Quanta (PWR)

We’d invest in Quanta. Its revenue is growing quickly while its profitability is rising, giving it multiple ways to win.― StockStory Analyst Team

1. News

2. Summary

Why We Like Quanta

A construction engineering services company, Quanta (NYSE:PWR) provides infrastructure solutions to a variety of sectors, including energy and communications.

- Annual revenue growth of 19% over the past five years was outstanding, reflecting market share gains this cycle

- Earnings per share grew by 24.4% annually over the last five years and trumped its peers

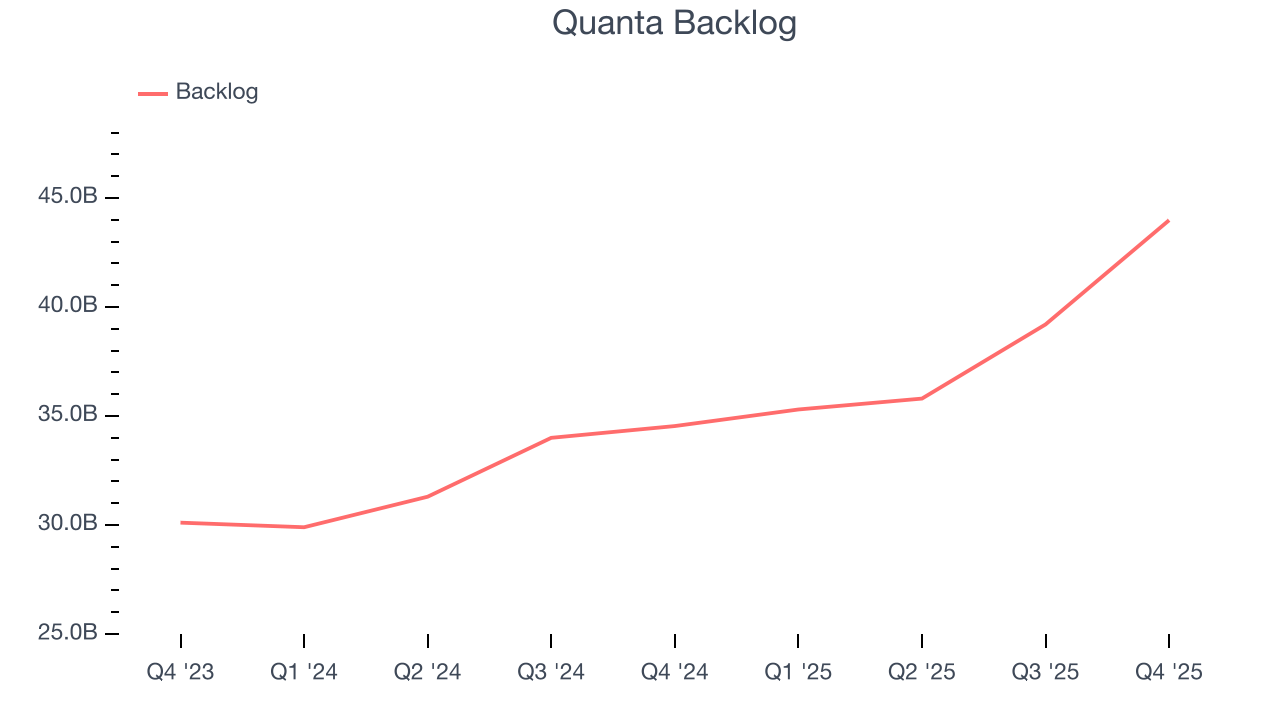

- Backlog has averaged 15.6% growth over the past two years, showing it has a pipeline of unfulfilled orders that will support revenue in the future

We expect great things from Quanta. No coincidence the stock is up 580% over the last five years.

Is Now The Time To Buy Quanta?

Is Now The Time To Buy Quanta?

Quanta is trading at $525.00 per share, or 44x forward P/E. The pricey valuation means expectations are high for this company over the near to medium term.

