RBC Bearings (RBC)

RBC Bearings is a great business. Its combination of fast growth, robust profitability, and superb prospects makes it a coveted asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like RBC Bearings

With a Guinness World Record for engineering the largest spherical plain bearing, RBC Bearings (NYSE:RBC) is a manufacturer of bearings and related components for the aerospace & defense, industrial, and transportation industries.

- Annual revenue growth of 21% over the last five years was superb and indicates its market share increased during this cycle

- Earnings per share grew by 19.7% annually over the last five years, massively outpacing its peers

- Excellent operating margin highlights the strength of its business model, and its operating leverage amplified its profits over the last five years

We’re optimistic about RBC Bearings. No surprise this ranks among our best industrials stocks.

Is Now The Time To Buy RBC Bearings?

High Quality

Investable

Underperform

Is Now The Time To Buy RBC Bearings?

RBC Bearings’s stock price of $499.44 implies a valuation ratio of 40.1x forward P/E. There’s no denying that the lofty valuation means there’s much good news priced into the stock.

Are you a fan of the company and believe in the bull case? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. RBC Bearings (RBC) Research Report: Q3 CY2025 Update

Bearings manufacturer RBC Bearings (NYSE:RBC) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 14.4% year on year to $455.3 million. The company expects next quarter’s revenue to be around $458 million, close to analysts’ estimates. Its non-GAAP profit of $2.88 per share was 5.3% above analysts’ consensus estimates.

RBC Bearings (RBC) Q3 CY2025 Highlights:

- Revenue: $455.3 million vs analyst estimates of $450.3 million (14.4% year-on-year growth, 1.1% beat)

- Adjusted EPS: $2.88 vs analyst estimates of $2.73 (5.3% beat)

- Adjusted EBITDA: $145.3 million vs analyst estimates of $137.2 million (31.9% margin, 5.9% beat)

- Revenue Guidance for Q4 CY2025 is $458 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 21.5%, in line with the same quarter last year

- Free Cash Flow Margin: 15.7%, up from 6.7% in the same quarter last year

- Market Capitalization: $12.77 billion

Company Overview

With a Guinness World Record for engineering the largest spherical plain bearing, RBC Bearings (NYSE:RBC) is a manufacturer of bearings and related components for the aerospace & defense, industrial, and transportation industries.

Its origins can be traced back to 1919, and the company has grown and evolved over time through organic growth as well as acquisitions. Acquisitions such as ABB’s Dodge division have substantially increased scale, product depth, and reach in the market.

Its product lineup includes a diverse range of bearings (mechanical components that reduce friction between moving parts) along with associated components like bearing housings, seals, and lubrication systems. These bearings and components play essential roles in machinery and equipment by facilitating efficient movement, reducing friction, and supporting heavy loads. The company’s products contribute to various mechanical systems in the aerospace, defense, industrial, and transportation industries.

RBC Bearings utilizes multiple channels to sell its products. In addition to direct sales through its sales representatives and distribution network, RBC Bearings also leverages e-commerce platforms to cater to customers' needs. Furthermore, the company actively participates in industry trade shows, exhibitions, and conferences to showcase its products. Contracts with original equipment manufacturers (OEMs) and government entities may involve long-term agreements, recurring purchases, or one-time transactions, depending on the needs of the OEMs and the nature of the products.

4. Engineered Components and Systems

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Timken (NYSE:TKR), NN (NASDAQ:NNBR), Kadant (NYSE:KAI), and Kaydon (NYSE:KDN).

