Enpro (NPO)

Enpro doesn’t excite us. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why Enpro Is Not Exciting

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE:NPO) designs, manufactures, and sells products used for machinery in various industries.

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last five years

- Underwhelming 6.5% return on capital reflects management’s difficulties in finding profitable growth opportunities

- On the plus side, its earnings per share have outperformed its peers over the last five years, increasing by 25.6% annually

Enpro’s quality isn’t great. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Enpro

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Enpro

Enpro is trading at $235.15 per share, or 28.3x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the weaker revenue growth you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Enpro (NPO) Research Report: Q3 CY2025 Update

Industrial technology solutions provider EnPro Industries (NYSE:NPO) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 9.9% year on year to $286.6 million. Its non-GAAP profit of $1.99 per share was 1.7% above analysts’ consensus estimates.

Enpro (NPO) Q3 CY2025 Highlights:

- Revenue: $286.6 million vs analyst estimates of $276.6 million (9.9% year-on-year growth, 3.6% beat)

- Adjusted EPS: $1.99 vs analyst estimates of $1.96 (1.7% beat)

- Adjusted EBITDA: $69.3 million vs analyst estimates of $68.37 million (24.2% margin, 1.4% beat)

- Management reiterated its full-year Adjusted EPS guidance of $7.85 at the midpoint

- EBITDA guidance for the full year is $275 million at the midpoint, in line with analyst expectations

- Operating Margin: 14.3%, up from 13.2% in the same quarter last year

- Free Cash Flow Margin: 18.2%, similar to the same quarter last year

- Market Capitalization: $4.92 billion

Company Overview

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE:NPO) designs, manufactures, and sells products used for machinery in various industries.

Established in 2002 as a spin-off from Goodrich Corporation, Enpro has developed into a company focusing on applications across various markets, including semiconductor, photonics, industrial process, aerospace, food, biopharmaceuticals, and life sciences. Enpro's business model centers on the design, development, manufacture, and marketing of products and solutions for industrial applications. The company operates through two main segments: Sealing Technologies and Advanced Surface Technologies.

The Sealing Technologies segment, which includes Garlock, Technetics, and STEMCO, produces a range of sealing products such as gaskets, dynamic seals, and compression packing. These products are used in industries like chemical processing, nuclear energy, and aerospace. The Advanced Surface Technologies segment, comprising NxEdge, Technetics Semi, LeanTeq, and Alluxa, provides services and products for the semiconductor industry and other high-tech sectors.

The company has made several purchases to expand its product offerings and market presence. Notable acquisitions include NxEdge in 2021, which increased Enpro's involvement in the semiconductor industry, and Alluxa in 2020, which added optical filters and thin-film coatings to its product line.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Parker-Hannifin (NYSE:PH), Timken (NYSE:TKR), and Flowserve (NYSE:FLS).

