UiPath (PATH)

We’re cautious of UiPath. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think UiPath Will Underperform

Starting with robotic process automation (RPA) and evolving into a comprehensive automation powerhouse, UiPath (NYSE:PATH) provides an AI-powered business automation platform that enables organizations to create software robots that mimic human actions to streamline repetitive tasks and processes.

- Average billings growth of 2.3% over the last year was subpar, suggesting it struggled to push its software and might have to lower prices to stimulate demand

- Estimated sales growth of 9.4% for the next 12 months implies demand will slow from its two-year trend

- On the plus side, its software is difficult to replicate at scale and results in a premier gross margin of 83.4%

UiPath’s quality is lacking. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than UiPath

High Quality

Investable

Underperform

Why There Are Better Opportunities Than UiPath

At $10.82 per share, UiPath trades at 3.6x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. UiPath (PATH) Research Report: Q3 CY2025 Update

Automation software company UiPath (NYSE:PATH) announced better-than-expected revenue in Q3 CY2025, with sales up 15.9% year on year to $411.1 million. The company expects next quarter’s revenue to be around $464.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.16 per share was 9.6% above analysts’ consensus estimates.

UiPath (PATH) Q3 CY2025 Highlights:

- Revenue: $411.1 million vs analyst estimates of $392.8 million (15.9% year-on-year growth, 4.7% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.15 (9.6% beat)

- Adjusted Operating Income: $87.78 million vs analyst estimates of $69.98 million (21.4% margin, 25.4% beat)

- Revenue Guidance for Q4 CY2025 is $464.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 3.2%, up from -12.2% in the same quarter last year

- Free Cash Flow Margin: 6.1%, down from 11.5% in the previous quarter

- Annual Recurring Revenue: $1.78 billion vs analyst estimates of $1.77 billion (10.9% year-on-year growth, 0.5% beat)

- Market Capitalization: $7.59 billion

Company Overview

Starting with robotic process automation (RPA) and evolving into a comprehensive automation powerhouse, UiPath (NYSE:PATH) provides an AI-powered business automation platform that enables organizations to create software robots that mimic human actions to streamline repetitive tasks and processes.

UiPath's platform works by allowing users to build digital workers that can replicate human interactions with software applications - from logging into systems and extracting information from documents to updating databases and processing forms. These automations can be created through an intuitive drag-and-drop interface that requires minimal coding knowledge, democratizing automation capabilities across organizations regardless of technical expertise.

The company's technology integrates artificial intelligence, machine learning, and natural language processing to handle increasingly complex scenarios. For example, a financial services company might use UiPath to automate invoice processing by having software robots extract data from incoming documents, validate information against multiple systems, and initiate payment workflows - all with minimal human intervention.

UiPath generates revenue through software licensing and subscription models. Its customer base spans organizations of all sizes across industries, though it maintains a strategic focus on enterprise clients, particularly among the Forbes Global 2000. The company sells both directly and through channel partnerships with systems integrators who help implement the technology.

The platform can be deployed on-premises, in the cloud, or in hybrid environments. For customers seeking faster implementation, UiPath offers Automation Cloud, a SaaS version that requires no additional infrastructure setup.

4. Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

UiPath competes with automation and workflow software providers including Automation Anywhere, Blue Prism (now part of SS&C Technologies), Microsoft Power Automate (NASDAQ: MSFT), ServiceNow (NYSE: NOW), and IBM (NYSE: IBM), along with broader business process management platforms.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, UiPath grew its sales at a solid 24.7% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. UiPath’s recent performance shows its demand has slowed as its annualized revenue growth of 13.2% over the last two years was below its five-year trend.

