ServiceNow (NOW)

ServiceNow is a great business. Its stellar unit economics and efficient sales strategy tee it up for immense long-term profits.― StockStory Analyst Team

1. News

2. Summary

Why We Like ServiceNow

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE:NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

- Impressive 22.3% annual revenue growth over the last two years indicates it’s winning market share

- Healthy operating margin shows it’s a well-run company with efficient processes, and its operating leverage amplified its profits over the last year

ServiceNow is a top-tier company. The price looks fair when considering its quality, so this might be a favorable time to invest in some shares.

Why Is Now The Time To Buy ServiceNow?

High Quality

Investable

Underperform

Why Is Now The Time To Buy ServiceNow?

At $132.38 per share, ServiceNow trades at 9.5x forward price-to-sales. Many software names may carry a lower valuation multiple, but ServiceNow’s price is fair given its business quality.

By definition, where you buy a stock impacts returns. Still, our extensive analysis shows that investors should worry much more about business quality than entry price if the ultimate goal is long-term returns.

3. ServiceNow (NOW) Research Report: Q4 CY2025 Update

Enterprise workflow automation company ServiceNow (NYSE:NOW) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 20.7% year on year to $3.57 billion. Its non-GAAP profit of $0.92 per share was 3.9% above analysts’ consensus estimates.

ServiceNow (NOW) Q4 CY2025 Highlights:

- Revenue: $3.57 billion vs analyst estimates of $3.53 billion (20.7% year-on-year growth, 1% beat)

- Adjusted EPS: $0.92 vs analyst estimates of $0.89 (3.9% beat)

- Adjusted Operating Income: $1.1 billion vs analyst estimates of $1.07 billion (30.9% margin, 3.3% beat)

- Operating Margin: 12.4%, in line with the same quarter last year

- Free Cash Flow Margin: 57%, up from 17.4% in the previous quarter

- cRPO (current remaining performance obligations): $12.85 billion (21% constant-current growth, in line)

- Market Capitalization: $136.7 billion

Company Overview

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE:NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

The company's flagship product, the Now Platform, serves as a central digital command center for enterprises, connecting disparate systems and breaking down departmental silos. Rather than requiring organizations to juggle multiple applications for different functions, ServiceNow's platform integrates these capabilities through a unified interface. For example, when an employee needs a new laptop, the platform can automatically route the request, track the approval process, update inventory systems, and schedule delivery—all without manual intervention.

ServiceNow's offerings are organized into four main categories: Technology Workflows for IT departments, Customer and Industry Workflows for service delivery, Employee Workflows for HR and workplace services, and Creator Workflows that allow businesses to build custom applications. The company has heavily invested in AI capabilities through its "Now Assist" solutions, which can summarize incidents, generate knowledge articles, and even create code with minimal human input.

The company generates revenue primarily through subscription-based licensing of its cloud software. It targets large enterprises across industries ranging from healthcare and manufacturing to financial services and government agencies. ServiceNow enhances its platform with biannual releases that introduce new features and capabilities, maintaining technological relevance in the rapidly evolving enterprise software market.

4. Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

ServiceNow competes with large enterprise software vendors like Salesforce (NYSE:CRM), Microsoft (NASDAQ:MSFT), and Oracle (NYSE:ORCL) in various segments of its business. In IT service management, it faces competition from Atlassian's Jira Service Management (NASDAQ:TEAM) and BMC Software, while in customer service it competes with Zendesk (private) and Freshworks (NASDAQ:FRSH).

