Motorola Solutions (MSI)

Motorola Solutions is an exciting business. It not only prints profits but also has increased its margins, showing its fundamentals are improving.― StockStory Analyst Team

1. News

2. Summary

Why We Like Motorola Solutions

Born from the company that invented the first portable handheld police radio in 1940, Motorola Solutions (NYSE:MSI) provides mission-critical communications, video security, and command center software solutions for public safety agencies and enterprise customers.

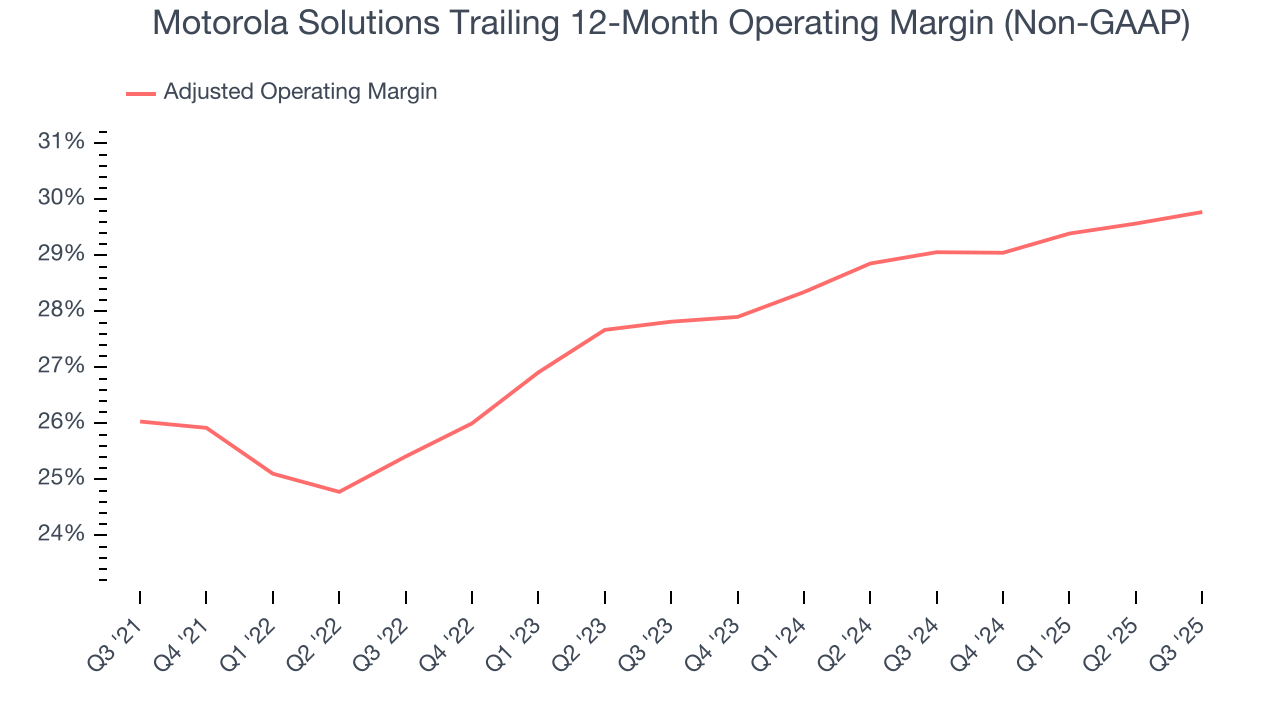

- Disciplined cost controls and effective management have materialized in a strong adjusted operating margin

- Strong free cash flow margin of 18.8% gives it the option to reinvest, repurchase shares, or pay dividends, and its recently improved profitability means it has even more resources to invest or distribute

- Sizeable revenue base of $11.31 billion gives it economies of scale and distribution advantages

We expect great things from Motorola Solutions. The price looks reasonable in light of its quality, so this might be a favorable time to invest in some shares.

Why Is Now The Time To Buy Motorola Solutions?

Why Is Now The Time To Buy Motorola Solutions?

