Moog (MOG.A)

We’re cautious of Moog. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why Moog Is Not Exciting

Responsible for the flight control actuation system integrated in the B-2 stealth bomber, Moog (NYSE:MOG.A) provides precision motion control solutions used in aerospace and defense applications

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 1.6% for the last five years

- Low returns on capital reflect management’s struggle to allocate funds effectively

- A consolation is that its annual earnings per share growth of 9.8% over the last five years modestly outpaced its peers

Moog’s quality is lacking. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Moog

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Moog

Moog is trading at $236.95 per share, or 25.3x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Moog (MOG.A) Research Report: Q2 CY2025 Update

Precision motion and control systems manufacturer Moog (NYSE:MOG.A) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.4% year on year to $971.4 million. Its non-GAAP profit of $2.37 per share was 10% above analysts’ consensus estimates.

Moog (MOG.A) Q2 CY2025 Highlights:

- Revenue: $971.4 million vs analyst estimates of $917.6 million (7.4% year-on-year growth, 5.9% beat)

- Adjusted EPS: $2.37 vs analyst estimates of $2.16 (10% beat)

- Adjusted EBITDA: $121.6 million vs analyst estimates of $139.4 million (12.5% margin, 12.8% miss)

- Operating Margin: 9.9%, in line with the same quarter last year

- Free Cash Flow was $92.67 million, up from -$1.92 million in the same quarter last year

- Market Capitalization: $6.49 billion

Company Overview

Responsible for the flight control actuation system integrated in the B-2 stealth bomber, Moog (NYSE:MOG.A) provides precision motion control solutions used in aerospace and defense applications

Founded in 1951 and headquartered in East Aurora, New York, Moog has established itself as a leader in providing innovative solutions for complex control challenges.The company operates through three primary segments: Aircraft Controls, Space and Defense Controls, and Industrial Systems.

The Aircraft Controls segment focuses on flight control systems for both commercial and military aircraft. The Space and Defense Controls segment provides solutions for spacecraft, launch vehicles, and various defense applications. The Industrial Systems segment serves markets including energy, industrial automation, and medical equipment.

Moog’s customer base includes original equipment manufacturers (OEMs) and end users for whom it provides aftermarket support. The aerospace and defense sector, particularly OEMs, represents a significant portion of Moog's sales. Additionally, internationally, Moog conducts operations primarily through wholly-owned foreign subsidiaries, with a significant presence in Europe and the Asia-Pacific region.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

MOOG’s competitors include TransDigm (NYSE:TDG), Lockheed Martin (NYSE:LMT), and General Dynamics (NYSE:GD).

