Annaly Capital Management (NLY)

We wouldn’t buy Annaly Capital Management. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Annaly Capital Management Will Underperform

Operating as a real estate investment trust since 1996 with a focus on generating income from interest rate spreads, Annaly Capital Management (NYSE:NLY) is a diversified capital manager that invests in agency mortgage-backed securities, residential mortgage loans, and mortgage servicing rights.

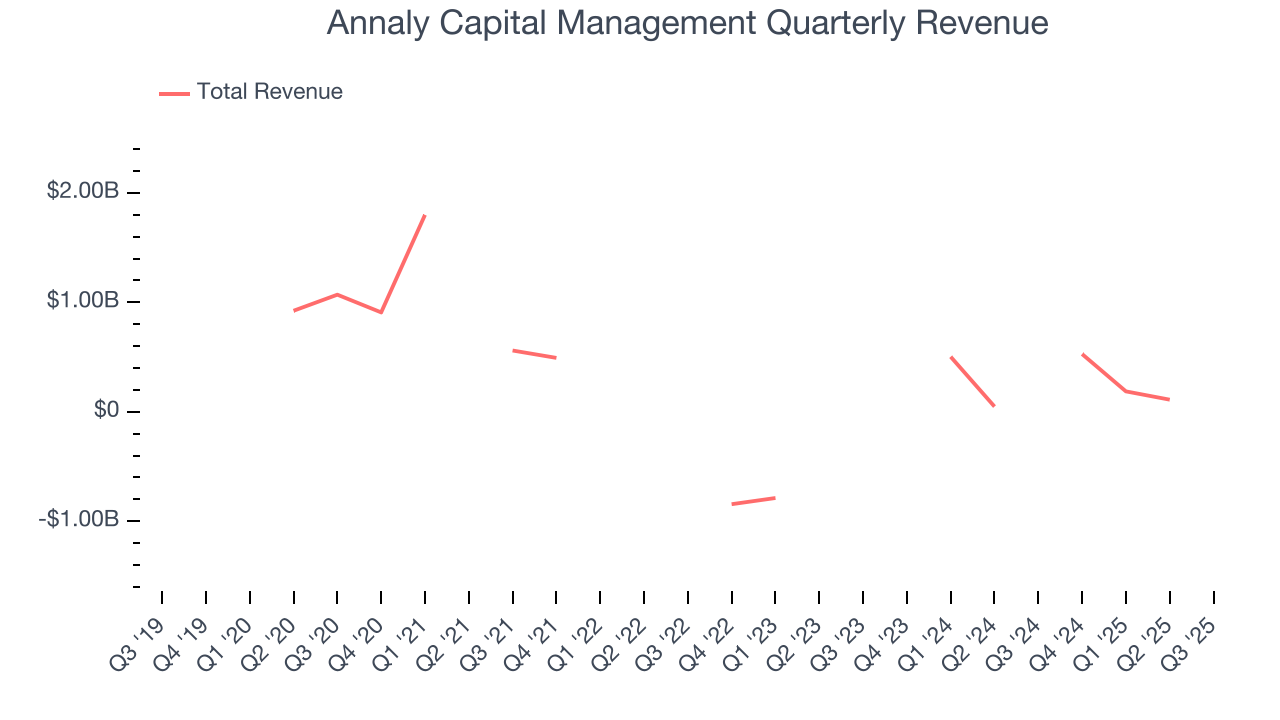

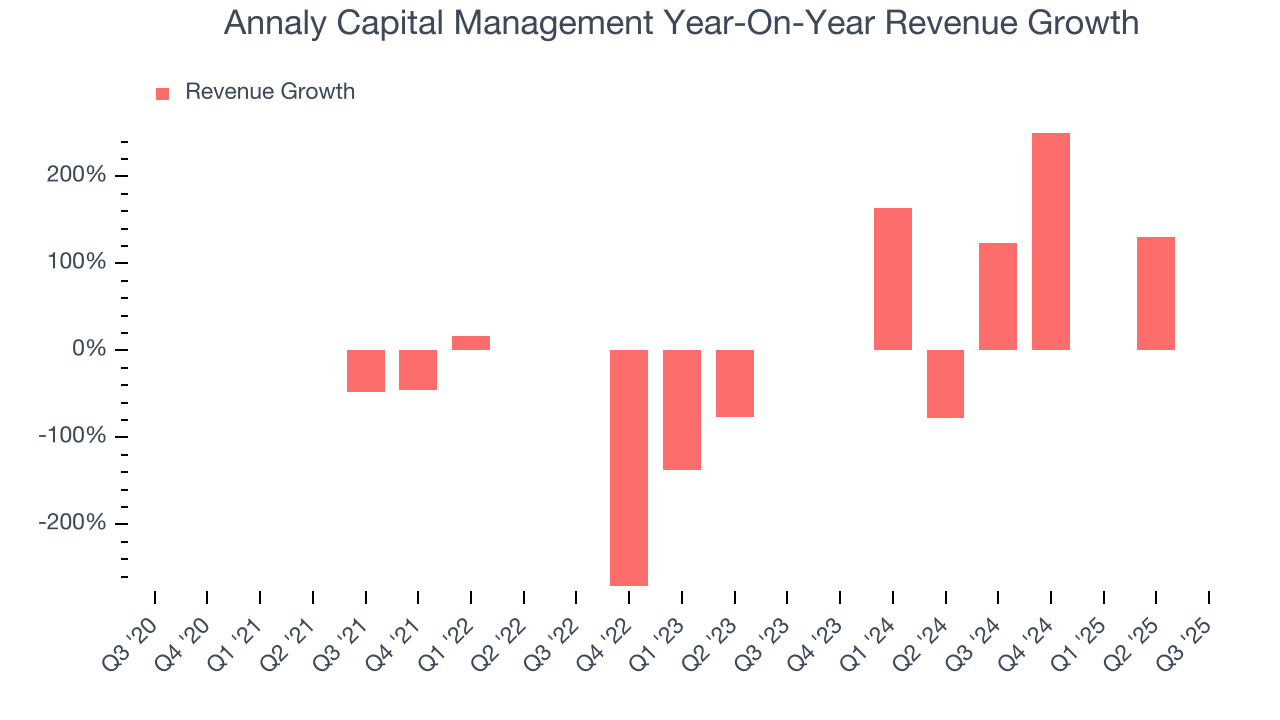

- Sales tumbled by 22% annually over the last five years, showing market trends are working against its favor during this cycle

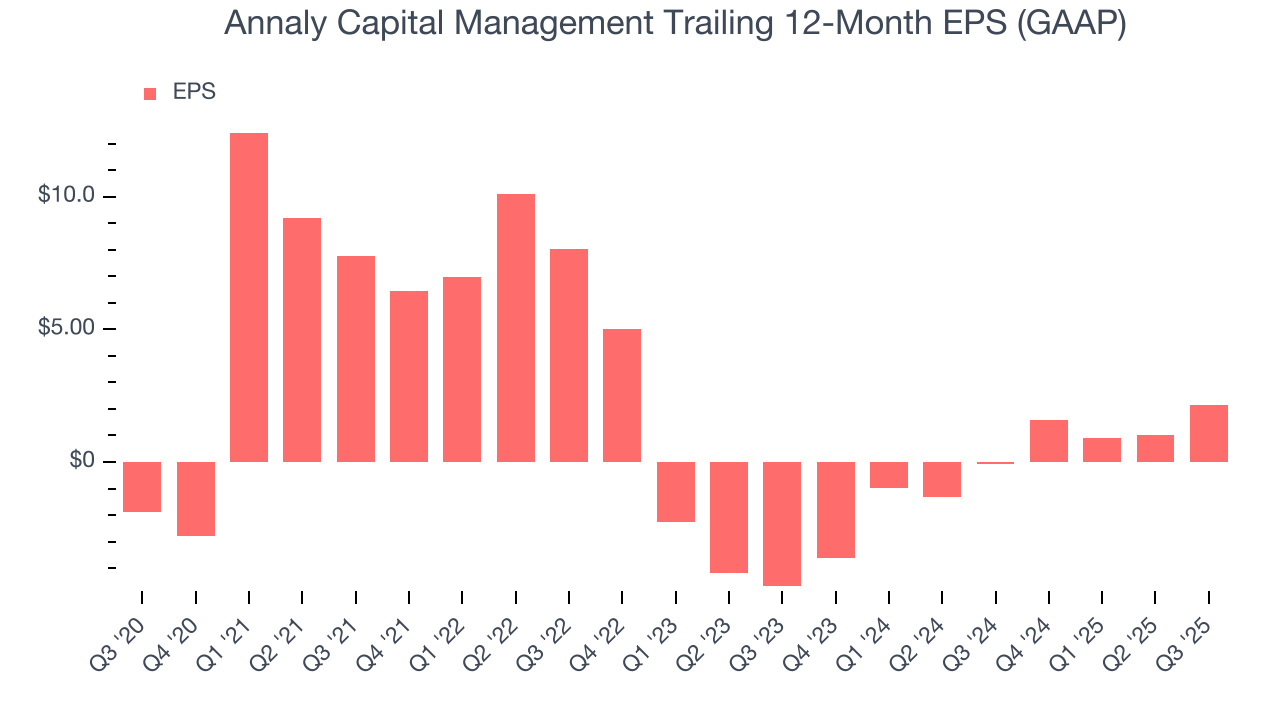

- Earnings per share have contracted by 7.3% annually over the last five years, a headwind for returns as stock prices often echo long-term EPS performance

