Pinterest (PINS)

Pinterest is a sound business. It’s not only a cash cow but also has increased its profitability, showing its fundamentals are improving.― StockStory Analyst Team

1. News

2. Summary

Why Pinterest Is Interesting

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

- Disciplined cost controls and effective management have materialized in a strong EBITDA margin, and its rise over the last few years was fueled by some leverage on its fixed costs

- Strong free cash flow margin of 27.9% gives it the option to reinvest, repurchase shares, or pay dividends, and its improved cash conversion implies it’s becoming a less capital-intensive business

- The stock is trading at a reasonable price if you like its story and growth prospects

Pinterest has some respectable qualities. If you believe in the company, the valuation looks reasonable.

Why Is Now The Time To Buy Pinterest?

Why Is Now The Time To Buy Pinterest?

At $19.07 per share, Pinterest trades at 6.9x forward EV/EBITDA. Pinterest’s valuation seems like a good deal for the revenue momentum you get.

Now could be a good time to invest if you believe in the story.

3. Pinterest (PINS) Research Report: Q4 CY2025 Update

Social commerce platform Pinterest (NYSE: PINS) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 14.3% year on year to $1.32 billion. Next quarter’s revenue guidance of $961 million underwhelmed, coming in 2.1% below analysts’ estimates. Its non-GAAP profit of $0.67 per share was in line with analysts’ consensus estimates.

Pinterest (PINS) Q4 CY2025 Highlights:

- Revenue: $1.32 billion vs analyst estimates of $1.33 billion (14.3% year-on-year growth, 0.8% miss)

- Adjusted EPS: $0.67 vs analyst estimates of $0.67 (in line)

- Adjusted EBITDA: $541.5 million vs analyst estimates of $547.1 million (41% margin, 1% miss)

- Revenue Guidance for Q1 CY2026 is $961 million at the midpoint, below analyst estimates of $981.8 million

- EBITDA guidance for Q1 CY2026 is $176 million at the midpoint, below analyst estimates of $205.4 million

- Operating Margin: 22.8%, in line with the same quarter last year

- Free Cash Flow Margin: 28.8%, down from 30.3% in the previous quarter

- Monthly Active Users: 619 million, up 66 million year on year

- Market Capitalization: $12.9 billion

Company Overview

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

Pinterest is an online content and visual discovery platform that allows its users to create personalized collections of curated design or inspiration ideas while also providing recommendations based on a user’s personal interests. One part search engine and one part media platform, Pinterest is a hybrid of ecommerce and social media platform. For its users, most of which are female, Pinterest is a platform that offers discovery of items such as recipes, fashion, and home goods, and does so in an aspirational social media like use case.

For advertisers, Pinterest’s scale of hundreds of million monthly users is a valuable platform to target advertising where users innately are actively moving from ideation to purchasing, which is exactly where advertisers most like to insert themselves, when a potential customer is showing buying intent. As a bonus, unlike other social media platforms, advertising on Pinterest is content, a unique situation for advertisers.

4. Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Pinterest (NASDAQ: PINS) competes with fellow social media advertising platforms like Google (NASDAQ: GOOGL), Meta Platforms (NASDAQ:FB), Snapchat (NYSE: SNAP), and Twitter (NYSE: TWTR).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Pinterest’s sales grew at a solid 14.6% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Pinterest’s revenue grew by 14.3% year on year to $1.32 billion but fell short of Wall Street’s estimates. Company management is currently guiding for a 12.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.5% over the next 12 months, similar to its three-year rate. This projection is noteworthy and indicates the market is forecasting success for its products and services.

