Robert Half (RHI)

We wouldn’t buy Robert Half. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Robert Half Will Underperform

With roots dating back to 1948 as the first specialized recruiting firm for accounting and finance professionals, Robert Half (NYSE:RHI) provides specialized talent solutions and business consulting services, connecting skilled professionals with companies across various fields.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 8.3% annually over the last two years

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 13.3% annually

- Projected sales for the next 12 months are flat and suggest demand will be subdued

Robert Half doesn’t live up to our standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Robert Half

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Robert Half

Robert Half’s stock price of $26.47 implies a valuation ratio of 17.6x forward P/E. This multiple is high given its weaker fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Robert Half (RHI) Research Report: Q4 CY2025 Update

Specialized talent solutions company Robert Half (NYSE:RHI) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 5.8% year on year to $1.30 billion. Its GAAP profit of $0.32 per share was 8.4% above analysts’ consensus estimates.

Robert Half (RHI) Q4 CY2025 Highlights:

- Revenue: $1.30 billion vs analyst estimates of $1.29 billion (5.8% year-on-year decline, 1.1% beat)

- EPS (GAAP): $0.32 vs analyst estimates of $0.30 (8.4% beat)

- Operating Margin: 1.7%, down from 4.7% in the same quarter last year

- Market Capitalization: $2.69 billion

Company Overview

With roots dating back to 1948 as the first specialized recruiting firm for accounting and finance professionals, Robert Half (NYSE:RHI) provides specialized talent solutions and business consulting services, connecting skilled professionals with companies across various fields.

Robert Half operates through three main segments: Contract Talent Solutions, Permanent Placement Talent Solutions, and Protiviti. The Contract Talent Solutions business provides companies with professionals on a temporary basis across finance, technology, marketing, legal, and administrative fields. This helps organizations manage workload fluctuations, special projects, or staff shortages without committing to permanent hires. The Permanent Placement division focuses on recruiting full-time employees across these same specialties.

Protiviti, a wholly owned subsidiary, offers business consulting services in areas like regulatory compliance, technology, risk management, and internal audit. This consulting arm allows Robert Half to provide more comprehensive solutions to clients beyond just staffing needs.

For example, a mid-sized company experiencing rapid growth might use Robert Half to find temporary financial analysts during budget season, hire a permanent CFO through their placement services, and engage Protiviti consultants to strengthen their internal controls and compliance processes.

Robert Half generates revenue primarily through placement fees. For contract positions, clients pay hourly rates that include both the professional's wages and Robert Half's service fee. For permanent placements, the company typically earns a percentage of the placed employee's first-year salary.

The company has embraced technology in its operations, using proprietary artificial intelligence to match candidates with job openings more efficiently. This AI-powered matching helps Robert Half quickly identify qualified professionals for client needs, giving them a competitive edge in the fast-moving talent marketplace.

4. Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

Robert Half competes with other specialized staffing firms like ManpowerGroup (NYSE:MAN), Kforce (NASDAQ:KFRC), and Heidrick & Struggles (NASDAQ:HSII), as well as with general staffing companies like Adecco Group (SWX:ADEN) and Randstad (AMS:RAND). In the consulting space, Protiviti faces competition from firms like Accenture (NYSE:ACN) and the Big Four accounting firms.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $5.38 billion in revenue over the past 12 months, Robert Half is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. For Robert Half to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

As you can see below, Robert Half’s sales grew at a sluggish 1% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Robert Half’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 8.3% annually.

This quarter, Robert Half’s revenue fell by 5.8% year on year to $1.30 billion but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

