Otis (OTIS)

We’re skeptical of Otis. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Otis Will Underperform

Credited with inventing the first hydraulic passenger elevator, Otis Worldwide (NYSE:OTIS) is an elevator and escalator manufacturing, installation and service company.

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 2.6% over the last five years was below our standards for the industrials sector

- One positive is that its healthy operating margin shows it’s a well-run company with efficient processes

Otis lacks the business quality we seek. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Otis

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Otis

Otis is trading at $90.40 per share, or 21.2x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Otis (OTIS) Research Report: Q4 CY2025 Update

Elevator manufacturer Otis (NYSE:OTIS) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.3% year on year to $3.80 billion. The company’s full-year revenue guidance of $15.15 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $1.03 per share was in line with analysts’ consensus estimates.

Otis (OTIS) Q4 CY2025 Highlights:

- Revenue: $3.80 billion vs analyst estimates of $3.87 billion (3.3% year-on-year growth, 1.8% miss)

- Adjusted EPS: $1.03 vs analyst estimates of $1.03 (in line)

- Adjusted EBITDA: $651 million vs analyst estimates of $675.7 million (17.1% margin, 3.7% miss)

- Operating Margin: 15.5%, up from 14.4% in the same quarter last year

- Free Cash Flow Margin: 20.3%, up from 17.7% in the same quarter last year

- Organic Revenue rose 1% year on year (miss)

- Market Capitalization: $35.29 billion

Company Overview

Credited with inventing the first hydraulic passenger elevator, Otis Worldwide (NYSE:OTIS) is an elevator and escalator manufacturing, installation and service company.

Otis Worldwide was established in 1853 by Elisha Otis. After Elisha's death, his sons Charles and Norton took over. Throughout the American Civil War, the company's elevators were sought after for moving supplies. This led to to widespread adoption by businesses across the US, and Otis eventually expanded into international markets, including splashy buildings such as the Eiffel Tower and the Burj Khalifa.

Today, Otis provides a range of passenger and freight elevators, as well as escalators and moving walkways for residential, commercial and infrastructure projects. Products the company offers include the Gen2, a low-and mid-rise elevator solution, and the SkyRise, an elevator platform for skyscrapers, and customers for these products consist of building owners, facility managers, and government agencies. Otis also offers installations, aftermarket services, and software for its products as the world digitizes. These from relatively simple repairs and upgrades of interior finishes to complex upgrades of larger components and subsystems.

The company generates revenue through the sale of its physical products as well as installation and aftermarket service offerings. Otis sells its products through a direct sales force that is augmented by agents and distributors given its global scale. Customers typically make an advance payment to cover costs including design and contract engineering, reducing some of the risk from projects. Its aftermarket service offerings provide recurring revenue through the form of long term maintenance contracts and subscriptions for its premium software solutions.

4. General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include KONE (HEL:KNEBV), Schindler (SWX:SCHN), and Thyssenkrupp Elevator (FWB:TKA).