5. Revenue Growth

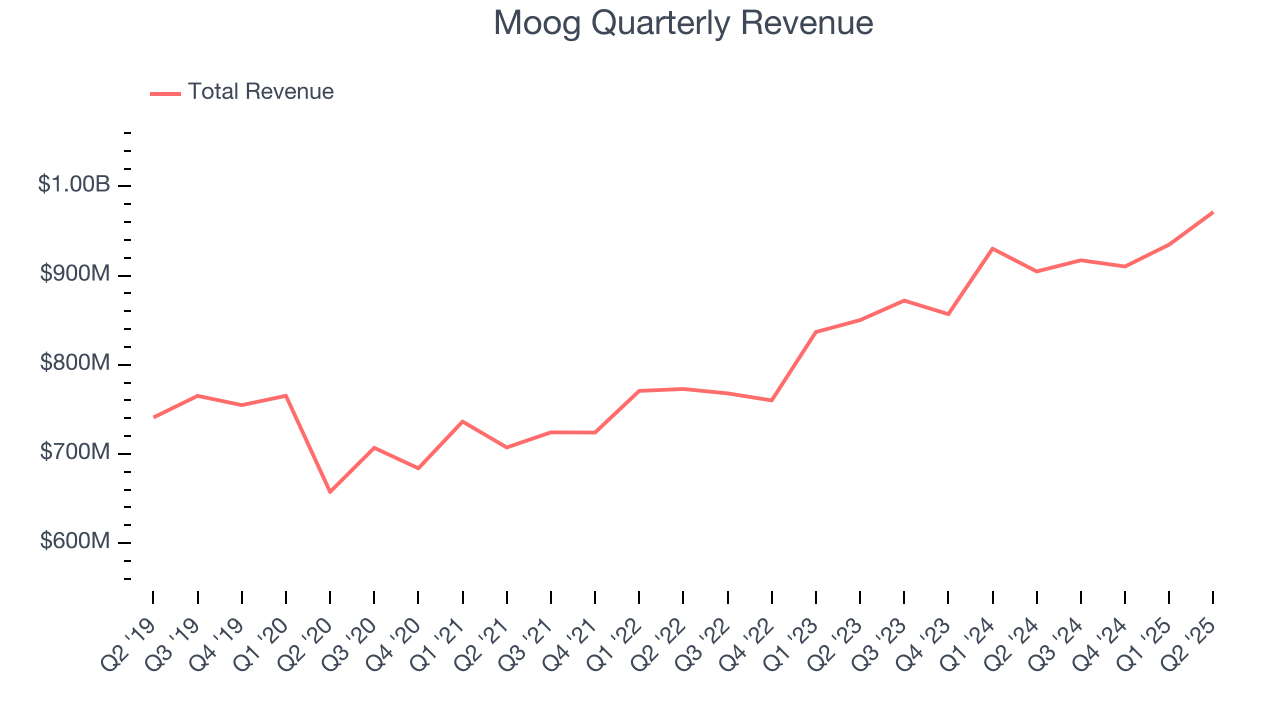

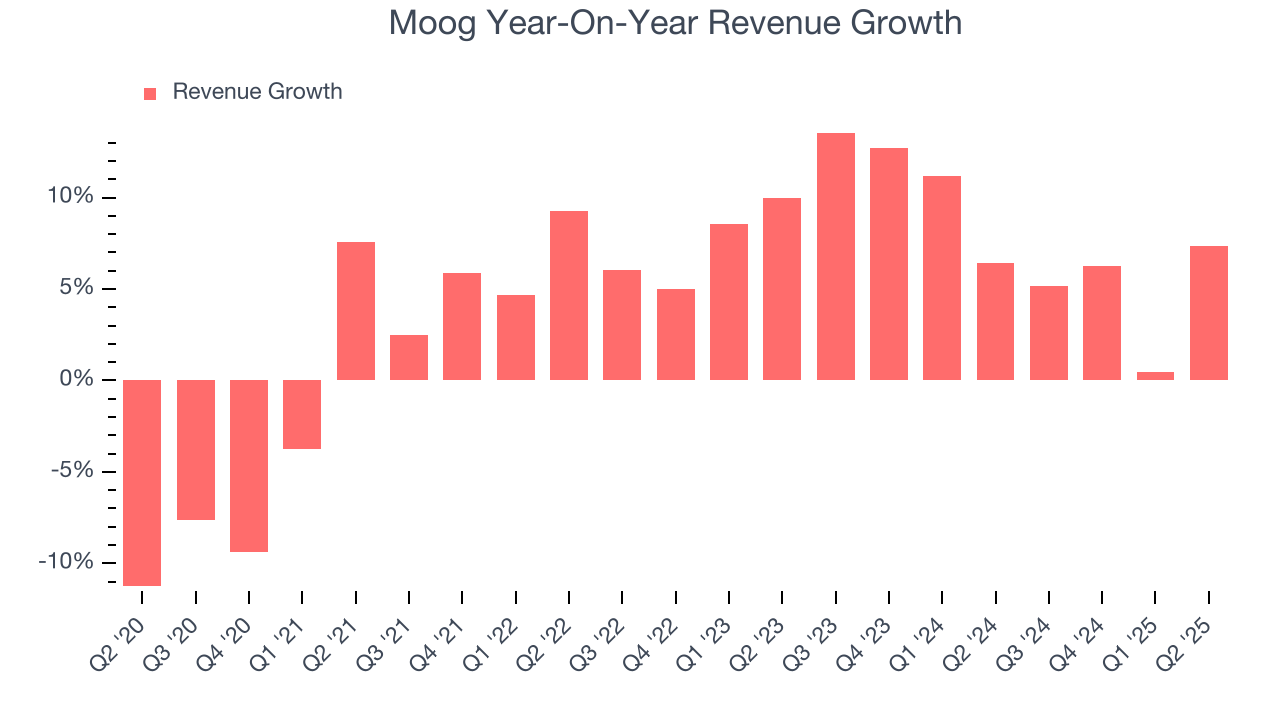

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Moog’s sales grew at a tepid 4.9% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Moog’s annualized revenue growth of 7.8% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Moog