McKesson (MCK)

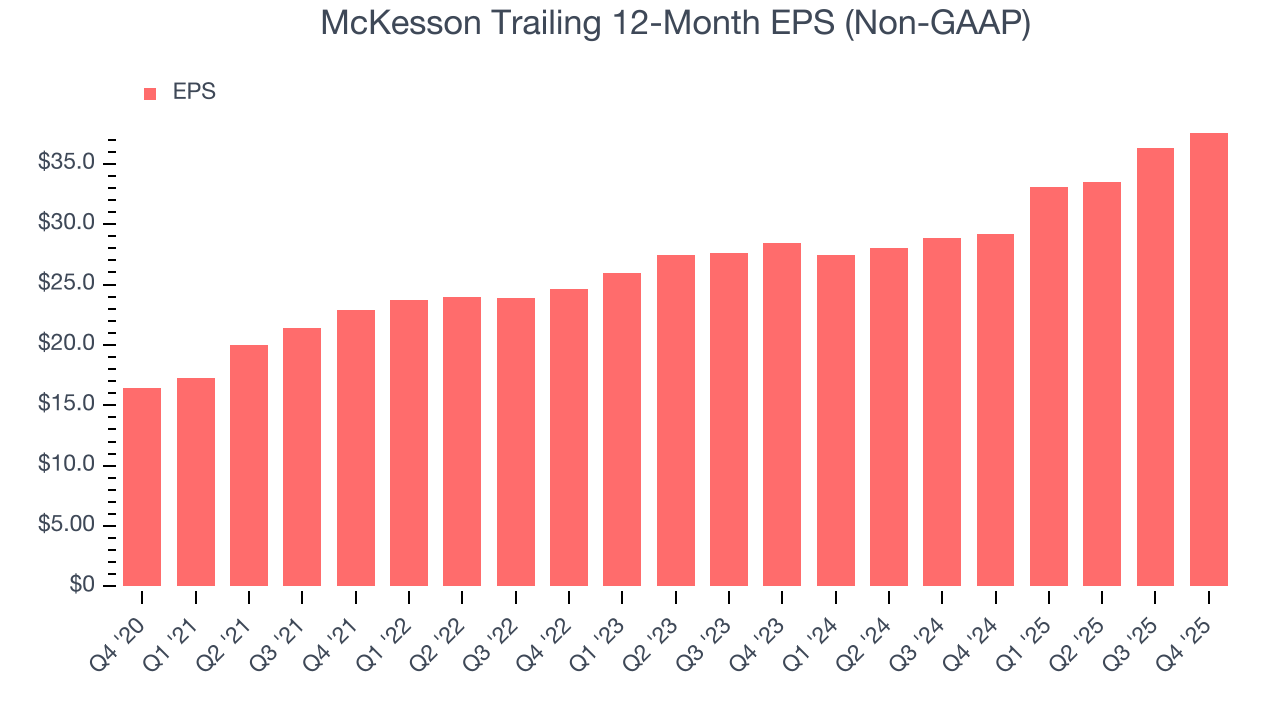

We see solid potential in McKesson. Its eye-popping 18.3% annualized EPS growth over the last five years has significantly outpaced its peers.― StockStory Analyst Team

1. News

2. Summary

Why We Like McKesson

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE:MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

- Earnings growth has massively outpaced its peers over the last five years as its EPS has compounded at 18.3% annually

- Enormous revenue base of $387.1 billion gives it economies of scale and advantages over new entrants due to the industry’s regulatory complexity

- Projected revenue growth of 10.4% for the next 12 months suggests its momentum from the last two years will persist

We have an affinity for McKesson. The price looks reasonable relative to its quality, so this might be a favorable time to buy some shares.

Why Is Now The Time To Buy McKesson?

Why Is Now The Time To Buy McKesson?

McKesson is trading at $855.39 per share, or 20.6x forward P/E. This price is justified - even cheap depending on how much you believe in the bull case - for the business fundamentals.