Motorola Solutions is trading at $383.80 per share, or 24.4x forward P/E. Valuation is above that of many business services companies, but we think the price is justified given its business fundamentals.

Entry price may seem important in the moment, but our work shows that time and again, long-term market outperformance is determined by business quality rather than getting an absolute bargain on a stock.

3. Motorola Solutions (MSI) Research Report: Q3 CY2025 Update

Public safety technology company Motorola Solutions (NYSE:MSI) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.8% year on year to $3.01 billion. Its non-GAAP profit of $4.06 per share was 5.5% above analysts’ consensus estimates.

Motorola Solutions (MSI) Q3 CY2025 Highlights:

- Revenue: $3.01 billion vs analyst estimates of $2.99 billion (7.8% year-on-year growth, 0.6% beat)

- Adjusted EPS: $4.06 vs analyst estimates of $3.85 (5.5% beat)

- Adjusted EBITDA: $1 billion vs analyst estimates of $993.1 million (33.3% margin, 0.8% beat)

- Operating Margin: 25.6%, in line with the same quarter last year

- Free Cash Flow Margin: 24.4%, similar to the same quarter last year

- Market Capitalization: $63.84 billion

Company Overview

Born from the company that invented the first portable handheld police radio in 1940, Motorola Solutions (NYSE:MSI) provides mission-critical communications, video security, and command center software solutions for public safety agencies and enterprise customers.

Motorola Solutions' technology ecosystem spans three main areas. Its Land Mobile Radio (LMR) systems provide the reliable two-way radios and infrastructure that police officers, firefighters, and paramedics depend on during emergencies. The company's video security offerings include AI-powered cameras, access control systems, and analytics software that help organizations from schools to airports monitor facilities and respond to incidents. Its command center software supports the entire public safety workflow, from handling 911 calls to managing investigations and evidence.

Public safety agencies rely on Motorola Solutions' technology to coordinate emergency responses. For example, when a 911 call comes in, dispatchers use the company's software to gather information, send first responders to the scene, and provide them with critical data. Officers equipped with Motorola's radios can communicate securely even in challenging environments where cell phones might fail.

For enterprise customers like hospitals, stadiums, and manufacturing facilities, Motorola provides similar safety and security capabilities adapted to business needs. The company generates revenue through device sales, system installations, software licenses, and recurring services like maintenance, cybersecurity, and cloud hosting. With customers in over 100 countries, Motorola Solutions combines its hardware expertise with growing software capabilities to create integrated safety ecosystems.

4. Safety & Security Services

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

Motorola Solutions' competitors vary across its business areas, including L3Harris Technologies and Hytera in radio communications, Axon Enterprise and Genetec in video security, and CentralSquare Technologies and Tyler Technologies in command center software.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $11.31 billion in revenue over the past 12 months, Motorola Solutions is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices.

