ResMed (RMD)

ResMed is intriguing. It generates heaps of cash that are reinvested into the business, creating a virtuous cycle of returns.― StockStory Analyst Team

1. News

2. Summary

Why ResMed Is Interesting

Founded in 1989 to address the then-underdiagnosed condition of sleep apnea, ResMed (NYSE:RMD) develops cloud-connected medical devices and software solutions that treat sleep apnea, COPD, and other respiratory disorders for home and clinical use.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 14.2% outpaced its revenue gains

- Disciplined cost controls and effective management have materialized in a strong adjusted operating margin

- The stock is trading at a reasonable price if you like its story and growth prospects

ResMed has the potential to be a high-quality business. If you’re a believer, the price looks reasonable.

Why Is Now The Time To Buy ResMed?

High Quality

Investable

Underperform

Why Is Now The Time To Buy ResMed?

ResMed’s stock price of $256.76 implies a valuation ratio of 22.8x forward P/E. When stacked up against other healthcare companies, we think ResMed’s multiple is fair for the fundamentals you get.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. ResMed (RMD) Research Report: Q4 CY2025 Update

Medical device company ResMed (NYSE:RMD) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 11% year on year to $1.42 billion. Its non-GAAP profit of $2.81 per share was 3.2% above analysts’ consensus estimates.

ResMed (RMD) Q4 CY2025 Highlights:

- Revenue: $1.42 billion vs analyst estimates of $1.40 billion (11% year-on-year growth, 1.6% beat)

- Adjusted EPS: $2.81 vs analyst estimates of $2.72 (3.2% beat)

- Adjusted EBITDA: $570.5 million vs analyst estimates of $550.8 million (40.1% margin, 3.6% beat)

- Operating Margin: 34.6%, up from 32.5% in the same quarter last year

- Free Cash Flow Margin: 21.9%, similar to the same quarter last year

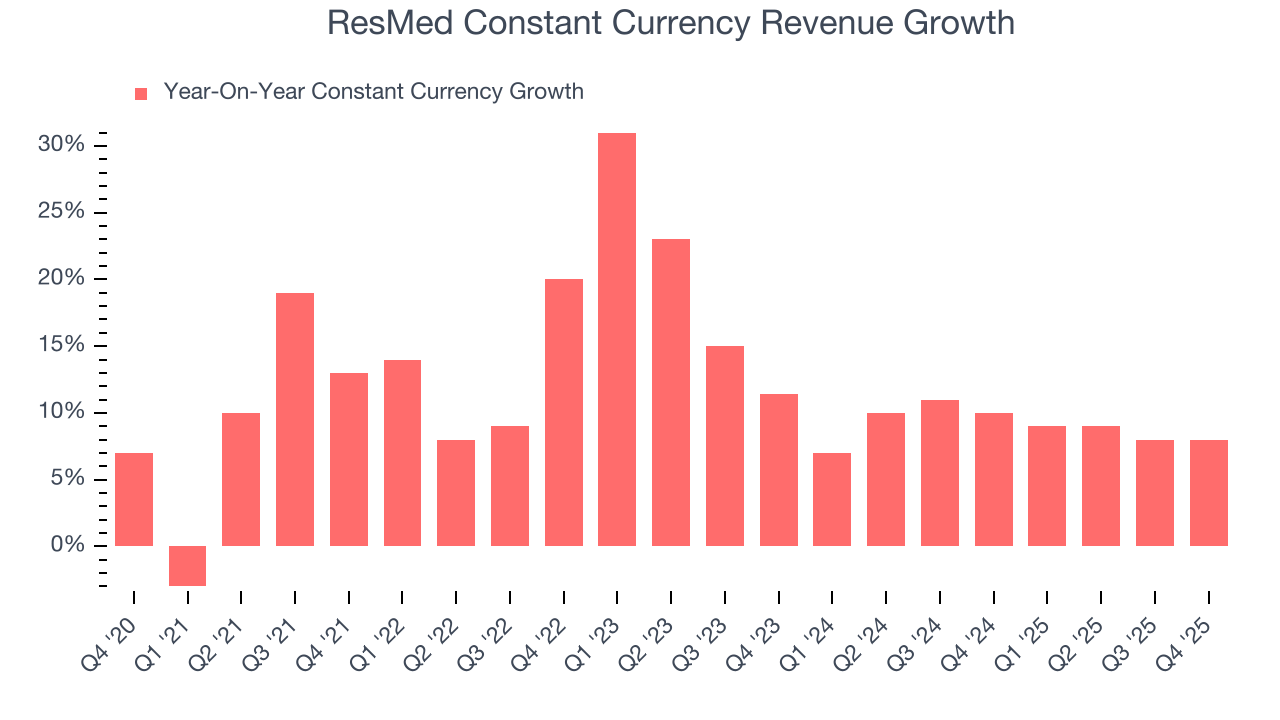

- Constant Currency Revenue rose 8% year on year (10% in the same quarter last year)