6. Monthly Active Users

User Growth

As a social network, Pinterest generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

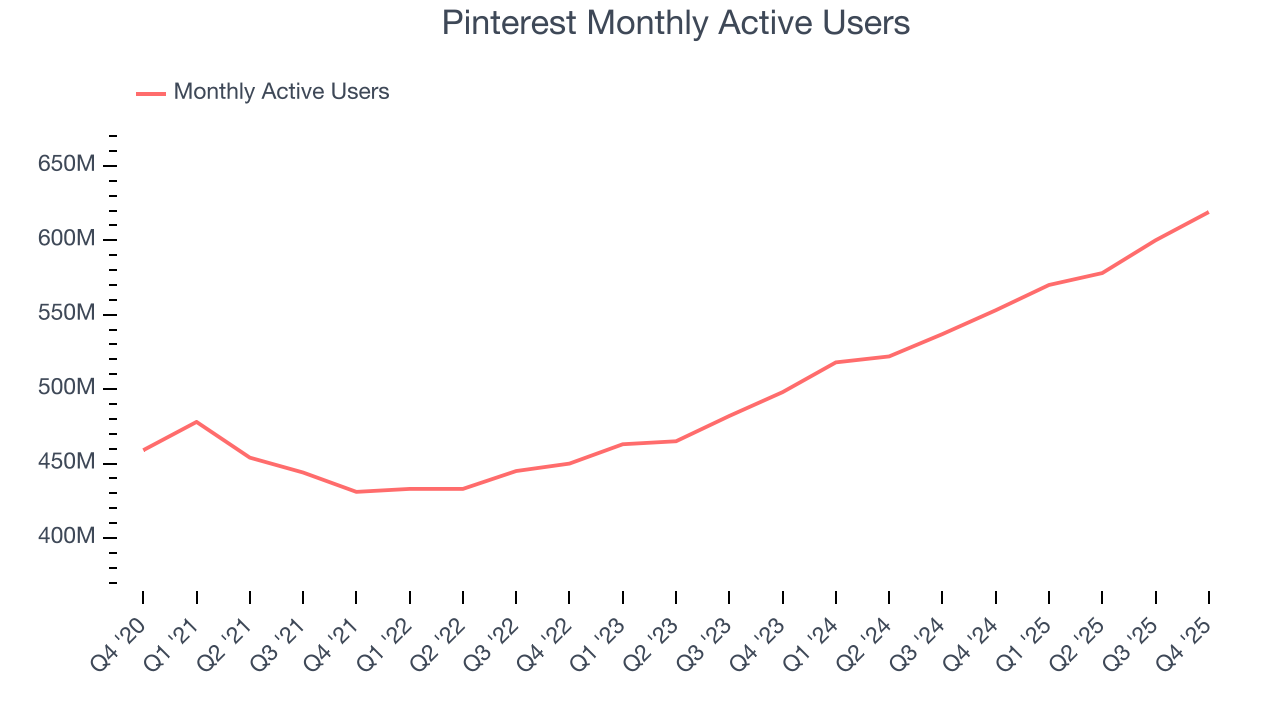

Over the last two years, Pinterest’s monthly active users, a key performance metric for the company, increased by 11.4% annually to 619 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q4, Pinterest added 66 million monthly active users, leading to 11.9% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Pinterest’s audience and its ad-targeting capabilities.

Pinterest’s ARPU growth has been strong over the last two years, averaging 6.3%. Its ability to increase monetization while quickly growing its monthly active users reflects the strength of its platform, as its users continue to spend more each year.

This quarter, Pinterest’s ARPU clocked in at $2.16. It grew by 1.9% year on year, slower than its user growth.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For social network businesses like Pinterest, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

Pinterest’s gross margin is one of the best in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 79.8% gross margin over the last two years. That means Pinterest only paid its providers $20.23 for every $100 in revenue.

In Q4, Pinterest produced a 82.8% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Pinterest grow from a combination of product virality, paid advertisement, and incentives.

Pinterest is efficient at acquiring new users, spending 35.3% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates relatively solid competitive positioning, giving Pinterest the freedom to invest its resources into new growth initiatives.

9. EBITDA

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

Pinterest has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 29.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Pinterest’s EBITDA margin rose by 13.7 percentage points over the last few years, as its sales growth gave it operating leverage.