Are you a fan of the company and believe in the bull case? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Quanta (PWR) Research Report: Q4 CY2025 Update

Infrastructure solutions provider Quanta (NYSE:PWR) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 19.7% year on year to $7.84 billion. The company’s full-year revenue guidance of $33.5 billion at the midpoint came in 6.4% above analysts’ estimates. Its non-GAAP profit of $3.16 per share was 4.7% above analysts’ consensus estimates.

Quanta (PWR) Q4 CY2025 Highlights:

- Revenue: $7.84 billion vs analyst estimates of $7.37 billion (19.7% year-on-year growth, 6.4% beat)

- Adjusted EPS: $3.16 vs analyst estimates of $3.02 (4.7% beat)

- Adjusted EBITDA: $845.3 million vs analyst estimates of $792.8 million (10.8% margin, 6.6% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $13 at the midpoint, beating analyst estimates by 5%

- EBITDA guidance for the upcoming financial year 2026 is $3.42 billion at the midpoint, above analyst estimates of $3.22 billion

- Operating Margin: 6.2%, in line with the same quarter last year

- Free Cash Flow Margin: 11.9%, up from 8.8% in the same quarter last year

- Backlog: $43.98 billion at quarter end, up 27.3% year on year

- Market Capitalization: $77.44 billion

Company Overview

A construction engineering services company, Quanta (NYSE:PWR) provides infrastructure solutions to a variety of sectors, including energy and communications.

Infrastructure that’s become a regular need in our everyday lives relies on businesses like Quanta.

The company’s services include the design, construction, installation, and maintenance of electric power infrastructure, like electrical power grids (Electrical Power Business Segment), renewable energy infrastructure, like hydropower generation facilities (Renewable Energy Business Segment), and natural gas systems, like underground gas piping (Underground & Infrastructure Business Segment).

Quanta makes money through the services and construction it provides for these three markets. Its main revenue stream is generated by its Electrical Power segment, with its Renewable Energy and Underground & Infrastructure segments following, respectively. Recurring revenue is a part of the company’s business model through asset maintenance, upgrade, and repair.

4. Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Quanta’s top competitors include MasTec (NYSE:MTZ), Dycom Industries (NYSE:DY), and MYR Group (NASDAQ:MYRG).

