PennyMac Financial Services (PFSI)

We’re not sold on PennyMac Financial Services. Its declining sales show demand has evaporated, a red flag for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why PennyMac Financial Services Is Not Exciting

Founded during the 2008 financial crisis to help address the mortgage market meltdown, PennyMac Financial Services (NYSE:PFSI) is a specialty financial services company that originates, services, and manages investments related to residential mortgage loans in the United States.

- Annual sales declines of 6.9% for the past five years show its products and services struggled to connect with the market during this cycle

- Earnings per share have dipped by 4.7% annually over the past five years, which is concerning because stock prices follow EPS over the long term

- The good news is that its market share is on track to rise over the next 12 months as its 72.5% projected net interest income growth implies demand will accelerate from its five-year trend

PennyMac Financial Services’s quality is inadequate. Better stocks can be found in the market.

Why There Are Better Opportunities Than PennyMac Financial Services

High Quality

Investable

Underperform

Why There Are Better Opportunities Than PennyMac Financial Services

At $146.99 per share, PennyMac Financial Services trades at 1.8x forward P/B. This multiple is higher than most banking companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. PennyMac Financial Services (PFSI) Research Report: Q4 CY2025 Update

Mortgage banking company PennyMac Financial Services (NYSE:PFSI) missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $538 million. Its GAAP profit of $1.97 per share was 39.6% below analysts’ consensus estimates.

PennyMac Financial Services (PFSI) Q4 CY2025 Highlights:

- Revenue: $538 million vs analyst estimates of $640.5 million (flat year on year, 16% miss)

- EPS (GAAP): $1.97 vs analyst expectations of $3.26 (39.6% miss)

- Market Capitalization: $7.64 billion

Company Overview

Founded during the 2008 financial crisis to help address the mortgage market meltdown, PennyMac Financial Services (NYSE:PFSI) is a specialty financial services company that originates, services, and manages investments related to residential mortgage loans in the United States.

PennyMac operates through three main business segments: Production, Servicing, and Investment Management. The Production segment sources new mortgage loans through correspondent production (purchasing loans from other lenders), consumer direct lending (originating loans directly with borrowers online and via call centers), and broker direct lending (working with mortgage brokers).

In its correspondent channel, PennyMac purchases loans that meet specific investor guidelines, particularly those insured or guaranteed by government agencies like FHA, VA, and USDA. These loans are typically pooled into mortgage-backed securities guaranteed by Ginnie Mae and sold to institutional investors. The company earns revenue through loan origination fees, interest income during the holding period, gains on sales, and by retaining the mortgage servicing rights.

The Servicing segment handles loan administration activities including collecting payments, managing escrow accounts for taxes and insurance, assisting borrowers with inquiries, and managing delinquencies and foreclosures when necessary. PennyMac services loans both as the owner of mortgage servicing rights and as a subservicer for PennyMac Mortgage Investment Trust (PMT), a publicly traded mortgage REIT that the company manages.

Through its investment management subsidiary, PNMAC Capital Management, PennyMac earns management fees based on PMT's net assets and potential incentive compensation tied to investment performance. This relationship creates a symbiotic business model where PennyMac Financial Services provides operational expertise while PMT supplies investment capital for mortgage-related assets.

4. Thrifts & Mortgage Finance

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

PennyMac Financial Services competes with large financial institutions and other independent mortgage producers and servicers, including Rocket Mortgage (NYSE:RKT), Mr. Cooper Group (NASDAQ:COOP), and United Wholesale Mortgage (NYSE:UWMC), as well as the cash windows of government-sponsored enterprises Fannie Mae and Freddie Mac.