5. Revenue Growth

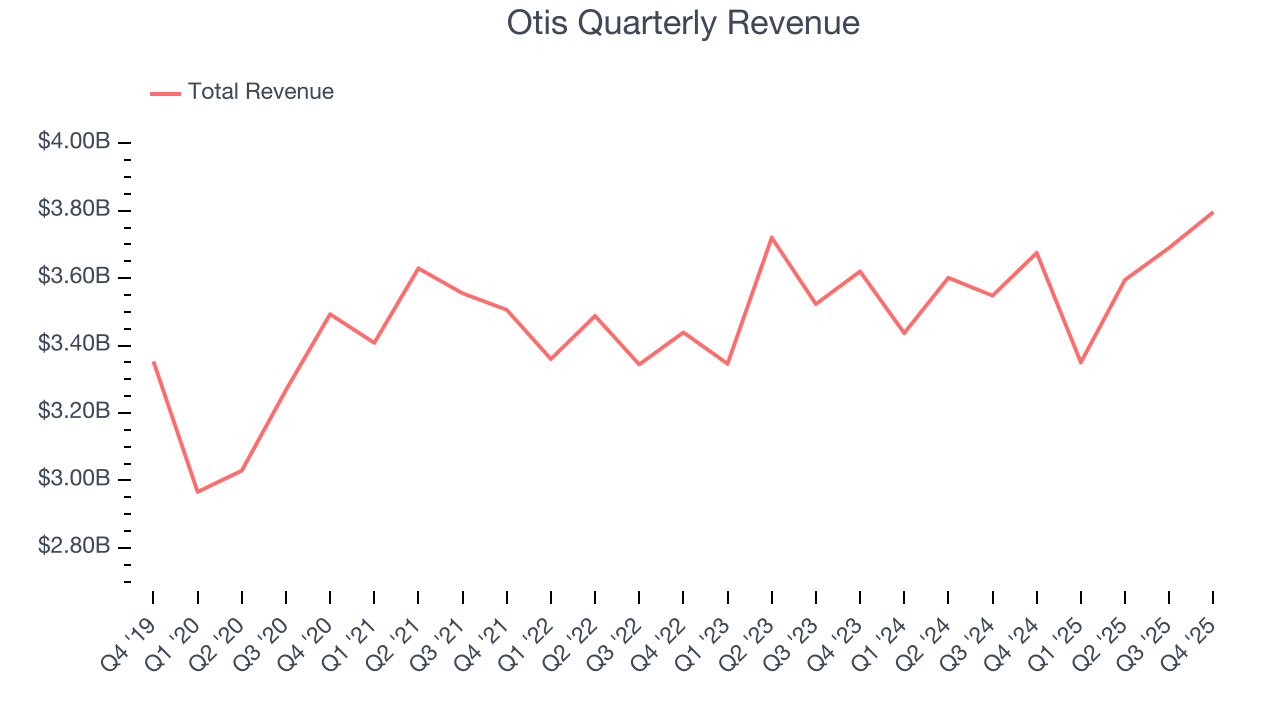

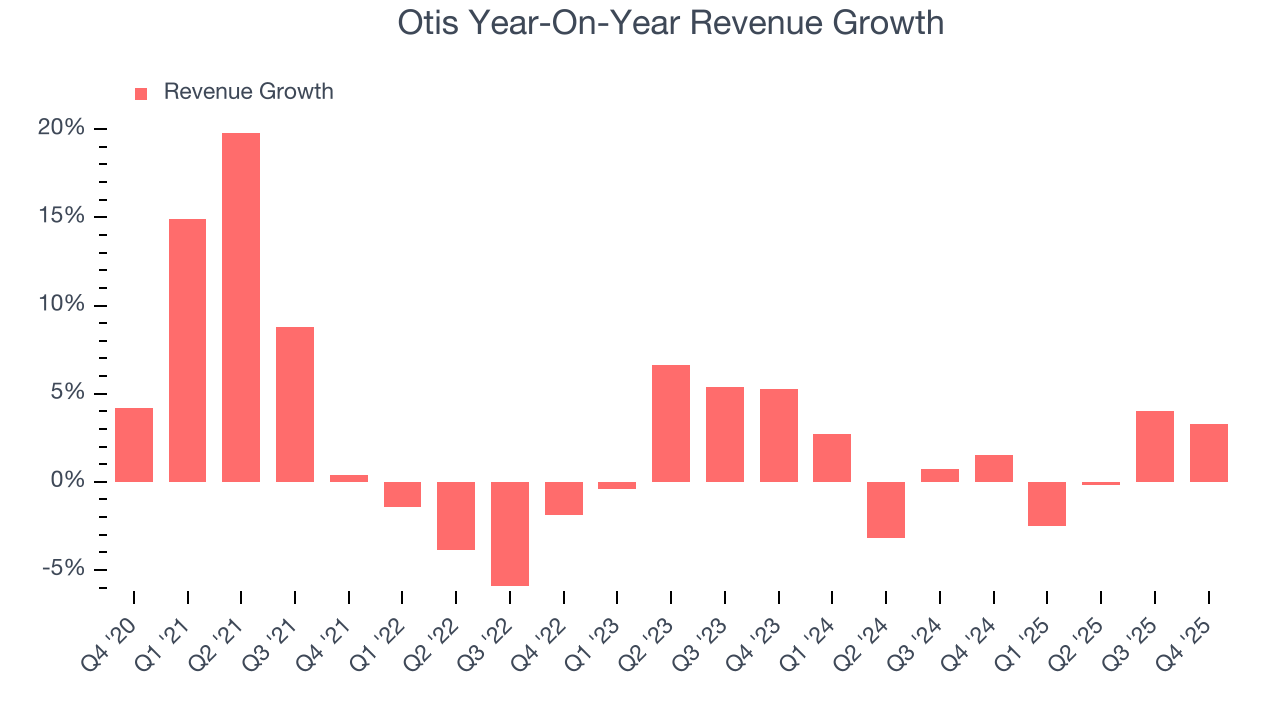

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Otis’s 2.5% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Otis’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

