ManpowerGroup (MAN)

ManpowerGroup keeps us up at night. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think ManpowerGroup Will Underperform

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE:MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

- Sales stagnated over the last five years and signal the need for new growth strategies

- Earnings per share fell by 18.4% annually over the last five years while its revenue was flat, showing each sale was less profitable

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

ManpowerGroup lacks the business quality we seek. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than ManpowerGroup

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ManpowerGroup

At $30.62 per share, ManpowerGroup trades at 9.2x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. ManpowerGroup (MAN) Research Report: Q3 CY2025 Update

Workforce solutions provider ManpowerGroup (NYSE:MAN) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 2.3% year on year to $4.63 billion. Its GAAP profit of $0.38 per share was 53.7% below analysts’ consensus estimates.

ManpowerGroup (MAN) Q3 CY2025 Highlights:

- Revenue: $4.63 billion vs analyst estimates of $4.60 billion (2.3% year-on-year growth, 0.7% beat)

- EPS (GAAP): $0.38 vs analyst expectations of $0.82 (53.7% miss, included restructuring costs and Argentina hyperinflationary related non-cash currency translation losses which reduced earnings per share by $0.45 in the third quarter)

- Adjusted EBITDA: $93.6 million vs analyst estimates of $109.7 million (2% margin, 14.7% miss)

- EPS (GAAP) guidance for Q4 CY2025 is $0.83 at the midpoint, beating analyst estimates by 6.2%

- Operating Margin: 1.4%, in line with the same quarter last year

- Free Cash Flow Margin: 1%, similar to the same quarter last year

- Organic Revenue rose 1% year on year vs analyst estimates of 1.9% declines (288 basis point beat)

- Market Capitalization: $1.76 billion

Company Overview

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE:MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

The company operates through three main brands that address different segments of the labor market. Manpower focuses on contingent staffing and permanent recruitment across administrative, industrial, and office positions. Experis specializes in professional resourcing for technology fields, including IT infrastructure, cybersecurity, cloud computing, and digital transformation projects. Talent Solutions provides enterprise-level workforce management through recruitment process outsourcing (RPO), managed service provider (MSP) programs, and career transition services.

ManpowerGroup serves as an intermediary in the labor market, helping both job seekers and employers navigate changing workforce needs. For job seekers, the company provides access to temporary assignments, permanent positions, skills assessments, and training programs to enhance employability. For employers, it offers flexible staffing solutions during peak periods, specialized recruitment for hard-to-fill positions, and comprehensive workforce strategy consulting.

A manufacturing company might engage ManpowerGroup to quickly staff a production line during a seasonal surge, while a technology firm might use Experis to find specialized software developers for a specific project. Meanwhile, a multinational corporation could utilize Talent Solutions to manage its entire contingent workforce across multiple countries.

The company generates revenue primarily through markup on the wages of temporary workers it places, fees for permanent placements, and ongoing service contracts for its outsourcing and consulting offerings. With operations in approximately 75 countries and territories, ManpowerGroup maintains a truly global footprint, allowing it to serve multinational clients with consistent service delivery across regions while also addressing local market needs.

4. Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

ManpowerGroup competes with global staffing and workforce solutions providers like Adecco Group, Randstad, and Robert Half (NYSE:RHI), as well as specialized firms such as Kelly Services (NASDAQ:KELYA), Korn Ferry (NYSE:KFY), and Recruit Holdings (owner of Indeed and Glassdoor).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $17.64 billion in revenue over the past 12 months, ManpowerGroup is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. To expand meaningfully, ManpowerGroup likely needs to tweak its prices, innovate with new offerings, or enter new markets.

