PJT (PJT)

PJT catches our eye. Its superb 27.3% ROE illustrates its skill in making high-return investments.― StockStory Analyst Team

1. News

2. Summary

Why PJT Is Interesting

Spun off from Blackstone in 2015 and founded by former Morgan Stanley executive Paul J. Taubman, PJT Partners (NYSE:PJT) is an advisory-focused investment bank that provides strategic advice, restructuring services, and fundraising solutions to corporations, boards, and investment firms.

- Stellar return on equity showcases management’s ability to surface highly profitable business ventures

- Balance sheet strength has increased this cycle as its 116% annual tangible book value per share growth over the last two years was exceptional

- On the flip side, its incremental sales over the last five years were less profitable as its 9.2% annual earnings per share growth lagged its revenue gains

PJT almost passes our quality test. You should keep tabs on this company.

Why Should You Watch PJT

High Quality

Investable

Underperform

Why Should You Watch PJT

At $174.03 per share, PJT trades at 23.4x forward P/E. This multiple is higher than most financials companies.

PJT can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. PJT (PJT) Research Report: Q4 CY2025 Update

Investment banking firm PJT Partners (NYSE:PJT) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 12.1% year on year to $535.2 million. Its non-GAAP profit of $2.55 per share was 6.4% above analysts’ consensus estimates.

PJT (PJT) Q4 CY2025 Highlights:

- Revenue: $535.2 million vs analyst estimates of $540.2 million (12.1% year-on-year growth, 0.9% miss)

- Pre-tax Profit: $122.9 million (23% margin)

- Adjusted EPS: $2.55 vs analyst estimates of $2.40 (6.4% beat)

- Market Capitalization: $4.23 billion

Company Overview

Spun off from Blackstone in 2015 and founded by former Morgan Stanley executive Paul J. Taubman, PJT Partners (NYSE:PJT) is an advisory-focused investment bank that provides strategic advice, restructuring services, and fundraising solutions to corporations, boards, and investment firms.

PJT Partners operates through three main business segments that work together to serve clients facing complex financial challenges. The Strategic Advisory division helps companies navigate transformative events like mergers, acquisitions, spin-offs, and activist defense situations. Their professionals guide boards and management teams through shareholder engagement strategies and environmental, social, and governance (ESG) transitions, while also providing capital markets advisory for debt and equity raises.

The Restructuring and Special Situations group works with companies experiencing financial distress, helping them reorganize, manage liabilities, and navigate bankruptcy proceedings. This division has established itself as a leading global advisor in financial restructuring, consistently ranking among the top three advisors in global restructuring volume.

Through PJT Park Hill, the company provides fundraising and advisory services for alternative asset managers across various investment strategies including private equity, hedge funds, real estate, and private credit. This division also advises general partners and limited partners on liquidity solutions.

The firm's business model centers on providing high-touch, personalized service from experienced professionals. A typical client might be a Fortune 500 company considering a strategic acquisition, seeking PJT's advice on valuation, negotiation strategy, and financing options. Alternatively, a private equity firm might engage PJT Park Hill to raise capital for a new fund, leveraging the firm's relationships with institutional investors.

PJT Partners generates revenue primarily through advisory fees based on the size and complexity of transactions, as well as through placement fees for fundraising activities. The firm operates globally with offices across North America, Europe, and Asia, allowing it to serve multinational clients while navigating different regulatory environments.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

PJT Partners competes with independent advisory firms like Evercore (NYSE:EVR), Lazard (NYSE:LAZ), and Moelis & Company (NYSE:MC), as well as the investment banking divisions of major financial institutions such as Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), and JPMorgan Chase (NYSE:JPM).