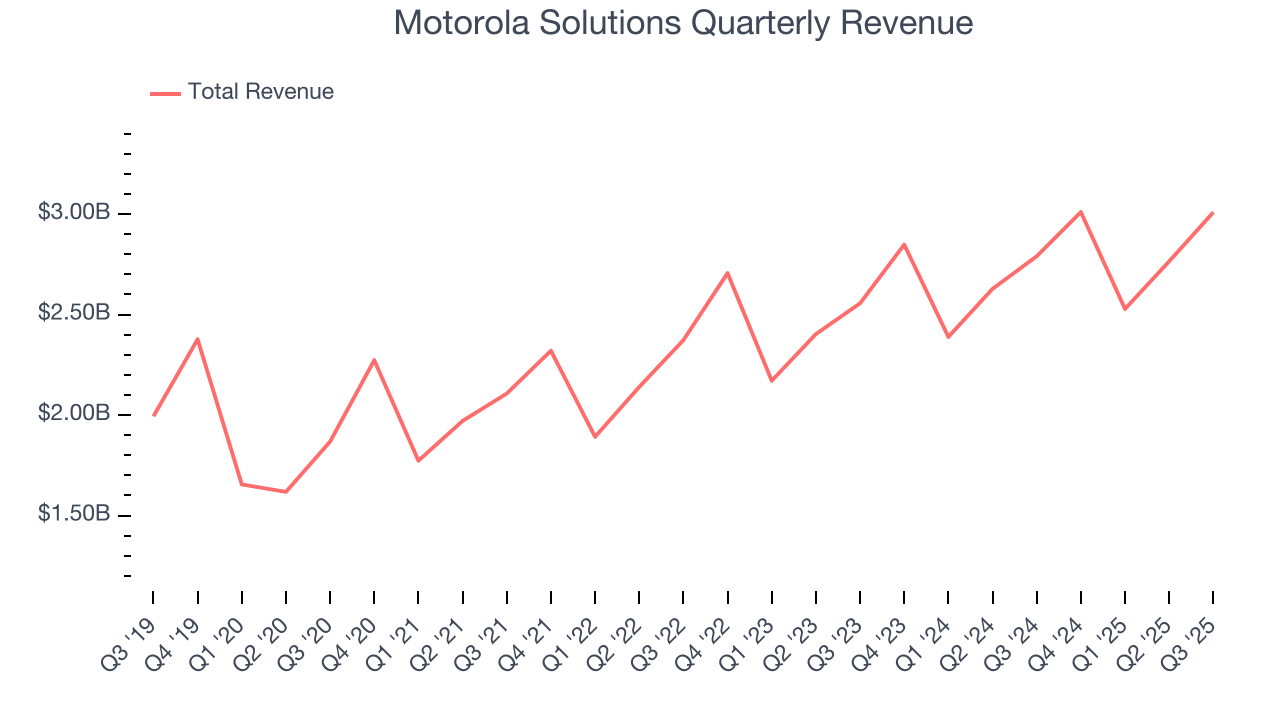

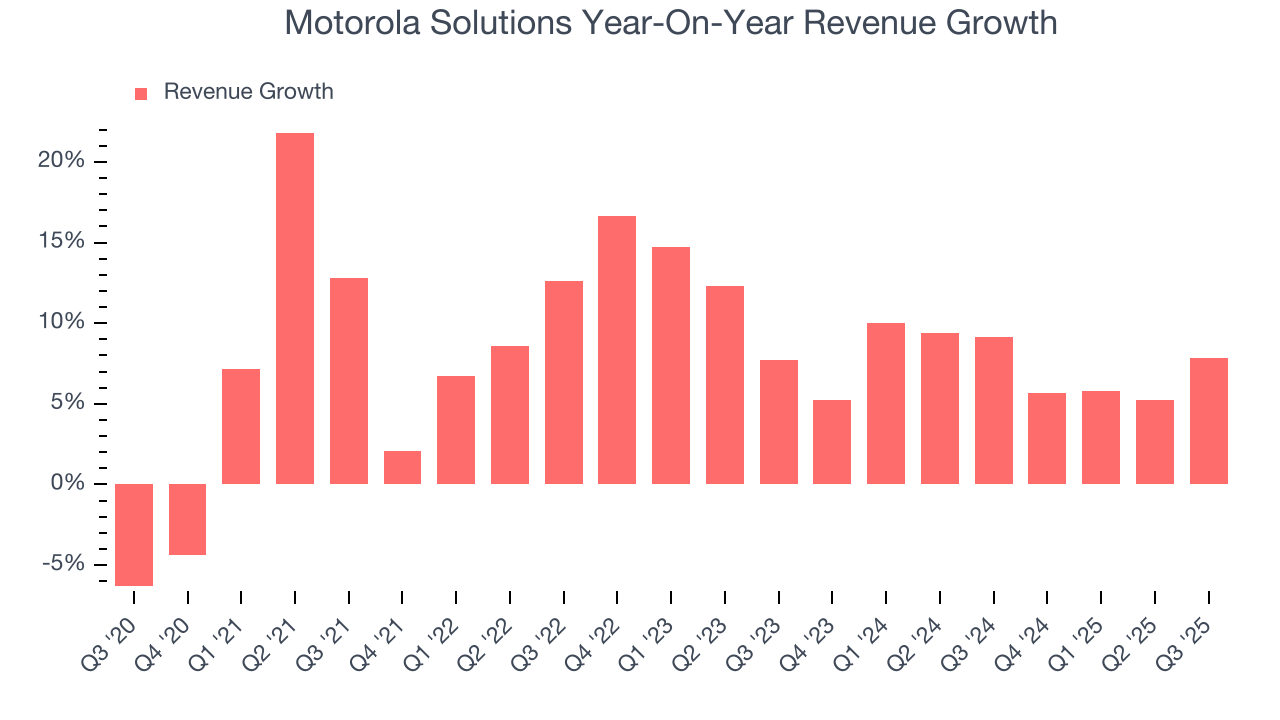

As you can see below, Motorola Solutions grew its sales at a solid 8.5% compounded annual growth rate over the last five years. This is a good starting point for our analysis because it shows Motorola Solutions’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Motorola Solutions’s annualized revenue growth of 7.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Motorola Solutions reported year-on-year revenue growth of 7.8%, and its $3.01 billion of revenue exceeded Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 9.2% over the next 12 months, an improvement versus the last two years. This projection is particularly healthy for a company of its scale and indicates its newer products and services will fuel better top-line performance.

6. Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Motorola Solutions has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average adjusted operating margin of 27.8%.

Analyzing the trend in its profitability, Motorola Solutions’s adjusted operating margin rose by 3.7 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Motorola Solutions generated an adjusted operating margin profit margin of 30.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

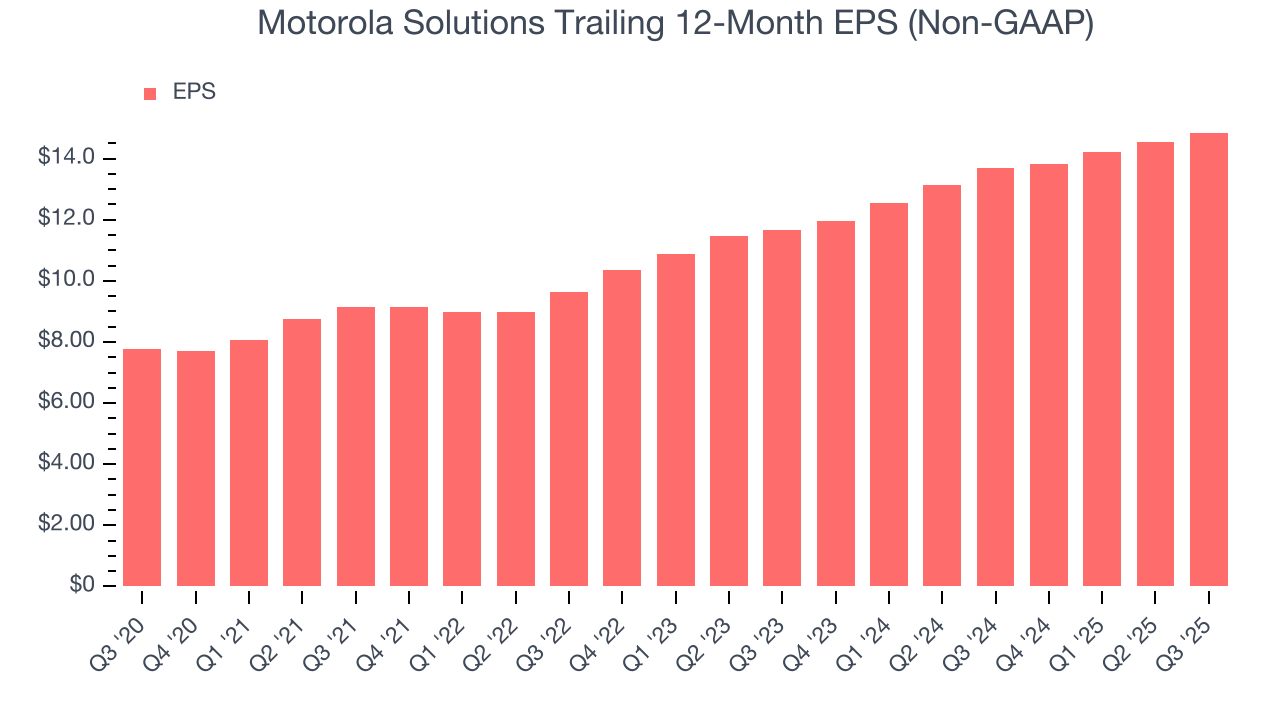

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Motorola Solutions’s EPS grew at a spectacular 13.8% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

