Envista (NVST)

We wouldn’t recommend Envista. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Envista Will Underperform

Uniting more than 30 trusted brands including Nobel Biocare, Ormco, and DEXIS under one corporate umbrella, Envista Holdings (NYSE:NVST) is a global dental products company that provides equipment, consumables, and specialized technologies for dental professionals.

- Push for growth has led to negative returns on capital, signaling value destruction, and its falling returns suggest its earlier profit pools are drying up

- Sales stagnated over the last two years and signal the need for new growth strategies

- Anticipated sales growth of 3.7% for the next year implies demand will be shaky

Envista doesn’t satisfy our quality benchmarks. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Envista

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Envista

Envista’s stock price of $23.50 implies a valuation ratio of 18.4x forward P/E. This multiple is lower than most healthcare companies, but for good reason.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Envista (NVST) Research Report: Q4 CY2025 Update

Dental products company Envista Holdings (NYSE:NVST) announced better-than-expected revenue in Q4 CY2025, with sales up 15% year on year to $750.6 million. Its non-GAAP profit of $0.38 per share was 17.7% above analysts’ consensus estimates.

Envista (NVST) Q4 CY2025 Highlights:

- Revenue: $750.6 million vs analyst estimates of $678.7 million (15% year-on-year growth, 10.6% beat)

- Adjusted EPS: $0.38 vs analyst estimates of $0.32 (17.7% beat)

- Adjusted EBITDA: $111 million vs analyst estimates of $100.7 million (14.8% margin, 10.2% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.40 at the midpoint, beating analyst estimates by 9.6%

- Operating Margin: 9.8%, up from 7.1% in the same quarter last year

- Free Cash Flow Margin: 14.4%, down from 19% in the same quarter last year

- Market Capitalization: $3.89 billion

Company Overview

Uniting more than 30 trusted brands including Nobel Biocare, Ormco, and DEXIS under one corporate umbrella, Envista Holdings (NYSE:NVST) is a global dental products company that provides equipment, consumables, and specialized technologies for dental professionals.

Envista's business is organized into two main segments. The Specialty Products & Technologies segment focuses on implant-based tooth replacements and orthodontic solutions, including dental implant systems, regenerative solutions, and orthodontic products like brackets and clear aligners. Their Spark clear aligner system competes in the growing clear aligner market with proprietary materials designed for efficiency and patient comfort.

The Equipment & Consumables segment offers digital imaging systems, intraoral scanners, endodontic systems, restorative materials, and infection prevention products. A key offering is their DTX software suite, which creates an integrated digital platform for dental imaging, diagnosis, and treatment planning.

Dental professionals use Envista's products for a wide range of procedures. For example, an oral surgeon might use Nobel Biocare implants and guided surgery systems to replace missing teeth, while an orthodontist might use Spark aligners to straighten a patient's teeth. General dentists might use Kerr restorative materials to repair damaged teeth or DEXIS imaging systems to diagnose dental conditions.

Envista generates revenue through both direct sales and distribution partnerships. The company sells directly to dental professionals for specialized products like implant systems and orthodontic appliances, while using distributors for more general dental products. Henry Schein, a major dental supplier, accounts for approximately 10% of Envista's sales.

The company maintains a global presence with operations across North America, Europe, Asia, the Middle East, and Latin America. Approximately 52% of sales come from North America, with emerging markets representing 21% of revenue.

4. Dental Equipment & Technology

The dental equipment and technology industry encompasses companies that manufacture orthodontic products, dental implants, imaging systems, and digital tools for dental professionals. These companies benefit from recurring revenue streams tied to consumables, ongoing maintenance, and growing demand for aesthetic and restorative dentistry. However, high R&D costs, significant capital investment requirements, and reliance on discretionary spending make them vulnerable to economic cycles. Over the next few years, tailwinds for the sector include innovation in digital workflows, such as 3D printing and AI-driven diagnostics, which enhance the efficiency and precision of dental care. However, headwinds include economic uncertainty, which could reduce patient spending on elective procedures, regulatory challenges, and potential pricing pressures from consolidated dental service organizations (DSOs).

