Lemonade (LMND)

Lemonade doesn’t excite us. Its negative returns on capital suggest it eroded shareholder value by squandering business opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lemonade Will Underperform

Built on the principle of giving back unused premiums to charitable causes selected by policyholders, Lemonade (NYSE:LMND) is a technology-driven insurance company that offers homeowners, renters, pet, car, and life insurance through an AI-powered digital platform.

- Book value per share tumbled by 7.2% annually over the last five years, showing insurance sector trends are working against its favor during this cycle

- Push for growth has led to negative returns on capital, signaling value destruction

- The good news is that its annual revenue growth of 46.6% over the past five years was outstanding, reflecting market share gains this cycle

Lemonade falls short of our expectations. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Lemonade

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Lemonade

Lemonade is trading at $93.17 per share, or 14.3x forward P/B. This valuation is extremely expensive, especially for the quality you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Lemonade (LMND) Research Report: Q3 CY2025 Update

Digital insurance provider Lemonade (NYSE:LMND) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 42.4% year on year to $194.5 million. Its GAAP loss of $0.51 per share was 27.6% above analysts’ consensus estimates.

Lemonade (LMND) Q3 CY2025 Highlights:

Company Overview

Built on the principle of giving back unused premiums to charitable causes selected by policyholders, Lemonade (NYSE:LMND) is a technology-driven insurance company that offers homeowners, renters, pet, car, and life insurance through an AI-powered digital platform.

Lemonade's business model differs fundamentally from traditional insurers by using artificial intelligence throughout the customer journey. The company's AI bots—Maya for onboarding, Jim for claims processing, and CX.AI for customer service—handle most customer interactions without human intervention. This technology-first approach allows Lemonade to process applications and claims in seconds rather than days or weeks, creating both cost efficiencies and higher customer satisfaction.

The company's revenue comes from fixed fees on monthly premiums, with a unique "Giveback" feature that donates unused premiums to customer-selected nonprofits. This structure aims to align the company's interests with policyholders by removing the traditional insurance incentive to deny claims. Lemonade transfers much of its underwriting risk to reinsurance partners, reducing volatility in its financial results.

A typical Lemonade customer might use the mobile app to purchase renters insurance in under two minutes, add coverage for valuable electronics, and later file a claim for a stolen laptop—receiving payment within seconds after answering a few questions and recording a short video explanation. The entire process happens digitally without paperwork or phone calls.

Lemonade has expanded beyond its initial renters and homeowners insurance offerings to include pet insurance, car insurance, and life insurance (through partnerships). The company operates throughout the United States and has entered several European markets including Germany, France, the Netherlands, and the United Kingdom, leveraging its pan-European license to scale across the continent.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

Lemonade competes with traditional insurance giants like State Farm, Allstate, Liberty Mutual, GEICO, and Progressive, as well as other insurtech companies such as Root Insurance (NASDAQ: ROOT) and Hippo (NYSE: HIPO).