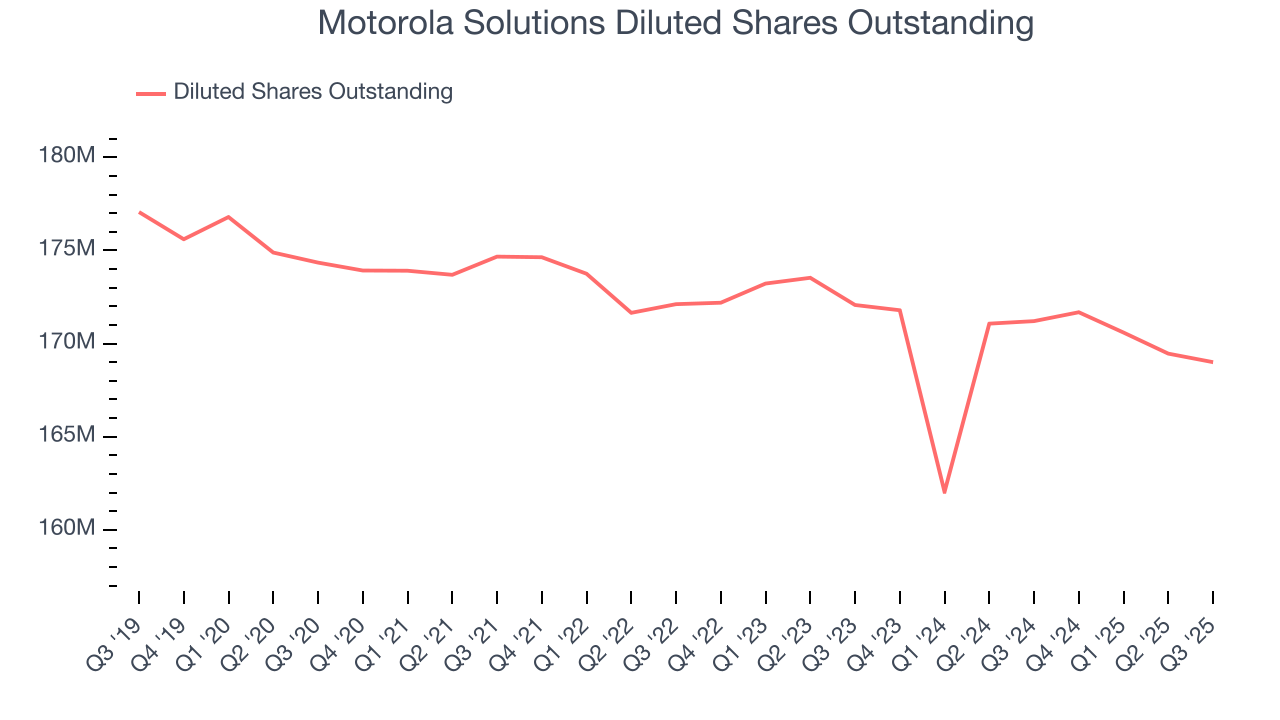

We can take a deeper look into Motorola Solutions’s earnings to better understand the drivers of its performance. As we mentioned earlier, Motorola Solutions’s adjusted operating margin was flat this quarter but expanded by 3.7 percentage points over the last five years. On top of that, its share count shrank by 3.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Motorola Solutions, its two-year annual EPS growth of 12.9% is similar to its five-year trend, implying strong and stable earnings power.

In Q3, Motorola Solutions reported adjusted EPS of $4.06, up from $3.74 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects Motorola Solutions’s full-year EPS of $14.85 to grow 5.9%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Motorola Solutions has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 18.8% over the last five years.

