PROG (PRG)

PROG is up against the odds. Not only has it failed to grow sales but also its profitability has shrunk, suggesting it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think PROG Will Underperform

Evolving from its origins as Aaron's, Inc. before rebranding in 2020, PROG Holdings (NYSE:PRG) provides alternative payment solutions including lease-to-own options and second-look credit products for consumers who may not qualify for traditional financing.

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last five years

- Earnings per share fell by 5.7% annually over the last five years while its revenue was flat, showing each sale was less profitable

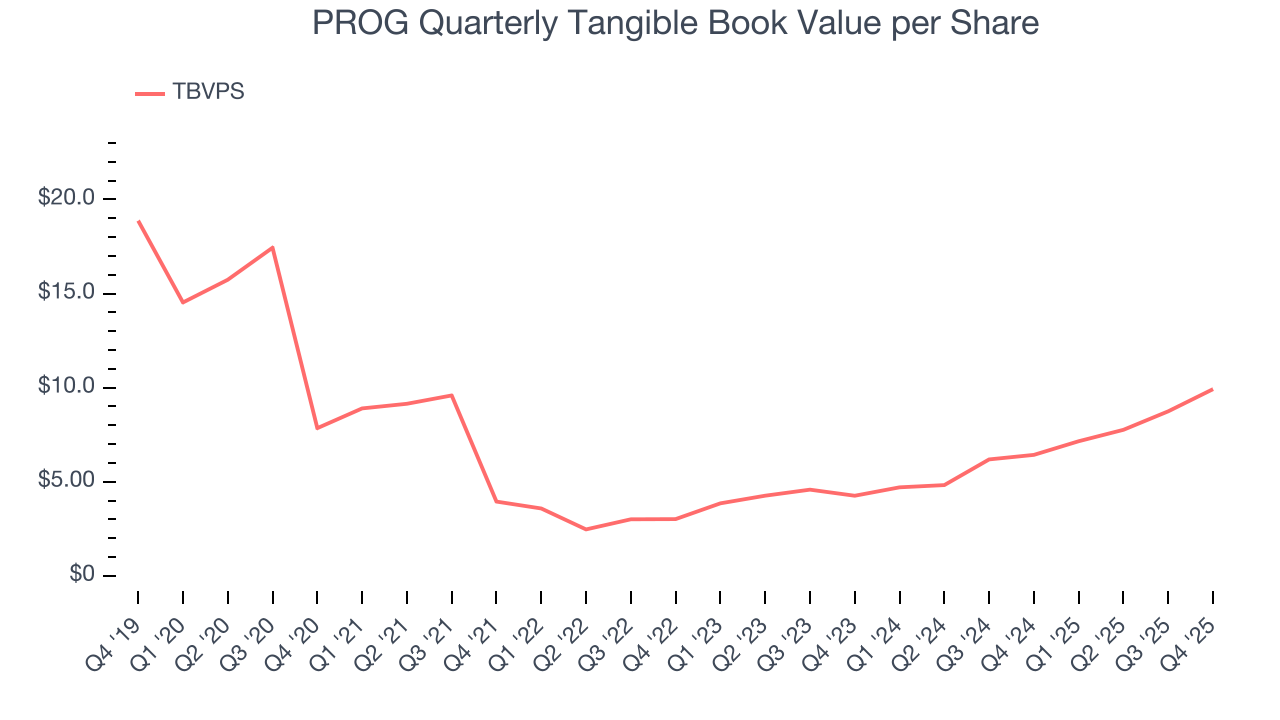

- Capital trends were unexciting over the last five years as its 3.8% annual tangible book value per share growth was below the typical financials firm

PROG’s quality isn’t up to par. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than PROG

High Quality

Investable

Underperform

Why There Are Better Opportunities Than PROG

PROG’s stock price of $32.72 implies a valuation ratio of 7.8x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. PROG (PRG) Research Report: Q4 CY2025 Update

Financial technology company PROG Holdings (NYSE:PRG) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 7.8% year on year to $574.6 million. On the other hand, the company’s full-year revenue guidance of $3.08 billion at the midpoint came in 8% above analysts’ estimates. Its non-GAAP profit of $0.90 per share was 48.8% above analysts’ consensus estimates.