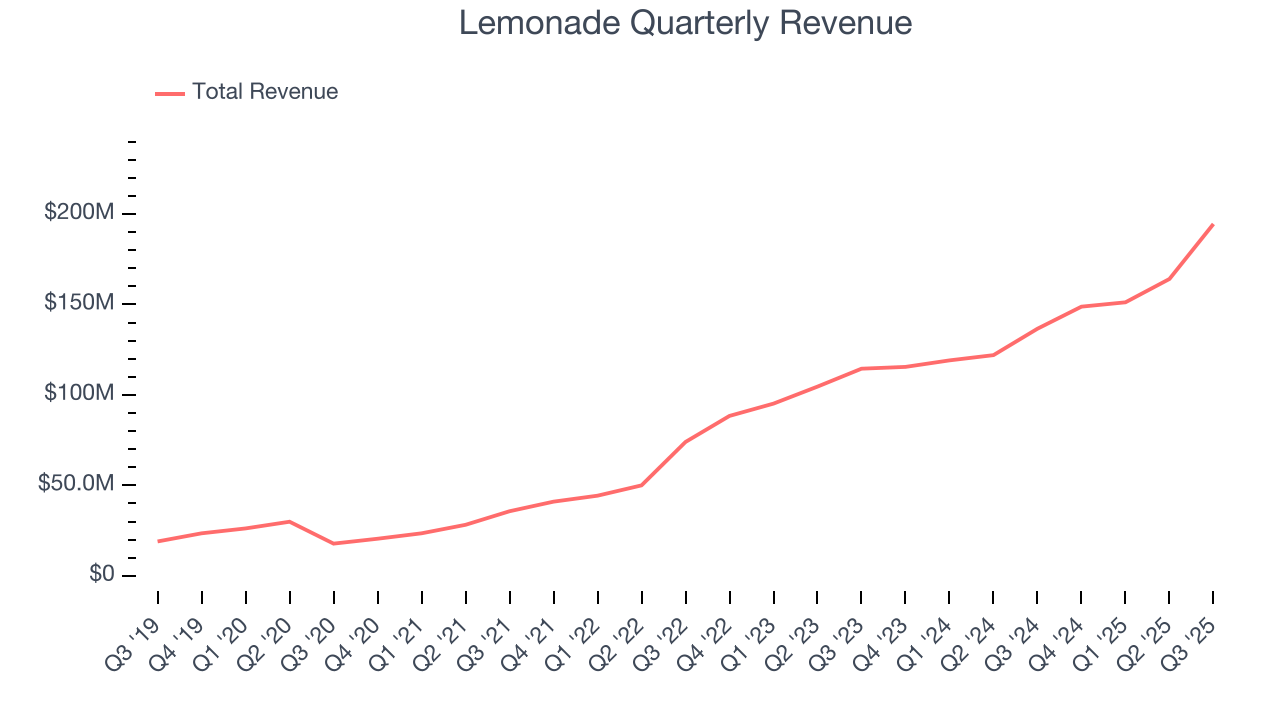

5. Revenue Growth

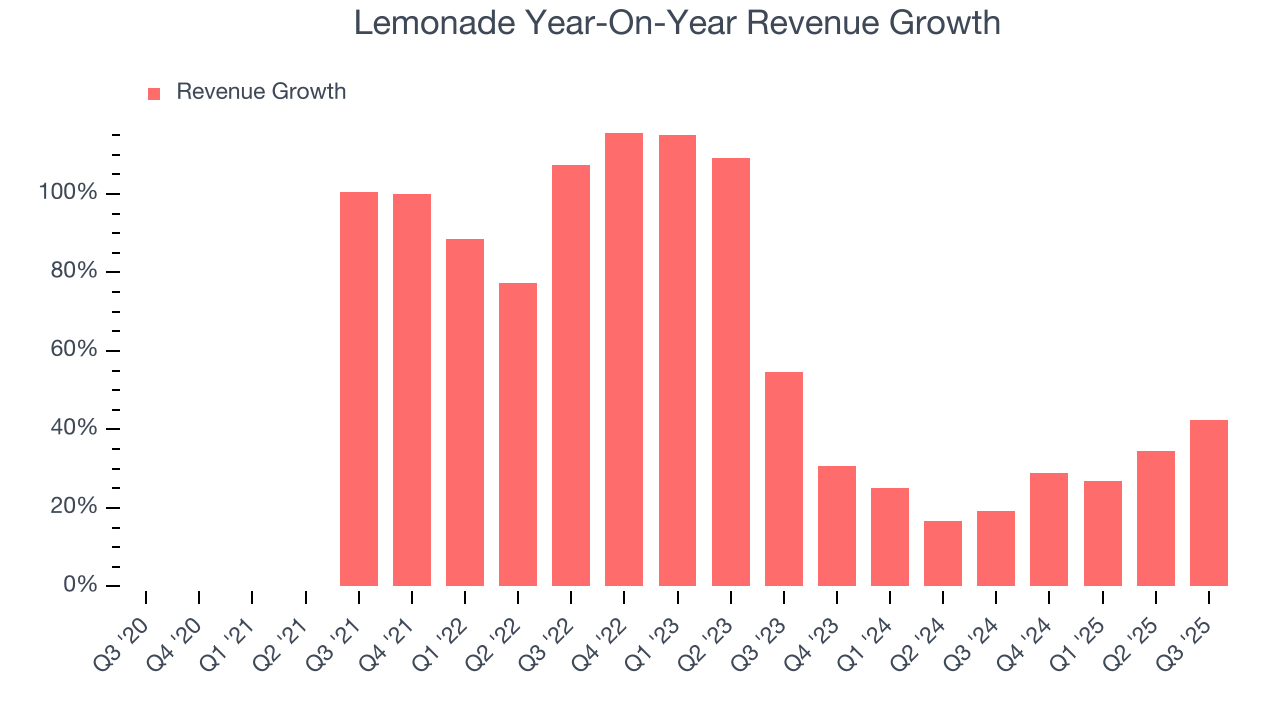

Insurance companies earn revenue from three primary sources: 1) The core insurance business itself, often called underwriting and represented in the income statement as premiums 2) Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities 3) Fees from various sources such as policy administration, annuities, or other value-added services. Luckily, Lemonade’s revenue grew at an incredible 46.6% compounded annual growth rate over the last five