5. Revenue Growth

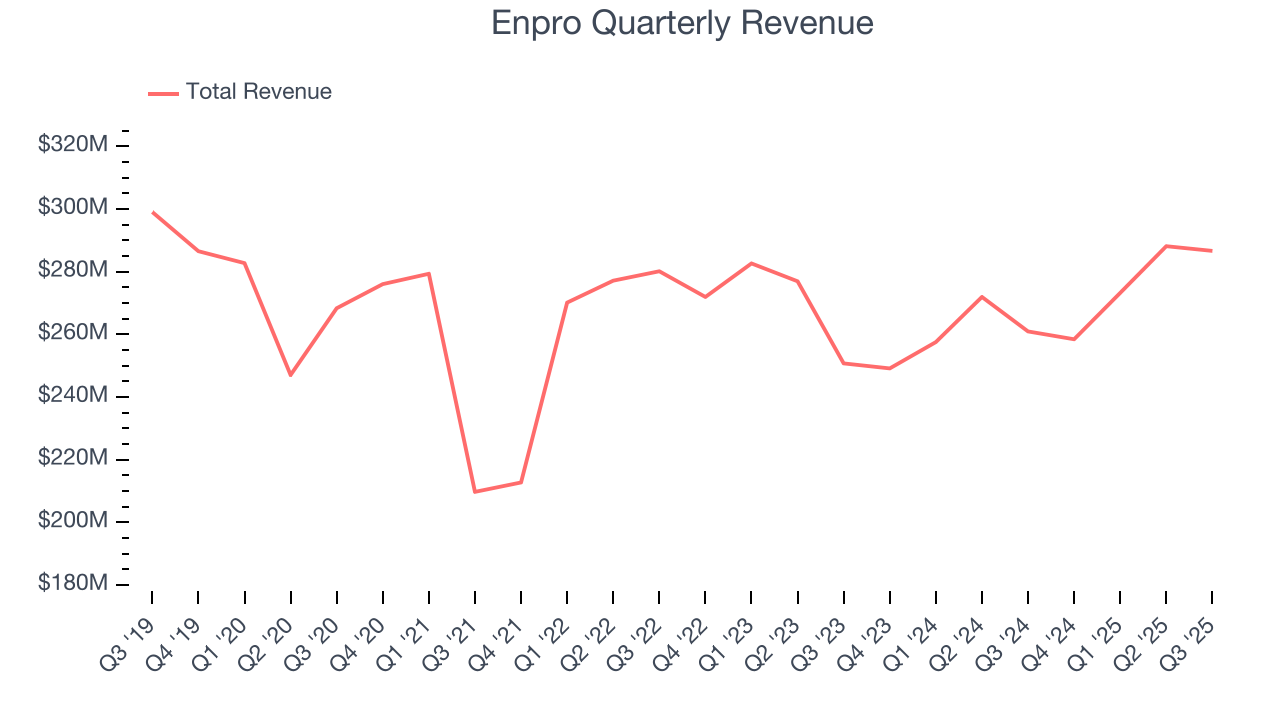

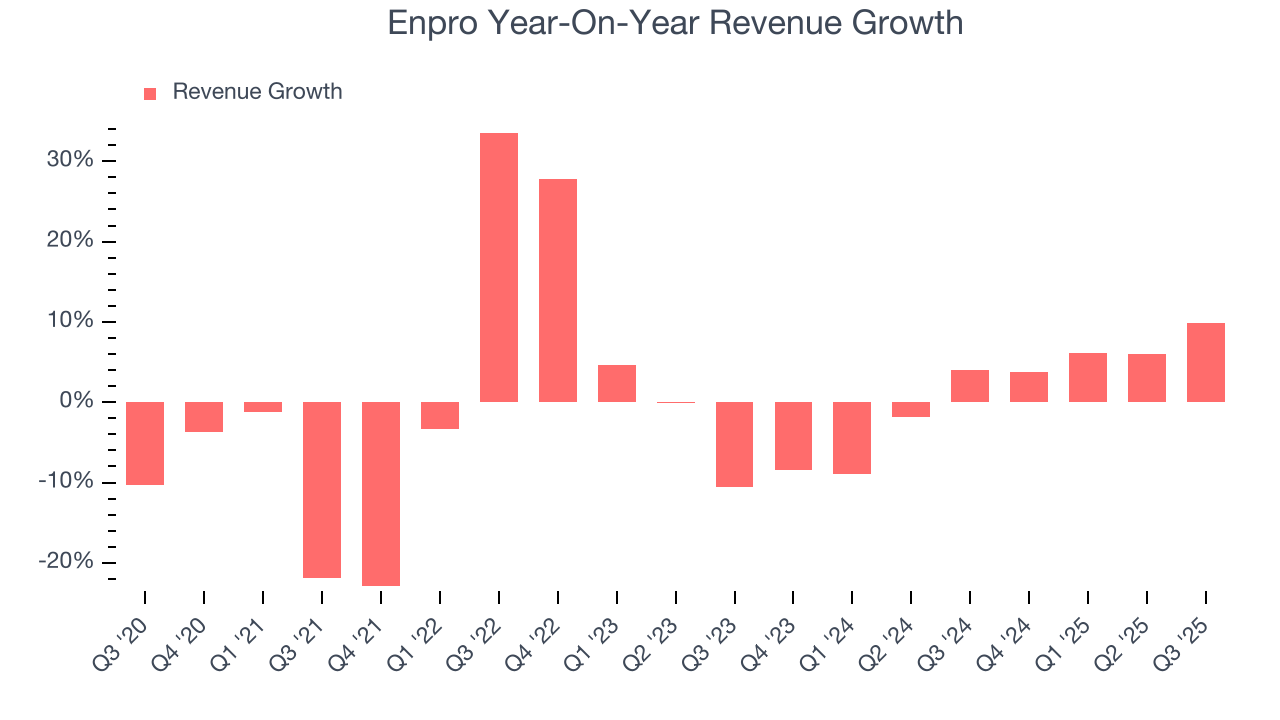

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Enpro struggled to consistently increase demand as its $1.11 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Enpro’s annualized revenue growth of 1.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Enpro reported year-on-year revenue growth of 9.9%, and its $286.6 million of revenue exceeded Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

