Medifast (MED)

Medifast is up against the odds. Its shrinking sales suggest demand is waning and its lousy free cash flow generation doesn’t do it any favors.― StockStory Analyst Team

1. News

2. Summary

Why We Think Medifast Will Underperform

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE:MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

- Sales tumbled by 36% annually over the last three years, showing consumer trends are working against its favor

- Sales are projected to tank by 22% over the next 12 months as its demand continues evaporating

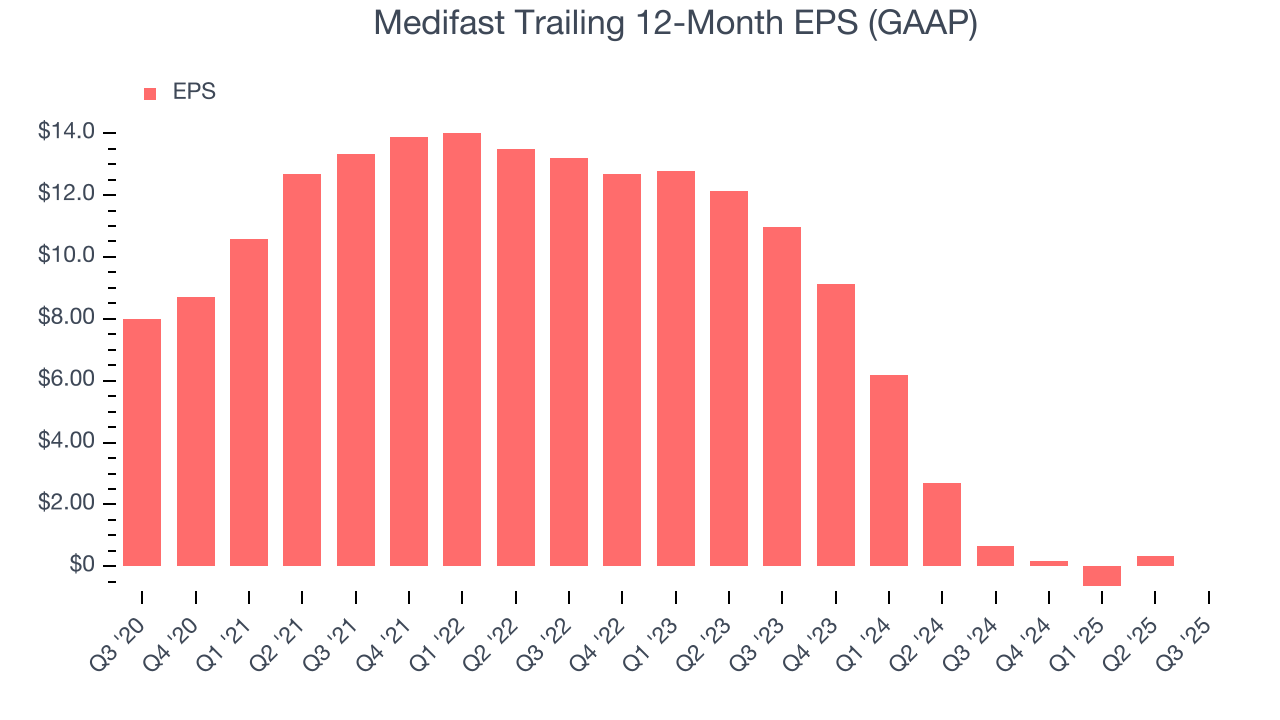

- Performance over the past three years shows each sale was less profitable as its earnings per share dropped by 90.9% annually, worse than its revenue

Medifast falls below our quality standards. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Medifast

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Medifast

At $12.05 per share, Medifast trades at 2.6x forward EV-to-EBITDA. Medifast’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Medifast (MED) Research Report: Q3 CY2025 Update

Wellness company Medifast (NYSE:MED) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 36.2% year on year to $89.41 million. On the other hand, next quarter’s revenue guidance of $72.5 million was less impressive, coming in 1.8% below analysts’ estimates. Its GAAP loss of $0.21 per share was 41.7% above analysts’ consensus estimates.

Medifast (MED) Q3 CY2025 Highlights:

- Revenue: $89.41 million vs analyst estimates of $89.7 million (36.2% year-on-year decline, in line)

- EPS (GAAP): -$0.21 vs analyst estimates of -$0.36 (41.7% beat)

- Revenue Guidance for Q4 CY2025 is $72.5 million at the midpoint, below analyst estimates of $73.8 million

- EPS (GAAP) guidance for Q4 CY2025 is $0.98 at the midpoint, beating analyst estimates by 317%

- Operating Margin: -4.6%, down from 1.5% in the same quarter last year

- Market Capitalization: $123.4 million

Company Overview

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE:MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

The company was founded in 1980 by Dr. William Vitale. It initially provided weight-loss solutions directly to doctors, who would then pass them on to patients. While the company initially grew organically through its doctor-driven model, a notable 2010 acquisition of a digital platform has allowed Medifast to establish an online presence.