Envista's competitors include Dentsply Sirona (NASDAQ:XRAY), Align Technology (NASDAQ:ALGN), Straumann Group (SWX:STMN), and Henry Schein (NASDAQ:HSIC), as well as privately-held companies like Planmeca and Carestream Dental.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.72 billion in revenue over the past 12 months, Envista has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

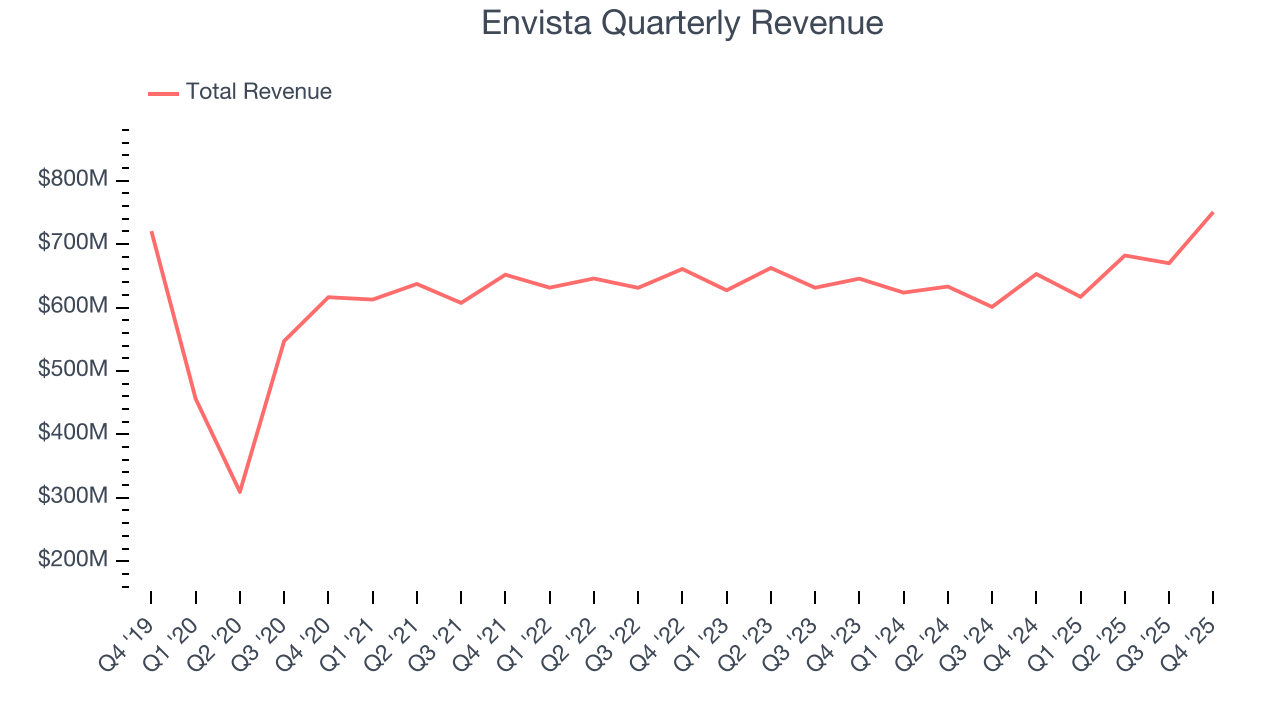

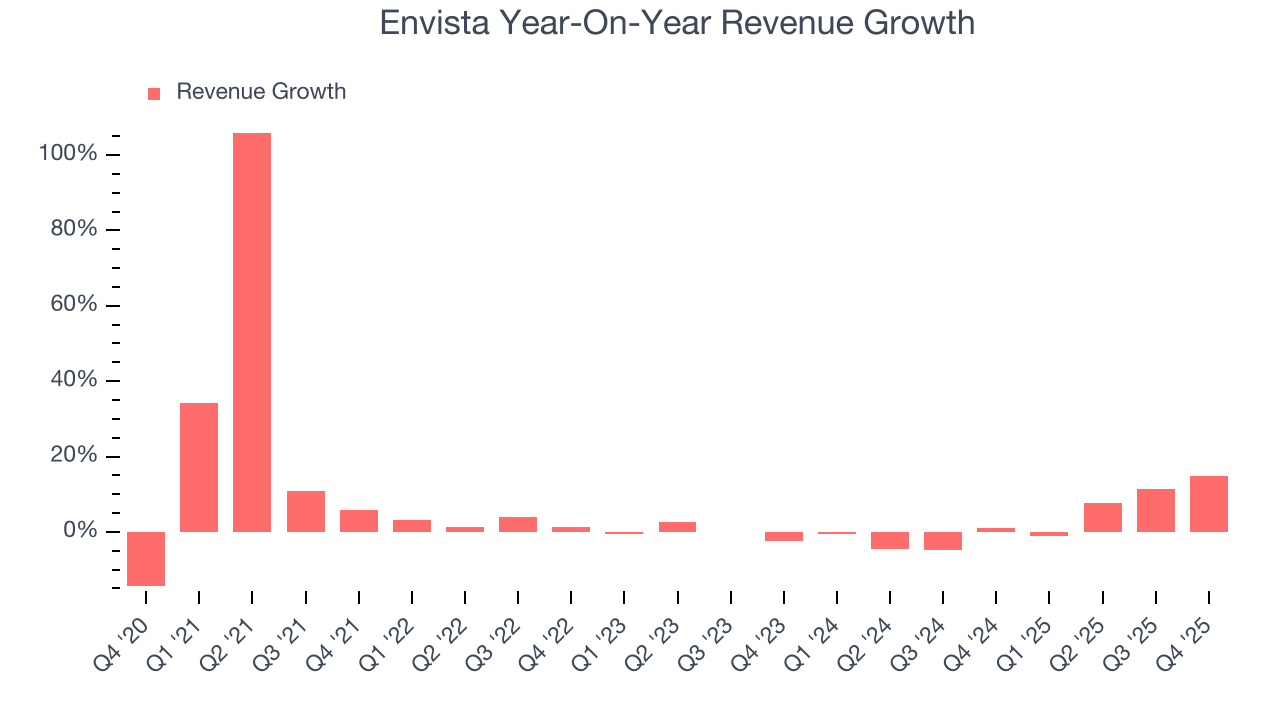

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Envista grew its sales at a mediocre 7.1% compounded annual growth rate. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Envista’s recent performance shows its demand has slowed as its annualized revenue growth of 2.9% over the last two years was below its five-year trend.

This quarter, Envista reported year-on-year revenue growth of 15%, and its $750.6 million of revenue exceeded Wall Street’s estimates by 10.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

