Lowe's (LOW)

We’re skeptical of Lowe's. Not only is its demand weak but also its falling returns on capital suggest it’s becoming less profitable.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lowe's Will Underperform

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

- Poor same-store sales performance over the past two years indicates it’s having trouble bringing new shoppers into its brick-and-mortar locations

- Widely-available products (and therefore stiff competition) result in an inferior gross margin of 33.4% that must be offset through higher volumes

- On the bright side, its stellar returns on capital showcase management’s ability to surface highly profitable business ventures

Lowe’s quality isn’t up to par. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Lowe's

Why There Are Better Opportunities Than Lowe's

Lowe’s stock price of $275.40 implies a valuation ratio of 21.7x forward P/E. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Lowe's (LOW) Research Report: Q3 CY2025 Update

Home improvement retailer Lowe’s (NYSE:LOW) met Wall Streets revenue expectations in Q3 CY2025, with sales up 3.2% year on year to $20.81 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $86 billion at the midpoint. Its non-GAAP profit of $3.06 per share was 3.6% above analysts’ consensus estimates.

Lowe's (LOW) Q3 CY2025 Highlights:

- Revenue: $20.81 billion vs analyst estimates of $20.87 billion (3.2% year-on-year growth, in line)

- Adjusted EPS: $3.06 vs analyst estimates of $2.95 (3.6% beat)

- The company lifted its revenue guidance for the full year to $86 billion at the midpoint from $85 billion, a 1.2% increase

- Management lowered its full-year Adjusted EPS guidance to $12.25 at the midpoint, a 0.6% decrease

- Operating Margin: 11.9%, in line with the same quarter last year

- Free Cash Flow Margin: 0.4%, down from 3.6% in the same quarter last year

- Same-Store Sales were flat year on year (-1.1% in the same quarter last year)

- Market Capitalization: $123.1 billion

Company Overview

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

The core Lowe’s customer is the do-it-yourself (DIY) homeowner, often shopping for design, remodeling, or home decor needs. The company also serves professional contractors as well. Like its closest competitor Home Depot, Lowe’s has a broad range of home improvement and design products at competitive prices. For the DIY shopper, Lowe’s offers installation services for products such as cabinets and flooring as well as design consultation services. For the professional contractor, Lowe’s has loyalty programs and volume discounts. There is also a Pro Desk in most stores, where contractors can place large or custom orders and consult with specialists trained to specifically assist professionals.

Since Lowe’s and Home Depot are the two largest home improvement retailers in North America with many similarities, a common question is how they differ. One difference is that Home Depot has a larger selection of appliances and power tools, while Lowe's may have a better selection of home decor and seasonal items. Another difference is the store aesthetic. When you walk into a Home Depot, it looks like a sprawling warehouse, and the feel is very utilitarian. Lowe’s stores, on the other hand, are slightly smaller and have a more traditional retail aesthetic with brighter colors.

4. Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Home improvement retail competitors include Home Depot (NYSE:HD) and private company Ace Hardware. Amazon.com (NASDAQ:AMZN) and Wayfair (NYSE:W) also offer some home improvement products.

