Primerica (PRI)

Primerica catches our eye. Its stellar 27.2% ROE illustrates management’s exceptional investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why Primerica Is Interesting

With a sales force of over 140,000 licensed representatives operating on an independent contractor model, Primerica (NYSE:PRI) provides term life insurance, investment products, and other financial services to middle-income households in the United States and Canada.

- ROE punches in at 27.2%, illustrating management’s expertise in identifying profitable investments

- Pre-tax profits increased over the last five years as the company gained some leverage on its fixed costs and became more efficient

- A drawback is its 6.8% annualized net premiums earned growth over the last five years lagged behind its insurance peers

Primerica is close to becoming a high-quality business. This company is certainly worth watching.

Why Should You Watch Primerica

Why Should You Watch Primerica

Primerica is trading at $262.17 per share, or 3.5x forward P/B. The rich valuation multiple means there is a lot of good news priced into the stock; short-term price swings could result if anything bursts that bubble.

Primerica could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Primerica (PRI) Research Report: Q3 CY2025 Update

Financial services company Primerica (NYSE:PRI) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 8.5% year on year to $839.9 million. Its non-GAAP profit of $6.33 per share was 14.2% above analysts’ consensus estimates.

Primerica (PRI) Q3 CY2025 Highlights:

Company Overview

With a sales force of over 140,000 licensed representatives operating on an independent contractor model, Primerica (NYSE:PRI) provides term life insurance, investment products, and other financial services to middle-income households in the United States and Canada.

Primerica's business model centers on transforming individuals into part-time financial representatives who primarily sell to their personal networks. The company targets households earning between $30,000 and $130,000 annually, a demographic often underserved by traditional financial advisors who typically focus on wealthier clients. This approach allows Primerica to reach millions of middle-income families through person-to-person connections.

The company's product lineup is designed to address basic financial needs. Its term life insurance policies offer straightforward death benefits without investment components, with coverage periods ranging from 10 to 35 years. On the investment side, Primerica representatives help clients build retirement savings through mutual funds, managed investments, annuities, and employer-sponsored retirement plans.

In 2021, Primerica expanded into the senior health insurance market by acquiring e-TeleQuote, which sells Medicare Advantage and Medicare Supplement plans to eligible beneficiaries. Unlike Primerica's core business, e-TeleQuote employs full-time licensed health insurance agents who enroll seniors in plans from major carriers like UnitedHealthcare and Humana.

Primerica's representatives earn commissions on initial sales and ongoing trails based on client asset values. The company attracts representatives by offering a business opportunity with low entry costs, allowing individuals to supplement their income without leaving their current jobs. This entrepreneurial pitch helps Primerica continuously recruit new representatives to replace those who leave, maintaining its distribution network across the United States and Canada.

4. Life Insurance

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

Primerica competes with traditional life insurance companies like Northwestern Mutual and New York Life, discount brokerages such as Charles Schwab (NYSE:SCHW) and Fidelity, and other financial services firms targeting middle-income consumers including Edward Jones and Ameriprise Financial (NYSE:AMP).