5. Revenue Growth

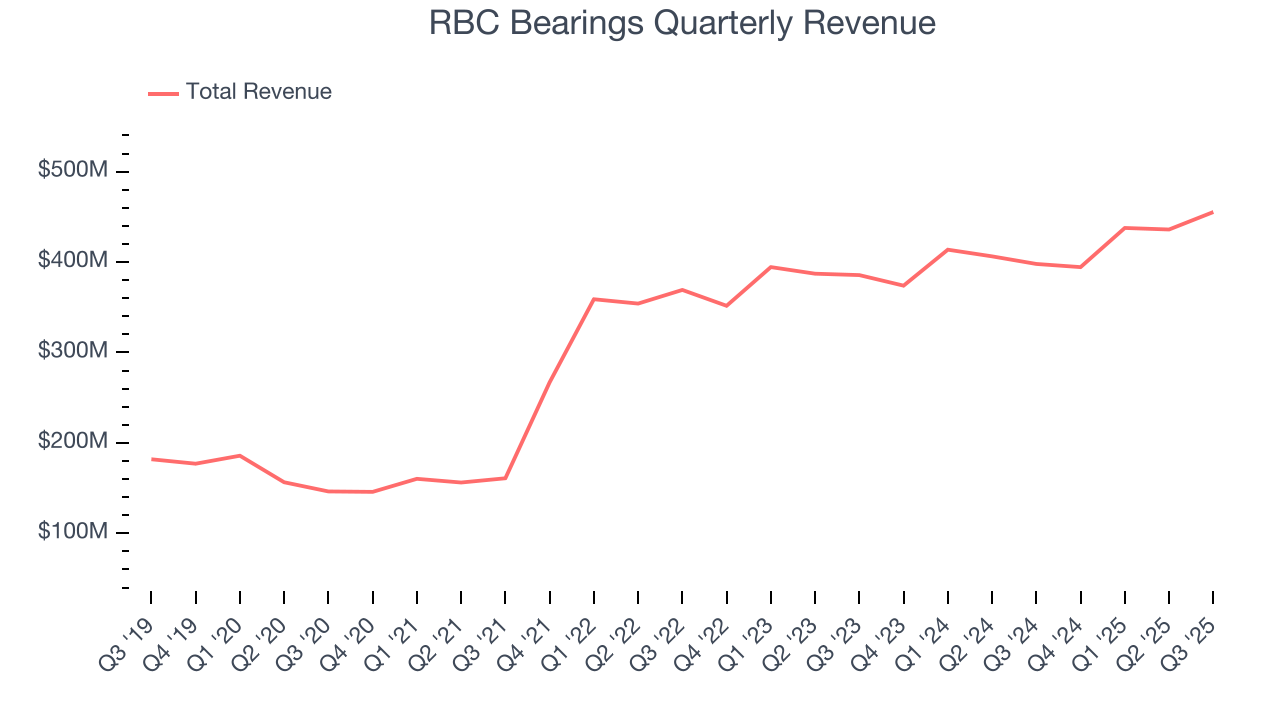

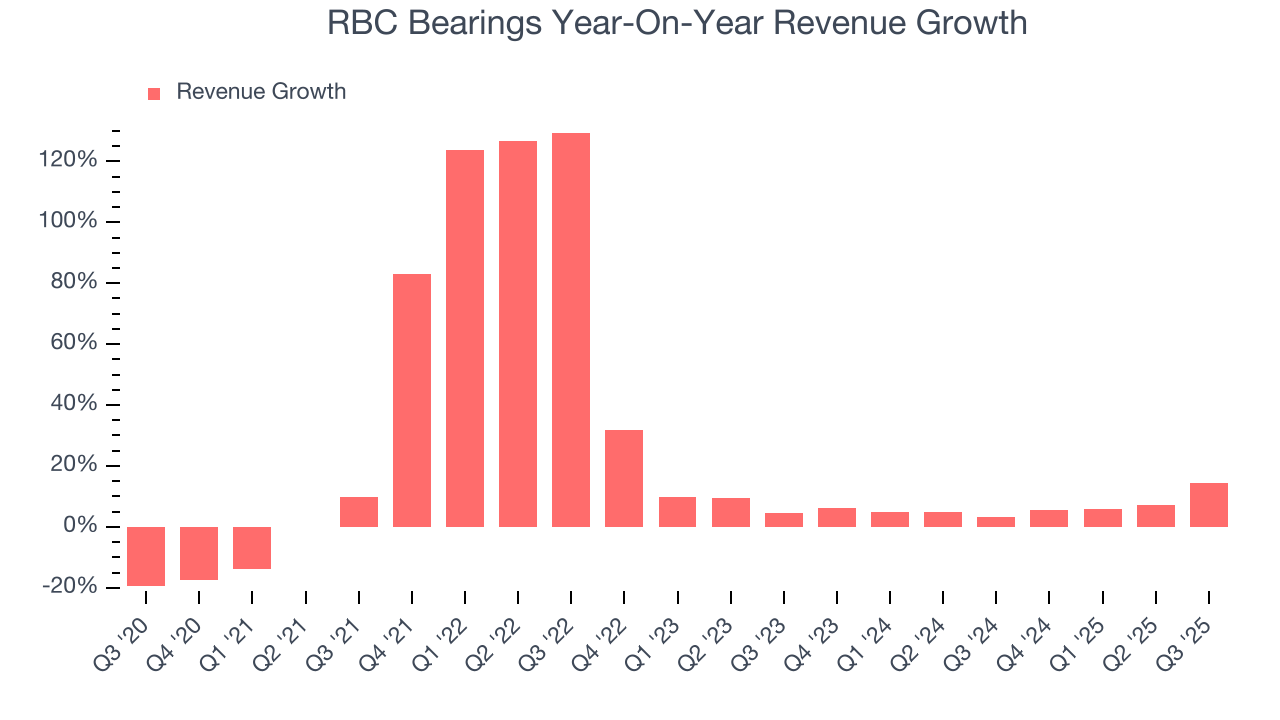

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, RBC Bearings’s 21% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. RBC Bearings’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6.5% over the last two years was well below its five-year trend.

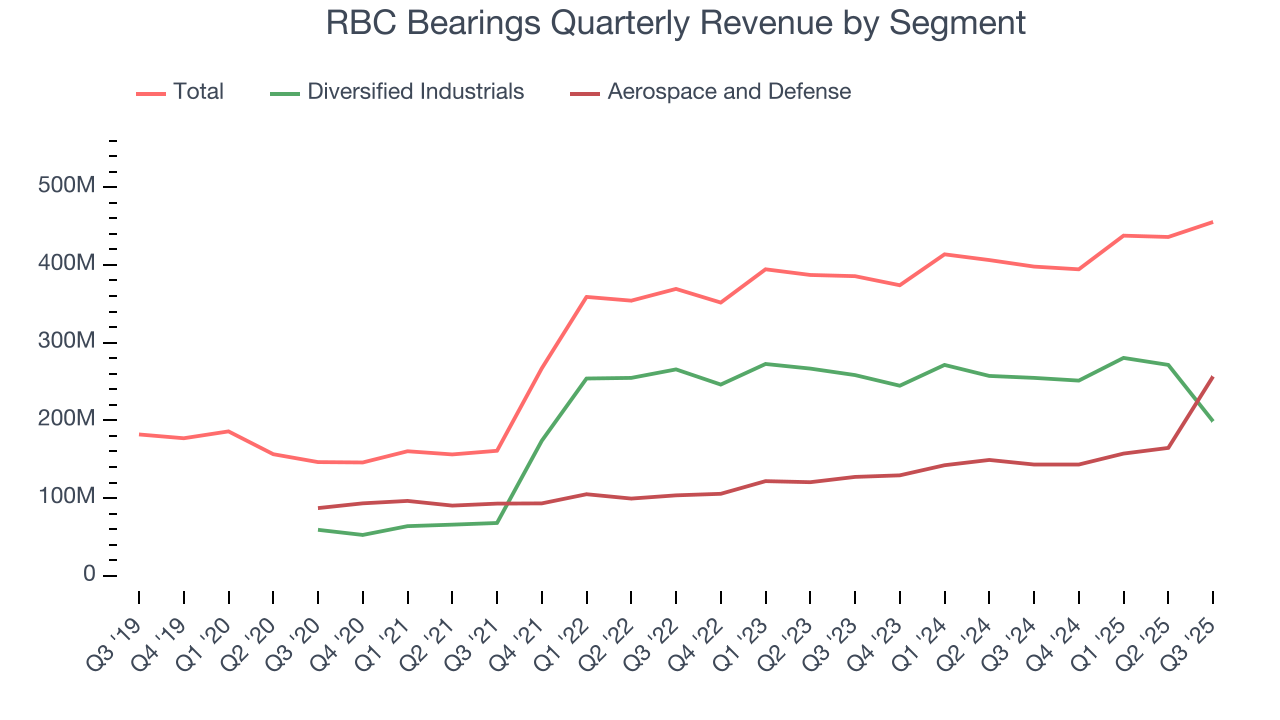

RBC Bearings also breaks out the revenue for its most important segments, Diversified Industrials and Aerospace and Defense, which are 43.7% and 56.3% of revenue. Over the last two years, RBC Bearings’s Diversified Industrials revenue (general industrial equipment) averaged 2% year-on-year declines. On the other hand, its Aerospace and Defense revenue (aircraft equipment, radar, missiles) averaged 23.3% growth.