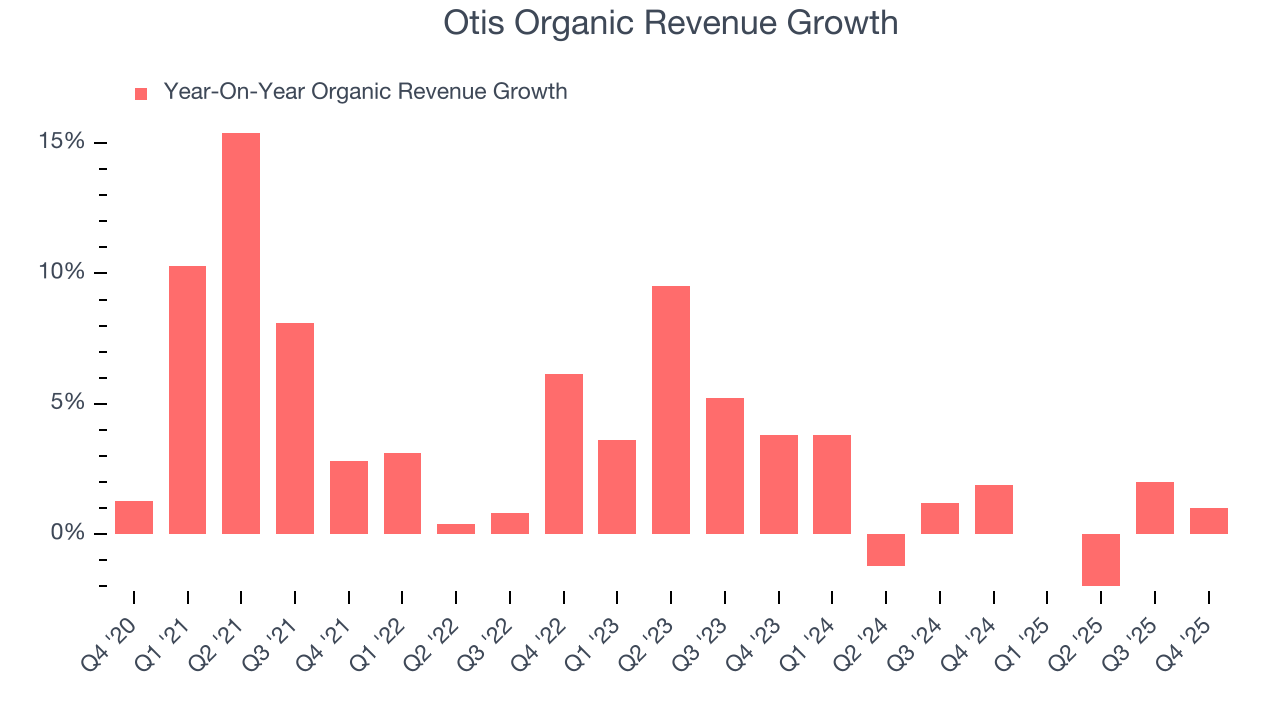

Otis also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Otis’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Otis’s revenue grew by 3.3% year on year to $3.80 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