PROG (PRG) Q4 CY2025 Highlights:

- Revenue: $574.6 million vs analyst estimates of $584.3 million (7.8% year-on-year decline, 1.7% miss)

- Pre-tax Profit: $31.41 million (5.5% margin)

- Adjusted EPS: $0.90 vs analyst estimates of $0.61 (48.8% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.23 at the midpoint, beating analyst estimates by 17.5%

- Market Capitalization: $1.34 billion

Company Overview

Evolving from its origins as Aaron's, Inc. before rebranding in 2020, PROG Holdings (NYSE:PRG) provides alternative payment solutions including lease-to-own options and second-look credit products for consumers who may not qualify for traditional financing.

PROG Holdings operates through three main segments, with Progressive Leasing being its flagship business, accounting for approximately 97% of the company's revenue. This segment partners with approximately 23,000 retailers across 45 states, allowing consumers to acquire furniture, electronics, appliances, and other durable goods through lease-to-own arrangements when they might not qualify for traditional credit. Unlike traditional rent-to-own businesses, Progressive Leasing has no physical stores, instead integrating its technology platform directly with retail partners' point-of-sale systems both in-store and online.

The company's Vive Financial segment offers second-look revolving credit products through private label and Vive-branded credit cards at over 7,500 merchant locations. These products serve customers who have been declined for prime credit but still need financing options for purchases like furniture, mattresses, and even medical services. The smallest segment, Four Technologies, provides Buy Now, Pay Later solutions that allow consumers to split purchases into four interest-free installments.

PROG Holdings' business model addresses a significant market need by serving the approximately one-third of American adults who have limited access to traditional credit. For example, a customer wanting to purchase a $1,000 refrigerator but lacking sufficient credit might use Progressive Leasing's service at a participating retailer. The company would purchase the refrigerator from the retailer and lease it to the customer with flexible payment terms and early buyout options. This arrangement benefits the retailer by enabling a sale that might otherwise be lost, while providing the consumer with access to necessary goods with transparent payment terms.

4. Specialty Finance

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

PROG Holdings competes with traditional rent-to-own providers like Rent-A-Center (NASDAQ:RCII) and Conn's (NASDAQ:CONN), as well as with financial technology companies offering alternative payment solutions such as Affirm (NASDAQ:AFRM), Katapult (NASDAQ:KPLT), and privately-held Acima.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, PROG struggled to consistently increase demand as its $2.46 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. PROG’s annualized revenue growth of 1% over the last two years is above its five-year trend, which is encouraging.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PROG missed Wall Street’s estimates and reported a rather uninspiring 7.8% year-on-year revenue decline, generating $574.6 million of revenue.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Specialty Finance companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, PROG’s pre-tax profit margin has risen by 3.7 percentage points, going from 12.3% to 7.2%. Expenses have stabilized more recently as the company’s pre-tax profit margin was flat on a two-year basis.

In Q4, PROG’s pre-tax profit margin was 5.5%. This result was 1.2 percentage points worse than the same quarter last year.

