Optimum Communications (OPTU)

We wouldn’t buy Optimum Communications. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Optimum Communications Will Underperform

Based in Long Island City, Optimum Communications (NYSE:OPTU) is a telecommunications company offering cable, internet, telephone, and television services across the United States.

- Products and services aren't resonating with the market as its revenue declined by 2.8% annually over the last five years

- Sales were less profitable over the last five years as its earnings per share fell by 48% annually, worse than its revenue declines

- 8× net-debt-to-EBITDA ratio makes lenders less willing to extend additional capital, potentially necessitating dilutive equity offerings

Optimum Communications’s quality is lacking. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Optimum Communications

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Optimum Communications

Optimum Communications is trading at $1.56 per share, or 7.8x forward EV-to-EBITDA. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Optimum Communications (OPTU) Research Report: Q4 CY2025 Update

Telecommunications and cable services provider Optimum Communications (NYSE:OPTU) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 2.3% year on year to $2.18 billion. Its GAAP loss of $0.15 per share was significantly below analysts’ consensus estimates.

Optimum Communications (OPTU) Q4 CY2025 Highlights:

- Revenue: $2.18 billion vs analyst estimates of $2.13 billion (2.3% year-on-year decline, 2.3% beat)

- EPS (GAAP): -$0.15 vs analyst estimates of -$0.01 (significant miss)

- Adjusted EBITDA: $902.2 million vs analyst estimates of $894.7 million (41.3% margin, 0.8% beat)

- Operating Margin: 18.2%, up from 15.2% in the same quarter last year

- Free Cash Flow Margin: 9.1%, up from 2.2% in the same quarter last year

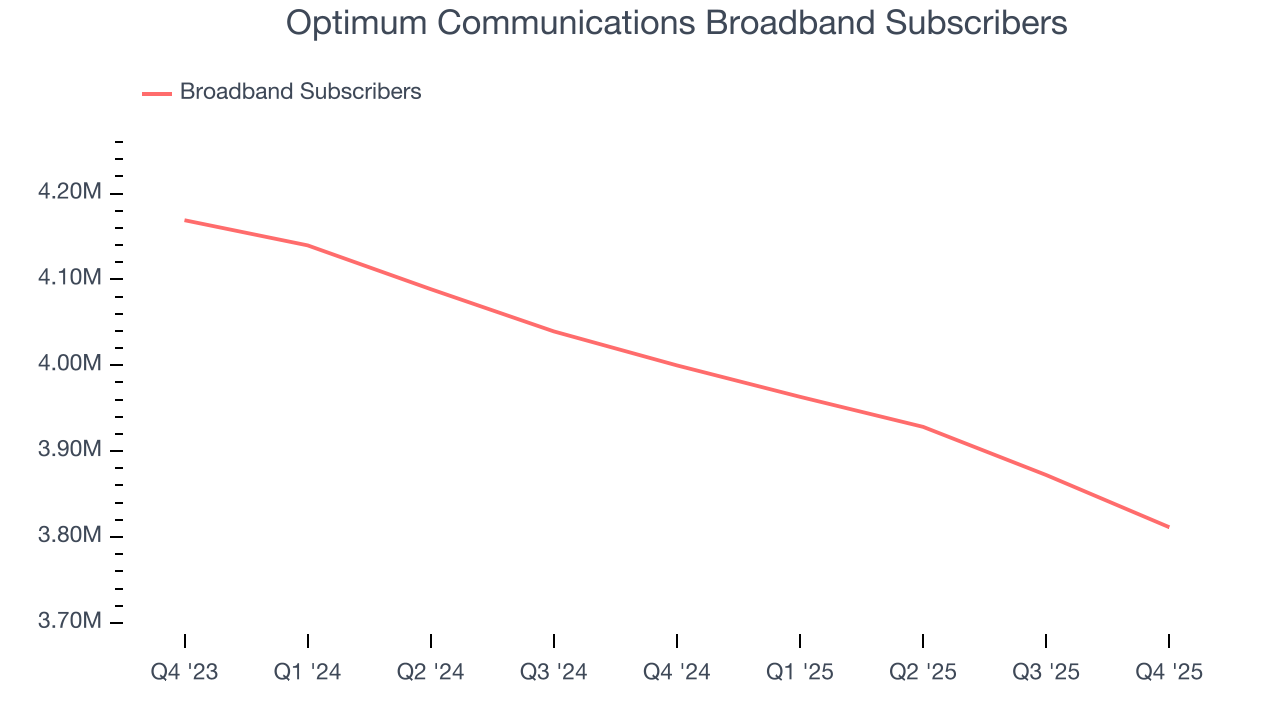

- Broadband Subscribers: 3.81 million, down 188,500 year on year

- Market Capitalization: $760.8 million

Company Overview

Based in Long Island City, Optimum Communications (NYSE:OPTU) is a telecommunications company offering cable, internet, telephone, and television services across the United States.