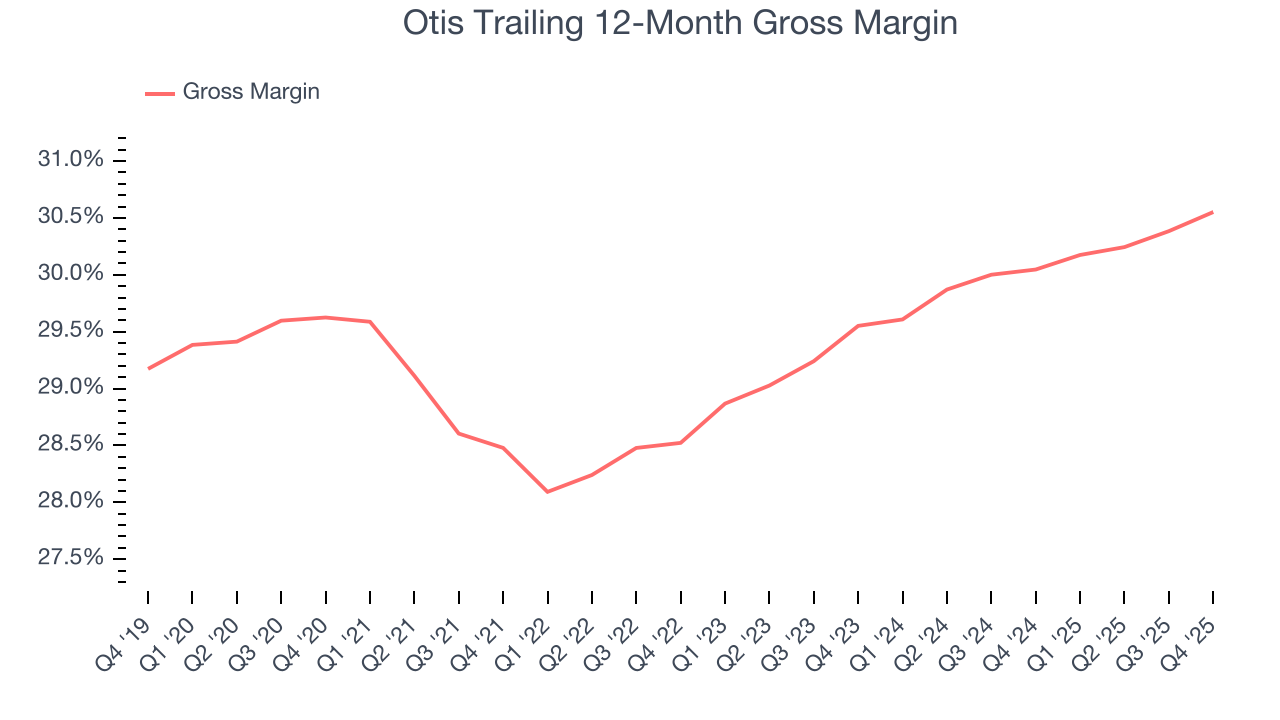

Otis’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29.4% gross margin over the last five years. Said differently, Otis had to pay a chunky $70.56 to its suppliers for every $100 in revenue.

