NVR (NVR)

We’re cautious of NVR. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think NVR Will Underperform

Known for its unique land acquisition strategy, NVR (NYSE:NVR) is a respected homebuilder and mortgage company in the United States.

- Projected sales decline of 10.2% for the next 12 months points to a tough demand environment ahead

- New orders were hard to come by as its backlog was flat over the past two years

- On the bright side, its healthy operating margin shows it’s a well-run company with efficient processes

NVR doesn’t measure up to our expectations. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than NVR

High Quality

Investable

Underperform

Why There Are Better Opportunities Than NVR

NVR is trading at $7,663 per share, or 19.3x forward P/E. NVR’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. NVR (NVR) Research Report: Q3 CY2025 Update

Homebuilder NVR (NYSE:NVR) met Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 6.3% year on year to $2.56 billion. Its GAAP profit of $112.33 per share was 2.7% above analysts’ consensus estimates.

NVR (NVR) Q3 CY2025 Highlights:

- Revenue: $2.56 billion vs analyst estimates of $2.57 billion (6.3% year-on-year decline, in line)

- EPS (GAAP): $112.33 vs analyst estimates of $109.36 (2.7% beat)

- Operating Margin: 17.3%, down from 18.5% in the same quarter last year

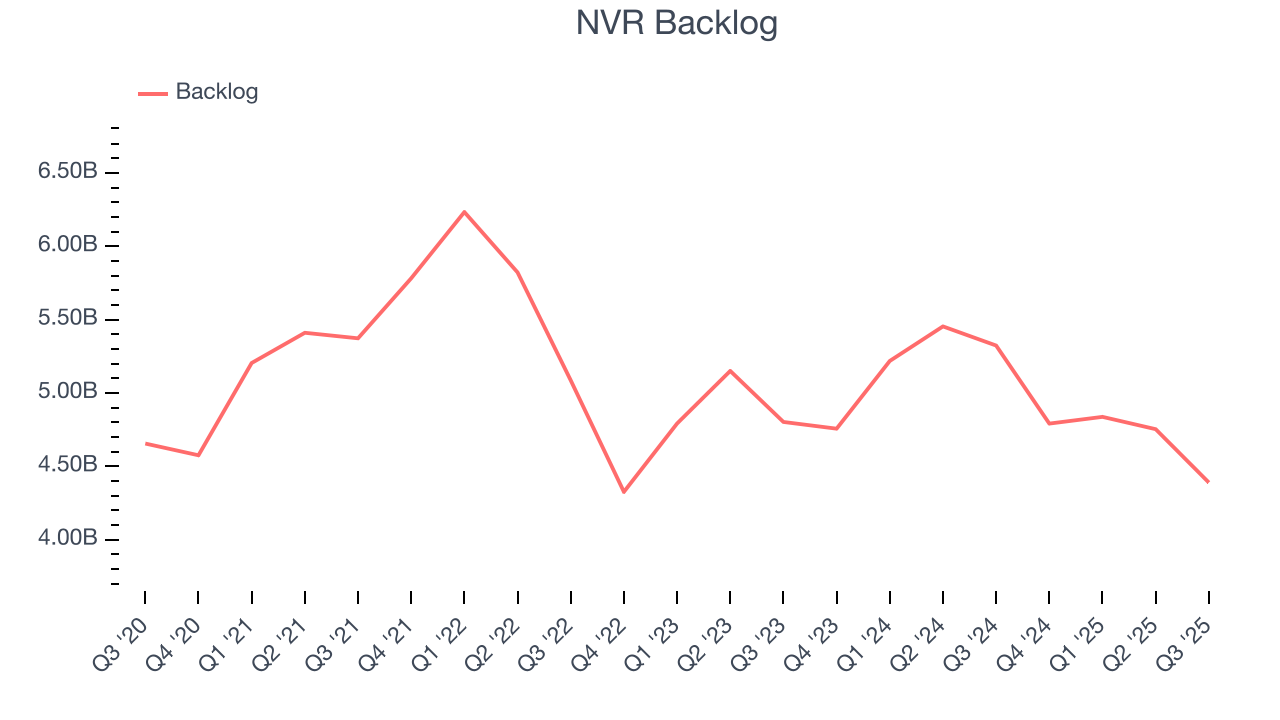

- Backlog: $4.39 billion at quarter end, down 17.5% year on year

- Market Capitalization: $22.39 billion

Company Overview

Known for its unique land acquisition strategy, NVR (NYSE:NVR) is a respected homebuilder and mortgage company in the United States.