The company was founded to become a comprehensive telecommunications provider. Its solutions address the need for dependable internet connectivity, varied entertainment choices, and effective communication, providing a unified solution for entertainment and communication needs.

Optimum Communications' services encompass high-speed internet, cable television, voice telephony, and digital television offerings, catering to both residential and business clients. The company's revenue is primarily derived from subscription-based services, and its ability to deliver a full suite of services makes it appealing to customers seeking convenience and simplification.

4. Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Competitors in the telecommunications and media services sector include Comcast (NASDAQ:CMCSA), Charter Communications (NASDAQ:CHTR), and DISH Network (NASDAQ:DISH).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Optimum Communications struggled to consistently generate demand over the last five years as its sales dropped at a 2.8% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Optimum Communications’s annualized revenue declines of 3.6% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

Optimum Communications also discloses its number of broadband subscribers and pay tv subscribers, which clocked in at 3.81 million and 1.63 million in the latest quarter. Over the last two years, Optimum Communications’s broadband subscribers averaged 4.2% year-on-year declines while its pay tv subscribers averaged 13.9% year-on-year declines.

This quarter, Optimum Communications’s revenue fell by 2.3% year on year to $2.18 billion but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to decline by 4.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

Optimum Communications’s operating margin has shrunk over the last 12 months and averaged 8.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Optimum Communications generated an operating margin profit margin of 18.2%, up 3 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

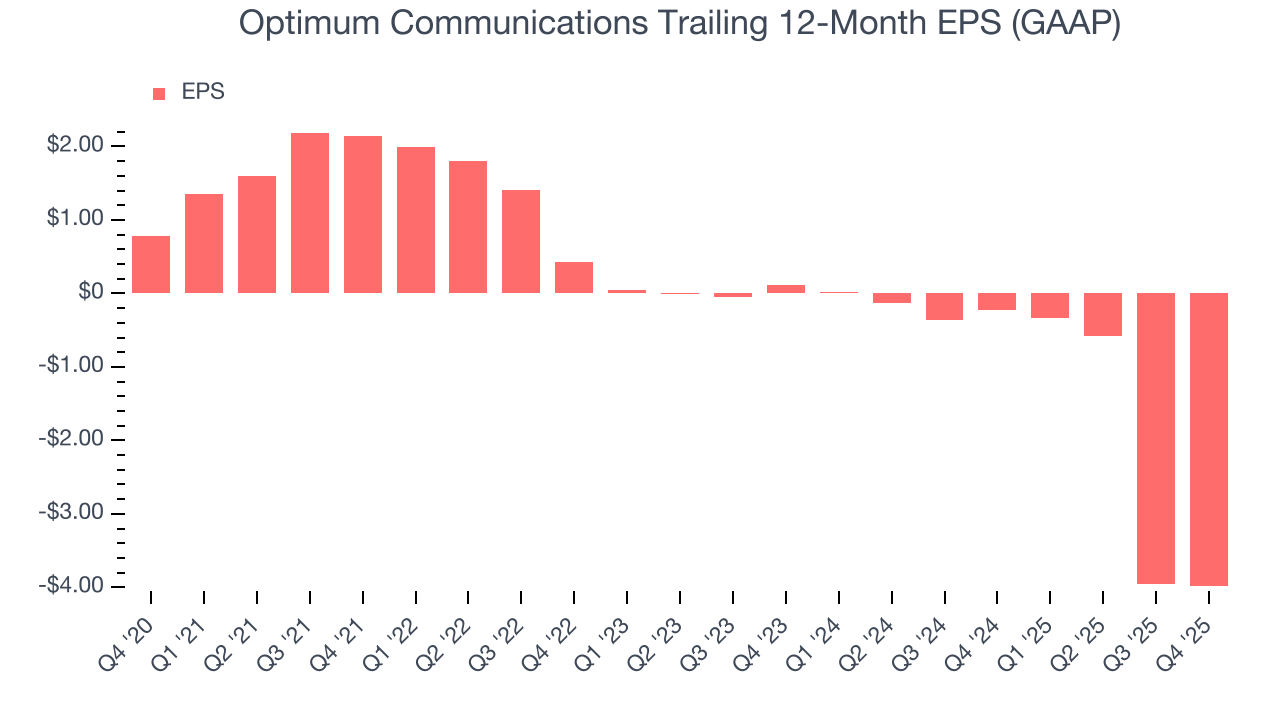

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Optimum Communications, its EPS declined by 48% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, Optimum Communications reported EPS of negative $0.15, down from negative $0.12 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Optimum Communications to improve its earnings losses. Analysts forecast its full-year EPS of negative $3.99 will advance to negative $0.23.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