This quarter, RBC Bearings reported year-on-year revenue growth of 14.4%, and its $455.3 million of revenue exceeded Wall Street’s estimates by 1.1%. Company management is currently guiding for a 16.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.3% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

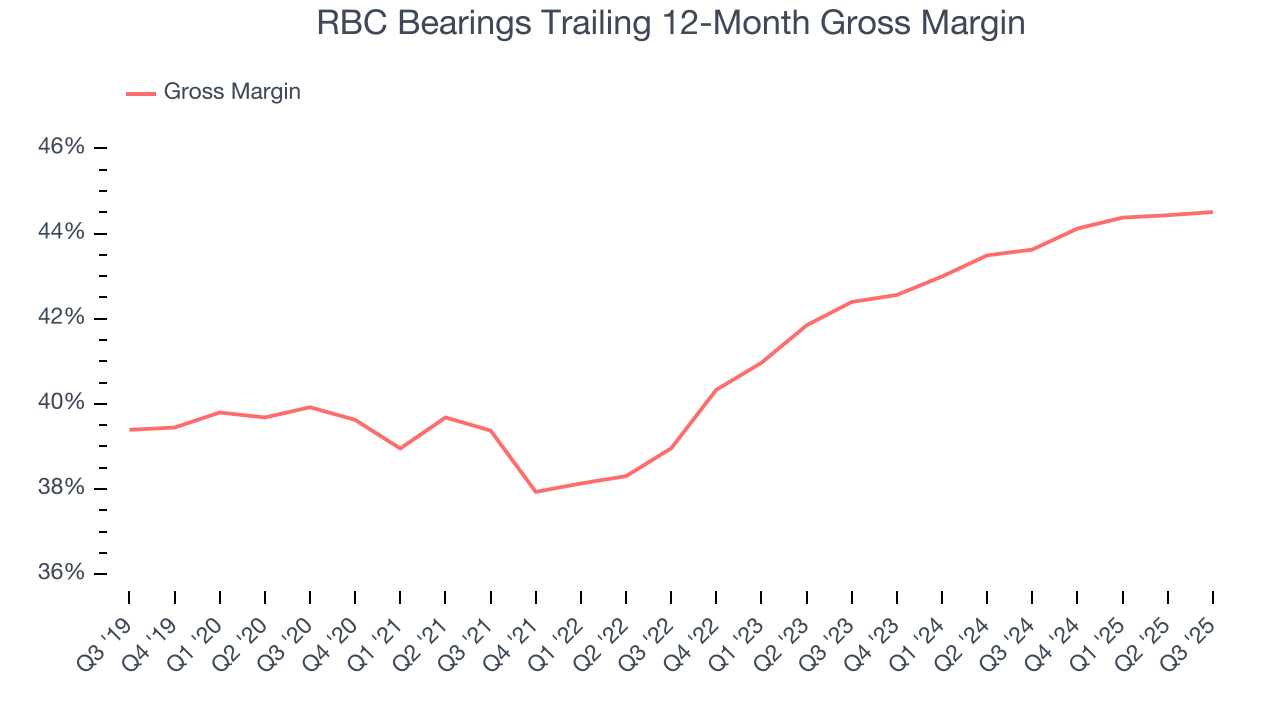

RBC Bearings has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 42.3% gross margin over the last five years. Said differently, roughly $42.26 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

RBC Bearings produced a 44.1% gross profit margin in Q3, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

