Lemonade (LMND)

We aren’t fans of Lemonade. Its negative returns on capital show it destroyed shareholder value by losing money.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lemonade Will Underperform

Built on the principle of giving back unused premiums to charitable causes selected by policyholders, Lemonade (NYSE:LMND) is a technology-driven insurance company that offers homeowners, renters, pet, car, and life insurance through an AI-powered digital platform.

- Annual book value per share declines of 7.2% for the past five years show its capital management struggled during this cycle

- Push for growth has led to negative returns on capital, signaling value destruction

- On the bright side, its impressive 46.6% annual revenue growth over the last five years indicates it’s winning market share this cycle

Lemonade lacks the business quality we seek. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Lemonade

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Lemonade

Lemonade’s stock price of $70.53 implies a valuation ratio of 9.6x forward P/B. This valuation is extremely expensive, especially for the quality you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Lemonade (LMND) Research Report: Q4 CY2025 Update

Digital insurance provider Lemonade (NYSE:LMND) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 53.3% year on year to $228.1 million. Its GAAP loss of $0.29 per share was 26.1% above analysts’ consensus estimates.

Lemonade (LMND) Q4 CY2025 Highlights:

- Net Premiums Earned: $179.5 million vs analyst estimates of $165.8 million (77.4% year-on-year growth, 8.3% beat)

- Revenue: $228.1 million vs analyst estimates of $217.6 million (53.3% year-on-year growth, 4.8% beat)

- Pre-tax Profit: -$20.6 million (-9% margin)

- EPS (GAAP): -$0.29 vs analyst estimates of -$0.39 (26.1% beat)

- Market Capitalization: $4.91 billion

Company Overview

Built on the principle of giving back unused premiums to charitable causes selected by policyholders, Lemonade (NYSE:LMND) is a technology-driven insurance company that offers homeowners, renters, pet, car, and life insurance through an AI-powered digital platform.

Lemonade's business model differs fundamentally from traditional insurers by using artificial intelligence throughout the customer journey. The company's AI bots—Maya for onboarding, Jim for claims processing, and CX.AI for customer service—handle most customer interactions without human intervention. This technology-first approach allows Lemonade to process applications and claims in seconds rather than days or weeks, creating both cost efficiencies and higher customer satisfaction.

The company's revenue comes from fixed fees on monthly premiums, with a unique "Giveback" feature that donates unused premiums to customer-selected nonprofits. This structure aims to align the company's interests with policyholders by removing the traditional insurance incentive to deny claims. Lemonade transfers much of its underwriting risk to reinsurance partners, reducing volatility in its financial results.

A typical Lemonade customer might use the mobile app to purchase renters insurance in under two minutes, add coverage for valuable electronics, and later file a claim for a stolen laptop—receiving payment within seconds after answering a few questions and recording a short video explanation. The entire process happens digitally without paperwork or phone calls.

Lemonade has expanded beyond its initial renters and homeowners insurance offerings to include pet insurance, car insurance, and life insurance (through partnerships). The company operates throughout the United States and has entered several European markets including Germany, France, the Netherlands, and the United Kingdom, leveraging its pan-European license to scale across the continent.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

Lemonade competes with traditional insurance giants like State Farm, Allstate, Liberty Mutual, GEICO, and Progressive, as well as other insurtech companies such as Root Insurance (NASDAQ: ROOT) and Hippo (NYSE: HIPO).