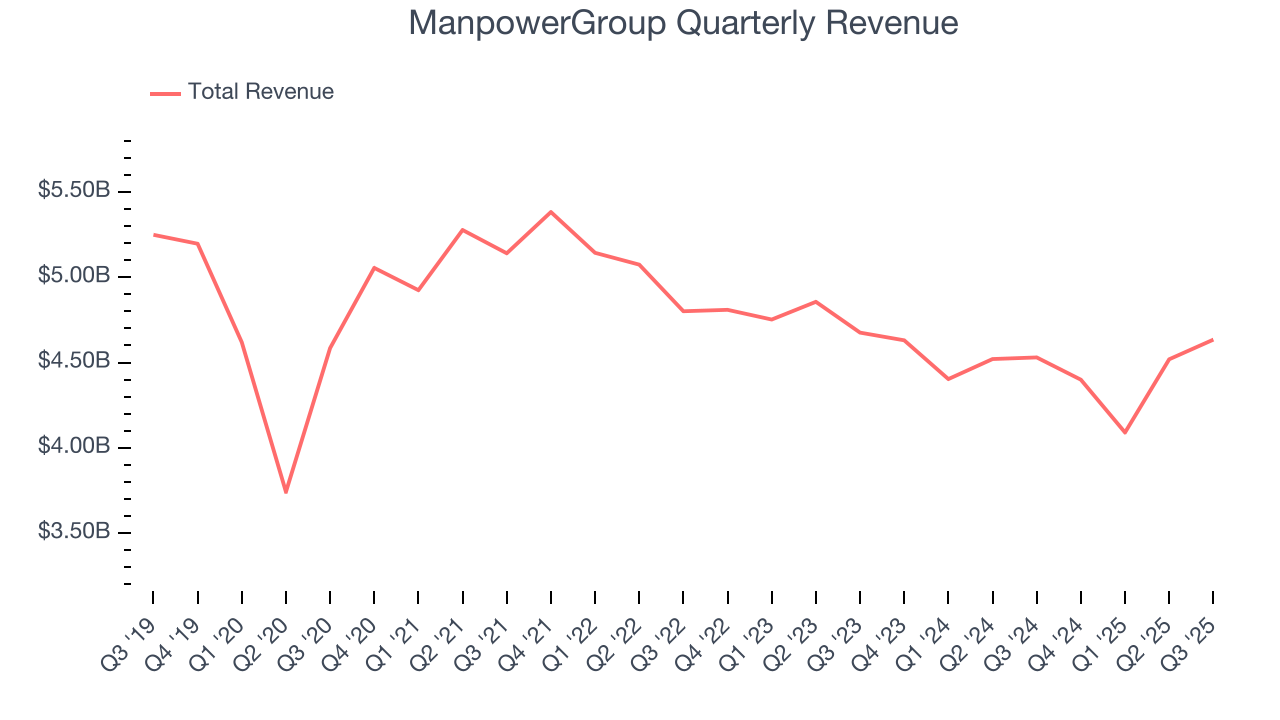

As you can see below, ManpowerGroup struggled to increase demand as its $17.64 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a rough starting point for our analysis.