5. Revenue Growth

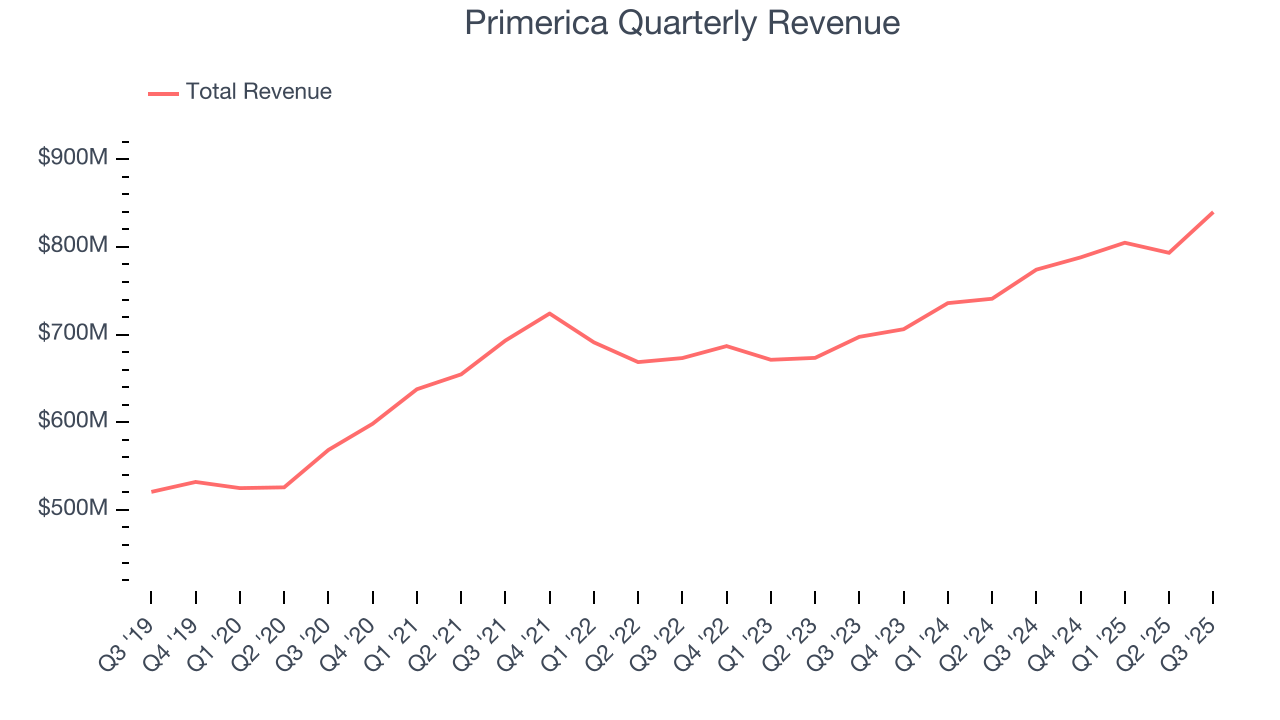

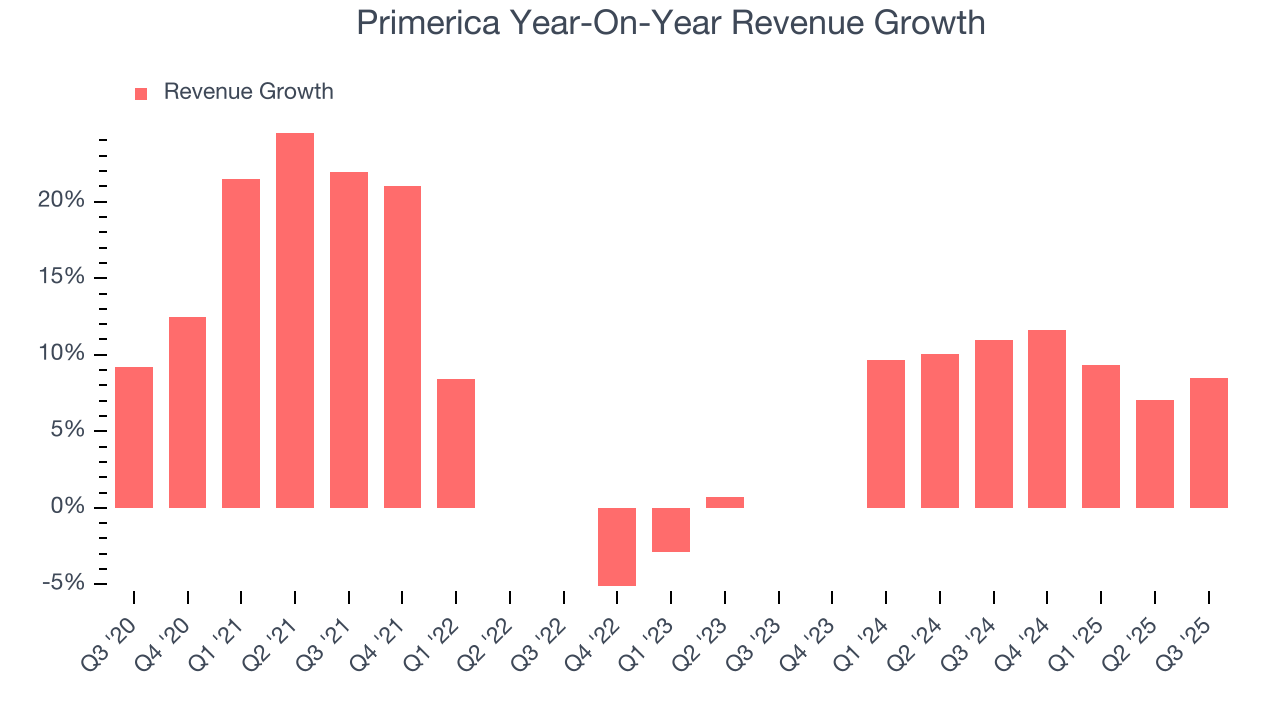

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Thankfully, Primerica’s 8.4% annualized revenue growth over the last five years was decent. Its growth was slightly above the average insurance company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Primerica’s annualized revenue growth of 8.7% over the last two years aligns with its five-year trend, suggesting its demand was stable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Primerica reported year-on-year revenue growth of 8.5%, and its $839.9 million of revenue exceeded Wall Street’s estimates by 1.8%.