5. Revenue Growth

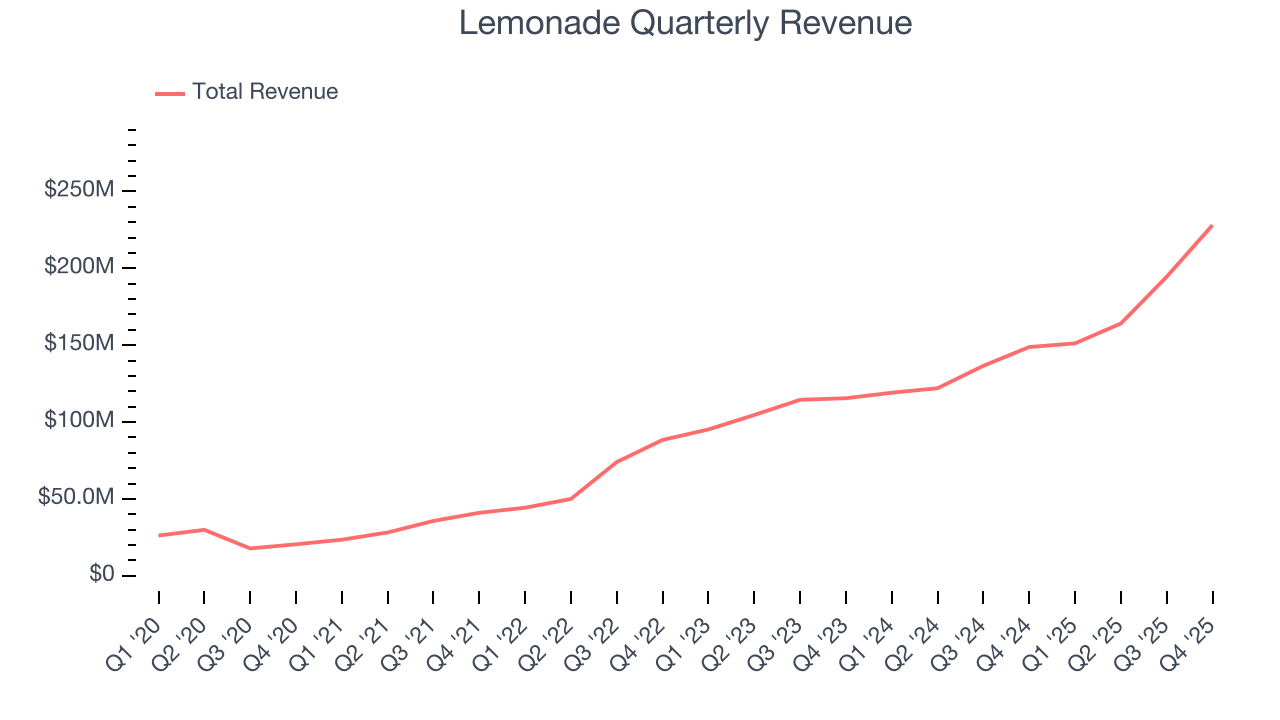

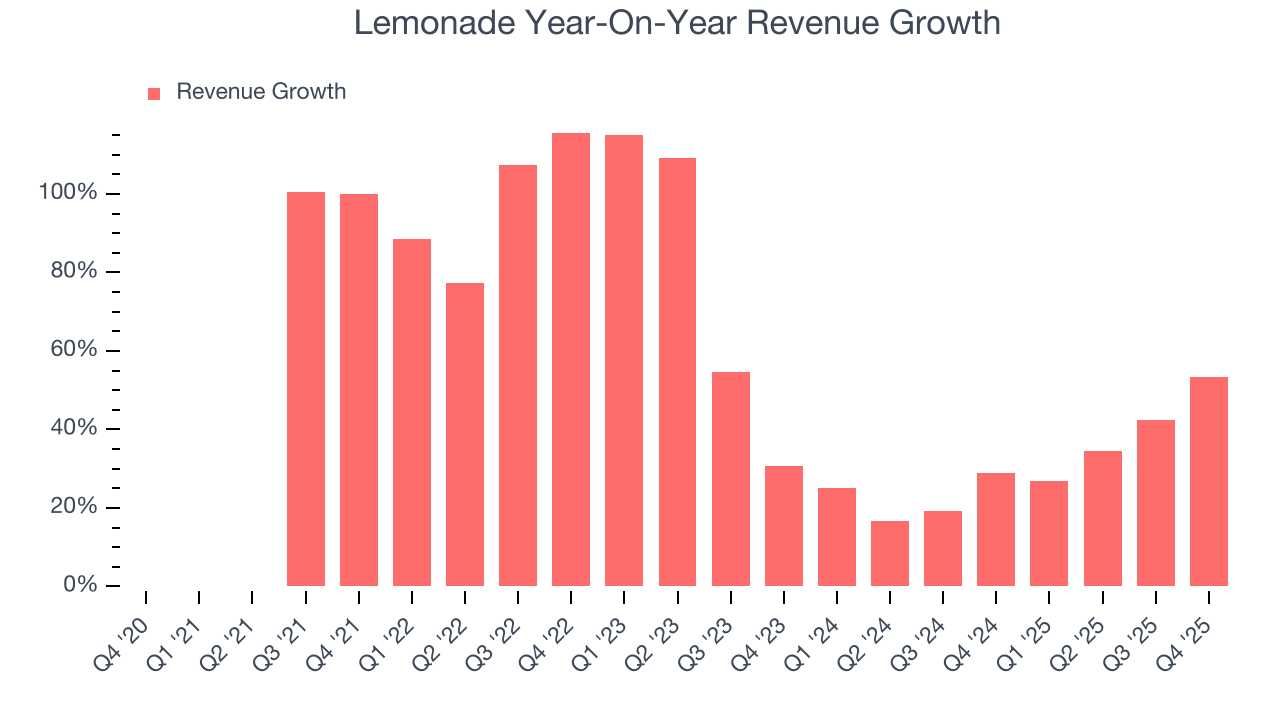

Insurance companies earn revenue from three primary sources: 1) The core insurance business itself, often called underwriting and represented in the income statement as premiums 2) Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities 3) Fees from various sources such as policy administration, annuities, or other value-added services. Luckily, Lemonade’s revenue grew at an incredible 50.9% compounded annual growth rate over the last five years. Its growth beat the average insurance company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Lemonade’s annualized revenue growth of 31% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Lemonade reported magnificent year-on-year revenue growth of 53.3%, and its $228.1 million of revenue beat Wall Street’s estimates by 4.8%.