5. Sales Growth

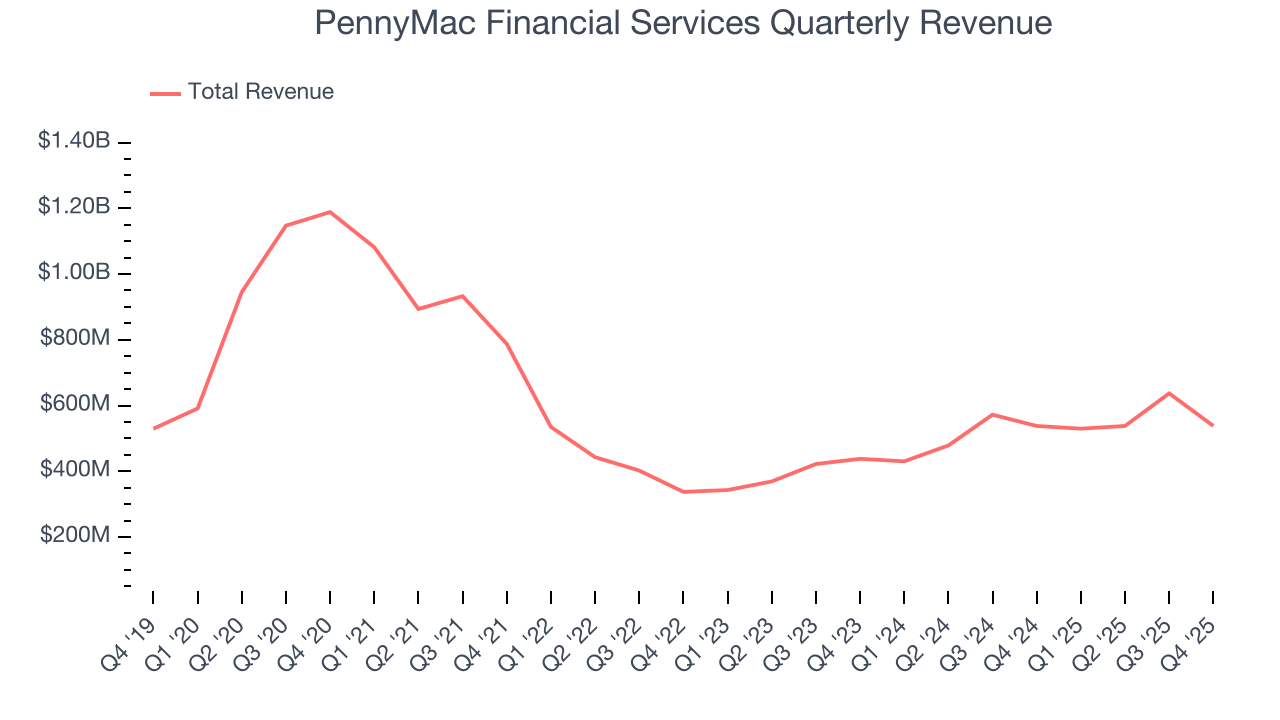

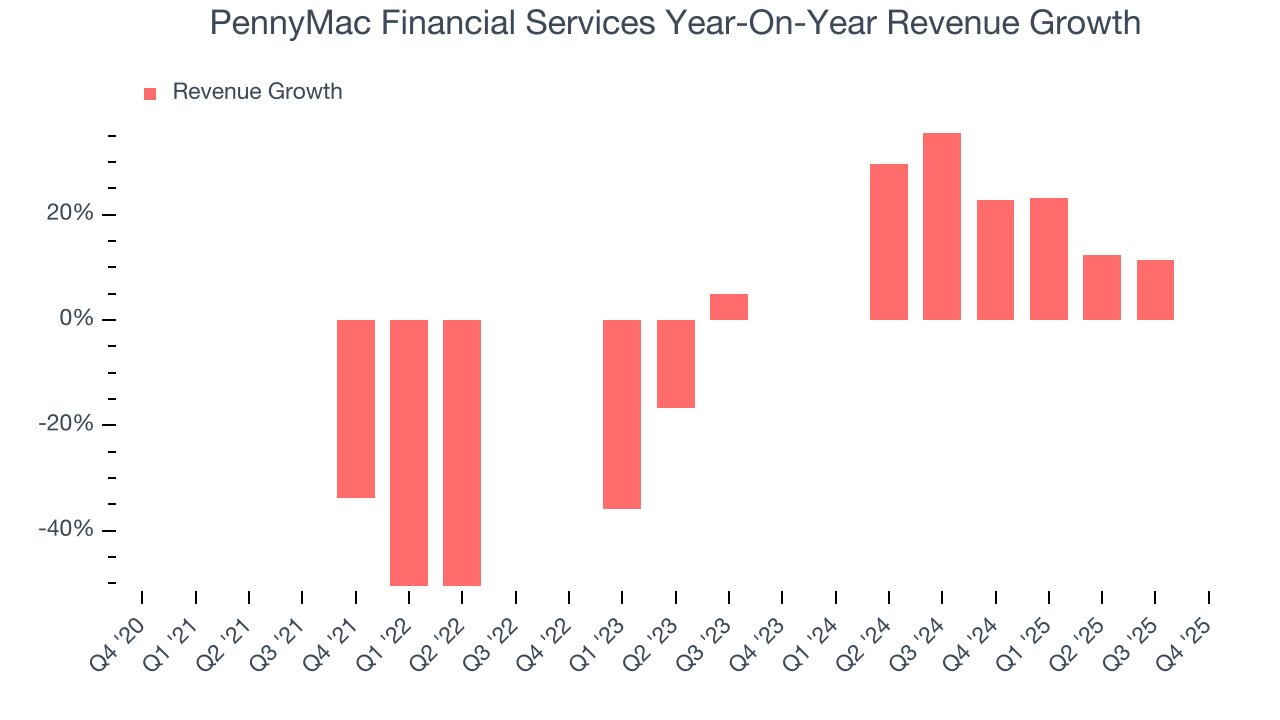

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. PennyMac Financial Services’s demand was weak over the last five years as its revenue fell at a 10.3% annual rate. This wasn’t a great result and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. PennyMac Financial Services’s annualized revenue growth of 19.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PennyMac Financial Services’s $538 million of revenue was flat year on year, falling short of Wall Street’s estimates.