5. Revenue Growth

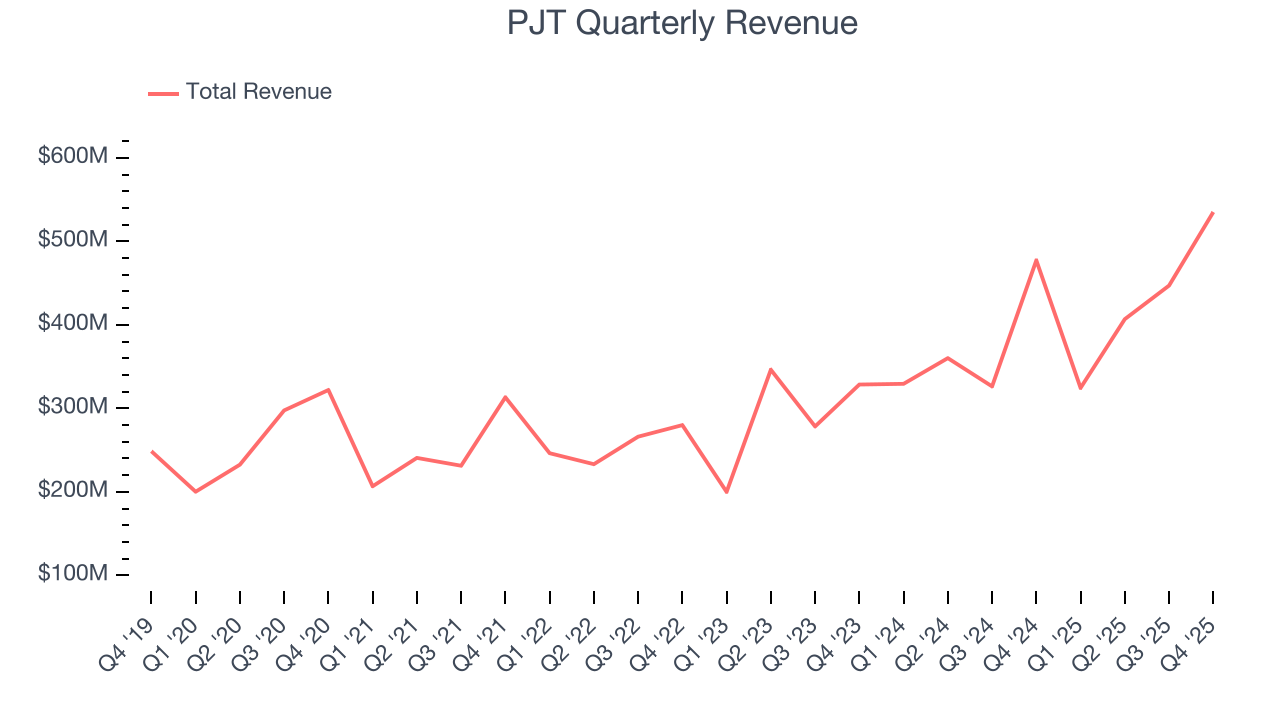

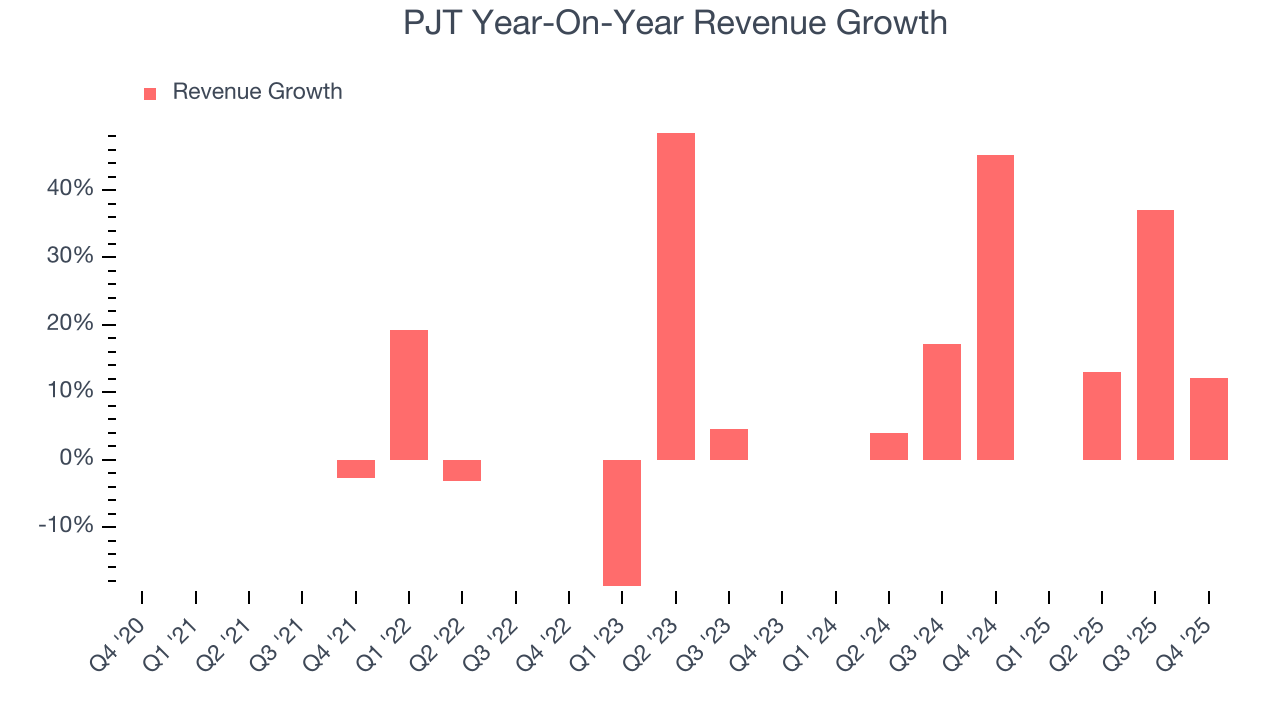

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, PJT grew its revenue at a decent 10.2% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. PJT’s annualized revenue growth of 21.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PJT’s revenue grew by 12.1% year