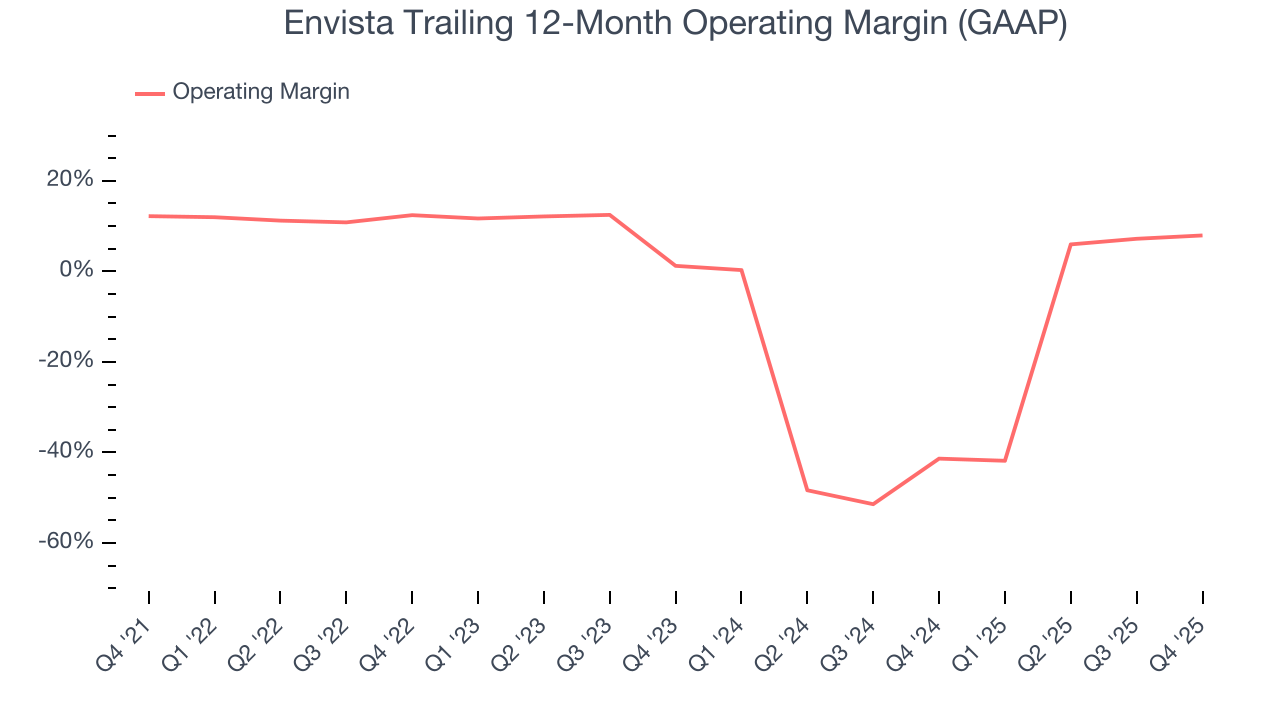

Although Envista was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.3% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Envista’s operating margin decreased by 4.3 percentage points over the last five years, but it rose by 6.7 percentage points on a two-year basis. Still, shareholders will want to see Envista become more profitable in the future.

This quarter, Envista generated an operating margin profit margin of 9.8%, up 2.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