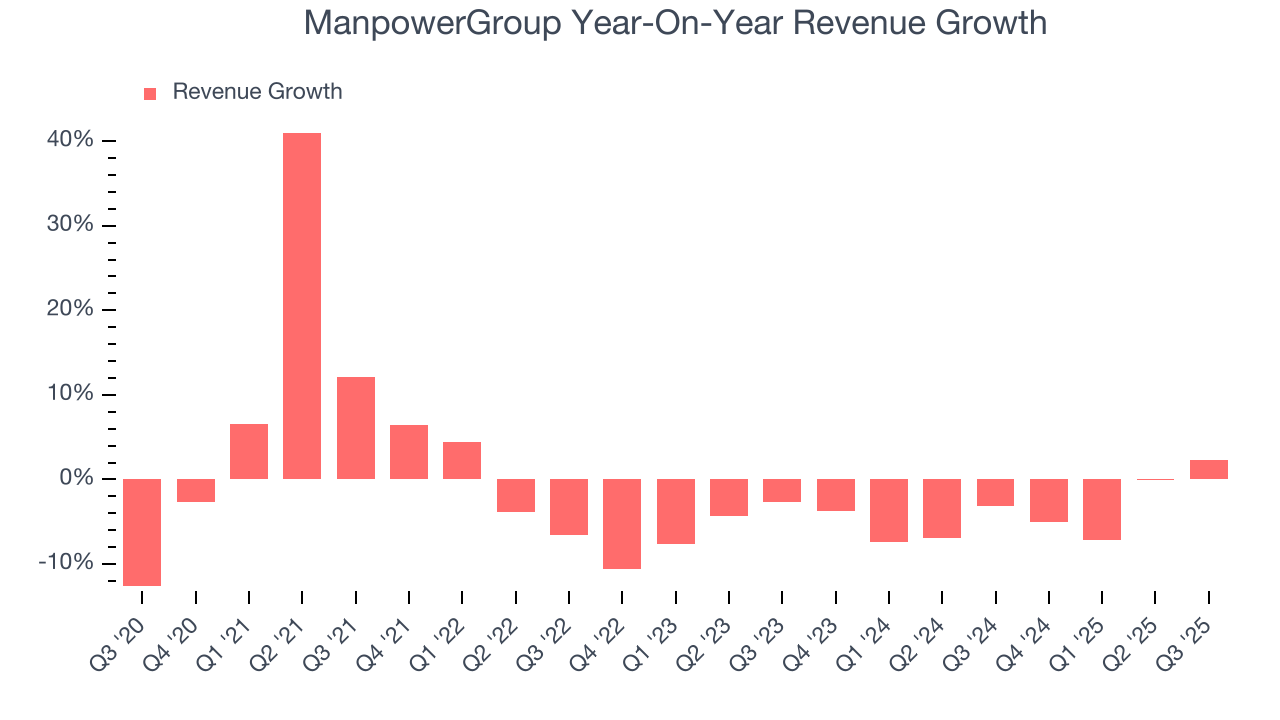

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ManpowerGroup’s recent performance shows its demand remained suppressed as its revenue has declined by 3.9% annually over the last two years.

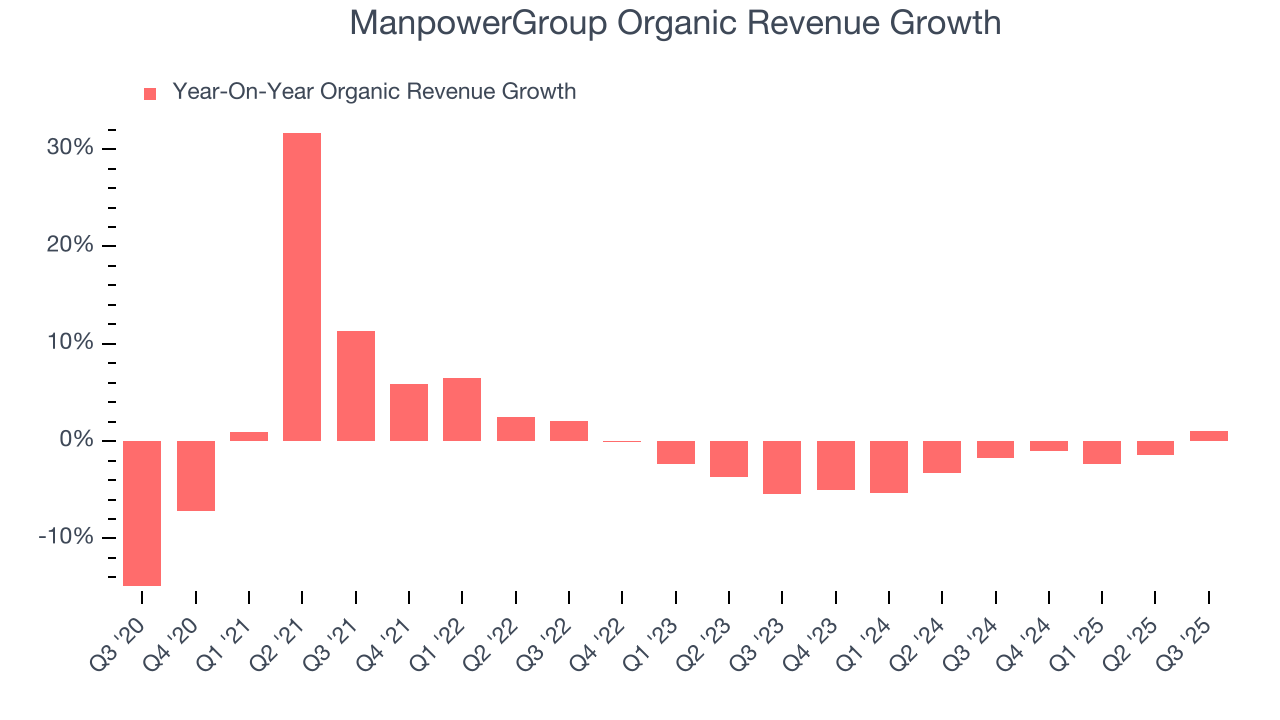

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ManpowerGroup’s organic revenue averaged 2.4% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, ManpowerGroup reported modest year-on-year revenue growth of 2.3% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