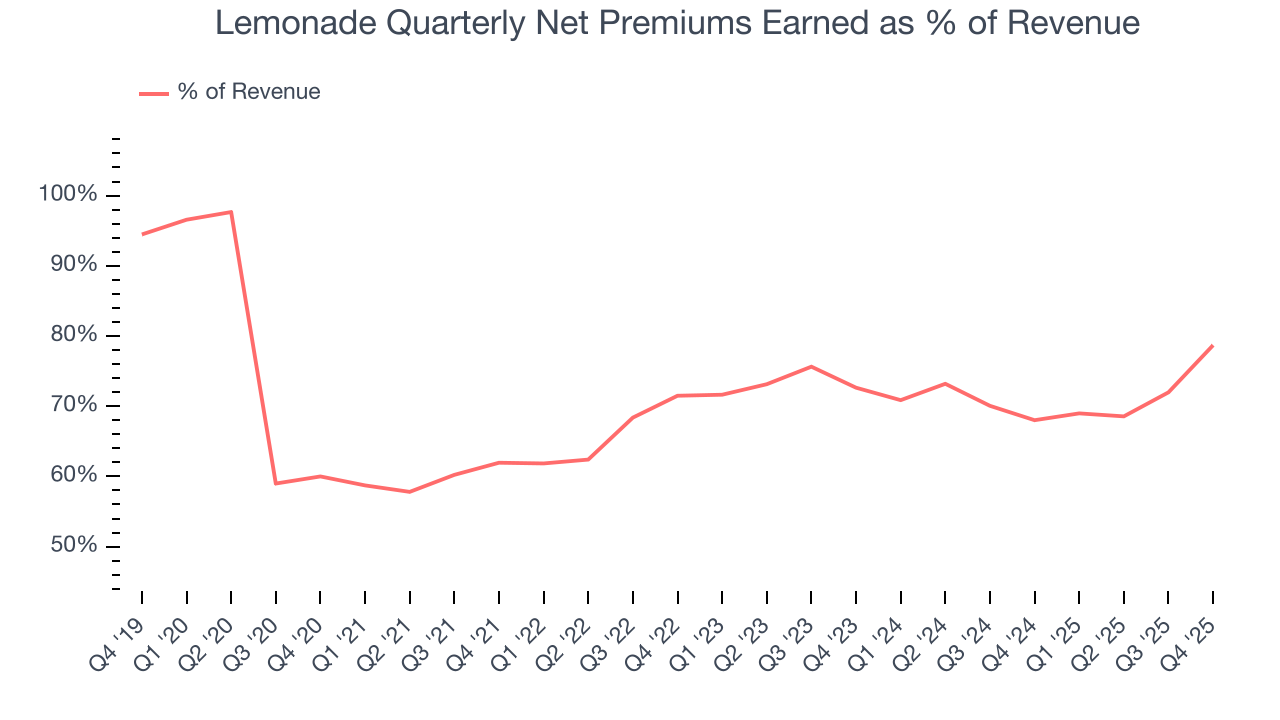

Net premiums earned made up 70.8% of the company’s total revenue during the last five years, meaning insurance operations are Lemonade’s largest source of revenue.

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

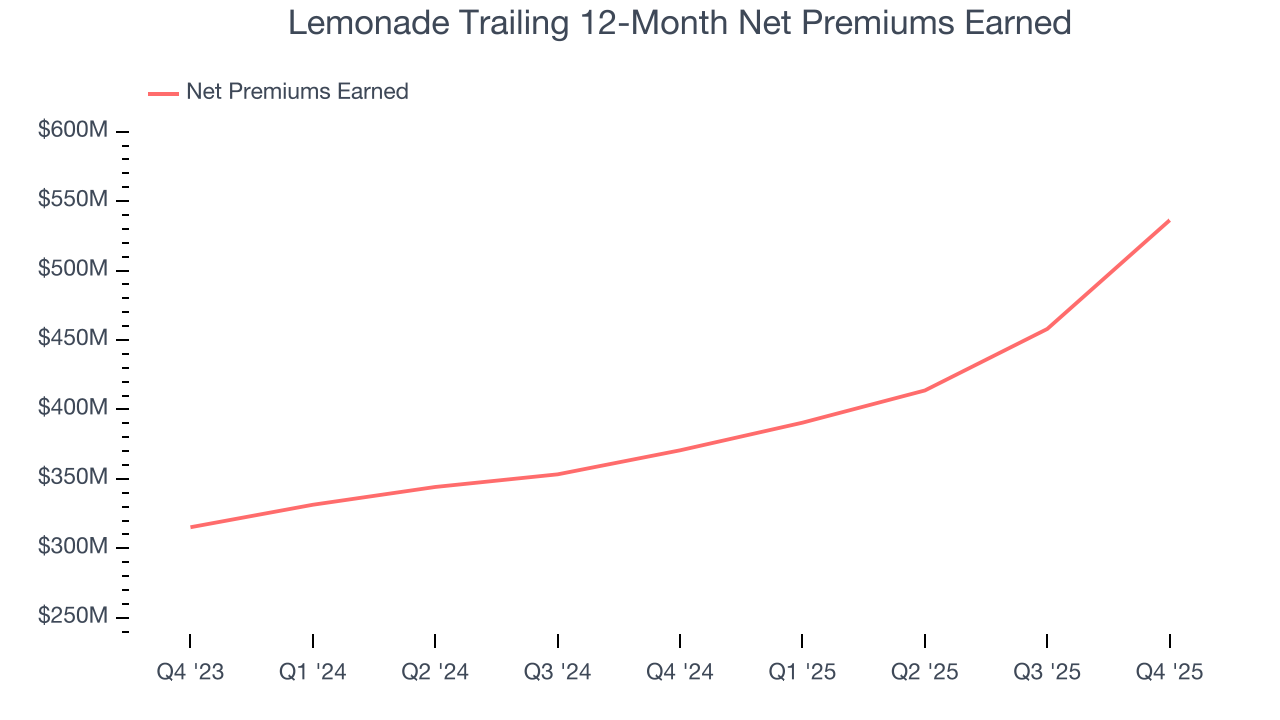

Lemonade’s net premiums earned has grown at a 47.3% annualized rate over the last five years, much better than the broader insurance industry but slower than its total revenue.