Where you buy a stock impacts returns. Our analysis shows that business quality is a much bigger determinant of market outperformance over the long term compared to entry price, but getting a good deal on a stock certainly isn’t a bad thing.

3. McKesson (MCK) Research Report: Q4 CY2025 Update

Healthcare distributor and services company McKesson (NYSE:MCK) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.4% year on year to $106.2 billion. Its non-GAAP profit of $9.34 per share was 0.7% above analysts’ consensus estimates.

McKesson (MCK) Q4 CY2025 Highlights:

- Revenue: $106.2 billion vs analyst estimates of $106.2 billion (11.4% year-on-year growth, in line)

- Adjusted EPS: $9.34 vs analyst estimates of $9.27 (0.7% beat)

- Management raised its full-year Adjusted EPS guidance to $39 at the midpoint, a 1% increase

- Operating Margin: 1.5%, in line with the same quarter last year

- Free Cash Flow was $1.06 billion, up from -$2.58 billion in the same quarter last year

- Market Capitalization: $105.1 billion

Company Overview

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE:MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

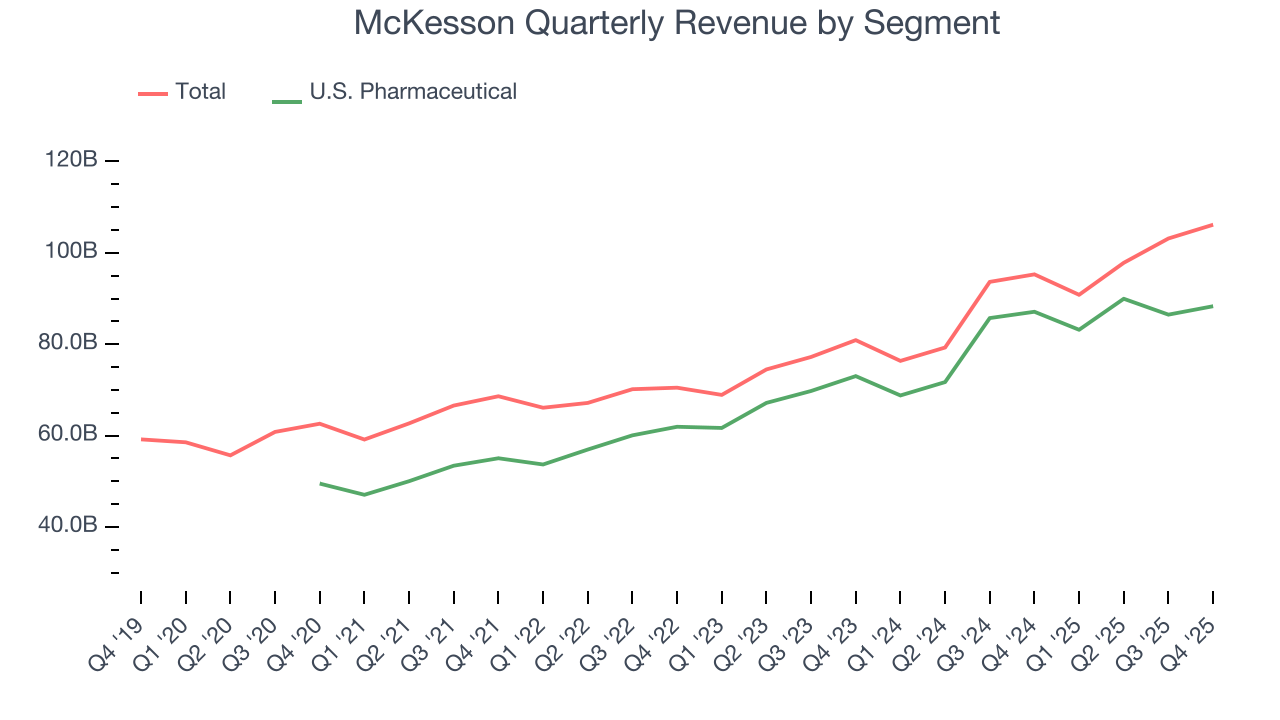

McKesson operates through four main business segments that together form a comprehensive healthcare ecosystem. The U.S. Pharmaceutical segment, its largest division, distributes branded, generic, specialty, and over-the-counter drugs to retail chains, community pharmacies, hospitals, and specialty practices. This segment maintains a network of distribution centers across the country, including strategic redistribution centers that enable efficient inventory management and delivery.

