PJT (PJT)

PJT is a sound business. Its stellar 27% ROE illustrates management’s exceptional investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why PJT Is Interesting

Spun off from Blackstone in 2015 and founded by former Morgan Stanley executive Paul J. Taubman, PJT Partners (NYSE:PJT) is an advisory-focused investment bank that provides strategic advice, restructuring services, and fundraising solutions to corporations, boards, and investment firms.

- Stellar return on equity showcases management’s ability to surface highly profitable business ventures

- Annual revenue growth of 21.9% over the past two years was outstanding, reflecting market share gains this cycle

- A downside is its annual tangible book value per share declines of 189% for the past five years show its capital management struggled during this cycle

PJT is close to becoming a high-quality business. This company is a good candidate for your watchlist.

Why Should You Watch PJT

High Quality

Investable

Underperform

Why Should You Watch PJT

PJT’s stock price of $158.76 implies a valuation ratio of 22.4x forward P/E. PJT’s valuation represents a premium to other names in the financials sector.

PJT can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. PJT (PJT) Research Report: Q4 CY2025 Update

Investment banking firm PJT Partners (NYSE:PJT) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 12.1% year on year to $535.2 million. Its non-GAAP profit of $2.55 per share was 6.4% above analysts’ consensus estimates.

PJT (PJT) Q4 CY2025 Highlights:

- Revenue: $535.2 million vs analyst estimates of $540.2 million (12.1% year-on-year growth, 0.9% miss)

- Pre-tax Profit: $122.9 million (23% margin)

- Adjusted EPS: $2.55 vs analyst estimates of $2.40 (6.4% beat)

- Market Capitalization: $4.23 billion

Company Overview

Spun off from Blackstone in 2015 and founded by former Morgan Stanley executive Paul J. Taubman, PJT Partners (NYSE:PJT) is an advisory-focused investment bank that provides strategic advice, restructuring services, and fundraising solutions to corporations, boards, and investment firms.

PJT Partners operates through three main business segments that work together to serve clients facing complex financial challenges. The Strategic Advisory division helps companies navigate transformative events like mergers, acquisitions, spin-offs, and activist defense situations. Their professionals guide boards and management teams through shareholder engagement strategies and environmental, social, and governance (ESG) transitions, while also providing capital markets advisory for debt and equity raises.

The Restructuring and Special Situations group works with companies experiencing financial distress, helping them reorganize, manage liabilities, and navigate bankruptcy proceedings. This division has established itself as a leading global advisor in financial restructuring, consistently ranking among the top three advisors in global restructuring volume.

Through PJT Park Hill, the company provides fundraising and advisory services for alternative asset managers across various investment strategies including private equity, hedge funds, real estate, and private credit. This division also advises general partners and limited partners on liquidity solutions.

The firm's business model centers on providing high-touch, personalized service from experienced professionals. A typical client might be a Fortune 500 company considering a strategic acquisition, seeking PJT's advice on valuation, negotiation strategy, and financing options. Alternatively, a private equity firm might engage PJT Park Hill to raise capital for a new fund, leveraging the firm's relationships with institutional investors.

PJT Partners generates revenue primarily through advisory fees based on the size and complexity of transactions, as well as through placement fees for fundraising activities. The firm operates globally with offices across North America, Europe, and Asia, allowing it to serve multinational clients while navigating different regulatory environments.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

PJT Partners competes with independent advisory firms like Evercore (NYSE:EVR), Lazard (NYSE:LAZ), and Moelis & Company (NYSE:MC), as well as the investment banking divisions of major financial institutions such as Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), and JPMorgan Chase (NYSE:JPM).