5. Revenue Growth

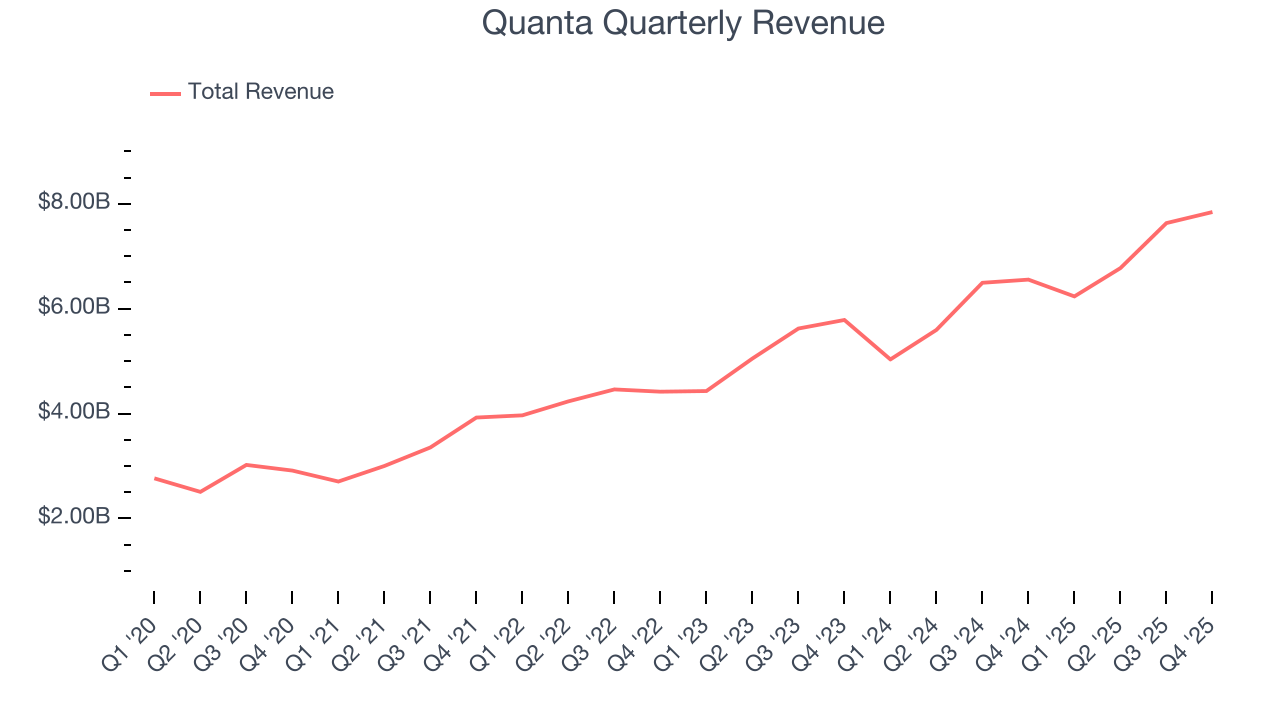

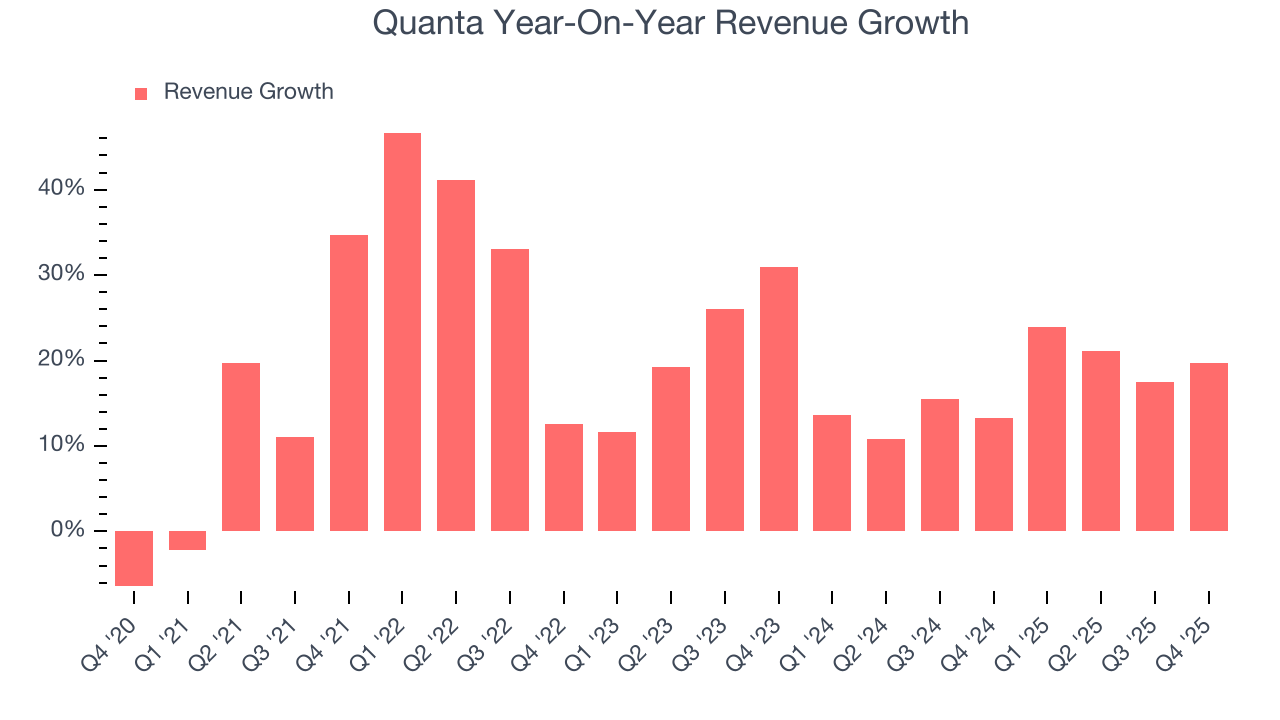

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Quanta’s 20.5% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Quanta’s annualized revenue growth of 16.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Quanta’s backlog reached $43.98 billion in the latest quarter and averaged 18% year-on-year growth over the last two years. Because this number is in line with its revenue growth, we can see the company effectively balanced its new order intake and fulfillment processes.