- Market Capitalization: $37.54 billion

Company Overview

Founded in 1989 to address the then-underdiagnosed condition of sleep apnea, ResMed (NYSE:RMD) develops cloud-connected medical devices and software solutions that treat sleep apnea, COPD, and other respiratory disorders for home and clinical use.

ResMed operates through two main segments: Sleep and Respiratory Care, which focuses on therapy-based equipment, and Software as a Service (SaaS), which provides healthcare management software. The company's flagship products include CPAP (Continuous Positive Airway Pressure) and APAP (Automatic Positive Airway Pressure) devices that deliver pressurized air through masks to keep airways open during sleep.

The company's devices, like the AirSense 11 platform, feature cloud connectivity that allows healthcare providers to remotely monitor patient therapy and adjust settings as needed. This digital health approach enables clinicians to manage more patients efficiently while giving patients tools to track their own progress. For example, a sleep apnea patient might use ResMed's myAir app to review their previous night's therapy data and receive personalized coaching to improve compliance.

ResMed's mask systems are designed with patient comfort in mind, offering various styles including minimalist designs that reduce facial contact, "freedom" masks with top-of-head tubing for easier sleep position changes, and ultra-soft cushions to enhance comfort. The company also produces diagnostic devices like ApneaLink Air and NightOwl that measure sleep data to help physicians diagnose sleep disorders.

Beyond hardware, ResMed's SaaS offerings include Brightree, HEALTHCAREfirst, MatrixCare, and MEDIFOX DAN solutions. These platforms help out-of-hospital care providers manage their operations more efficiently. For instance, a home medical equipment provider might use Brightree to streamline billing, inventory management, and patient documentation.

ResMed sells its products in over 140 countries through a combination of direct sales teams and independent distributors. The company maintains a significant research and development program, investing hundreds of millions annually to improve existing products and develop new applications for its technology.

4. Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

ResMed's primary competitors in the sleep and respiratory care market include Philips BV, Fisher & Paykel Healthcare, DeVilbiss Healthcare, Apex Medical, BMC Medical, and React Health. In the healthcare SaaS space, ResMed competes with various electronic health record and business management software providers.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.40 billion in revenue over the past 12 months, ResMed has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