Otis produced a 30.2% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

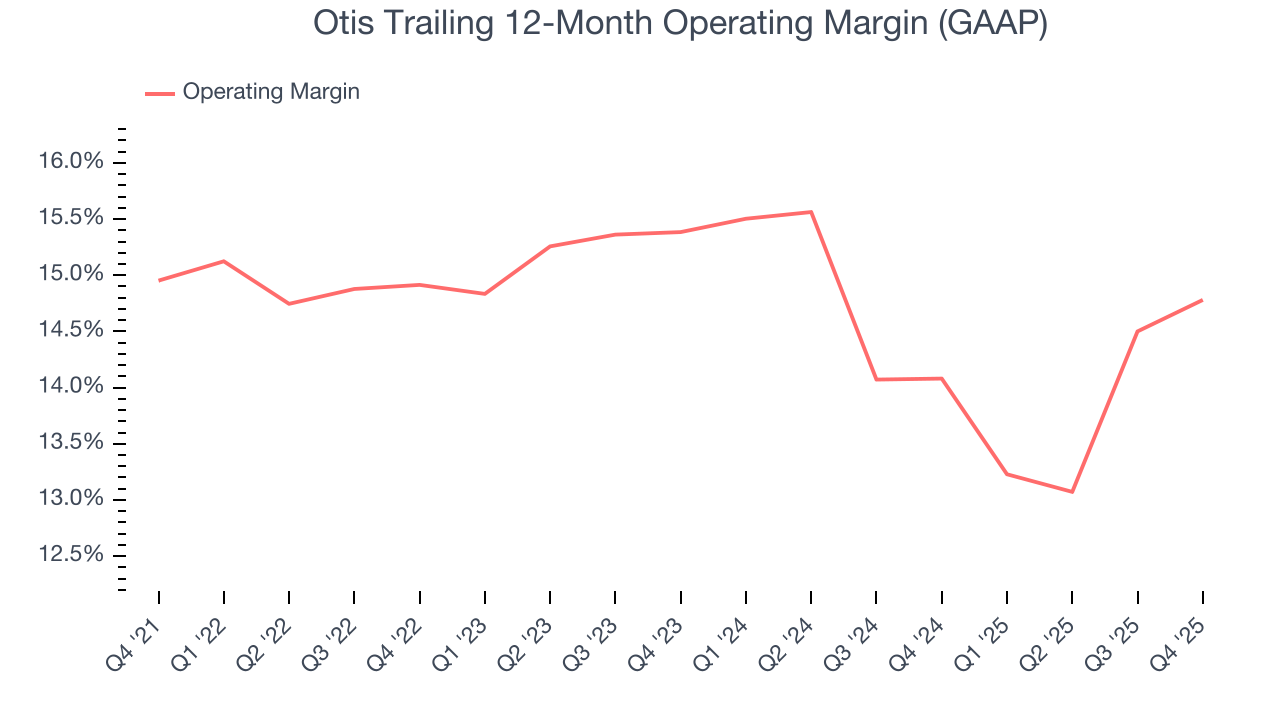

Otis’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 14.8% over the last five years. This profitability was top-notch for an industrials business, showing it’s an well-run company with an efficient cost structure. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Otis’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Otis generated an operating margin profit margin of 15.5%, up 1.1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