years. Its growth beat the average insurance company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Lemonade’s annualized revenue growth of 27.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Lemonade reported magnificent year-on-year revenue growth of 42.4%, and its $194.5 million of revenue beat Wall Street’s estimates by 4.8%.

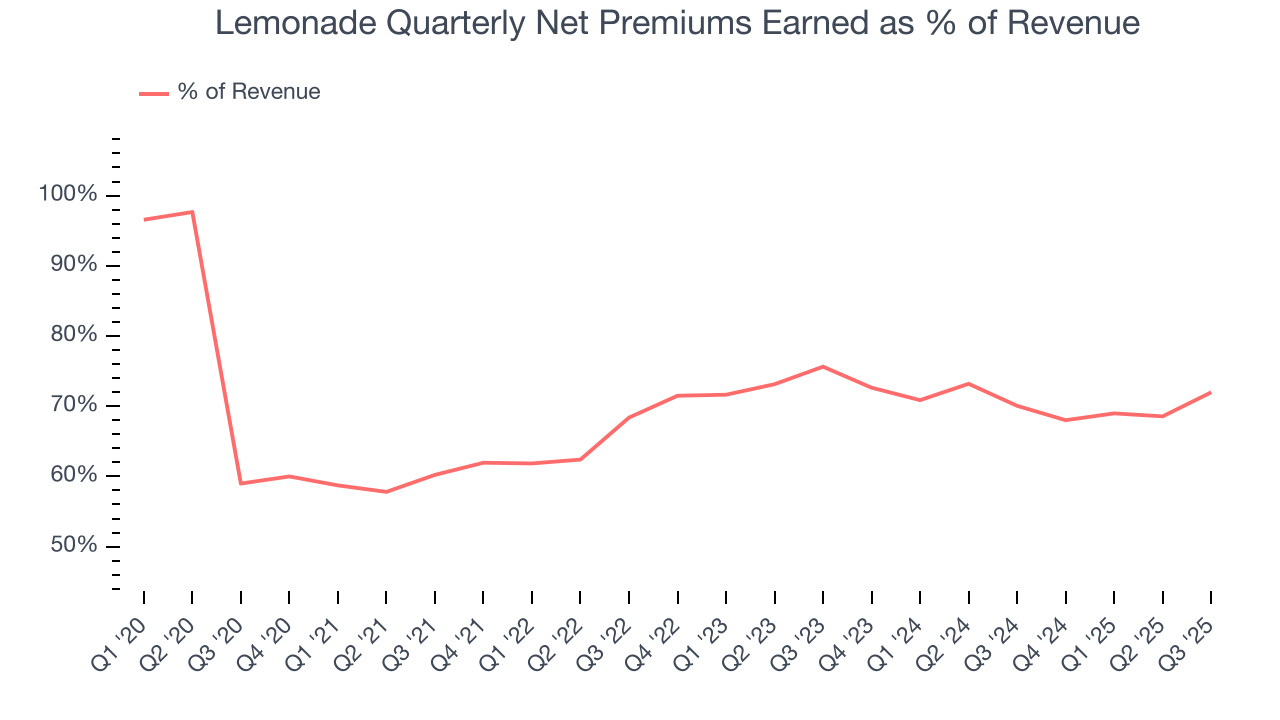

Net premiums earned made up 69.7% of the company’s total revenue during the last five years, meaning insurance operations are Lemonade’s largest source of revenue.