This quarter, UiPath reported year-on-year revenue growth of 15.9%, and its $411.1 million of revenue exceeded Wall Street’s estimates by 4.7%. Company management is currently guiding for a 9.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

UiPath’s ARR came in at $1.78 billion in Q3, and over the last four quarters, its growth was underwhelming as it averaged 12% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

UiPath is quite efficient at acquiring new customers, and its CAC payback period checked in at 31.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like UiPath, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

UiPath’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 83.4% gross margin over the last year. That means UiPath only paid its providers $16.62 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. UiPath has seen gross margins decline by 1 percentage points over the last 2 year, which is poor compared to software peers.

UiPath produced a 83.3% gross profit margin in Q3, up 1.2 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

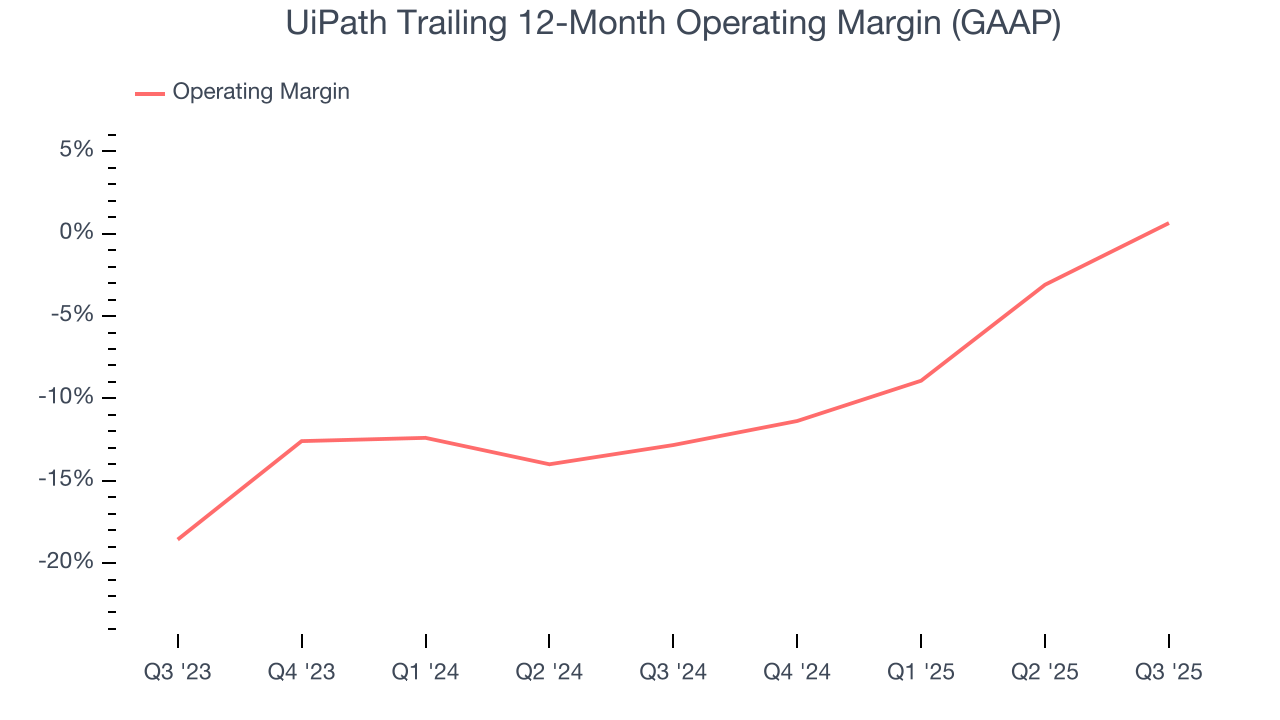

UiPath was roughly breakeven when averaging the last year of quarterly operating profits, decent for a software business.