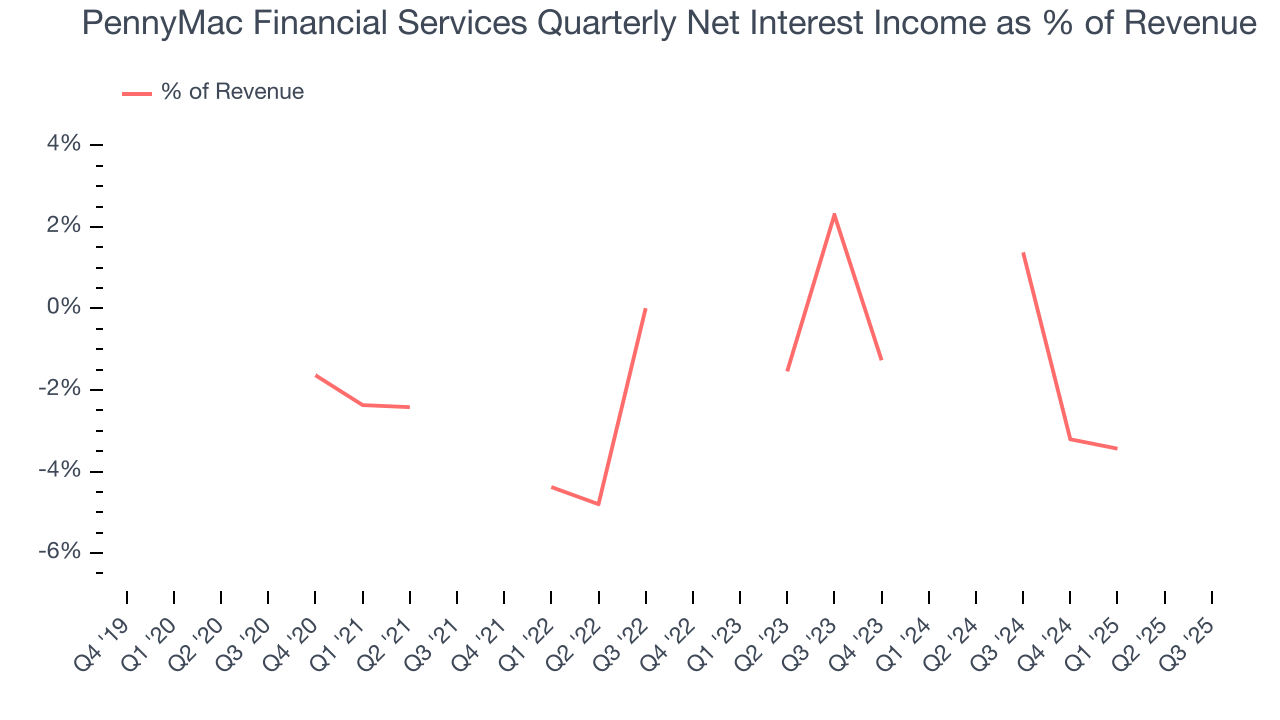

Net interest income made up -1.7% of the company’s total revenue during the last five years, meaning PennyMac Financial Services is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.6. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

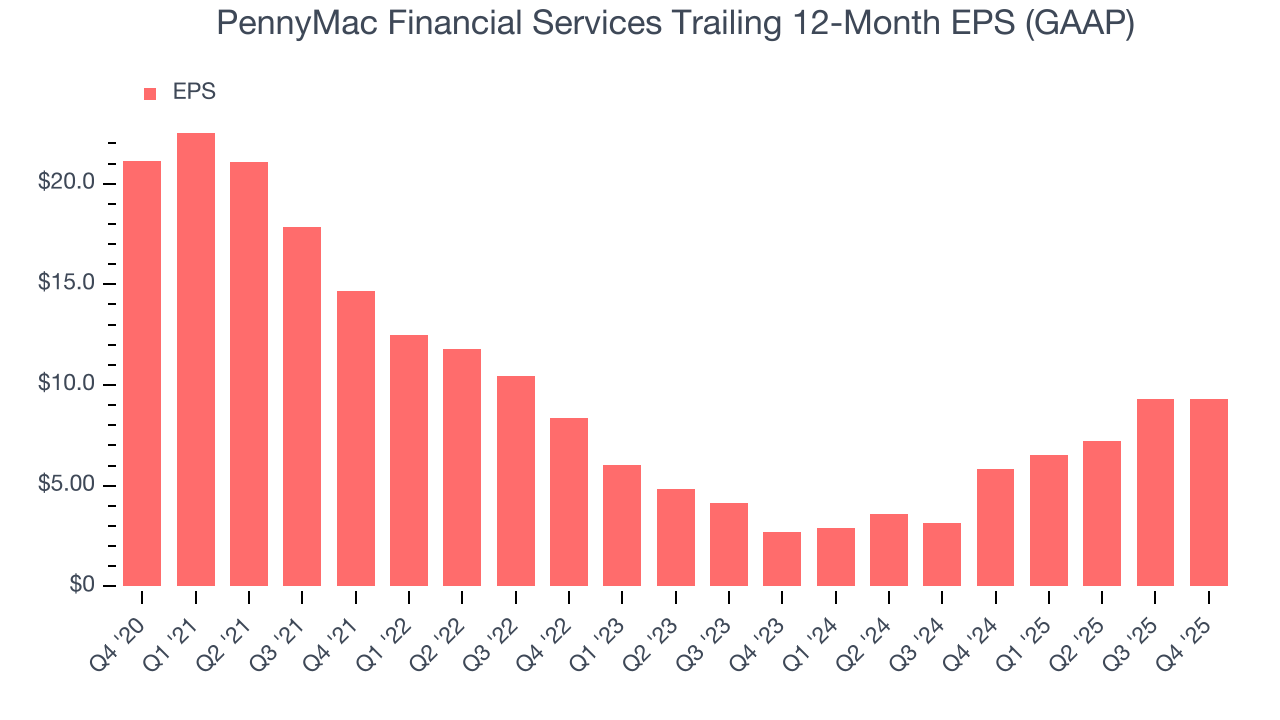

Sadly for PennyMac Financial Services, its EPS declined by 15.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For PennyMac Financial Services, its two-year annual EPS growth of 85.2% was higher than its five-year trend. This acceleration made it one of the faster-growing banking companies in recent history.