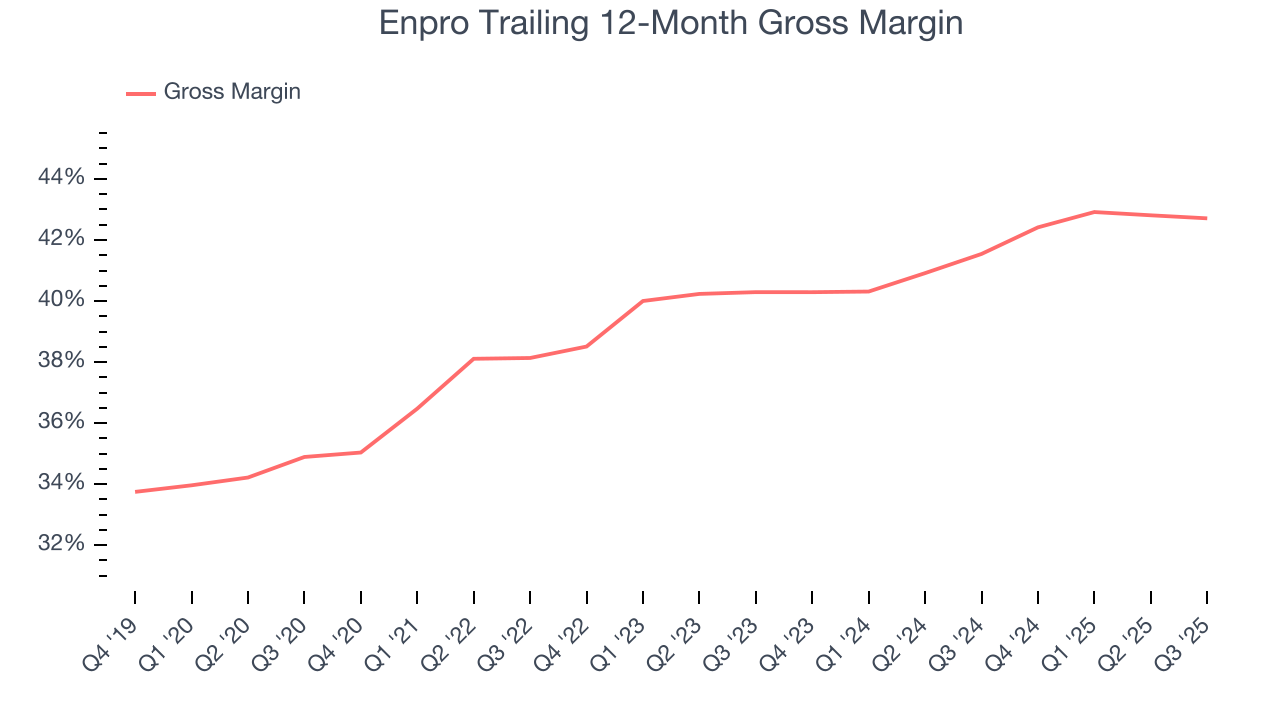

Enpro’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 40.3% gross margin over the last five years. Said differently, roughly $40.32 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Enpro’s gross profit margin came in at 41.9% this quarter, in line with the same quarter last year. Zooming out, Enpro’s full-year margin has been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

