Main Street Capital (MAIN)

We’re skeptical of Main Street Capital. Its decelerating revenue growth and even worse EPS performance give us little confidence it can beat the market.― StockStory Analyst Team

1. News

2. Summary

Why Main Street Capital Is Not Exciting

With a focus on building long-term partnerships rather than quick transactions, Main Street Capital (NYSE:MAIN) is a business development company that provides long-term debt and equity capital to lower middle market and middle market companies.

- A consolation is that its annual revenue growth of 20.5% over the past five years was outstanding, reflecting market share gains this cycle

Main Street Capital doesn’t satisfy our quality benchmarks. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Main Street Capital

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Main Street Capital

Main Street Capital is trading at $57.41 per share, or 14.3x forward P/E. This multiple is quite expensive for the quality you get.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Main Street Capital (MAIN) Research Report: Q4 CY2025 Update

Business development company Main Street Capital (NYSE:MAIN) announced better-than-expected revenue in Q4 CY2025, with sales up 3.6% year on year to $145.5 million. Its GAAP profit of $1.46 per share was 10.8% above analysts’ consensus estimates.

Main Street Capital (MAIN) Q4 CY2025 Highlights:

- Revenue: $145.5 million vs analyst estimates of $143 million (3.6% year-on-year growth, 1.8% beat)

- Pre-tax Profit: $94.08 million (64.6% margin)

- EPS (GAAP): $1.46 vs analyst estimates of $1.32 (10.8% beat)

- Market Capitalization: $5.28 billion

Company Overview

With a focus on building long-term partnerships rather than quick transactions, Main Street Capital (NYSE:MAIN) is a business development company that provides long-term debt and equity capital to lower middle market and middle market companies.

Main Street Capital operates with a distinctive two-tier investment approach. For lower middle market companies (those with annual revenues between $10 million and $150 million), it typically provides both debt and equity financing, often taking a significant minority ownership position. This allows Main Street to participate in the growth of these businesses while collecting interest payments. For middle market companies (generally larger businesses with revenues above $150 million), Main Street primarily offers debt investments with some selective equity opportunities.

The company generates revenue through multiple streams: interest income from debt investments, dividend income from equity investments, and capital appreciation when portfolio companies are sold or go public. Main Street's investment professionals conduct thorough due diligence before investing, analyzing factors like management quality, competitive position, and growth potential.

A manufacturing company seeking expansion capital might receive a $15 million investment from Main Street, structured as $10 million in debt and $5 million in equity. This allows the manufacturer to build a new production facility while Main Street earns interest on the loan and participates in future growth through its equity stake.

Unlike many competitors, Main Street employs an internally managed structure, meaning its management team works directly for the company rather than through an external advisory firm. This approach can reduce conflicts of interest and align management incentives with shareholder returns. The company maintains offices in several U.S. cities to source deals across the country and provides not just capital but also strategic guidance to its portfolio companies.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

Main Street Capital competes with other business development companies like Ares Capital Corporation (NASDAQ:ARCC), FS KKR Capital Corp. (NYSE:FSK), and Blackstone Secured Lending Fund (NYSE:BXSL), as well as private equity firms, commercial banks, and investment banks that provide capital to middle market companies.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Main Street Capital’s 20.5% annualized revenue growth over the last five years was excellent. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Main Street Capital’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6.4% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Main Street Capital reported modest year-on-year revenue growth of 3.6% but beat Wall Street’s estimates by 1.8%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Specialty Finance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Main Street Capital’s pre-tax profit margin has fallen by 77.2 percentage points, going from 126% to 84.3%. However, the company gave back some of its expense savings as its pre-tax profit margin declined by 5.8 percentage points on a two-year basis.

Main Street Capital’s pre-tax profit margin came in at 64.6% this quarter. This result was 57.2 percentage points worse than the same quarter last year.