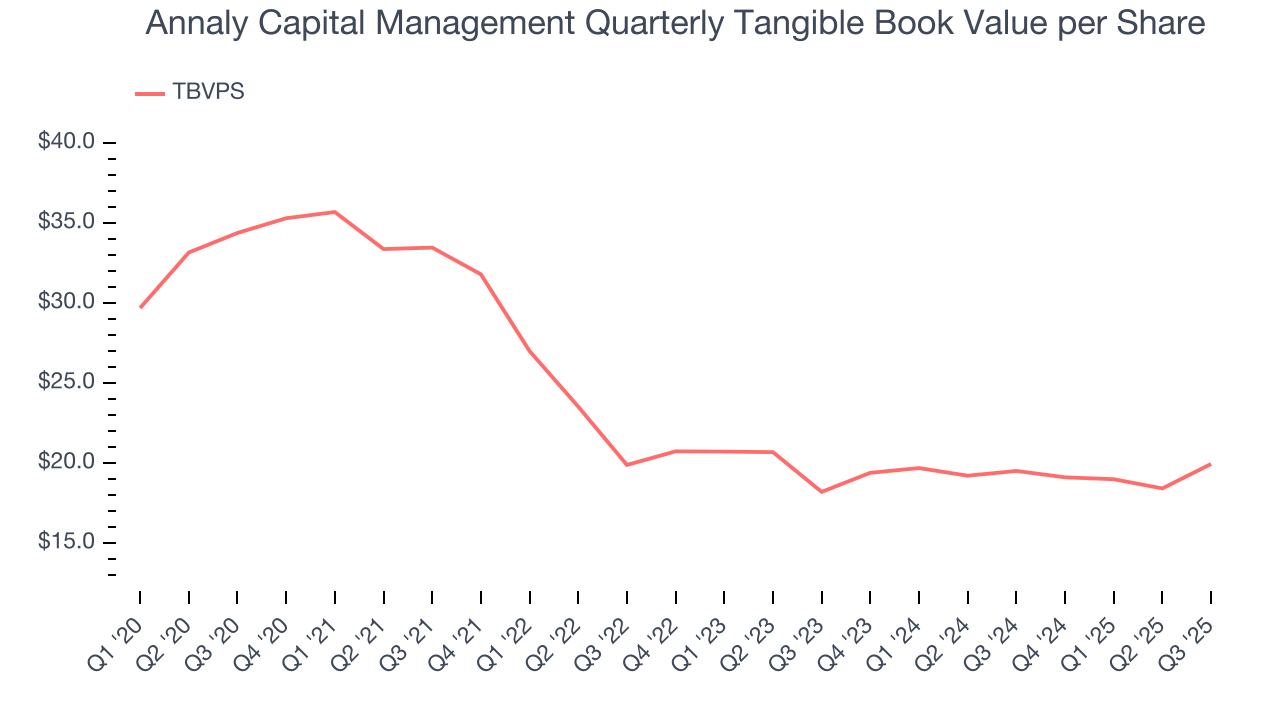

- Tangible book value per share tumbled by 11% annually over the last five years, showing banking sector trends are working against its favor during this cycle

Annaly Capital Management’s quality is lacking. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Annaly Capital Management

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Annaly Capital Management

Annaly Capital Management’s stock price of $23.73 implies a valuation ratio of 1.2x forward P/B. Annaly Capital Management’s valuation may seem like a bargain, especially when stacked up against other banking companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Annaly Capital Management (NLY) Research Report: Q3 CY2025 Update

Mortgage finance REIT Annaly Capital Management (NYSE:NLY) announced better-than-expected revenue in Q3 CY2025, with sales up 637% year on year to $885.6 million. Its GAAP profit of $1.20 per share was 5.9% above analysts’ consensus estimates.