Taking a step back, we can see that Motorola Solutions’s margin expanded by 1.7 percentage points during that time. This is encouraging because it gives the company more optionality.

Motorola Solutions’s free cash flow clocked in at $733 million in Q3, equivalent to a 24.4% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

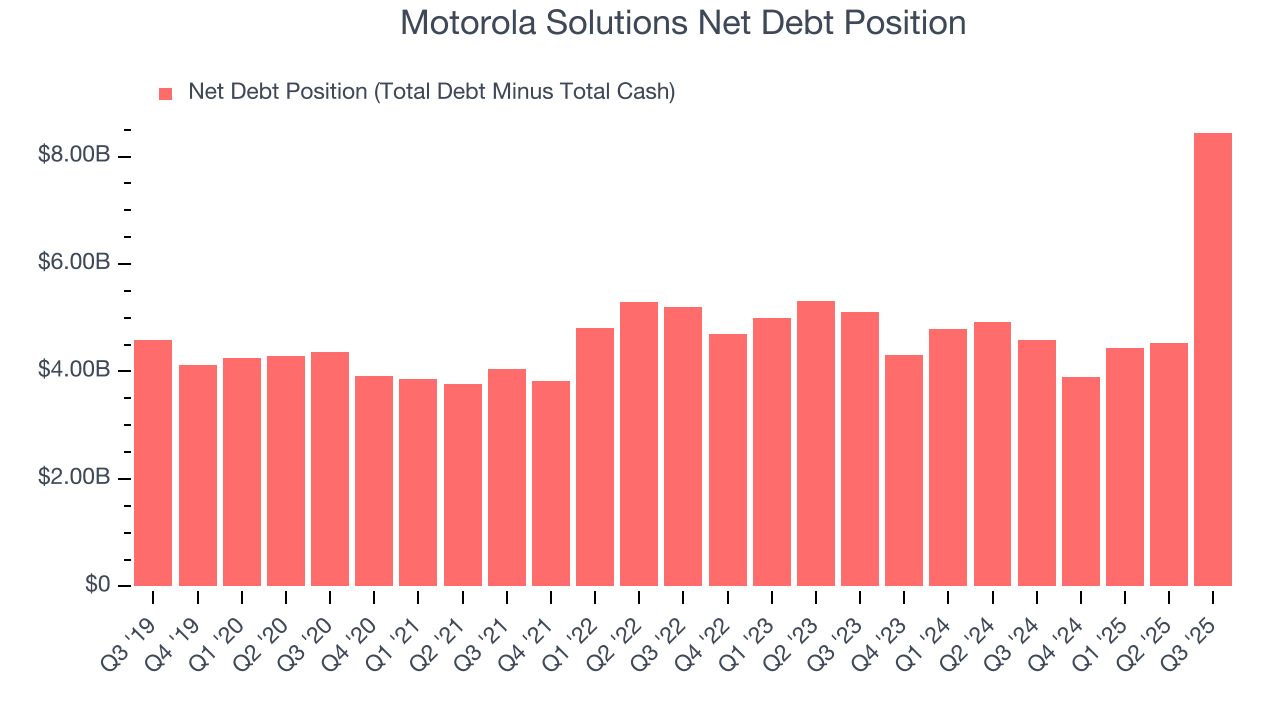

9. Balance Sheet Assessment

Motorola Solutions reported $894 million of cash and $9.34 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.66 billion of EBITDA over the last 12 months, we view Motorola Solutions’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $86 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Motorola Solutions’s Q3 Results

It was good to see Motorola Solutions beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $383.80 immediately after reporting.

11. Is Now The Time To Buy Motorola Solutions?

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Motorola Solutions.

There are multiple reasons why we think Motorola Solutions is an amazing business. First, the company’s revenue growth was solid over the last five years, and analysts believe it can continue growing at these levels. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive operating margins show it has a highly efficient business model.

Motorola Solutions’s P/E ratio based on the next 12 months is 24.4x. Analyzing the business services landscape today, Motorola Solutions’s positive attributes shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $490.10 on the company (compared to the current share price of $383.80), implying they see 27.7% upside in buying Motorola Solutions in the short term.