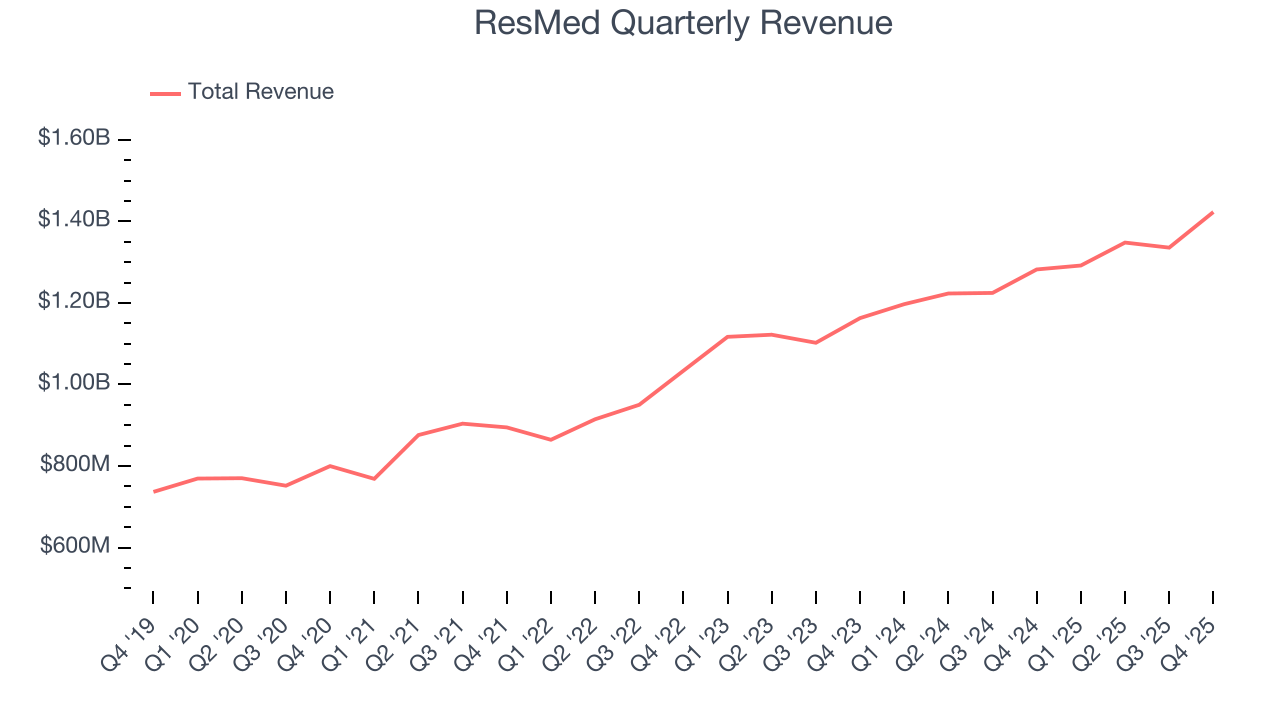

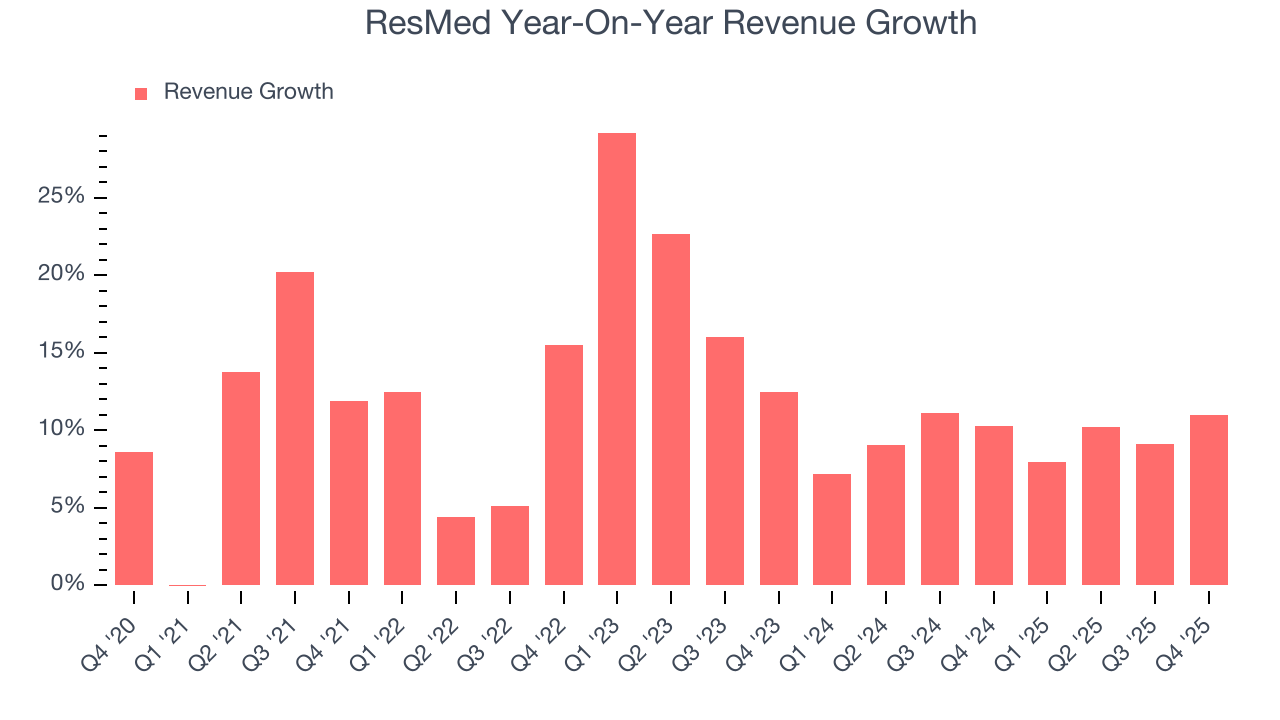

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, ResMed’s 11.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. ResMed’s annualized revenue growth of 9.5% over the last two years is below its five-year trend, but we still think the results were respectable.