This quarter, Quanta reported year-on-year revenue growth of 19.7%, and its $7.84 billion of revenue exceeded Wall Street’s estimates by 6.4%.

Looking ahead, sell-side analysts expect revenue to grow 10.7% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and implies the market is forecasting success for its products and services.

6. Gross Margin & Pricing Power

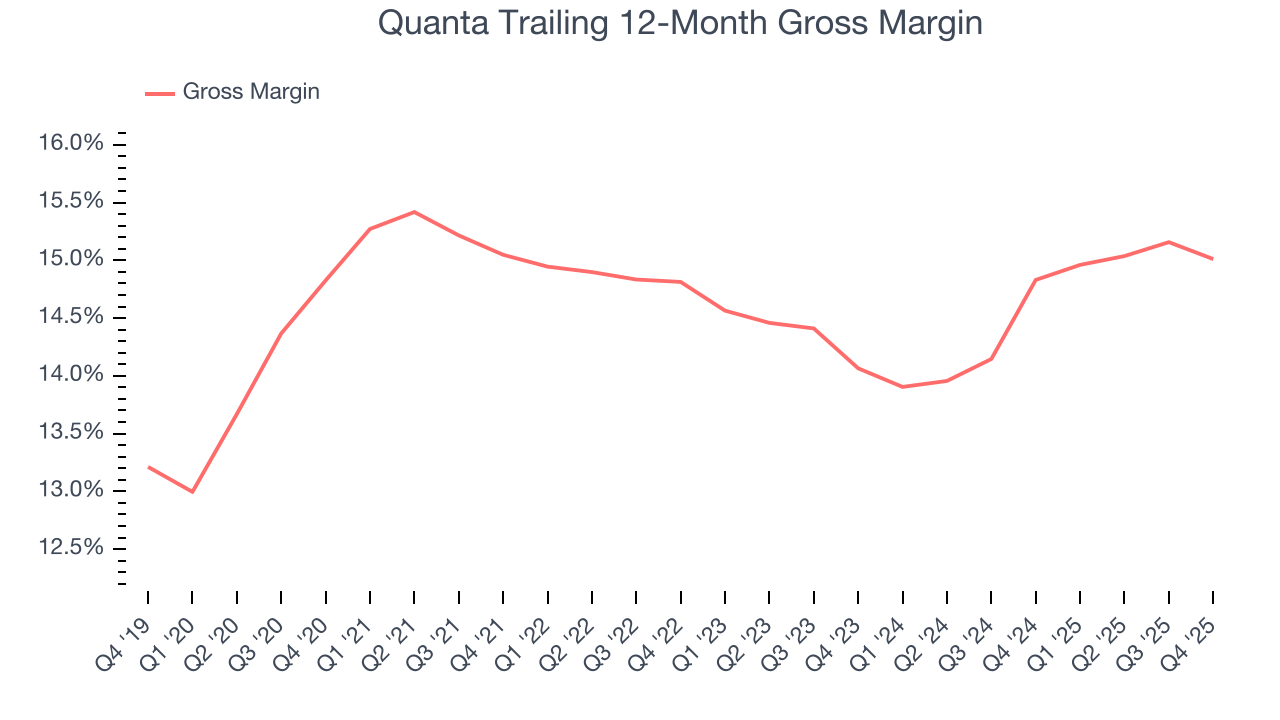

Quanta has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 14.7% gross margin over the last five years. Said differently, Quanta had to pay a chunky $85.25 to its suppliers for every $100 in revenue.