NVR, Inc., a Virginia corporation formed in 1980, primarily focuses on the construction and sale of single-family detached homes, townhomes, and condominium buildings, which are primarily built on a pre-sold basis.

The company operates its homebuilding activities directly and its mortgage banking operations primarily through a wholly owned subsidiary, NVR Mortgage Finance (NVRM).

As one of the largest homebuilders in the United States, NVR operates in 30+ metropolitan areas across 15+states and Washington, D.C. The company's homebuilding operations include the construction and sale of homes under three trade names: Ryan Homes, NVHomes, and Heartland Homes. These brands cater to different segments of the market, with Ryan Homes targeting first-time and first-time move-up buyers (current homeowners looking to upgrade their homes), while NVHomes and Heartland Homes focus on move-up and luxury buyers.

NVR typically acquires finished building lots from third-party land developers through fixed-price finished lot purchase agreements (LPAs) rather than engaging in direct land development. This strategy helps the company avoid the financial requirements and risks associated with direct land ownership and development. NVR seeks to maintain control over a supply of lots suitable for its five-year business plan.

The company generates revenue primarily through the sale of its homes. It also brings in revenue through NVRM, where it originates mortgages, , records gains and losses from the sale of loans, and provides title services. NVRM sells almost all of the mortgage loans it closes into the secondary markets.

4. Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Other homebuilders operating in NVR’s market include Lennary (NYSE:LEN), PulteGroup (NYSE:PHM), and DR Horton (NYSE:NVR).