5. Revenue Growth

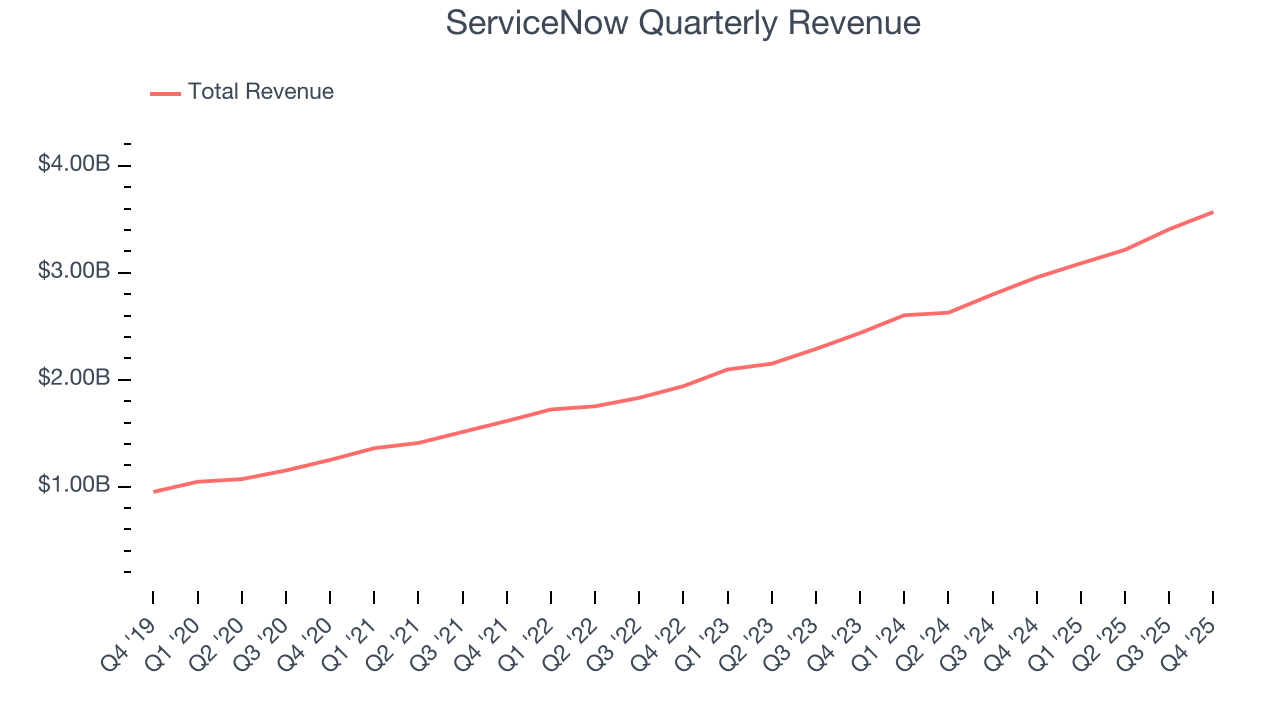

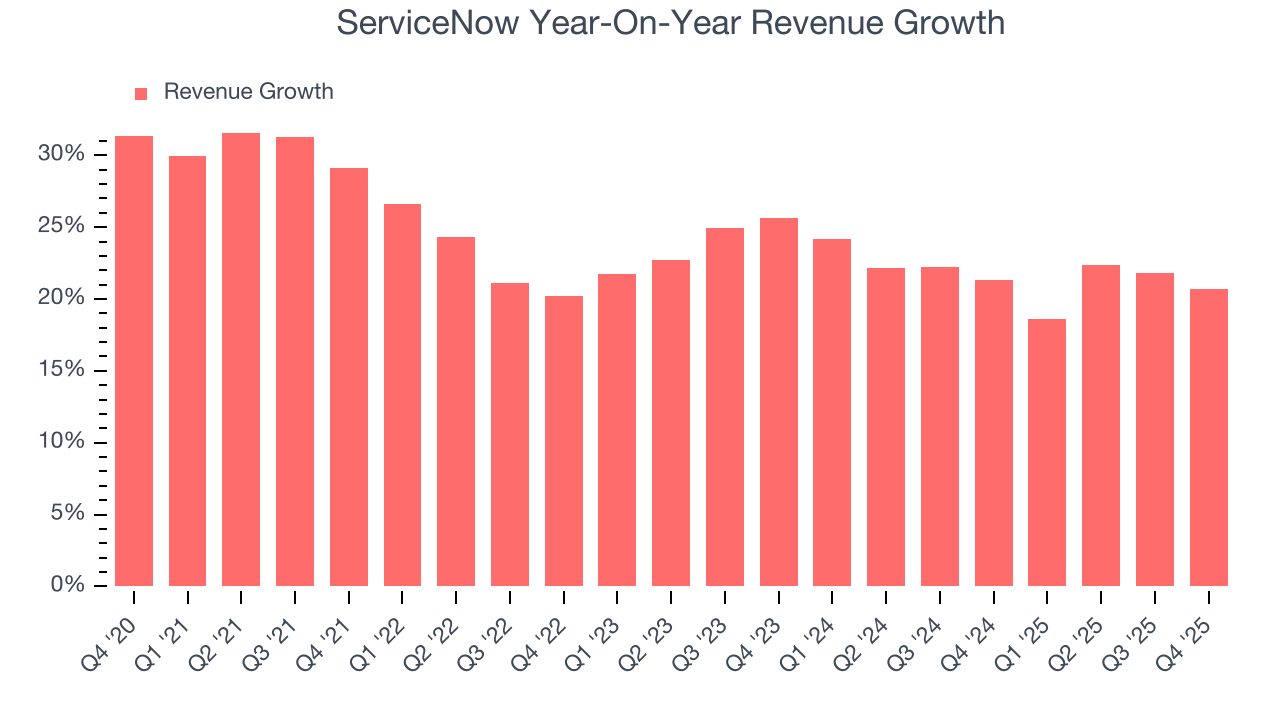

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, ServiceNow’s sales grew at a solid 24.1% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. ServiceNow’s annualized revenue growth of 21.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, ServiceNow reported robust year-on-year revenue growth of 20.7%, and its $3.57 billion of revenue topped Wall Street estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 18.2% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and implies the market is baking in success for its products and services.