Quanta produced a 15.5% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

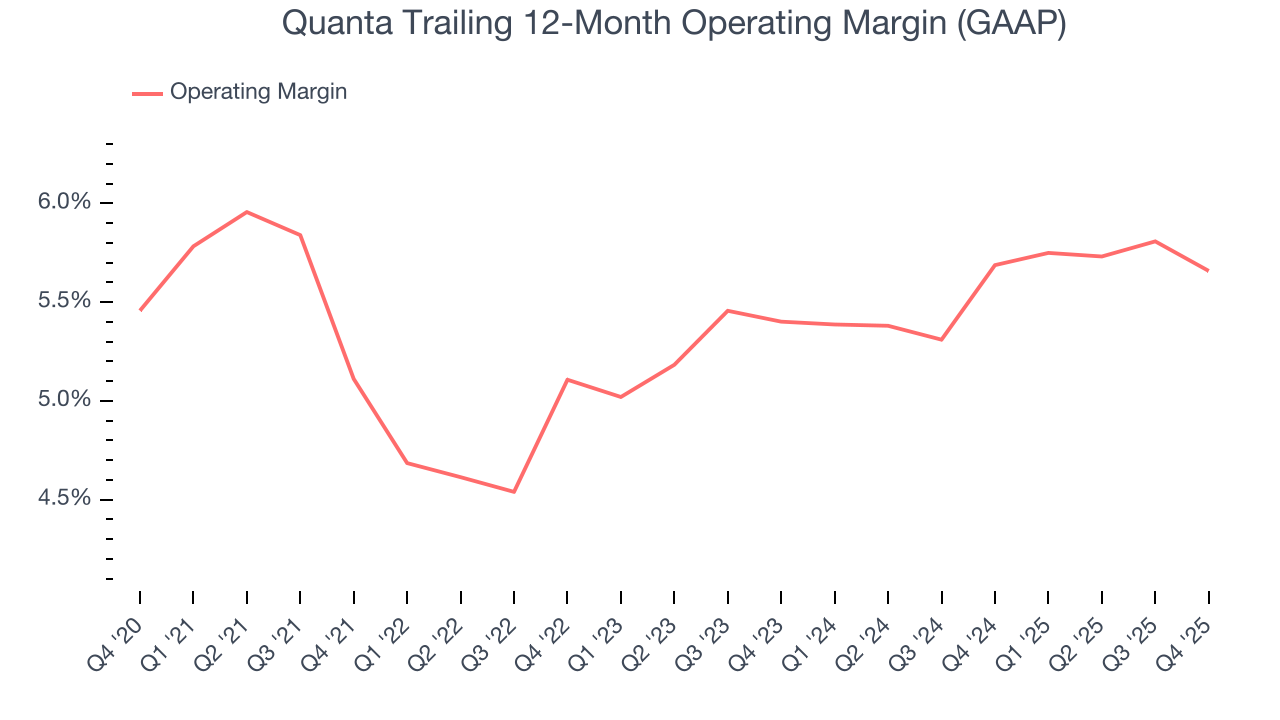

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Quanta’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 5.5% over the last five years. This profitability was paltry for an industrials business and caused by its suboptimal cost structureand low gross margin.

Looking at the trend in its profitability, Quanta’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Quanta generated an operating margin profit margin of 6.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

