Radian Group (RDN)

Radian Group doesn’t excite us. Its declining sales show demand has evaporated, a red flag for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Radian Group Is Not Exciting

Founded during the housing boom of 1977 and weathering multiple real estate cycles since, Radian Group (NYSE:RDN) provides mortgage insurance and real estate services, helping lenders manage risk and homebuyers achieve affordable homeownership.

- Sales tumbled by 1.8% annually over the last five years, showing market trends are working against its favor during this cycle

- Net premiums earned contracted by 3.2% annually over the last five years, showing unfavorable market dynamics this cycle

- A silver lining is that its market share is on track to rise over the next 12 months as its 27.2% projected revenue growth implies demand will accelerate from its two-year trend

Radian Group’s quality is inadequate. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Radian Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Radian Group

Radian Group is trading at $32.77 per share, or 0.8x forward P/B. Yes, this valuation multiple is lower than that of other insurance peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Radian Group (RDN) Research Report: Q4 CY2025 Update

Mortgage insurance provider Radian Group (NYSE:RDN) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 9.9% year on year to $300.5 million. Its non-GAAP profit of $1.16 per share was 6.8% above analysts’ consensus estimates.

Radian Group (RDN) Q4 CY2025 Highlights:

- Net Premiums Earned: $237.2 million (flat year on year)

- Revenue: $300.5 million vs analyst estimates of $302.3 million (9.9% year-on-year decline, 0.6% miss)

- Pre-tax Profit: $201 million (66.9% margin)

- Adjusted EPS: $1.16 vs analyst estimates of $1.09 (6.8% beat)

- Book Value per Share: $35.29 (12.6% year-on-year growth)

- Market Capitalization: $4.43 billion

Company Overview

Founded during the housing boom of 1977 and weathering multiple real estate cycles since, Radian Group (NYSE:RDN) provides mortgage insurance and real estate services, helping lenders manage risk and homebuyers achieve affordable homeownership.

Radian operates through two main business segments: Mortgage Insurance and homegenius. The Mortgage Insurance segment, which generates most of the company's revenue, offers private mortgage insurance that protects lenders when borrowers default on residential mortgage loans. This insurance is particularly important for borrowers who make down payments of less than 20%, as it enables them to qualify for loans that might otherwise be unavailable or would require higher interest rates.

For example, a family purchasing a $300,000 home with a 10% down payment might need Radian's mortgage insurance to secure their loan. If the borrowers later default, Radian would cover a percentage of the lender's losses, typically the first losses up to a specified coverage limit.

Through its homegenius segment, Radian offers a suite of title, real estate, and technology services. These include title insurance that protects against property ownership disputes, real estate asset management services for financial institutions, property valuation services, and a digital platform that connects homebuyers with real estate agents and provides tools throughout the homeownership journey.

Radian earns revenue primarily through insurance premiums from its mortgage insurance business and transaction-based fees from its homegenius services. The company's business is cyclical, influenced by interest rates, housing market activity, and mortgage origination volumes. Radian is authorized to write mortgage insurance in all 50 states, the District of Columbia, and Guam, with its largest state concentration in Texas.

4. Property & Casualty Insurance

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

Radian Group's primary competitors include other private mortgage insurers such as MGIC Investment Corporation (NYSE:MTG), Essent Group (NYSE:ESNT), and NMI Holdings (NASDAQ:NMIH), as well as government agencies like the Federal Housing Administration (FHA) and Veterans Administration (VA). In its homegenius segment, Radian competes with major title insurance companies including Fidelity National Financial (NYSE:FNF) and First American Financial (NYSE:FAF).

5. Revenue Growth

Insurers earn revenue three ways. The core insurance business itself, often called underwriting and represented in the income statement as premiums earned, is one way. Investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities is the second way. Fees from various sources such as policy administration, annuities, or other value-added services is the third. Over the last five years, Radian Group’s demand was weak and its revenue declined by 1.8% per year. This was below our standards and suggests it’s a lower quality business.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Radian Group’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Radian Group missed Wall Street’s estimates and reported a rather uninspiring 9.9% year-on-year revenue decline, generating $300.5 million of revenue.

Net premiums earned made up 75% of the company’s total revenue during the last five years, meaning insurance operations are Radian Group’s largest source of revenue.

