Rocket Companies (RKT)

Rocket Companies is interesting. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why Rocket Companies Is Interesting

Born in Detroit during the 1980s and evolving into a tech-driven financial powerhouse, Rocket Companies (NYSE:RKT) is a fintech company that provides digital mortgage lending, real estate services, and personal finance solutions through its technology platform.

- Expected net interest income growth of 40% for the next year suggests its market share will rise

- Tangible book value per share outlook for the upcoming 12 months is outstanding and shows it’s on track to build significant equity value

- On the flip side, its sales tumbled by 16.7% annually over the last five years, showing market trends are working against its favor during this cycle

Rocket Companies shows some promise. This company is certainly worth watching.

Why Should You Watch Rocket Companies

High Quality

Investable

Underperform

Why Should You Watch Rocket Companies

Rocket Companies is trading at $22.04 per share, or 3.8x forward P/B. The rich valuation multiple means there is a lot of good news priced into the stock; short-term price swings could result if anything bursts that bubble.

Rocket Companies could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Rocket Companies (RKT) Research Report: Q3 CY2025 Update

Fintech mortgage provider Rocket Companies (NYSE:RKT) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 21.3% year on year to $1.61 billion. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $2.2 billion at the midpoint, or 4.5% above analysts’ estimates. Its non-GAAP profit of $0.07 per share was 46.5% above analysts’ consensus estimates.

Rocket Companies (RKT) Q3 CY2025 Highlights:

- Net Interest Income: $35.68 million vs analyst estimates of $26.7 million (33.6% beat)

- Revenue: $1.61 billion vs analyst estimates of $1.66 billion (21.3% year-on-year growth, 3.5% miss)

- Adjusted EPS: $0.07 vs analyst estimates of $0.05 (46.5% beat)

- Revenue Guidance for Q4 CY2025 is $2.2 billion at the midpoint, above analyst estimates of $2.10 billion

- Market Capitalization: $45.7 billion

Company Overview

Born in Detroit during the 1980s and evolving into a tech-driven financial powerhouse, Rocket Companies (NYSE:RKT) is a fintech company that provides digital mortgage lending, real estate services, and personal finance solutions through its technology platform.

The company operates through several interconnected businesses centered around homeownership and financial services. Its flagship business, Rocket Mortgage, offers a digital mortgage application and approval process that allows clients to apply, upload documents, e-sign, and manage their loans through a mobile app or website. Rocket Mortgage functions both as a loan originator and servicer, maintaining relationships with clients throughout the life of their loans.

Rocket's ecosystem extends beyond mortgages to include Rocket Homes, a real estate search platform with agent referral services; Rocket Money, a personal finance app for budget management and subscription tracking; Rocket Loans, which provides personal loans; and Amrock, which handles title insurance, property valuation, and settlement services. This integrated approach allows clients to navigate the entire homebuying process within the Rocket platform.

The company generates revenue primarily by originating mortgage loans that it sells to government-backed entities like Fannie Mae and Freddie Mac or other investors in the secondary mortgage market. Rocket operates through both direct-to-consumer channels and partner networks, including relationships with mortgage brokers and financial institutions.

Rocket has heavily invested in artificial intelligence and data analytics, leveraging its vast data assets (10 petabytes) to automate processes and enhance client experiences. For instance, a homebuyer might use Rocket Homes to find a property, connect with a real estate agent, secure mortgage pre-approval through Rocket Mortgage, and close the transaction with Amrock's services—all within the same technology ecosystem.

4. Thrifts & Mortgage Finance

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

Rocket Companies competes with traditional mortgage lenders like Wells Fargo (NYSE:WFC) and Bank of America (NYSE:BAC), as well as digital-first mortgage providers such as UWM Holdings (NYSE:UWMC), loanDepot (NYSE:LDI), and PennyMac Financial Services (NYSE:PFSI).