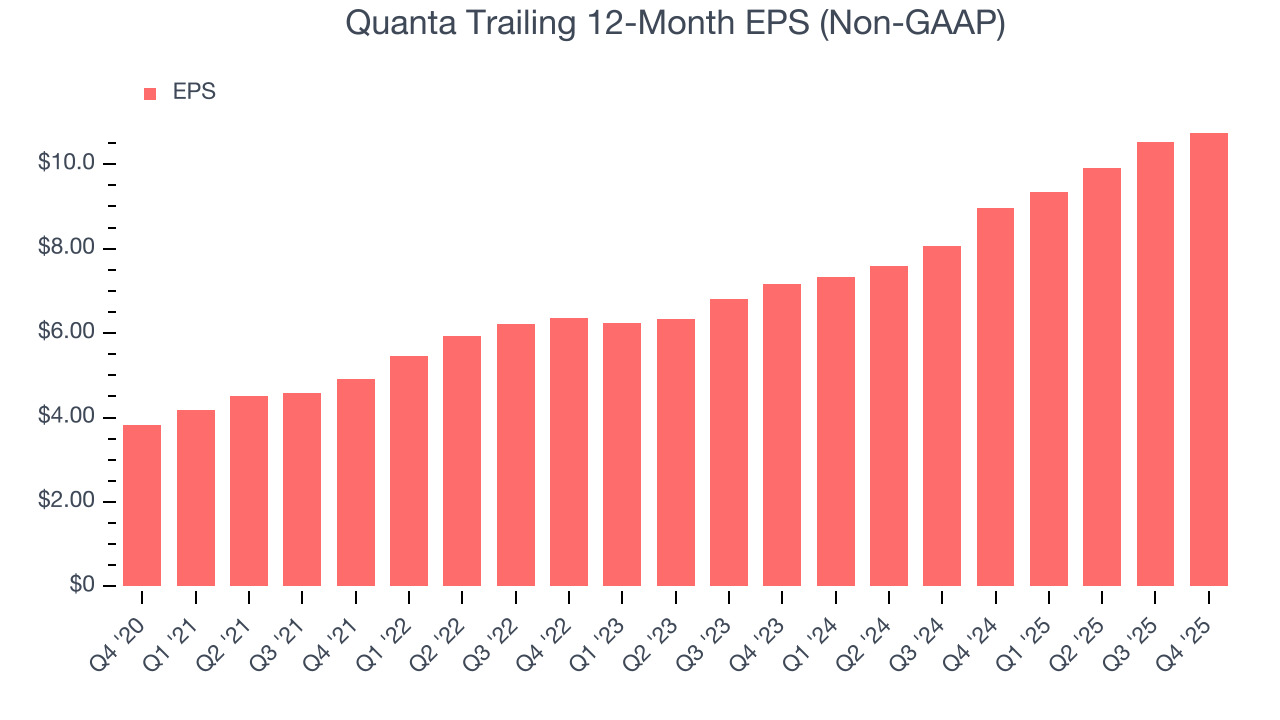

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Quanta’s EPS grew at an astounding 22.9% compounded annual growth rate over the last five years, higher than its 20.5% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Quanta, its two-year annual EPS growth of 22.4% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, Quanta reported adjusted EPS of $3.16, up from $2.94 in the same quarter last year. This print beat analysts’ estimates by 4.7%. Over the next 12 months, Wall Street expects Quanta’s full-year EPS of $10.75 to grow 15.2%.