6. Customer Acquisition Efficiency

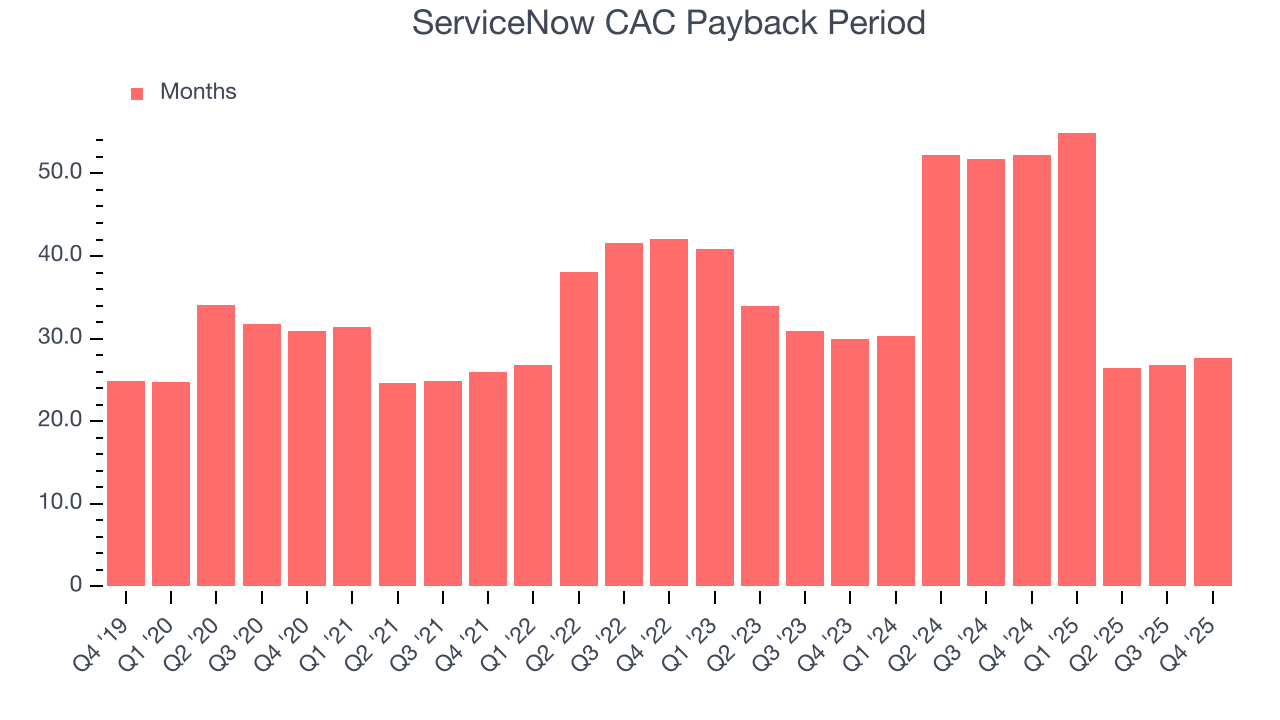

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

ServiceNow is very efficient at acquiring new customers, and its CAC payback period checked in at 27.6 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give ServiceNow more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