reported year-on-year revenue growth of 7.4%, and its $971.4 million of revenue exceeded Wall Street’s estimates by 5.9%.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

6. Operating Margin

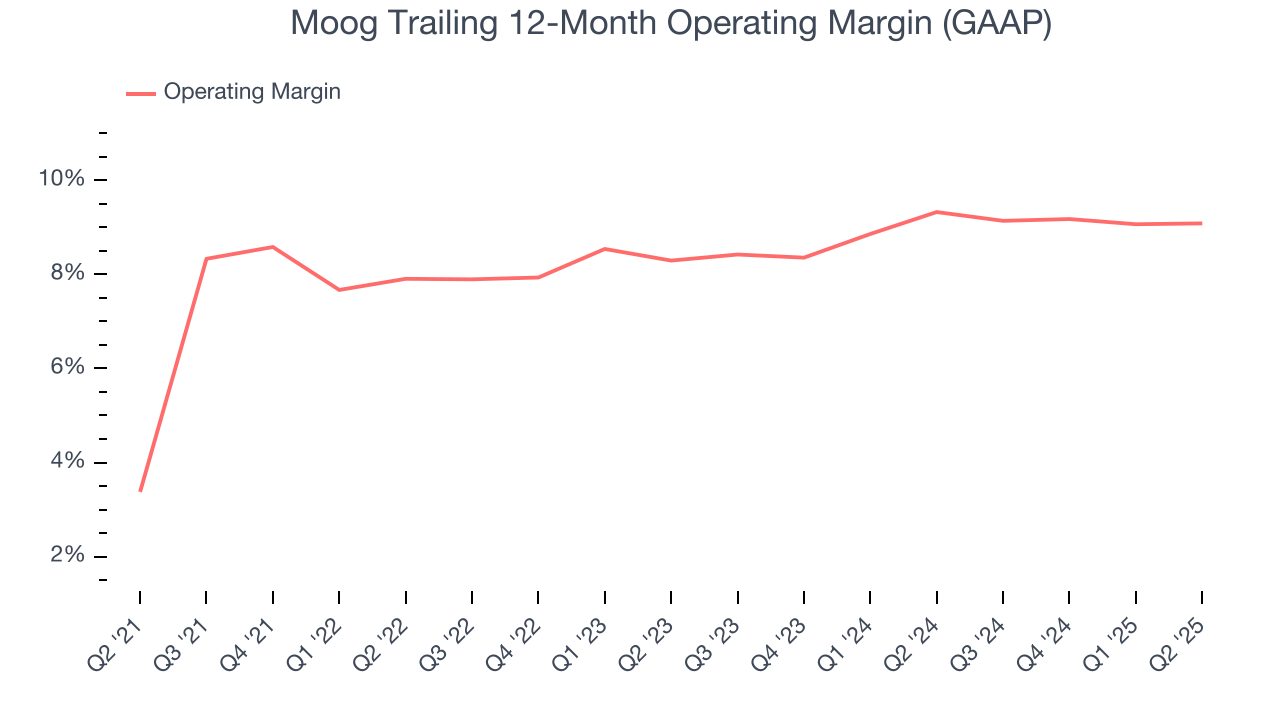

Moog was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.8% was weak for an industrials business.