In Q4, PennyMac Financial Services reported EPS of $1.97, up from $1.95 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects PennyMac Financial Services’s full-year EPS of $9.31 to grow 64.1%.

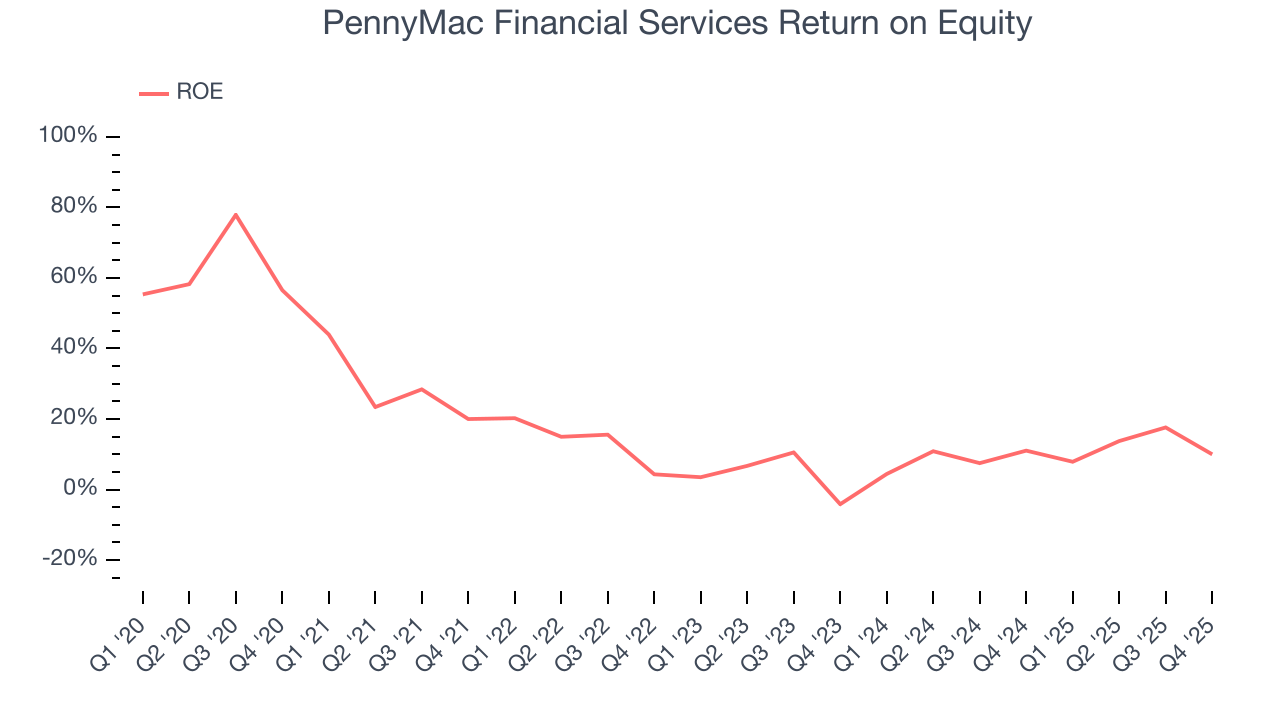

7. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, PennyMac Financial Services has averaged an ROE of 13.5%, healthy for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This is a bright spot for PennyMac Financial Services.

8. Key Takeaways from PennyMac Financial Services’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates, and these shortfalls were huge. Overall, this was a softer quarter. The stock traded down 22.5% to $116 immediately after reporting.

9. Is Now The Time To Buy PennyMac Financial Services?

Updated: January 29, 2026 at 5:23 PM EST

Before deciding whether to buy PennyMac Financial Services or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

PennyMac Financial Services has some positive attributes, but it isn’t one of our picks. Although its revenue has declined over the last five years, its growth over the next 12 months is expected to be higher. And while PennyMac Financial Services’s declining EPS over the last five years makes it a less attractive asset to the public markets, its estimated net interest income growth for the next 12 months is great.

PennyMac Financial Services’s P/B ratio based on the next 12 months is 1.5x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $154.75 on the company (compared to the current share price of $116).