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

6. Net Premiums Earned

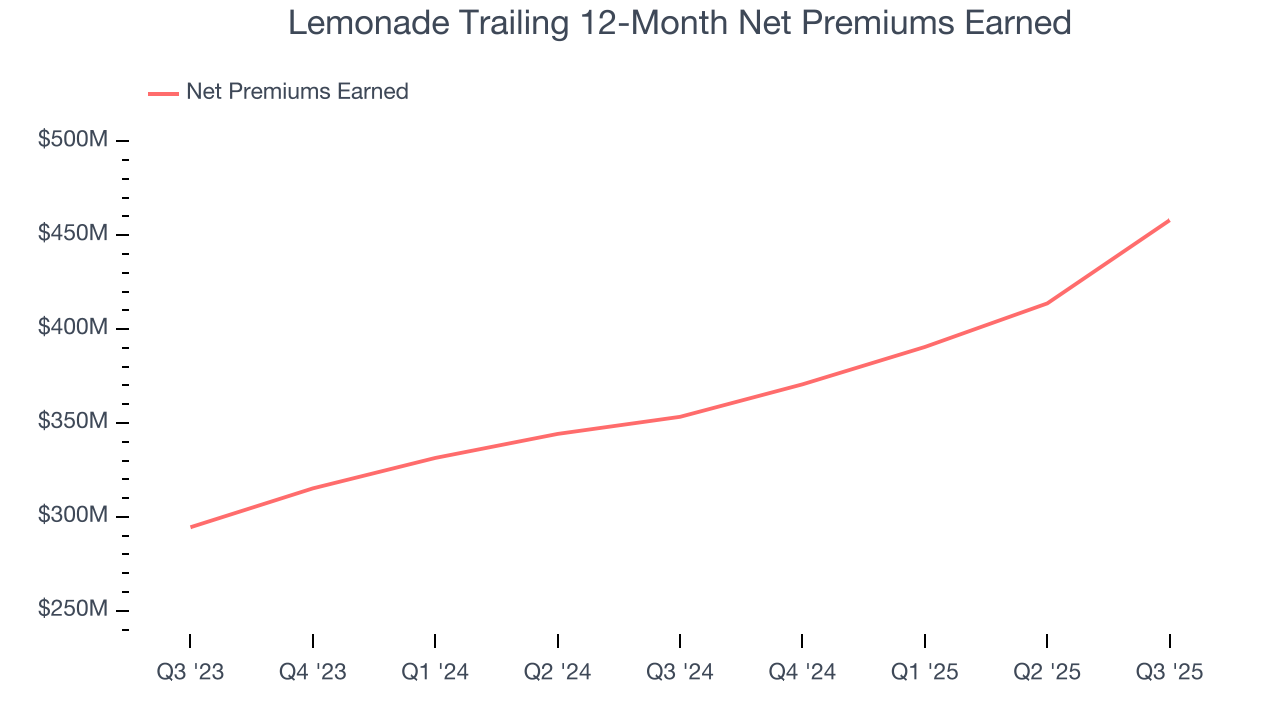

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Lemonade’s net premiums earned has grown at a 40.6% annualized rate over the last five years, much better than the broader insurance industry but slower than its total revenue.

When analyzing Lemonade’s net premiums earned over the last two years, we can see that growth decelerated to 24.7% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these supplementary streams affect the bottom line, their contribution can fluctuate. Some firms have been more successful and consistent in investing their float over the long term, but sharp movements in the fixed income and equity markets can play a substantial role in short-term performance.

Lemonade produced $140 million of net premiums earned in Q3, up a hearty 46.3% year on year and topping Wall Street Consensus estimates by 1.6%.