On the plus side, Moog’s operating margin rose by 5.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, Moog generated an operating margin profit margin of 9.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

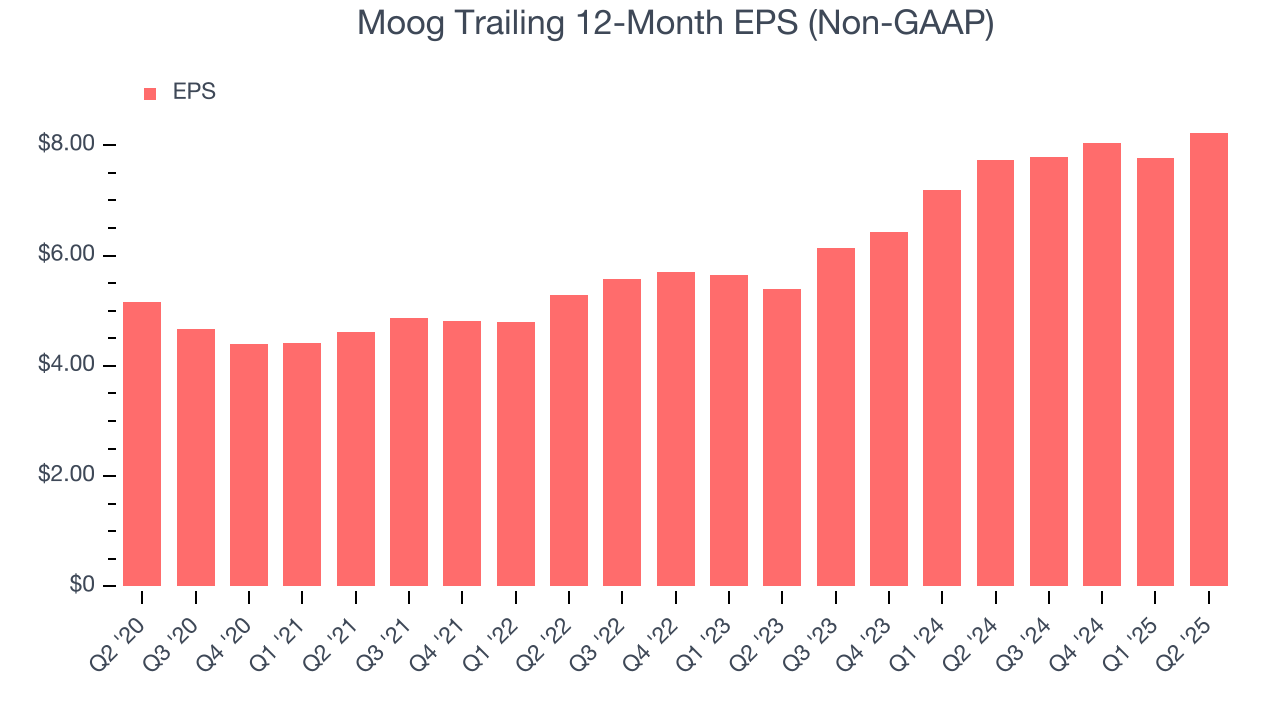

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

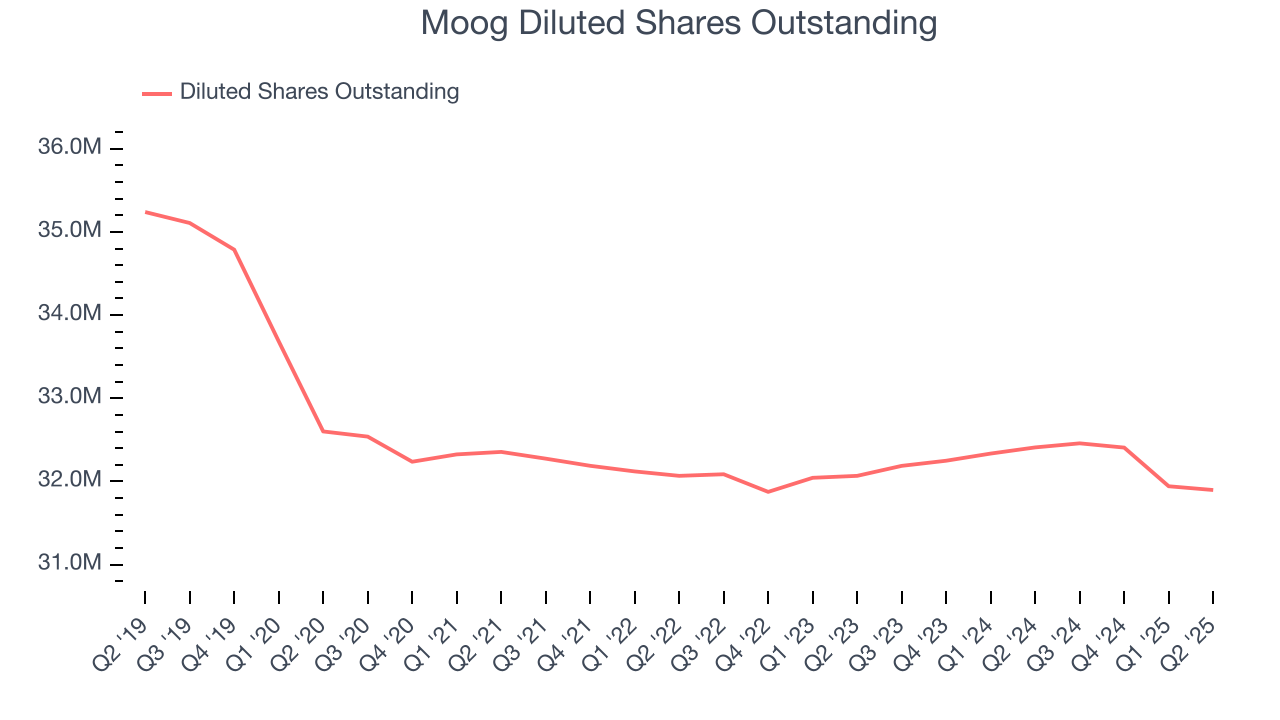

Moog’s EPS grew at a decent 9.8% compounded annual growth rate over the last five years, higher than its 4.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Moog’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Moog’s operating margin was flat this quarter but expanded by 5.7 percentage points over the last five years. On top of that, its share count shrank by 2.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Moog, its two-year annual EPS growth of 23.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, Moog reported adjusted EPS of $2.37, up from $1.91 in the same quarter last year. This print beat analysts’ estimates by 10%. Over the next 12 months, Wall Street expects Moog’s full-year EPS of $8.23 to grow 12.2%.