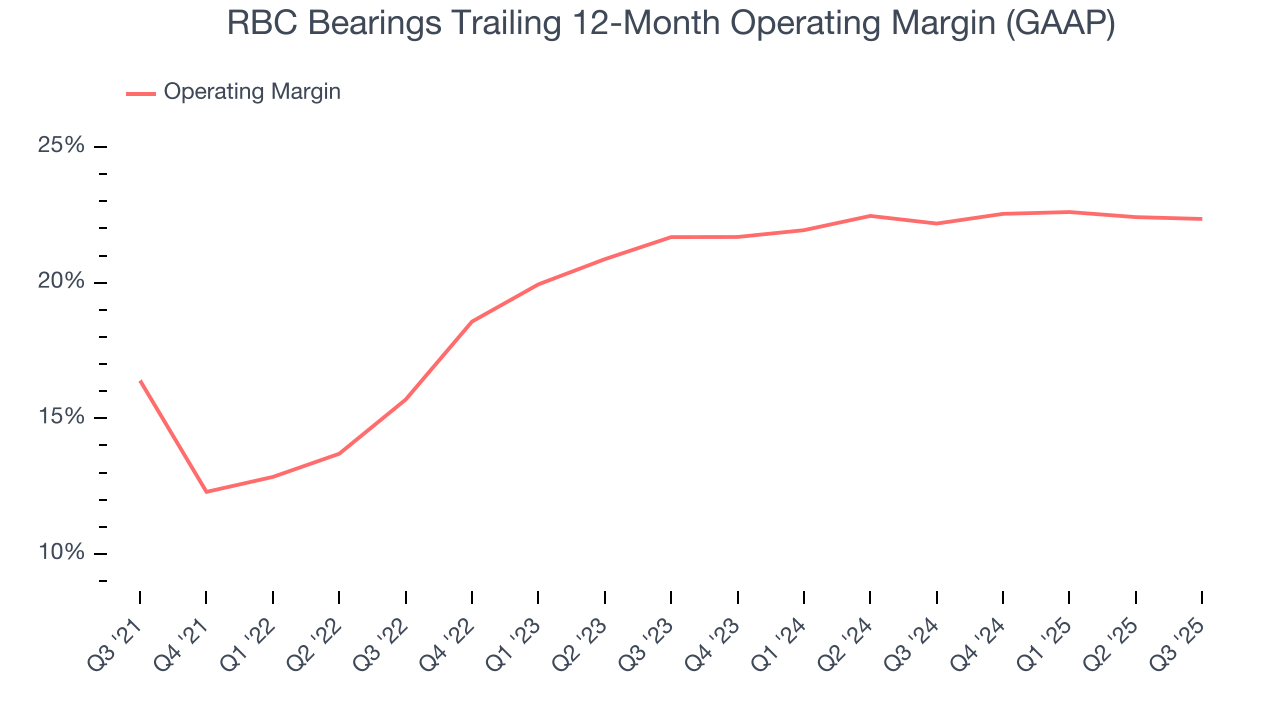

7. Operating Margin

RBC Bearings has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, RBC Bearings’s operating margin rose by 6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, RBC Bearings generated an operating margin profit margin of 21.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

