Polaris (PII)

Polaris is up against the odds. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Polaris Will Underperform

Founded in 1954, Polaris (NYSE:PII) designs and manufactures high-performance off-road vehicles, snowmobiles, and motorcycles.

- Sales were flat over the last five years, indicating it’s failed to expand its business

- Sales over the last five years were less profitable as its earnings per share fell by 14.9% annually while its revenue was flat

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

Polaris falls short of our quality standards. There are more promising alternatives.

Why There Are Better Opportunities Than Polaris

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Polaris

At $56.06 per share, Polaris trades at 35x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Polaris (PII) Research Report: Q4 CY2025 Update

Off-Road and powersports vehicle corporation Polaris (NYSE:PII) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 7.9% year on year to $1.92 billion. Its non-GAAP profit of $0.08 per share was significantly above analysts’ consensus estimates.

Polaris (PII) Q4 CY2025 Highlights:

- Revenue: $1.92 billion vs analyst estimates of $1.82 billion (7.9% year-on-year growth, 5.8% beat)

- Adjusted EPS: $0.08 vs analyst estimates of $0.04 (significant beat)

- Adjusted EBITDA: $98.1 million vs analyst estimates of $109.5 million (5.1% margin, 10.4% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.55 at the midpoint, missing analyst estimates by 8.8%

- Operating Margin: -16.7%, down from 3.7% in the same quarter last year

- Free Cash Flow Margin: 5.9%, down from 7.7% in the same quarter last year

- Market Capitalization: $3.89 billion

Company Overview

Founded in 1954, Polaris (NYSE:PII) designs and manufactures high-performance off-road vehicles, snowmobiles, and motorcycles.

Polaris was established to develop vehicles that could navigate the rugged landscapes of the Midwest. The company quickly made a name for itself with the introduction of the snowmobile, which opened up winter landscapes to new recreational possibilities.

Polaris stands at the forefront of the powersports industry, offering an extensive lineup of off-road vehicles, including ATVs, UTVs, and the Polaris RANGER®. Their motorcycles, under the Indian Motorcycle brand, and the Polaris Slingshot®, a three-wheeled roadster, complement the off-road range. While these vehicles are not for everyone, Polaris has identified its core market of adventurers and outdoor enthusiasts, who the company caters to with these unique and specialized products. These customers tend to be middle to higher income individuals who have extra disposable income to spend on a vehicle that is very unlikely to be their or their family's primary vehicle.

Polaris generates revenue through the sales of its vehicles, parts, garments, and accessories. It is supported by a network of dealerships and after-market services that not only make sales but serve a customer through the life of his/her vehicle, which deepens brand engagement. Those in search of a new Polaris vehicle or in need of services can find a dealership in many states across the US, spanning from the Northeast to the Southwest.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the outdoor sports industry include Vista Outdoor (NYSE:VSTO), Brunswick (NYSE:BC), and Malibu Boats (NASDAQ:MBUU).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Polaris struggled to consistently increase demand as its $7.22 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Polaris’s recent performance shows its demand remained suppressed as its revenue has declined by 10.5% annually over the last two years.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Off-road Vehicles, On-road Vehicles, and Marine, which are 83.1%, 9.7%, and 7.2% of revenue. Over the last two years, Polaris’s Off-road Vehicles (snowmobiles and 4x4s) and On-road Vehicles (motorcycles) revenues averaged year-on-year growth of 11.1% and 3.5% while its Marine revenue (boats) was flat.

This quarter, Polaris reported year-on-year revenue growth of 7.9%, and its $1.92 billion of revenue exceeded Wall Street’s estimates by 5.8%.

Looking ahead, sell-side analysts expect revenue to decline by 2.3% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Operating Margin

Polaris’s operating margin has shrunk over the last 12 months, and it ended up breaking even over the last two years. The company’s performance was inadequate, showing its operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Polaris generated an operating margin profit margin of negative 16.7%, down 20.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Polaris, its EPS declined by 14.9% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q4, Polaris reported adjusted EPS of $0.08, down from $0.92 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Polaris’s full-year EPS of negative $0.01 will flip to positive $1.73.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Polaris has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.9%, lousy for a consumer discretionary business.