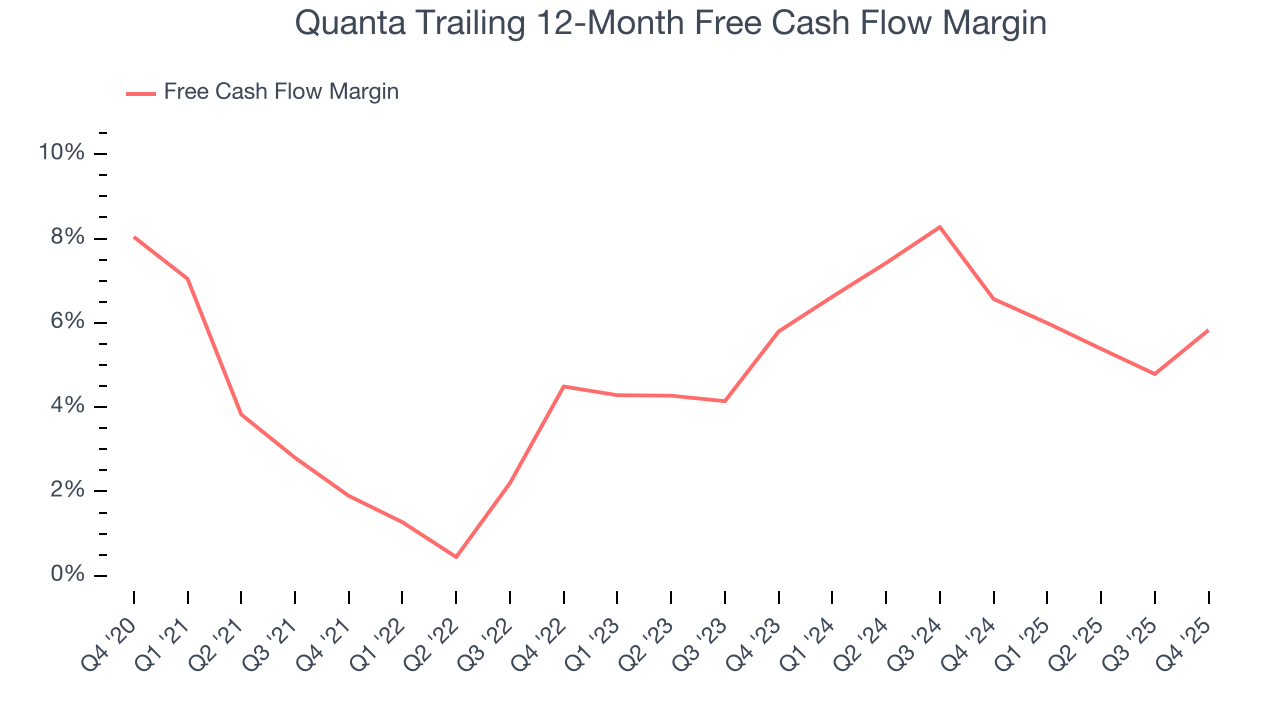

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Quanta has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.3%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Quanta’s margin expanded by 3.9 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Quanta’s free cash flow clocked in at $934 million in Q4, equivalent to a 11.9% margin. This result was good as its margin was 3.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

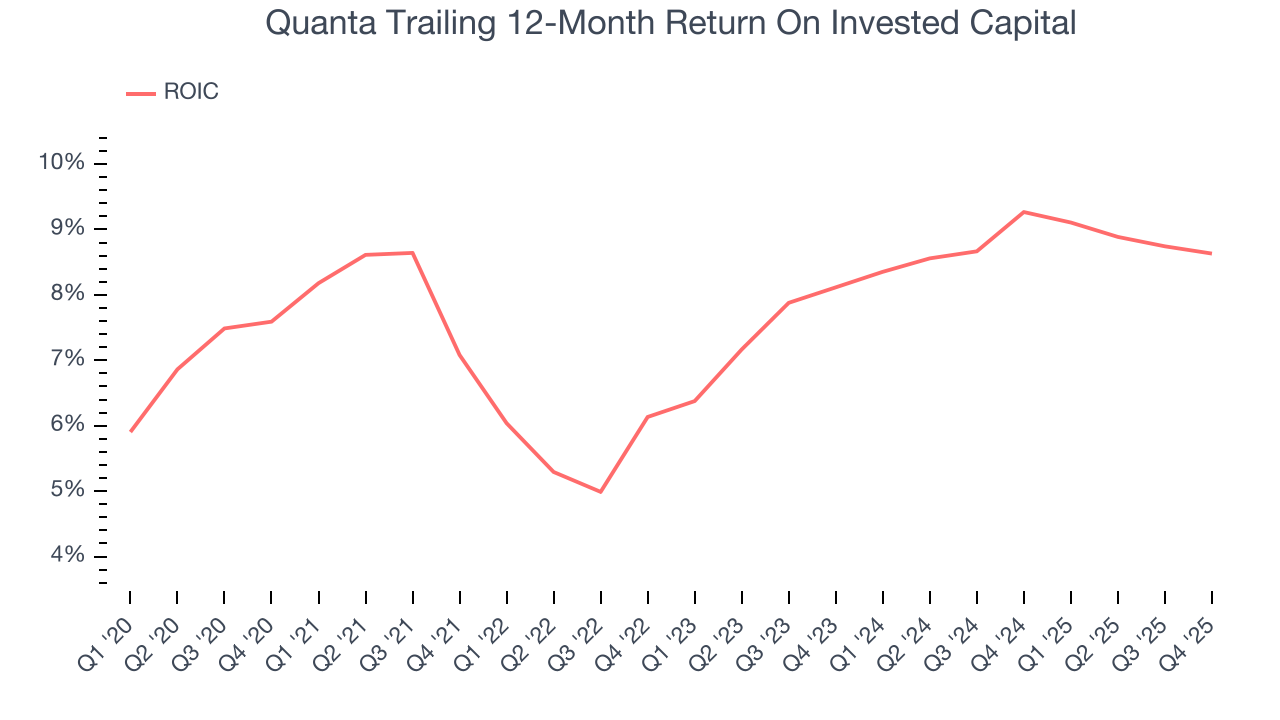

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Quanta has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Quanta’s ROIC averaged 2.3 percentage point increases each year. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