When analyzing Lemonade’s net premiums earned over the last two years, we can see that growth decelerated to 30.4% annually. This performance was similar to its total revenue.

This quarter, Lemonade’s net premiums earned was $179.5 million, up a hearty 77.4% year on year and topping Wall Street Consensus estimates by 8.3%.

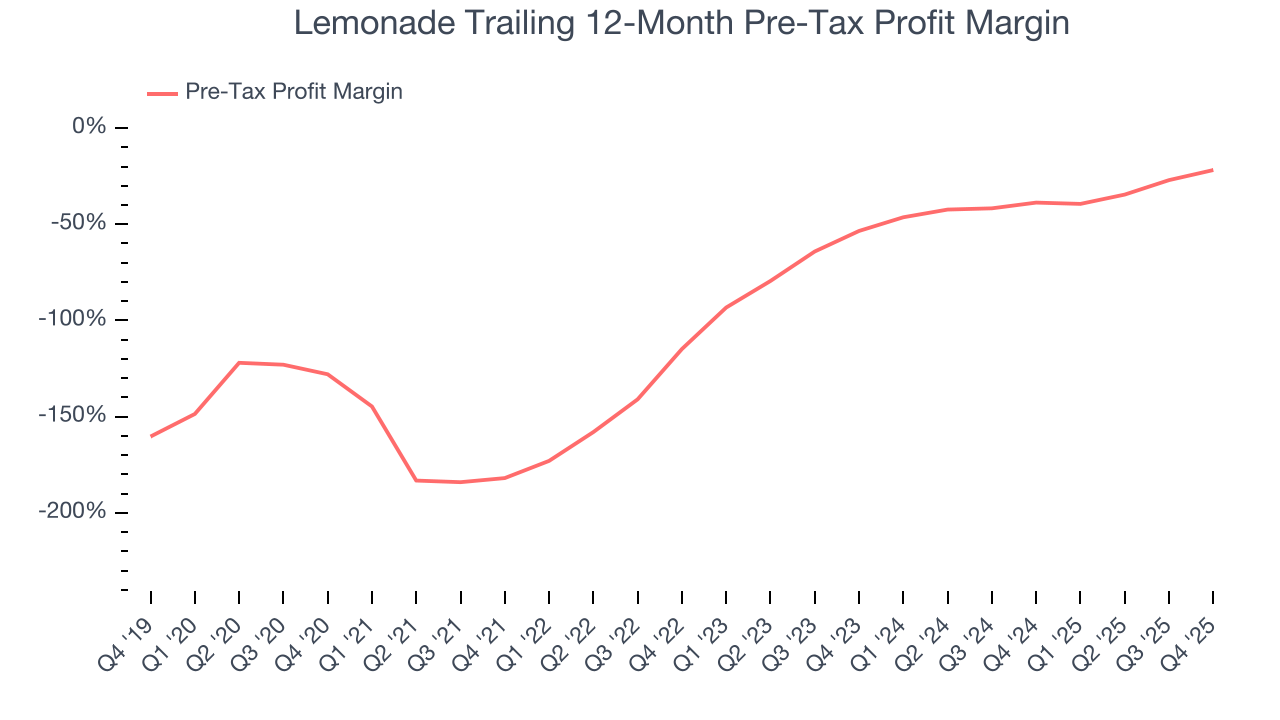

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because insurers are balance sheet businesses, where assets and liabilities define the core economics. This means that interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company’s control - should not.