Polaris’s free cash flow clocked in at $114 million in Q4, equivalent to a 5.9% margin. The company’s cash profitability regressed as it was 1.8 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts predict Polaris’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 7.7% for the last 12 months will decrease to 3.9%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Polaris historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 15.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Polaris’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

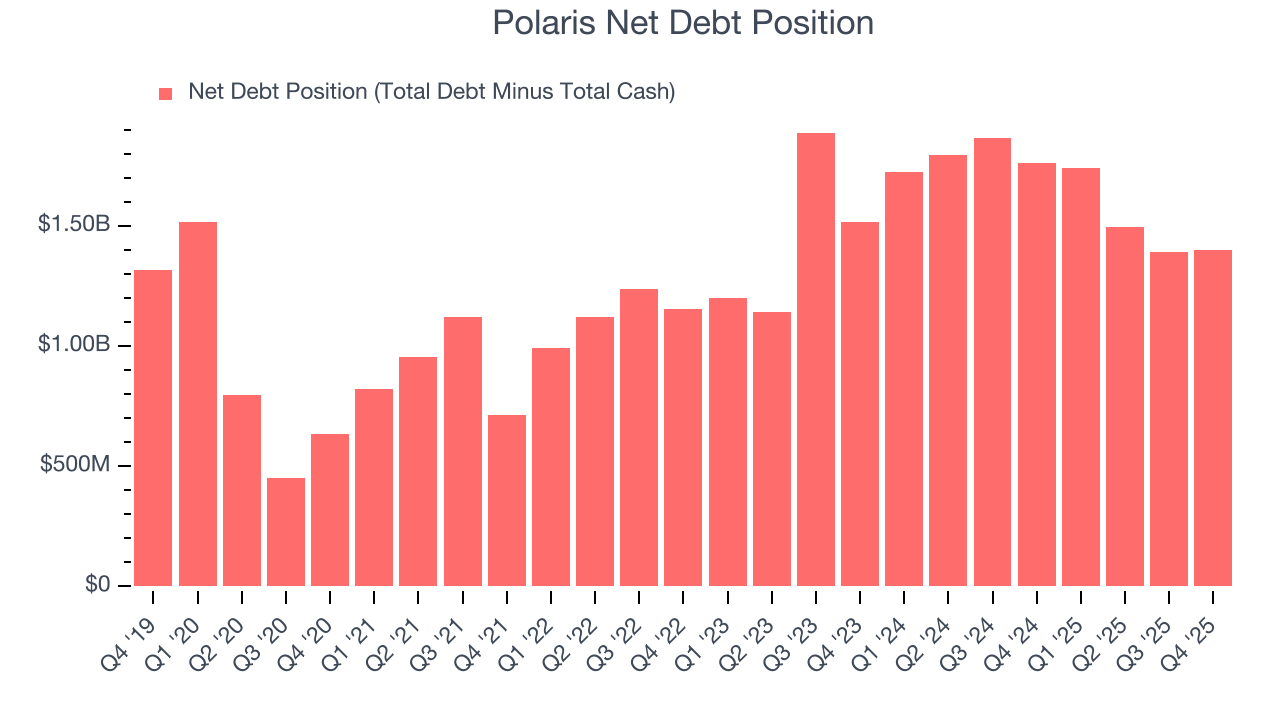

Polaris reported $138 million of cash and $1.54 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $410.2 million of EBITDA over the last 12 months, we view Polaris’s 3.4× net-debt-to-EBITDA ratio as safe. We also see its $69.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Polaris’s Q4 Results

It was good to see Polaris beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.5% to $66 immediately following the results.

12. Is Now The Time To Buy Polaris?

Updated: March 5, 2026 at 9:08 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies helping consumers, but in the case of Polaris, we’re out. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its Forecasted free cash flow margin suggests the company will ramp up its investments next year. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Polaris’s P/E ratio based on the next 12 months is 34.1x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $67.85 on the company (compared to the current share price of $54.61).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.