This quarter, Pinterest generated an EBITDA margin profit margin of 41%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

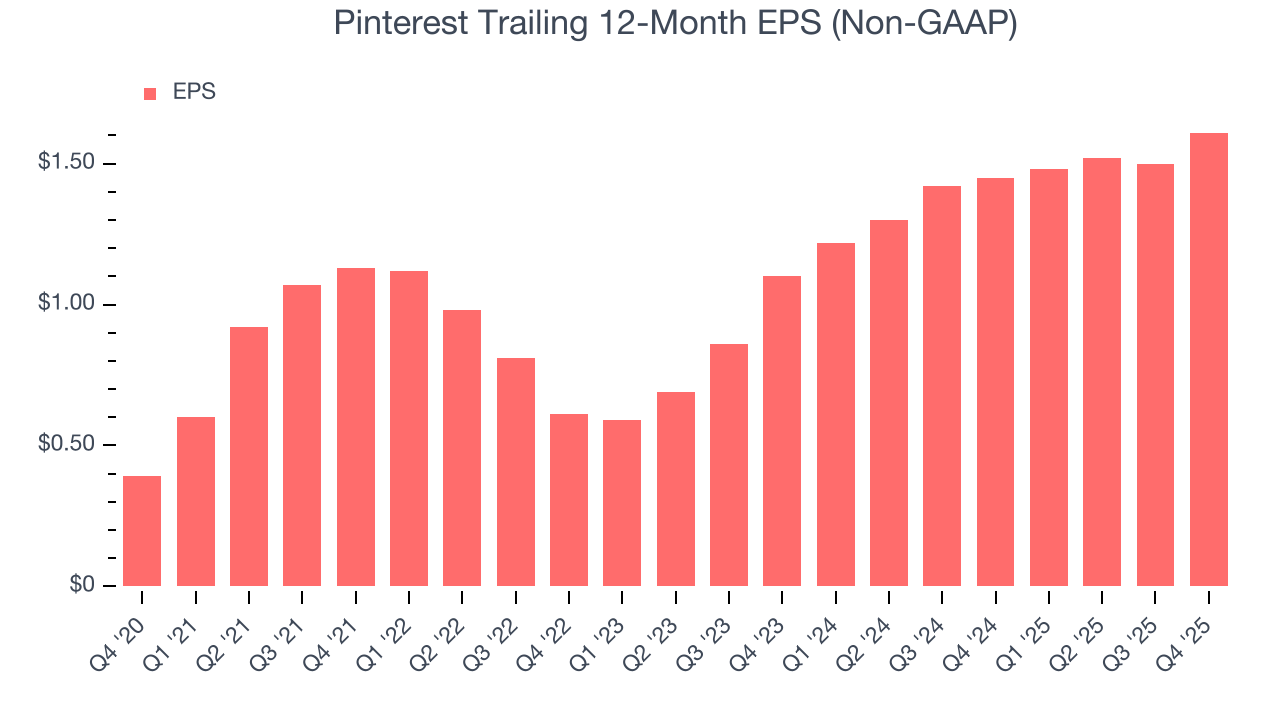

Pinterest’s EPS grew at an astounding 38.2% compounded annual growth rate over the last three years, higher than its 14.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Pinterest’s earnings can give us a better understanding of its performance. As we mentioned earlier, Pinterest’s EBITDA margin was flat this quarter but expanded by 13.7 percentage points over the last three years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Pinterest reported adjusted EPS of $0.67, up from $0.56 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Pinterest’s full-year EPS of $1.61 to grow 14.7%.

11. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Pinterest has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 27.9% over the last two years.

Taking a step back, we can see that Pinterest’s margin expanded by 13.9 percentage points over the last few years. This is encouraging because it gives the company more optionality.