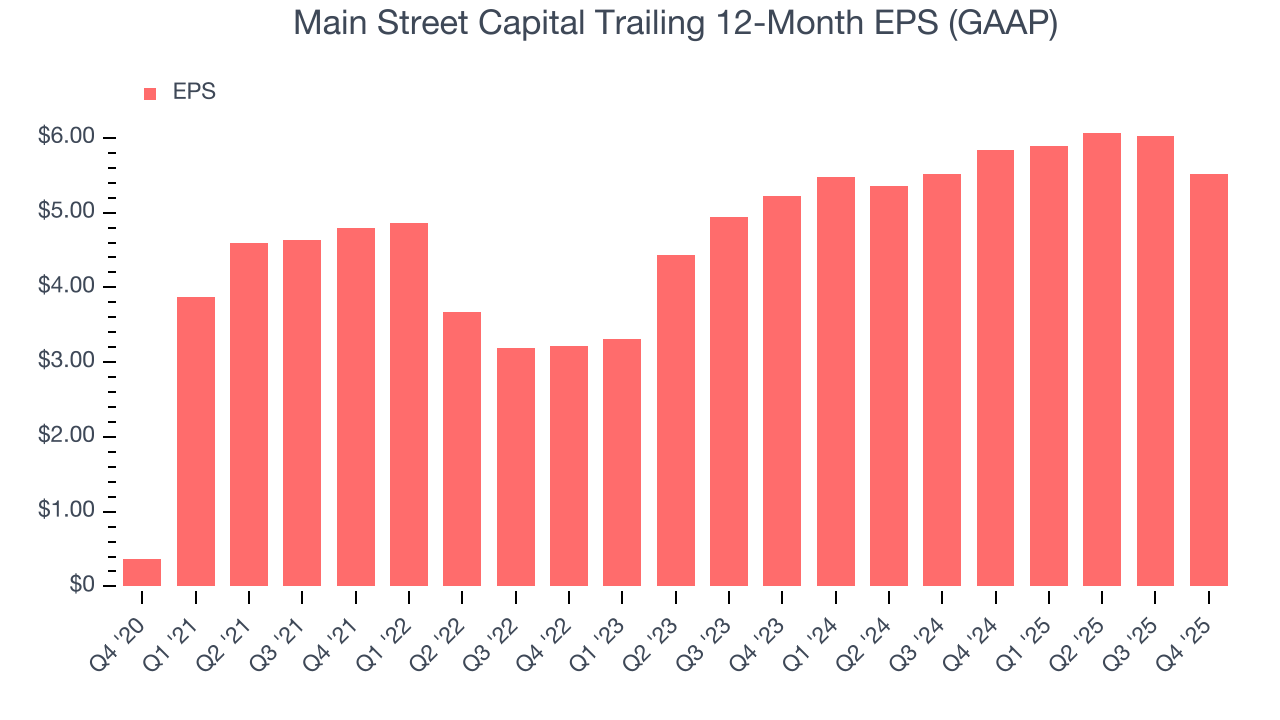

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Main Street Capital’s EPS grew at an astounding 71.7% compounded annual growth rate over the last five years, higher than its 20.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Main Street Capital, its two-year annual EPS growth of 2.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Main Street Capital reported EPS of $1.46, down from $1.97 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Main Street Capital’s full-year EPS of $5.52 to shrink by 20.3%.

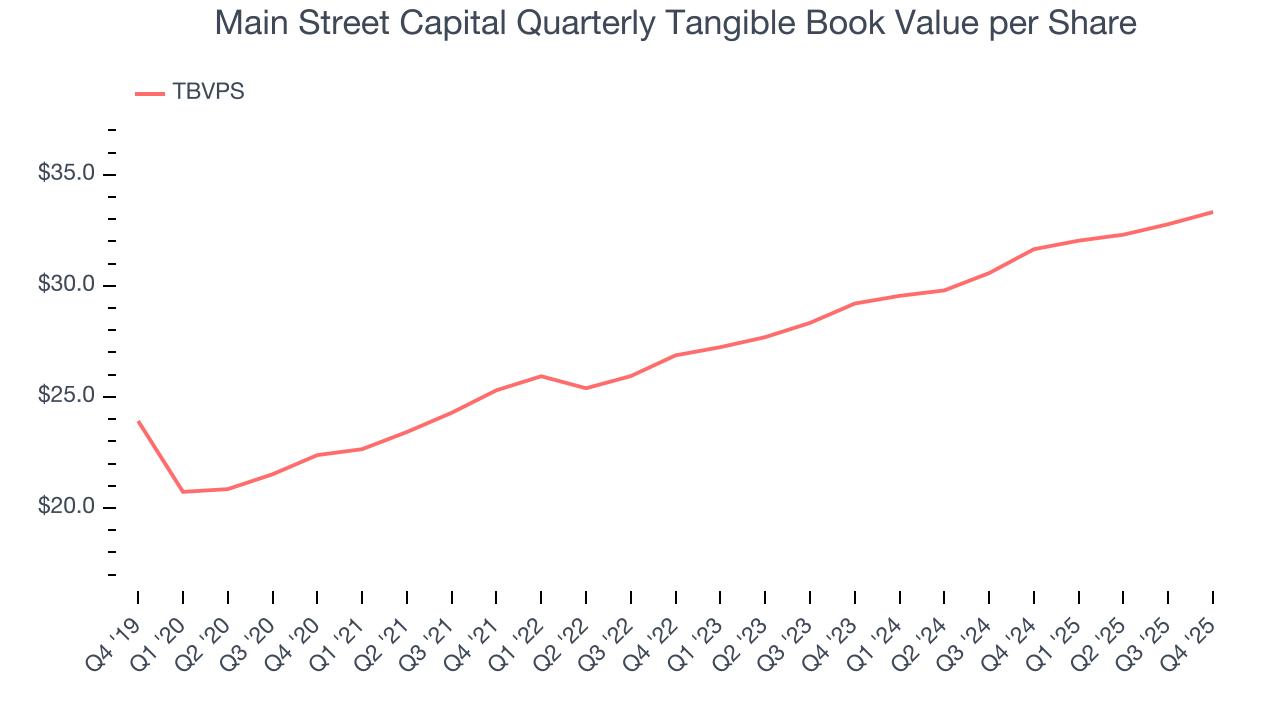

8. Tangible Book Value Per Share (TBVPS)

Financial firms generate earnings through diverse intermediation activities, making them fundamentally balance sheet-driven enterprises. Investors focus on balance sheet quality and consistent book value compounding when evaluating these multifaceted financial institutions.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Main Street Capital’s TBVPS grew at a decent 8.3% annual clip over the last five years. However, TBVPS growth has recently decelerated a bit to 6.8% annual growth over the last two years (from $29.20 to $33.32 per share).

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Main Street Capital has averaged an ROE of 17.6%, impressive for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Main Street Capital.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Main Street Capital currently has $2.46 billion of debt and $2.99 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.8×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from Main Street Capital’s Q4 Results

It was good to see Main Street Capital beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $58.60 immediately following the results.

12. Is Now The Time To Buy Main Street Capital?

Updated: March 7, 2026 at 12:32 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Main Street Capital, you should also grasp the company’s longer-term business quality and valuation.

Main Street Capital isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its TBVPS growth was decent over the last five years

Main Street Capital’s P/E ratio based on the next 12 months is 14.3x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $63.83 on the company (compared to the current share price of $57.41).