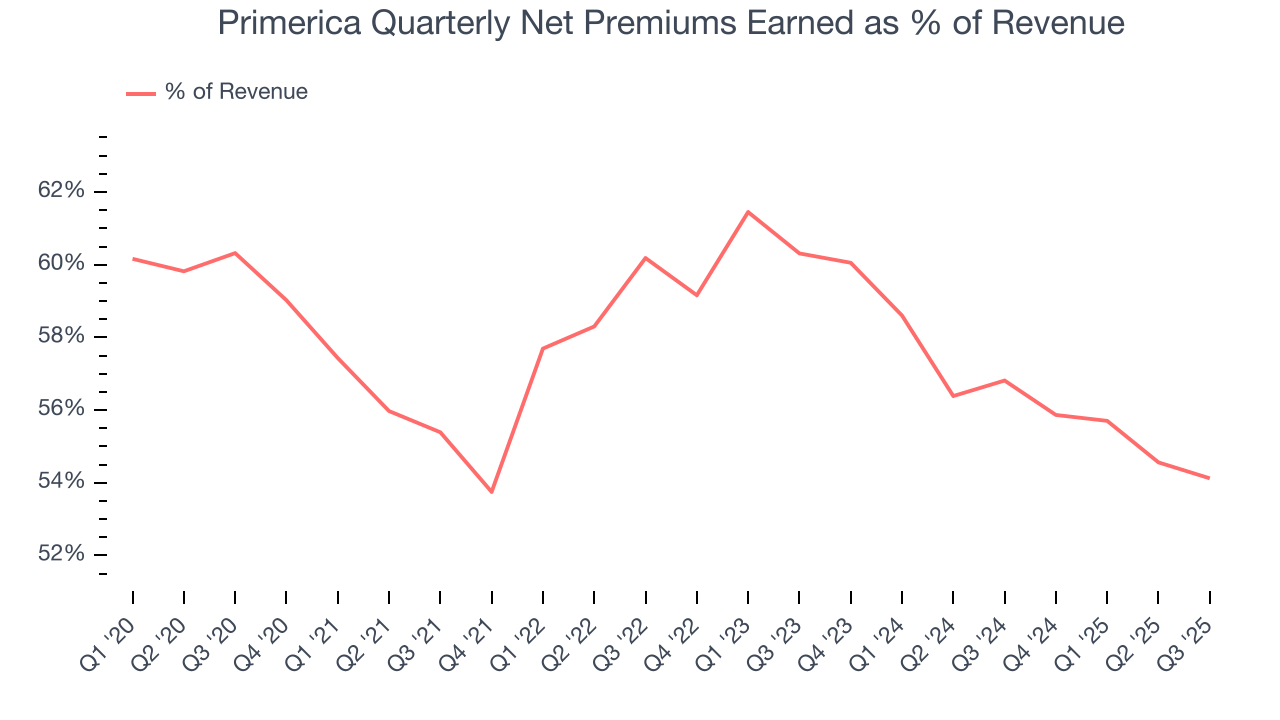

Net premiums earned made up 57.3% of the company’s total revenue during the last five years, meaning Primerica’s growth drivers strike a balance between insurance and non-insurance activities.

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

6. Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

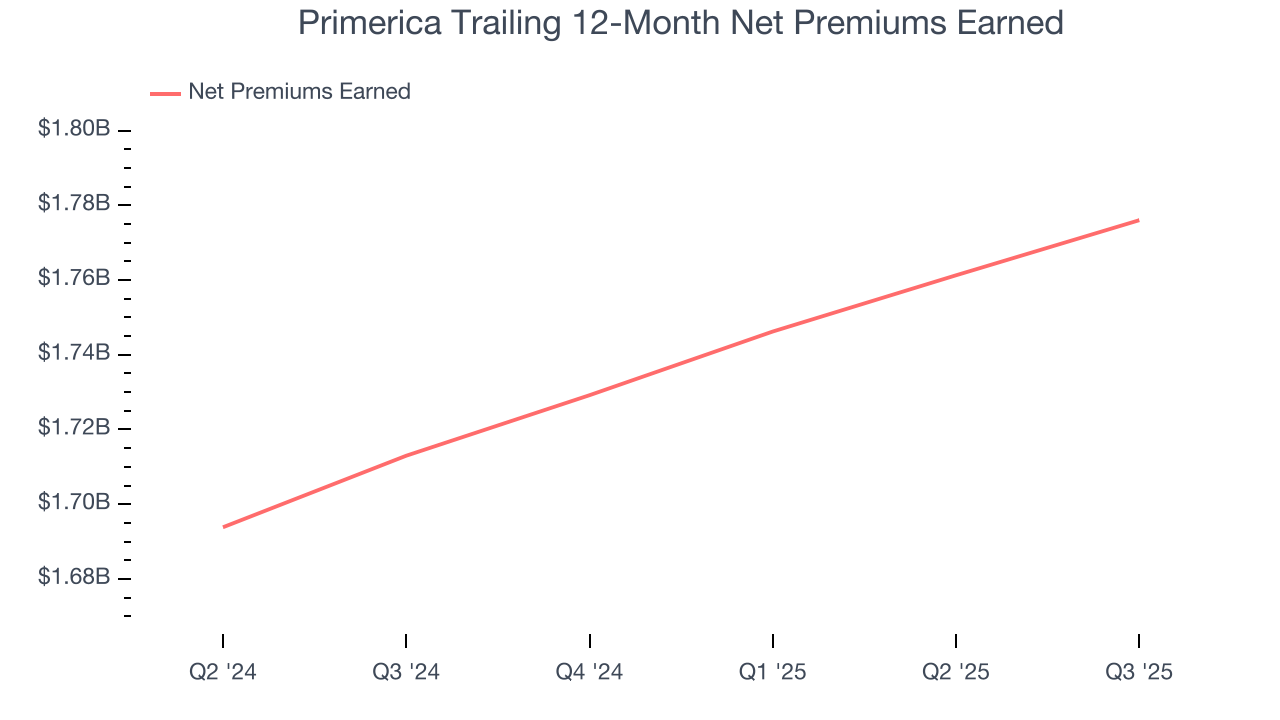

Primerica’s net premiums earned has grown at a 6.5% annualized rate over the last five years, slightly worse than the broader insurance industry and slower than its total revenue.