The Prescription Technology Solutions segment serves as a connector between various healthcare stakeholders, helping patients access and afford medications regardless of insurance coverage. This division works with pharmacies, providers, health plans, and pharmaceutical companies to streamline medication access, provide price transparency, and support improved health outcomes.

Through its Medical-Surgical Solutions segment, McKesson delivers medical supplies, equipment, and logistics services to alternate-site healthcare providers like physician offices, surgery centers, nursing homes, and home health agencies. The company distributes both national brands and its own private-label products through this channel.

Internationally, McKesson maintains a significant presence in Canada, where it operates wholesale pharmaceutical distribution and owns retail pharmacy chains including Rexall and Well.ca. The company has largely exited its European operations, though it maintains some business in Norway.

McKesson generates revenue primarily through the distribution of pharmaceuticals and medical products, charging a markup on the products it distributes. For example, a community pharmacy might order a month's supply of various medications through McKesson's ordering system, which the company then delivers from its distribution centers. The company also earns revenue through service fees for its technology solutions and patient support programs.

4. Healthcare Distribution & Related Services

Healthcare distributors operate scale-driven business models that thrive on high volumes. Their recurring revenue streams from contracts with hospitals, pharmacies, and healthcare providers provide stability, but profitability can be squeezed by powerful stakeholders on both sides (suppliers and customers), pricing pressures, and regulatory changes. Looking ahead, the sector is positioned for growth due to increasing demand for healthcare services driven by an aging population and advancements in medical technology. However, rising operational costs, potential drug pricing reforms, and supply chain vulnerabilities present potential headwinds. Additionally, the push for digitalization and value-based care creates opportunities for innovation but requires significant investment to remain competitive.

McKesson's primary competitors in healthcare distribution include AmerisourceBergen (NYSE:ABC) and Cardinal Health (NYSE:CAH), which together with McKesson form the "Big Three" pharmaceutical distributors in the United States. In its technology and services segments, McKesson competes with companies like Cerner (now part of Oracle, NYSE:ORCL), Change Healthcare (acquired by UnitedHealth Group, NYSE:UNH), and various specialized healthcare technology providers.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $398 billion in revenue over the past 12 months, McKesson is one of the most scaled enterprises in healthcare. This is particularly important because healthcare distribution & related services companies are volume-driven businesses due to their low margins.

