Insperity (NSP)

Insperity faces an uphill battle. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Insperity Will Underperform

Pioneering the professional employer organization (PEO) industry it helped establish, Insperity (NYSE:NSP) provides human resources outsourcing services to small and medium-sized businesses, handling payroll, benefits, compliance, and HR administration.

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 26% annually

- Adjusted operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

- Lacking free cash flow margin got worse over the last five years as its investment needs accelerated

Insperity doesn’t fulfill our quality requirements. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Insperity

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Insperity

Insperity is trading at $33.47 per share, or 15.7x forward P/E. Insperity’s valuation may seem like a bargain, especially when stacked up against other business services companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Insperity (NSP) Research Report: Q4 CY2025 Update

HR outsourcing provider Insperity (NYSE:NSP) fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 3.4% year on year to $1.67 billion. Its GAAP loss of $0.88 per share was 16% below analysts’ consensus estimates.

Insperity (NSP) Q4 CY2025 Highlights:

- Revenue: $1.67 billion vs analyst estimates of $1.68 billion (3.4% year-on-year growth, 0.5% miss)

- EPS (GAAP): -$0.88 vs analyst expectations of -$0.76 (16% miss)

- Adjusted EBITDA: -$13 million (-0.8% margin, 157% year-on-year decline)

- EBITDA guidance for the upcoming financial year 2026 is $200 million at the midpoint, below analyst estimates of $202 million

- Operating Margin: -2.8%, down from -0.9% in the same quarter last year

- Market Capitalization: $1.38 billion

Company Overview

Pioneering the professional employer organization (PEO) industry it helped establish, Insperity (NYSE:NSP) provides human resources outsourcing services to small and medium-sized businesses, handling payroll, benefits, compliance, and HR administration.

Through its PEO model, Insperity acts as a co-employer with its clients, taking on many employer responsibilities while allowing business owners to focus on their core operations. The company offers two main service packages: Workforce Optimization, its comprehensive flagship offering, and Workforce Synchronization, a more customizable solution targeted at mid-sized companies with 150-5,000 employees.

Clients gain access to enterprise-level benefits that would typically be unavailable to smaller businesses, including health insurance, retirement plans, and workers' compensation coverage. This helps them compete for talent against larger organizations. For example, a 30-person marketing agency might leverage Insperity's services to offer its employees the same caliber of health insurance and 401(k) options as a Fortune 500 company.

Insperity's platform combines high-touch personal service with technology solutions. Its cloud-based Insperity Premier system allows clients and their employees to manage HR information, payroll, benefits, and performance management online. Meanwhile, HR advisors provide expertise on personnel policies, compliance with employment laws, and risk management.

The company generates revenue through a comprehensive service fee based on factors like client workforce size, benefit elections, and applicable regulations. This fee encompasses both the administrative services and the costs of providing employee benefits.

Beyond its PEO services, Insperity offers standalone solutions including traditional payroll processing, recruiting, employment screening, retirement plan administration, and business insurance services. The company operates through 83 physical office locations across 48 markets in the United States, with regional service centers coordinating client support.

4. Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

Insperity competes with the PEO divisions of large business services companies like Automatic Data Processing (NASDAQ:ADP) and Paychex (NASDAQ:PAYX), as well as other national PEO providers such as TriNet Group (NYSE:TNET), Vensure, and Rippling.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $6.81 billion in revenue over the past 12 months, Insperity is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