5. Revenue Growth

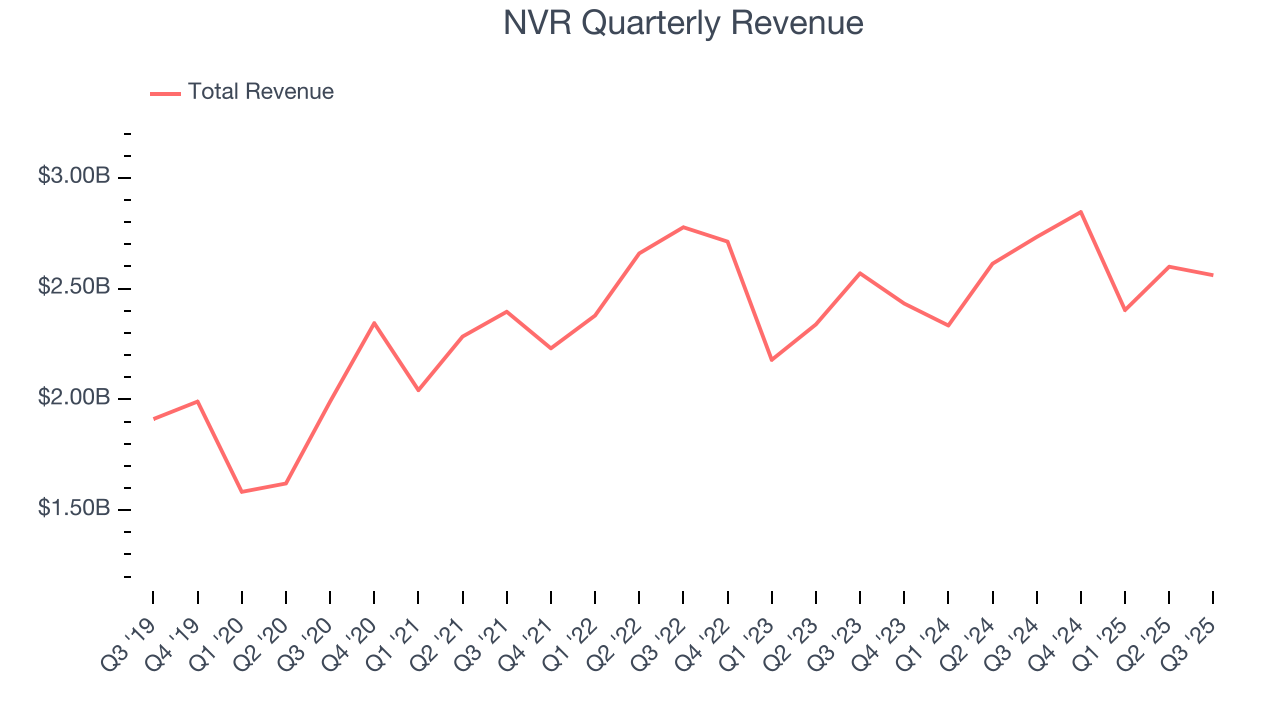

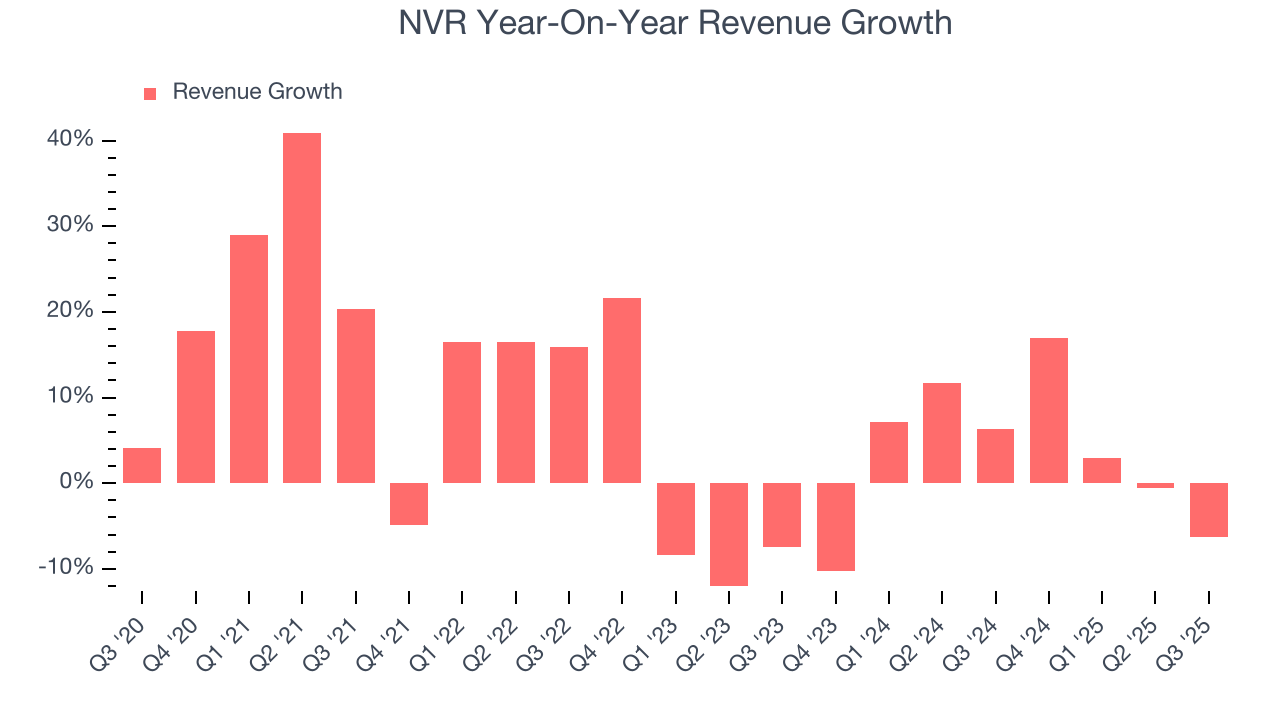

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, NVR’s 7.7% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. NVR’s recent performance shows its demand has slowed as its annualized revenue growth of 3.1% over the last two years was below its five-year trend.

NVR also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. NVR’s backlog reached $4.39 billion in the latest quarter and was flat over the last two years. Because this number is lower than its revenue growth, we can see the company hasn’t secured enough new orders to maintain its growth rate in the future.

This quarter, NVR reported a rather uninspiring 6.3% year-on-year revenue decline to $2.56 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 5.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