Annaly Capital Management (NLY) Q3 CY2025 Highlights:

- Net Interest Income: $275.8 million vs analyst estimates of $452.8 million (39.1% miss)

- Net Interest Margin: 1.7% vs analyst estimates of 1.7% (4 basis point beat)

- Revenue: $885.6 million vs analyst estimates of $826.3 million (637% year-on-year growth, 7.2% beat)

- Efficiency Ratio: 5.7% (3,087.5 basis point year-on-year increase)

- EPS (GAAP): $1.20 vs analyst estimates of $1.13 (5.9% beat)

- Market Capitalization: $13.52 billion

Company Overview

Operating as a real estate investment trust since 1996 with a focus on generating income from interest rate spreads, Annaly Capital Management (NYSE:NLY) is a diversified capital manager that invests in agency mortgage-backed securities, residential mortgage loans, and mortgage servicing rights.

Annaly operates through three main investment groups, each focusing on different segments of the mortgage market. The Annaly Agency Group invests in mortgage-backed securities guaranteed by government-sponsored enterprises like Fannie Mae and Freddie Mac. The Residential Credit Group focuses on non-Agency residential whole loans and securitized products, while the Mortgage Servicing Rights Group invests in the rights to service residential mortgage loans.

The company finances its investments primarily through repurchase agreements with multiple counterparties to diversify exposure. Its wholly-owned subsidiary, Arcola Securities, provides direct access to third-party funding as a FINRA member broker-dealer. Another subsidiary, Onslow Bay Financial, sponsors private-label securitizations that help finance residential mortgage loan investments.

Annaly has established strategic relationships with key mortgage loan originators and aggregators, including major banks, to source proprietary originations. A notable partnership includes a joint venture with GIC Private Limited, a sovereign wealth fund, to invest in residential credit assets. The company has also partnered with Fifth Wall Ventures to identify innovative real estate technology platforms.

As a Real Estate Investment Trust (REIT), Annaly must distribute at least 90% of its taxable income to shareholders annually. This structure provides tax advantages but requires the company to carefully monitor its investments to maintain REIT qualification. The company operates within a complex regulatory framework that includes oversight from FINRA, the SEC, and various state agencies, particularly for its subsidiaries involved in mortgage aggregation and servicing.

4. Thrifts & Mortgage Finance

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

Annaly's main competitors include other mortgage REITs such as AGNC Investment Corp (NASDAQ:AGNC), Starwood Property Trust (NYSE:STWD), and New Residential Investment Corp (NYSE:NRZ), as well as diversified REITs and financial institutions that invest in mortgage-backed securities.

5. Sales Growth

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. Annaly Capital Management struggled to consistently generate demand over the last five years as its revenue dropped at a 22% annual rate. This wasn’t a great result, but there are still things to like about Annaly Capital Management.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Annaly Capital Management’s annualized revenue growth of 369% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Annaly Capital Management reported magnificent year-on-year revenue growth of 637%, and its $885.6 million of revenue beat Wall Street’s estimates by 7.2%.

Net interest income made up 54.7% of the company’s total revenue during the last five years, meaning Annaly Capital Management’s growth drivers strike a balance between lending and non-lending activities.

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

6. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Annaly Capital Management’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Annaly Capital Management, its two-year annual EPS growth of 56.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Annaly Capital Management reported EPS of $1.20, up from $0.05 in the same quarter last year. This print beat analysts’ estimates by 5.9%. Over the next 12 months, Wall Street expects Annaly Capital Management’s full-year EPS of $2.16 to grow 47%.

7. Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

When analyzing banks, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value by removing intangible assets of debatable liquidation worth. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to M&A or accounting rules allowing for loan losses to be spread out.

Annaly Capital Management’s TBVPS declined at a 10.3% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 4.7% annually over the last two years from $18.22 to $19.96 per share.

Over the next 12 months, Consensus estimates call for Annaly Capital Management’s TBVPS to shrink by 4.6% to $19.05, a sour projection.

8. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Annaly Capital Management has averaged an ROE of 7.3%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

9. Key Takeaways from Annaly Capital Management’s Q3 Results

We were impressed by how significantly Annaly Capital Management blew past analysts’ revenue expectations this quarter despite a net interest income miss. EPS also beat. Zooming out, we think this was a mixed quarter. The stock remained flat at $21.31 immediately after reporting.

10. Is Now The Time To Buy Annaly Capital Management?

Updated: January 20, 2026 at 11:38 PM EST

Before making an investment decision, investors should account for Annaly Capital Management’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies supporting the economy, but in the case of Annaly Capital Management, we’ll be cheering from the sidelines. First off, its revenue has declined over the last five years. On top of that, Annaly Capital Management’s TBVPS has declined over the last five years, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

Annaly Capital Management’s P/B ratio based on the next 12 months is 1.2x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $23.07 on the company (compared to the current share price of $23.73), implying they don’t see much short-term potential in Annaly Capital Management.