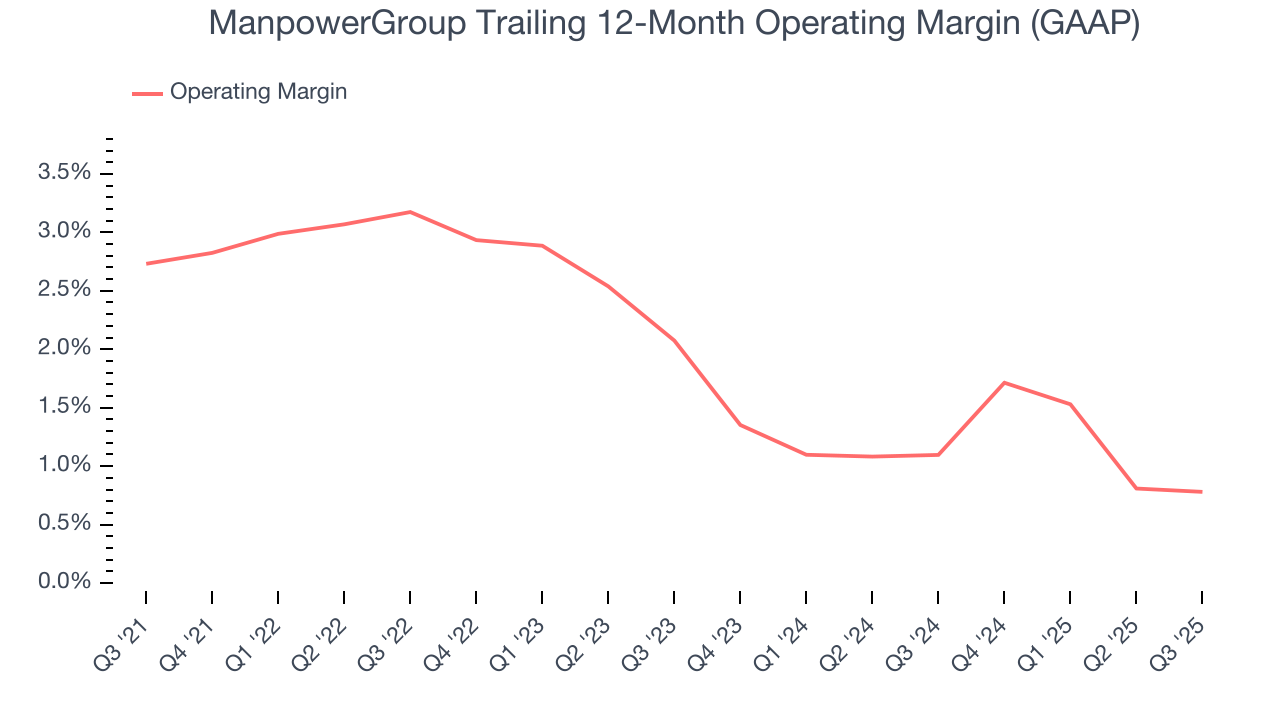

ManpowerGroup was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for a business services business.

Looking at the trend in its profitability, ManpowerGroup’s operating margin decreased by 2 percentage points over the last five years. ManpowerGroup’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, ManpowerGroup generated an operating margin profit margin of 1.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