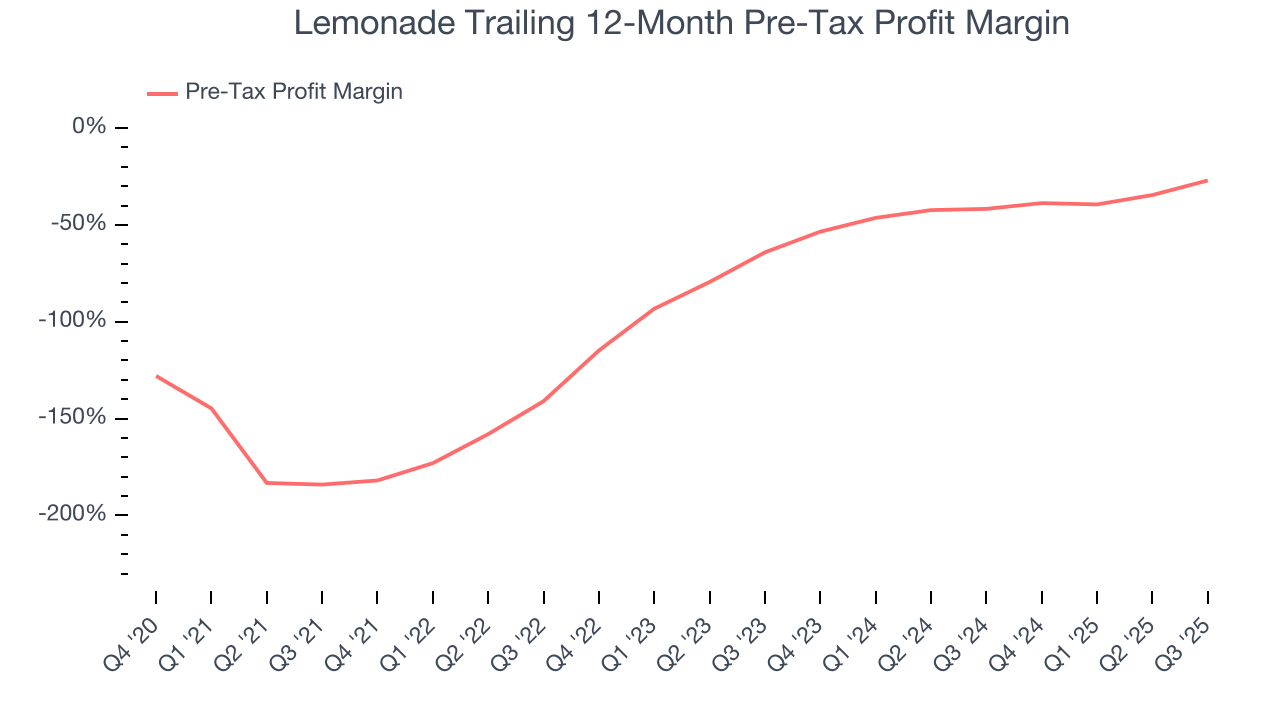

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Insurance companies are balance sheet businesses, where assets and liabilities define the economics. Interest income and expense should therefore be factored into the definition of profit but taxes - which are largely out of a company’s control - should not. This is pre-tax profit by definition.

Over the last four years, Lemonade’s pre-tax profit margin has fallen by 157 percentage points, going from negative 184% to negative 27%. It has also expanded by 37.1 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q3, Lemonade’s pre-tax profit margin was negative 18.7%. This result was 29.5 percentage points better than the same quarter last year.