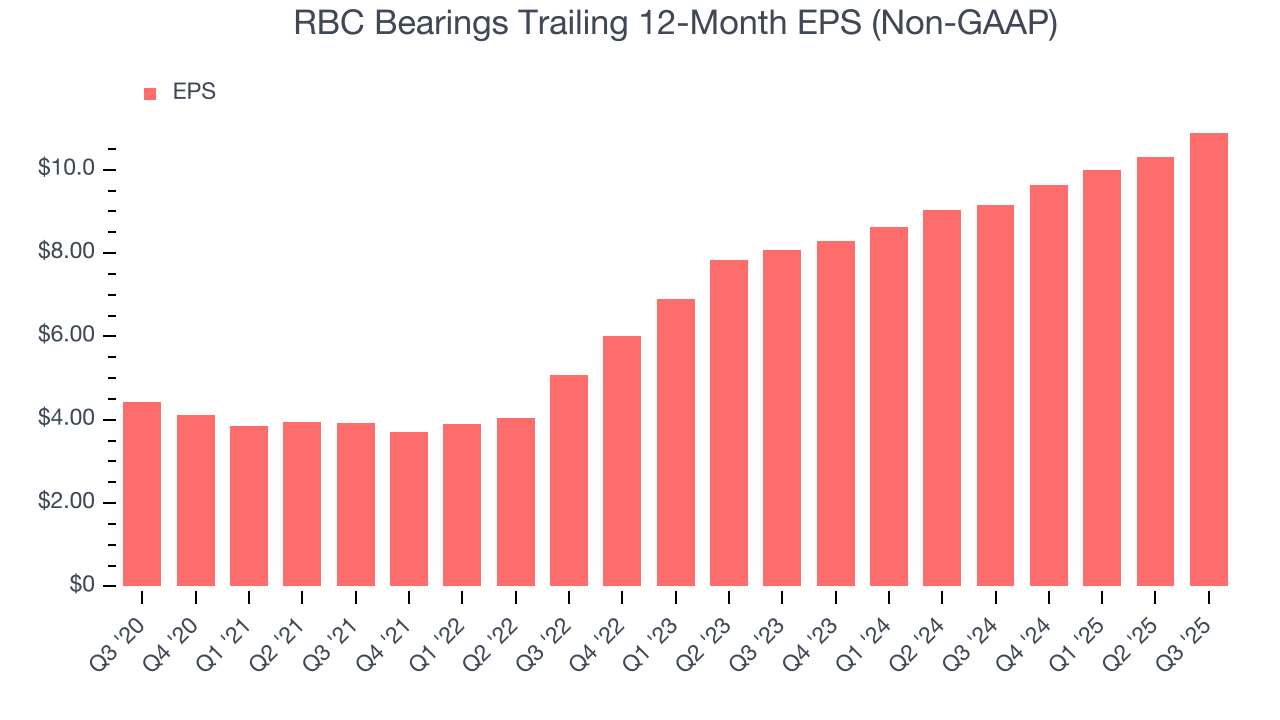

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

RBC Bearings’s astounding 19.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For RBC Bearings, its two-year annual EPS growth of 16.2% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, RBC Bearings reported adjusted EPS of $2.88, up from $2.29 in the same quarter last year. This print beat analysts’ estimates by 5.3%. Over the next 12 months, Wall Street expects RBC Bearings’s full-year EPS of $10.89 to grow 14.2%.