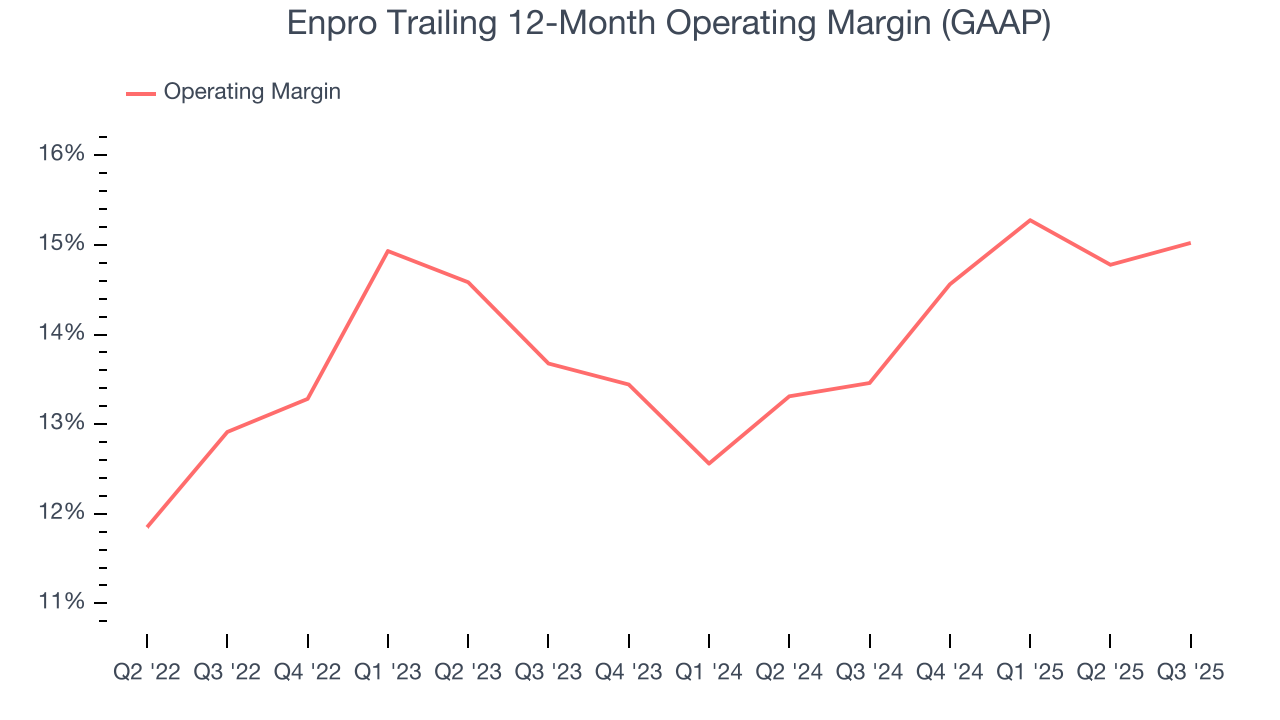

Enpro has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Enpro’s operating margin rose by 4.2 percentage points over the last five years, showing its efficiency has improved.

This quarter, Enpro generated an operating margin profit margin of 14.3%, up 1.1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