Over the last five years, Lemonade’s pre-tax profit margin has fallen by 106.2 percentage points, going from negative 182% to negative 21.8%. It has also expanded by 31.7 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, Lemonade’s pre-tax profit margin was negative 9%. This result was 16.4 percentage points better than the same quarter last year.

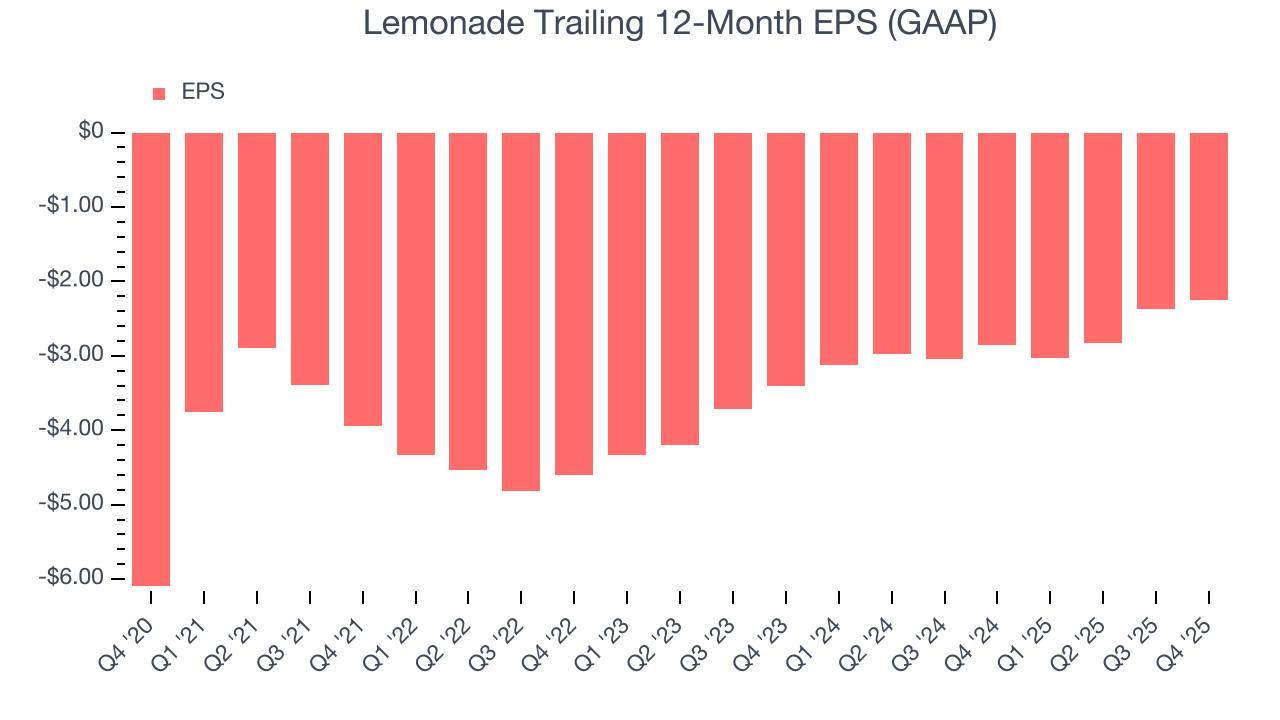

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Lemonade’s full-year earnings are still negative, it reduced its losses and improved its EPS by 18.1% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lemonade, its two-year annual EPS growth of 18.7% is similar to its five-year trend, implying stable earnings.

In Q4, Lemonade reported EPS of negative $0.29, up from negative $0.42 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lemonade to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.25 will advance to negative $1.64.