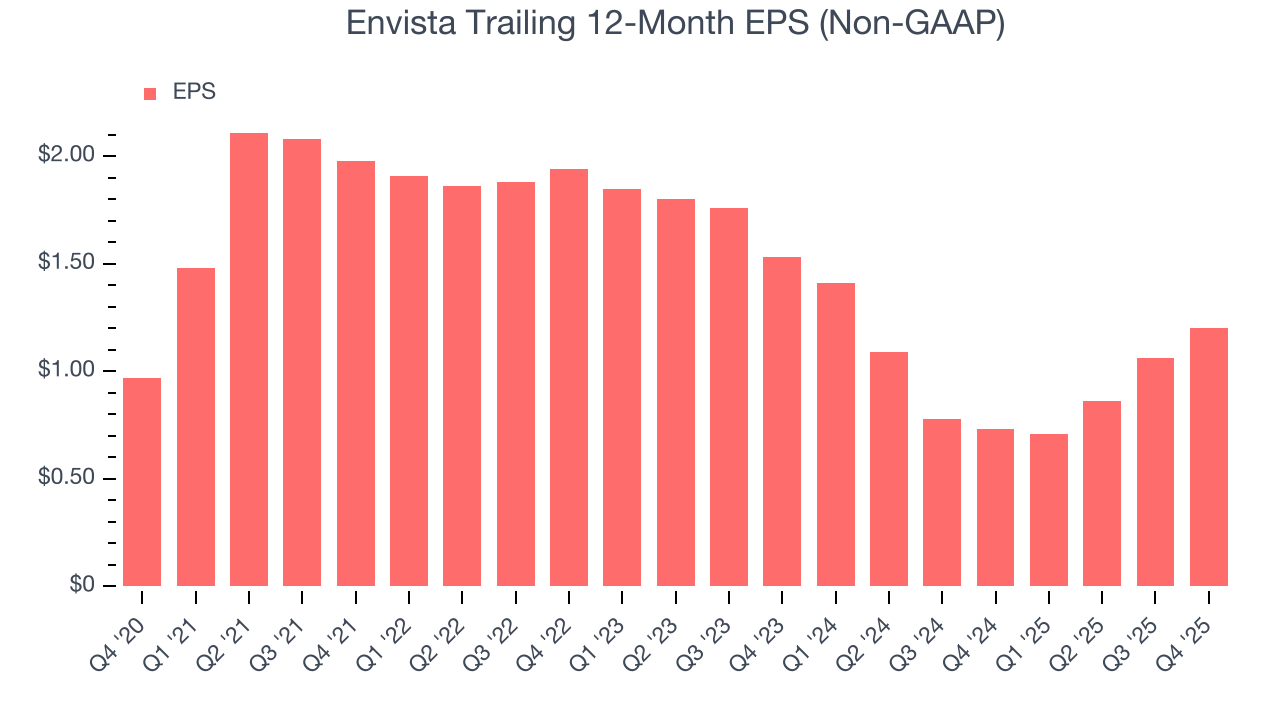

Envista’s EPS grew at an unimpressive 4.3% compounded annual growth rate over the last five years, lower than its 7.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Envista’s earnings to better understand the drivers of its performance. As we mentioned earlier, Envista’s operating margin expanded this quarter but declined by 4.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Envista reported adjusted EPS of $0.38, up from $0.24 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Envista’s full-year EPS of $1.20 to grow 6.7%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