When analyzing Primerica’s net premiums earned over the last two years, we can see that growth decelerated to 4.1% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these additional streams certainly contribute to the bottom line, their impact can vary. Some firms have shown greater success and long-term consistency in investing their float compared to peers. However, sharp fluctuations in the fixed income and equity markets can significantly affect short-term performance.

In Q3, Primerica produced $454.5 million of net premiums earned, up 3.4% year on year and in line with Wall Street Consensus estimates.

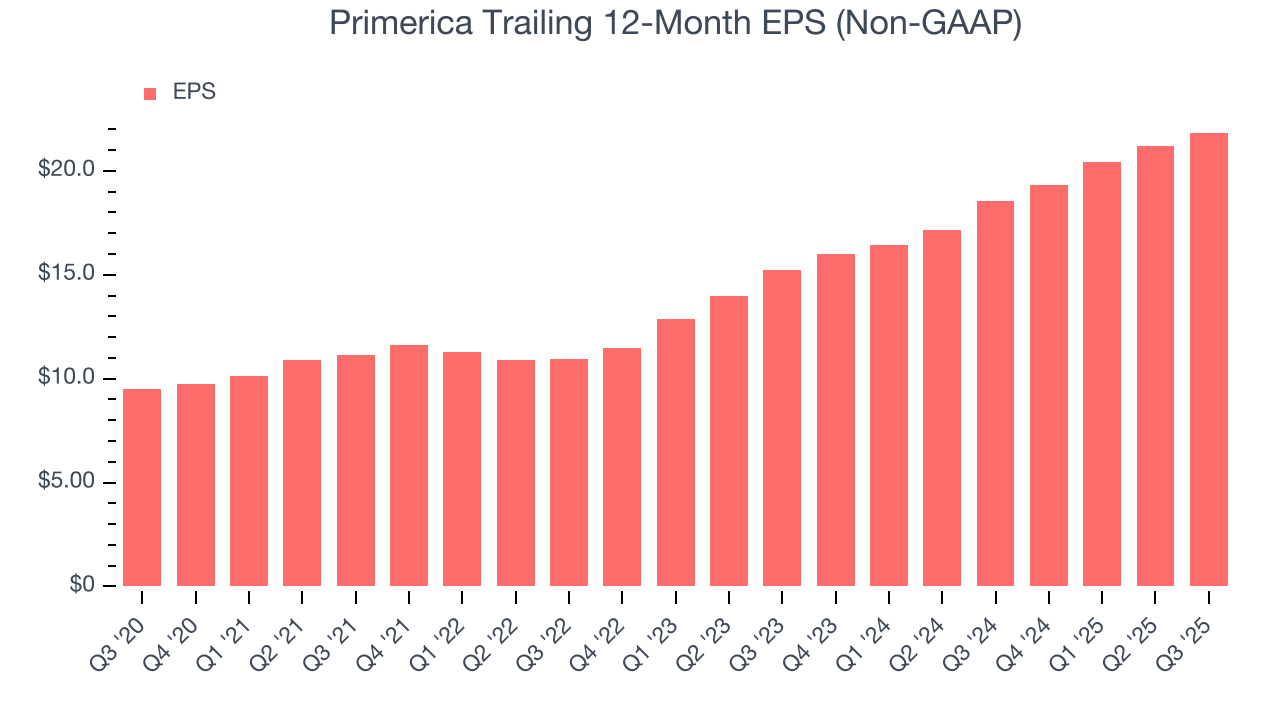

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Primerica’s EPS grew at a remarkable 18.1% compounded annual growth rate over the last five years, higher than its 8.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Primerica, its two-year annual EPS growth of 19.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Primerica reported adjusted EPS of $6.33, up from $5.68 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Primerica’s full-year EPS of $21.84 to grow 5.5%.