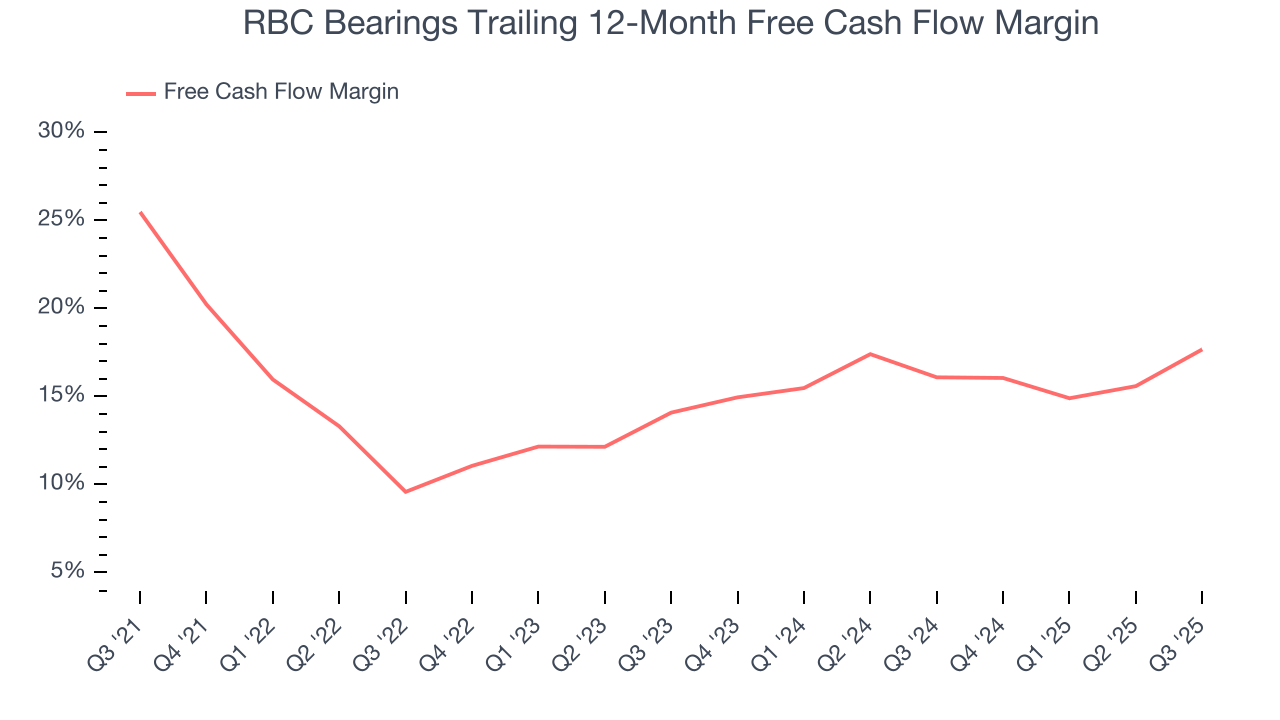

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

RBC Bearings has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 15.6% over the last five years.

Taking a step back, we can see that RBC Bearings’s margin dropped by 7.8 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

RBC Bearings’s free cash flow clocked in at $71.7 million in Q3, equivalent to a 15.7% margin. This result was good as its margin was 9 percentage points higher than in the same quarter last year. We hope the company can build on this trend.

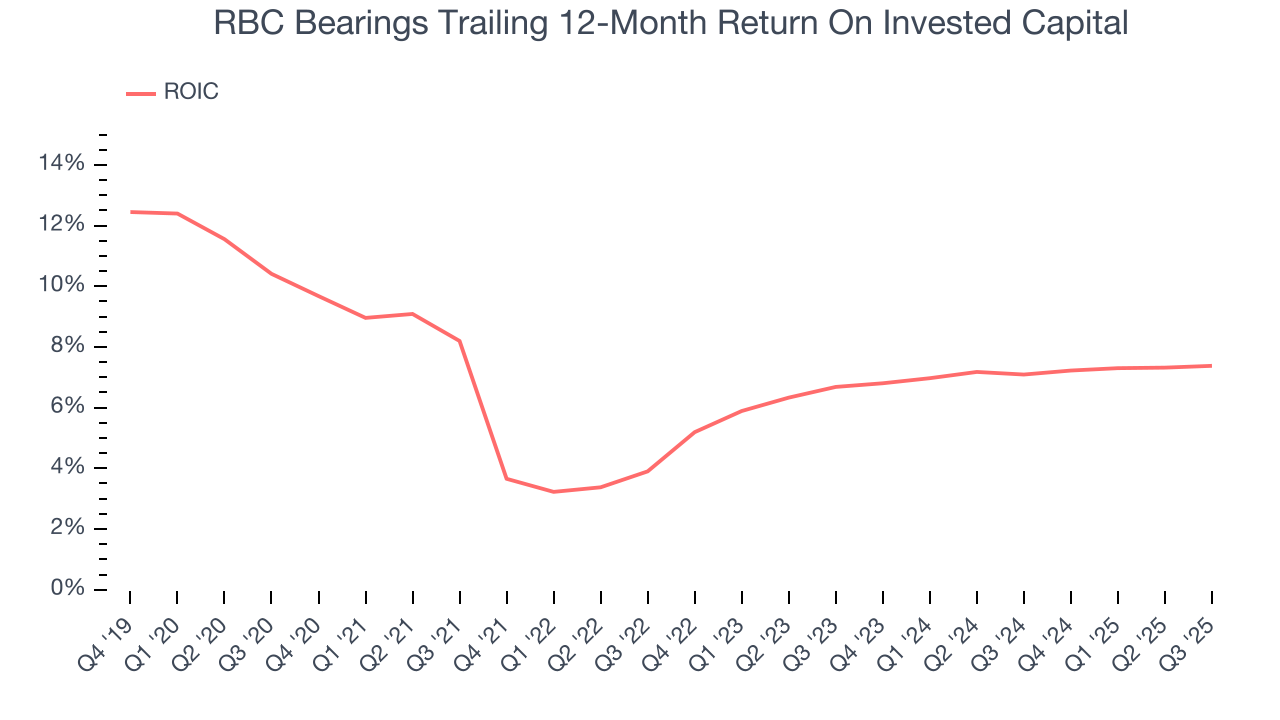

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although RBC Bearings has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, RBC Bearings’s ROIC averaged 1.2 percentage point increases each year. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

