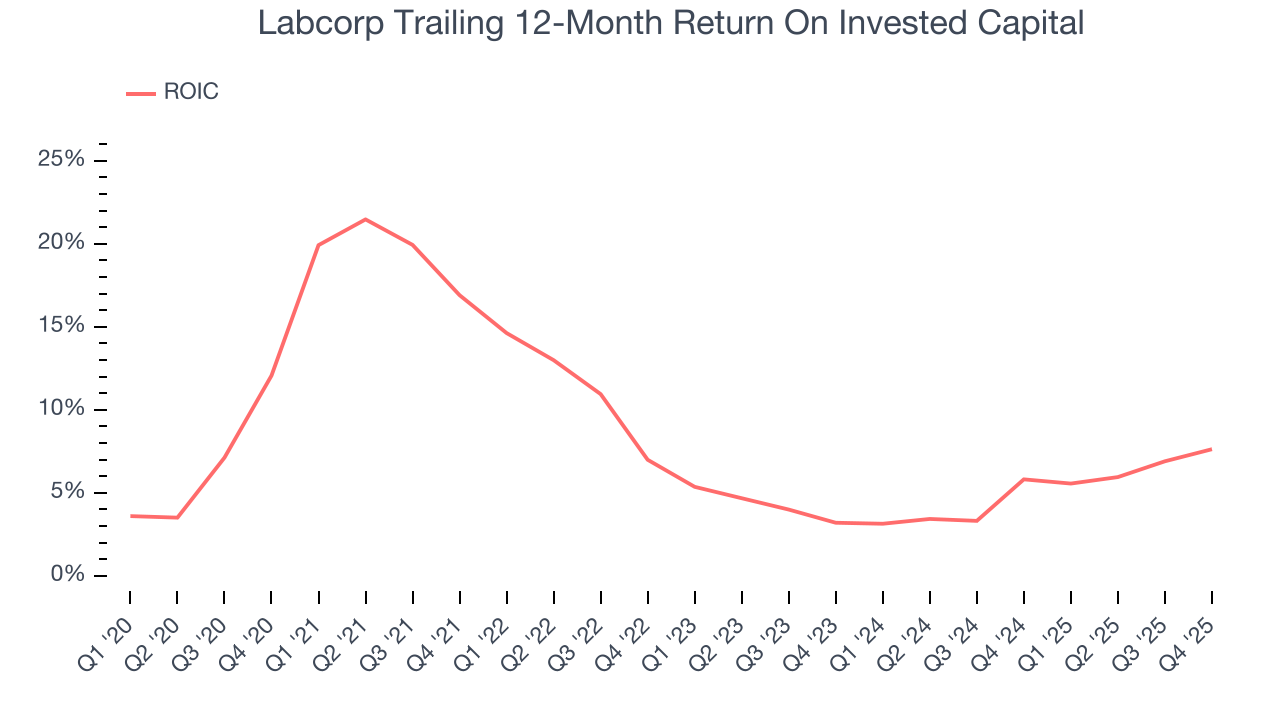

Labcorp’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 8.1%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Labcorp’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

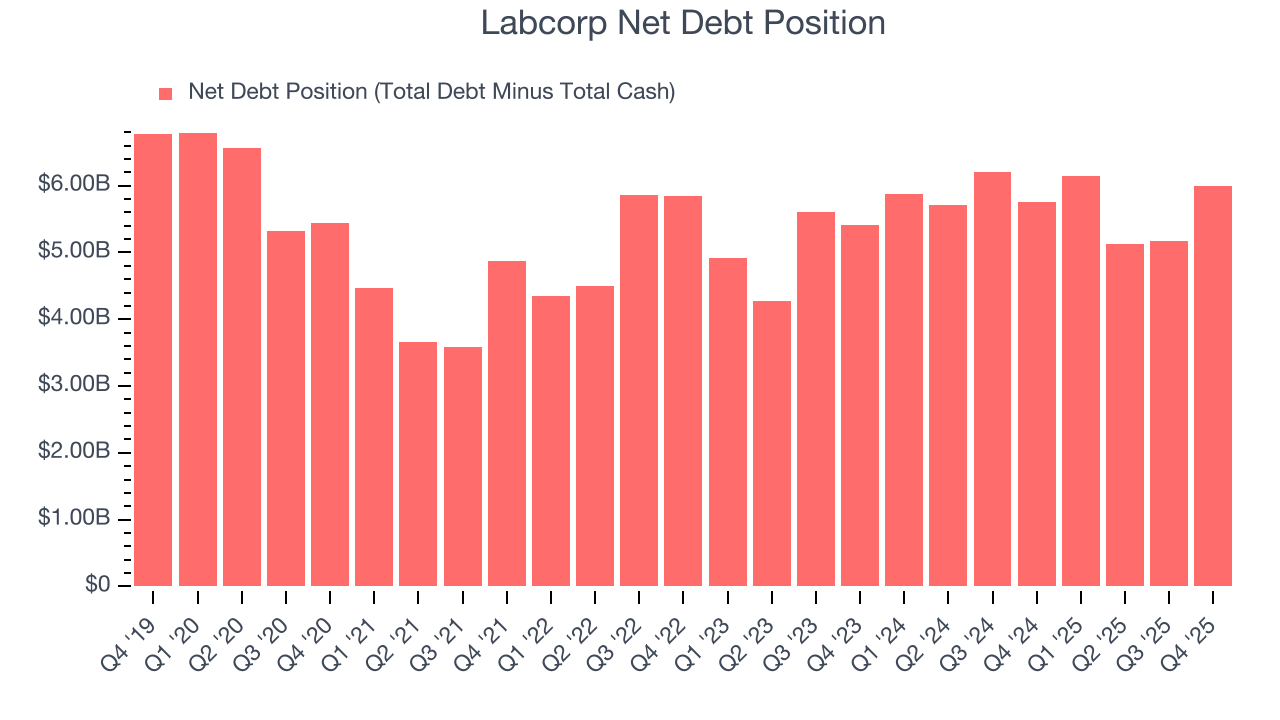

Labcorp reported $532.3 million of cash and $6.53 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.27 billion of EBITDA over the last 12 months, we view Labcorp’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $105.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Labcorp’s Q4 Results

It was encouraging to see Labcorp beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its full-year revenue guidance was in line with Wall Street’s estimates. On the other hand, its revenue slightly missed and its organic revenue fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $282.50 immediately following the results.

13. Is Now The Time To Buy Labcorp?

Updated: February 17, 2026 at 7:01 AM EST

Before investing in or passing on Labcorp, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Labcorp isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was uninspiring over the last five years. While its scale and strong customer awareness give it negotiating power, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its declining operating margin shows the business has become less efficient.

Labcorp’s EV-to-EBITDA ratio based on the next 12 months is 2.4x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $300.18 on the company (compared to the current share price of $282.50).