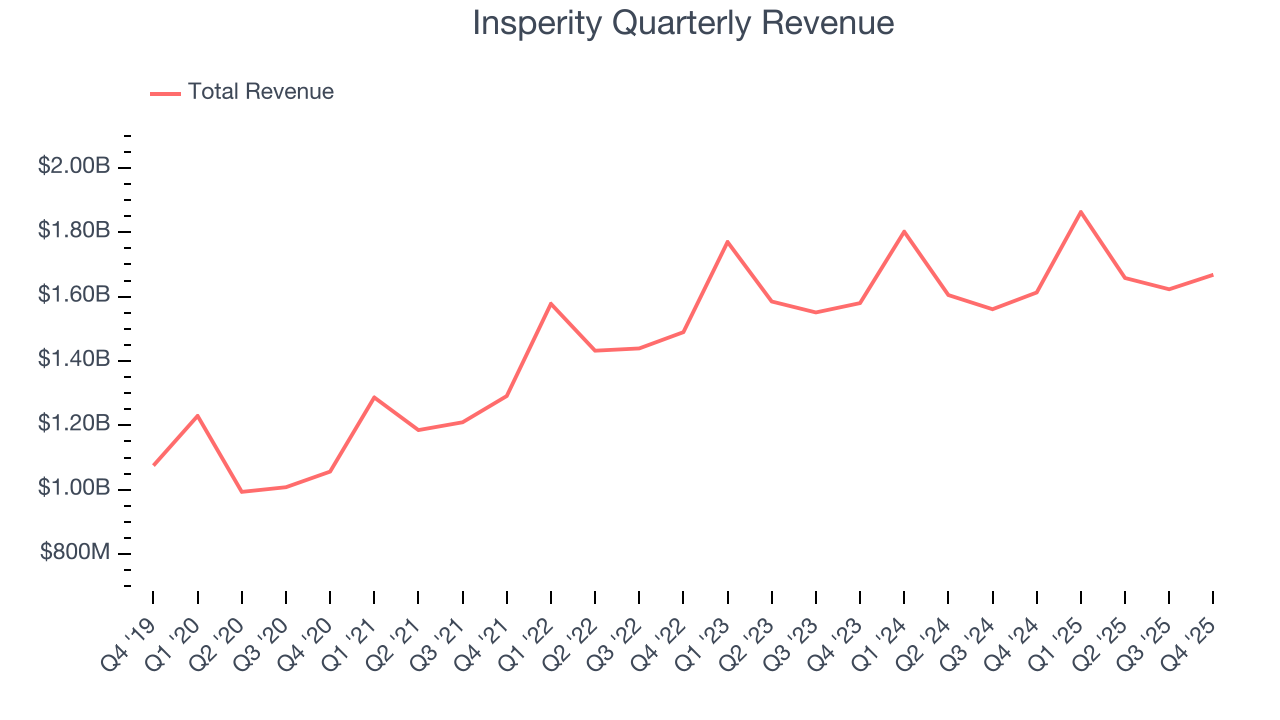

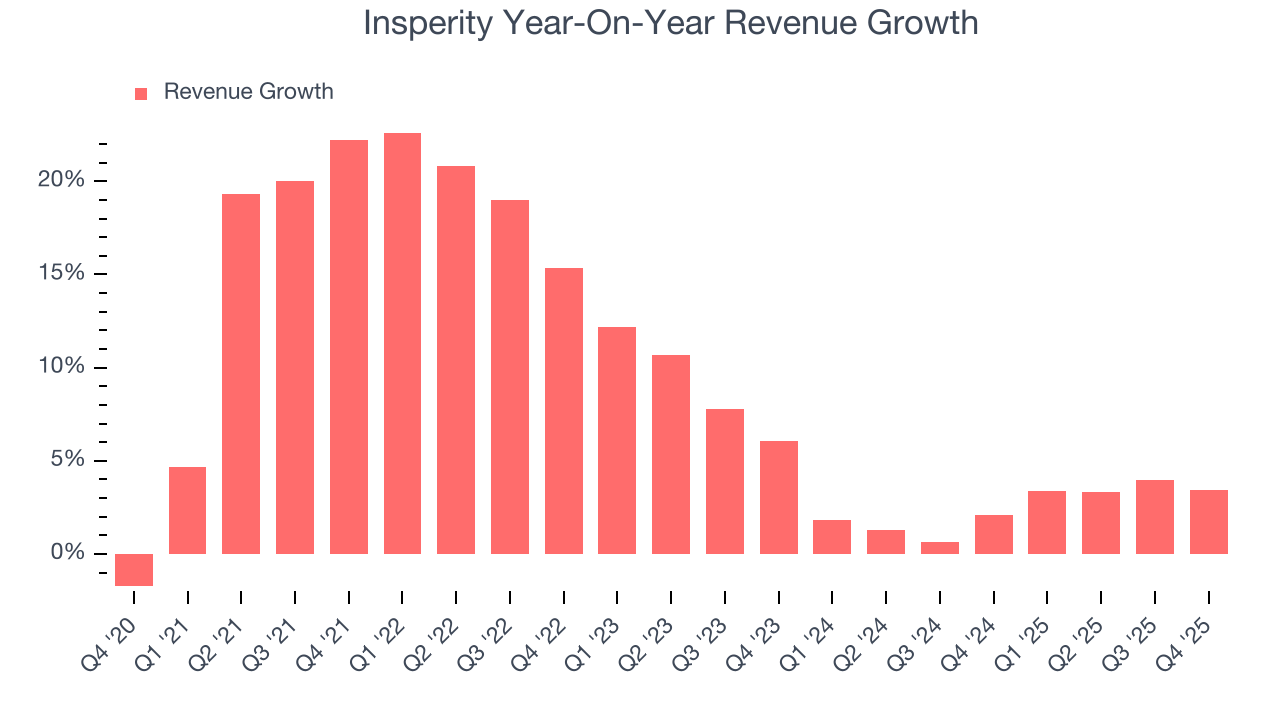

As you can see below, Insperity grew its sales at an impressive 9.7% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Insperity’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2.5% over the last two years was well below its five-year trend.

This quarter, Insperity’s revenue grew by 3.4% year on year to $1.67 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will spur better top-line performance.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