ResMed also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 9% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that ResMed has properly hedged its foreign currency exposure.

This quarter, ResMed reported year-on-year revenue growth of 11%, and its $1.42 billion of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is forecasting some success for its newer products and services.

7. Operating Margin

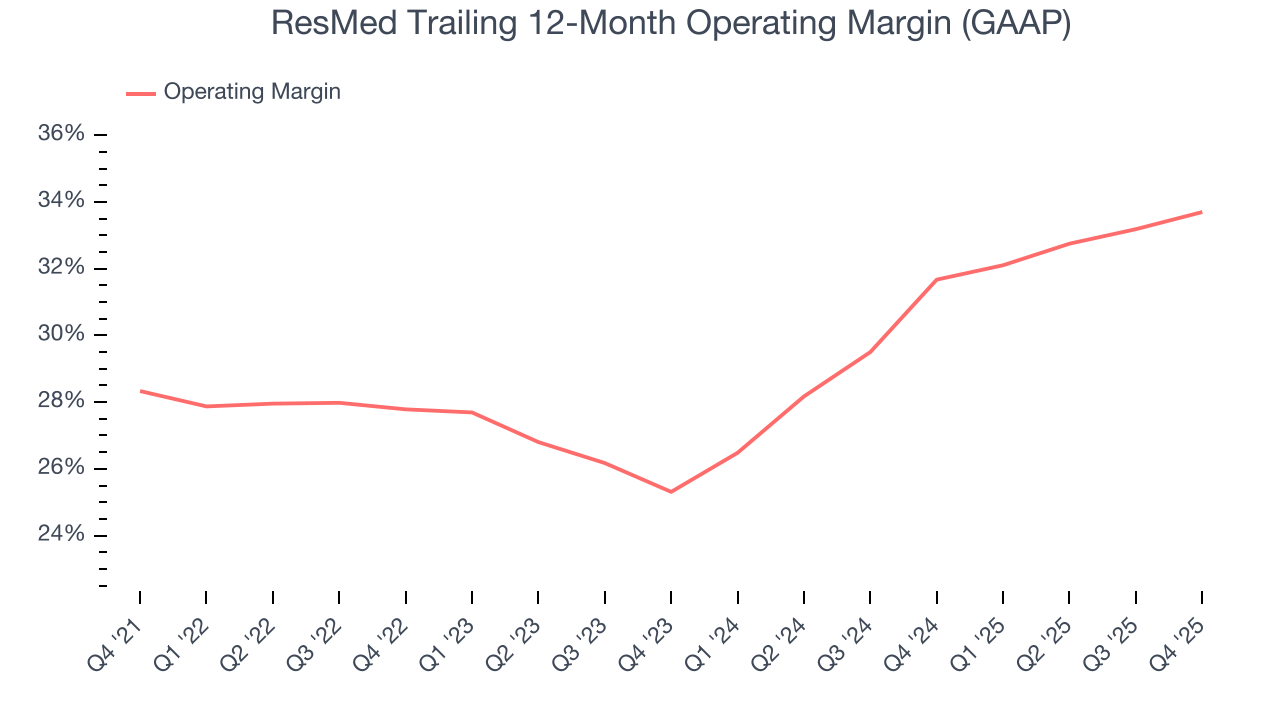

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

ResMed has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 29.7%.

Analyzing the trend in its profitability, ResMed’s operating margin rose by 5.4 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 8.4 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q4, ResMed generated an operating margin profit margin of 34.6%, up 2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