5. Revenue Growth

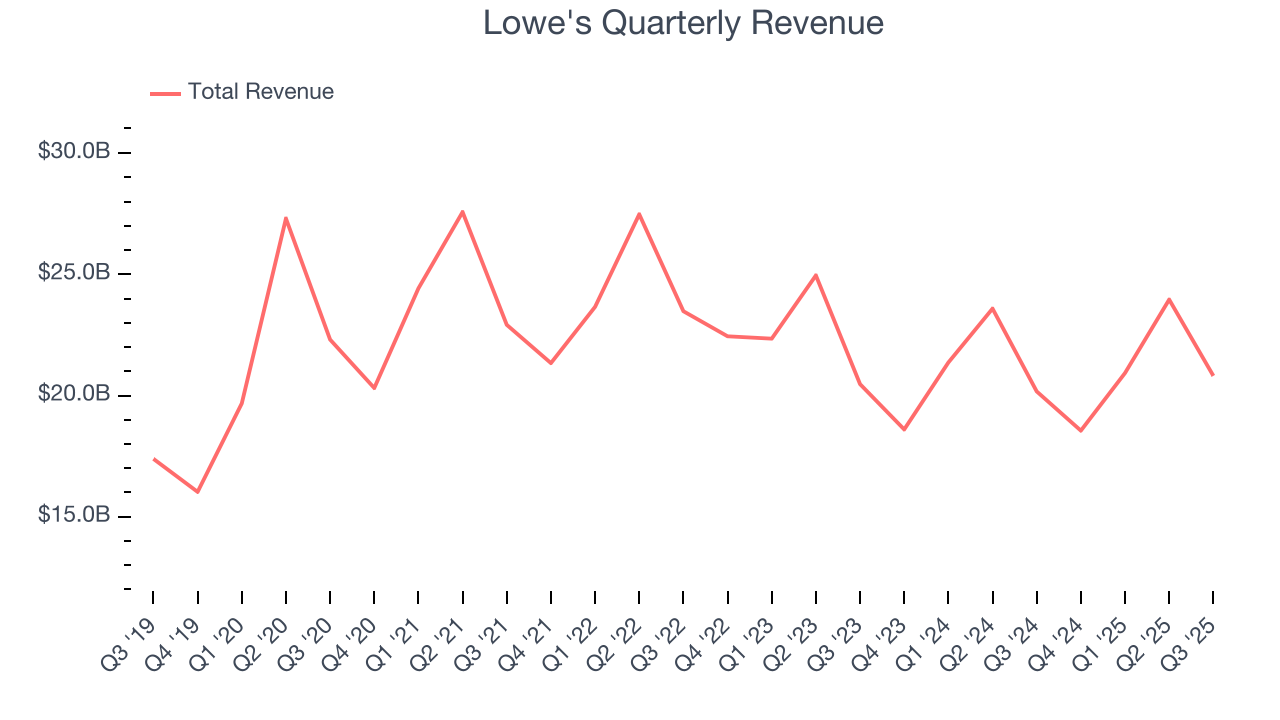

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $84.26 billion in revenue over the past 12 months, Lowe's is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth. To expand meaningfully, Lowe's likely needs to tweak its prices or enter new markets.

As you can see below, Lowe’s sales grew at a sluggish 2.7% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores.

This quarter, Lowe's grew its revenue by 3.2% year on year, and its $20.81 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, an acceleration versus the last six years. This projection is particularly healthy for a company of its scale and implies its newer products will spur better top-line performance.