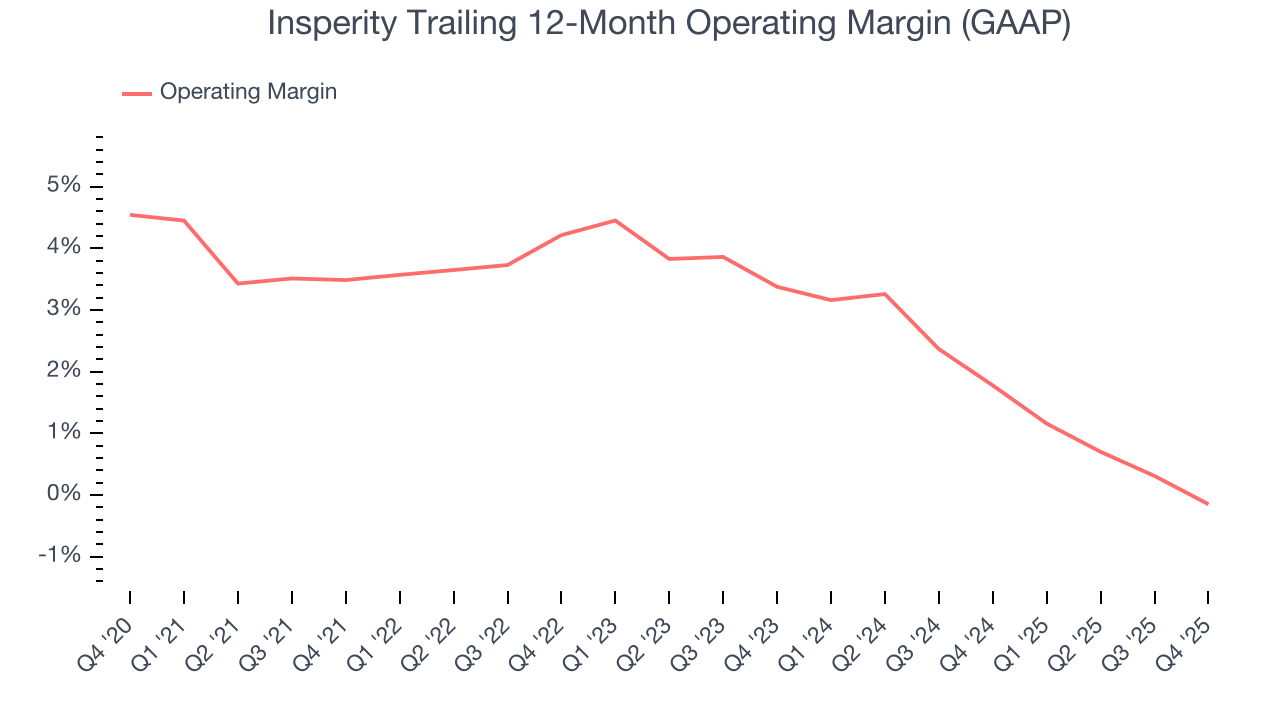

Insperity was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.4% was weak for a business services business.

Analyzing the trend in its profitability, Insperity’s operating margin decreased by 3.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Insperity’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Insperity generated an operating margin profit margin of negative 2.8%, down 1.8 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

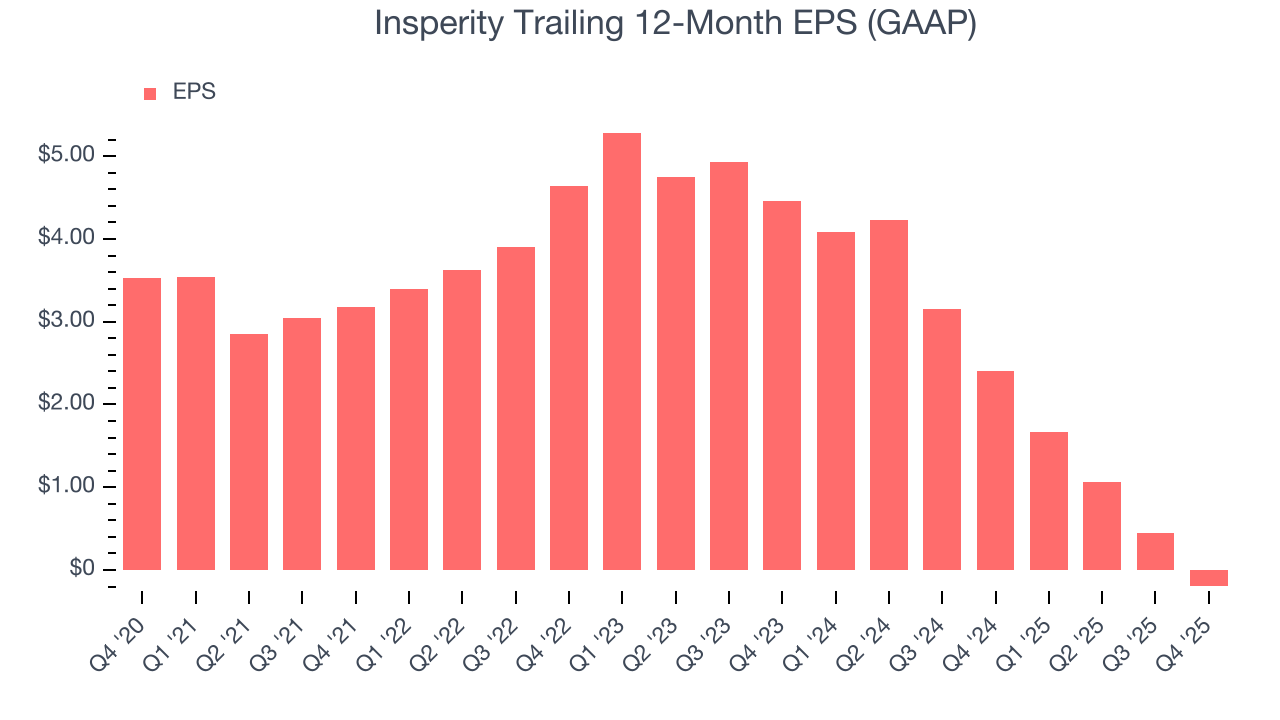

Sadly for Insperity, its EPS declined by 15.5% annually over the last five years while its revenue grew by 9.7%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Insperity’s earnings to better understand the drivers of its performance. As we mentioned earlier, Insperity’s operating margin declined by 3.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Insperity, its two-year annual EPS declines of 43% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Insperity reported EPS of negative $0.88, down from negative $0.23 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Insperity’s full-year EPS of negative $0.20 will flip to positive $0.92.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