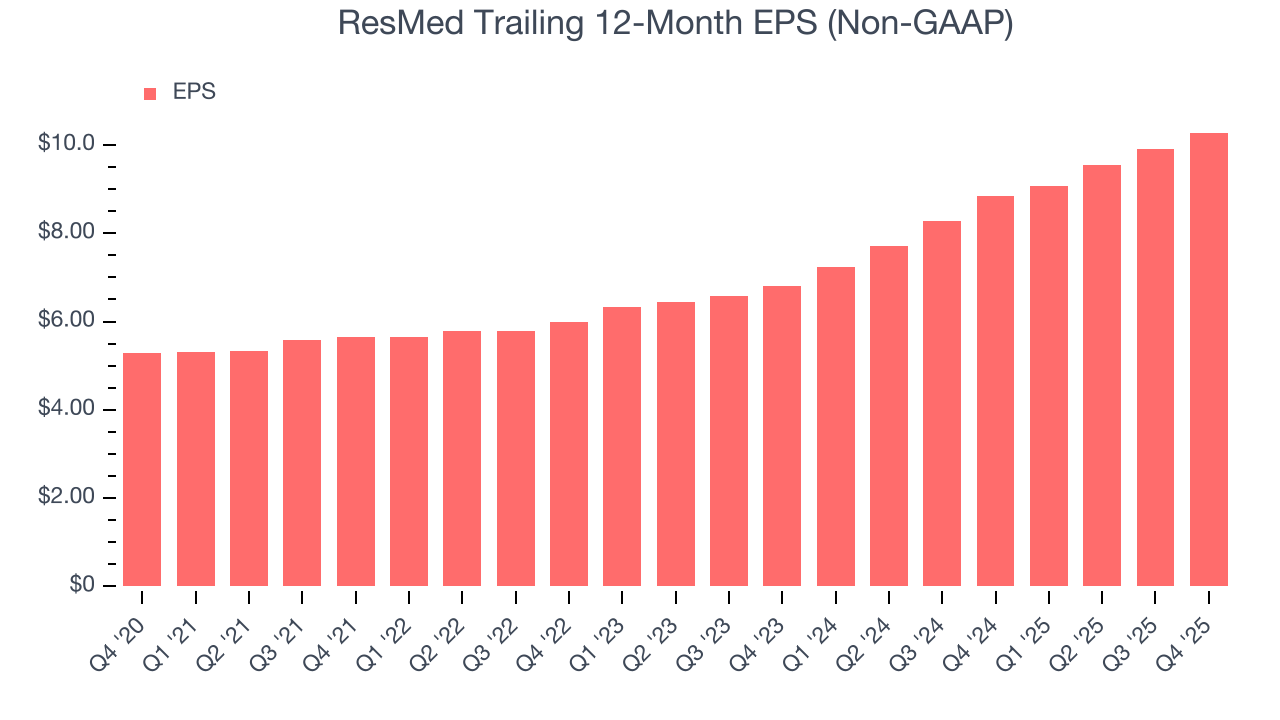

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

ResMed’s EPS grew at a spectacular 14.2% compounded annual growth rate over the last five years, higher than its 11.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into ResMed’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, ResMed’s operating margin expanded by 5.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, ResMed reported adjusted EPS of $2.81, up from $2.43 in the same quarter last year. This print beat analysts’ estimates by 3.2%. Over the next 12 months, Wall Street expects ResMed’s full-year EPS of $10.28 to grow 11.8%.