6. Store Performance

Number of Stores

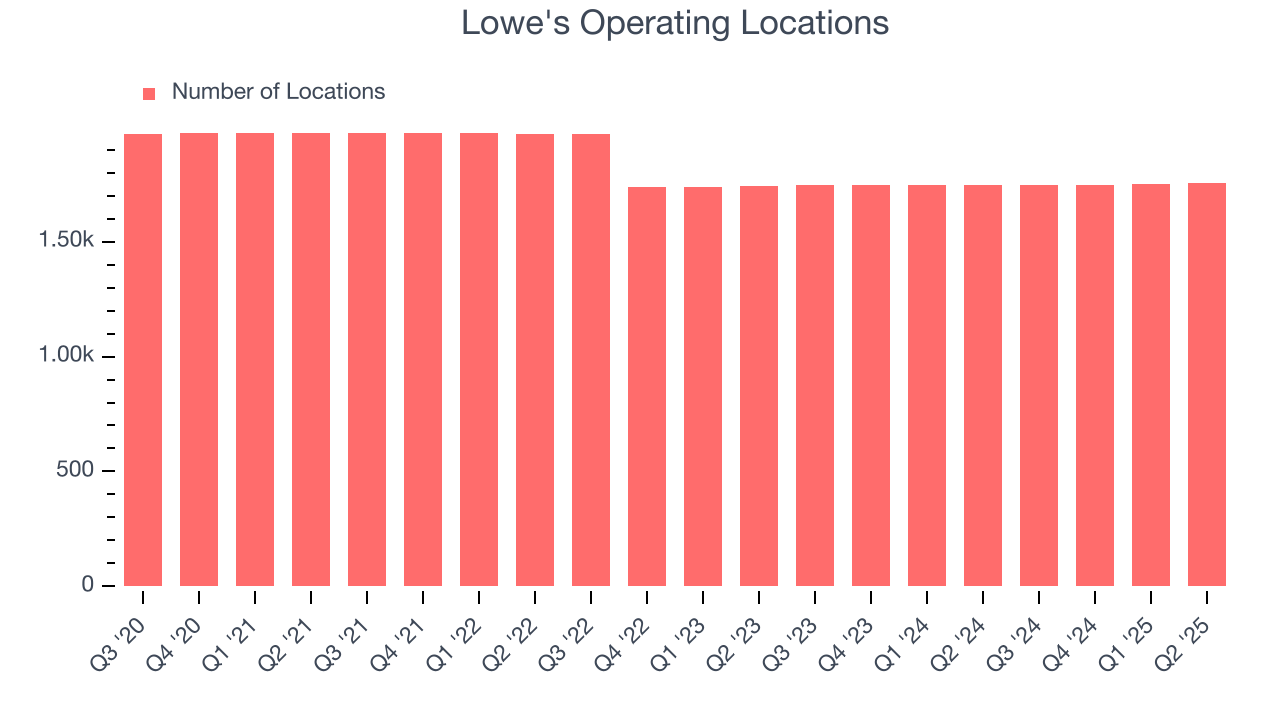

Lowe's has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Note that Lowe's reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

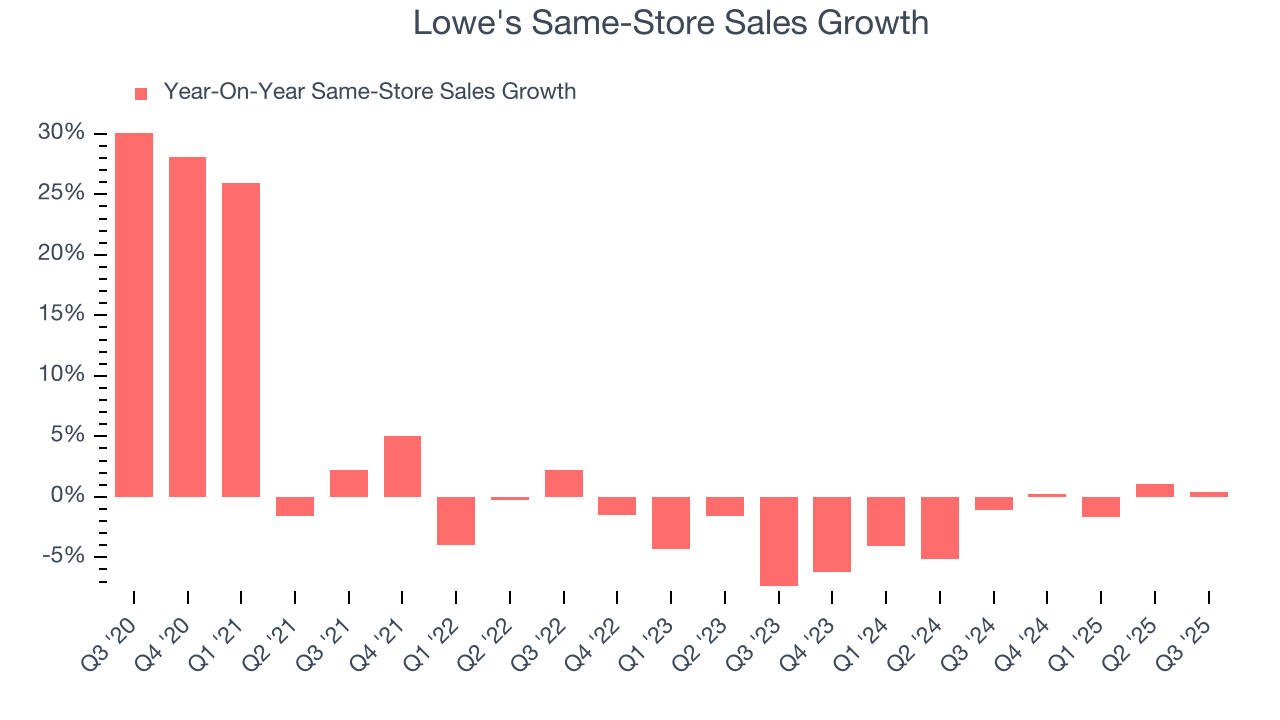

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Lowe’s demand has been shrinking over the last two years as its same-store sales have averaged 2.1% annual declines. This performance isn’t ideal, and we’d be concerned if Lowe's starts opening new stores to artificially boost revenue growth.