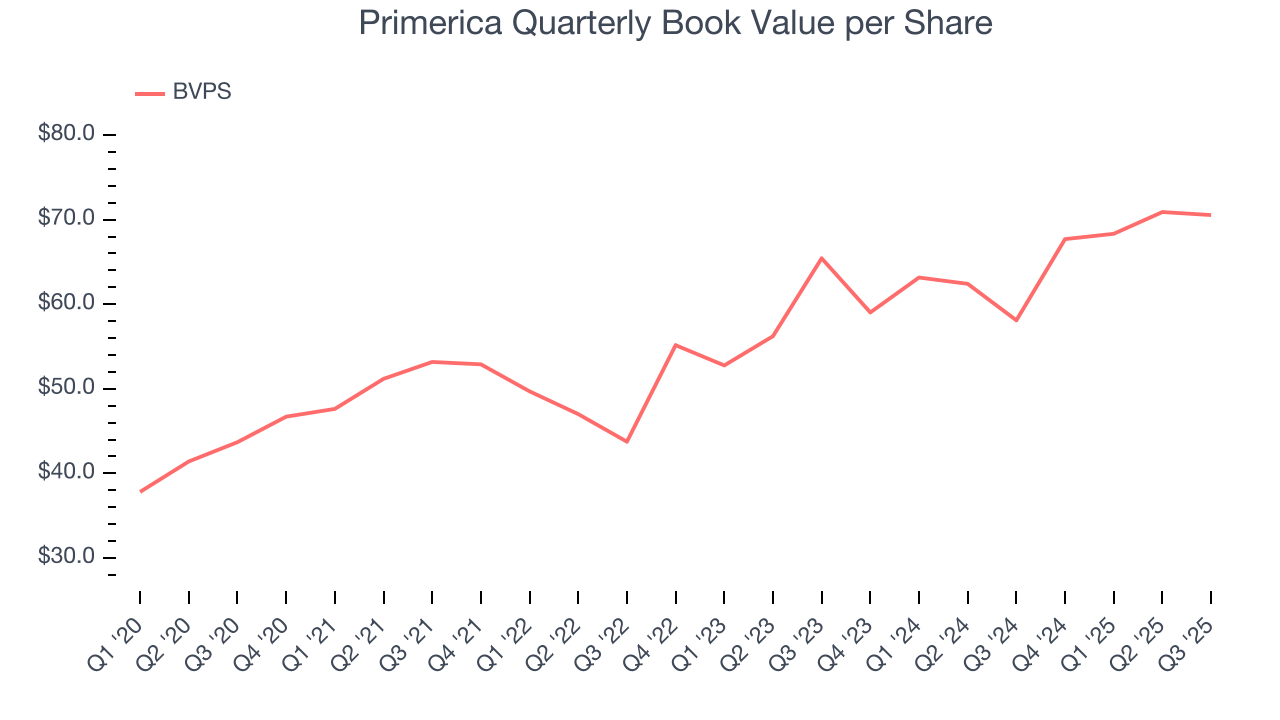

8. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float – premiums collected but not yet paid out – are invested, creating an asset base supported by a liability structure. Book value captures this dynamic by measuring:

- Assets (investment portfolio, cash, reinsurance recoverables) - liabilities (claim reserves, debt, future policy benefits)

BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

Primerica’s BVPS grew at a solid 10.1% annual clip over the last five years. However, BVPS growth has recently decelerated to 3.8% annual growth over the last two years (from $65.43 to $70.55 per share).

Over the next 12 months, Consensus estimates call for Primerica’s BVPS to grow by 11% to $72.79, decent growth rate.