5. Revenue Growth

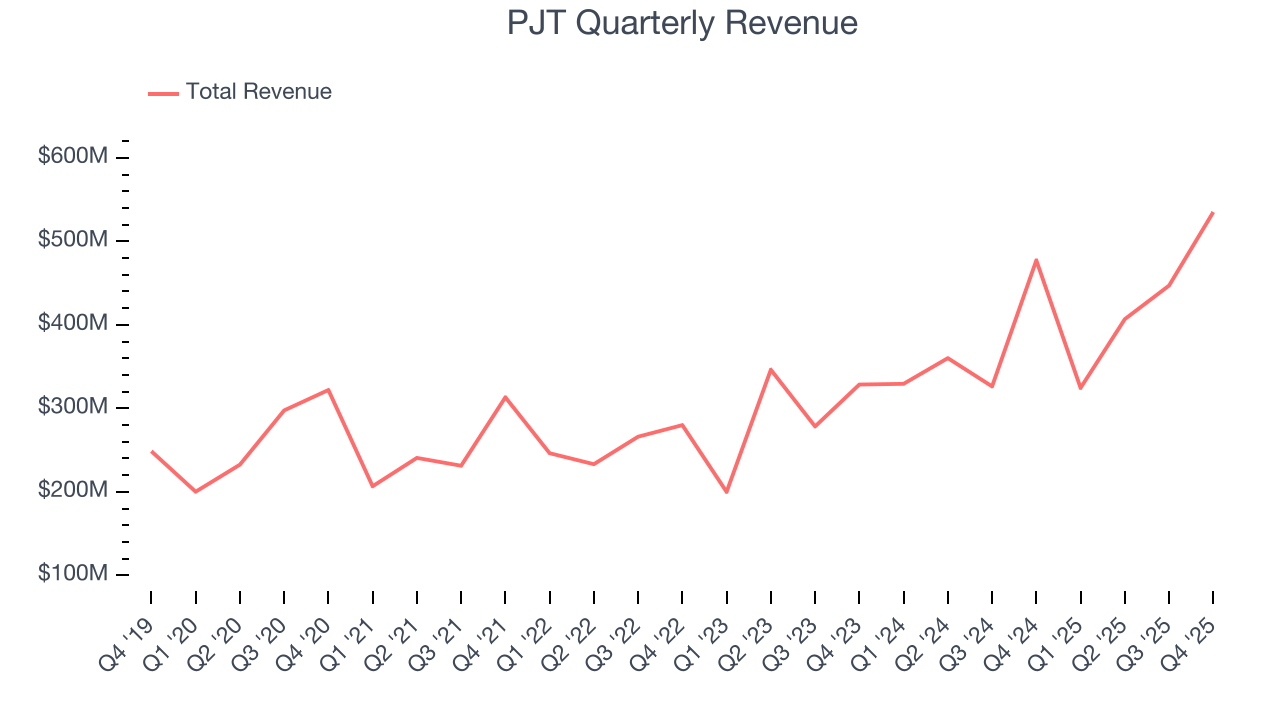

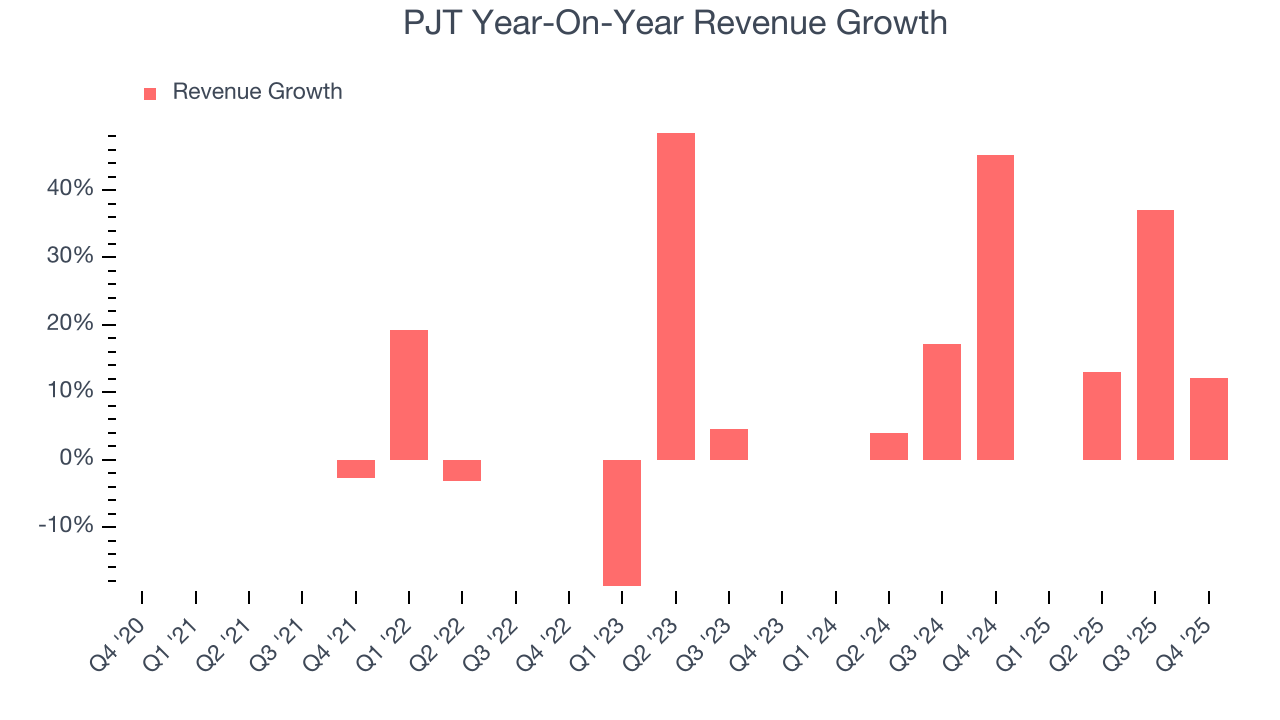

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, PJT grew its revenue at a decent 10.2% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