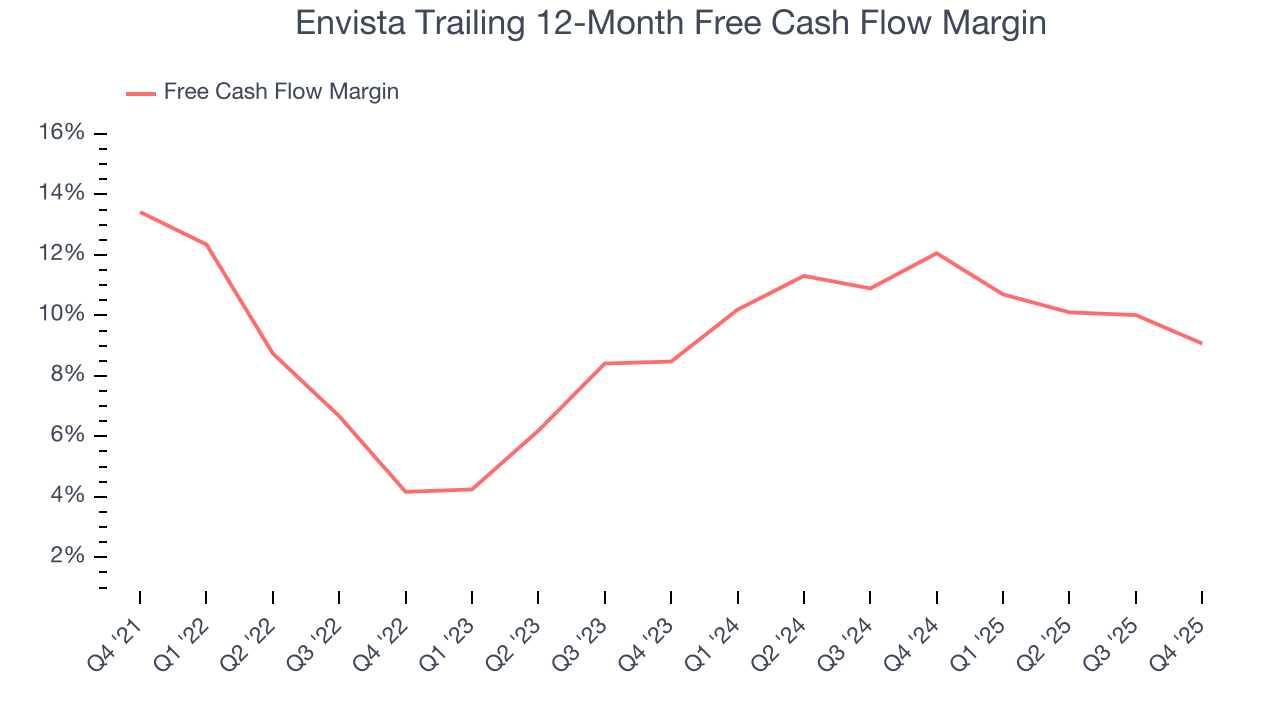

Envista has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.4% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Envista’s margin dropped by 4.3 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Envista’s free cash flow clocked in at $108 million in Q4, equivalent to a 14.4% margin. The company’s cash profitability regressed as it was 4.6 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

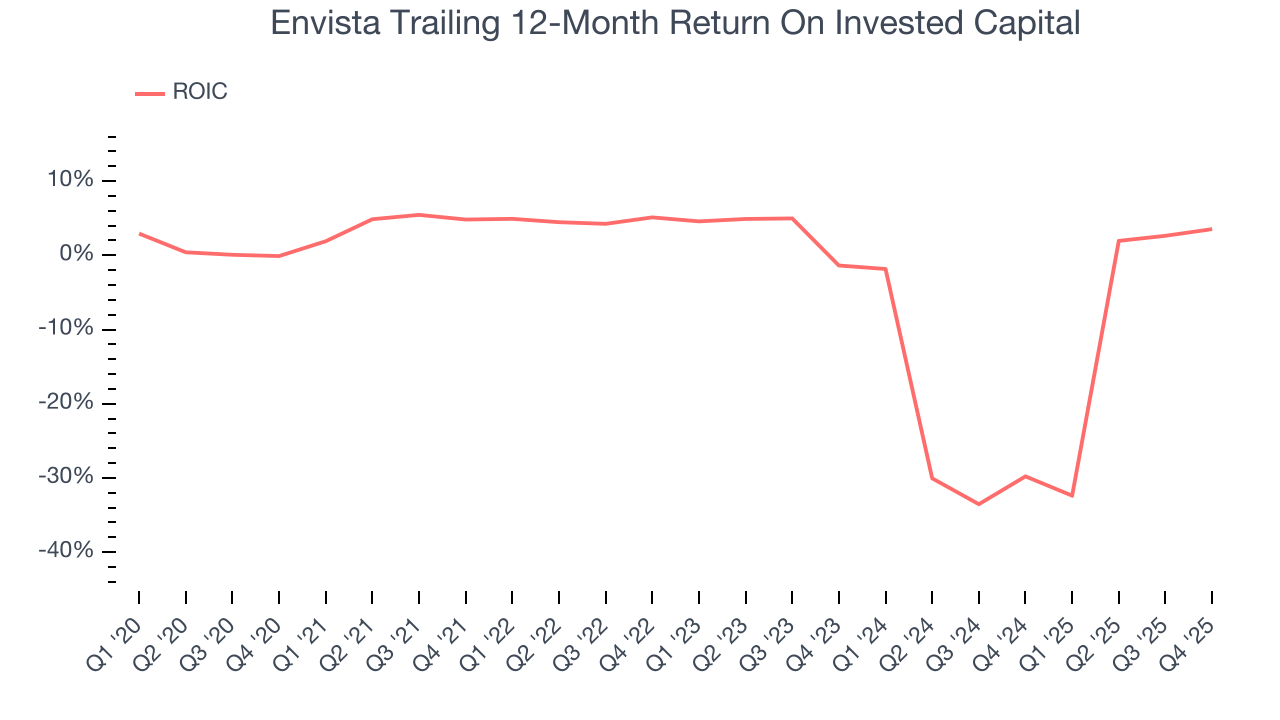

Envista’s five-year average ROIC was negative 3.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Envista’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