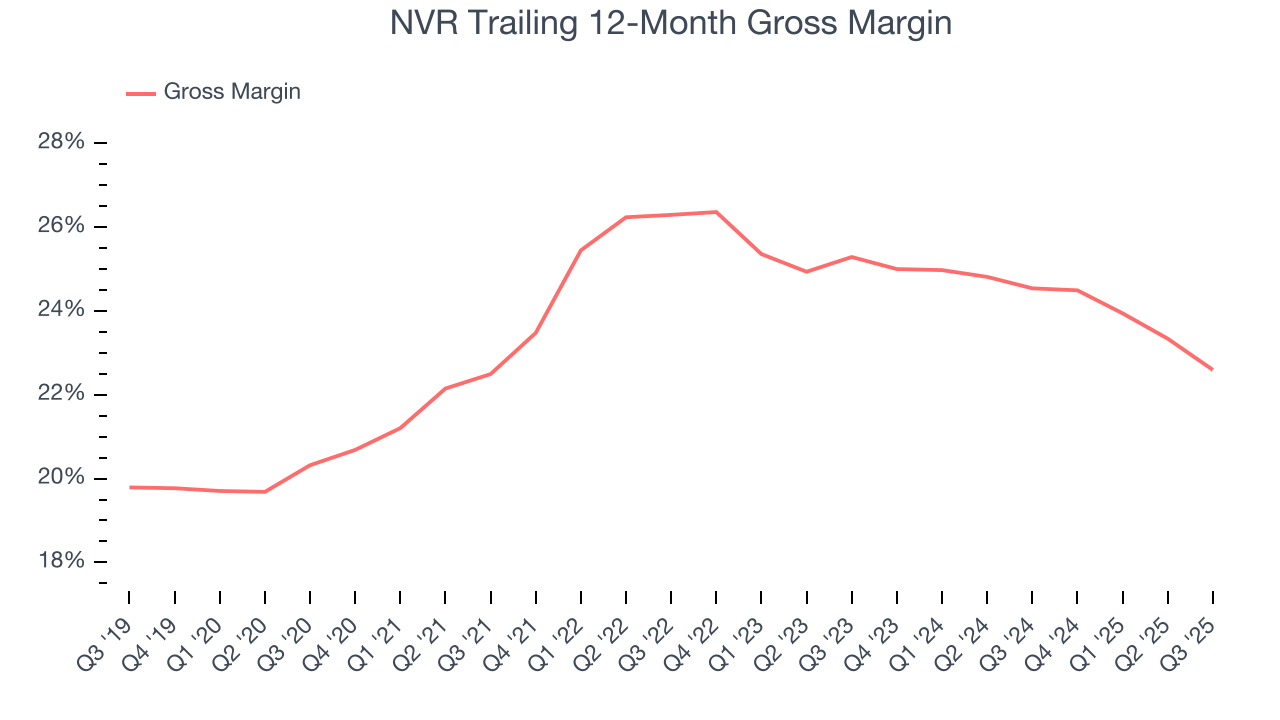

NVR has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 24.3% gross margin over the last five years. That means NVR paid its suppliers a lot of money ($75.74 for every $100 in revenue) to run its business.

This quarter, NVR’s gross profit margin was 21%, down 3 percentage points year on year. NVR’s full-year margin has also been trending down over the past 12 months, decreasing by 1.9 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