In the latest quarter, Lowe’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

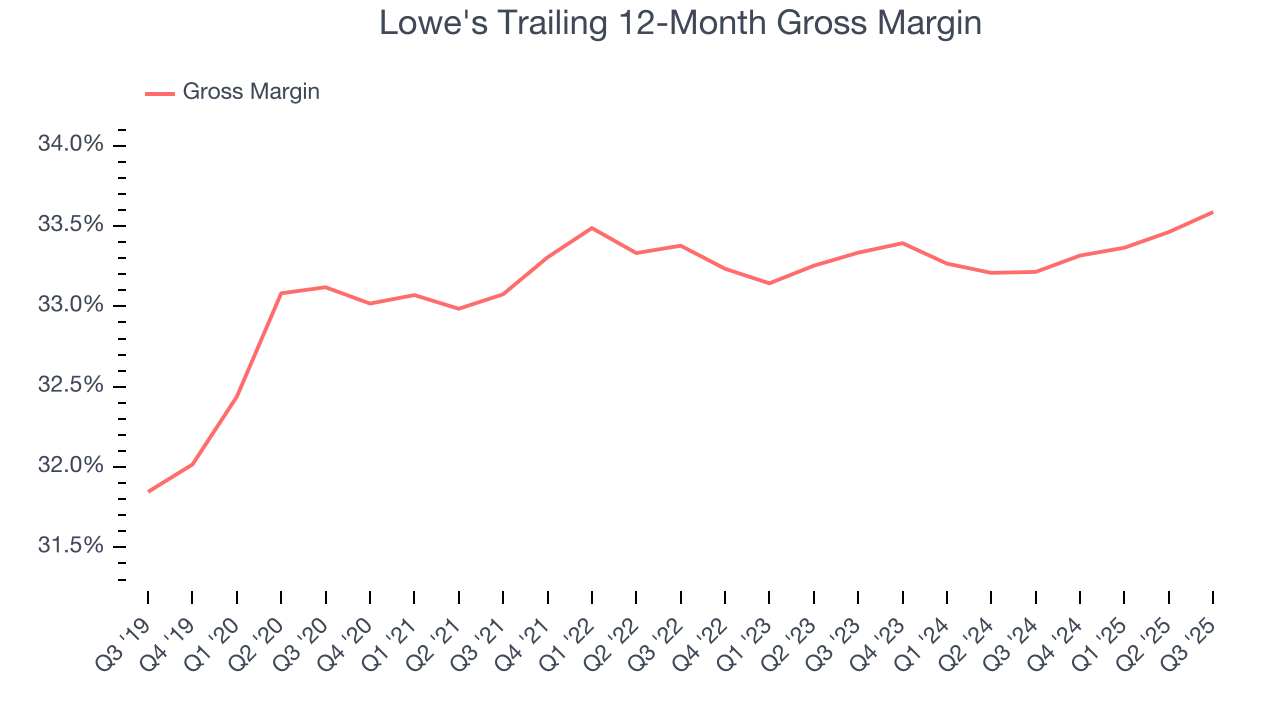

7. Gross Margin & Pricing Power

Lowe’s gross margin is slightly below the average retailer, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 33.4% gross margin over the last two years. That means Lowe's paid its suppliers a lot of money ($66.60 for every $100 in revenue) to run its business.

Lowe's produced a 34.2% gross profit margin in Q3, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