7. Gross Margin & Pricing Power

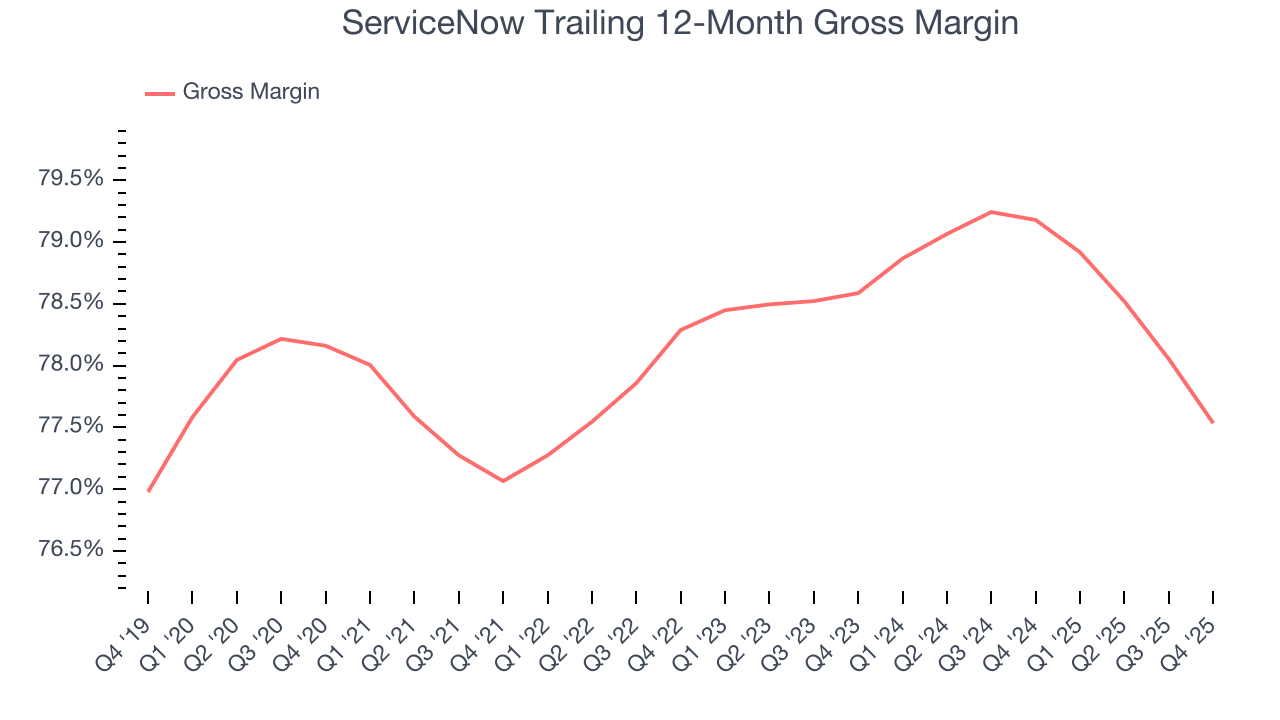

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

ServiceNow’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 77.5% gross margin over the last year. That means ServiceNow only paid its providers $22.47 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. ServiceNow has seen gross margins decline by 1.1 percentage points over the last 2 year, which is poor compared to software peers.

ServiceNow’s gross profit margin came in at 76.6% this quarter, marking a 2 percentage point decrease from 78.7% in the same quarter