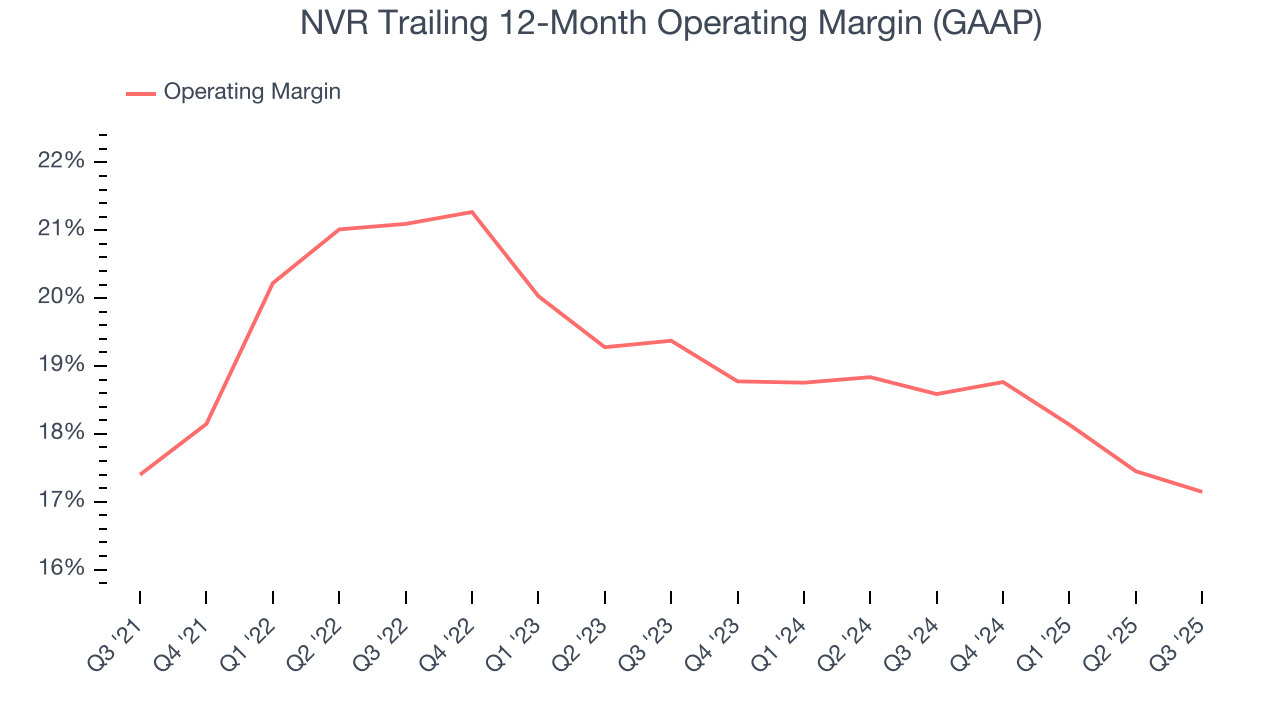

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

NVR’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 18.7% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, NVR’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but we’re still happy with NVR’s performance considering most Home Builders companies saw their margins plummet.

This quarter, NVR generated an operating margin profit margin of 17.3%, down 1.2 percentage points year on year. Since NVR’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