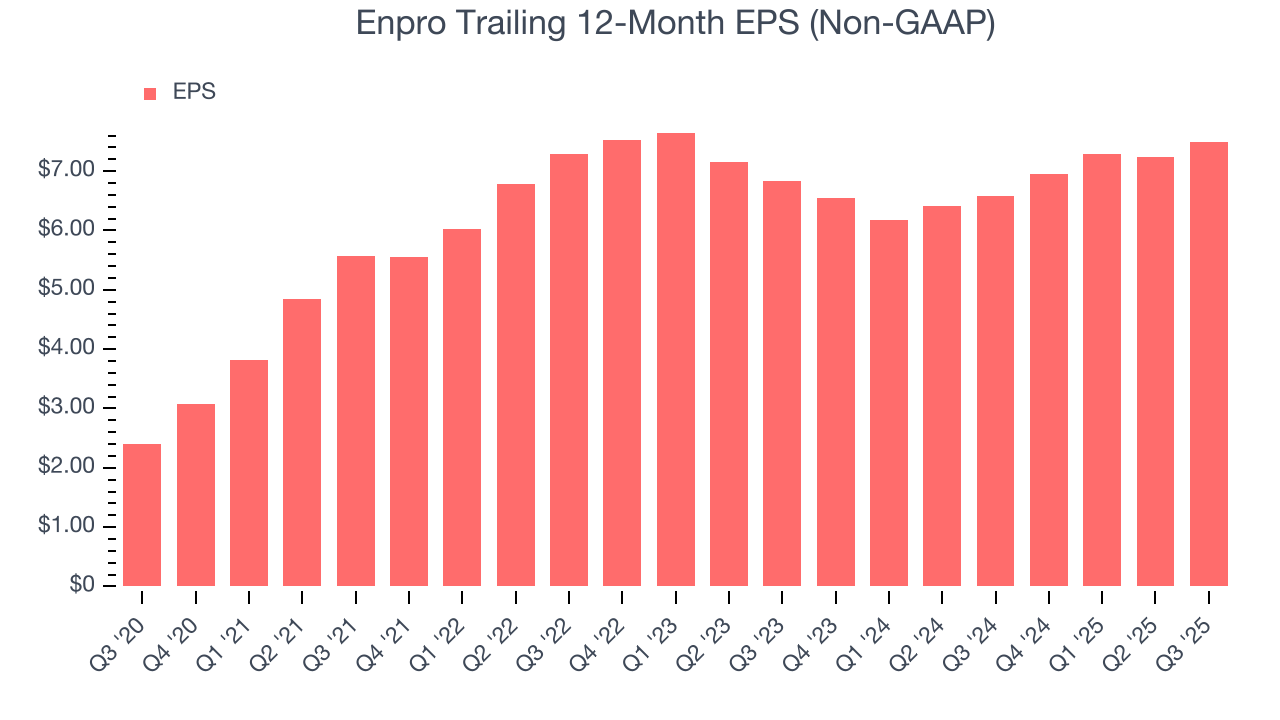

Enpro’s EPS grew at an astounding 25.6% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

We can take a deeper look into Enpro’s earnings to better understand the drivers of its performance. As we mentioned earlier, Enpro’s operating margin expanded by 4.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Enpro, its two-year annual EPS growth of 4.7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Enpro reported adjusted EPS of $1.99, up from $1.74 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects Enpro’s full-year EPS of $7.49 to grow 16.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