6. Revenue Growth

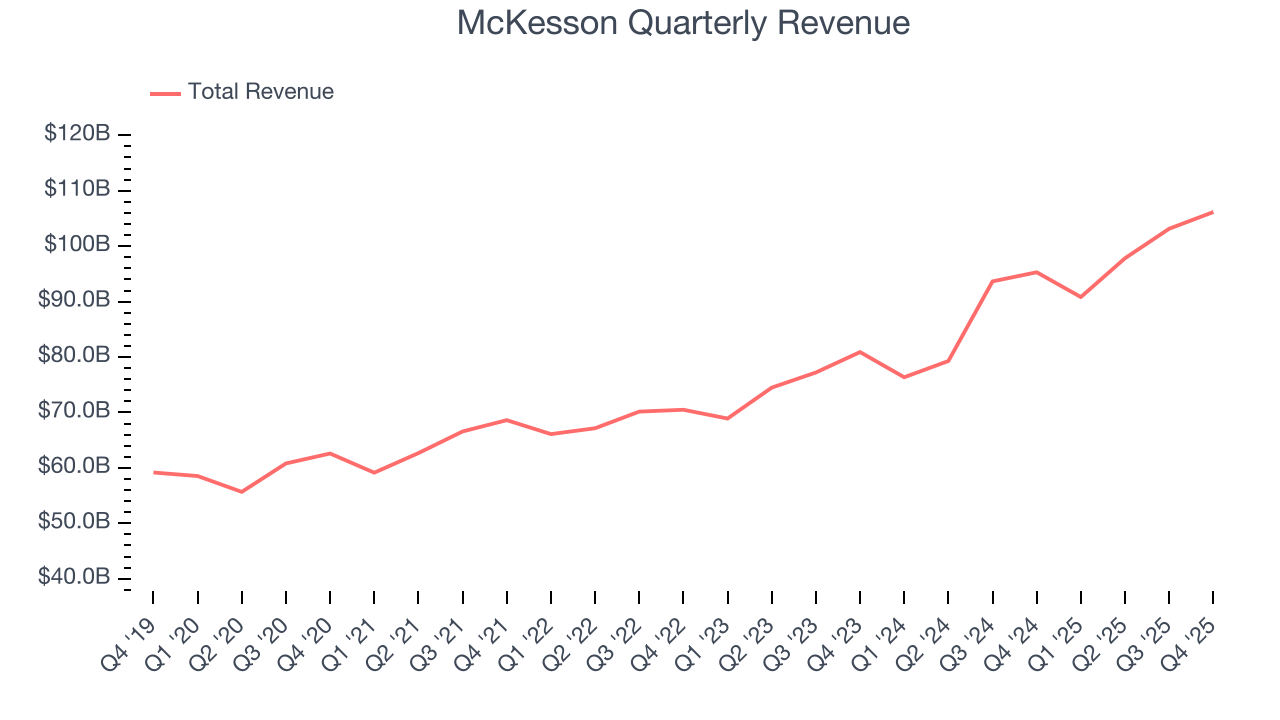

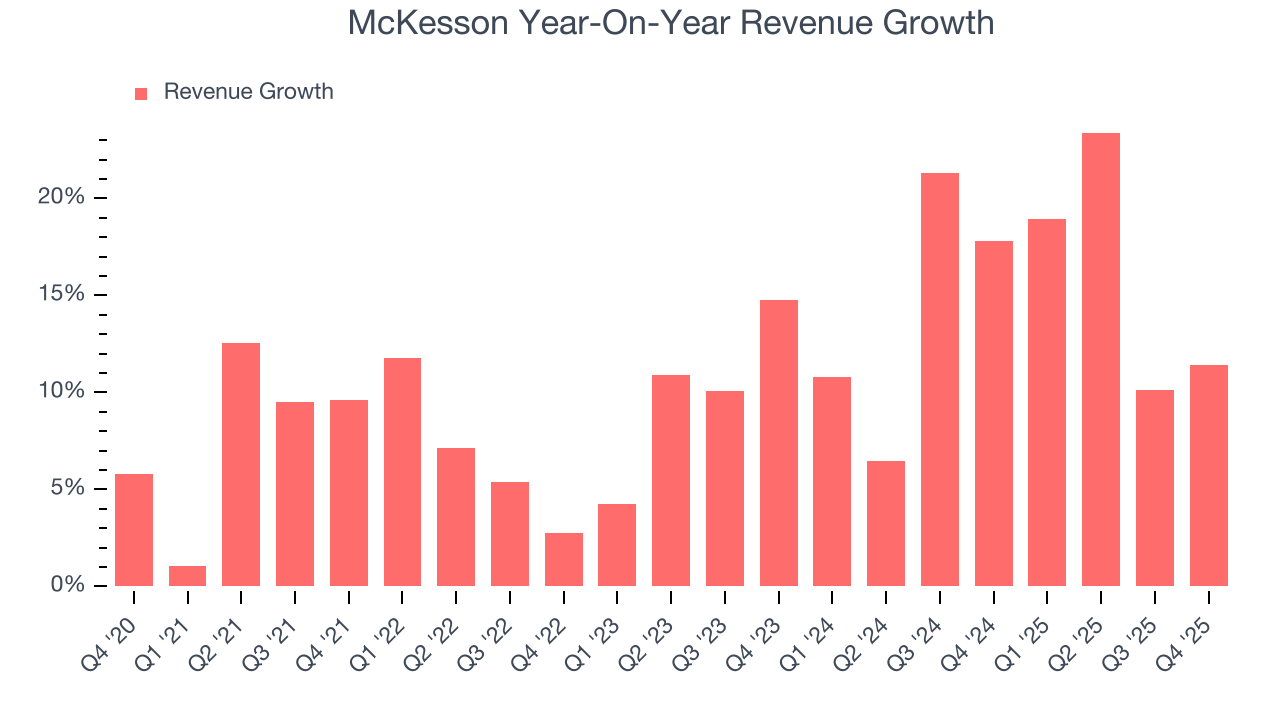

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, McKesson’s 10.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. McKesson’s annualized revenue growth of 14.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

McKesson also breaks out the revenue for its most important segment, U.S. Pharmaceutical . Over the last two years, McKesson’s U.S. Pharmaceutical revenue averaged 13.6% year-on-year growth.

This quarter, McKesson’s year-on-year revenue growth was 11.4%, and its $106.2 