Today, Medifast is known for its Optavia program. The company also offers bars, snacks such as pretzels and puffs, drinks, and soups that help customers maintain or lose weight. Medifast targets individuals looking to adopt a healthier lifestyle. These are individuals who may have struggled with their weight and found other dieting approaches unsuccessful.

In addition to the products themselves, Medifast offers personal coaching. The coaching aspect is how Medifast facilitates a multi-level marketing approach to selling. Coaches are often customers who sign on to make money by purchasing Medifast products at wholesale prices and selling them at retail to clients.

The multi-level marketing model also lets coaches earn a portion of earnings from other coaches they recruit into the Medifast ecosystem. This model is sometimes a source of skepticism, though. Some argue that these models rely mostly on recruitment to sustain themselves rather than actual demand for products.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Multi-level marketing companies offering health and wellness supplements and products include Herbalife (NYSE:HLF), USANA Health Sciences (NYSE:USNA), and Nature’s Sunshine Products (NASDAQ:NATR).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $429.7 million in revenue over the past 12 months, Medifast is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

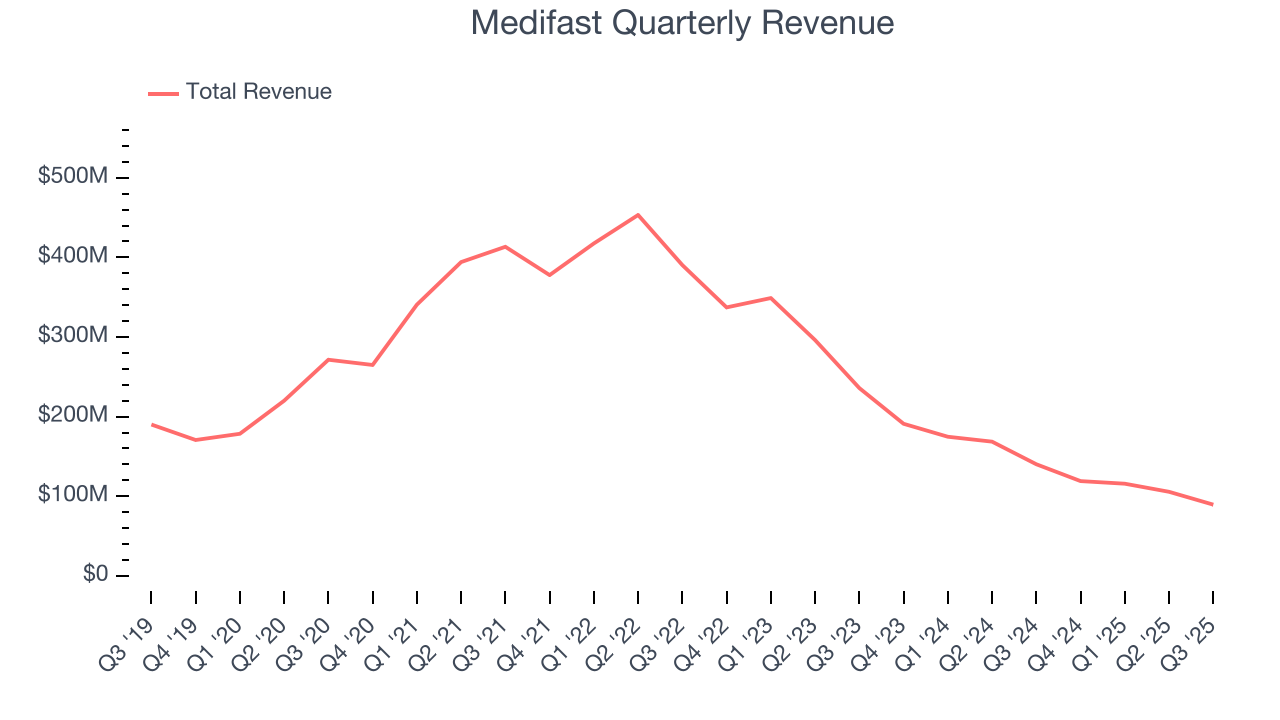

As you can see below, Medifast’s demand was weak over the last three years. Its sales fell by 36% annually, a tough starting point for our analysis.