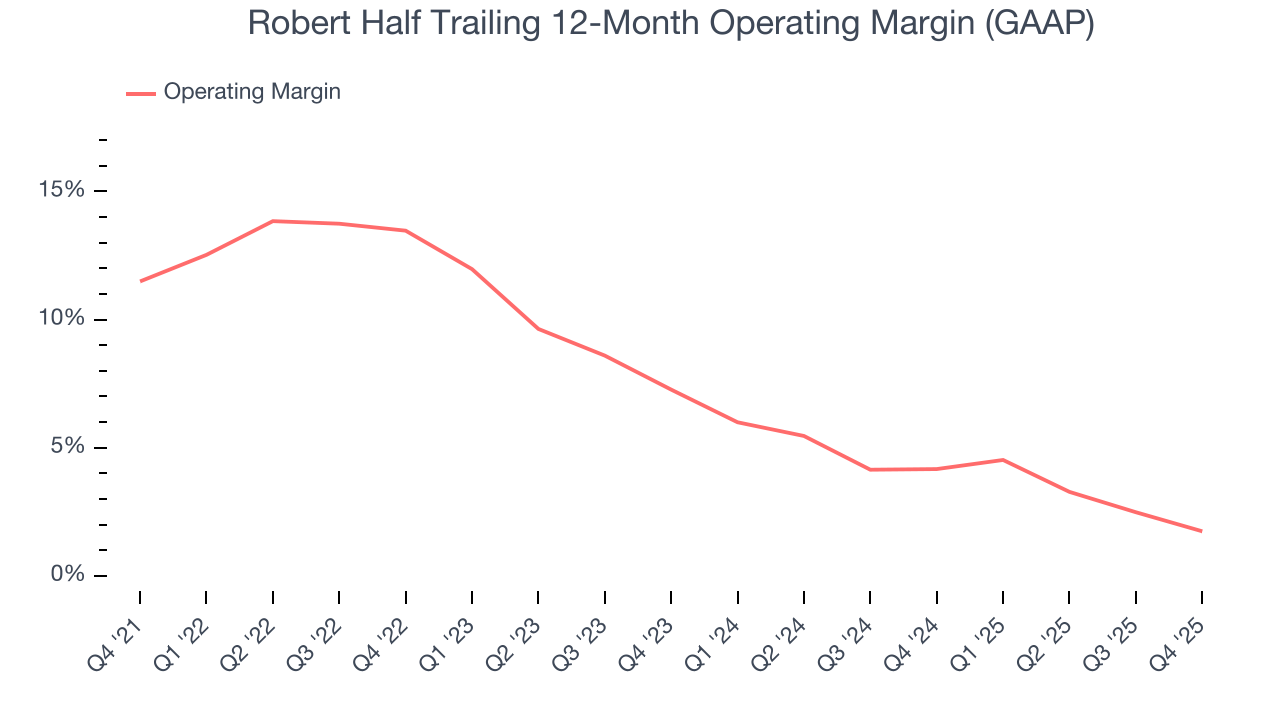

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Robert Half was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.1% was weak for a business services business.

Analyzing the trend in its profitability, Robert Half’s operating margin decreased by 9.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Robert Half’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Robert Half generated an operating margin profit margin of 1.7%, down 2.9 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Robert Half, its EPS declined by 13.2% annually over the last five years while its revenue grew by 1%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Robert Half’s earnings can give us a better understanding of its performance. As we mentioned earlier, Robert Half’s operating margin declined by 9.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Robert Half, its two-year annual EPS declines of 41.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Robert Half reported EPS of $0.32, down from $0.53 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8.4%. Over the next 12 months, Wall Street expects Robert Half’s full-year EPS of $1.33 to grow 22.3%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Robert Half has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.4% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Robert Half’s margin dropped by 6.9 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Robert Half hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 37.8%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Robert Half’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

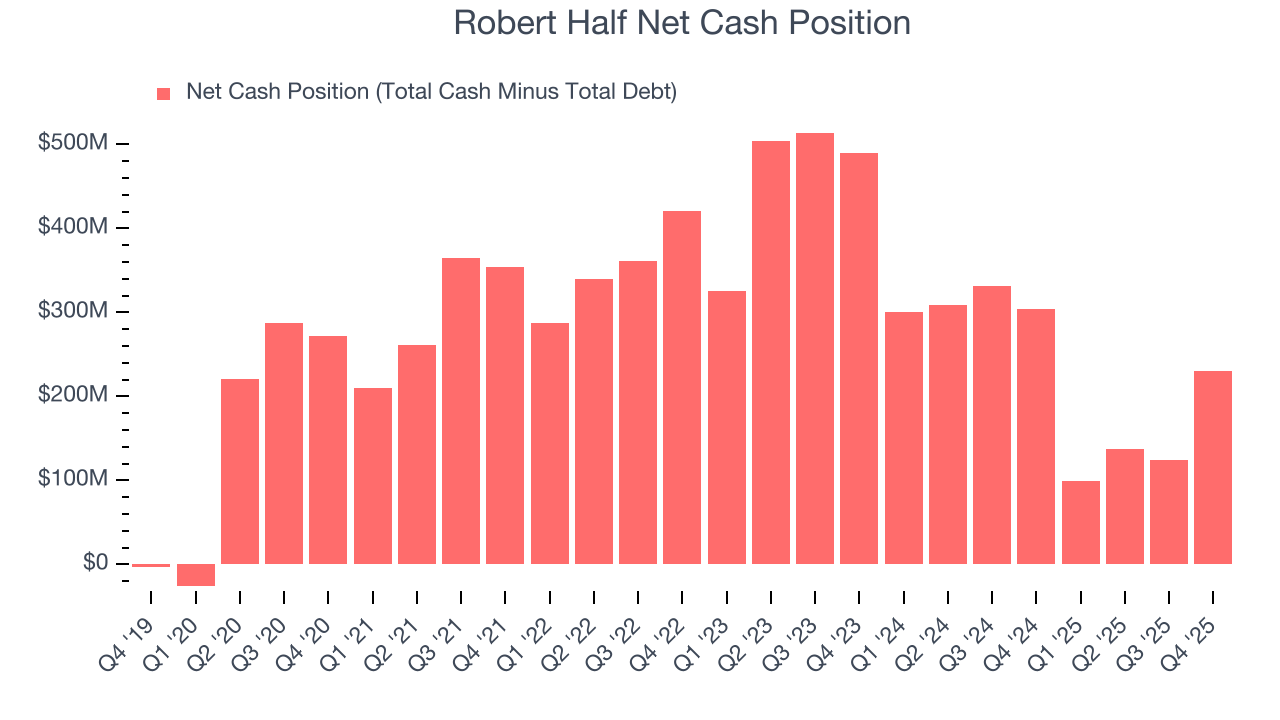

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Robert Half is a profitable, well-capitalized company with $464.4 million of cash and $234.8 million of debt on its balance sheet. This $229.7 million net cash position is 8.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Robert Half’s Q4 Results

It was good to see Robert Half beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 9.8% to $29.75 immediately after reporting.

12. Is Now The Time To Buy Robert Half?

Updated: February 19, 2026 at 11:33 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Robert Half.

Robert Half falls short of our quality standards. To begin with, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its stellar ROIC suggests it has been a well-run company historically, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Robert Half’s P/E ratio based on the next 12 months is 17.6x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $32.39 on the company (compared to the current share price of $26.47).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.