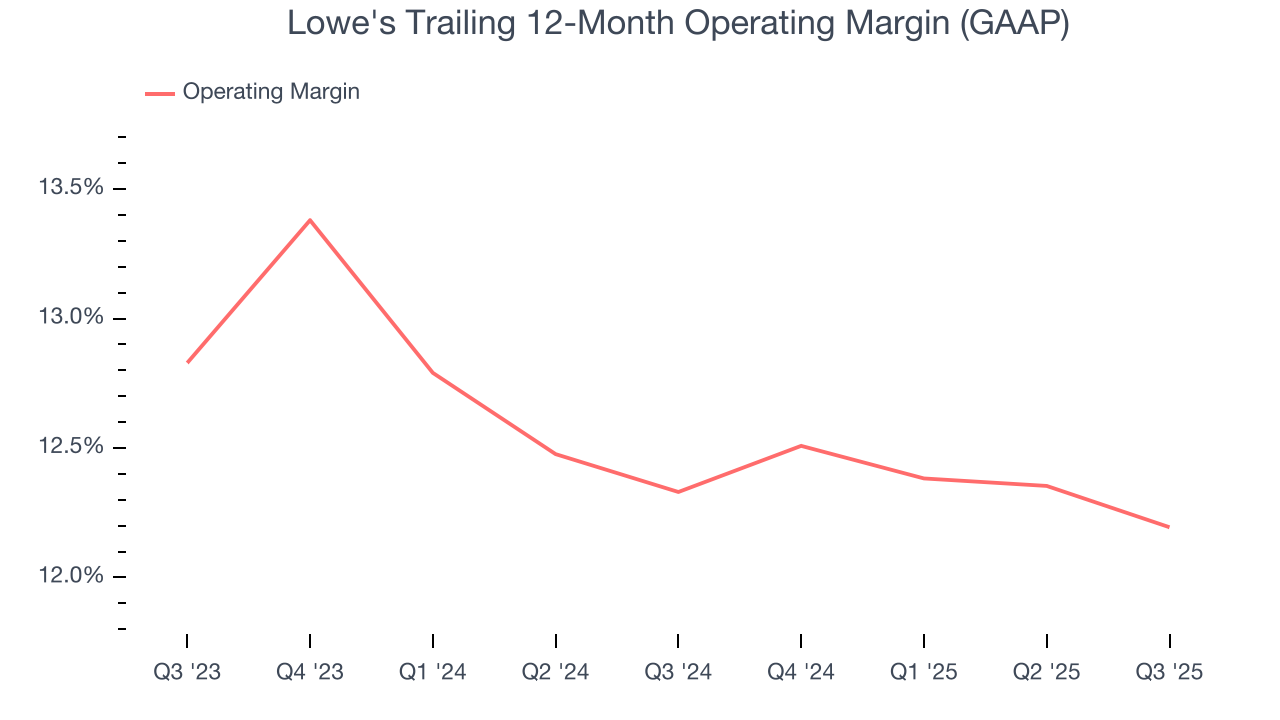

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Lowe’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 12.3% over the last two years. This profitability was top-notch for a consumer retail business, showing it’s an well-run company with an efficient cost structure. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Lowe’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Lowe's generated an operating margin profit margin of 11.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

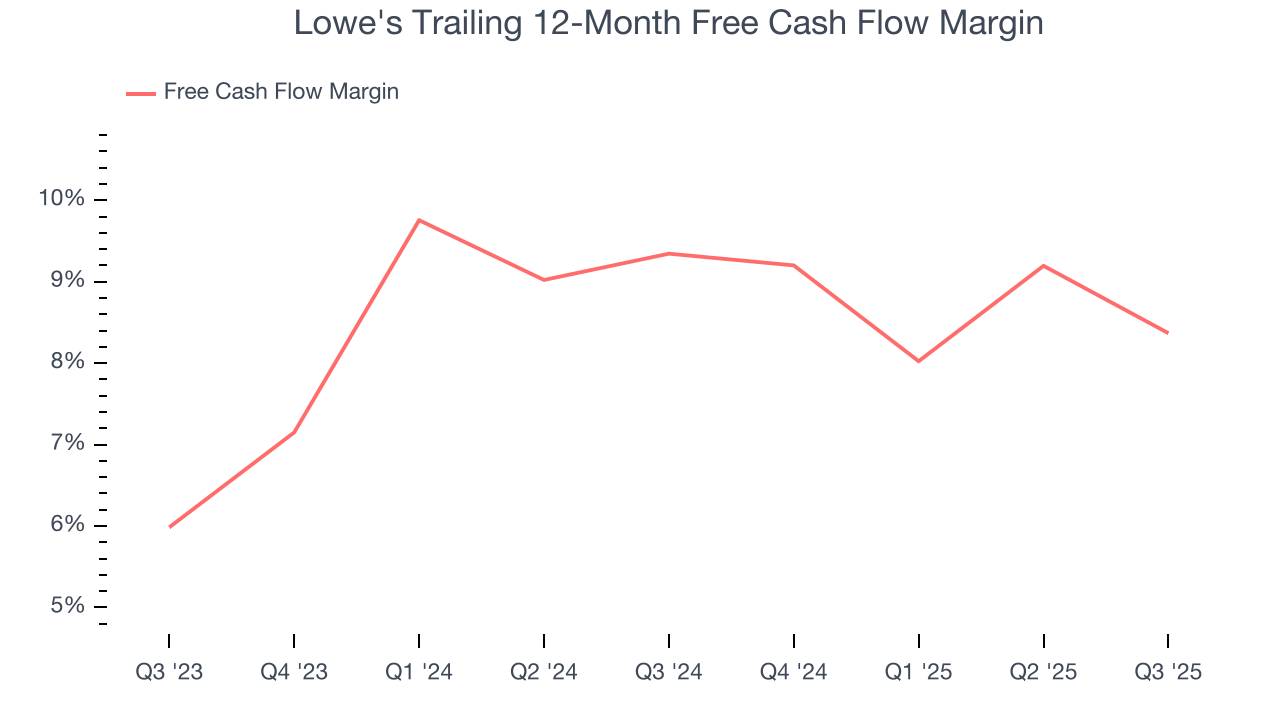

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Lowe's has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 8.9% over the last two years.