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.8% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and suggests the market is forecasting success for its products and services.

7. Operating Margin

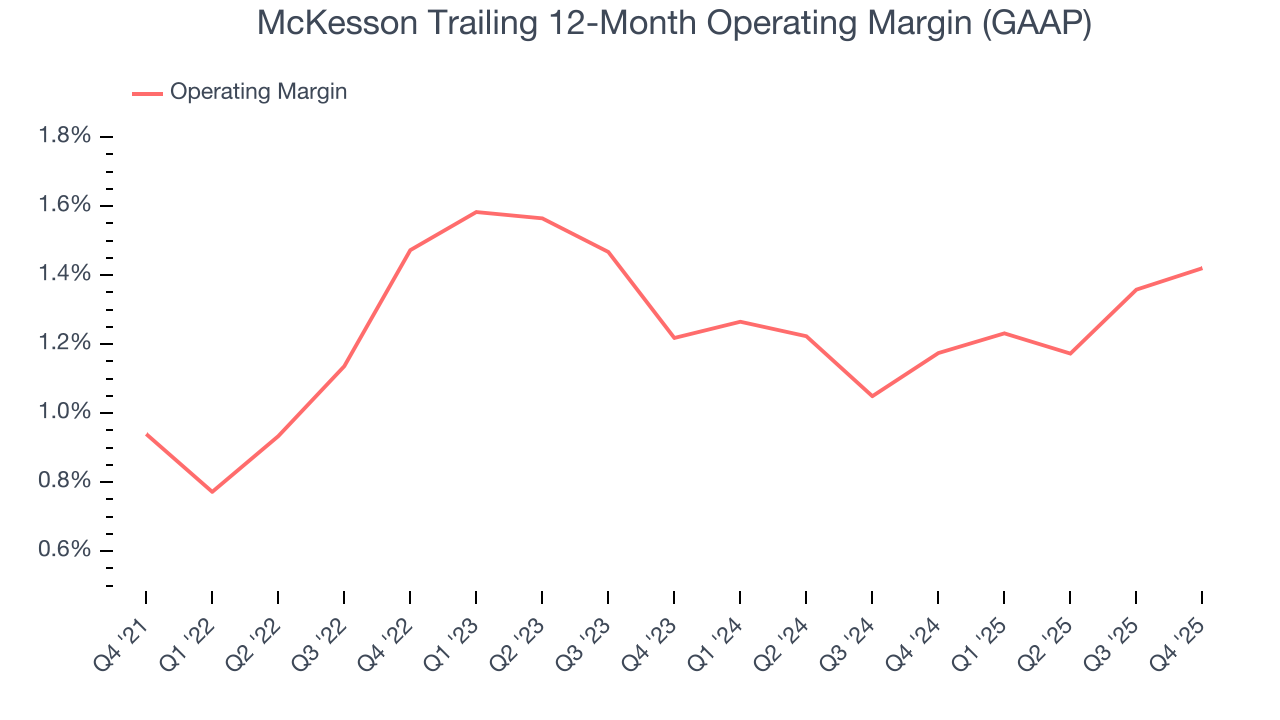

McKesson’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 1.3% over the last five years. This profitability was lousy for a healthcare business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, McKesson’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, McKesson generated an operating margin profit margin of 1.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