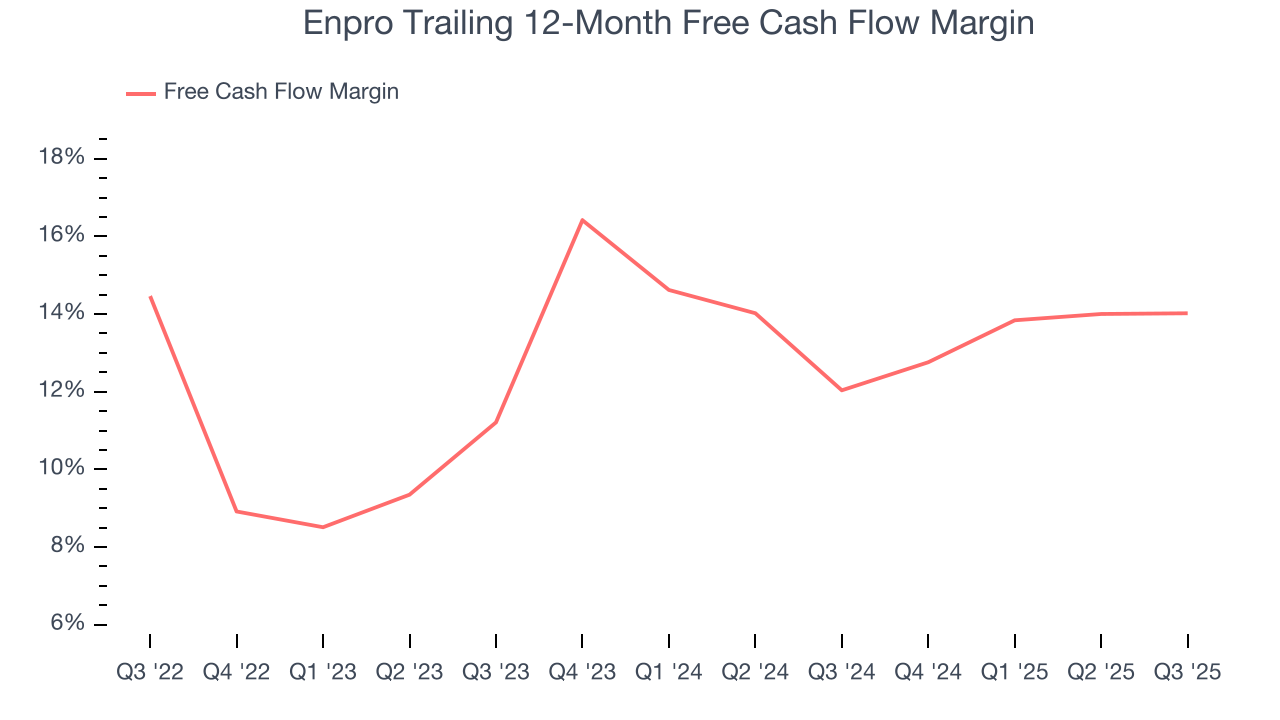

Enpro has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.8% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Enpro’s margin expanded by 8.4 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Enpro’s free cash flow clocked in at $52.1 million in Q3, equivalent to a 18.2% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

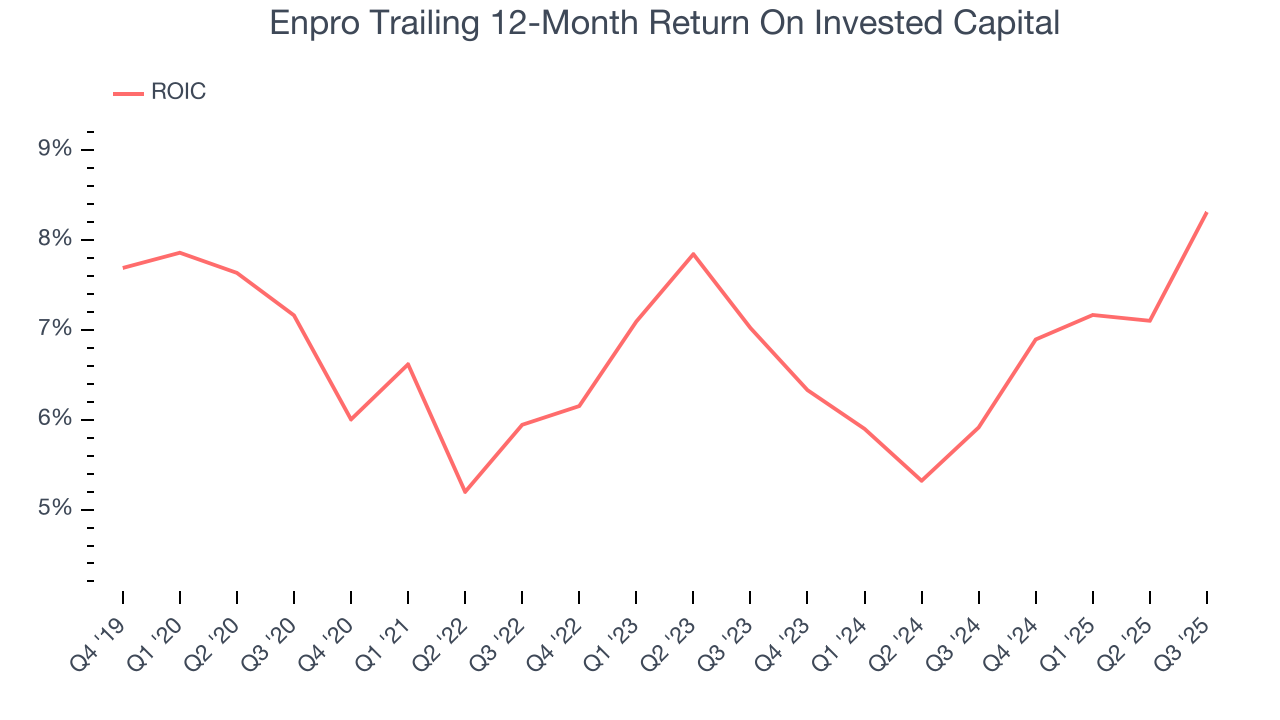

Enpro historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Enpro’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