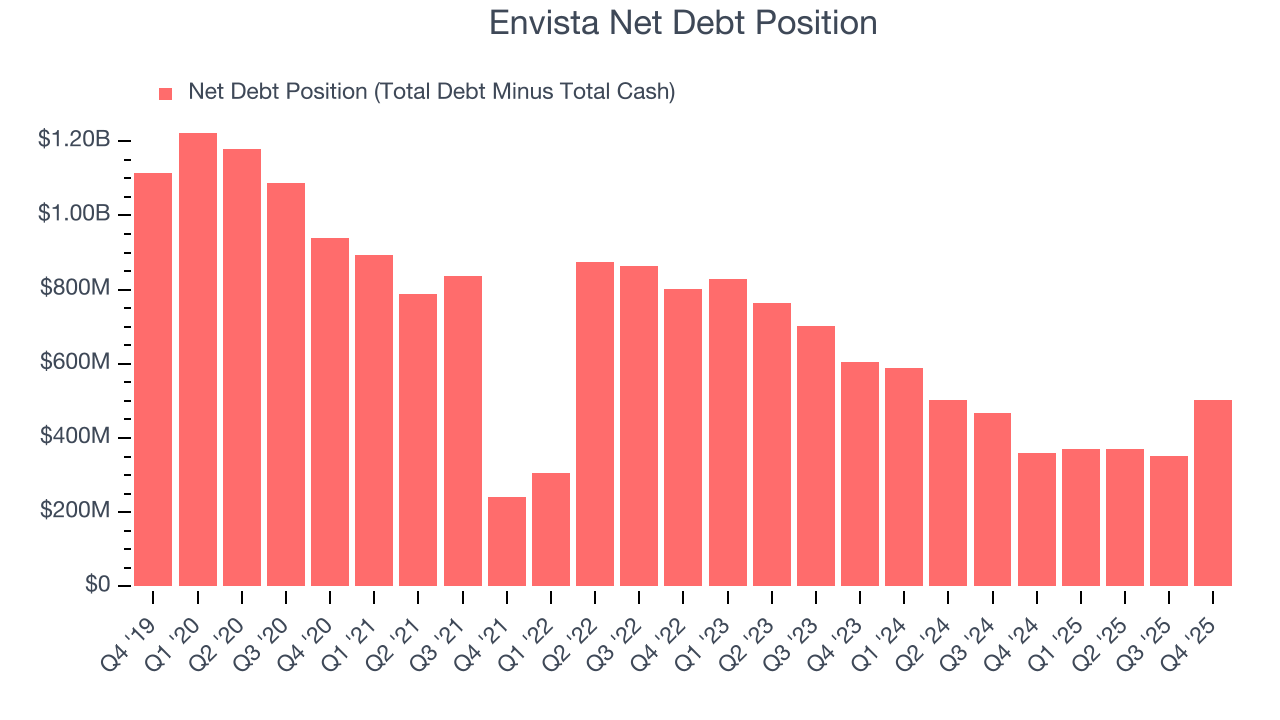

Envista reported $1.21 billion of cash and $1.71 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $371.4 million of EBITDA over the last 12 months, we view Envista’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $16 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Envista’s Q4 Results

We were impressed by how significantly Envista blew past analysts’ revenue expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 2.3% to $25.27 immediately following the results.

13. Is Now The Time To Buy Envista?

Updated: February 5, 2026 at 4:09 PM EST

Before investing in or passing on Envista, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Envista doesn’t pass our quality test. For starters, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its solid free cash flow generation gives it reinvestment options, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Envista’s P/E ratio based on the next 12 months is 19.7x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $23.77 on the company (compared to the current share price of $25.27), implying they don’t see much short-term potential in Envista.