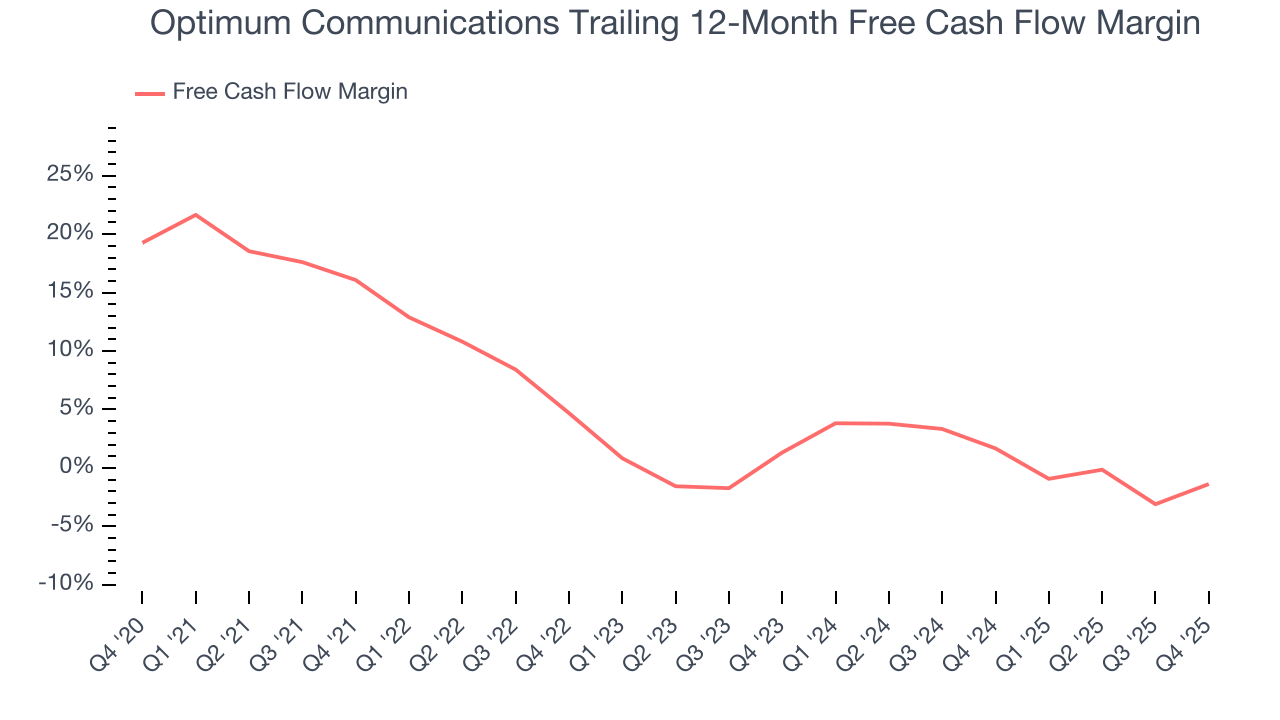

Optimum Communications broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Optimum Communications’s free cash flow clocked in at $199.4 million in Q4, equivalent to a 9.1% margin. This result was good as its margin was 6.9 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Optimum Communications historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Optimum Communications’s ROIC averaged 4.3 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Optimum Communications’s $26.41 billion of debt exceeds the $1.01 billion of cash on its balance sheet. Furthermore, its 8× net-debt-to-EBITDA ratio (based on its EBITDA of $3.34 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Optimum Communications could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Optimum Communications can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from Optimum Communications’s Q4 Results

It was encouraging to see Optimum Communications beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its adjusted operating income fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $1.64 immediately after reporting.

12. Is Now The Time To Buy Optimum Communications?

Updated: February 22, 2026 at 10:18 PM EST

Before making an investment decision, investors should account for Optimum Communications’s business fundamentals and valuation in addition to what happened in the latest quarter.

Optimum Communications doesn’t pass our quality test. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its number of broadband subscribers has disappointed. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Optimum Communications’s EV-to-EBITDA ratio based on the next 12 months is 7.8x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $1.73 on the company (compared to the current share price of $1.56).