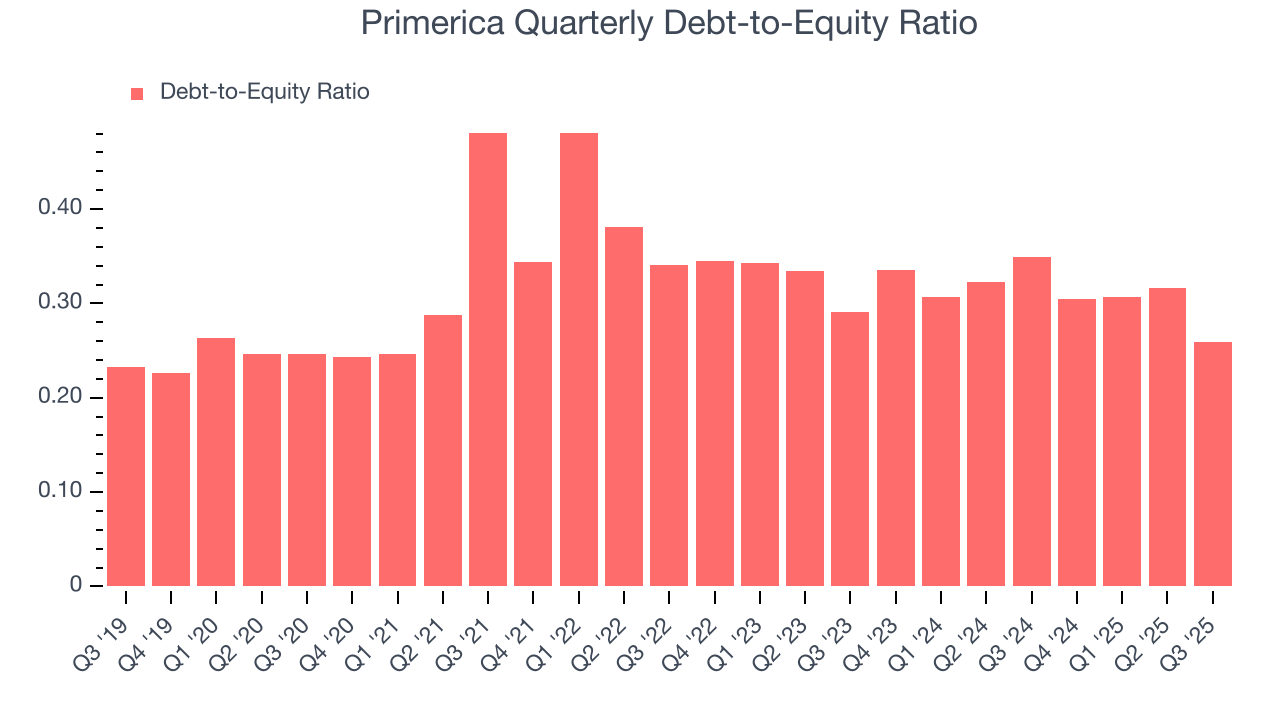

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Primerica currently has $595.1 million of debt and $2.30 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.3×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

10. Return on Equity

Return on equity, or ROE, represents the ultimate measure of an insurer's effectiveness, quantifying how well it transforms shareholder investments into profits. Over the long term, insurance companies with robust ROE metrics typically deliver superior shareholder returns through a balanced approach to capital management.

Over the last five years, Primerica has averaged an ROE of 27.2%, exceptional for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This shows Primerica has a strong competitive moat.

11. Key Takeaways from Primerica’s Q3 Results

It was good to see Primerica beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.1% to $263.10 immediately following the results.

12. Is Now The Time To Buy Primerica?

Updated: January 30, 2026 at 11:32 PM EST

Are you wondering whether to buy Primerica or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are a lot of things to like about Primerica. First off, its revenue growth was good over the last five years. And while its projected EPS for the next year is lacking, its stellar ROE suggests it has been a well-run company historically. On top of that, its expanding pre-tax profit margin shows the business has become more efficient.

Primerica’s P/B ratio based on the next 12 months is 3.5x. At this valuation, there’s a lot of good news priced in. Primerica is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $298.50 on the company (compared to the current share price of $262.17).