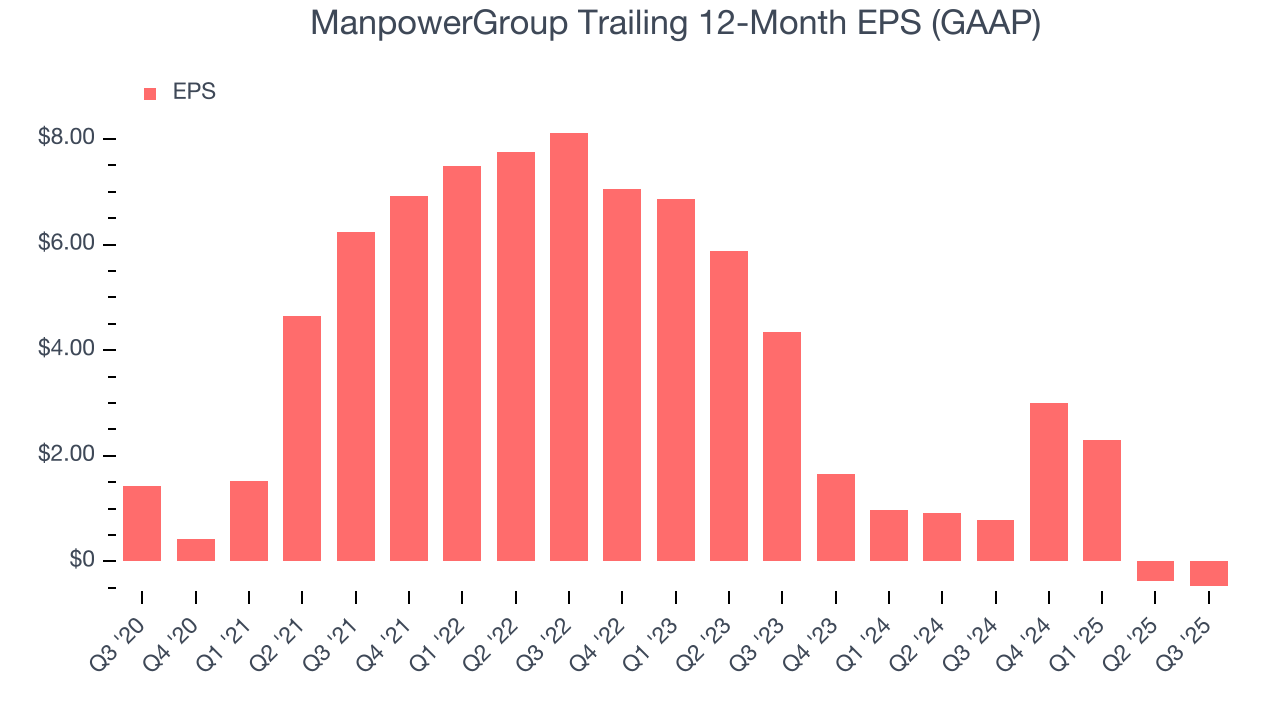

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for ManpowerGroup, its EPS declined by 18.4% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Diving into the nuances of ManpowerGroup’s earnings can give us a better understanding of its performance. As we mentioned earlier, ManpowerGroup’s operating margin was flat this quarter but declined by 2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ManpowerGroup, its two-year annual EPS declines of 45.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, ManpowerGroup reported EPS of $0.38, down from $0.47 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast ManpowerGroup’s full-year EPS of negative $0.47 will flip to positive $3.69.