9. Cash Is King

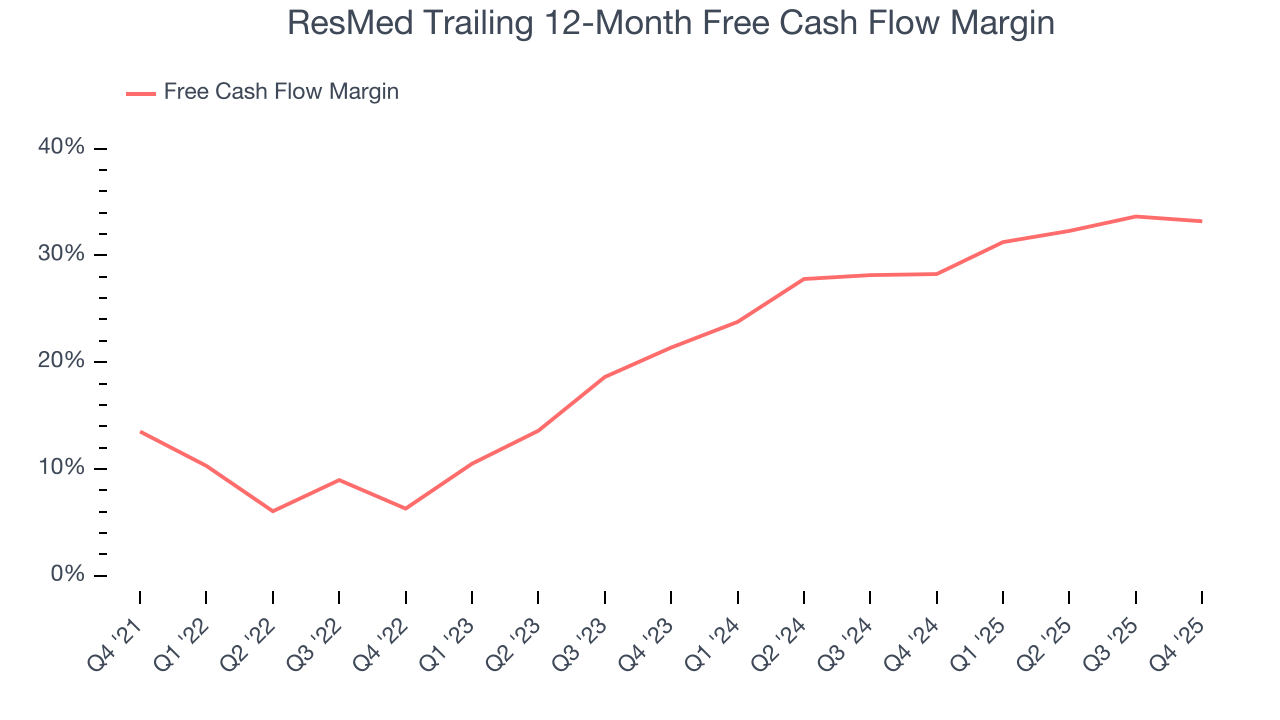

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ResMed has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 22% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that ResMed’s margin expanded by 19.7 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

ResMed’s free cash flow clocked in at $311.2 million in Q4, equivalent to a 21.9% margin. This cash profitability was in line with the comparable period last year and its five-year average.

10. Return on Invested Capital (ROIC)

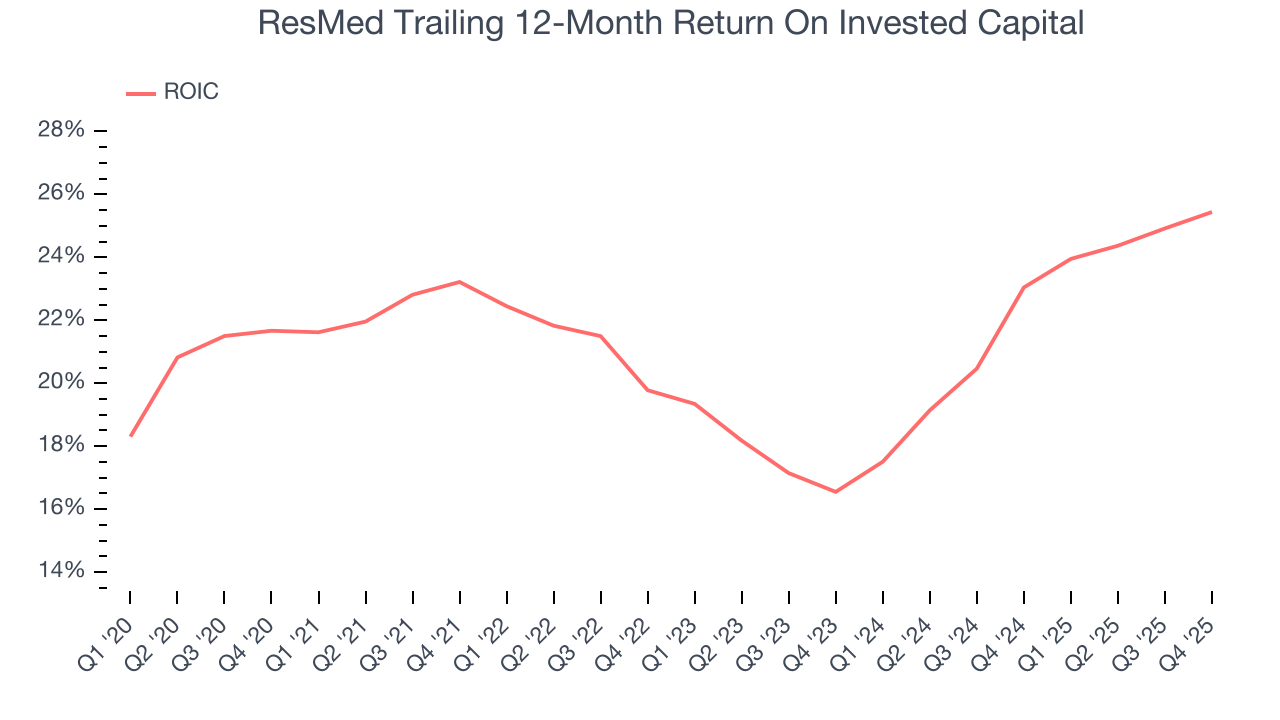

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

ResMed’s five-year average ROIC was 21.6%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, ResMed’s ROIC increased by 2.7 percentage points annually over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