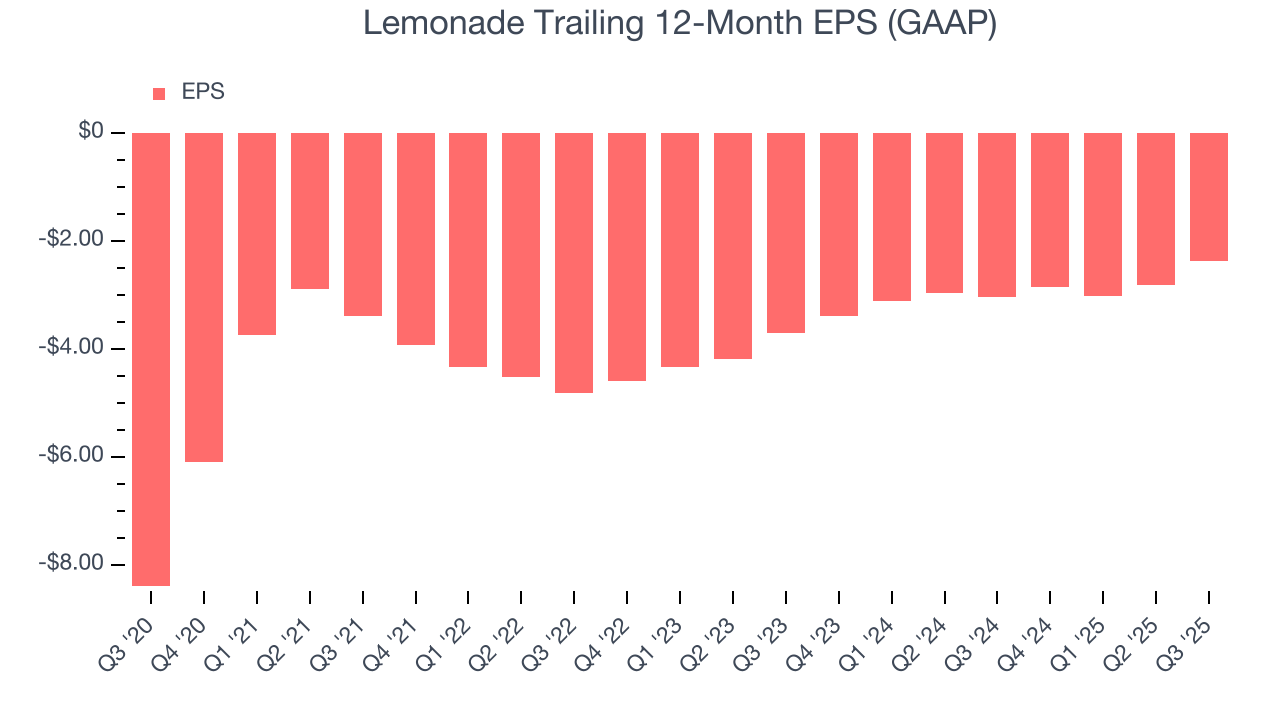

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Lemonade’s full-year earnings are still negative, it reduced its losses and improved its EPS by 22.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lemonade, its two-year annual EPS growth of 20% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Lemonade reported EPS of negative $0.51, up from negative $0.95 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lemonade to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.38 will advance to negative $2.02.

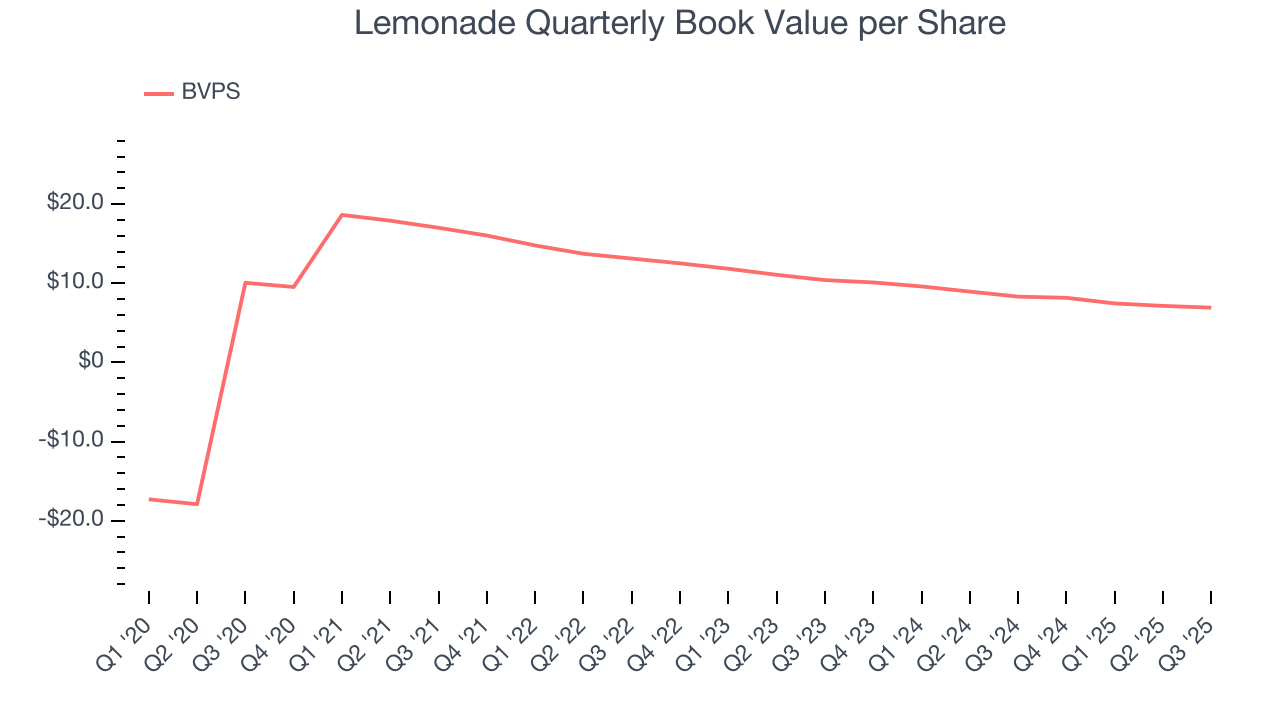

9. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float – premiums collected but not yet paid out – are invested, creating an asset base supported by a liability structure. Book value captures this dynamic by measuring:

- Assets (investment portfolio, cash, reinsurance recoverables) - liabilities (claim reserves, debt, future policy benefits)

BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

Lemonade’s BVPS declined at a 7.2% annual clip over the last five years. A turnaround doesn’t seem to be in sight as its BVPS also dropped by 18.5% annually over the last two years ($10.40 to $6.91 per share).