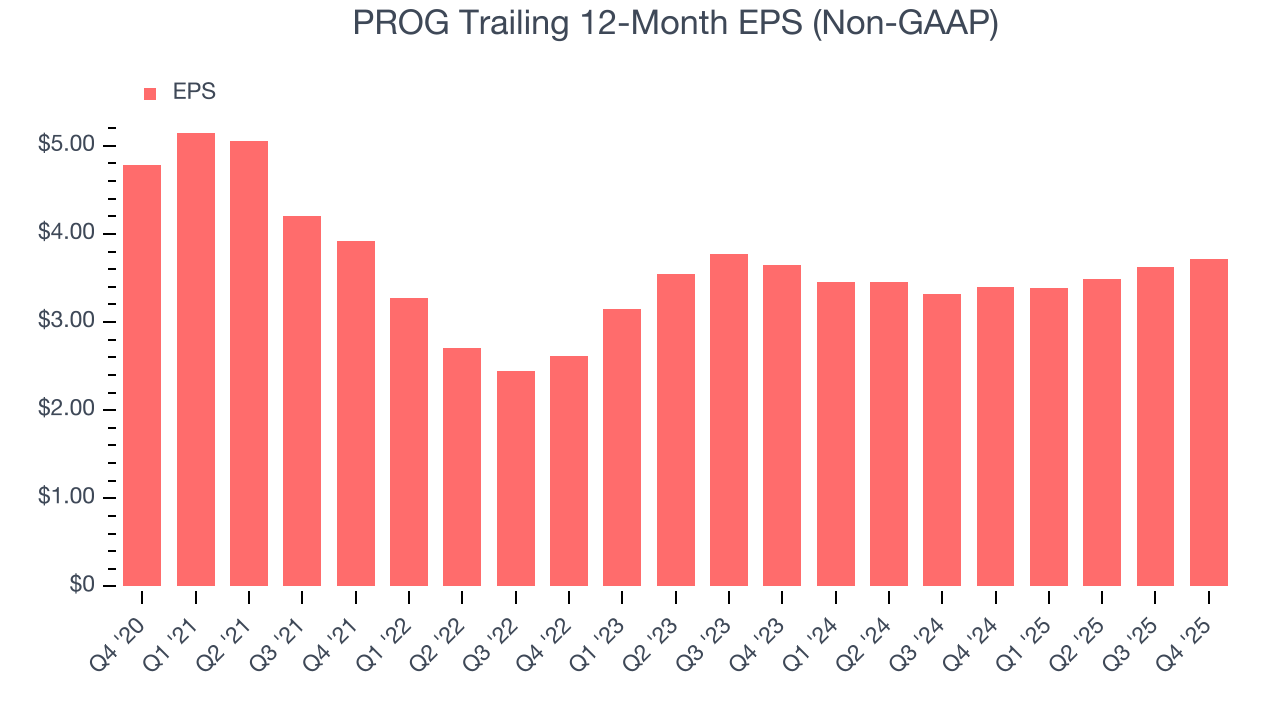

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for PROG, its EPS declined by 4.9% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For PROG, EPS didn’t budge over the last two years, but at least that was better than its five-year trend. We hope its earnings can grow in the coming years.

In Q4, PROG reported adjusted EPS of $0.90, up from $0.80 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects PROG’s full-year EPS of $3.72 to shrink by 4.6%.

8. Tangible Book Value Per Share (TBVPS)

Financial firms are valued based on their balance sheet strength and ability to compound book value across diverse business lines.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

PROG’s TBVPS grew at a tepid 4.8% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 52.7% annually over the last two years from $4.26 to $9.92 per share.

9. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, PROG has averaged an ROE of 23.7%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for PROG.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

PROG currently has $602.1 million of debt and $746.4 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.9×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from PROG’s Q4 Results

It was good to see PROG beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its revenue missed. Zooming out, we think this quarter featured some important positives. The stock traded up 3.9% to $35.20 immediately after reporting.

12. Is Now The Time To Buy PROG?

Updated: March 3, 2026 at 11:51 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own PROG, you should also grasp the company’s longer-term business quality and valuation.

We see the value of companies driving economic growth, but in the case of PROG, we’re out. First off, its revenue growth was weak over the last five years. While its stellar ROE suggests it has been a well-run company historically, the downside is its declining pre-tax profit margin shows the business has become less efficient. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

PROG’s P/E ratio based on the next 12 months is 7.8x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $43.71 on the company (compared to the current share price of $32.72).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.