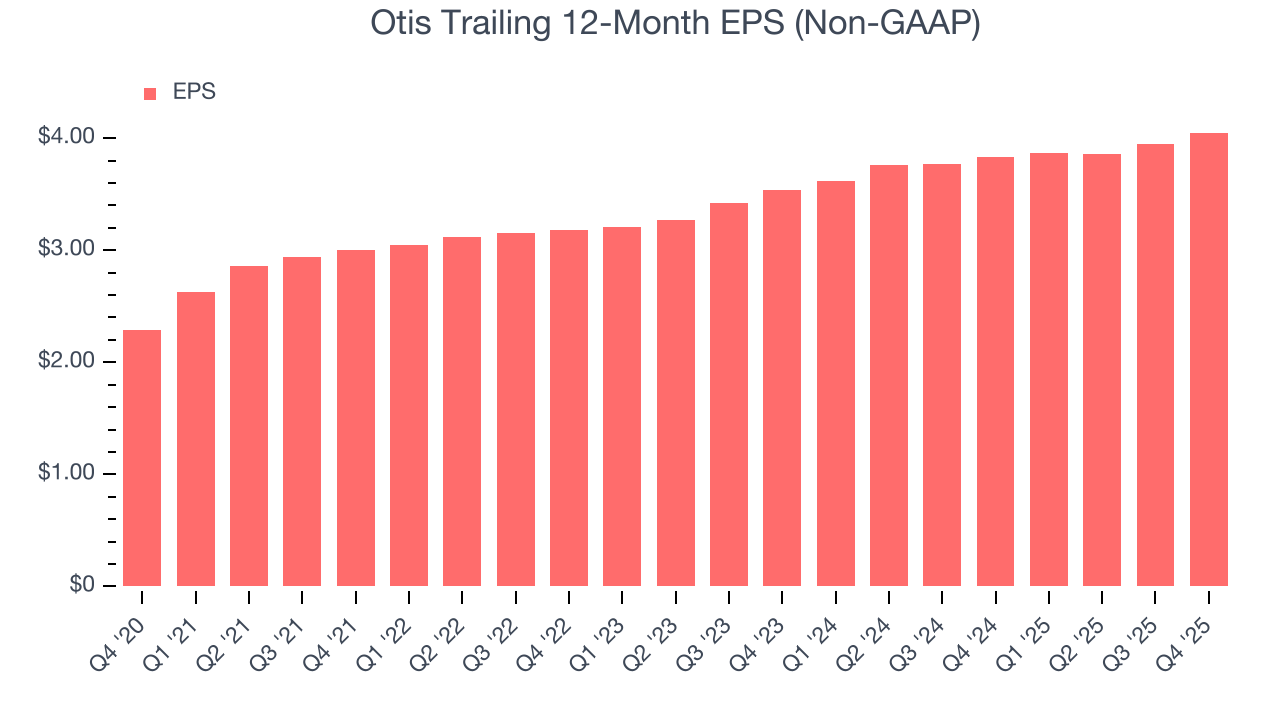

Otis’s EPS grew at a remarkable 12.1% compounded annual growth rate over the last five years, higher than its 2.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