last year. ServiceNow’s full-year margin has also been trending down over the past 12 months, decreasing by 1.6 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

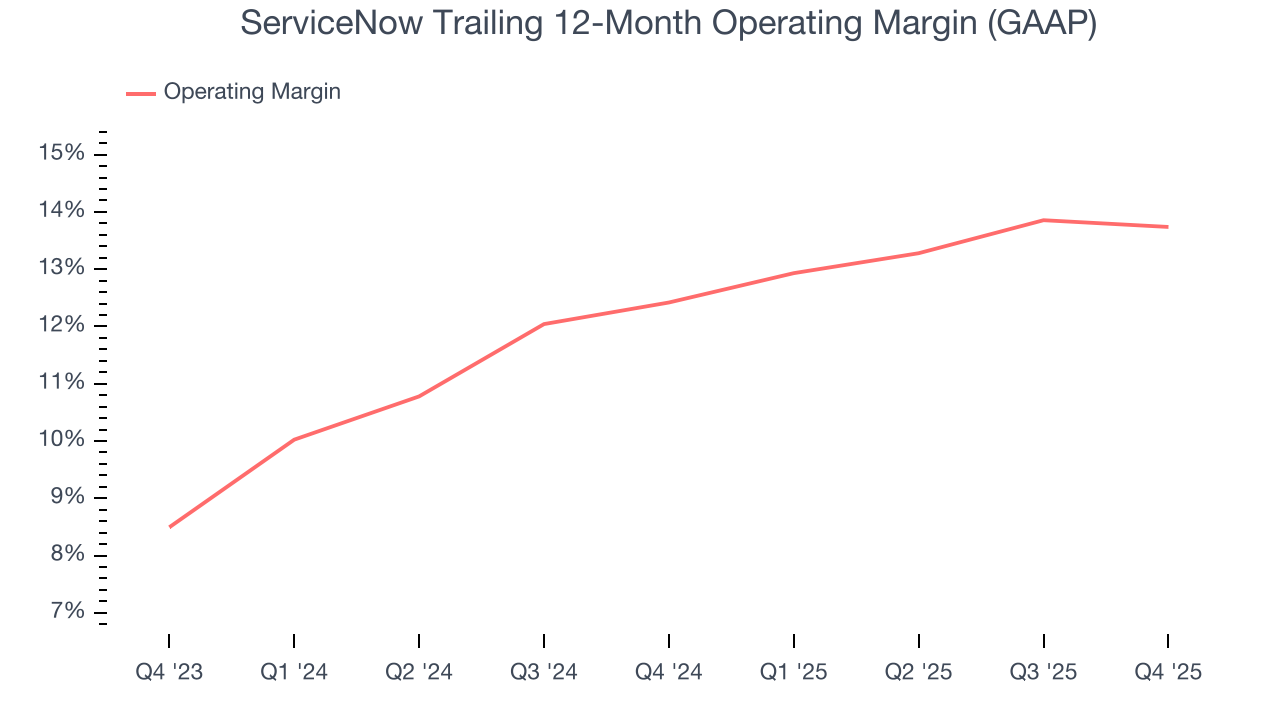

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

ServiceNow has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 13.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, ServiceNow’s operating margin rose by 1.3 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, ServiceNow generated an operating margin profit margin of 12.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