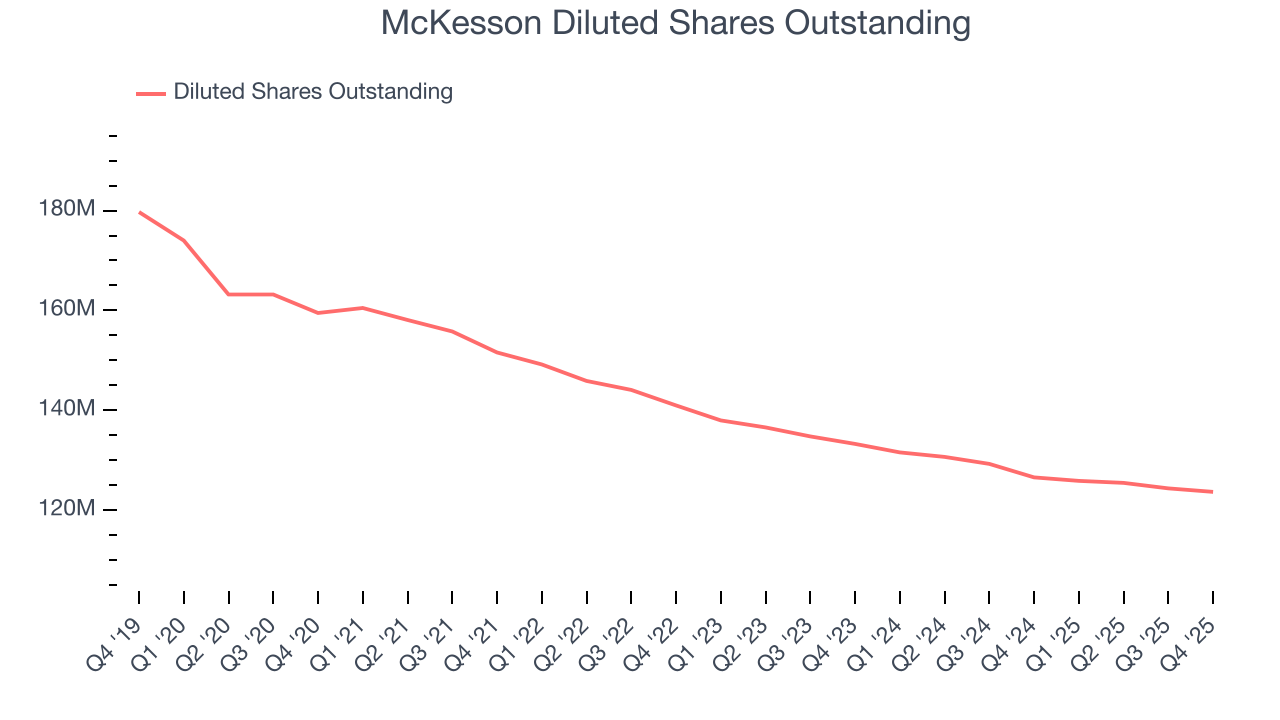

McKesson’s EPS grew at an astounding 18% compounded annual growth rate over the last five years, higher than its 10.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of McKesson’s earnings can give us a better understanding of its performance. A five-year view shows that McKesson has repurchased its stock, shrinking its share count by 22.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, McKesson reported adjusted EPS of $9.34, up from $8.03 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects McKesson’s full-year EPS of $37.58 to grow 14.2%.