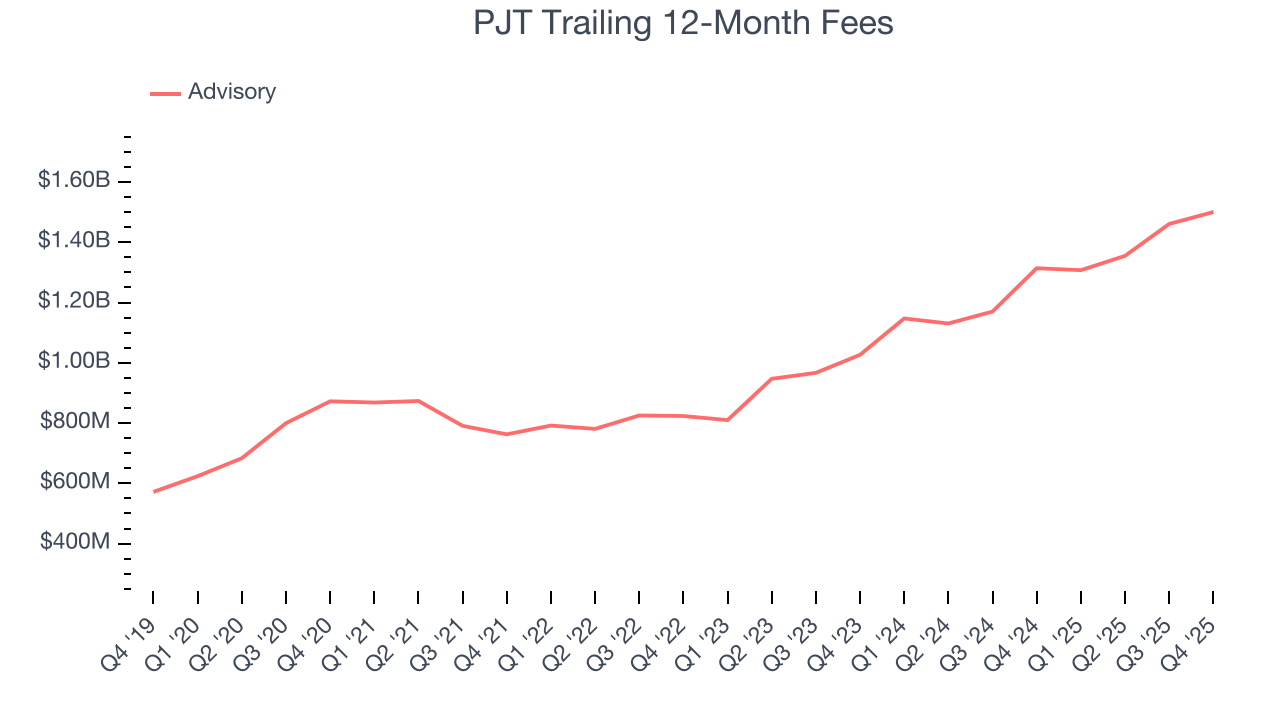

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. PJT’s annualized revenue growth of 21.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PJT’s revenue grew by 12.1% year on year to $535.2 million but fell short of Wall Street’s estimates.

6. Advisory, Servicing, and Other Fees

Fee income for financial institutions can come from specialized services such as M&A advisory, capital raising initiatives, and ongoing client support arrangements.

PJT’s fees have grown at an annual rate of 11.5% over the last five years, a step above the broader financials industry and faster than its total revenue. This tells us its advisory and servicing operations helped top-line performance. When analyzing PJT’s fees over the last two years, we can see that growth accelerated to 20.9% annually.

PJT’s fees punched in at $473.9 million this quarter, falling 2.6% short of analysts’ expectations. This print was 9.1% higher than the same quarter last year.