on year to $535.2 million but fell short of Wall Street’s estimates.

6. Pre-Tax Profit Margin

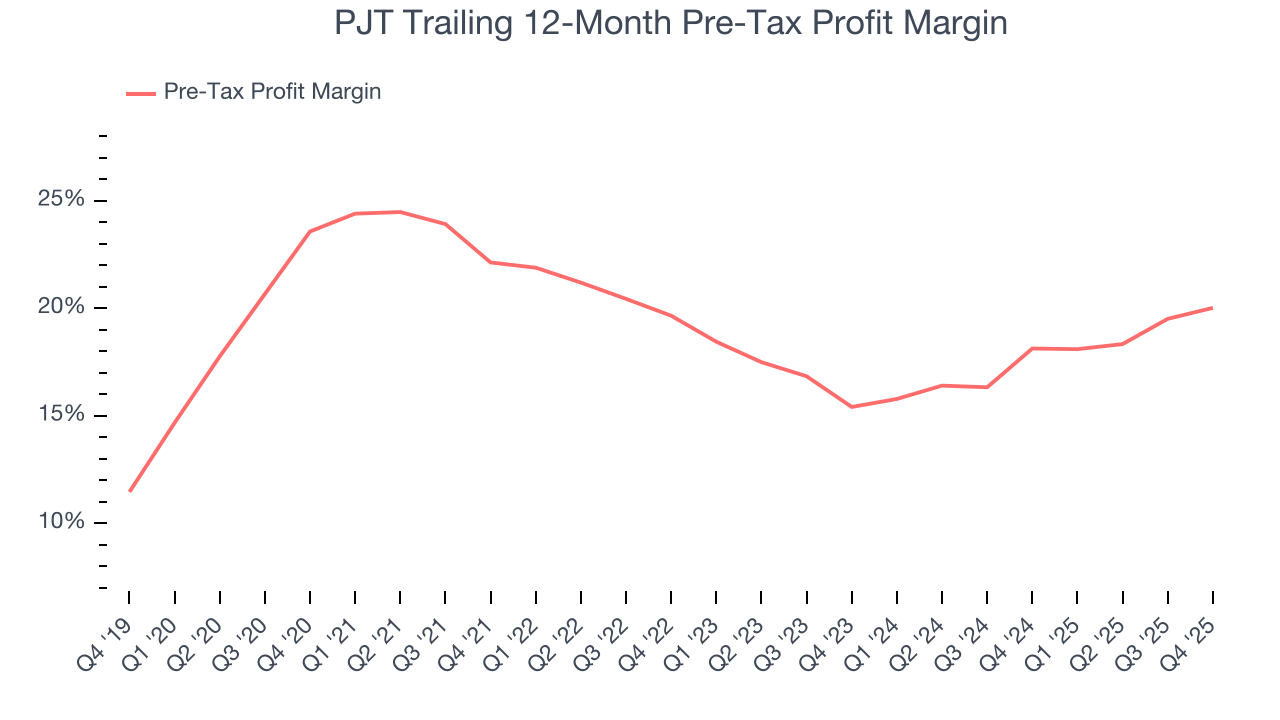

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, PJT’s pre-tax profit margin has risen by 3.6 percentage points, going from 22.1% to 20%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 4.6 percentage points on a two-year basis.