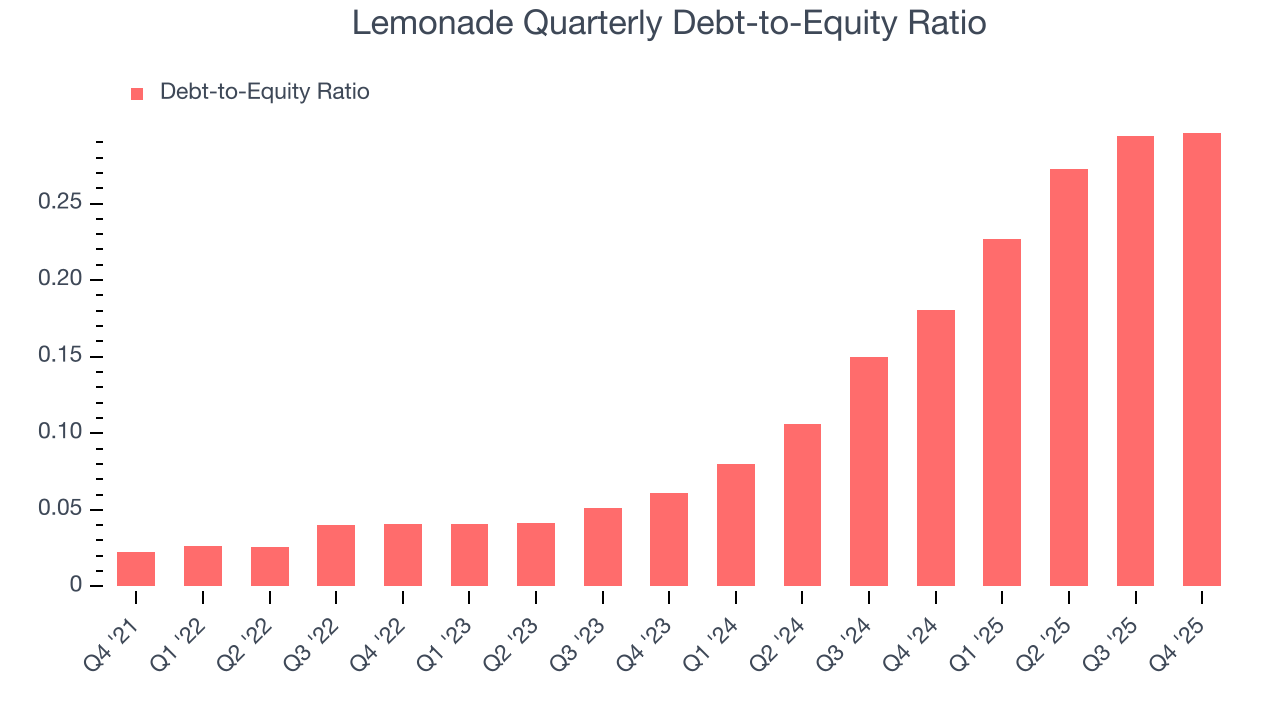

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Lemonade currently has $158.1 million of debt and $533.6 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.3×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

10. Return on Equity

Return on Equity, or ROE, ties everything together and is a vital metric. It tells us how much profit the insurer generates for each dollar of shareholder equity entrusted to management. Over a long period, insurers with higher ROEs tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Lemonade has averaged an ROE of negative 30.6%, a bad result not only in absolute terms but also relative to the majority of insurers putting up 20%+. It also shows that Lemonade has little to no competitive moat.

11. Key Takeaways from Lemonade’s Q4 Results

It was good to see Lemonade beat analysts’ EPS expectations this quarter. We were also excited its net premiums earned outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 11.1% to $73.05 immediately after reporting.

12. Is Now The Time To Buy Lemonade?

Updated: February 19, 2026 at 7:56 AM EST

When considering an investment in Lemonade, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are some bright spots in Lemonade’s fundamentals, but its business quality ultimately falls short. First off, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its relatively low ROE suggests management has struggled to find compelling investment opportunities, its net premiums earned growth was exceptional over the last five years. On top of that, its expanding pre-tax profit margin shows the business has become more efficient.

Lemonade’s P/B ratio based on the next 12 months is 11.5x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $67.11 on the company (compared to the current share price of $73.05).