This quarter, Medifast reported a rather uninspiring 36.2% year-on-year revenue decline to $89.41 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 39.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 17.6% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

6. Gross Margin & Pricing Power

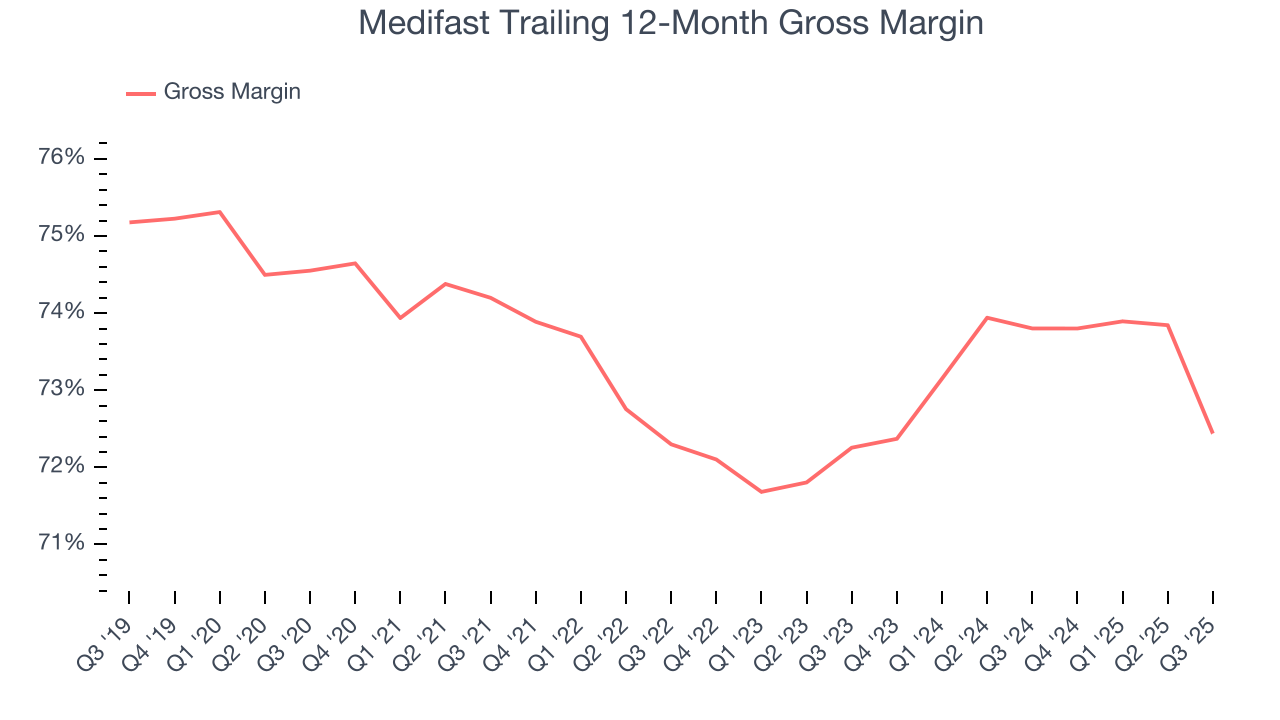

Medifast has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 73.3% gross margin over the last two years. That means for every $100 in revenue, only $26.73 went towards paying for raw materials, production of goods, transportation, and distribution.

Medifast produced a 69.5% gross profit margin in Q3, marking a 5.9 percentage point decrease from 75.4% in the same quarter last year. Medifast’s full-year margin has also been trending down over the past 12 months, decreasing by 1.4 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