Net premiums earned commands greater market attention due to its reliability and consistency, whereas investment and fee income are often seen as more volatile revenue streams that fluctuate with market conditions.

6. Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Radian Group’s net premiums earned has declined by 3.2% annually over the last five years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

When analyzing Radian Group’s net premiums earned over the last two years, we can see that growth accelerated to 1.6% annually. Since two-year net premiums earned grew faster than total revenue over this period, it's implied that other line items such as investment income grew at a slower rate. These extra revenue streams are important to the bottom line, yet their performance can be inconsistent. Some firms have been more successful and consistent in managing their float, but sharp fluctuations in the fixed income and equity markets can dramatically affect short-term results.

In Q4, Radian Group produced $237.2 million of net premiums earned, flat year on year.

7. Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio sums the costs of underwriting (salaries, commissions, overhead) as well as what an insurer pays out in claims (losses) and divides it by net premiums earned. If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Given the calculation, a lower expense ratio is better. Over the last five years, Radian Group’s combined ratio has swelled by 34.7 percentage points, going from 27.2% to 33.1%. However, the company gave back some of its expense savings as its combined ratio worsened by 11.7 percentage points on a two-year basis.

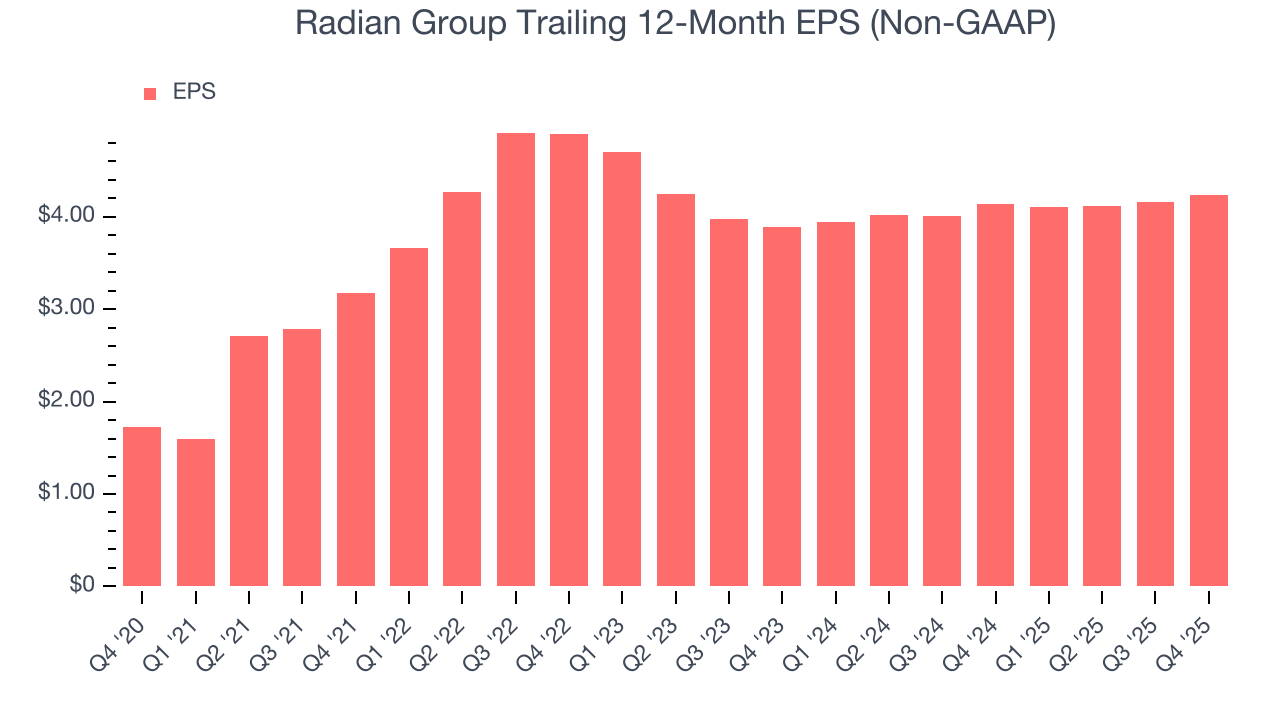

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Radian Group’s EPS grew at a remarkable 19.7% compounded annual growth rate over the last five years, higher than its 1.8% annualized revenue declines. However, this alone doesn’t tell us much about its business quality because its combined ratio didn’t improve.