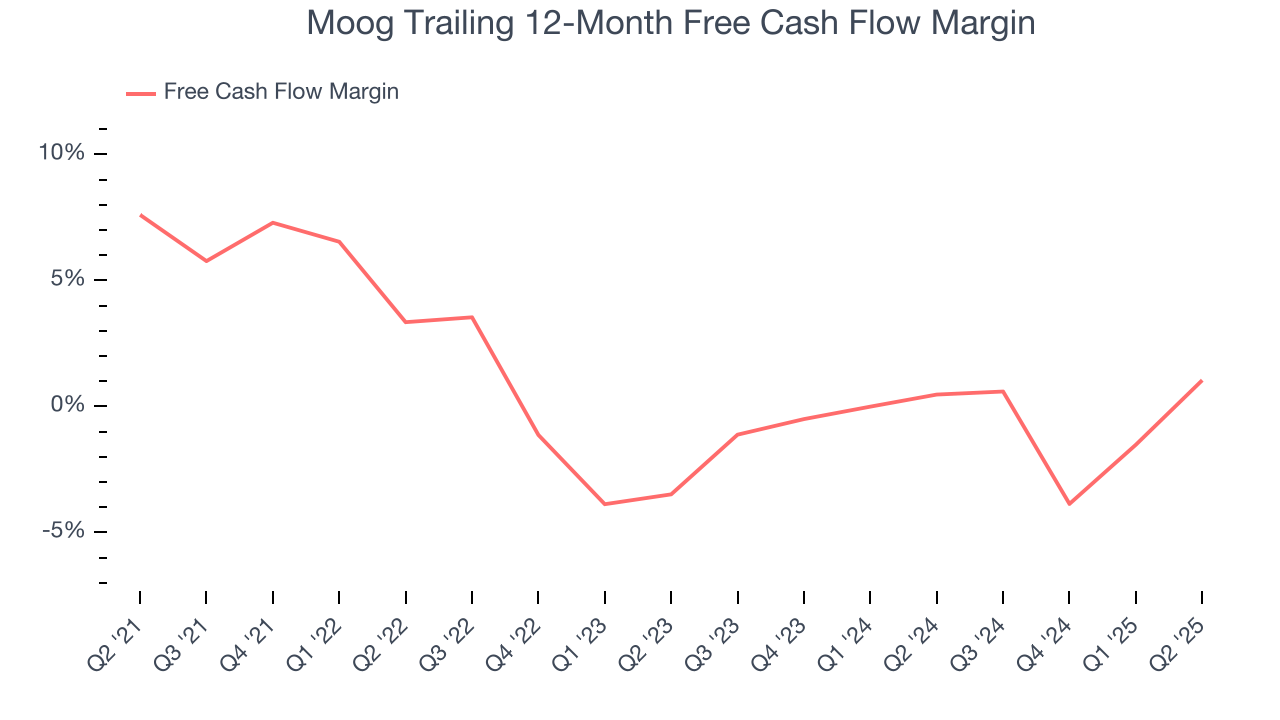

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Moog has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.6%, lousy for an industrials business.

Taking a step back, we can see that Moog’s margin dropped by 6.6 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Moog’s free cash flow clocked in at $92.67 million in Q2, equivalent to a 9.5% margin. This result was good as its margin was 9.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

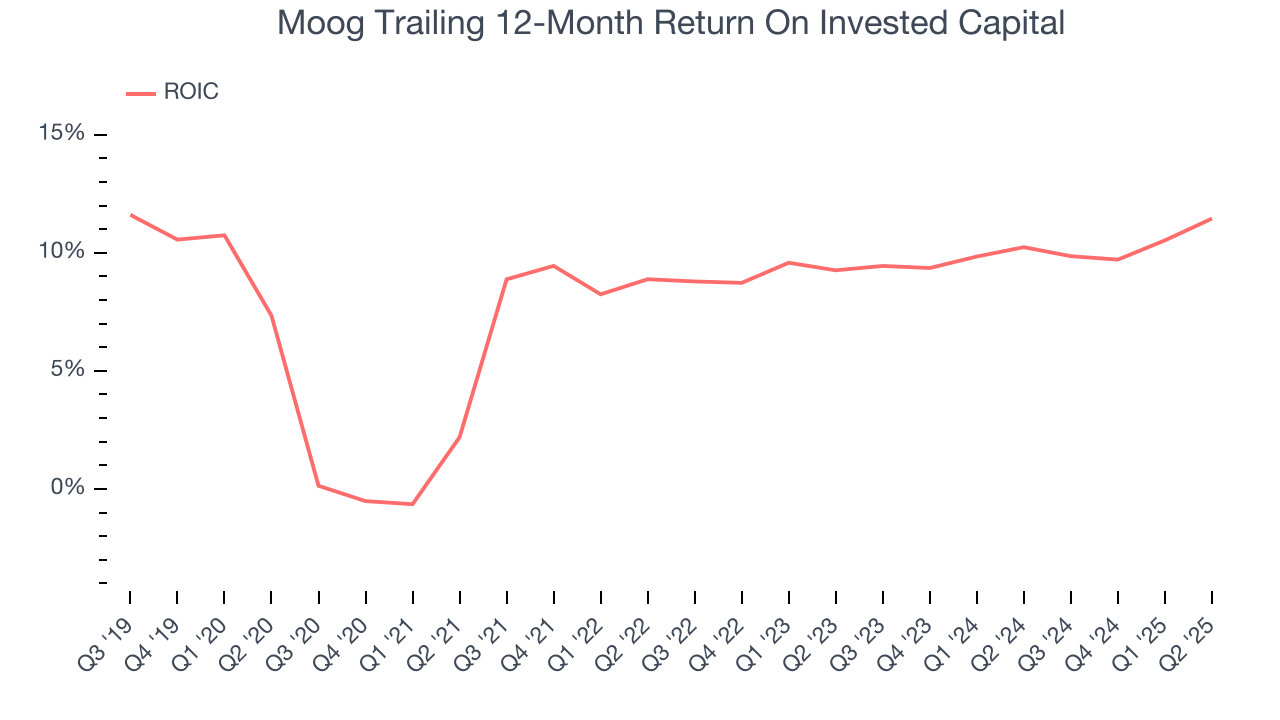

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Moog historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Moog’s has increased over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