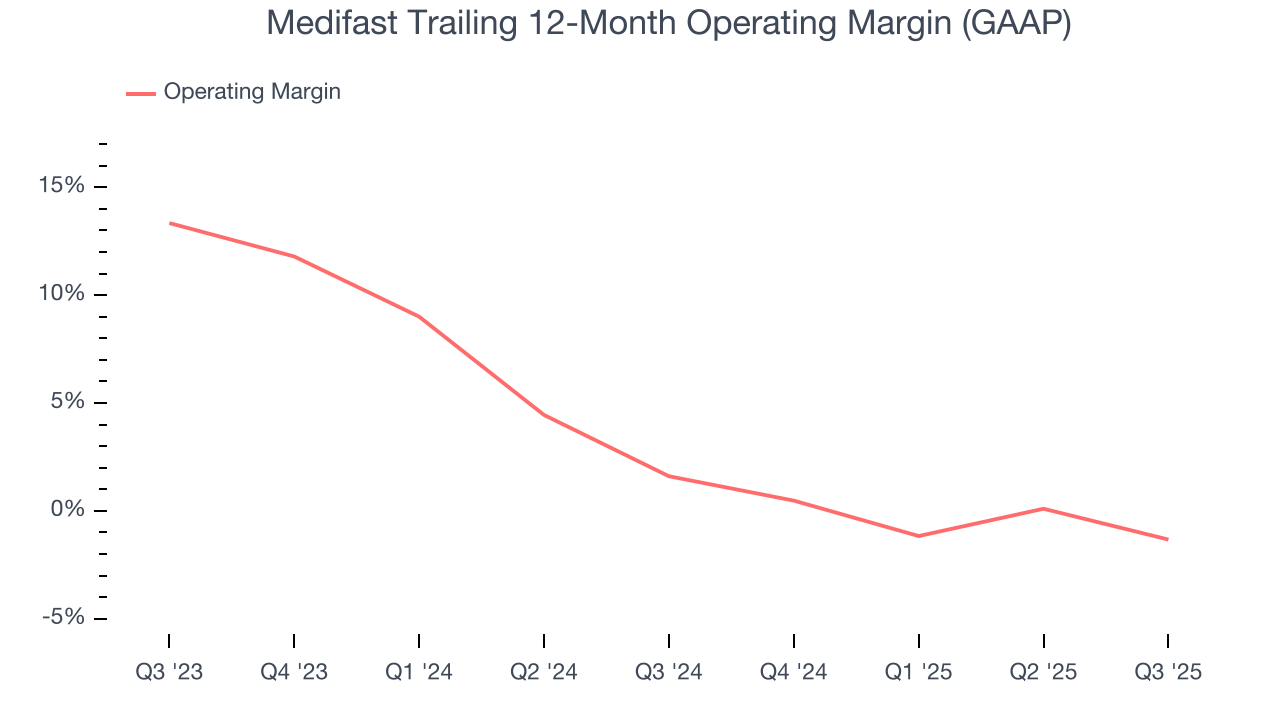

Medifast was roughly breakeven when averaging the last two years of quarterly operating profits, lousy for a consumer staples business. This result is surprising given its high gross margin as a starting point.

Looking at the trend in its profitability, Medifast’s operating margin decreased by 2.9 percentage points over the last year. Medifast’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Medifast generated an operating margin profit margin of negative 4.6%, down 6.1 percentage points year on year. Since Medifast’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

8. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Medifast reported EPS of negative $0.21, down from $0.10 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Medifast to perform poorly. Analysts forecast its full-year EPS of $0.01 will invert to negative negative $1.48.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