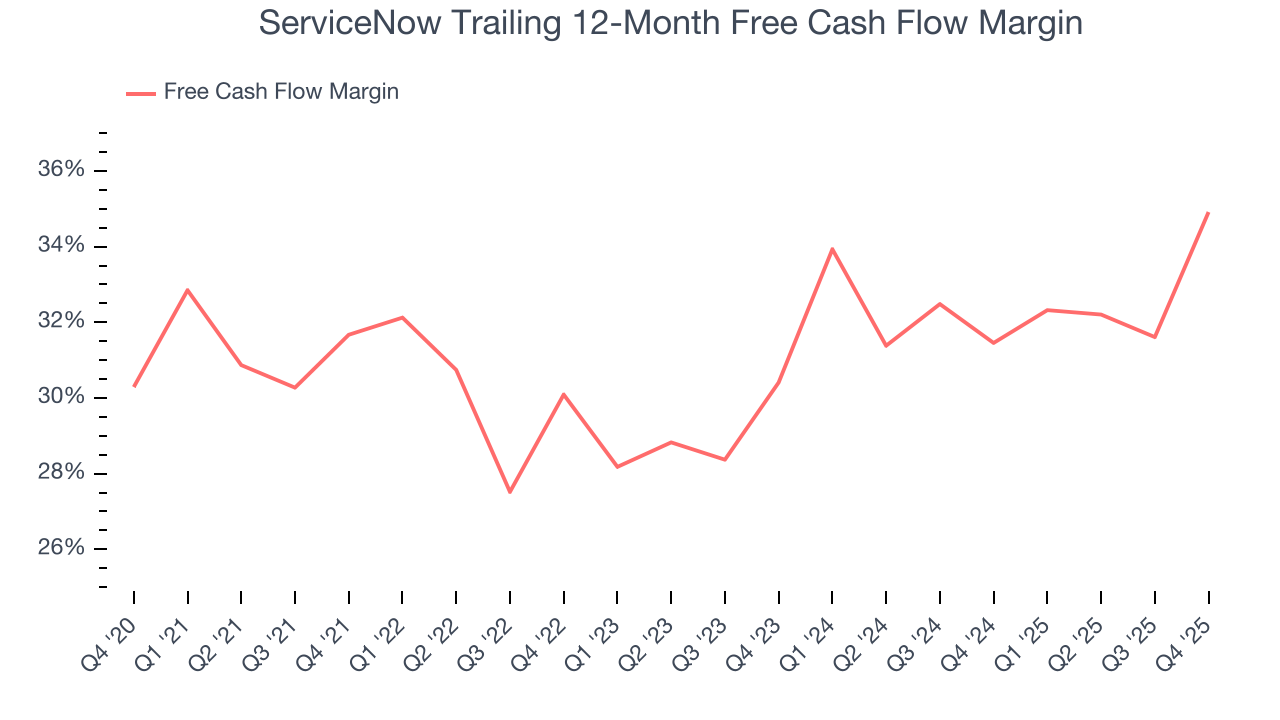

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ServiceNow has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 34.9% over the last year.

ServiceNow’s free cash flow clocked in at $2.03 billion in Q4, equivalent to a 57% margin. This result was good as its margin was 9.6 percentage points higher than in the same quarter last year. Its cash profitability was also above its one-year level, and we hope the company can build on this trend.

Over the next year, analysts’ consensus estimates show they’re expecting ServiceNow’s free cash flow margin of 34.9% for the last 12 months to remain the same.