PJT’s pre-tax profit margin came in at 23% this quarter. This result was 1.4 percentage points better than the same quarter last year.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

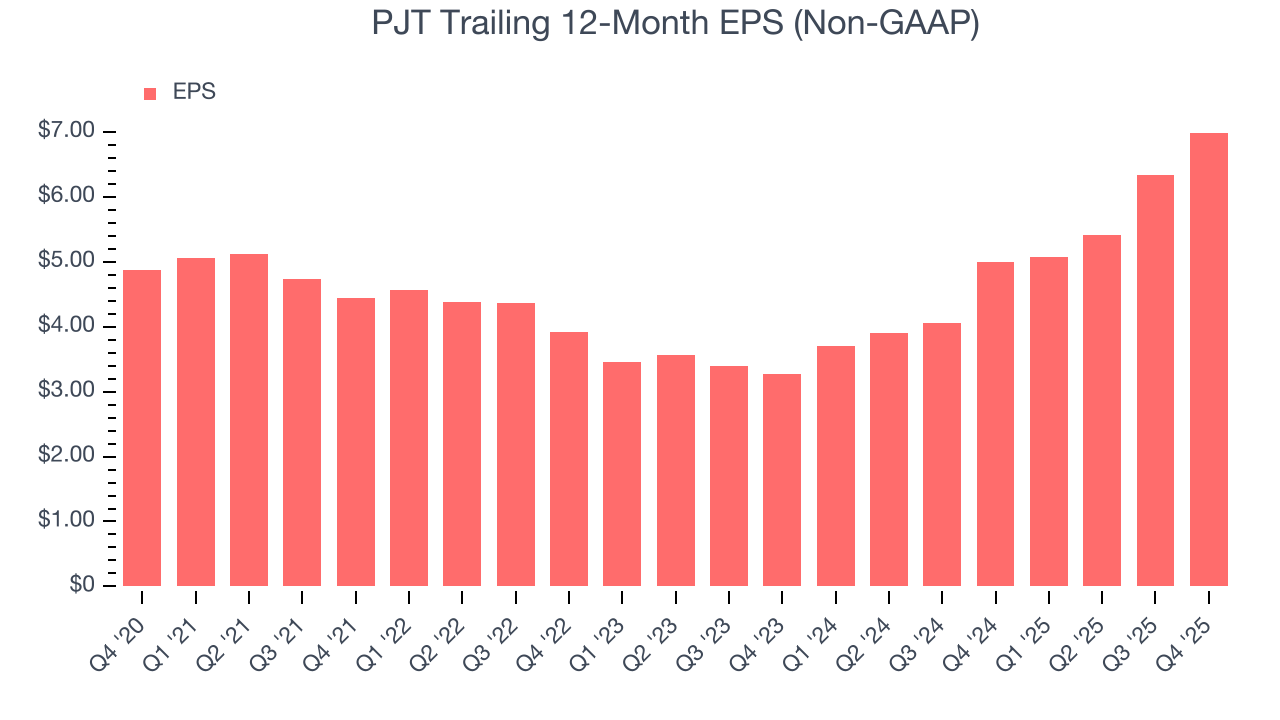

PJT’s EPS grew at an unimpressive 7.5% compounded annual growth rate over the last five years, lower than its 10.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For PJT, its two-year annual EPS growth of 46.2% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, PJT reported adjusted EPS of $2.55, up from $1.90 in the same quarter last year. This print beat analysts’ estimates by 6.4%. Over the next 12 months, Wall Street expects PJT’s full-year EPS of $6.99 to grow 8.7%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, PJT has averaged an ROE of 26.2%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows PJT has a strong competitive moat.

9. Key Takeaways from PJT’s Q4 Results

It was good to see PJT beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $174.03 immediately following the results.

10. Is Now The Time To Buy PJT?

Updated: February 3, 2026 at 7:04 AM EST

When considering an investment in PJT, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

For starters, its revenue growth was good over the last five years and is expected to accelerate over the next 12 months. And while its declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically.

PJT’s P/E ratio based on the next 12 months is 22.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $182.40 on the company (compared to the current share price of $174.03).