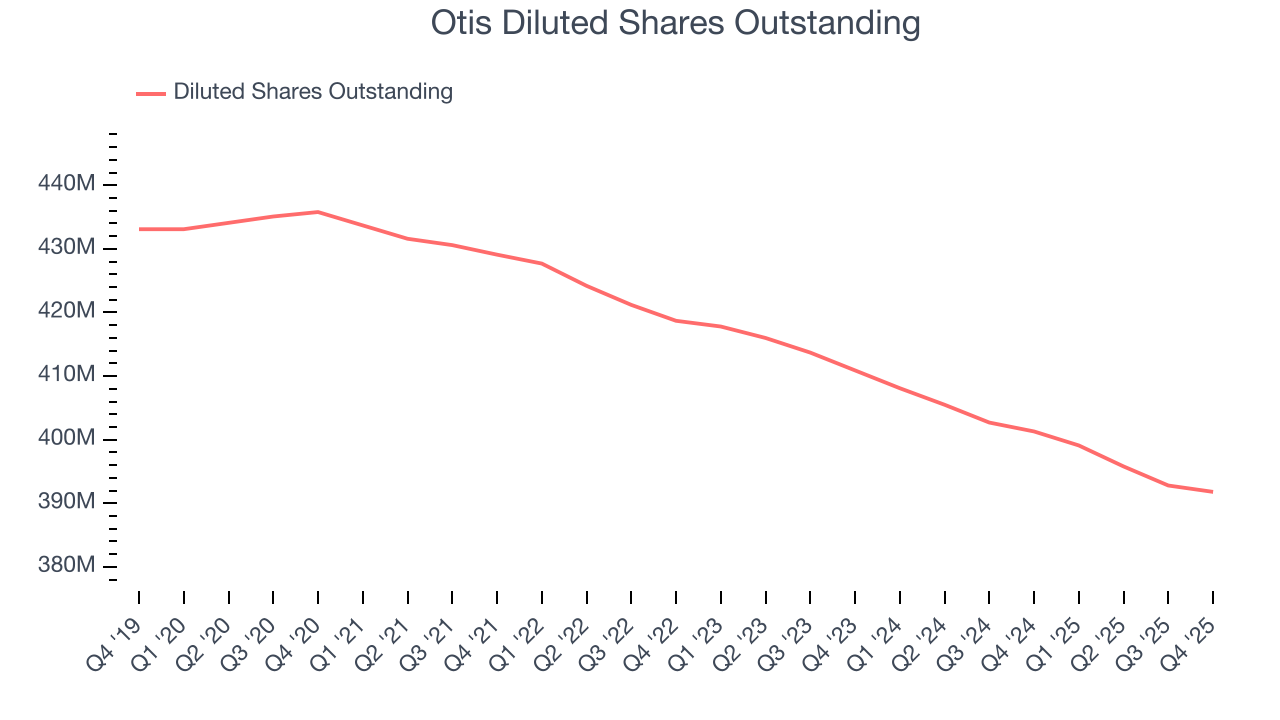

We can take a deeper look into Otis’s earnings quality to better understand the drivers of its performance. A five-year view shows that Otis has repurchased its stock, shrinking its share count by 10.1%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Otis, its two-year annual EPS growth of 7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Otis reported adjusted EPS of $1.03, up from $0.93 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Otis’s full-year EPS of $4.05 to grow 9%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

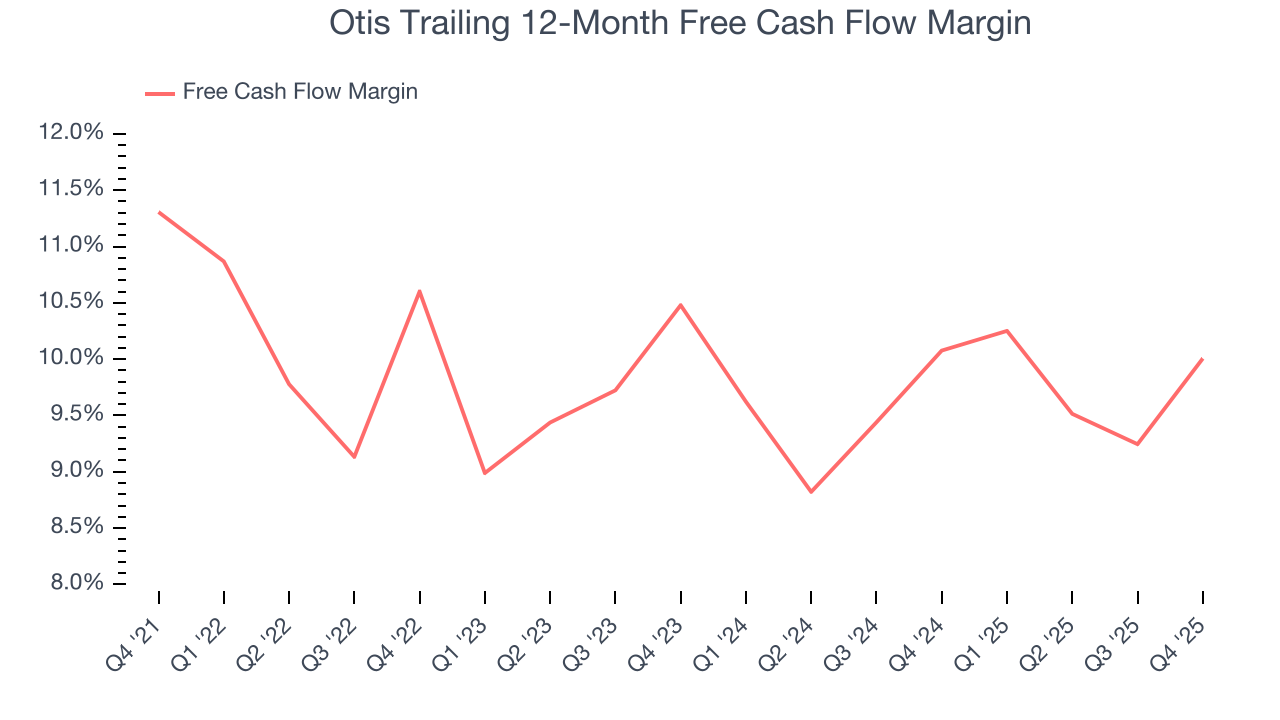

Otis has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 10.5% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Otis’s margin dropped by 1.3 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Otis’s free cash flow clocked in at $772 million in Q4, equivalent to a 20.3% margin. This result was good as its margin was 2.6 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