Diving into the nuances of Radian Group’s earnings can give us a better understanding of its performance. As we mentioned earlier, Radian Group’s combined ratio improved by 34.7 percentage points over the last five years. On top of that, its share count shrank by 29%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Radian Group, its two-year annual EPS growth of 4.3% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Radian Group reported adjusted EPS of $1.16, up from $1.09 in the same quarter last year. This print beat analysts’ estimates by 6.8%. Over the next 12 months, Wall Street expects Radian Group’s full-year EPS of $4.23 to grow 5.9%.

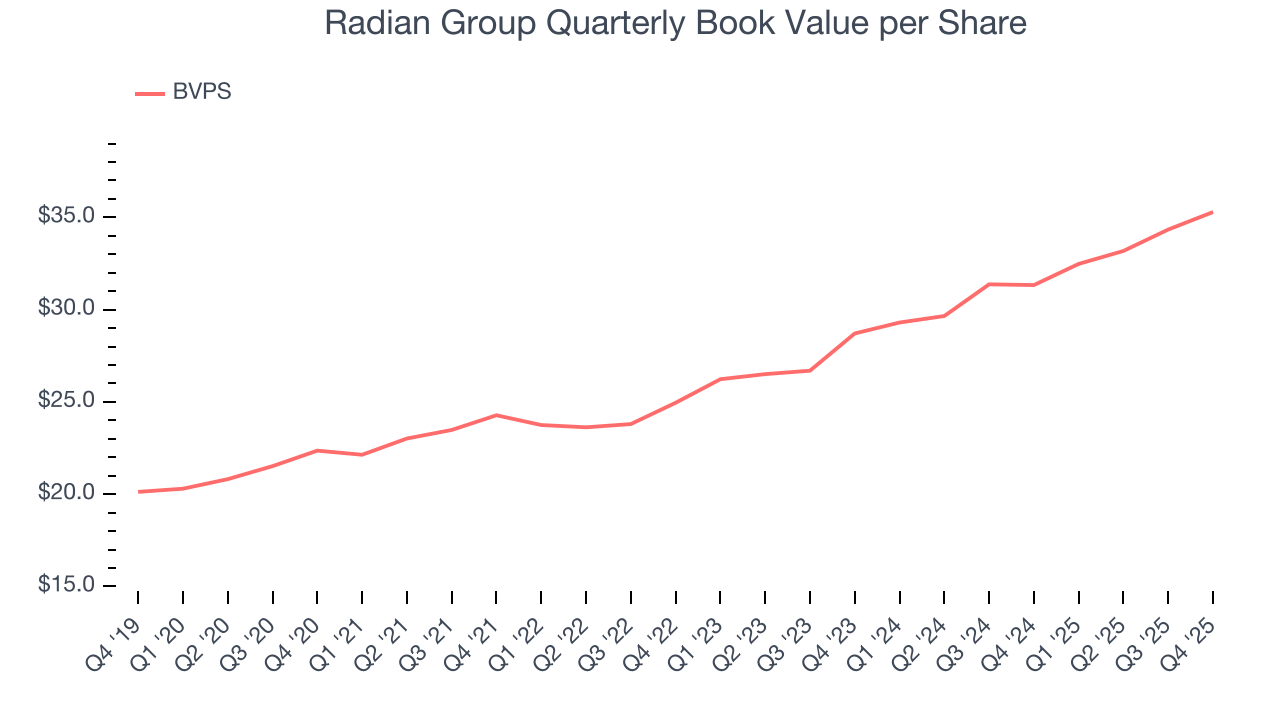

9. Book Value Per Share (BVPS)

Insurance companies are balance sheet businesses, collecting premiums upfront and paying out claims over time. The float – premiums collected but not yet paid out – are invested, creating an asset base supported by a liability structure. Book value captures this dynamic by measuring:

- Assets (investment portfolio, cash, reinsurance recoverables) - liabilities (claim reserves, debt, future policy benefits)

BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality because it reflects long-term capital growth and is harder to manipulate than more commonly-used metrics like EPS.

Radian Group’s BVPS grew at a solid 9.6% annual clip over the last five years. BVPS growth has also accelerated recently, growing by 10.9% annually over the last two years from $28.71 to $35.29 per share.