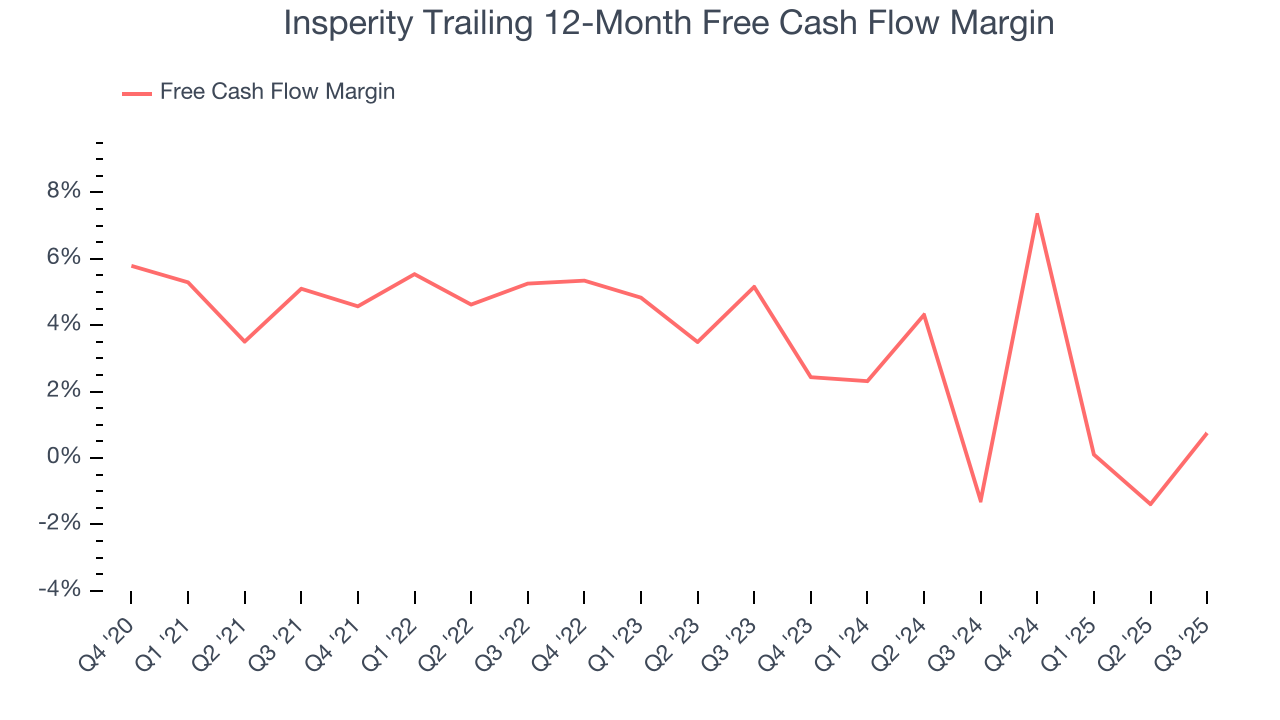

Insperity has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.2%, lousy for a business services business.

Taking a step back, we can see that Insperity’s margin dropped by 11.6 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

9. Key Takeaways from Insperity’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $33.47 immediately following the results.

10. Is Now The Time To Buy Insperity?

Updated: February 10, 2026 at 11:21 PM EST

Before making an investment decision, investors should account for Insperity’s business fundamentals and valuation in addition to what happened in the latest quarter.

Insperity doesn’t pass our quality test. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its cash profitability fell over the last five years.

Insperity’s P/E ratio based on the next 12 months is 15.7x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $42.75 on the company (compared to the current share price of $33.47).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.