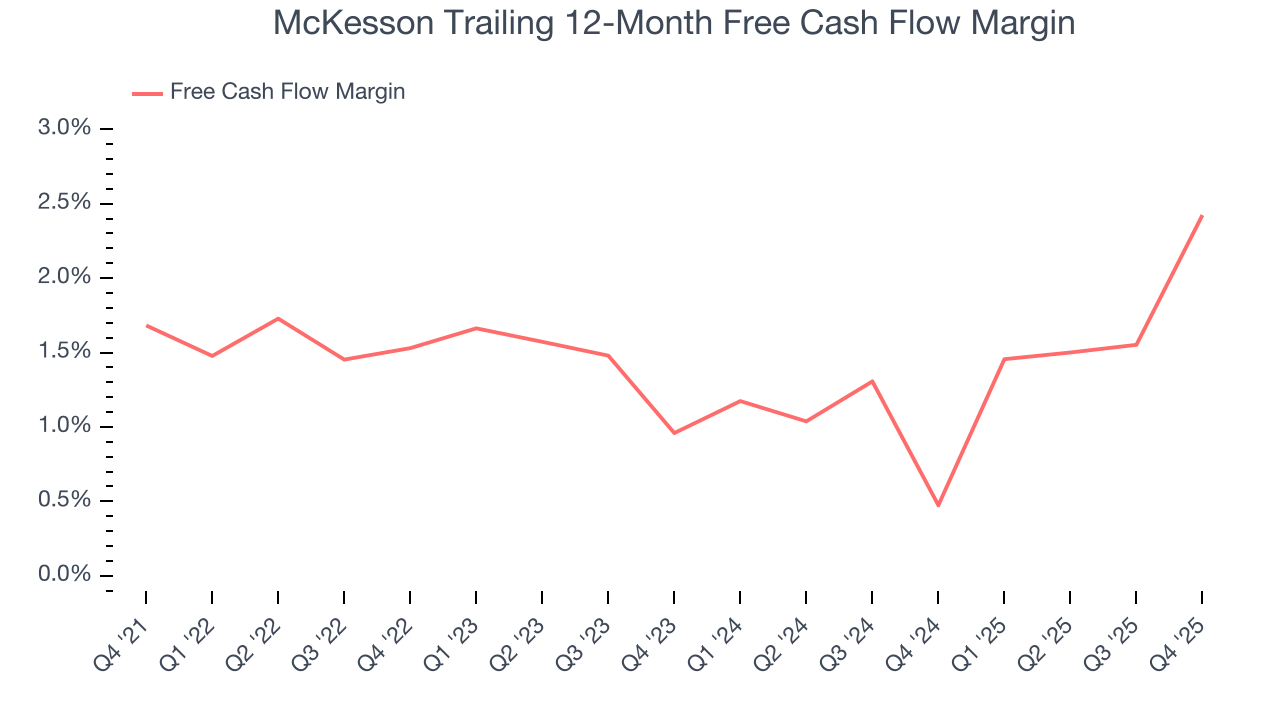

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

McKesson has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.4%, subpar for a healthcare business.

McKesson broke even from a free cash flow perspective in Q4. This result was good as its margin was 3.7 percentage points higher than in the same quarter last year. We hope the company can build on this trend.

10. Key Takeaways from McKesson’s Q4 Results

It was good to see McKesson narrowly top analysts’ full-year EPS guidance expectations this quarter. Zooming out, we think this was a decent quarter. The stock traded up 2.1% to $839 immediately following the results.

11. Is Now The Time To Buy McKesson?

Updated: February 4, 2026 at 5:03 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are several reasons why we think McKesson is a great business. First of all, the company’s revenue growth was good over the last five years. And while its operating margins are low compared to other healthcare companies, its scale makes it a trusted partner with negotiating leverage. On top of that, McKesson’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

McKesson’s P/E ratio based on the next 12 months is 19.2x. Analyzing the healthcare landscape today, McKesson’s positive attributes shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $945.33 on the company (compared to the current share price of $839), implying they see 12.7% upside in buying McKesson in the short term.