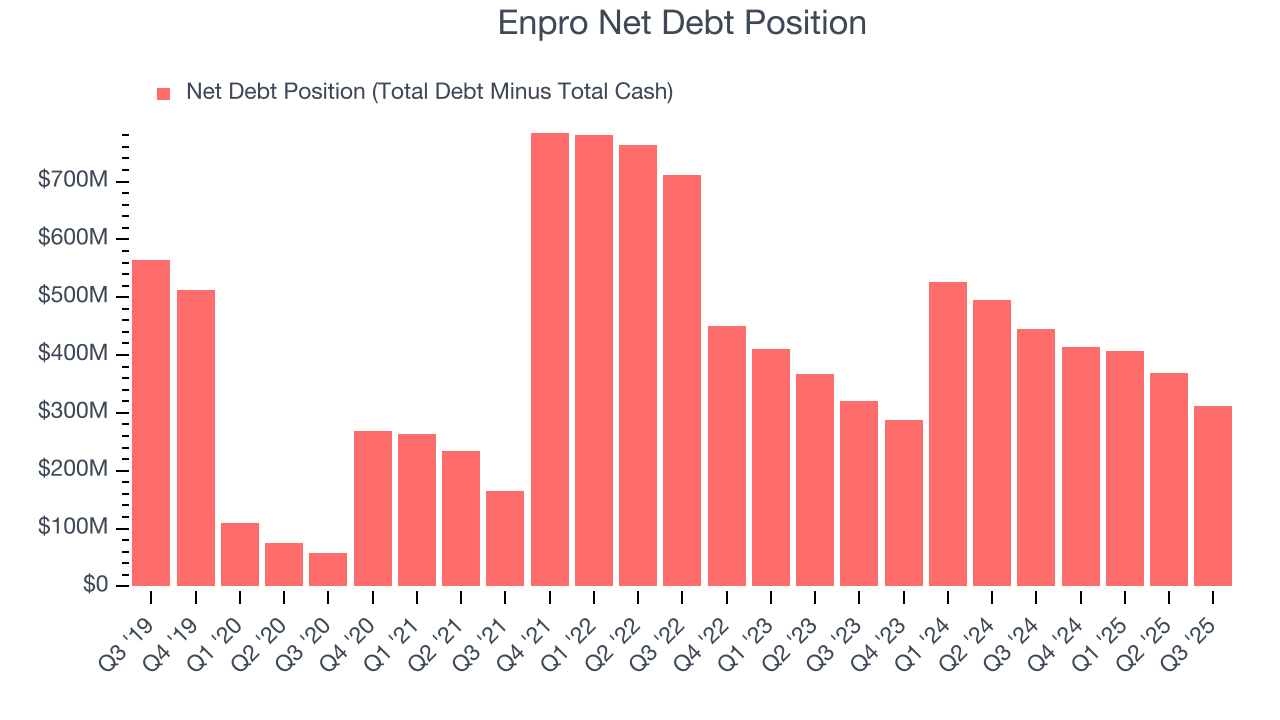

Enpro reported $132.9 million of cash and $445.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $266.4 million of EBITDA over the last 12 months, we view Enpro’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $16.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Enpro’s Q3 Results

We were impressed by how significantly Enpro blew past analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $233.87 immediately after reporting.

13. Is Now The Time To Buy Enpro?

Updated: January 25, 2026 at 10:26 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Enpro’s business quality ultimately falls short of our standards. First off, its revenue growth was weak over the last five years. And while Enpro’s rising cash profitability gives it more optionality, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Enpro’s P/E ratio based on the next 12 months is 28.3x. Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $249 on the company (compared to the current share price of $235.15).