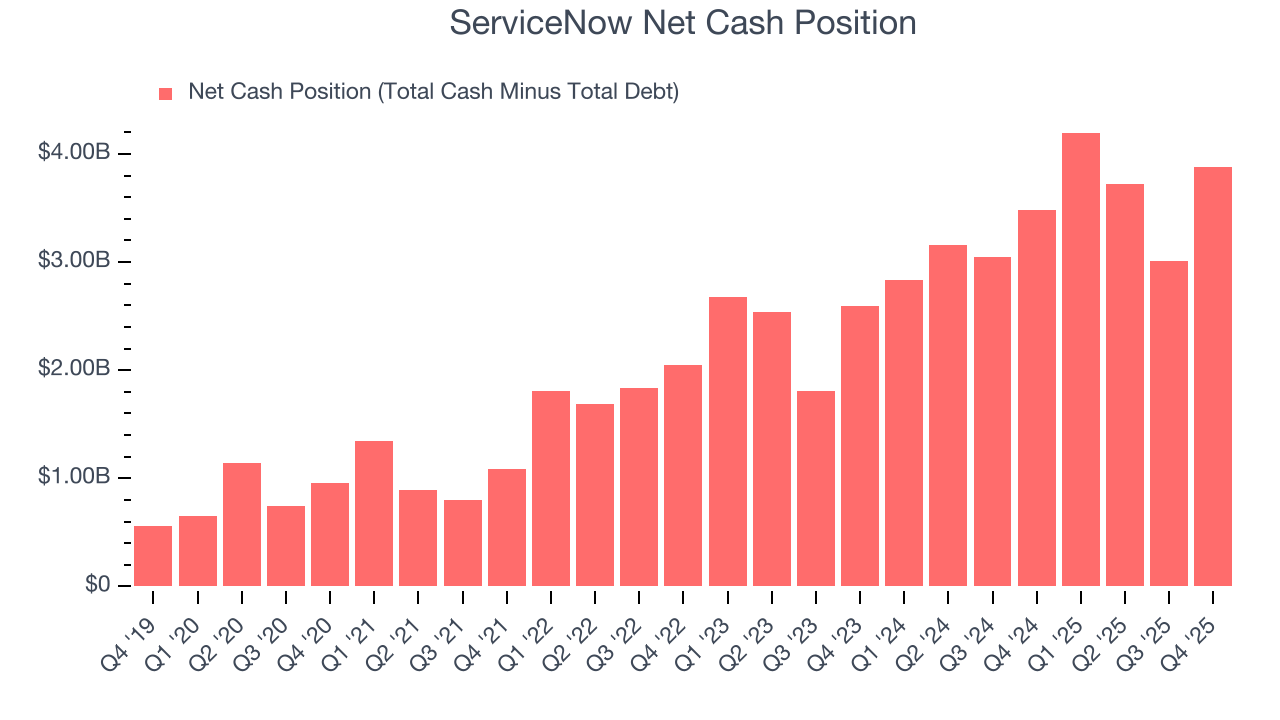

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

ServiceNow is a profitable, well-capitalized company with $6.28 billion of cash and $2.4 billion of debt on its balance sheet. This $3.88 billion net cash position is 2.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from ServiceNow’s Q4 Results

Current RPO (remaining performance obligations) was just in line with expectations, and ServiceNow only narrowly topped analysts’ revenue expectations this quarter. While adjusted operating profit in the quarter beat and subscription revenue guidance was slightly ahead, the overall results were not convincingly ahead of Wall Street's estimates enough to ease fears that AI may be a net negative for the company. The stock traded down 5.4% to $123.05 immediately following the results.

12. Is Now The Time To Buy ServiceNow?

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in ServiceNow.

There are multiple reasons why we think ServiceNow is an amazing business. First of all, the company’s revenue growth was solid over the last five years. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its bountiful generation of free cash flow empowers it to invest in growth initiatives. Additionally, ServiceNow’s strong operating margins show it’s a well-run business.

ServiceNow’s price-to-sales ratio based on the next 12 months is 8.6x. Looking at the software landscape today, ServiceNow’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $206.29 on the company (compared to the current share price of $123.05), implying they see 67.7% upside in buying ServiceNow in the short term.