7. Pre-Tax Profit Margin

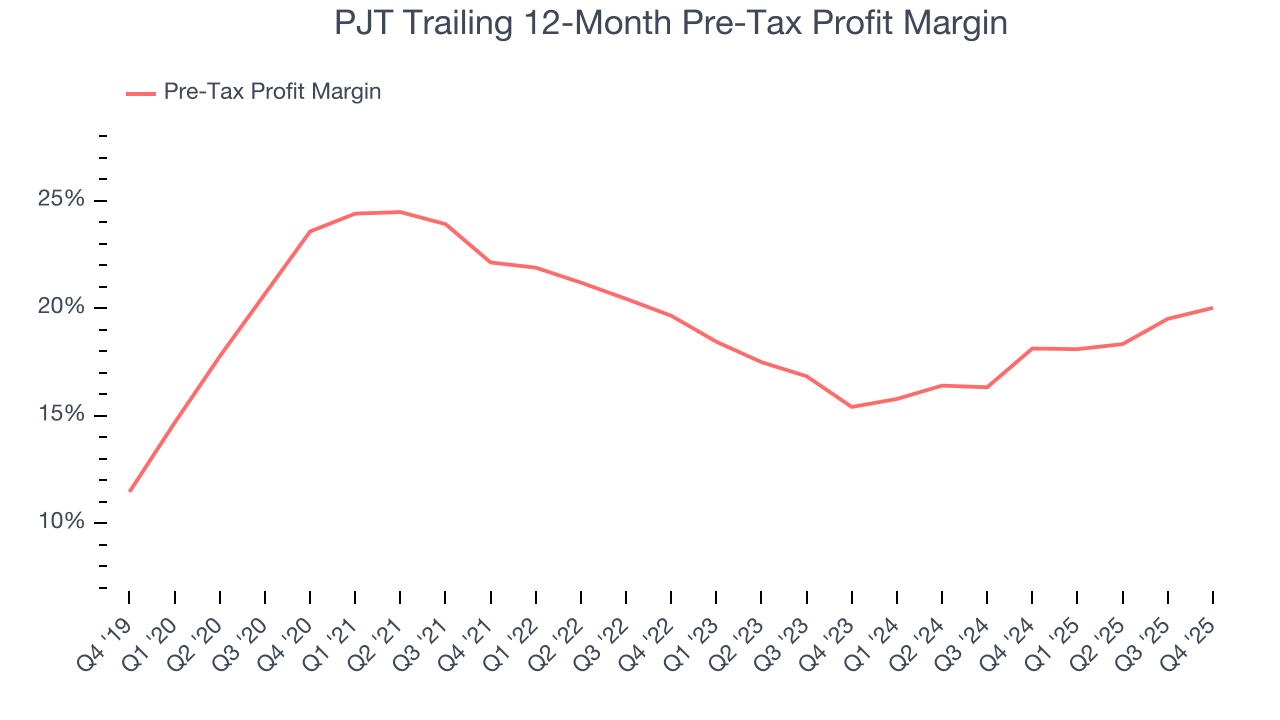

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, PJT’s pre-tax profit margin has risen by 3.6 percentage points, going from 22.1% to 20%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 4.6 percentage points on a two-year basis.

PJT’s pre-tax profit margin came in at 23% this quarter. This result was 1.4 percentage points better than the same quarter last year.

8. Earnings Per Share

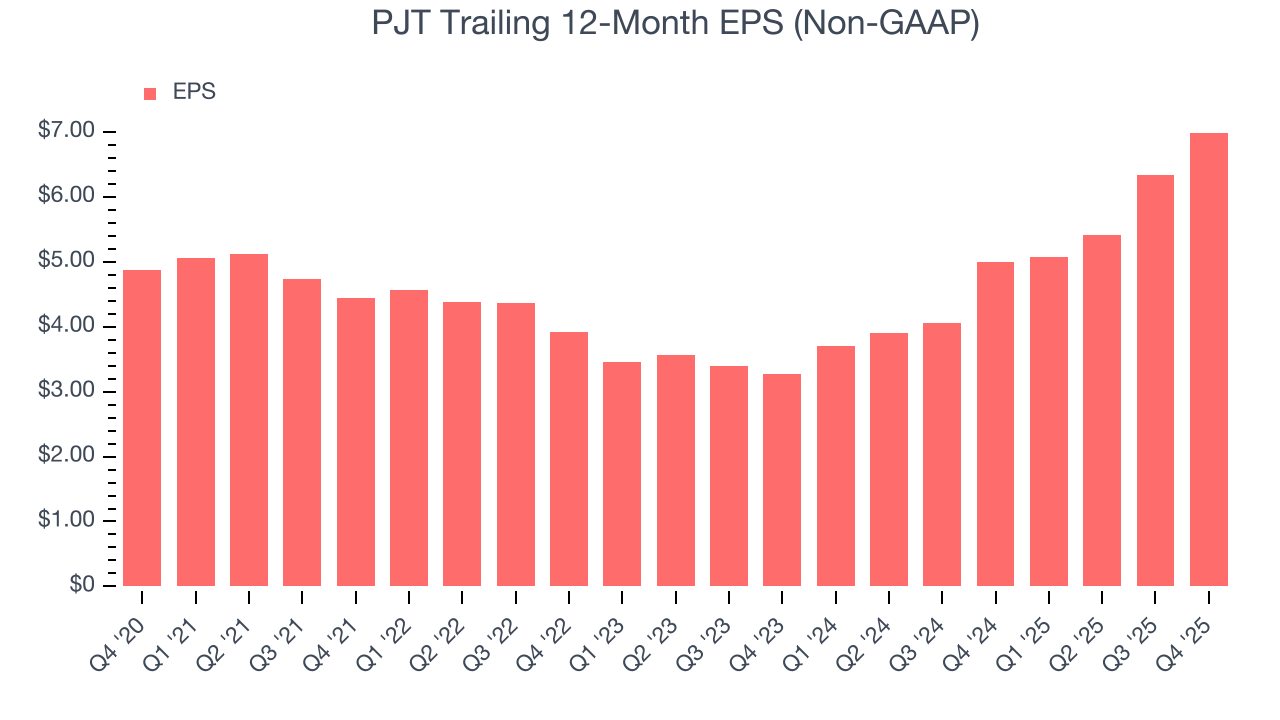

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

PJT’s EPS grew at an unimpressive 7.5% compounded annual growth rate over the last five years, lower than its 10.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For PJT, its two-year annual EPS growth of 46.2% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, PJT reported adjusted EPS of $2.55, up from $1.90 in the same quarter last year. This print beat analysts’ estimates by 6.4%. Over the next 12 months, Wall Street expects PJT’s full-year EPS of $6.99 to grow 8.7%.