10. Balance Sheet Assessment

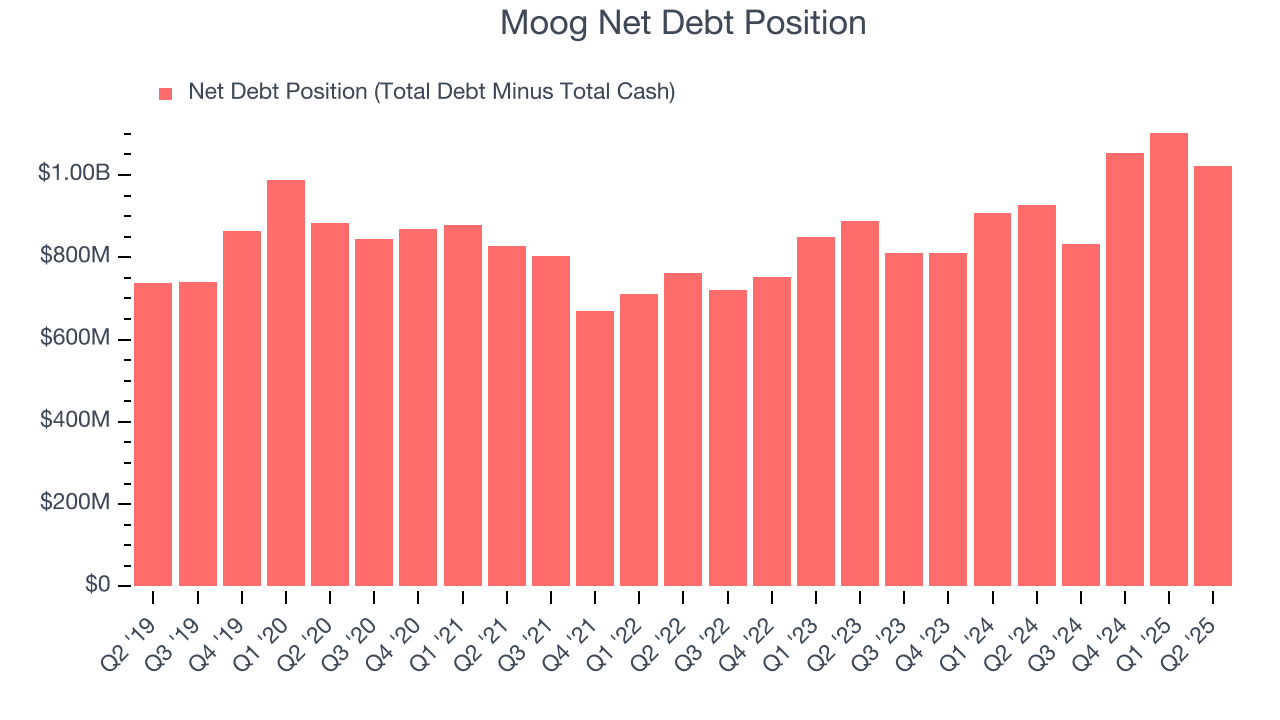

Moog reported $59.01 million of cash and $1.08 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $436.7 million of EBITDA over the last 12 months, we view Moog’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $11.07 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Moog’s Q2 Results

We were impressed by how significantly Moog blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, this print had some key positives. The stock traded flat following the results.

12. Is Now The Time To Buy Moog?

Updated: December 7, 2025 at 10:23 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Moog, you should also grasp the company’s longer-term business quality and valuation.

Moog’s business quality ultimately falls short of our standards. To begin with, its revenue growth was uninspiring over the last five years. And while its expanding operating margin shows the business has become more efficient, the downside is its cash profitability fell over the last five years. On top of that, its low free cash flow margins give it little breathing room.

Moog’s P/E ratio based on the next 12 months is 25.3x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $243 on the company (compared to the current share price of $236.95).