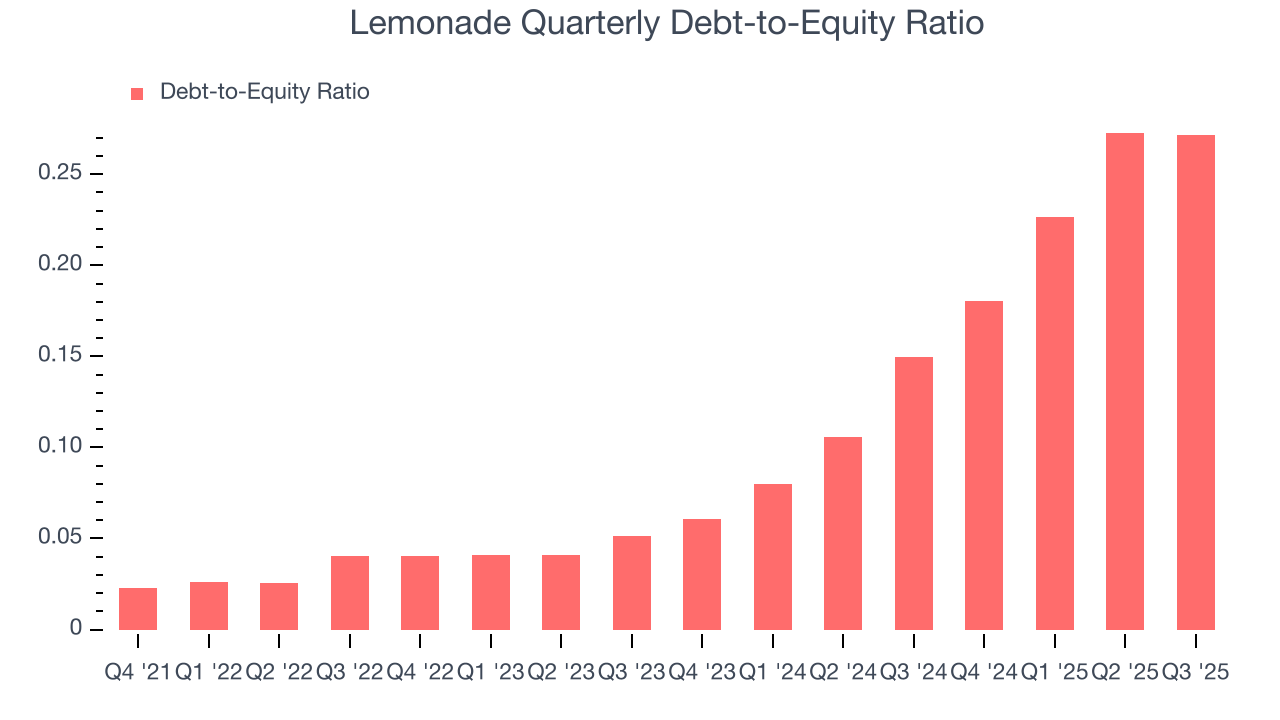

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Lemonade currently has $139 million of debt and $512.2 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

11. Return on Equity

Return on equity (ROE) is a crucial yardstick for insurance companies, measuring their ability to generate returns on the capital provided by shareholders. Insurers that consistently deliver superior ROE tend to create more value for their investors over time through strategic capital allocation and shareholder-friendly policies.

Over the last five years, Lemonade has averaged an ROE of negative 30.4%, a bad result not only in absolute terms but also relative to the majority of insurers putting up 20%+. It also shows that Lemonade has little to no competitive moat.

12. Key Takeaways from Lemonade’s Q3 Results

It was good to see Lemonade beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 11.3% to $65.25 immediately after reporting.

13. Is Now The Time To Buy Lemonade?

Updated: January 24, 2026 at 11:24 PM EST

Are you wondering whether to buy Lemonade or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Lemonade isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months, its relatively low ROE suggests management has struggled to find compelling investment opportunities. And while the company’s net premiums earned growth was exceptional over the last five years, the downside is its BVPS has declined over the last five years.

Lemonade’s P/B ratio based on the next 12 months is 14.3x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $67.11 on the company (compared to the current share price of $93.17), implying they don’t see much short-term potential in Lemonade.