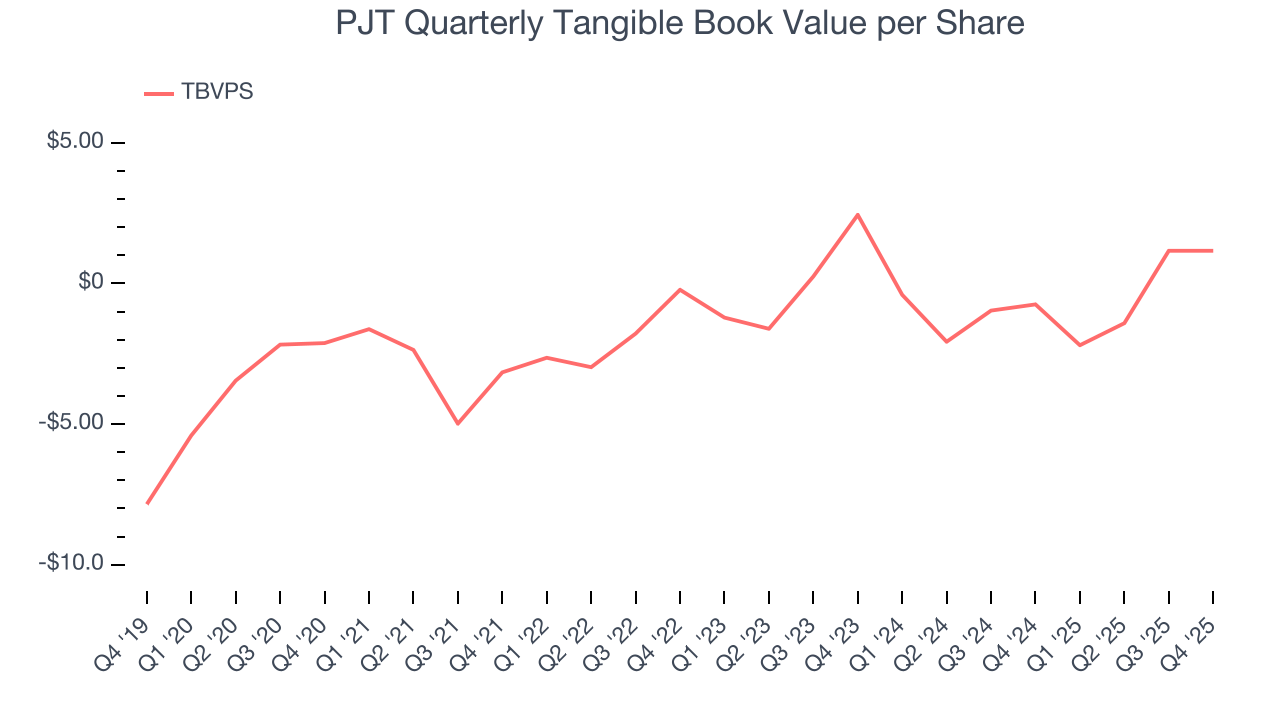

9. Tangible Book Value Per Share (TBVPS)

Financial firms generate earnings through diverse intermediation activities, making them fundamentally balance sheet-driven enterprises. Investors focus on balance sheet quality and consistent book value compounding when evaluating these multifaceted financial institutions.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. EPS can become murky due to the complexity of multiple revenue streams, acquisition impacts, or accounting flexibility across different financial services, and book value resists financial engineering manipulation.