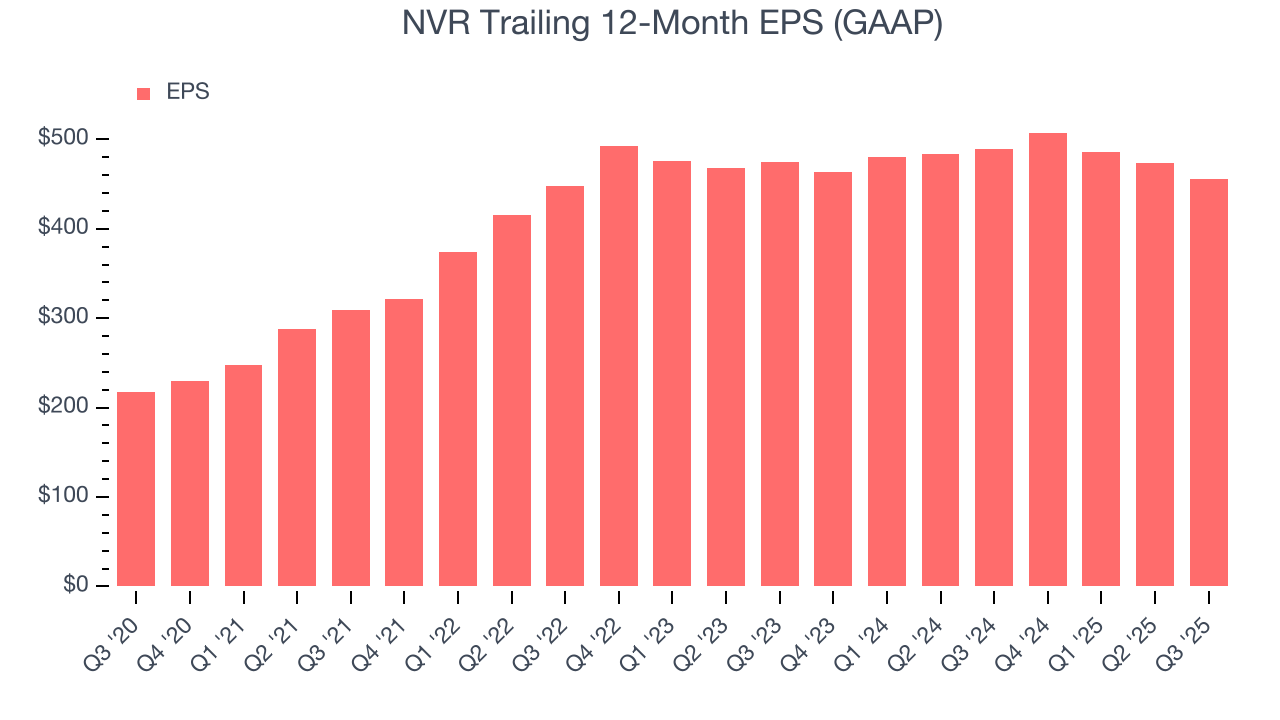

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

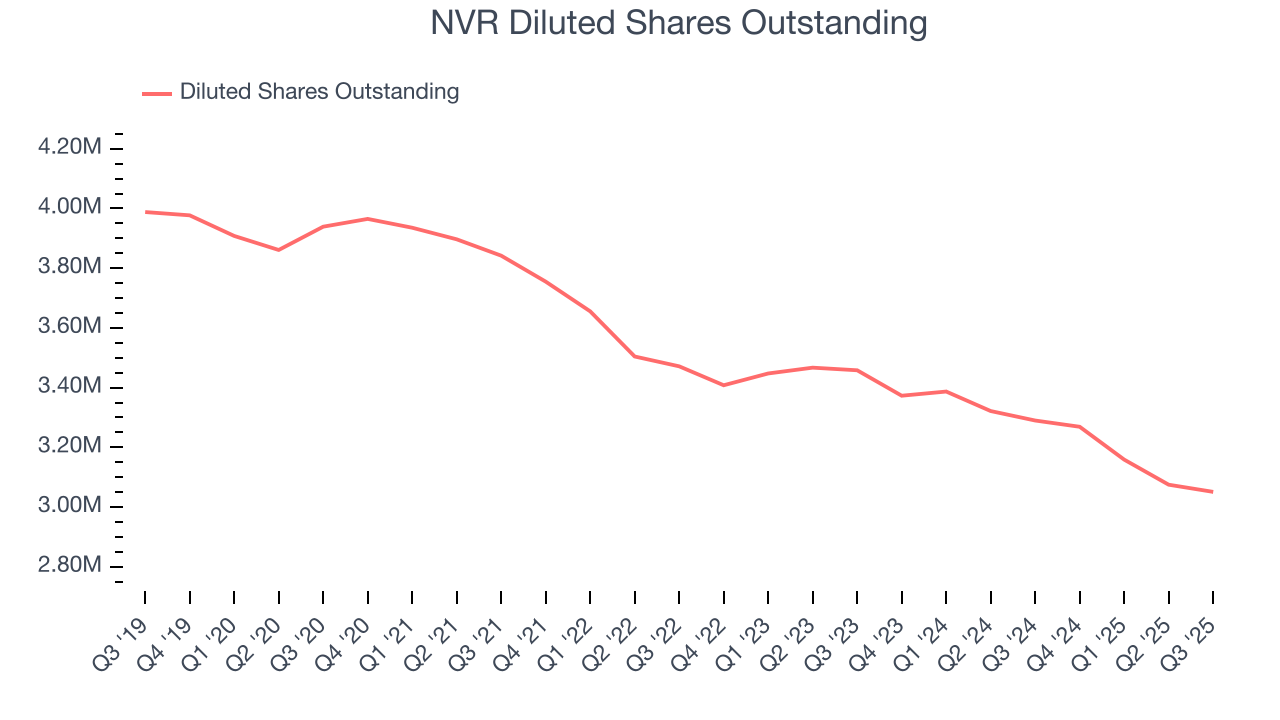

NVR’s EPS grew at a spectacular 16% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Diving into NVR’s quality of earnings can give us a better understanding of its performance. A five-year view shows that NVR has repurchased its stock, shrinking its share count by 22.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For NVR, its two-year annual EPS declines of 2.1% mark a reversal from its (seemingly) healthy five-year trend. We hope NVR can return to earnings growth in the future.

In Q3, NVR reported EPS of $112.33, down from $130.49 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.7%. Over the next 12 months, Wall Street expects NVR’s full-year EPS of $455.63 to shrink by 1.2%.