Looking at the trend in its profitability, UiPath’s operating margin rose by 13.5 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, UiPath generated an operating margin profit margin of 3.2%, up 15.4 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

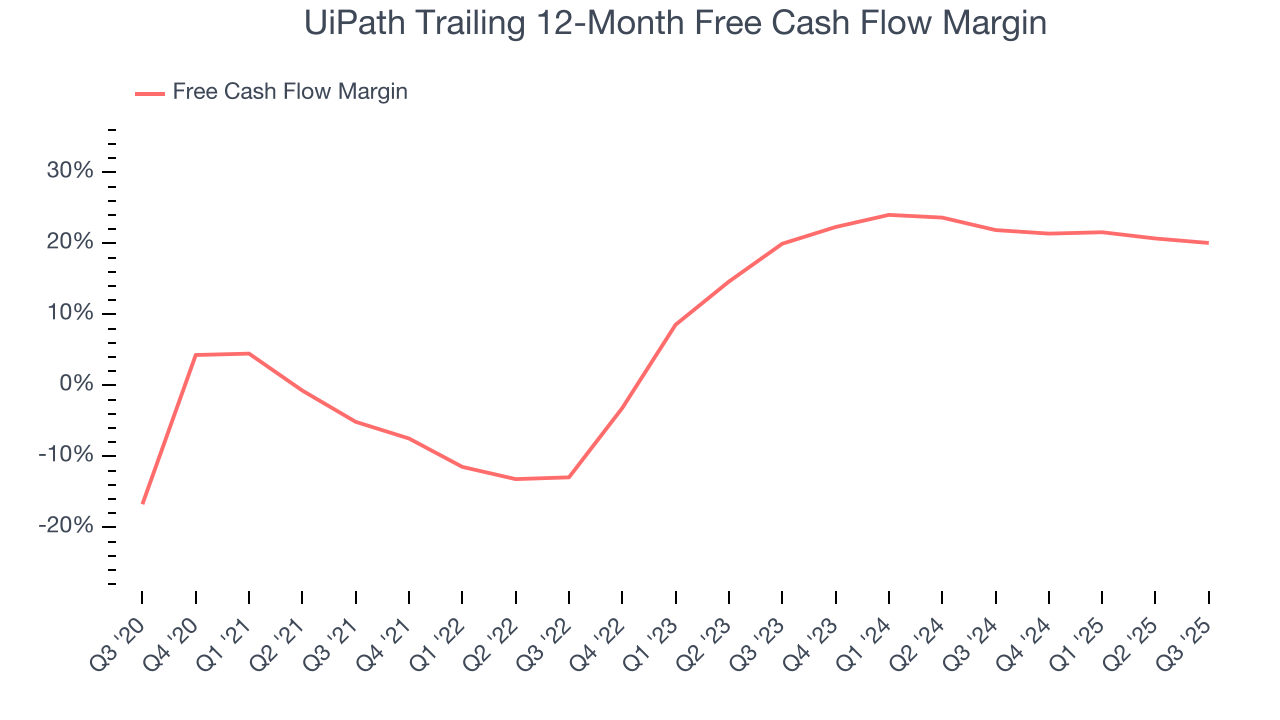

UiPath has shown impressive cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that give it the option to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 20.1% over the last year, better than the broader software sector.

UiPath’s free cash flow clocked in at $25.11 million in Q3, equivalent to a 6.1% margin. This cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict UiPath’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 20.1% for the last 12 months will increase to 24.4%, giving it more flexibility for investments, share buybacks, and dividends.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

UiPath is a profitable, well-capitalized company with $1.40 billion of cash and $72.02 million of debt on its balance sheet. This $1.33 billion net cash position is 13.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from UiPath’s Q3 Results

It was encouraging to see UiPath beat analysts’ revenue expectations this quarter. We were also happy its annual recurring revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 7.6% to $16.18 immediately following the results.

13. Is Now The Time To Buy UiPath?

Updated: February 21, 2026 at 9:26 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in UiPath.

UiPath’s business quality ultimately falls short of our standards. Although its revenue growth was strong over the last five years, it’s expected to deteriorate over the next 12 months and its ARR has disappointed and shows the company is having difficulty retaining customers and their spending.

UiPath’s price-to-sales ratio based on the next 12 months is 3.6x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $16.19 on the company (compared to the current share price of $10.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.