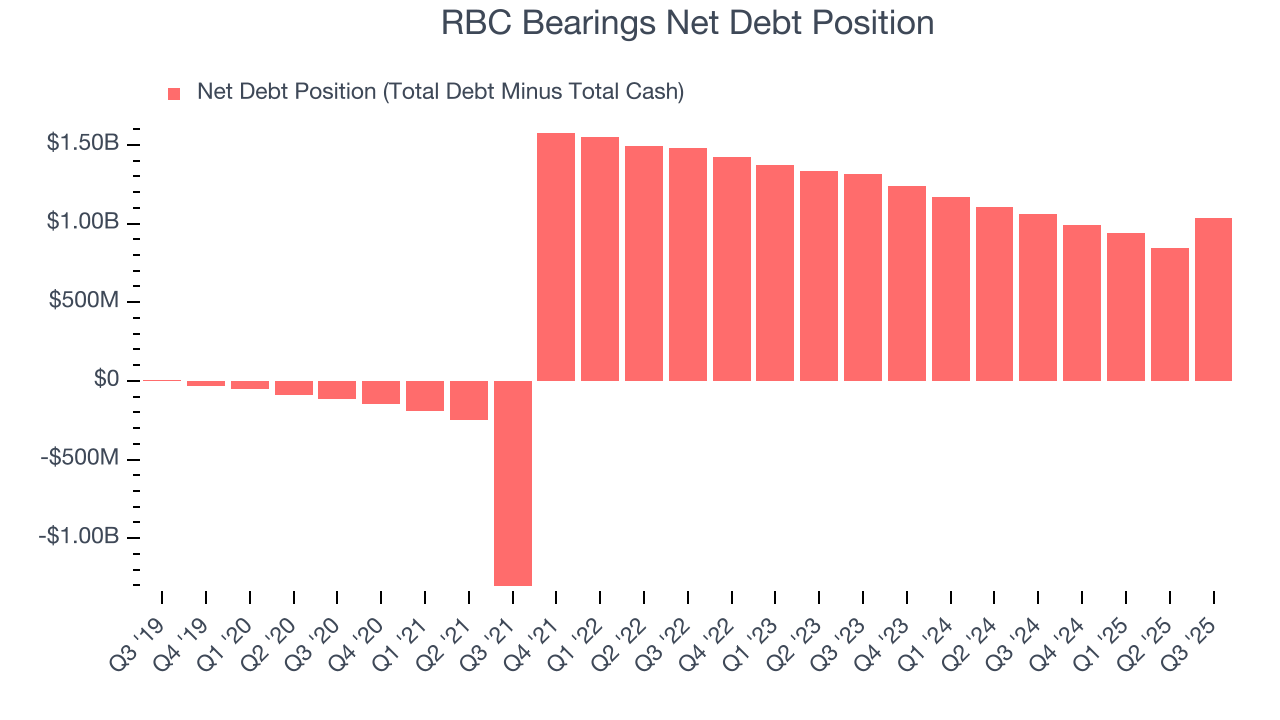

RBC Bearings reported $91.2 million of cash and $1.13 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $527.3 million of EBITDA over the last 12 months, we view RBC Bearings’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $25.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from RBC Bearings’s Q3 Results

We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its . Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $406.45 immediately after reporting.

13. Is Now The Time To Buy RBC Bearings?

Updated: January 30, 2026 at 10:05 PM EST

Before investing in or passing on RBC Bearings, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are multiple reasons why we think RBC Bearings is an amazing business. For starters, its revenue growth was exceptional over the last five years. And while its cash profitability fell over the last five years, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. Additionally, RBC Bearings’s impressive operating margins show it has a highly efficient business model.

RBC Bearings’s P/E ratio based on the next 12 months is 40.1x. A lot of good news is certainly baked in given its premium multiple, but we’ll happily own RBC Bearings as its fundamentals really stand out. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with high valuations.

Wall Street analysts have a consensus one-year price target of $518.67 on the company (compared to the current share price of $499.44).