8. Cash Is King

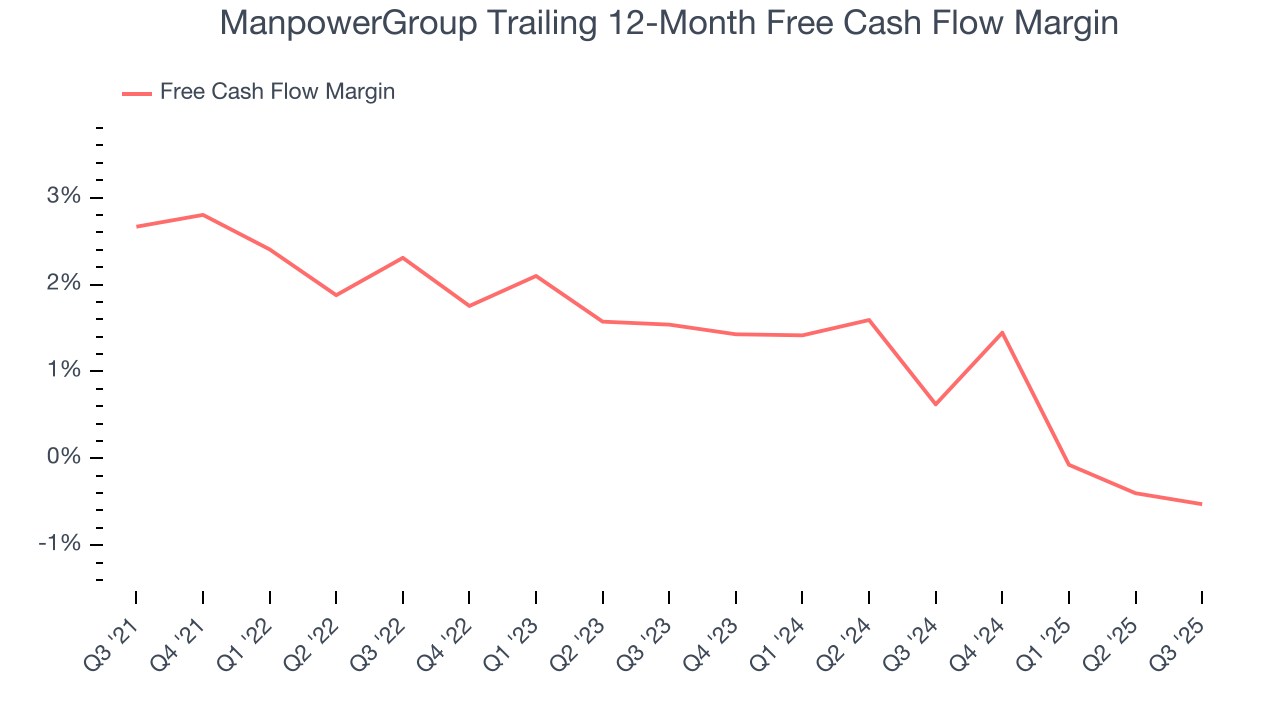

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ManpowerGroup has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.4%, lousy for a business services business.

Taking a step back, we can see that ManpowerGroup’s margin dropped by 3.2 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

ManpowerGroup broke even from a free cash flow perspective in Q3. This cash profitability was in line with the comparable period last year and its five-year average.

9. Return on Invested Capital (ROIC)

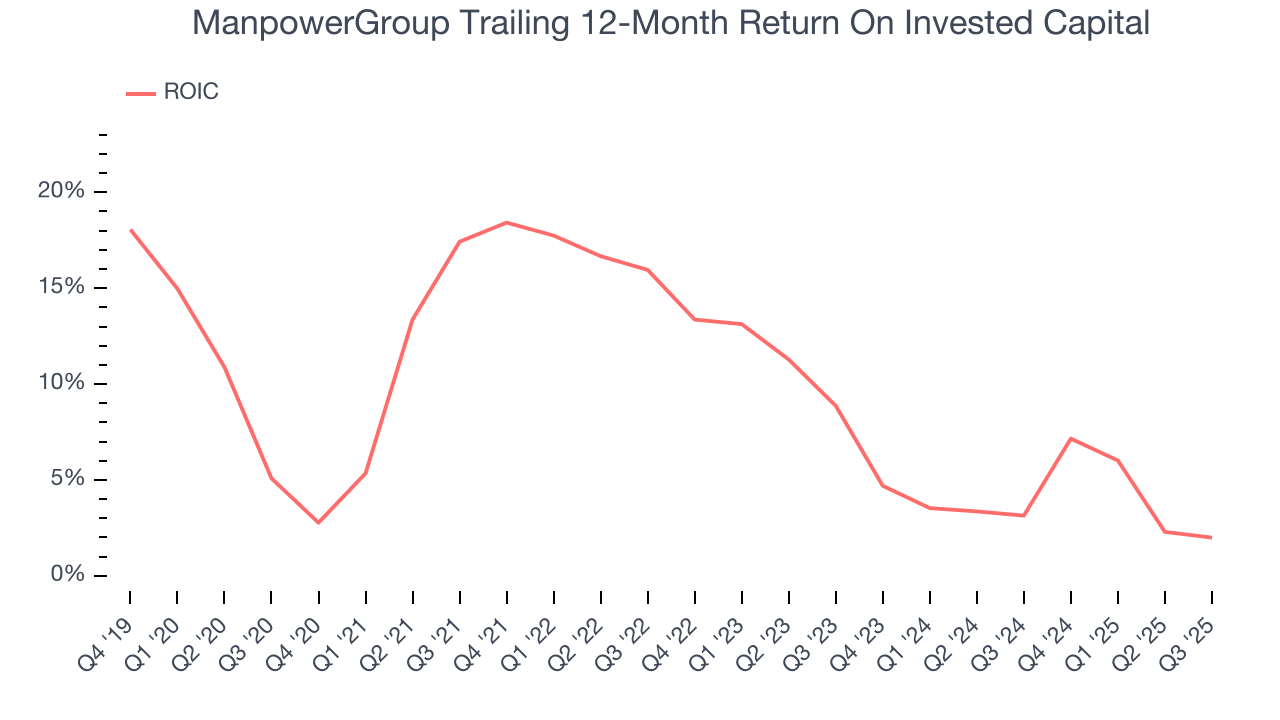

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

ManpowerGroup historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.5%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, ManpowerGroup’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