Lowe's broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 3.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Lowe's hasn’t been the highest-quality company lately because of its poor top-line performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 35.6%, splendid for a consumer retail business.

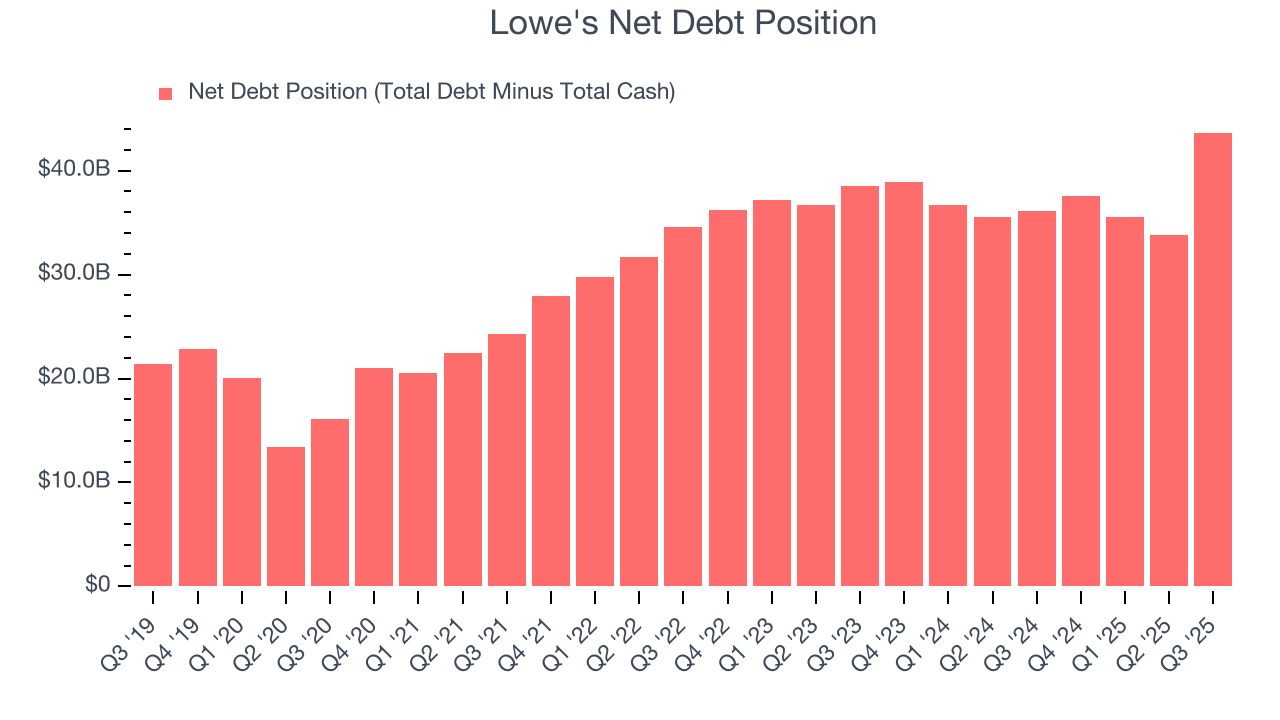

11. Balance Sheet Assessment

Lowe's reported $1.03 billion of cash and $44.7 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $12.06 billion of EBITDA over the last 12 months, we view Lowe’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $626 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Lowe’s Q3 Results

It was encouraging to see Lowe's beat analysts’ gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, same-store sales did not grow (sales at mature stores did not increase year on year) and the company lowered its full-year EPS guidance. Overall, this quarter could have been better. The stock traded up 3.8% to $227.81 immediately after reporting.

13. Is Now The Time To Buy Lowe's?

Updated: January 22, 2026 at 9:37 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Lowe's, you should also grasp the company’s longer-term business quality and valuation.

Lowe's isn’t a terrible business, but it doesn’t pass our quality test. For starters, its revenue has declined over the last three years. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its shrinking same-store sales tell us it will need to change its strategy to succeed. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

Lowe’s P/E ratio based on the next 12 months is 21.7x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $279.53 on the company (compared to the current share price of $275.40).