Pinterest’s free cash flow clocked in at $380.4 million in Q4, equivalent to a 28.8% margin. This result was good as its margin was 7.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

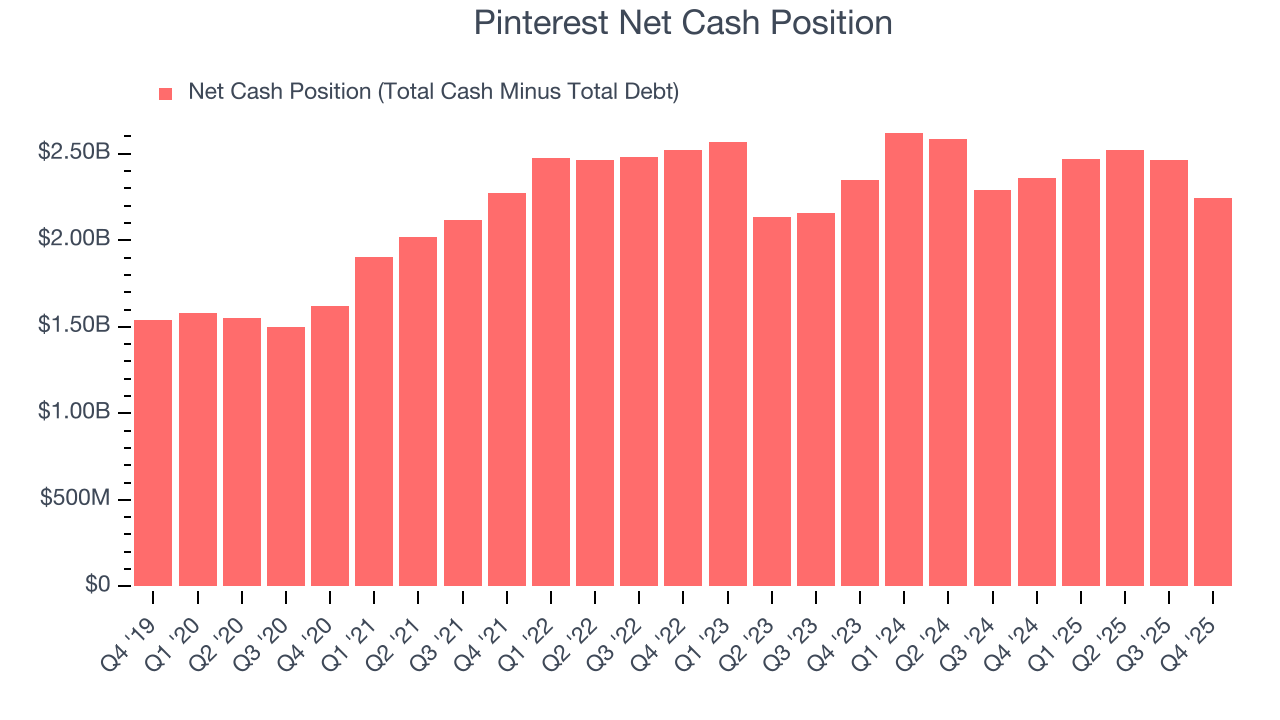

Pinterest is a profitable, well-capitalized company with $2.47 billion of cash and $220.6 million of debt on its balance sheet. This $2.25 billion net cash position is 17.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Pinterest’s Q4 Results

It was good to see Pinterest increase its number of users this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 15.9% to $15.54 immediately following the results.

14. Is Now The Time To Buy Pinterest?

Updated: March 3, 2026 at 9:23 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Pinterest, you should also grasp the company’s longer-term business quality and valuation.

There’s plenty to admire about Pinterest. First off, its revenue growth was solid over the last three years. And while its projected EPS for the next year is lacking, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its impressive EBITDA margins show it has a highly efficient business model.

Pinterest’s EV/EBITDA ratio based on the next 12 months is 6.9x. Looking at the consumer internet landscape right now, Pinterest trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $23.81 on the company (compared to the current share price of $19.07), implying they see 24.9% upside in buying Pinterest in the short term.