10. Balance Sheet Assessment

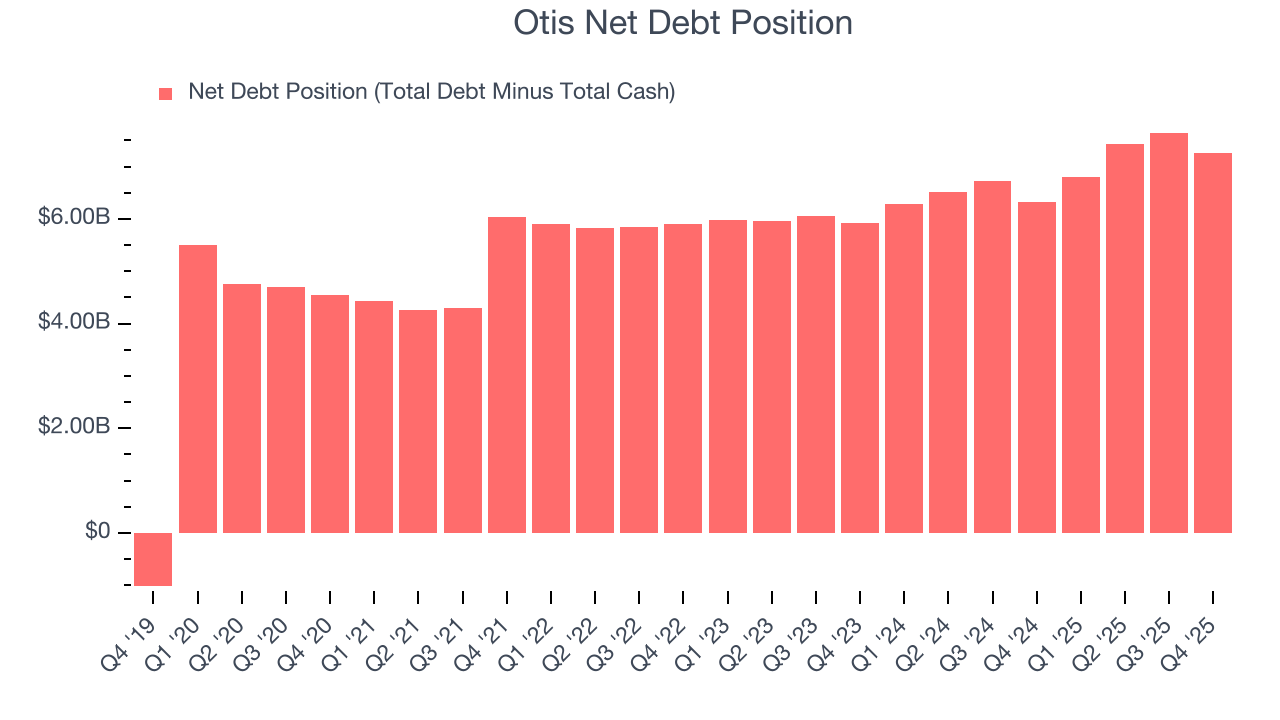

Otis reported $1.10 billion of cash and $8.35 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.59 billion of EBITDA over the last 12 months, we view Otis’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $68 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Otis’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.7% to $88.11 immediately following the results.

12. Is Now The Time To Buy Otis?

Updated: January 28, 2026 at 6:31 AM EST

Are you wondering whether to buy Otis or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Otis isn’t a terrible business, but it isn’t one of our picks. To kick things off, its revenue growth was weak over the last five years. And while Otis’s strong operating margins show it’s a well-run business, its flat organic revenue disappointed.

Otis’s P/E ratio based on the next 12 months is 20.5x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $105.18 on the company (compared to the current share price of $88.11).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.