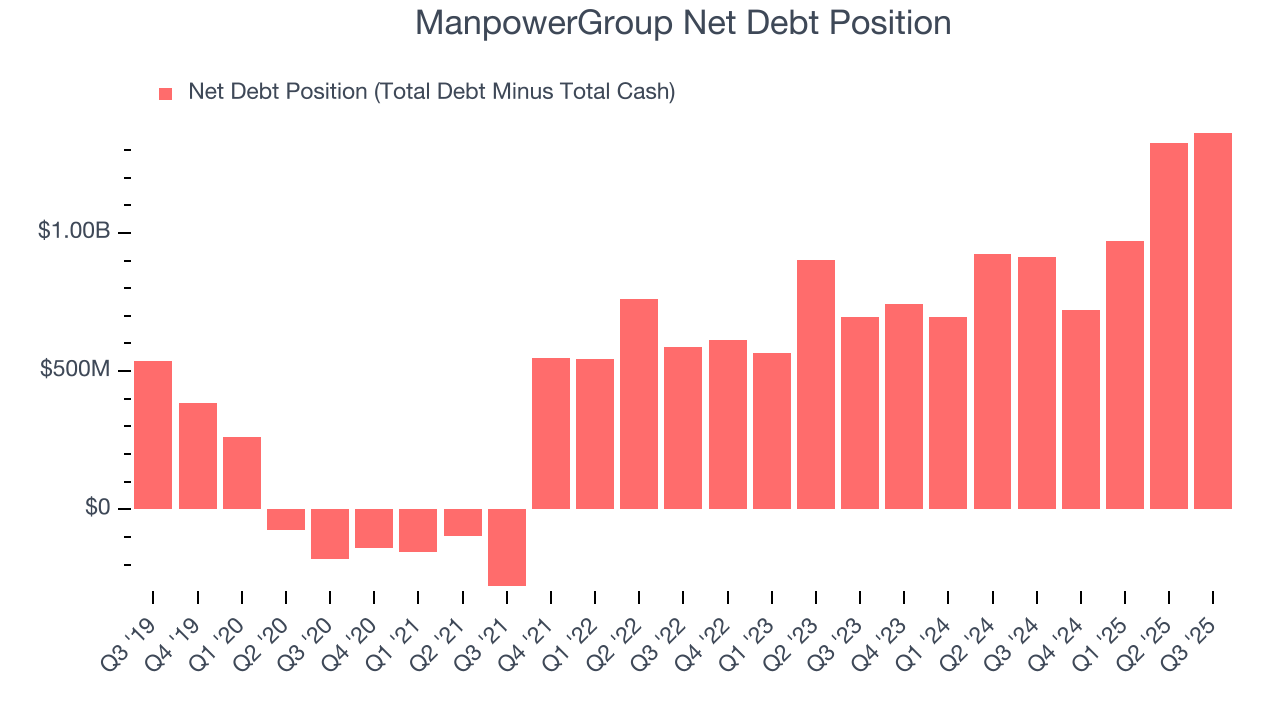

10. Balance Sheet Assessment

ManpowerGroup reported $274.6 million of cash and $1.64 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $349.1 million of EBITDA over the last 12 months, we view ManpowerGroup’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $33.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from ManpowerGroup’s Q3 Results

We were impressed by how significantly ManpowerGroup blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. On the other hand, its GAAP EPS missed but this was due to restructuring costs and Argentina hyperinflationary related non-cash currency translation losses which reduced earnings per share by $0.45 in the third quarter. Overall, this print had some key fundamental positives. The stock traded up 5.2% to $40 immediately following the results.

12. Is Now The Time To Buy ManpowerGroup?

Updated: January 24, 2026 at 11:08 PM EST

Before deciding whether to buy ManpowerGroup or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

ManpowerGroup falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years. And while its scale makes it a trusted partner with negotiating leverage, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

ManpowerGroup’s P/E ratio based on the next 12 months is 9.2x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $38.67 on the company (compared to the current share price of $30.62).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.