5. Sales Growth

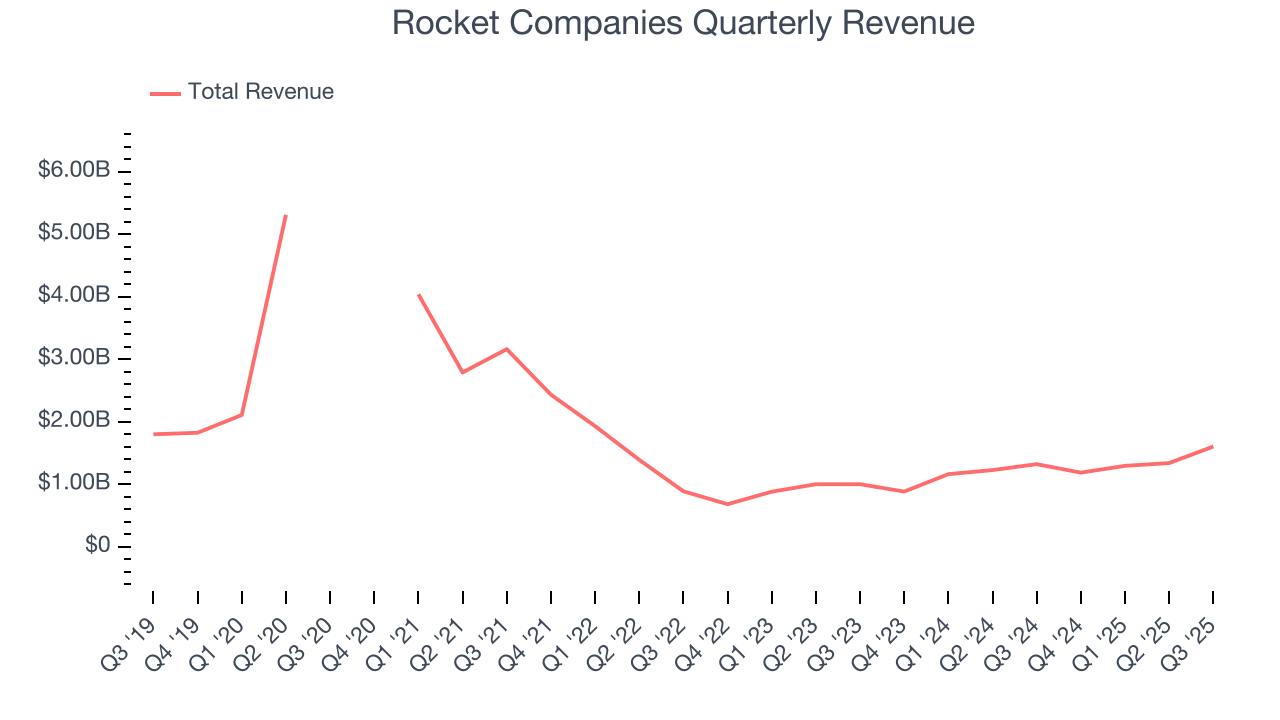

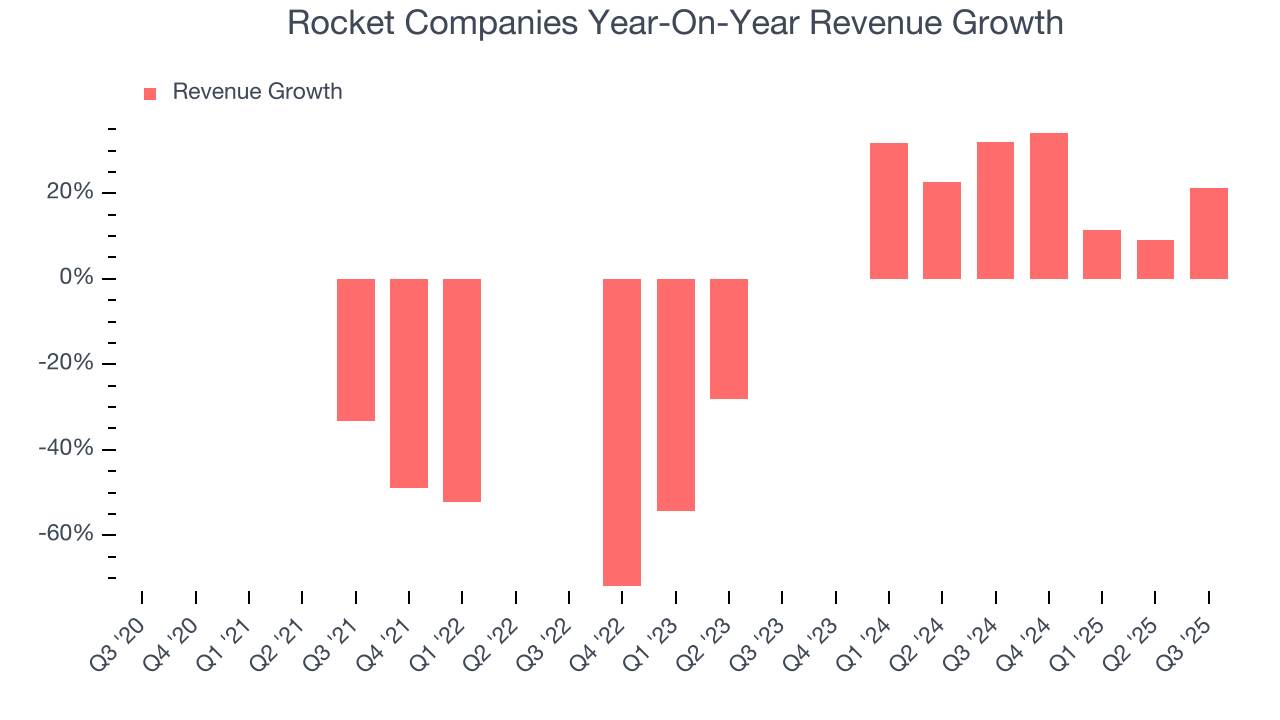

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions. Over the last five years, Rocket Companies’s demand was weak and its revenue declined by 17.2% per year. This wasn’t a great result, but there are still things to like about Rocket Companies.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Rocket Companies’s annualized revenue growth of 23.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Rocket Companies generated an excellent 21.3% year-on-year revenue growth rate, but its $1.61 billion of revenue fell short of Wall Street’s high expectations. Company management is currently guiding for a 85.3% year-on-year increase in sales next quarter.

6. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

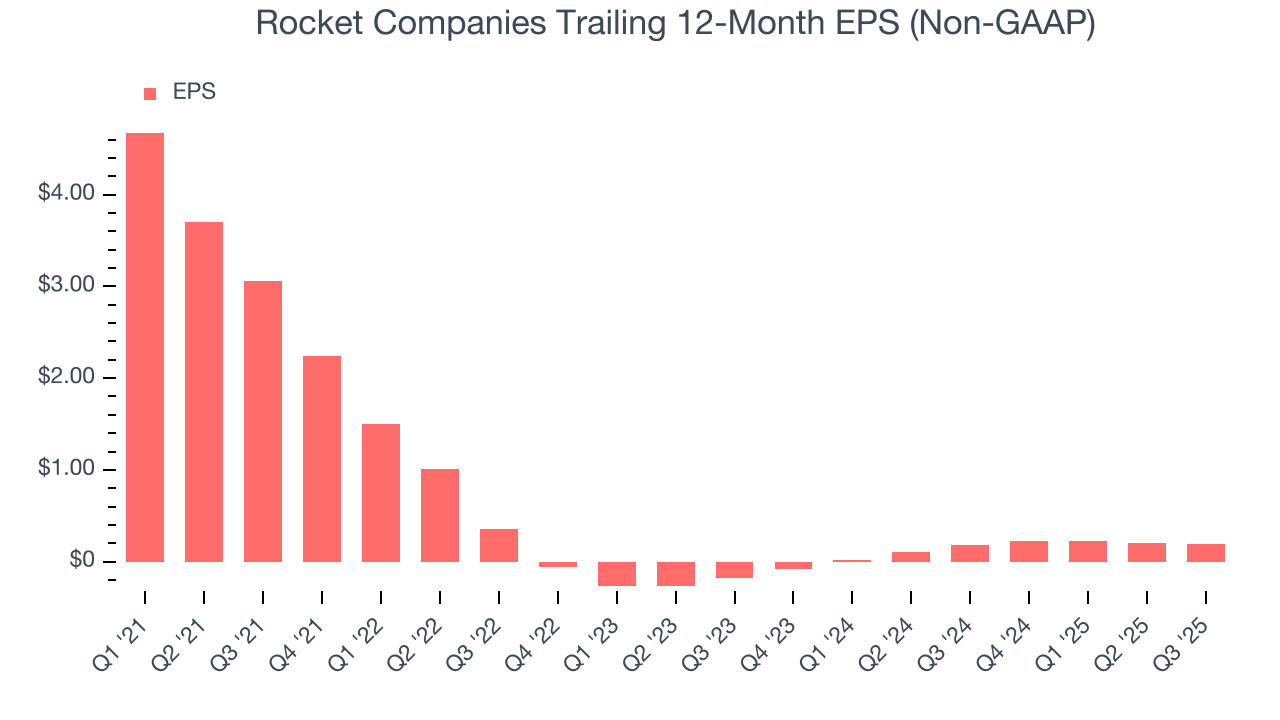

Sadly for Rocket Companies, its EPS declined by 47.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Rocket Companies, its two-year annual EPS growth of 74.8% was higher than its five-year trend. This acceleration made it one of the faster-growing banking companies in recent history.

In Q3, Rocket Companies reported adjusted EPS of $0.07, down from $0.08 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Rocket Companies’s full-year EPS of $0.19 to grow 291%.

7. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Rocket Companies has averaged an ROE of 25.3%, exceptional for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This shows Rocket Companies has a strong competitive moat.

8. Key Takeaways from Rocket Companies’s Q3 Results

It was good to see Rocket Companies beat analysts’ EPS expectations this quarter. We were also excited its net interest income outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 3.3% to $16.45 immediately after reporting.

9. Is Now The Time To Buy Rocket Companies?

Updated: January 20, 2026 at 11:56 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Rocket Companies, you should also grasp the company’s longer-term business quality and valuation.

We think Rocket Companies is a good business. Although its revenue has declined over the last five years, its growth over the next 12 months is expected to be higher. And while Rocket Companies’s declining EPS over the last five years makes it a less attractive asset to the public markets, its estimated net interest income growth for the next 12 months is great. On top of that, its projected EPS for the next year implies the company’s fundamentals will improve.

Rocket Companies’s P/B ratio based on the next 12 months is 3.8x. At this valuation, there’s a lot of good news priced in. Rocket Companies is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $21.57 on the company (compared to the current share price of $22.04).