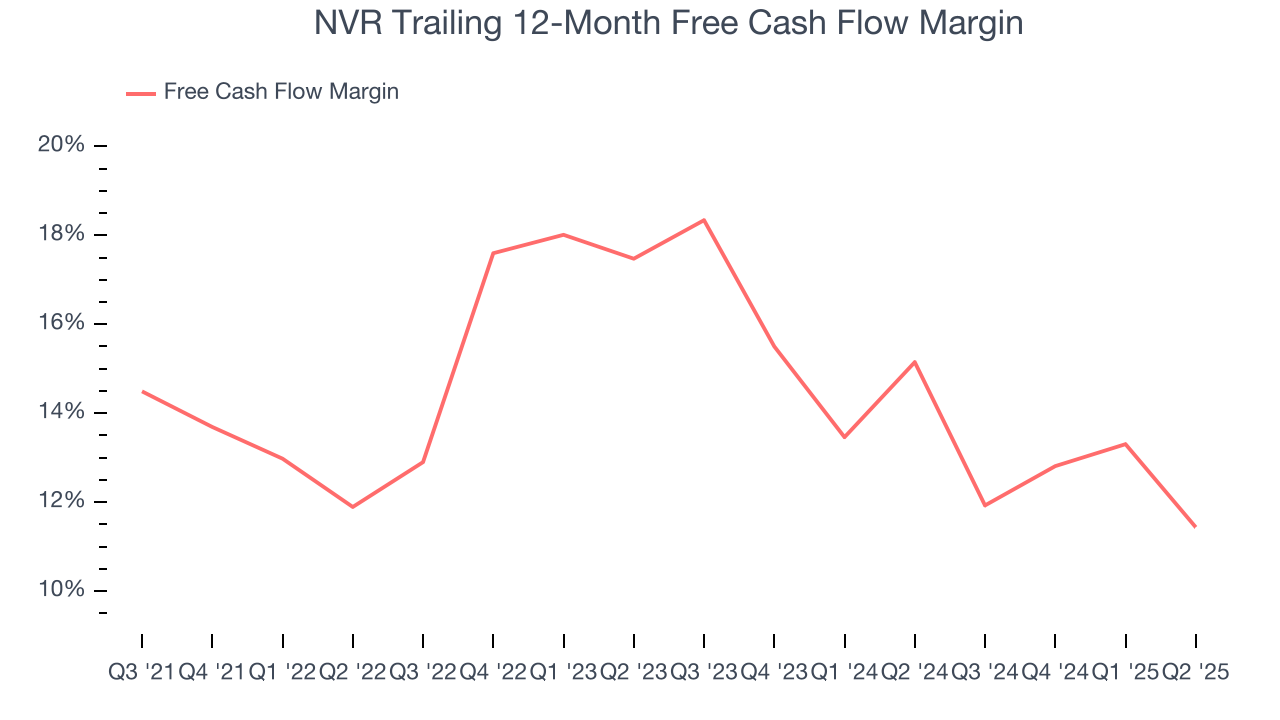

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

NVR has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.8% over the last five years.

Taking a step back, we can see that NVR’s margin dropped by 1.9 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

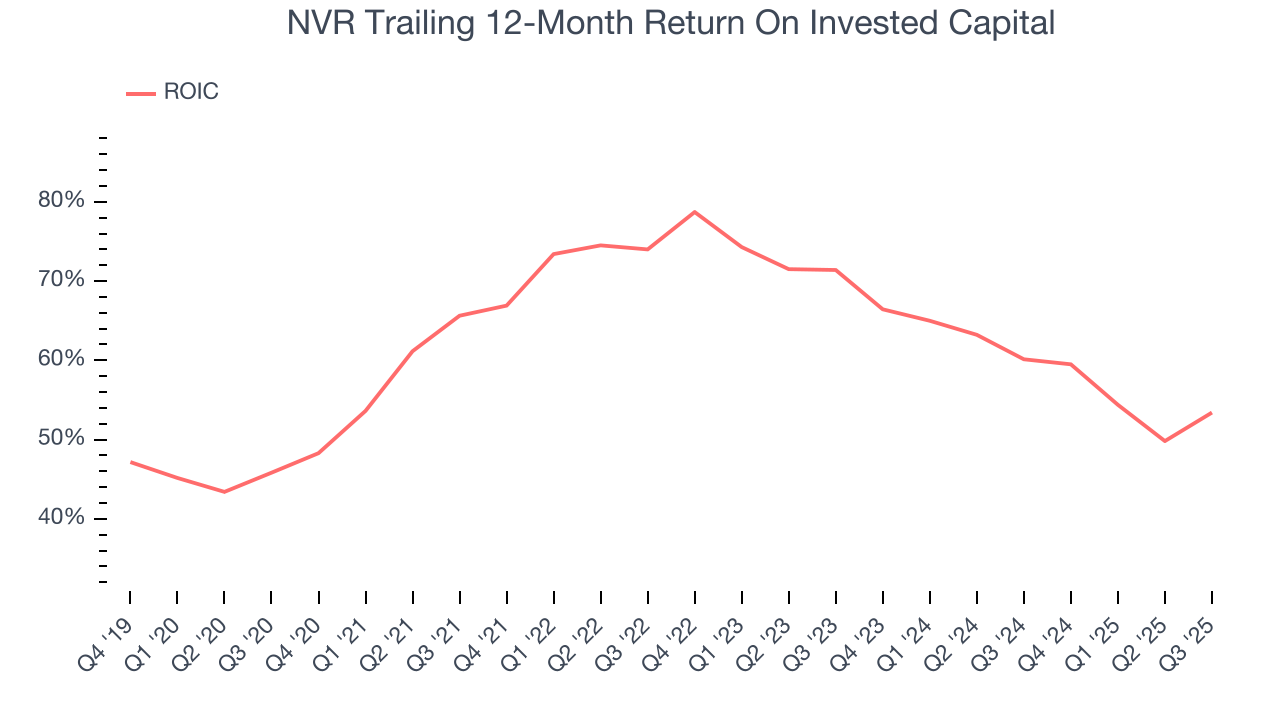

Although NVR hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 64.9%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, NVR’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