PJT’s TBVPS declined at a 189% annual clip over the last five years. On a two-year basis, TBVPS fell at a slower pace, dropping by 31% annually from $2.44 to $1.16 per share.

10. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, PJT has averaged an ROE of 26.2%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows PJT has a strong competitive moat.

11. Balance Sheet Assessment

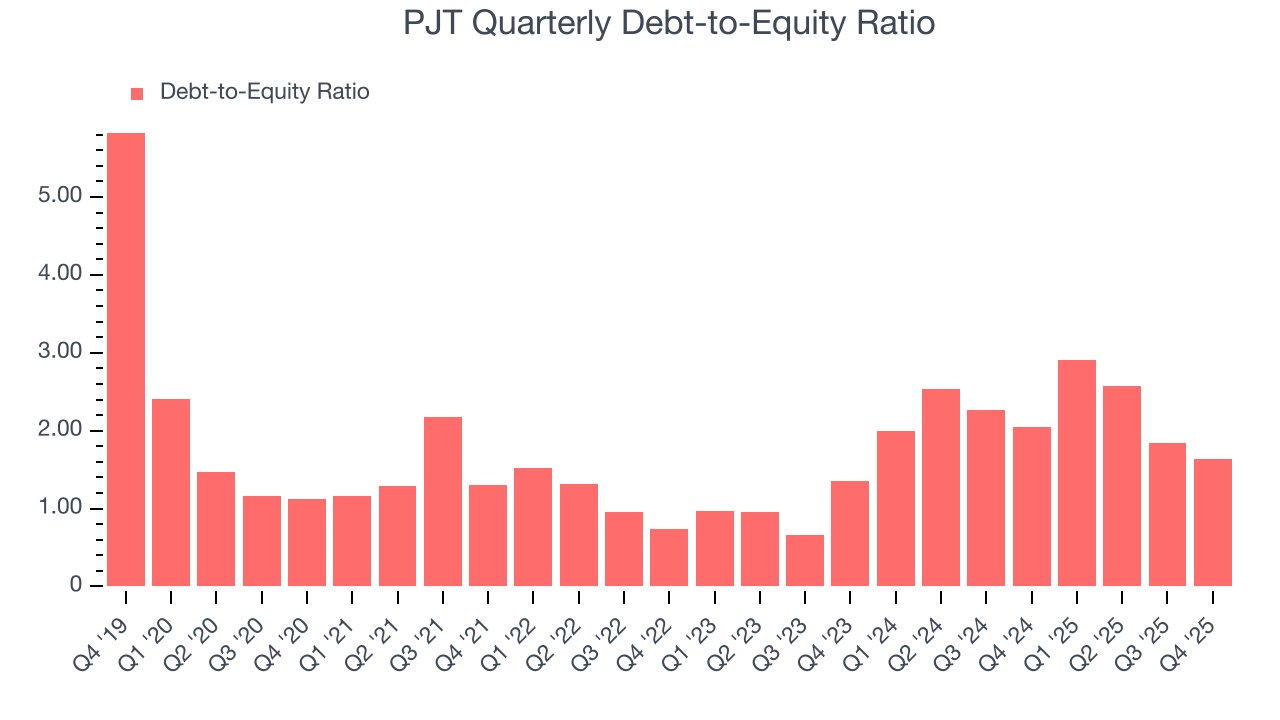

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

PJT currently has $408.2 million of debt and $249.6 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.2×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

12. Key Takeaways from PJT’s Q4 Results

It was good to see PJT beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $174.03 immediately following the results.

13. Is Now The Time To Buy PJT?

Updated: February 3, 2026 at 11:51 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own PJT, you should also grasp the company’s longer-term business quality and valuation.

There are some positives when it comes to PJT’s fundamentals. First off, its revenue growth was good over the last five years and is expected to accelerate over the next 12 months. And while PJT’s declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically.

PJT’s P/E ratio based on the next 12 months is 22.4x. This multiple tells us that a lot of good news is priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $177.80 on the company (compared to the current share price of $158.76).