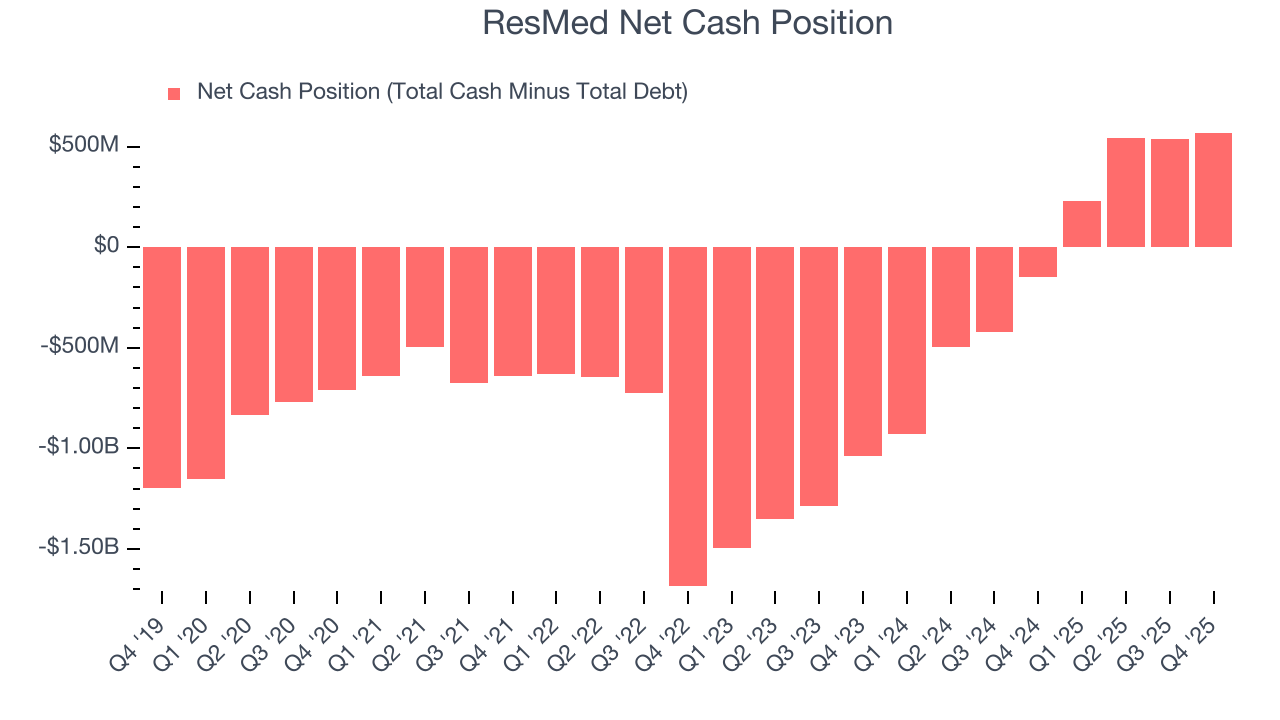

ResMed is a profitable, well-capitalized company with $1.42 billion of cash and $847.7 million of debt on its balance sheet. This $569.3 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from ResMed’s Q4 Results

It was encouraging to see ResMed beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.5% to $264.04 immediately following the results.

13. Is Now The Time To Buy ResMed?

Updated: January 29, 2026 at 5:07 PM EST

When considering an investment in ResMed, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

In our opinion, ResMed is a solid company. First off, its revenue growth was good over the last five years. Plus, ResMed’s rising cash profitability gives it more optionality, and its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders.

ResMed’s P/E ratio based on the next 12 months is 22.4x. When scanning the healthcare space, ResMed trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $292.67 on the company (compared to the current share price of $264.04), implying they see 10.8% upside in buying ResMed in the short term.