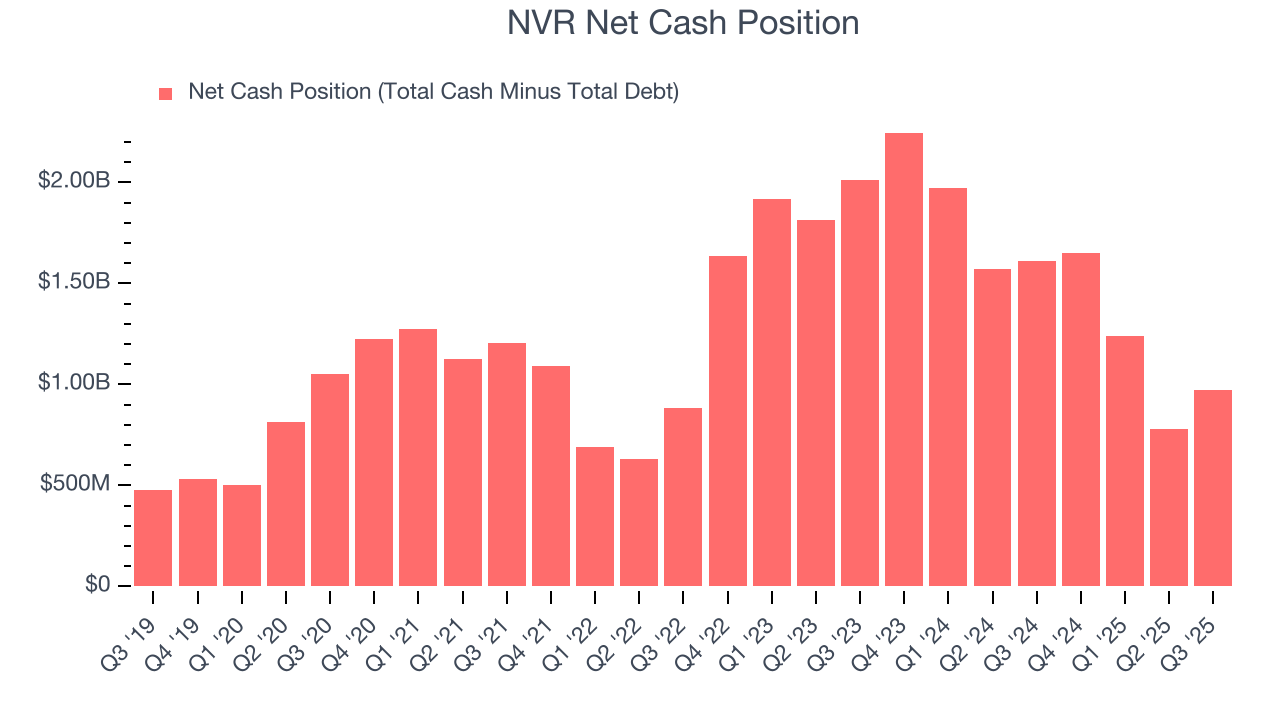

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

NVR is a profitable, well-capitalized company with $1.98 billion of cash and $1.00 billion of debt on its balance sheet. This $973.4 million net cash position is 4.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from NVR’s Q3 Results

It was good to see NVR beat analysts’ EPS expectations this quarter. On the other hand, its backlog slightly missed and its revenue was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.3% to $7,700 immediately following the results.

13. Is Now The Time To Buy NVR?

Updated: January 24, 2026 at 10:14 PM EST

Before making an investment decision, investors should account for NVR’s business fundamentals and valuation in addition to what happened in the latest quarter.

NVR’s business quality ultimately falls short of our standards. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s impressive operating margins show it has a highly efficient business model, the downside is its projected EPS for the next year is lacking.

NVR’s P/E ratio based on the next 12 months is 19.3x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $8,371 on the company (compared to the current share price of $7,663).