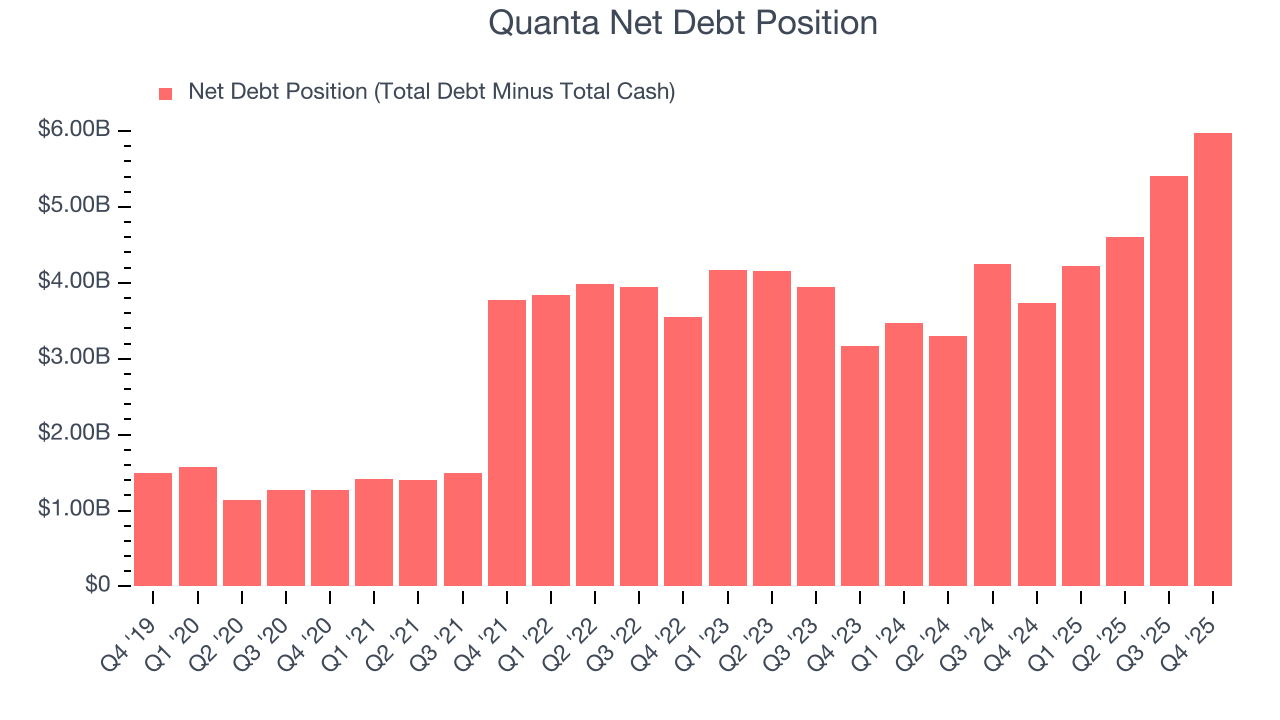

Quanta reported $439.5 million of cash and $6.42 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.88 billion of EBITDA over the last 12 months, we view Quanta’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $103 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Quanta’s Q4 Results

We were impressed by how significantly Quanta blew past analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 5.9% to $550.00 immediately after reporting.

13. Is Now The Time To Buy Quanta?

Updated: February 19, 2026 at 7:14 AM EST

Before investing in or passing on Quanta, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Quanta is a high-quality business worth owning. For starters, its revenue growth was exceptional over the last five years. And while its low gross margins indicate some combination of competitive pressures and high production costs, its backlog growth has been marvelous. Additionally, Quanta’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Quanta’s P/E ratio based on the next 12 months is 41.9x. Expectations are high given its premium multiple, but we’ll happily own Quanta as its fundamentals shine bright. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany high valuations.

Wall Street analysts have a consensus one-year price target of $479.09 on the company (compared to the current share price of $550.00).