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Radian Group currently has $1.11 billion of debt and $4.78 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.3×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 1.0× for an insurance business. Anything below 0.5× is a bonus.

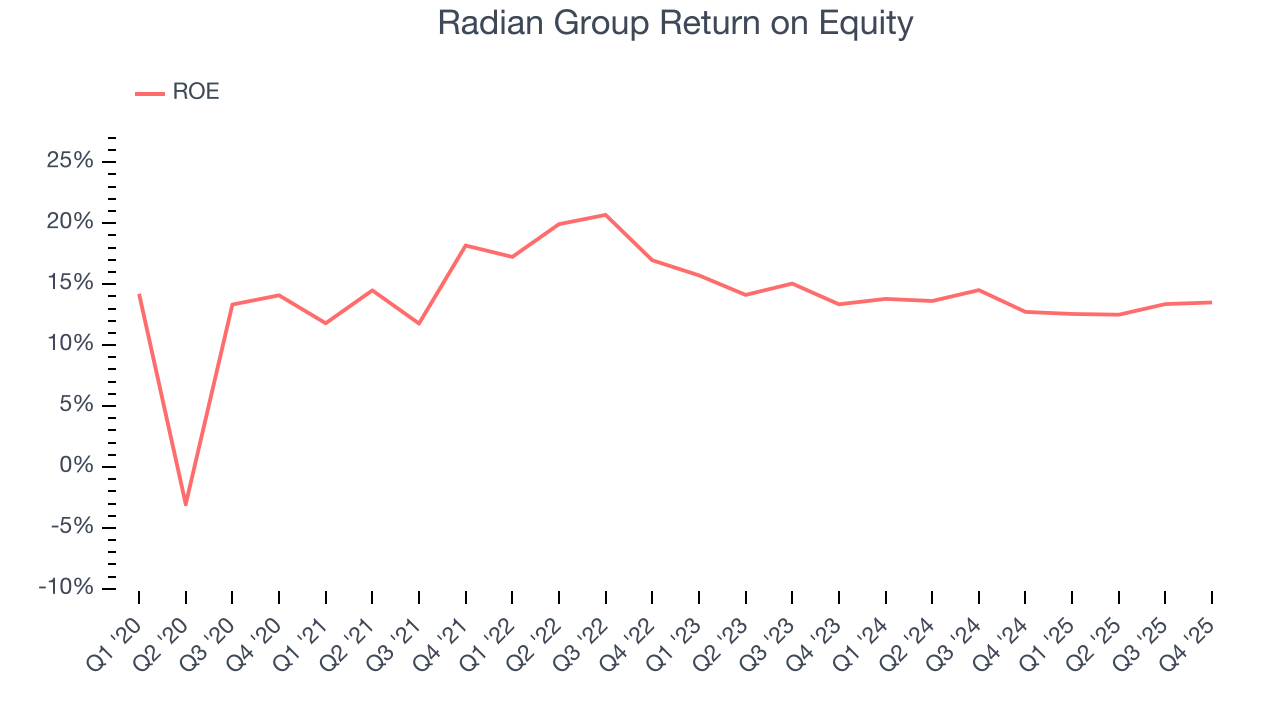

11. Return on Equity

Return on equity, or ROE, represents the ultimate measure of an insurer's effectiveness, quantifying how well it transforms shareholder investments into profits. Over the long term, insurance companies with robust ROE metrics typically deliver superior shareholder returns through a balanced approach to capital management.

Over the last five years, Radian Group has averaged an ROE of 14.8%, healthy for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This is a bright spot for Radian Group.

12. Key Takeaways from Radian Group’s Q4 Results

It was good to see Radian Group beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $32.30 immediately following the results.

13. Is Now The Time To Buy Radian Group?

Updated: February 19, 2026 at 11:21 PM EST

Are you wondering whether to buy Radian Group or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Radian Group has a few positive attributes, but it doesn’t top our wishlist. Although its revenue has declined over the last five years, its growth over the next 12 months is expected to be higher. And while Radian Group’s net premiums earned has declined over the last five years, its improving combined ratio shows the business has become more productive.

Radian Group’s P/B ratio based on the next 12 months is 0.8x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $39.50 on the company (compared to the current share price of $32.77).