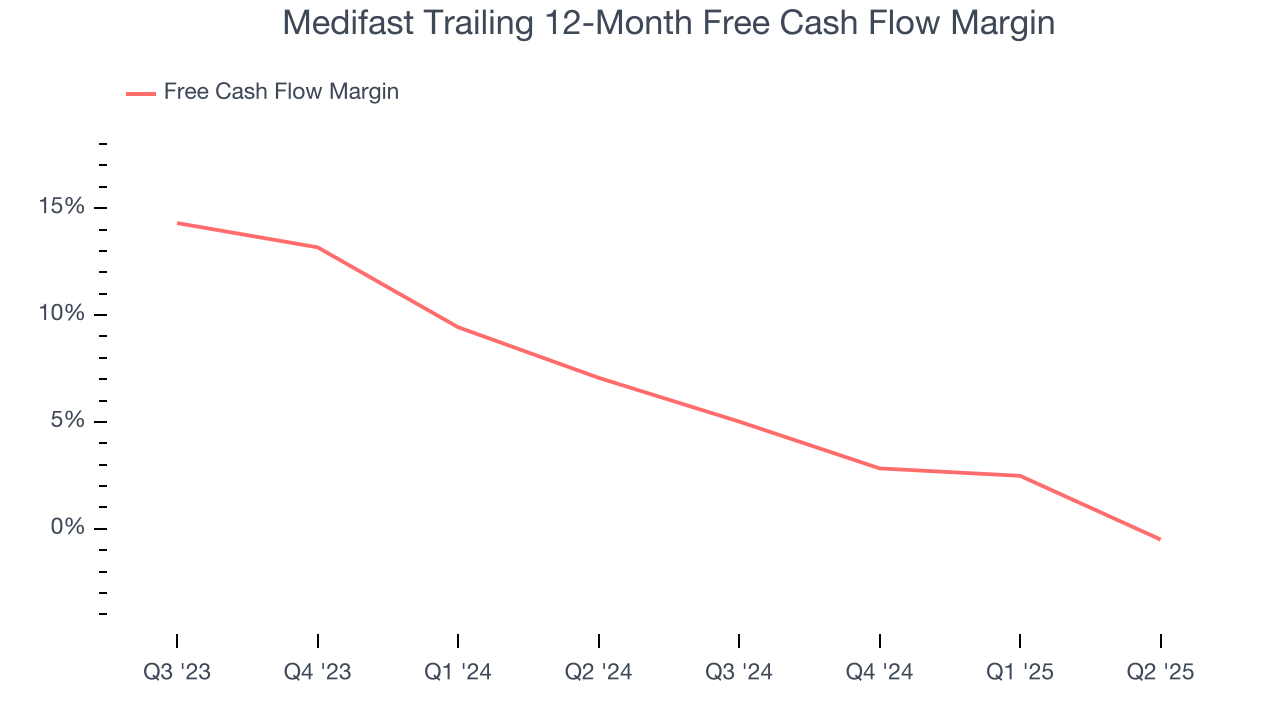

Medifast has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, subpar for a consumer staples business.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

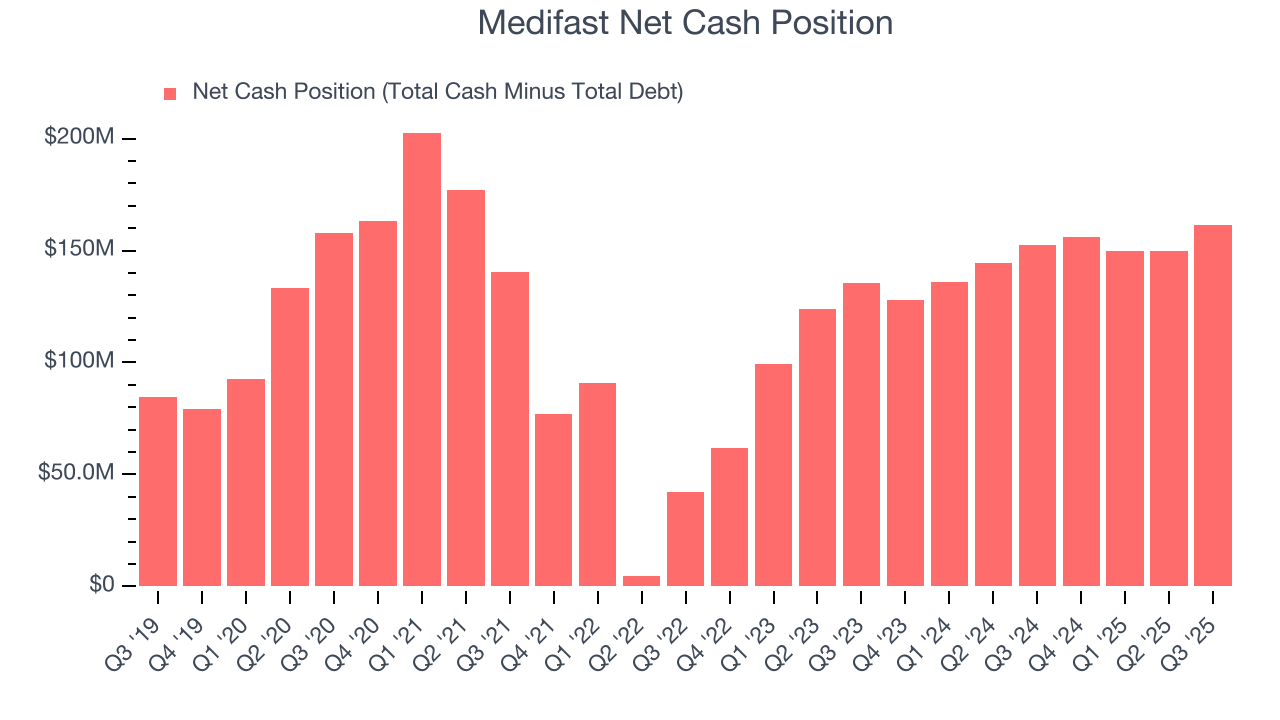

Medifast is a well-capitalized company with $173.5 million of cash and $12.26 million of debt on its balance sheet. This $161.3 million net cash position is 131% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Medifast’s Q3 Results

We were impressed by Medifast’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, we think this was a mixed quarter. The stock remained flat at $11.79 immediately after reporting.

12. Is Now The Time To Buy Medifast?

Updated: January 21, 2026 at 9:53 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Medifast.

Medifast doesn’t pass our quality test. To begin with, its revenue has declined over the last three years. And while its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its brand caters to a niche market. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

Medifast’s EV-to-EBITDA ratio based on the next 12 months is 2.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $15 on the company (compared to the current share price of $11.80).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.